Professional Documents

Culture Documents

PRTC TOA First Preboard

Uploaded by

ralphalonzo0 ratings0% found this document useful (0 votes)

135 views9 pagestoa

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttoa

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

135 views9 pagesPRTC TOA First Preboard

Uploaded by

ralphalonzotoa

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

Theory of Accounts

SETA

INSTRUCTIONS: Select the best

following questions, Mark only one an:

e swer for

answer sheet provided. Strictly NO” ERASURES “sr oythe

Erasures will render your examinati WARS

Use PENCILNO. 2 only, GOODLUCKI.» NST Sheet INVALID,

answer for each of the

@ Financial Reporting Stand:

oe anes 19 Standards Council (FRSC) was

o a. The it

. The - Phil

The-Phippine Institute of Certified Public Accountants

b. The Board of Accountancy (BOA)

c. The Association of CPAs in Public Practice (ACPAPP)

ee and PICPA

D The chairman of the FRSC should have been or presently a

senior practitioner in

a+ Public accountancy

b. Commerce and industry

7 which statement is (are) correct regarding Pt

A” Reporting Standards (PFRSs)?

a. PFRSs set out recognition, measurement, presentation and

disclosure requirements dealing with transactions and

events that are important in general purpose financial

statements.

b. PFRSs are not designed to apply to the general purpose

financial statements and other financial reporting of all

profit-oriented entities.

c. PFRSS are designed to apply to not-for-profit activities in

\e private sector.

il of the above

age TT aid

tt

Theory of Accounts SETA

4. Which fit aad or the accounting standard-setting process

in the Phitppi

(Ux a Preparation of a draft of proposed Philippine Financial

6

4

Reporting Standards (PFRS) by a Task Force organiz.

— ea crgeanie ae

b. Exposure of the proposed draft for comments and

suggestion to PICPA members, FINEX members and other

interested parties.

c. Approval of the final PFRS by the Profession Regulation

Commission.

4. Publication in the Official Gazette or in newspaper of

gegeral circulation of the proposed draft.

5,-Sfandards approved by the FRSC include paragraphs in bold

type and plain type, which have equal authority. Paragraphs

in plain type indicate the main principles. =

boi.

‘Any limitation of the scope of a PFRS is made clear in the

standard. T

a. True, True

b. False, True

c. False, False

d. True, False

6. The Philippine Interpretation Committee (PIC) members were

¢ appointed by the ____ and include accountants in public

* D¥ practice, the academe and regulatory bodies and users of

financial statements

a. SE c, BOA

b. PRC d. FRSC

BR

7. General purpose financial statements are financial statements

prepared in accordance with a financial reporting framework

that is designed to:

3. meet the particular information needs of a wide range of

users

b, meet the particular information needs of a group of users

c. meet the common information needs of a wide range of

users.

4. meet the common information needs of a group of users

a a ey

Page TTR

een

A hich of the followin:

ke

Fage TP

SETA

statements

framework isfinco eee regarding the conceptual

a. The framework is

con

financial statements, WAN Seneral-purpose

The framework applies to financial sta

reporting enterprises beth in the priv

public sector

In cases where there is conflict be

and an PFRS, the requirement of

prevail X

b.

tements of busin

ess

ate Sector and in the

‘tween the framework

f the framework, will

FERS

‘The FRSC conceptual framework assists the FRSC -

I. In the development of PSAS

Il. In the review of existing PFRSs

IIL. In promoting the harmonization of accounting standards ?

a. Land I only ©. Ionly 7

d. UT only

1@_users of financial statements who are interested in

formation that enables them to determine whether their

a

fis, and the interest attaching to them, will be paid when

due

©. suppliers

Creditors d. investors

a. Have an interest in information about the continuance of

an enterprise especially when they have a long-term

invoivement with or are dependent on the enterprise. “ustemes”

‘Are interested in information which enables them to

assess the ability of the enterprise to provide retirement

benefits and employment opportunities. ~

Are interested in information that enables them to

determine whether their loans and the interest attaching

to them will be paid when due. Lende«>

d. Are concerned with the risk inherent in and return

provided by their investments and need information, to

ave

does,

Tok. openisthB5.14

“waewiniiccoma

zal

‘Theory of Accounts SETA

help them determine whether they should buy or sell the

lowing is a fundemental quality of useful

CC. accounting information?

a, Conservatism.

