Professional Documents

Culture Documents

Tax - Talusan Vs Tayag

Uploaded by

thedoodlbot0 ratings0% found this document useful (0 votes)

470 views1 pageRPT

Original Title

Tax - Talusan vs Tayag

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRPT

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

470 views1 pageTax - Talusan Vs Tayag

Uploaded by

thedoodlbotRPT

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

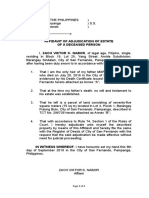

TALUSAN VS.

TAYAG & HERNANDEZ (2001)

G.R. No. 133698

FACTS: The case involves auction sale of a condominium unit, covered by

Condominium Certificate of Title No. 651 and located in Building IV, Europa

Condominium Villas, Baguio City.

Elias imperial, the former owner, sold his condominium unit to Antonio Talusan

and Celia Talusan, as evidenced by an Absolute Deed of Sale.

Juan Hernandez, the City Treasurer of Baguio City, wrote a letter to Imperial

informing him that the property would be sold at public auction if Imperial failed to satisfy

the delinquent real estate taxes, penalties and cost of sale, amounting to Php4,039.80.

Unbeknownst to Hernandez, Imperial and his family had already migrated to Australia.

The property was sold through auction sale to Hermenegildo Tayag for

Php4,400.00 and a final bill of sale was issued in his favor.

The Talusans, who were still in possession of the property, offered to pay the

same to Tayag were rejected. They filed for writ of preliminary injunction.

RTC of Baguio, Branch 6, ruled in favor of Tayag, finding that Tayag is not bound

to the Deed of Sale between Imperial and the Talusans because such was never

registered with the Register of Deeds.

The Talusans sought for the annulment of the auction sale, but the legality of the

sale was upheld. The CA affirmed.

ISSUE: Whether the auction sale was not valid because of non-publication of delinquent

real estate taxes.

HELD: The SC ruled in favor of the respondents.

Cases involving an auction sale of land for the collection of delinquent taxes are

in personam, unlike land registration proceedings. Thus, notice by publication, though

sufficient in proceedings in rem, does not as a rule satisfy the requirement of

proceedings in personam. Mere publication of the notice of delinquency would not

suffice, considering that the procedure in tax sales is in personam. It was, therefore, still

incumbent upon the city treasurer to send the notice of tax delinquency directly to the

taxpayer in order to protect the interests of the latter.

In the present case, the notice of delinquency was sent by registered mail to the

permanent address of the registered owner in Manila. In that notice, the city treasurer of

Baguio City directed him to settle the charges immediately and to protect his interest in

the property. Under the circumstances, we hold that the notice sent by registered mail

adequately protected the rights of the taxpayer, who was the registered owner of the

condominium unit.

For purposes of the real property tax, the registered owner of the property is

deemed the taxpayer. Hence, only the registered owner is entitled to a notice of tax

delinquency and other proceedings relative to the tax sale. Not being registered owners

of the property, petitioners cannot claim to have been deprived of such notice. In fact,

they were not entitled to it.

You might also like

- Talusan Vs TayagDocument6 pagesTalusan Vs TayagAnton SingeNo ratings yet

- Spouses Tan Vs BanteguiDocument2 pagesSpouses Tan Vs BanteguiPaul EsparagozaNo ratings yet

- Lopez vs. City of ManilaDocument2 pagesLopez vs. City of ManilaDeniel Salvador B. MorilloNo ratings yet

- PBCom v. CIR DigestDocument2 pagesPBCom v. CIR DigestKaren PanisalesNo ratings yet

- TY vs. TRAMPE Taxation 2 DigestDocument2 pagesTY vs. TRAMPE Taxation 2 DigestEllen Glae Daquipil100% (1)

- DE LA RIVA DigestDocument2 pagesDE LA RIVA DigestChristine Rose Bonilla LikiganNo ratings yet

- LGU EXPROPRIATION VS. EJECTMENT CASEDocument1 pageLGU EXPROPRIATION VS. EJECTMENT CASEandresuiioNo ratings yet

