Professional Documents

Culture Documents

Wrap-Up Exercise No. 2 Installment Sales: Problem 1

Uploaded by

Samantha DionisioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wrap-Up Exercise No. 2 Installment Sales: Problem 1

Uploaded by

Samantha DionisioCopyright:

Available Formats

WRAP-UP EXERCISE No.

2

Installment Sales

Problem 1

1. RGP, 2015

2. DGP End, 2015

3. RGP, 2016

4. DGP End, 2016

5. Net Income, 2015

6. Net Income, 2016

On January 1, 2015, DASH ONE Co. sold equipment to DASH TWO Co. on installment for 2M. Equal payments of 500,000 are to be made semi-annually

every June 30 and December 31. The carrying value of the equipment is 1,299,375. The market rate of interest is 12%. Expense for the year is 50,000.

Problem 2

1. Determine the equal semi-annual payments.

2. Determine the total realized gross profit in 2015. (installment method)

3. How much of the 2015 total collections apply to interest?

On January 1, 2015, DASH THREE Co. sold property carried in the inventory at a cost of 840,000 for 1.4M. A 10% down payment was made and the

balance payable in 4 equal installments inclusive of 6% interest, payable semi-annually every June 30 and December 31.

Problem 3

1. Prepare the adjusting entry on December 31, 2015.

2. Determine the adjusted or correct amounts of the ff:

A. Retained Earnings

B. GP Rate

C. RGP

D. DGP, end 2013-2015

E. Loss on repossession

F. Net Income

G. Gross Profit on Regular Sales

H. Total Assets

I. Total Liabilities

J. Total Shareholders Equity

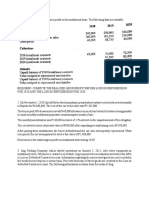

A trial balance prepared for the CUTE Corp on December 31, 2015 is given below:

The Following account balances appeared in the post-closing trial balance

at the end of 2014:

Installment Accounts Receivable, 2014 480,000

Installment Accounts Receivable, 2013 200,000

DGP, 2014 192,000

DGP, 2013 45,000

At the end of December, before preparing the trial balance, the bookkeeper

made the following incomplete entry:

Problem 4

1. Determine the RGP to be recognized at December 31, 2015.

TAX Co. sold vehicles on Installment basis. On October 1, 2015, FSRM

model costing 748,200 was sold for 1,236,000. A 2008 ADVISORY model

was accepted as down payment with a trade in value of 300,000 and the

balance payable in 36 monthly installments due starting at the end of

October plus 10% interest on diminishing balance. The ADVISORY model

has an estimated selling price of 400,000 after reconditioning the same

for 50,000. The normal gross profit, to be considered in the fair value

computation, is 10%.

That in all things, God may be glorified.

LONG TERM CONSTRUCTION CONTRACTS

Problem 1

1. How much is the Due to/ from account in 2014?

2. How much is the revenue, cost and profit in 2014?

3. How much is the RGP in 2015?

On March 1, 2013, MALAYA Co. was contracted to construct a factory building for MASAYA Co. for a total contract price of 8,400,000. The building was

completed by October 31, 2015. See the table below for the additional information.

Problem 2

1. Determine the contract revenue, contract cost and gross profit from 2013-2015.

2. Determine the Due to/ from account in 2013-2014.

3. Journalize all entries from 2013-2015.

A construction contractor has a fixed contract price for 9M to build a building. The initial amount of revenue agreed in the contract is 9M. The

contractors initial estimate of contract costs is 8M. It will take three years to build the building.

By the end of year 2013, the contractors estimate of contract costs has increased to 8,050,000. By the end of 2014, the customer approves a variation

resulting in an increase in contract revenue of 300,000 and estimated additional contract cost of 470,000. At the end of 2014, cost incurred include

100,000 for standard materials stored at the site to be used in year 2015 to complete the project. The contractor determines the percentage of completion

by calculating the proportion that contract costs incurred for work performed to date to the estimated total contract costs.

A summary of financial data during the construction period is as follows:

Problem 3

1. What is the estimated total gross profit for this contract?

2. How much is the contract price of the project?

On January 3, 2015, a fire destroyed the office building of BLISSFUL CO and destroyed all the files in the accountants desk. The president of the

company contacted you to help reconstruct the contract information. The following data were taken from the salvage files:

Problem 4

1. How much is the realized gross profit in 2013?

2. How much is the excess of CIP over progress billings or progress billing over CIP in 2014?

3. How much is the RGP in 2013?

On July 1, 2013, GLEE Corp obtained a contract to construct a building. The building was estimated to be built at a total of 5,250,000 and is scheduled

for completion on October 2015. The contract contains a penalty clause to the effect that the other party was to deduct 17,500 from the contract price

each week of delay. Completion was delayed for 3 weeks. There was an increase in the amount of 200,000 per cost escalation clause. GLEE Corp uses the

percentage of completion method. Below are the data

That in all things, God may be glorified.