. Faithful representation.

b. Compara!

ity. d. Consistency.

py .23-According to the conceptual framework, predicive, and

+ 5 are ingredients of.

ity. Faithful representation,

No

Yes

Yes 1st choie

No.

|. Qualitative characteristics are non-quantitative aspects of an

. ys position and performance and changes in financial

A position

Under the financial capital maintenance concent, @ profit is

earned only if the physical productive capacity (or operating

capability) of the enterprise (or the resources or funds needed

to achieve that capacity) at the end of the period exceeds the

physical productive capacity at the beginning of the period,

biter excluding any distributions to, and contibutions from,

‘owners during the period. T

c. True, False

True

a. ee 4. False, True

b. False,

ISAAC the process of incorporating in the balance sheet or

income statement an item that meets the definition of an

bial nts.

element of financial statemer

a. zation . Recognition

b, Allocation d. Measurement

Fae eonnertccom.an Fon Open istPas.24

Teese rococo

A

C

Theory of Accounts

eee sera

“Which of the following

is a condit

recognition of an asset? — necessary for the

a, It is probable that future econor

mic benefits

the terse ye cost of mee te

ralabie the asset can be Measureg

b. The cost of the asset can be measured reliably

© It is probable that future econo

mic benefits wi

the enterprise or the cost of th rs

the on fe asset can be meascnes

4. It is probable that future economic

the e1 benefits will flow to

Se and the asset is paid for

“RS regards the relationshi

Framework, are the follo\

I. The Conceptual Frat

IL. In cases of cox

Framework prevai

Statement 1

ip between PFRS and the Con

cept

wing statements true or false?

mework Is a reporting standard

the requirements of the Conceptual

ver those of the relevant PS

Statement II wa

2. False True

b. True True

© False False

e FRSC Conceptual Framework identifies two fundamental

qualitative characteristics that make the information in

financial statements useful to investors, creditors and others.

‘These characteristics are:

1 Compara

Mi, Relevance.

MIL. Subjectivity.

a. Iandv

b.

Faithful Representation

Understandability.

|. Vand V

“The qualitative characteristic of Faithful Representation of

financial information means that the information are:

‘Theory of Accounts SETA

1, IH, 1V and V 11,111, IV and V only;

b. 1, Ul and IV only; d. 11, I and V only.

20.11 is the undiscounted amount of cash or cash equivalent

‘expected to be paid to satisfy the liabilities in the normal

WA course of business

a. present value: . “Settle

b. Zurrent cost 4.

A 2 Ferlying theme of the conceptu

‘a. decision usefulness. 3

b, understangability.

Two fundamental qualities that make accounting

ioh useful for decision making are

©. relevance and faithful representation.

4. reliability and comparability.

E : tude user

The,"Pam of franca Iformaton inl

2 SIP aT aS ernployees, customers, government and thei

9

he Under the financial capital concept, capi

1) productive capacity of the enterprise. T-

3 True, True true, False

b. Fale, false Gi. Fal

24, n-eéCordance with PAS 1, an entity must present additional

fe items in a statement of financial position when __suct

‘sentation is a generally accepted practice in the sector in

Which the entity operates.

An entity shall present the statement. of cash flows more

prominently than the other statements.

stor , nds, Sup

regarded as the

agencies, and the publ 5

&

1. Reliable IV. Costless. . True, False

As yautral a terial respects. a. True, True . True,

TIL. Free from erro” Complete in all ma e b. False, False d. False, True

area

Ty ‘eer Ton Openr

Pape Coe meena Ton OpentatPas Te Bae oD

sad

‘Theory of Accounts

SETA

2 25: Deferred tax assets and liabilities shail

Statement of Financial P Pe (Classified on the

mn as.noncurrent, T~

Due to measurement problems, some

, some enterprise resoun

and obligations are not reported on the Statement of Fineness

Position. "F

2. True, True c. True, False

b. False, Fal d. False, True

2 amount of any cumulative preferen :

7 Sa Preference dividends not

Jobb. names of the recipients ofthe dividends;

. addresses of all shareholders who are entitled to ri

the dividends; ini

4. asschedule of cumulative dividends paid in prior periods.

the computation of'profit? |

o r @._ Finance cost.

xe gain on change on value of available for sale

Post-tax

«

aay gain on change in value of biological assets

Vihat is the purpose of reporting comprehensive income?

jn (loss) on discontinued operations.

Be *

owners X

b. To report a measure of overall enterprise performance

¢. To replace net income with a better estimate

d. To combine income from continuing operations and

extraordinary items

Page SoH

sa

b

fi

Theory of Accounis seTA

29. The statement of changes in equity includes reconciliation

between: —S

a. the carrying amount of retained earings at the beginning

and the end of the period. X

b. the carrying amount of total equity at the beginning and

the end of the period.