- 172 Michigan Holdings v. City Treasurer of MakatiDocument2 pages172 Michigan Holdings v. City Treasurer of MakatiKatrina Monica CajucomNo ratings yet

- VIVE EAGLE LAND, INC., PETITIONER, vs. NATIONAL HOME MORTGAGE FINANCE CORPORATIONDocument2 pagesVIVE EAGLE LAND, INC., PETITIONER, vs. NATIONAL HOME MORTGAGE FINANCE CORPORATIONAbe PuntualNo ratings yet

- Piedad vs. Lanao Del Norte Electric Cooperative, Inc.,we Ruled That A Series of Irregularities WhenDocument1 pagePiedad vs. Lanao Del Norte Electric Cooperative, Inc.,we Ruled That A Series of Irregularities Whenana ortizNo ratings yet

- Opinaldo v. RavinaDocument2 pagesOpinaldo v. RavinaCeedee RagayNo ratings yet

- Philippine Match Co. vs. The City of Cebu - DigestDocument1 pagePhilippine Match Co. vs. The City of Cebu - DigestGem S. AlegadoNo ratings yet

- CA upholds search warrants for IP infringementDocument5 pagesCA upholds search warrants for IP infringementAdhara Celerian100% (1)

- Case Digests LaborDocument2 pagesCase Digests LaborGabriel CenizaNo ratings yet

- Statutory Construction Case on Tax AssessmentsDocument1 pageStatutory Construction Case on Tax AssessmentsleslieannjoseNo ratings yet

- Vagilidad v. Vagilidad, Jr. case analysisDocument2 pagesVagilidad v. Vagilidad, Jr. case analysisRed HoodNo ratings yet

- Camp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)Document3 pagesCamp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)lexxNo ratings yet

- Ericsson Telecommunications vs. City of PasigDocument1 pageEricsson Telecommunications vs. City of Pasigxx_stripped52100% (2)

- Rule 22 Computation of TimeDocument2 pagesRule 22 Computation of TimeMarichelNo ratings yet

- Judge Aguilar DisqualifiedDocument2 pagesJudge Aguilar DisqualifiedMidzmar KulaniNo ratings yet

- PEA Cannot Transfer Public Lands to Private FirmDocument2 pagesPEA Cannot Transfer Public Lands to Private FirmAngel Salazar100% (1)

- 12 Republic Vs Cortez SRDocument1 page12 Republic Vs Cortez SRelobenia100% (1)

- Felisa de Roy Vs Court of AppealsDocument2 pagesFelisa de Roy Vs Court of AppealsMae DadullaNo ratings yet

- Duterte vs. Kingswood Trading Co. Ruling on Article 284Document2 pagesDuterte vs. Kingswood Trading Co. Ruling on Article 284Nej AdunayNo ratings yet

- Fernandez vs. FernandezDocument1 pageFernandez vs. FernandezKitchie San PedroNo ratings yet

- People of The PhilippinesDocument8 pagesPeople of The PhilippinesRham PheraltaNo ratings yet

- Espiritu vs. CiprianoDocument9 pagesEspiritu vs. CiprianoRommel RosasNo ratings yet

- Republic Vs Lozada Case DigestDocument3 pagesRepublic Vs Lozada Case Digestmaanyag6685No ratings yet

- Agrarian Law (Sps. Endaya, Et. Al. vs. CA Digest)Document8 pagesAgrarian Law (Sps. Endaya, Et. Al. vs. CA Digest)Maestro LazaroNo ratings yet

- M. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Document3 pagesM. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Marry LasherasNo ratings yet

- LIM KIEH TONG Vs CADocument2 pagesLIM KIEH TONG Vs CAJay Kent RoilesNo ratings yet

- Manuel Pablico and Master’s Pub Resto Bar v. Numeriano Cerro case rulingDocument3 pagesManuel Pablico and Master’s Pub Resto Bar v. Numeriano Cerro case rulingBeulah Alanah EspirituNo ratings yet

- PAL v. Edu, GR No. L-41383, 15 August 1988Document1 pagePAL v. Edu, GR No. L-41383, 15 August 1988Christopher Jan DotimasNo ratings yet

