Professional Documents

Culture Documents

Key GST definitions under 40 characters

Uploaded by

jsphdvd0 ratings0% found this document useful (0 votes)

54 views3 pagesdefinitions under gst

Original Title

Definitions Under Gst

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdefinitions under gst

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

54 views3 pagesKey GST definitions under 40 characters

Uploaded by

jsphdvddefinitions under gst

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Key Definitions Under GST Model

Aggregate turnover Aggregate turnover means the aggregate

value of all taxable and nontaxable supplies,

exempt supplies and exports of goods and/or

services of a person having the same PAN, to

be computed on all India basis and excludes

taxes, if any, charged under the CGST Act,

SGST Act and the IGST Act, as the case may

be. Aggregate turnover does not include the

value of supplies on which tax is levied on

reverse charge basis and the value of inward

supplies.

Business Business has been widely defined to include

trade, commerce, manufacture, profession,

vocation or any other similar activity, including

transactions related or incidental thereto,

irrespective of volume or frequency, as well as

supply of goods/ services in connection with

commencement or closure of business.

The definition of business is expansive and

appears to have been borrowed from State

VAT legislations, with modifications made to

include transactions in services.

Capital goods Capital goods definition is similar to the

current definition in Rule 2(a) of CENVAT Credit

Rules, 2004. The definition however does not

appear to include the changes brought in by

the Union Budget 2016-17 amendments to the

CENVAT Credit Rules. Further, for

manufacturers, capital goods have been

confined to only those used at the place of

business.

Consideration Consideration in relation to the supply of

goods and/or services to any person, includes

(a) any payment made or to be made, whether

in money or otherwise, in respect of, in

response to, or for the inducement of, the

supply of goods and/or services, whether by

the said person or by any other person (b) the

monetary value of any act or forbearance,

whether or not voluntary, in respect of, in

response to, or for the inducement of, the

supply of goods and/or services, whether by

CA VIPIN MISHRA | 9711998585 1

the said person or by any other person The

definition excludes from its ambit, any deposit,

whether refundable or not, given in respect of

the supply of goods and/or services unless the

supplier applies the deposit as a consideration

for the supply. Valuation Rules in this regard

have been prescribed, which are discussed

separately.

Deemed exports Deemed exports has been defined to include

transactions in which the goods supplied do

not leave India, and payment for such supplies

is received either in Indian Rupees or in

convertible foreign exchange. Transactions

that will get covered within deemed exports

shall be notified by the Government. The

Model GST Law is presently silent on

treatment of supplies to SEZS, STPs and EOUs;

it is likely that the same may find place in such

notification. Further, zero rated supply status

is expected to be granted to deemed exports.

Export of services and Import of services Export of services and Import of

services have been defined to exclude

transactions between establishments of the

same person in India and outside India.

Exports of goods and services Exports of goods and services have been

included within the scope of zero-rated

supplies. Zero-rated supplies are defined as

any supply of goods/ services on which no tax

is payable but credit of related input tax credit

is admissible.

Services Services means anything other than goods. It

has been clarified that services would include

intangible property and actionable claim but

not include money. Correspondingly, goods

have been defined to exclude intangibles.

While specific inclusion of intangible property

will go a long way, to resolve existing

controversy, inclusion of actionable claim is

likely to create ambiguity in various financial

and commercial arrangements. Further, under

separate provisions, supply of software, works

CA VIPIN MISHRA | 9711998585 2

contracts and leasing transactions have been

deemed to be services.

Works contract Works contract have been defined to mean an

agreement for carrying out for cash, deferred

payment or other valuable consideration,

building, construction, fabrication, erection,

installation, fitting out, improvement,

modification, repair, renovation or

commissioning of any moveable or immovable

property. Deeming of works contracts as

services should simplify taxation of works

contracts. However, whether a particular

contracting structure qualifies as a works

contract, is a determination that the taxpayer

would need to undertake.

Composite supply Composite supply have been defined to

include any combination of services and/ or

goods provided in the course of furtherance of

business. While the principles of classification

have not been included in the Model GST Law,

it is possible that such contracts could be

treated as bundled supplies and specific

classification rules proposed for the same.

especially because in all public discussion the

industry has been given to understand by

Government authorities that branch transfers

will attract IGST. It is specifically clarified that

supply of goods by a registered taxable person

to a job worker shall not be considered as a

supply of goods. Further, under Section 43A,

supply of raw material and receipt of goods

after completion of job-work may be done

without payment of tax, subject to permission

from the Commissioner.