That in all things, God may be glorified.

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- Revenue RecognitionDocument6 pagesRevenue RecognitionnaserNo ratings yet

- Ho P2 06 PDFDocument2 pagesHo P2 06 PDFcerapyaNo ratings yet

- p2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesp2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1AGNES CASTILLONo ratings yet

- Lecture 5 Events After The Reporting Period Multiple ChoiceDocument7 pagesLecture 5 Events After The Reporting Period Multiple ChoiceJeane Mae Boo0% (1)

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- DocxDocument4 pagesDocxMingNo ratings yet

- ACC1101-MT Exam Q-Sem2-22-23Document5 pagesACC1101-MT Exam Q-Sem2-22-23aainaazam04No ratings yet

- AS Financial Corporate Reporting May Jun 2016Document5 pagesAS Financial Corporate Reporting May Jun 2016swarna dasNo ratings yet

- AP 2001 - Students PDFDocument15 pagesAP 2001 - Students PDFdave excelleNo ratings yet

- Tutorial 13 & 14 (Exercise)Document2 pagesTutorial 13 & 14 (Exercise)Vidya IntaniNo ratings yet

- FDNACCT Quiz-3 Set-C Answer-KeyDocument4 pagesFDNACCT Quiz-3 Set-C Answer-KeyPia DigaNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- 2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFDocument25 pages2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFMae-shane SagayoNo ratings yet

- FDNACCT Quiz-3 Set-A Answer-KeyDocument4 pagesFDNACCT Quiz-3 Set-A Answer-KeyPia DigaNo ratings yet

- AFARicpaDocument23 pagesAFARicpaRegine YbañezNo ratings yet

- FDNACCT Quiz-3 Set-B Answer-KeyDocument4 pagesFDNACCT Quiz-3 Set-B Answer-KeyPia DigaNo ratings yet

- Quizzer 1 - Pas 8 and Cash/accrual, Single EntryDocument10 pagesQuizzer 1 - Pas 8 and Cash/accrual, Single Entryjaleummein100% (1)

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- Quiz No. 2Document3 pagesQuiz No. 2abbyNo ratings yet

- Comprehensive Exam EDocument10 pagesComprehensive Exam Ejdiaz_646247100% (1)

- AFAR FinalMockBoard ADocument11 pagesAFAR FinalMockBoard ACattleyaNo ratings yet

- IFRS 15 Questions 02042024 122821pmDocument4 pagesIFRS 15 Questions 02042024 122821pmAbdullah ButtNo ratings yet

- Quiz 1. Special Revenue RecognitionDocument6 pagesQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.No ratings yet

- 8th PICPA National Accounting Quiz ShowdownDocument28 pages8th PICPA National Accounting Quiz Showdownrcaa04No ratings yet

- Ho P2 06Document2 pagesHo P2 06Kriza Sevilla Matro50% (2)

- Mid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesDocument7 pagesMid-Term Exam: Professor: Kevin Petit-Frère Duration: 180 MinutesAbby Hacther0% (2)

- Nfjpia Nmbe Auditing 2017 AnsDocument9 pagesNfjpia Nmbe Auditing 2017 AnsBriana DizonNo ratings yet

- Tax3226N 3247N October 2024 AssignmentDocument10 pagesTax3226N 3247N October 2024 AssignmentKeaTumi Bokang LeagoNo ratings yet

- Correction of ErrorsDocument4 pagesCorrection of ErrorsKris Van HalenNo ratings yet

- Rmbe FarDocument15 pagesRmbe FarMiss Fermia0% (1)

- AFAR 4.0 Revenue Recognition Drill/AssessmentDocument7 pagesAFAR 4.0 Revenue Recognition Drill/AssessmentLOUISE ELIJAH GACUANNo ratings yet

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocument11 pagesName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaNo ratings yet

- TH THDocument8 pagesTH THM Noaman AkbarNo ratings yet

- Practice Exercise 1.1Document4 pagesPractice Exercise 1.1leshz zynNo ratings yet

- Guided Exercises Current Liabilities PDFDocument4 pagesGuided Exercises Current Liabilities PDFlexfred55No ratings yet

- Long Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeDocument5 pagesLong Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeMichael Brian TorresNo ratings yet

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Document5 pagesLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- Afar QuestionsDocument16 pagesAfar Questionspopsie tulalianNo ratings yet

- Finac3 Quiz1 PrelimsDocument2 pagesFinac3 Quiz1 PrelimsGloria BeltranNo ratings yet

- Diagnostic Exam 1.23 AKDocument13 pagesDiagnostic Exam 1.23 AKmarygraceomacNo ratings yet