- Case Digest Eduarte Vs CADocument2 pagesCase Digest Eduarte Vs CAMaria Cecilia Oliva100% (1)

- Ruperta Cano Vda. de Viray and Jesus Carlo Gerard Viray Vs - Spouses Jose UsiDocument2 pagesRuperta Cano Vda. de Viray and Jesus Carlo Gerard Viray Vs - Spouses Jose UsiDiane Dee YaneeNo ratings yet

- People v. Segun & ClamDocument4 pagesPeople v. Segun & ClamJohnCarrascoNo ratings yet

- Rodriguez Et Al vs. PAL (Jan 2016)Document6 pagesRodriguez Et Al vs. PAL (Jan 2016)Sam LeynesNo ratings yet

- Municipal Treasurer's Salary DisputeDocument21 pagesMunicipal Treasurer's Salary Disputeaspiringlawyer1234No ratings yet

- 110-Rodriguez vs. ECCDocument2 pages110-Rodriguez vs. ECCNimpa PichayNo ratings yet

- Tax-Digest 1-5Document16 pagesTax-Digest 1-5Royalhighness18No ratings yet

- Phil Guaranty v. CIR DigestsDocument2 pagesPhil Guaranty v. CIR Digestspinkblush717100% (1)

- CTA VAT Refund Claim RejectedDocument2 pagesCTA VAT Refund Claim RejectedJemima FalinchaoNo ratings yet

- CasesDocument564 pagesCasesJocelyn Baliwag-Alicmas Banganan Bayubay100% (1)

- Petitioners Entitled to 25% Premium Pay for Sunday WorkDocument1 pagePetitioners Entitled to 25% Premium Pay for Sunday Workmaria lourdes lopena100% (1)

- Sameer vs. NLRCDocument2 pagesSameer vs. NLRCKingNoeBadongNo ratings yet

- Labor Case DigestDocument6 pagesLabor Case Digesteugene_abanNo ratings yet

- (9-8) Mercantile Insurance vs. DMCIDocument10 pages(9-8) Mercantile Insurance vs. DMCIJan Carlo SanchezNo ratings yet

- City Government of San Pablo, Laguna Vs Reyes DegestDocument2 pagesCity Government of San Pablo, Laguna Vs Reyes DegestCybelShepheredSarolMalagaNo ratings yet

- Alcantara Vs RepublicDocument2 pagesAlcantara Vs RepublicRachel Leachon100% (1)

- Digest-Bank of AmericaDocument3 pagesDigest-Bank of AmericaImelda Arreglo-AgripaNo ratings yet

- Alimpoos Vs CADocument20 pagesAlimpoos Vs CAoliveNo ratings yet

- Advertising Associates vs. CADocument2 pagesAdvertising Associates vs. CAJyrnaRhea67% (3)

- Mecano vs. Commission On Audit DigestDocument2 pagesMecano vs. Commission On Audit DigestJulian DubaNo ratings yet

- Somes v. Government of The Phil. Islands, GR L-42754, Oct. 30, 1935, 62 Phil. 432Document2 pagesSomes v. Government of The Phil. Islands, GR L-42754, Oct. 30, 1935, 62 Phil. 432Gia DimayugaNo ratings yet

- Talusan v. TayagDocument10 pagesTalusan v. TayagMerideth SamNo ratings yet

- Mercado V Valley Mountain Case DigestDocument2 pagesMercado V Valley Mountain Case DigesthistabNo ratings yet

- Francia v. Intermediate Appellate Court: Tax Sale Annulment CaseDocument1 pageFrancia v. Intermediate Appellate Court: Tax Sale Annulment CasenadgbNo ratings yet

- Francia vs. IACDocument1 pageFrancia vs. IACEmma S. Ventura-DaezNo ratings yet

- Taxpayers Must Register Property, Pay DuesDocument11 pagesTaxpayers Must Register Property, Pay DuesrolandbcaspeNo ratings yet

- Supreme Court Upholds Tax Delinquency Auction SaleDocument5 pagesSupreme Court Upholds Tax Delinquency Auction SaleJoanna RodriguezNo ratings yet

