Professional Documents

Culture Documents

Econ 431

Uploaded by

Arima Chatterjee0 ratings0% found this document useful (0 votes)

13 views2 pagesTopics in eco

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTopics in eco

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesEcon 431

Uploaded by

Arima ChatterjeeTopics in eco

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

UG FOURTH SEMESTER

Paper 431 Elements of Financial Economics FM: 50

Module 1 Theories of Corporate Finance 30

Unit 1 Introduction - Corporate Finance, Corporate Firm and its goals:

basic concepts and ideas 02

Unit 2 Corporate Financial Reporting - Overview of financial

statement analysis, Structure of Financial Statements: Balance

Sheet, Income Statement, Statement of Cash Flow, Financial

Ratios and Financial Statement Analysis 06

Unit 3 Capital Budgeting Decision of firms - Introduction to risk, return

and opportunity cost of capital: measuring portfolio risk,

diversification and risk, limits to diversification, Capital Asset

Pricing Model 12

Unit 4 Theories of Capital Structure - capital structure and the pie

theory, Maximizing firm value versus maximizing stockholders

interest, Financial Leverage and Firm Value Modigliani and

Miller Propositions. 10

Reference:

Sharpe, W.F, Alexander, G.J. and Bailey, J.F. (2000),

Investments, Prentice Hall of India Pvt. Ltd., 5 th Edition.

Module 2 Introduction to financial markets 10

Introduction to stock market, bond market and money market,

their functions

Reference:

Bhole, L.M. and Mahakud, J. (2009), Financial Institutions and

Markets: Structure, Growth and Innovations, Tata McGraw-Hill

Education, 5th Edition.

Module 3 Elements of International Finance 24

Unit 1 The foreign exchange market, participants, characteristics and 02

operations

Unit 2 The Spot market- organization of the interbank spot market,

direct, indirect and cross rates, Bid-ask spread, triangular

arbitrage 04

Unit 3 Foreign Exchange Exposure and Risk Management concepts

only 10

Unit 4 Introduction to currency derivative - brief description of

forward, futures and options market operations 04

Unit 5 Multinational corporations origin, growth and operations 04

Reference:

Levi, M.D. (2005), International Finance, Routledge

Shapiro, A.C. (2003), Multinational Financial Management, John

Wiley and Sons, Inc. 7th Edition.

You might also like

- MBA 3 Electives PDFDocument20 pagesMBA 3 Electives PDFSanika YadavNo ratings yet

- Il - 401 - Finance Management PDFDocument2 pagesIl - 401 - Finance Management PDFKairavi BhattNo ratings yet

- BBA 6 Sem Fin PDFDocument8 pagesBBA 6 Sem Fin PDFvidyashree patilNo ratings yet

- BBA SyllabusDocument8 pagesBBA SyllabussmartculboflacmNo ratings yet

- FS FSMDocument3 pagesFS FSMAniketh KNo ratings yet

- Syllabus-PGDFM: Course I: Financial ManagementDocument6 pagesSyllabus-PGDFM: Course I: Financial ManagementShekhar MishraNo ratings yet

- Law of Corporate FinanceDocument3 pagesLaw of Corporate FinanceAbdul Qadir Juzer AeranpurewalaNo ratings yet

- Emba III Sem FinanceDocument10 pagesEmba III Sem Financejpaladi.2014No ratings yet

- DSS 004Document2 pagesDSS 004Rakesh SharmaNo ratings yet

- MFMC0001: Business Environment and Management Practices: ObjectivesDocument16 pagesMFMC0001: Business Environment and Management Practices: ObjectivesIshan SharmaNo ratings yet

- Financial Markets, Institutions and Services (SAPR)Document4 pagesFinancial Markets, Institutions and Services (SAPR)VampireNo ratings yet

- Syllabus IIP (MBA 4th Sem)Document7 pagesSyllabus IIP (MBA 4th Sem)Shakun VidyottamaNo ratings yet

- MMS Financial Markets and Institutions 1Document167 pagesMMS Financial Markets and Institutions 1Sonali MoreNo ratings yet

