Professional Documents

Culture Documents

SB 2273

Uploaded by

Tyler Axness0 ratings0% found this document useful (0 votes)

11 views2 pagesAmendment would cut state funds for senior citizen programs

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAmendment would cut state funds for senior citizen programs

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesSB 2273

Uploaded by

Tyler AxnessAmendment would cut state funds for senior citizen programs

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

17.0941.02001

Title.

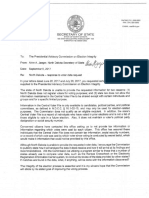

Prepared by the Legislative Council staff for

Representative Headland

March 16, 2017

PROPOSED AMENDMENTS TO ENGROSSED SENATE BILL NO. 2273

Page 1, line 1, after “A BILL" replace the remainder of the bill with “for an Act to create and

enact’a new subsection to section 11-10.1-05 of the North Dakota Century Code,

relating to fees charged by the county director of tax equalization; to amend and

reenact subsection 5 of section 57-15-56 and section 57-39,2-26.2 of the North Dakota

Century Code, relating to the senior citizen services and programs fund; and to provide

an effective date,

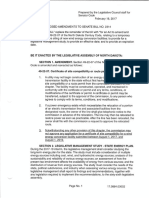

BE IT ENACTED BY THE LEGISLATIVE ASSEMBLY OF NORTH DAKOTA:

SECTION 1. Anew subsection to section 11-10.1-05 of the North Dakota

Century Code is created and enacted as follows:

‘The county director of tax equalization may charge. exceed

twenty-five dollars per parcel for information retained by the office of the

‘ounty director of tax equalization and provided to a requester in a paper

electronic format. The fee provided in this subsection does not apply to

requests for information relating to | made by the owner of the

cel or the owner's representative, The fees collected under thi

‘subsection must be placed in the county general fund to be used for

expenses related t tions of the office inty director of tax

equalization,

SECTION 2. AMENDMENT. Subsection 5 of section 57-15-56 of the North

Dakota Century Code is amended and reenacted as follows:

5,

The state treasurer shall provide matching funds as provided in this

subsection for counties for senior citizen services and programs funded as

required by this section. The grants must be made on or before March first

of each year to each eligible county. A county receiving a grant under this

section which has not levied a tax under this section shall transfer the

amount received to a city within the county which has levied a tax under

this section. A grant may not be made to any county that has not fled with

the state treasurer a written report verifying that grant funds received in the

previous year under this subsection have been budgeted for the same

purposes permitted for the expenditure of proceeds of a tax levied under

this section, The written report must be received by the state treasurer on

or before February first of each year following a year in which the reporting

‘county received grant funds under this subsection. A matching fund grant

must be provided from the senior citizen services and programs fund to

each eligible county equal to the lessor of eighty-seven and one-half

percent of the amount appropriated in dollars in the county under this

section for the taxable year, but-theor an eligible county's proportional

share of the maximum amount of grants that may be awarded under this

subsection. The matching fund grant applies only to an amount equal to a

levy of up to one mill under this section. The total amount of matching

Map 7] million

Page No. 4 ip i 0941.02001

grants provided under this subsection may not exceed three million five

hundred thousand dollars each year.

SECTION 3. AMENDMENT. Section 57-39.2-26.2 of the North Dakota Century

Code is amended and reenacted as follows:

57-39.2-26.2, Allocation of revenues to senior citizen services and

programs matching fund - Continuing appropriati

‘Notwithstanding any other provision of law, a portion of sales, use, and motor

vehicle excise tax collections equal to the lessor of the amount of revenue that would

have been generated by a levy of eighty-seven and one-half percent of one mill on the

taxable valuation of all property in the state subject to a levy under section 57-15-56 in

the previous taxable year, or three million five hundred thousand dollars, must be

deposited by the state treasurer in the senior citizen services and programs fund during

the period from July first through December thirty-first of each year. The state tax

commissioner shall certify to the state treasurer the portion of sales, use, and motor

vehicle excise tax revenues which must be deposited in the fund as determined under

this section. Revenues deposited in the senior citizen services and programs fund are

provided as a standing and continuing appropriation for allocation as provided in

subsection 5 of section 57-15-58. Any unexpended and unobligated amount in the

senior citizen services and programs fund at the end of any biennium must be

transferred by the state treasurer to the state general fund,

SECTION 4. EFFECTIVE DATE. Section 2 of this Act is effective for taxable

years beginning after December 31, 2016. Section 3 of this Act is effective for taxable

events occurring after June 30, 2017."