- Valid Exercise of Police Power in Implementing Nationwide Gun BanDocument1 pageValid Exercise of Police Power in Implementing Nationwide Gun BanthedoodlbotNo ratings yet

- Foundlings Can Be Natural-Born Filipino CitizensDocument3 pagesFoundlings Can Be Natural-Born Filipino Citizensthedoodlbot100% (3)

- List of Some Legal Maxims With "Animus"Document1 pageList of Some Legal Maxims With "Animus"thedoodlbotNo ratings yet

- Banking LawsDocument28 pagesBanking LawsthedoodlbotNo ratings yet

- AMLC vs Bolante and others - Supreme Court rules on petitions to nullify freeze order and allow inquiry into bank accountsDocument34 pagesAMLC vs Bolante and others - Supreme Court rules on petitions to nullify freeze order and allow inquiry into bank accountsthedoodlbotNo ratings yet

- Legal MaximsDocument1 pageLegal MaximsthedoodlbotNo ratings yet

- Tax - Talusan Vs TayagDocument1 pageTax - Talusan Vs TayagthedoodlbotNo ratings yet

- Case Digest For Spec Com RevisedDocument1 pageCase Digest For Spec Com RevisedmikeeNo ratings yet

- Torts - 6 - Rakes Vs Atlantic GulfDocument1 pageTorts - 6 - Rakes Vs Atlantic Gulfthedoodlbot100% (1)

- ARROJO Cross and RedirectDocument3 pagesARROJO Cross and RedirectthedoodlbotNo ratings yet

- IP CasesDocument28 pagesIP CasesthedoodlbotNo ratings yet

- CA Freeze Order on Ligot Assets UpheldDocument6 pagesCA Freeze Order on Ligot Assets UpheldthedoodlbotNo ratings yet

- Supreme Court: Tabaquero, Albano & Associates For Petitioner. The Government Corporate Counsel For Private RespondentDocument47 pagesSupreme Court: Tabaquero, Albano & Associates For Petitioner. The Government Corporate Counsel For Private RespondentthedoodlbotNo ratings yet

- Adjudication AffidavitDocument2 pagesAdjudication AffidavitthedoodlbotNo ratings yet

- RA 9160 AmendedDocument14 pagesRA 9160 AmendedthedoodlbotNo ratings yet

- Right To PrivacyDocument75 pagesRight To PrivacythedoodlbotNo ratings yet

- Affidavit Ownership PledgeDocument2 pagesAffidavit Ownership PledgethedoodlbotNo ratings yet

- Labor Cases 3Document65 pagesLabor Cases 3thedoodlbotNo ratings yet

- Cabacungan v. LaigoDocument12 pagesCabacungan v. LaigothedoodlbotNo ratings yet

- 1-2 Labor OrganizationDocument1 page1-2 Labor OrganizationthedoodlbotNo ratings yet

- The Constitutional Right To TravelDocument48 pagesThe Constitutional Right To TravelthedoodlbotNo ratings yet

- Labor CasesDocument74 pagesLabor CasesthedoodlbotNo ratings yet

- The Non-Establishment of Religion ClauseDocument225 pagesThe Non-Establishment of Religion ClausethedoodlbotNo ratings yet

- Freedom of Speech, Press, ExpressionDocument21 pagesFreedom of Speech, Press, ExpressionthedoodlbotNo ratings yet

- Freedom of Speech, Press, ExpressionDocument21 pagesFreedom of Speech, Press, ExpressionthedoodlbotNo ratings yet

- Texas Sharpshooter and False Dilemma Fallacies ExplainedDocument1 pageTexas Sharpshooter and False Dilemma Fallacies ExplainedthedoodlbotNo ratings yet

- Ra 6235Document1 pageRa 6235thedoodlbot75% (4)

- Code of Professional ResponsibilityDocument4 pagesCode of Professional ResponsibilitythedoodlbotNo ratings yet

- Summary of "To Kill A Mockingbird"Document2 pagesSummary of "To Kill A Mockingbird"thedoodlbotNo ratings yet

- DCB Bank auction notice for multiple Delhi and NCR propertiesDocument3 pagesDCB Bank auction notice for multiple Delhi and NCR propertiesAJEET KUMARNo ratings yet