- Orporate Inance S: Vii & Ix BA - LL.B. (H .) S: J N 2016: D - Y. P RDocument5 pagesOrporate Inance S: Vii & Ix BA - LL.B. (H .) S: J N 2016: D - Y. P RNaveen SihareNo ratings yet

- MBA FIN 2nd YrDocument11 pagesMBA FIN 2nd Yryaseen_hihNo ratings yet

- Forth Sem Syllabus-29805Document27 pagesForth Sem Syllabus-29805SharmaDeepNo ratings yet

- CLS-Corporate Finance (Hons.)Document5 pagesCLS-Corporate Finance (Hons.)Satyam JainNo ratings yet

- Sub. Code: MBA-401 Credits: 03: Total Marks: 100 Minimum Pass Marks: 40%Document8 pagesSub. Code: MBA-401 Credits: 03: Total Marks: 100 Minimum Pass Marks: 40%Subhra PalNo ratings yet

- MBA 915-18 International Finance and Financial Derivatives: Unit IDocument3 pagesMBA 915-18 International Finance and Financial Derivatives: Unit IRk BainsNo ratings yet

- Syallabus Corporate Finance 2 ModuleDocument1 pageSyallabus Corporate Finance 2 ModuleDharamveer SharmaNo ratings yet

- Finm551:Corporate Finance - Ii: Course OutcomesDocument2 pagesFinm551:Corporate Finance - Ii: Course OutcomesGAGAN SINGHNo ratings yet

- BBA-F603 Financial Institutions and MarketDocument2 pagesBBA-F603 Financial Institutions and Marketraja14feb2000No ratings yet

- Year Plan XII Eco 2024 25Document4 pagesYear Plan XII Eco 2024 25TOMY PERIKOROTTE CHACKONo ratings yet

- IFS SyllabusDocument2 pagesIFS SyllabusLAKSHMIDHARNo ratings yet

- CO PO SAMPLE syllabus-FMIDocument5 pagesCO PO SAMPLE syllabus-FMISonali MoreNo ratings yet

- BFM Sem Vi 1920Document8 pagesBFM Sem Vi 1920Hitesh BaneNo ratings yet

- Investment ManagementDocument3 pagesInvestment Management29_ramesh170No ratings yet

- Fundamentals of Financial Management: (Theory and Practicals)Document15 pagesFundamentals of Financial Management: (Theory and Practicals)tawandaNo ratings yet

- Second Semester BirDocument8 pagesSecond Semester BirUrvashi KumariNo ratings yet

- Syllabus Mba - Iind Year FinanceDocument6 pagesSyllabus Mba - Iind Year FinanceTheRHKapadiaCollegeNo ratings yet

- IV AccDocument9 pagesIV AccAzharNo ratings yet

- Master of Business Administration 4 SemesterDocument7 pagesMaster of Business Administration 4 SemesterRupal DhimanNo ratings yet

- FM 05Document3 pagesFM 05roshandd2001No ratings yet

- Course Outline All in OneDocument50 pagesCourse Outline All in OneMillionNo ratings yet

- 3rd Trim SyllabusDocument12 pages3rd Trim Syllabusகார்த்திக் ஆனந்த்No ratings yet

- T2015-Introduction To Financial Markets & InstitutionsDocument5 pagesT2015-Introduction To Financial Markets & InstitutionsvikasNo ratings yet

- Business Finance Course Outline & NotesDocument173 pagesBusiness Finance Course Outline & NotesramboNo ratings yet

- RBI Grade B Syllabus Phase 2 For StudyDocument3 pagesRBI Grade B Syllabus Phase 2 For Studyahil XO1BDNo ratings yet

- 3790 - Download - M.A. Economics Syllb FinalDocument5 pages3790 - Download - M.A. Economics Syllb FinalAyushi PatelNo ratings yet

- IV SemesterDocument7 pagesIV Semesterswetha52No ratings yet

- Mcom Syllabus-11-13Document3 pagesMcom Syllabus-11-13Ram YadavNo ratings yet

- 1.1: Accounting Conventions and Standards ObjectivesDocument6 pages1.1: Accounting Conventions and Standards ObjectivesbijuNo ratings yet