‘c. the carrying amount of each component of equity at the

beginning and the end of the period separately disclosing

changes resulting from: (i) profit or loss, (i) each item of

comprehensive income, and (iii) the amounts of

Investments by, and dividends and other distributions to,

‘owners. X,

d. the carrying amount of property, plant and equipment

he following is¢fiGEan application of accrual

30. Which of the flowing 6EEEEN =P

2. Recording advertising fees earned at the time the work is

A done.

b. Recording telephone expense when the monthly bil

received.

advertising fees earned at the time the cash

payment is received.

4. Adjusting unearned advertising fees to the proper balance

at the gaé-orthe month.

a. To select and apply snap) te accounting policies

vide additional disclosures when compliance with

speci is insufficient to understand the entity's

financial position and performance,”

¢. To comply with applicable PFRS. a

4. Allaf the above

32.When preparing financial statements, management is

required to make an assessment of an enterprise’s. ability to

continue as 2 going concern which’ should be at Jeast five’

xs from the balance sheet date. =

years from the ilco. mde

astra sama Fon Open eiraS. TA

Theory of Accounts

SETA

The reporting period of an ent

erpris

the decision of management 4- eee

a. True, True ©. True, False

- False, d. False, True

ly depends on

ch _of the following losses

“comprehensive income? OC} S'S

8. losses from discontinued operations.

b. losses arising on translating the financi

foreign operation.

losses on

equipment.

losses

gnized in other

ial statements of a

the revaluation of property, plant and

Management considers extraordinary items

ch statement isifalsé?

34

First statement: Comprehensive income reports an expanded

version of income to je certain types of gains and losses

B Not included in traditional income statements.

‘Second statement: Comprehensive income is the total change

in shareholders’ equity that occurred during the period. =

a. The first statement only

b. The second statement only

¢. Both statements

oe statements

a 3

the classification of expenses by_function method is used

° for the presentation of an income statement, additional

information on the following items must be disclosed:

f % Revenue

b . expensed. Gains on revaluation of assets

extraordinary item should be reported separately on the

statement of comprehensive income as a component

Page TOF ac

“TeROpantsPOSt4

“Theory of Accounts ark

Before discontinued

Net of ‘operations of a

Income taxes segment of a business

a. Yes Yes

b. Yes No

« No No

4. No, ‘Yes

practi PAS 1, the calculation of total comprehensive

8 income includes which of the following?

Income from Distribution

Continuing operations to owners

a. No ‘No

b. Yes No

c Yes Yes

4. No Yes

38. Under PAS 1, comprehensive income includes changes in

4 equity resulting from ;

© Investments by Distributions to

Dp» Owners: owners:

Bt a No No

b. No Yes

c Yes No

a. Yes Yes

30. Are the following statements true or false, according to PAS

?

Pa § mn ions. should be recognized in the,

* Seren of tne ition, F — NOES yqircse fang?

tion surplus on_non-current, aséts

f Comprehensive

should be recognized in the statement o igh

income and not in the Statement of Changes in Equity.

Statement atement(2) Statement(1) Statement(2)

se fale true false

False true d. true tue

Assets to be sold, consumed or realized as part of the entity's

normal operating cycle are:

ROT

rea % Z

Theory of Accounts,

SETA

|. Current assets

. Non-current assets

Classified as currefit or non-current in

accordar

other criteria. nce with

. all of the’ above

>

ogo

hich statement ig{correct Foncerning the presentation of the

Statement OF Eampprehiensive Income?

a. The functi expense method means that expense:

agaiegated according. to. their nature, for men

depreciation, purchases, employee " benefits and

advertising... i yy

b. The naturé oF’ EYpense method classifies ‘expenses

according to their function as part of cost of sales, Cost of

distribution and cost of administrative activities,

¢. Because the nature of expense method or the function of

expense method has merit for the different types of

entities, the standard requires management to select the

more relevant and reliable presentation.

d. If the function of expense method is used, no additional

disclosure is required about the nature of expenses.

42. Which of the following should be disclosed in the summary of

significant accounting policies?

Composition of Inventory

plant assets pricing

a. Yes Yes.

b, No Yes

© No No

4a. Yes No

43. PAS 1 requires the use of the cost of sales method because

this presentation often provides more relevant information to

users than nature of expense method.