- 3.1m (NHA-iligan City)Document3 pages3.1m (NHA-iligan City)arafatbauntoNo ratings yet

- MIll and Wage FundDocument25 pagesMIll and Wage FundJavy De la MorenaNo ratings yet

- (Govt of India Undertaking) : #6-3-353/2, Astral Heights, Banjara Hills, Hyderabad-500036Document4 pages(Govt of India Undertaking) : #6-3-353/2, Astral Heights, Banjara Hills, Hyderabad-500036Vishal NannaNo ratings yet

- Finnish Fur Sales Co., Ltd. v. Juliette Shulof Furs, Inc.Document4 pagesFinnish Fur Sales Co., Ltd. v. Juliette Shulof Furs, Inc.Ngỗng Ngáo NgácNo ratings yet

- Sales of Goods ActDocument9 pagesSales of Goods ActSankalp AgarwalNo ratings yet

- List of Residential Properties of Panchkula Zone For Auction On Dated 04.08.2022Document3 pagesList of Residential Properties of Panchkula Zone For Auction On Dated 04.08.2022Yogesh MittalNo ratings yet

- CIVIL LAW REVIEW II OBLIGATIONS AND CONTRACTSDocument94 pagesCIVIL LAW REVIEW II OBLIGATIONS AND CONTRACTSKateBarrionEspinosaNo ratings yet

- 5G Spectrum Auction - AssignmentDocument3 pages5G Spectrum Auction - AssignmentSANJIT PANIGRAHINo ratings yet

- 18ardennes RulesDocument20 pages18ardennes RulestobymaoNo ratings yet

- Unpacking Sourcing Business ModelsDocument37 pagesUnpacking Sourcing Business ModelsAlan Veeck100% (3)

- Pubbid030520ncr (ND)Document15 pagesPubbid030520ncr (ND)Susie SotoNo ratings yet

- DOCDocument207 pagesDOCdhaktodesatyajitNo ratings yet

- MBA 525 Chapter SummaryDocument38 pagesMBA 525 Chapter Summarystacy KairuNo ratings yet

- Final Exam 2007Document6 pagesFinal Exam 2007vuduyducNo ratings yet

- ProcurementDocument12 pagesProcurementHabtamuNo ratings yet

- Presented By:: Sooraja Nambiar Ravi ShahDocument17 pagesPresented By:: Sooraja Nambiar Ravi Shahhotrev86100% (2)

- RA Document RA DetailsDocument4 pagesRA Document RA DetailsSanjay BhagwatNo ratings yet

- Everything but the kitchen sink: Defining mutual mistakes in contractsDocument8 pagesEverything but the kitchen sink: Defining mutual mistakes in contractsBlessing ManezhuNo ratings yet

- Executive SummaryDocument13 pagesExecutive SummaryTuấn Anh Hoàng100% (1)

- Mts Journal v33 q1 Jan2017Document107 pagesMts Journal v33 q1 Jan2017Bagus Deddy Andri100% (1)

- Full CatalogueDocument128 pagesFull Cataloguemohammed naveedNo ratings yet

- Gr. Reggane - Tender No - cfb-REG-0270-19 - Provision of Fishing ServicesDocument1 pageGr. Reggane - Tender No - cfb-REG-0270-19 - Provision of Fishing ServicesOussama AmaraNo ratings yet

- Bid Evaluation MatrixDocument1 pageBid Evaluation MatrixLXN 6176No ratings yet

- Bayleys Real Estate Auction Results 24 Feb 2010Document2 pagesBayleys Real Estate Auction Results 24 Feb 2010Ariel LevinNo ratings yet

- Non Competitive BiddingDocument4 pagesNon Competitive BiddingSRINIVASANNo ratings yet

- Medida vs. CADocument1 pageMedida vs. CANiñoMaurinNo ratings yet

- 6 Auctions HandoutDocument6 pages6 Auctions HandoutAman MachraNo ratings yet

- BOND TerminologiesDocument95 pagesBOND TerminologiesPranjil Agrawal100% (1)