- Annexure - V: Mba (Full-Time & Part-Time) and Mib Courses List of ElectivesDocument21 pagesAnnexure - V: Mba (Full-Time & Part-Time) and Mib Courses List of ElectivesRizzy PopNo ratings yet

- Syllabus: Bachelor of Business ManagementDocument5 pagesSyllabus: Bachelor of Business ManagementIsmail AzadNo ratings yet

- BBA (FIA) Revised Syllabus 2019Document15 pagesBBA (FIA) Revised Syllabus 2019SD HAWKNo ratings yet

- Security Analysis and Portfolio ManagementDocument2 pagesSecurity Analysis and Portfolio Managementgarima50% (2)

- Sem 2 SyllabusDocument49 pagesSem 2 SyllabushankschraderimpNo ratings yet

- Fassh Bbe Sem 2Document11 pagesFassh Bbe Sem 2Areena KumariNo ratings yet

- Third Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementDocument58 pagesThird Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementsukeshNo ratings yet

- Syllabus 2020-22 FINTECHDocument58 pagesSyllabus 2020-22 FINTECHsukeshNo ratings yet

- SyllabusDocument8 pagesSyllabusyamumini07100% (1)

- MBA-Financial AdministrationDocument38 pagesMBA-Financial Administrationanjalibhopale1169No ratings yet

- CourseplanDocument6 pagesCourseplanManleen KaurNo ratings yet

- Syllabus Management of Financial ServicesDocument2 pagesSyllabus Management of Financial ServicesGURU SWARUPNo ratings yet

- Paper NO. BCH 5.4 (B) - Financial Markets, Institutions and ServicesDocument6 pagesPaper NO. BCH 5.4 (B) - Financial Markets, Institutions and Servicessuccess keyNo ratings yet

- Institute For Excellence in Higher Education (IEHE), Bhopal: B.A. (HONOURS) : SemesterDocument1 pageInstitute For Excellence in Higher Education (IEHE), Bhopal: B.A. (HONOURS) : SemesterSamkit ParetaNo ratings yet

- The Theory and Practice of Investment Management: Asset Allocation, Valuation, Portfolio Construction, and StrategiesFrom EverandThe Theory and Practice of Investment Management: Asset Allocation, Valuation, Portfolio Construction, and StrategiesNo ratings yet

- Behavioral Finance: Investors, Corporations, and MarketsFrom EverandBehavioral Finance: Investors, Corporations, and MarketsRating: 3.5 out of 5 stars3.5/5 (1)

- Advanced Bond Portfolio Management: Best Practices in Modeling and StrategiesFrom EverandAdvanced Bond Portfolio Management: Best Practices in Modeling and StrategiesNo ratings yet

- 6 Brands That Are Building Social Movements: Lena Roland Source: Warc Opinion, Lena RolandDocument4 pages6 Brands That Are Building Social Movements: Lena Roland Source: Warc Opinion, Lena RolandArima ChatterjeeNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Financial Habits: 21st Century Jam Jar Banking: Crawford Hollingworth Source: The Behavioural Architects, January 2015Document11 pagesFinancial Habits: 21st Century Jam Jar Banking: Crawford Hollingworth Source: The Behavioural Architects, January 2015Arima ChatterjeeNo ratings yet

- American Bar Association Antitrust Law JournalDocument11 pagesAmerican Bar Association Antitrust Law JournalArima ChatterjeeNo ratings yet

- Recurrent Pyoderma in A Golden Retriever: Make Your DiagnosisDocument2 pagesRecurrent Pyoderma in A Golden Retriever: Make Your DiagnosisArima ChatterjeeNo ratings yet

- Q1. Gender: Male Female OtherDocument5 pagesQ1. Gender: Male Female OtherArima ChatterjeeNo ratings yet

- Nestlé Ok Nestlé Tell Me More AbDocument10 pagesNestlé Ok Nestlé Tell Me More AbArima ChatterjeeNo ratings yet

- Strategic Themes in Food and Nutrition: Coronavirus Update: September 2020Document34 pagesStrategic Themes in Food and Nutrition: Coronavirus Update: September 2020Arima ChatterjeeNo ratings yet