Notes are normally presented in the following |

summary of ‘significant accounting polices, statement of

compliance with PRFSs; supporting information for iter

+

Page TE

‘Theory of Accounts SETA

Presented on the face of the FS; and lastly, other disclosures:

Including contingent liabilities and non-financial disclosures.

a. True, True eT

b. False, False a

44, PAS 18 (Revenue) deals with

D3 Construction contracts.

b. The extraction of mineral ores.

‘A# ©. Distributions of profits to holders of equity investments in

Proportion to their holdings of a particular class of capital.

4. None of the above

45.<7h€ Stage of completion of a transaction may be determined

1D bya variety of methods including the following, except

a, Surveys of work performed.

b. Services performed to date as a percentage of total

services to be performed.

¢. The proportion that costs incurred to date bear to the

estimated total costs of the transaction.

4. Progress payments and advances received from

\

246. when the outcome of the transaction involving the rendering

7) Of services_cannot_be estimated reliably, the revenue is

recognized

© a. In reference to the stage of completion of the transaction

@& % . Only to the extent of costs incurred that are expected to

® be recoverable

‘c. Upon cash.

4. Upor compl

lection

Of the services to be rendered

477Revenue should be measured at

a. Fair value of the consideration received or receivable

b. Cost of the consideration received or receivable

c. Amount of cash received or receivable

4d. Book value of the consideration received or receivable

‘ope 137

aa owas

‘Theory of Accounts SETA

48. Interest should be recognized

9 a. On an accrual basis in accordance with the substance of

the relevant agreement.

2b. When the shareholder's right to received payment is

established.

dy _ Using the effective interest method as set out in PAS

ff 39/PFRS 9.

d. Ona time proportion basis without taking into account the

a on the asset,

49 4vccordance with PAS 18, an entity shall disclose:

’a. The accounting policies adopted for the recognition of

9 revenue including the methods adopted to determine the

6 stage of completion of transactions involving the

rendering of services.

0% b. The amount of each si

recognized during the per

c. The amount of revenue arising from exchanges of goods

or services included in each significant category of

revenue.

d. Allgéatie above.

saeaiiich of the following isnot 2 condition_for recognition of

fn ‘nue from sale of goods*— Cf

Cy vere Mite incurred or to be incurred in respect of the

transaction can be measured reliably nineues

b. The seller has transferred to the buyer signifi

; hip.

ened en vement associated with

ng, continuing involv ciated

ane control over the 9

the owparship and effective be measured reliably.

4. a Speationnt of revenue can

jal

i sidered cash for financial

52-Which of the following Is at oon

jorting purposes?

Fpetty cash funds and change und 7

. orders, certi 7

Dein, currency, and available funds

& Postdated checks and 1.0.U.'s —

Fon OpentaPis Ie

Page 14 0f 22 Bs

icant category of revenue

D

nal checks“

I

Testi

seta

52, The‘Smount reported as "Cash"

“normaly shoujseneanseseeat oO" # company’s balance sheet

2. Postdated are

Cash ina payrol serene Paveble to the company feceveh te

b.

&. Undelivered 7

@._ penty sed checks written and signed by the company,

53. If the cash balance in a company's

i Y's bank statement is m

A Hat eta Sane hs A Sateen ere

the bank has made any errors, there must be

2 Deposits credited by the bank but not yet recorded by the

“company ="

Outstanding checks x Bete a ese

5 Bbnoral amounts of wasted matenals, labor oF other

Production costs

. storage costs, unless those costs are necessary in the

production process before a further production stage

:» administrative overheads that contribute to bringing

inventories to their present location and condition

53-The weighted average inventory costing method is particularly

suitable to inventory where:

a. dissimilar products are stored in separate locations;

b. the entity. carries stocks of raw materials, workin

progress and finished goods;

¢. goods have distinct use-by dates and the goods produced

first must be sold earliest;

4d, homogeneous products are mixed together.

63. Which of the following inventory estimating procedure is

allowed even for annual reporting purposes?