Renumber accordingly

Page No. 2 17.0941.02001

You might also like

- Special Session Delayed Bills Committee LetterDocument1 pageSpecial Session Delayed Bills Committee LetterTyler AxnessNo ratings yet

- D26 Alternative 2021 MapDocument48 pagesD26 Alternative 2021 MapTyler AxnessNo ratings yet

- Special Session Memo 2021Document1 pageSpecial Session Memo 2021Tyler AxnessNo ratings yet

- Cornyn Dallas Fundraiser For CramerDocument3 pagesCornyn Dallas Fundraiser For CramerTyler AxnessNo ratings yet

- Cramer Victory Fund Year End ReportDocument22 pagesCramer Victory Fund Year End ReportTyler AxnessNo ratings yet

- North Dakota Legislature PPPDocument2 pagesNorth Dakota Legislature PPPTyler AxnessNo ratings yet

- American Rescue Plan Act - Leg Council SummaryDocument3 pagesAmerican Rescue Plan Act - Leg Council SummaryTyler AxnessNo ratings yet

- USPS Warns ND On Mail-In Voting TimeframeDocument4 pagesUSPS Warns ND On Mail-In Voting TimeframeTyler AxnessNo ratings yet

- Coronavirus Relief Fund Reprioritization - October 2020Document39 pagesCoronavirus Relief Fund Reprioritization - October 2020Tyler AxnessNo ratings yet

- Joint Governors Letter For Judge Amy Coney Barrett 10.8.2020Document3 pagesJoint Governors Letter For Judge Amy Coney Barrett 10.8.2020Tyler AxnessNo ratings yet

- 4th Quarter Cramer For CongressDocument92 pages4th Quarter Cramer For CongressTyler AxnessNo ratings yet

- Gov Letter To Potus March 2018Document1 pageGov Letter To Potus March 2018Tyler AxnessNo ratings yet

- HB 1023 Veto MessageDocument1 pageHB 1023 Veto MessageTyler AxnessNo ratings yet

- KK Press ReleaseDocument1 pageKK Press ReleaseTyler AxnessNo ratings yet

- State Government ComplaintsDocument2 pagesState Government ComplaintsTyler AxnessNo ratings yet

- 1-10 ACA ND Impacts - FINAL PDFDocument1 page1-10 ACA ND Impacts - FINAL PDFTyler AxnessNo ratings yet

- State Government ComplaintsDocument2 pagesState Government ComplaintsTyler AxnessNo ratings yet

- Sos 00435320170907141547Document1 pageSos 00435320170907141547Rob PortNo ratings yet

- ND Tax Department Assessment On Amendment To SB 2273Document1 pageND Tax Department Assessment On Amendment To SB 2273Tyler AxnessNo ratings yet

- Oil Tax Collections Comparison ChartDocument1 pageOil Tax Collections Comparison ChartTyler AxnessNo ratings yet

- Oil Tax Collections Comparison ChartDocument1 pageOil Tax Collections Comparison ChartTyler AxnessNo ratings yet

- General Fund Turnback 2015-17Document1 pageGeneral Fund Turnback 2015-17Tyler AxnessNo ratings yet

- HB 1019 Veto Message SignedDocument1 pageHB 1019 Veto Message SignedTyler AxnessNo ratings yet

- 2273Document2 pages2273Tyler AxnessNo ratings yet

- SB 2206 House AmmendmentDocument1 pageSB 2206 House AmmendmentTyler AxnessNo ratings yet

- SB 2314Document2 pagesSB 2314Tyler AxnessNo ratings yet

- ND Tax Department Assessment On Amendment To SB 2273Document1 pageND Tax Department Assessment On Amendment To SB 2273Tyler AxnessNo ratings yet

- SB 2315Document3 pagesSB 2315Tyler AxnessNo ratings yet

- Burgum Revised Executive Recommendation BookDocument91 pagesBurgum Revised Executive Recommendation BookTyler AxnessNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Psac/Sait Well Testing Training ProgramDocument1 pagePsac/Sait Well Testing Training Programtidjani73No ratings yet