- A New View On The Market For Protein BarsDocument25 pagesA New View On The Market For Protein BarsArima ChatterjeeNo ratings yet

- Biscuits and Snack BarsDocument2 pagesBiscuits and Snack BarsArima ChatterjeeNo ratings yet

- Nielsen Featured Insights - Biting Into The Indian Snacking MarketDocument8 pagesNielsen Featured Insights - Biting Into The Indian Snacking MarketSamyak Spartacus JainNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentArima ChatterjeeNo ratings yet

- How Covid-19 Is Shaping The Snacks Market in IndiaDocument13 pagesHow Covid-19 Is Shaping The Snacks Market in IndiaArima ChatterjeeNo ratings yet

- Name of Range One Liner Value Proposition Nutrition & Indulgence in A Crunch Category Locally Sourced: Vocal For LocalDocument3 pagesName of Range One Liner Value Proposition Nutrition & Indulgence in A Crunch Category Locally Sourced: Vocal For LocalArima ChatterjeeNo ratings yet

- Ad AnalysisDocument4 pagesAd AnalysisArima ChatterjeeNo ratings yet

- The Big 15: Strategies and Priorities of Top Packaged Food Players in ComparisonDocument35 pagesThe Big 15: Strategies and Priorities of Top Packaged Food Players in ComparisonArima ChatterjeeNo ratings yet

- Effective Content Strategy Report Lessons From The 2019 WARC AwardsDocument36 pagesEffective Content Strategy Report Lessons From The 2019 WARC AwardsArima ChatterjeeNo ratings yet

- Market Entry Strategy For Nivea Face Was PDFDocument28 pagesMarket Entry Strategy For Nivea Face Was PDFJammigumpula PriyankaNo ratings yet

- Demographic Profile India 2016 UpdatedDocument2 pagesDemographic Profile India 2016 UpdatedArima ChatterjeeNo ratings yet

- Ad Analysis - QuestionsDocument9 pagesAd Analysis - QuestionsArima ChatterjeeNo ratings yet

- Case WorkshopDocument26 pagesCase WorkshopAnonymous 6evPjkcE67% (3)

- IIMA Casebook 2nd EditionDocument101 pagesIIMA Casebook 2nd Editionmanav fakey100% (2)

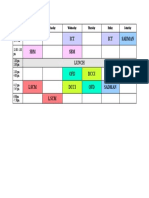

- ICT ICT Sadman SBM SBM Lunch OFD Dcci LSCM Dcci OFD Sadman LSCMDocument1 pageICT ICT Sadman SBM SBM Lunch OFD Dcci LSCM Dcci OFD Sadman LSCMArima ChatterjeeNo ratings yet

- Twix A Tale of Two Bars - How STDocument19 pagesTwix A Tale of Two Bars - How STArima ChatterjeeNo ratings yet

- Case Approach Crasher: Market Entry Strategy For Renault DusterDocument27 pagesCase Approach Crasher: Market Entry Strategy For Renault DusterArima Chatterjee100% (1)

- Marketing Prep MFDocument31 pagesMarketing Prep MFArima ChatterjeeNo ratings yet

- New Text DocumentDocument2 pagesNew Text DocumentArima ChatterjeeNo ratings yet

- Marketing PrepDocument521 pagesMarketing PrepArima ChatterjeeNo ratings yet

- GTM PrimerDocument2 pagesGTM PrimerArima ChatterjeeNo ratings yet

- 01 Summarized Kotler PDFDocument26 pages01 Summarized Kotler PDFMridulJainNo ratings yet

- Bdo Cash It Easy RefDocument2 pagesBdo Cash It Easy RefJC LampanoNo ratings yet

- Case Study 5Document3 pagesCase Study 5Farhanie NordinNo ratings yet

- The Economics of Tourism and HospitalityDocument38 pagesThe Economics of Tourism and HospitalityStraichea Mae TabanaoNo ratings yet

- Offer LetterDocument3 pagesOffer LetterAditya GadgilNo ratings yet

- P5-1A Dan P5-2ADocument6 pagesP5-1A Dan P5-2ASherly Meliana Geraldine100% (1)