CA VIPIN MISHRA | 9711998585 3

You might also like

- GST Supply ScopeDocument3 pagesGST Supply Scopenarender241No ratings yet

- 74811bos60500 cp2Document102 pages74811bos60500 cp2Kapil KumarNo ratings yet

- The Meaning and Scope of Supply NewDocument3 pagesThe Meaning and Scope of Supply NewRicha RajpalNo ratings yet

- (Merge) Unit 2 Concept of Supply (2) - 20210313 - 182534Document16 pages(Merge) Unit 2 Concept of Supply (2) - 20210313 - 182534Keerthana KeerthiNo ratings yet

- Article On SCOPE OF SUPPLYDocument7 pagesArticle On SCOPE OF SUPPLYAkarshan SrivastavaNo ratings yet

- Chapter-2 What Is Taxable and Exempted Unde GSTDocument47 pagesChapter-2 What Is Taxable and Exempted Unde GSTDR. PREETI JINDALNo ratings yet

- GST Impact on Real Estate SectorDocument5 pagesGST Impact on Real Estate Sectorprawin karnNo ratings yet

- Supply Under GST PDFDocument21 pagesSupply Under GST PDFNaveed AnsariNo ratings yet

- Levy and Collection of Tax: Indirect TaxationDocument11 pagesLevy and Collection of Tax: Indirect TaxationTejasNo ratings yet

- Basics of GST: Partners: CA Arvind Saraf CA Ritu Agarwal CA Atul MehtaDocument67 pagesBasics of GST: Partners: CA Arvind Saraf CA Ritu Agarwal CA Atul MehtaRagnor LordbrookNo ratings yet

- Imports Under Gst02june2017Document2 pagesImports Under Gst02june2017shahruchirNo ratings yet

- Supply Under GSTDocument14 pagesSupply Under GSTTreesa Mary RejiNo ratings yet

- GST Intermediary Services Vs. Export of Services: Key DifferencesDocument8 pagesGST Intermediary Services Vs. Export of Services: Key DifferencesMohit JangidNo ratings yet

- 013 Terms and phrases you must know under GST- Part IIDocument3 pages013 Terms and phrases you must know under GST- Part II0amrevkapeed0No ratings yet

- Major Changes to Key GST Sections Effective From 1st February 2019Document31 pagesMajor Changes to Key GST Sections Effective From 1st February 2019B.S. RawatNo ratings yet

- Write Back Amount Vs GSTDocument8 pagesWrite Back Amount Vs GSTashim1No ratings yet

- Taxguru - In-Major Amendments in GST ACTs Applicable From 01022019Document32 pagesTaxguru - In-Major Amendments in GST ACTs Applicable From 01022019staunch consultancyNo ratings yet

- GST - The Game Changer: What Is GST and How GST Works?Document8 pagesGST - The Game Changer: What Is GST and How GST Works?Vikas SharmaNo ratings yet

- CA Bimal JainDocument13 pagesCA Bimal JainGyanendra BhadouriaNo ratings yet

- Meaning and Scope of SupplyDocument8 pagesMeaning and Scope of SupplyAvila VarshiniNo ratings yet

- UNIT 2 (1) Taxable Event - Printed NotesDocument8 pagesUNIT 2 (1) Taxable Event - Printed NotesSania KhanNo ratings yet

- 6.case Study On Input Tax Credit Under GSTDocument17 pages6.case Study On Input Tax Credit Under GSTSUNIL PUJARINo ratings yet

- E-Text Unit 2: Concept of SupplyDocument29 pagesE-Text Unit 2: Concept of SupplyrajneeshkarloopiaNo ratings yet

- E-Text Unit 2: Concept of SupplyDocument29 pagesE-Text Unit 2: Concept of SupplyrajneeshkarloopiaNo ratings yet

- Construction Services Under GST - A Detailed InformationDocument27 pagesConstruction Services Under GST - A Detailed InformationMukul Yadav100% (1)

- Supply-By CA Arpit HaldiaDocument75 pagesSupply-By CA Arpit HaldiaCA Aravind100% (1)

- New Microsoft Word DocumentDocument5 pagesNew Microsoft Word Documentparth.sharma0029No ratings yet