- 9.liability Questionnaire QUIZDocument10 pages9.liability Questionnaire QUIZMark GaerlanNo ratings yet

- Local Media3172437425380563588Document20 pagesLocal Media3172437425380563588Candy SchrendiNo ratings yet

- Ad2 1Document13 pagesAd2 1MarjorieNo ratings yet

- Afar 3Document7 pagesAfar 3Diana Faye CaduadaNo ratings yet

- Actrev 3 - Adfina 1 - 2016NDocument4 pagesActrev 3 - Adfina 1 - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- 08 Long Term Construction ContractsDocument2 pages08 Long Term Construction ContractsErineNo ratings yet

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaNo ratings yet

- Comprehensiveexam eDocument10 pagesComprehensiveexam eNghiaBuiQuangNo ratings yet

- Account OneDocument2 pagesAccount Onehana kibebewNo ratings yet

- AdjustmentDocument5 pagesAdjustmentBeta TesterNo ratings yet

- Qa - Installment SalesDocument3 pagesQa - Installment SalesSittie Ainna Acmed UnteNo ratings yet

- Practical Accounting 2 ReviewDocument42 pagesPractical Accounting 2 ReviewJason BautistaNo ratings yet

- PreQB QuestionnaireDocument6 pagesPreQB QuestionnaireLeenNo ratings yet

- Local Media2481017670403448793 1Document3 pagesLocal Media2481017670403448793 1Drie LimNo ratings yet

- ACCExpanded Opportunity Part 1Document4 pagesACCExpanded Opportunity Part 1Hilarie JeanNo ratings yet

- Afar Construction Contracts PDFDocument10 pagesAfar Construction Contracts PDFArah Opalec0% (1)

- UCDocument2 pagesUCJohn Alden NatividadNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Equals On The Verge of Disagreement in DDocument164 pagesEquals On The Verge of Disagreement in DSamantha DionisioNo ratings yet

- Accounting Basics: For Beginners Dr. P. SreelakshmiDocument19 pagesAccounting Basics: For Beginners Dr. P. SreelakshmiridhiNo ratings yet

- Destination Choice by Young Australian TDocument18 pagesDestination Choice by Young Australian TSamantha DionisioNo ratings yet

- Accounting Basics: For Beginners Dr. P. SreelakshmiDocument19 pagesAccounting Basics: For Beginners Dr. P. SreelakshmiridhiNo ratings yet

- SalesDocument1 pageSalesSamantha DionisioNo ratings yet

- Destination Choice by Young Australian TDocument18 pagesDestination Choice by Young Australian TSamantha DionisioNo ratings yet

- Equals On The Verge of Disagreement in DDocument164 pagesEquals On The Verge of Disagreement in DSamantha DionisioNo ratings yet

- ScienceDocument1 pageScienceSamantha DionisioNo ratings yet

- Income TaxationDocument6 pagesIncome TaxationimaNo ratings yet

- Corp Reviewer - LadiaDocument87 pagesCorp Reviewer - Ladiadpante100% (6)

- Wrap-Up Exercise No. 2 Installment Sales: Problem 1Document3 pagesWrap-Up Exercise No. 2 Installment Sales: Problem 1Samantha Dionisio0% (1)

- OBLICON Super ReviewerDocument110 pagesOBLICON Super ReviewerStefan Salvator81% (16)

- OBLICON ReviewerDocument54 pagesOBLICON ReviewerMaria Diory Rabajante93% (301)

- OBLICON ReviewerDocument54 pagesOBLICON ReviewerMaria Diory Rabajante93% (301)

- Cost Accounting: Concepts and Terminologies By: Sir Ralph Dimaala, CPA/MBADocument21 pagesCost Accounting: Concepts and Terminologies By: Sir Ralph Dimaala, CPA/MBASamantha DionisioNo ratings yet

- Cost Accounting: Concepts and Terminologies By: Sir Ralph Dimaala, CPA/MBADocument21 pagesCost Accounting: Concepts and Terminologies By: Sir Ralph Dimaala, CPA/MBASamantha DionisioNo ratings yet

- Cost AccoutingDocument49 pagesCost AccoutingSamantha DionisioNo ratings yet

- Corporation LawDocument181 pagesCorporation LawRodil FlanciaNo ratings yet

- Factory Overhead - RFDDocument32 pagesFactory Overhead - RFDSamantha DionisioNo ratings yet

- Cost Allocation by Dept. - RFD - 1Document39 pagesCost Allocation by Dept. - RFD - 1Samantha DionisioNo ratings yet

- Taxation Law ReviewerDocument39 pagesTaxation Law ReviewerSamantha DionisioNo ratings yet

- Accounting For Labor - RFDDocument26 pagesAccounting For Labor - RFDSamantha DionisioNo ratings yet