- The General Ledger of Corso Care Corp A Veterinary CompanyDocument2 pagesThe General Ledger of Corso Care Corp A Veterinary CompanyBube KachevskaNo ratings yet

- Differences Between A Partnership and CorporationDocument4 pagesDifferences Between A Partnership and CorporationIvan BendiolaNo ratings yet

- NISM Series XXII Fixed Income Securities Workbook May 2021Document182 pagesNISM Series XXII Fixed Income Securities Workbook May 2021Karthick S Nair100% (2)

- Taxation (Mock Exam)Document16 pagesTaxation (Mock Exam)shahirah rahimNo ratings yet

- Role of Merchant BanksDocument20 pagesRole of Merchant BanksSai Bhaskar Kannepalli100% (1)

- 2013 Annual Report EditorialDocument55 pages2013 Annual Report EditorialbabydreaNo ratings yet

- Salon Business Plan For Starting Your Own Beauty Salon ServiceDocument97 pagesSalon Business Plan For Starting Your Own Beauty Salon ServiceAlhaji Daramy100% (5)

- Chap015 Auditing Debt and Equity CapitalDocument31 pagesChap015 Auditing Debt and Equity CapitalStevia Tjioe100% (6)

- Business Partner Configuration in SAP REFXDocument3 pagesBusiness Partner Configuration in SAP REFXdrdjdNo ratings yet

- Foreign Direct InvestmentDocument16 pagesForeign Direct InvestmentKuz StifflerNo ratings yet

- A Study On Training & Development of HDFC Bank: Project TitledDocument91 pagesA Study On Training & Development of HDFC Bank: Project Titleddolare07No ratings yet

- Muhammad Alfarizi - 142200278 - Ea-J - Tugas 2 Ap2Document4 pagesMuhammad Alfarizi - 142200278 - Ea-J - Tugas 2 Ap2Muhammad AlfariziNo ratings yet

- Vansh Pandhi - IGCSE Accounting Revision 21122021 Tuesday Work EmptyDocument3 pagesVansh Pandhi - IGCSE Accounting Revision 21122021 Tuesday Work EmptyVansh PandhiNo ratings yet

- Financial Reporting Standards Council (FRSC)Document43 pagesFinancial Reporting Standards Council (FRSC)Pam G.No ratings yet

- Ife761 Final AssessmentDocument12 pagesIfe761 Final AssessmentElySya SyaNo ratings yet

- Sign-Up Form For The Direct Express Card For Benefit PaymentsDocument2 pagesSign-Up Form For The Direct Express Card For Benefit PaymentsDawn Calvin67% (3)

- Chapter 11 Foreign ExchangeDocument55 pagesChapter 11 Foreign ExchangeAfzal Kabir DipuNo ratings yet

- Finance Problem Set 1Document4 pagesFinance Problem Set 1Hamid Yaghoubi0% (1)

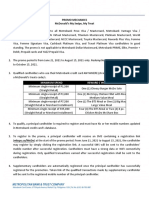

- 2021 - MSMT (McDonald's) - Promo Mechanics - 0620Document4 pages2021 - MSMT (McDonald's) - Promo Mechanics - 0620kheriane veeNo ratings yet

- Balance Sheet of Eicher Motors For MonicaDocument4 pagesBalance Sheet of Eicher Motors For MonicaBBA SFNo ratings yet

- Housing ReportDocument6 pagesHousing ReportJasmin QuebidoNo ratings yet

- Solutions To Chapter 8 (20ebooks - Com)Document18 pagesSolutions To Chapter 8 (20ebooks - Com)T. MuhammadNo ratings yet

- What Factor Makes It To Determine The Unemployment RateDocument6 pagesWhat Factor Makes It To Determine The Unemployment RateAbdiaziz Aden SudiNo ratings yet

- ATRAM Phil Equity Smart Index Fund Fact Sheet Apr 2020Document2 pagesATRAM Phil Equity Smart Index Fund Fact Sheet Apr 2020anton clementeNo ratings yet

- Coinremitter Allows Merchants To Integrate APIDocument5 pagesCoinremitter Allows Merchants To Integrate APIPratik MehetaNo ratings yet