- 56361bos44662s PDFDocument58 pages56361bos44662s PDFAlekhya SharmaNo ratings yet

- Supply Under GST: After Studying This Chapter, You Will Be Able ToDocument92 pagesSupply Under GST: After Studying This Chapter, You Will Be Able ToPremNo ratings yet

- 74816bos60500 cp7Document42 pages74816bos60500 cp7Looney ApacheNo ratings yet

- 66514bos53752 cp2Document79 pages66514bos53752 cp2Pallavi AwareNo ratings yet

- Goods and Services Tax: Basic ConceptsDocument11 pagesGoods and Services Tax: Basic ConceptsVenkatraman NatarajanNo ratings yet

- The Meaning and Scope of SupplyDocument3 pagesThe Meaning and Scope of SupplyRajeev KumarNo ratings yet

- Impact of GST On Construction and Real EstateDocument7 pagesImpact of GST On Construction and Real Estatesahilkaushik0% (1)

- GST Scope of SupplyDocument22 pagesGST Scope of SupplyBhavy GandhiNo ratings yet

- GST Chapter on Input Tax CreditDocument100 pagesGST Chapter on Input Tax CreditAditya ThesiaNo ratings yet

- Meaning and Scope of Supply Under GSTDocument5 pagesMeaning and Scope of Supply Under GSTRohit BajpaiNo ratings yet

- 2-Concept of SupplyDocument75 pages2-Concept of SupplyRAUNAQ SHARMANo ratings yet

- Value of Supply MechanismDocument85 pagesValue of Supply MechanismAdventure TimeNo ratings yet

- Imports of GST 07june2017 - DocumentDocument3 pagesImports of GST 07june2017 - DocumentinasapNo ratings yet

- Article On Works ContractDocument20 pagesArticle On Works ContractRafeek ShaikhNo ratings yet

- ITC FundamentalsDocument114 pagesITC FundamentalsRAUNAQ SHARMANo ratings yet

- Value of SupplyDocument10 pagesValue of SupplyAnshika PatwaNo ratings yet

- General Services Tax (GST) : An OverviewDocument101 pagesGeneral Services Tax (GST) : An Overviewnishanth vNo ratings yet

- GST - Unit 2 (Theory Questions)Document5 pagesGST - Unit 2 (Theory Questions)subash minecraft creatorNo ratings yet

- Levy Exemption ReturnsDocument44 pagesLevy Exemption ReturnsSuresh Kumar YathirajuNo ratings yet

- University of Petroleum & Energy Studies School of Law B.Com. LL.B. TL (Semester VIII) SESSION: JANUARY-MAY, 2020 ASSIGNMENT GST III (STATEDocument15 pagesUniversity of Petroleum & Energy Studies School of Law B.Com. LL.B. TL (Semester VIII) SESSION: JANUARY-MAY, 2020 ASSIGNMENT GST III (STATENitish Kumar NaveenNo ratings yet

- Idt 2Document10 pagesIdt 2manan agrawalNo ratings yet

- GST AmendmentsDocument15 pagesGST AmendmentsSana KhanNo ratings yet

- Composite and Mixed Supplies - Tax Liability Law of Taxation - IiDocument25 pagesComposite and Mixed Supplies - Tax Liability Law of Taxation - IiGudipi JanardhanNo ratings yet

- Supply Under GST: GlimpsesDocument19 pagesSupply Under GST: GlimpsesAdventure TimeNo ratings yet

- Concept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Document2 pagesConcept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Ranjan BaradurNo ratings yet

- (2021) 127 Taxmann - Com 899 (Article) Slump Sale - GST ImplicationsDocument7 pages(2021) 127 Taxmann - Com 899 (Article) Slump Sale - GST ImplicationsNikhil IssarNo ratings yet

- SupplyDocument25 pagesSupplyNEHA BBA2020EBNo ratings yet

- Excise Indirect Taxes: Page 1 of 28Document28 pagesExcise Indirect Taxes: Page 1 of 28prashant6687No ratings yet

- Treading-the-GST-Path-XLII-Transfer-of-Business-and-GST nnnnDocument6 pagesTreading-the-GST-Path-XLII-Transfer-of-Business-and-GST nnnnrehaliya15No ratings yet