Gross Profit Method —___Retail Inventory Method

a Allowed ‘Allowed

b. Not Allowed lowed

Gi Allowed Not Allowed

as Allowed Not Allowed

(The FIFO formula assumes that the items of Inventory that

were purchased or produced last_are sold first, and

J consequently the items remaining in Taventory at the end of

the period are those earlier purchased or produced. F

. _ Inventories are [Usually written down to net realizable value

D sitemby item. 7

c. True, False

d. False, True

Tee 7 oreo = Ton Openistbas ia

Prec ce An, =

SS Wh Statement S (are) Grrect Wegaruing reesngon of

_PWENENNS aS ANE? -

a PHONONS FE S

RF

PEBITADS VLE AW al ESE o

PRCOGMERE SS SLEWEENSS fh The pear the nte-cown oF

es ars F

& The amount of any reversa} of any wrte-donn of

inventores, arising from an increase in net reaizatie

value. sha be recognized as 2 rection in the emrount of

invertones recogadad as an expense in the penod 9

RK ceatzadie value of inventories may fall below cost for a

number of reasons inchuding:

1. Product obsolescence.

II. Physical deterioration of inventones.

III. An increase in the expected replacement costs of the

68. Which of the followil

a. Trees in a plant

¢. Hogs and poultry

d. Strawberry plants

a aa

ss

re Measured at fair value less costs to

ition and at each subsequent reporting

|

You might also like

- 08 Investmentquestfinal PDFDocument13 pages08 Investmentquestfinal PDFralphalonzo0% (1)

- Deductions From Gross IncomeDocument1 pageDeductions From Gross IncomeralphalonzoNo ratings yet

- FAR - Conceptual FrameworkDocument8 pagesFAR - Conceptual FrameworkralphalonzoNo ratings yet

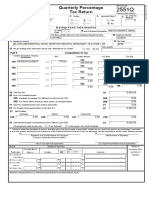

- Quarterly Percentage Tax Return: 12 - DecemberDocument1 pageQuarterly Percentage Tax Return: 12 - DecemberralphalonzoNo ratings yet

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDocument1 pageSunday Monday Tuesday Wednesday Thursday Friday SaturdayralphalonzoNo ratings yet

- PledgeDocument11 pagesPledgeralphalonzoNo ratings yet

- FAR - DerivativesDocument1 pageFAR - DerivativesralphalonzoNo ratings yet

- TAX - Gross Estate RemindersDocument2 pagesTAX - Gross Estate RemindersralphalonzoNo ratings yet

- MAS - DOL Vs DFLDocument3 pagesMAS - DOL Vs DFLralphalonzoNo ratings yet

- T02 - Capital BudgetingDocument121 pagesT02 - Capital Budgetingralphalonzo75% (4)

- RFBT - Directors and Stockholders' MeetingDocument1 pageRFBT - Directors and Stockholders' MeetingralphalonzoNo ratings yet

- HyperinflationDocument2 pagesHyperinflationralphalonzoNo ratings yet

- Afar AUD FAR MAS RFBT TAX TheoryDocument1 pageAfar AUD FAR MAS RFBT TAX TheoryralphalonzoNo ratings yet

- PRTC at 1st PreboardDocument11 pagesPRTC at 1st PreboardralphalonzoNo ratings yet

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- Estate Taxation - Oct 2017 - GCC - Self Test - Quiz 1Document4 pagesEstate Taxation - Oct 2017 - GCC - Self Test - Quiz 1ralphalonzoNo ratings yet

- Donor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2Document3 pagesDonor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2ralphalonzoNo ratings yet

- PRTC Mas First PBDocument11 pagesPRTC Mas First PBralphalonzo100% (2)

- PRTC P2 1st PreboardDocument10 pagesPRTC P2 1st PreboardRommel Royce0% (1)

- Cost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%Document10 pagesCost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%ralphalonzoNo ratings yet

- MAS.M-1405 Cost of Capital Straight ProblemsDocument12 pagesMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoNo ratings yet

- PRTC AP First PBDocument9 pagesPRTC AP First PBralphalonzoNo ratings yet

- ? (Ultipft Choice Questions: Supporting Analysis/ComputationDocument11 pages? (Ultipft Choice Questions: Supporting Analysis/Computationralphalonzo100% (1)

- A. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 MillionDocument11 pagesA. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 Millionralphalonzo100% (1)

- Quiz 12 Budgeting and Profit Planning SolutionsDocument6 pagesQuiz 12 Budgeting and Profit Planning Solutionsralphalonzo100% (1)

- 21 - Intangible AssetsDocument6 pages21 - Intangible AssetsralphalonzoNo ratings yet

- Theory of Accounts With AnswersDocument14 pagesTheory of Accounts With Answersralphalonzo100% (1)

- Partnership Exercises Answers and ExplanationsDocument25 pagesPartnership Exercises Answers and Explanationsralphalonzo100% (1)

- Theory of AccountsDocument7 pagesTheory of AccountsralphalonzoNo ratings yet

- Quiz 5 Activity Based Costing SolutionsDocument4 pagesQuiz 5 Activity Based Costing SolutionsralphalonzoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)