- Tax 2 Reviewer LectureDocument13 pagesTax 2 Reviewer LectureShiela May Agustin MacarayanNo ratings yet

- Module 13 - Inventories: IFRS Foundation: Training Material For The IFRSDocument47 pagesModule 13 - Inventories: IFRS Foundation: Training Material For The IFRSSamantha DionisioNo ratings yet

- 2 - Lean Management From The Ground Up in The Middle EastDocument7 pages2 - Lean Management From The Ground Up in The Middle EastTina UniyalNo ratings yet

- BUSI 400 - Group Case 1Document18 pagesBUSI 400 - Group Case 1reddawg213No ratings yet

- Businessware Technologies - Adempiere PresentationDocument32 pagesBusinessware Technologies - Adempiere Presentationsyedasim66No ratings yet

- BAT 4M Chapt 1 All SolutionsDocument78 pagesBAT 4M Chapt 1 All Solutionstasfia_khaledNo ratings yet

- Tle 7Document7 pagesTle 7Huricane SkyNo ratings yet

- Timetable For DGDDocument5 pagesTimetable For DGDThachiayane ChandranNo ratings yet

- TSN Banking 2016-2017 1st ExamDocument18 pagesTSN Banking 2016-2017 1st ExamSanchez RomanNo ratings yet

- PCIB V CADocument1 pagePCIB V CAVener Angelo MargalloNo ratings yet

- People and Markets MKDocument3 pagesPeople and Markets MKVarga CasianaNo ratings yet

- MS Preweek QuizzerDocument23 pagesMS Preweek QuizzerJun Guerzon PaneloNo ratings yet

- Flashcards Becker U2 P1Document18 pagesFlashcards Becker U2 P1Mohamed ElbariNo ratings yet

- C D D J T: Omplaint For Amages and Emand For URY RialDocument37 pagesC D D J T: Omplaint For Amages and Emand For URY Rialgmaddaus100% (3)

- tGr09TG ICTDocument116 pagestGr09TG ICTRislan MohammedNo ratings yet

- Packplus 2018 - Exhibitors Details Invitation Show Area Stand No. Hall Form 1 Status Zone GST NumberDocument75 pagesPackplus 2018 - Exhibitors Details Invitation Show Area Stand No. Hall Form 1 Status Zone GST NumberTruck Trailer & Tyre ExpoNo ratings yet

- Magic Quadrant For Content-Aware Data Loss PreventionDocument16 pagesMagic Quadrant For Content-Aware Data Loss PreventionpfvNo ratings yet

- Presentation On SBU Analysis of Bashundhara GroupDocument16 pagesPresentation On SBU Analysis of Bashundhara Groupmanagement 149100% (3)

- RESEARCHDocument44 pagesRESEARCHJereline OlivarNo ratings yet

- Small: Manufacturing EnterprisesDocument378 pagesSmall: Manufacturing EnterprisesEdictedNo ratings yet

- EntrepDocument30 pagesEntrepTrixie Delos Santos100% (1)

- FEIGENBAUM + Ishikawa + TaguchiDocument7 pagesFEIGENBAUM + Ishikawa + Taguchiaulia rakhmawatiNo ratings yet

- Retail Scenario in India Cii ReportDocument21 pagesRetail Scenario in India Cii Reportapi-3823513100% (1)

- 3 - DS SATK Form - Change of Ownership 1.2Document3 pages3 - DS SATK Form - Change of Ownership 1.2Maybielyn DavidNo ratings yet

- MCD MarketingDocument6 pagesMCD MarketingdjsexxxNo ratings yet

- Us 20190016231 A 1Document27 pagesUs 20190016231 A 1Fred Lamert100% (1)

- Corporate Social Responsibility Practices in Garments Sector of Bangladesh, A Study of Multinational Garments, CSR View in Dhaka EPZDocument11 pagesCorporate Social Responsibility Practices in Garments Sector of Bangladesh, A Study of Multinational Garments, CSR View in Dhaka EPZAlexander DeckerNo ratings yet

- Marketing AssignmentDocument11 pagesMarketing AssignmentDr Varghese JosephNo ratings yet

- Government BorrowingDocument19 pagesGovernment BorrowingMajid AliNo ratings yet

- LAB Task 2Document15 pagesLAB Task 2FaezzRaNo ratings yet

- My - Invoice - 2 Aug 2021, 23 - 01 - 47 - 300573249965Document2 pagesMy - Invoice - 2 Aug 2021, 23 - 01 - 47 - 300573249965Bibhor KumarNo ratings yet

- SAFe 4 Scrum Master Exam Study Guide (4.6)Document21 pagesSAFe 4 Scrum Master Exam Study Guide (4.6)Carlos Alberto Porras Porta100% (1)