- 46783bosfinal p8 Part1 Cp2Document48 pages46783bosfinal p8 Part1 Cp2Pranjul AgrawalNo ratings yet

- Students Guide To GST and Customs Law - Chapter2Document5 pagesStudents Guide To GST and Customs Law - Chapter2Aniket SharmaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2From EverandA Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2No ratings yet

- Using Lock Box Files SAP FIDocument2 pagesUsing Lock Box Files SAP FIjsphdvdNo ratings yet

- SAP FSCM Interview Question and AnswersDocument3 pagesSAP FSCM Interview Question and AnswersjsphdvdNo ratings yet

- The Ultimate Guide to SAP FI Dunning Procedure for Customer Outstanding InvoicesDocument18 pagesThe Ultimate Guide to SAP FI Dunning Procedure for Customer Outstanding Invoicesjsphdvd100% (1)

- Tips For Resume PreparationDocument2 pagesTips For Resume PreparationjsphdvdNo ratings yet

- Asset Accounting: Use Transaction Code: OaxeDocument12 pagesAsset Accounting: Use Transaction Code: OaxejsphdvdNo ratings yet

- Online Transactions GSTDocument2 pagesOnline Transactions GSTjsphdvdNo ratings yet

- AP FI Dunning Procedure For Customer Outstanding InvoicesDocument31 pagesAP FI Dunning Procedure For Customer Outstanding InvoicesjsphdvdNo ratings yet

- Inter Company Stock TransfersDocument28 pagesInter Company Stock TransfersjsphdvdNo ratings yet

- Howtoview Transaction CodesforimgDocument2 pagesHowtoview Transaction CodesforimgjsphdvdNo ratings yet

- Grace Days For Line Items and Minimum Numbers of Days in Arrears For AccountsDocument14 pagesGrace Days For Line Items and Minimum Numbers of Days in Arrears For AccountsjsphdvdNo ratings yet

- DMEE Complete TutorialDocument37 pagesDMEE Complete Tutorialbikash das100% (3)

- Day Limit in SapDocument1 pageDay Limit in SapjsphdvdNo ratings yet

- Profit Center Number Range IntervalsDocument1 pageProfit Center Number Range IntervalsjsphdvdNo ratings yet

- Biodata 12Document3 pagesBiodata 12jsphdvdNo ratings yet

- Unit Test Script: Test Scenario No. Re-Posting of CostsDocument2 pagesUnit Test Script: Test Scenario No. Re-Posting of CostsjsphdvdNo ratings yet

- EST Eport: NIT Test Scenario No: UT-FI-009Document2 pagesEST Eport: NIT Test Scenario No: UT-FI-009jsphdvdNo ratings yet

- Unit Test Script: Test Scenario No. Re-Posting of CostsDocument2 pagesUnit Test Script: Test Scenario No. Re-Posting of CostsjsphdvdNo ratings yet

- FadDocument16 pagesFadkhunsasiNo ratings yet

- Unit Test Script: Test Scenario No. Activity TypeDocument4 pagesUnit Test Script: Test Scenario No. Activity TypejsphdvdNo ratings yet

- Unit Test Script: Test Scenario No. Cost CenterDocument4 pagesUnit Test Script: Test Scenario No. Cost CenterjsphdvdNo ratings yet

- Module: Costing (Controlling) As-Is Business Process ListDocument28 pagesModule: Costing (Controlling) As-Is Business Process ListjsphdvdNo ratings yet

- Controlling: ABC Engineering (India) Ltd. To Be DocumentDocument38 pagesControlling: ABC Engineering (India) Ltd. To Be DocumentjsphdvdNo ratings yet

- SAP LandscapeDocument4 pagesSAP LandscapePrashant KumarNo ratings yet

- FICO TO BE Document For Abc LimitedDocument85 pagesFICO TO BE Document For Abc LimitedjsphdvdNo ratings yet

- ABC CO Production WIP Tracking GapsDocument3 pagesABC CO Production WIP Tracking GapsjsphdvdNo ratings yet

- TermsusedinprojectfinalDocument5 pagesTermsusedinprojectfinalyogamNo ratings yet

- Financial Accounting & Controlling AS IS Document for ABC LimitedDocument105 pagesFinancial Accounting & Controlling AS IS Document for ABC LimitedjsphdvdNo ratings yet

- What Is Gap AnalysisDocument1 pageWhat Is Gap AnalysisSrinivas PoolaNo ratings yet

- PROJECTCREATIONDocument4 pagesPROJECTCREATIONjsphdvdNo ratings yet

- Sap Implementation FlowDocument4 pagesSap Implementation FlowjsphdvdNo ratings yet

- 2022-11-13 2bat TDR Francesc MorenoDocument76 pages2022-11-13 2bat TDR Francesc MorenoFrancesc Moreno MorataNo ratings yet

- Unit II Competitve AdvantageDocument147 pagesUnit II Competitve Advantagejul123456No ratings yet

- Bhattacharyya2013 PDFDocument24 pagesBhattacharyya2013 PDFFermando CamposNo ratings yet

- World Bank Review Global AsiaDocument5 pagesWorld Bank Review Global AsiaRadhakrishnanNo ratings yet

- High Potential Near MissDocument12 pagesHigh Potential Near Missja23gonzNo ratings yet

- Notes On Alternative Centres of PowerDocument10 pagesNotes On Alternative Centres of PowerMimansaNo ratings yet

- Seminar Paper11111Document22 pagesSeminar Paper11111Mulugeta88% (8)

- Determination of Income, Consumption, SavingsDocument24 pagesDetermination of Income, Consumption, SavingsAmit PrabhakarNo ratings yet

- AMULDocument27 pagesAMULSewanti DharNo ratings yet

- Pay - Slip Oct. & Nov. 19Document1 pagePay - Slip Oct. & Nov. 19Atul Kumar MishraNo ratings yet

- Placements IIM ADocument8 pagesPlacements IIM Abhanu1991No ratings yet

- CMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementDocument10 pagesCMATking Innovation 35 Must Do Questions On CMAT NTA NET Innovation and Entrepreneurship ManagementCharusat UniversityNo ratings yet

- Certificate of AcceptanceDocument30 pagesCertificate of AcceptanceJamielor BalmedianoNo ratings yet

- Capital Market InstrumentsDocument6 pagesCapital Market Instrumentsgeet_rawat36No ratings yet

- BOOKING INVOICE M06AI22I08332696 To Edit 1Document2 pagesBOOKING INVOICE M06AI22I08332696 To Edit 1AkshayMilmileNo ratings yet

- Disrupting MobilityDocument346 pagesDisrupting MobilityMickey100% (1)

- List of Companies: Group - 1 (1-22)Document7 pagesList of Companies: Group - 1 (1-22)Mohammad ShuaibNo ratings yet

- Wildlife Management & Habitat ConservationDocument12 pagesWildlife Management & Habitat ConservationFireJadeFJNo ratings yet

- DonaldDocument26 pagesDonaldAnonymous V2Tf1cNo ratings yet

- Tutorial1 SolutionsDocument5 pagesTutorial1 Solutionsfgdfdfgd3No ratings yet

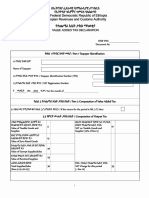

- VAT Declaration FormDocument2 pagesVAT Declaration FormWedaje Alemayehu67% (3)

- Chapter - 9 Multifactor ModelsDocument15 pagesChapter - 9 Multifactor ModelsAntora Hoque100% (1)

- Companies List 2014 PDFDocument36 pagesCompanies List 2014 PDFArnold JohnnyNo ratings yet

- Company accounts underwriting shares debenturesDocument7 pagesCompany accounts underwriting shares debenturesSakshi chauhanNo ratings yet

- Extrajudicial Settlement of Estate With Special Power of Attorney To Sell or To Enter Into Develpoment Agreement-1Document5 pagesExtrajudicial Settlement of Estate With Special Power of Attorney To Sell or To Enter Into Develpoment Agreement-1Lucille Teves78% (23)

- PART I - Multiple Choice (30 Marks)Document13 pagesPART I - Multiple Choice (30 Marks)Siyeong SimNo ratings yet

- Commercial BanksDocument9 pagesCommercial BanksPrathyusha ReddyNo ratings yet

- Regional Planning Techniques PDFDocument131 pagesRegional Planning Techniques PDFRicha Sagarika0% (1)

- HUL EthicsDocument29 pagesHUL EthicsRimci KalyanNo ratings yet

- PT 2 Social ScienceDocument11 pagesPT 2 Social ScienceDevanarayanan M. JNo ratings yet