- Clifford Clark Is A Recent Retiree Who Is Interested in PDFDocument1 pageClifford Clark Is A Recent Retiree Who Is Interested in PDFAnbu jaromiaNo ratings yet

- Apg-Deck-2022-50 - Nautical Charts & PublicationsDocument1 pageApg-Deck-2022-50 - Nautical Charts & PublicationsruchirrathoreNo ratings yet

- Bud APAC - Prospectus PDFDocument506 pagesBud APAC - Prospectus PDFtaixsNo ratings yet

- Act 201 Chapter 02 Debit & CreditDocument72 pagesAct 201 Chapter 02 Debit & Credittanvir ahmedNo ratings yet

- Treasurer-Tax Collector Rewrites Investment Policy: Safety Net GoneDocument36 pagesTreasurer-Tax Collector Rewrites Investment Policy: Safety Net GoneSan Mateo Daily JournalNo ratings yet

- Shareholding Agreement PFLDocument3 pagesShareholding Agreement PFLHitesh SainiNo ratings yet

- Immigration and Exploration of The USADocument6 pagesImmigration and Exploration of The USAТетяна МешкоNo ratings yet

- Datura in VajramahabhairavaDocument6 pagesDatura in VajramahabhairavaНандзед ДорджеNo ratings yet

- 79 Fair Empl - Prac.cas. (Bna) 1446, 75 Empl. Prac. Dec. P 45,771, 12 Fla. L. Weekly Fed. C 540 Mashell C. Dees v. Johnson Controls World Services, Inc., 168 F.3d 417, 11th Cir. (1999)Document9 pages79 Fair Empl - Prac.cas. (Bna) 1446, 75 Empl. Prac. Dec. P 45,771, 12 Fla. L. Weekly Fed. C 540 Mashell C. Dees v. Johnson Controls World Services, Inc., 168 F.3d 417, 11th Cir. (1999)Scribd Government DocsNo ratings yet

- Political Science Assignment Sem v-1Document4 pagesPolitical Science Assignment Sem v-1Aayush SinhaNo ratings yet

- Pooja RasidDocument3 pagesPooja RasidRajiuNo ratings yet

- iOS E PDFDocument1 pageiOS E PDFMateo 19alNo ratings yet

- Lecture 4 The Seven Years' War, 1756-1763Document3 pagesLecture 4 The Seven Years' War, 1756-1763Aek FeghoulNo ratings yet

- Product BrochureDocument18 pagesProduct Brochureopenid_Po9O0o44No ratings yet

- 2021 Pslce Selection - ShedDocument254 pages2021 Pslce Selection - ShedMolley KachingweNo ratings yet

- Philippines-Expanded Social Assistance ProjectDocument2 pagesPhilippines-Expanded Social Assistance ProjectCarlos O. TulaliNo ratings yet

- Developer Extensibility For SAP S4HANA Cloud On The SAP API Business HubDocument8 pagesDeveloper Extensibility For SAP S4HANA Cloud On The SAP API Business Hubkoizak3No ratings yet

- CH8 OligopolyModelsDocument37 pagesCH8 OligopolyModelsJeffrey LaoNo ratings yet

- Introduction To Distribution ManagementDocument18 pagesIntroduction To Distribution ManagementGaurav VermaNo ratings yet

- Lembar Jawaban Siswa - Corona-2020Document23 pagesLembar Jawaban Siswa - Corona-2020Kurnia RusandiNo ratings yet

- Agrade CAPSIM SECRETS PDFDocument3 pagesAgrade CAPSIM SECRETS PDFAMAN CHAVANNo ratings yet

- Q1. What Do You Understand by Construction Management? Discuss The Historical Evolution of Construction Management?Document5 pagesQ1. What Do You Understand by Construction Management? Discuss The Historical Evolution of Construction Management?Vranda AgarwalNo ratings yet

- Annex D Initial Evaluation Results IER 2Document6 pagesAnnex D Initial Evaluation Results IER 2ruffaNo ratings yet

- How To Have A BEAUTIFUL MIND Edward de BDocument159 pagesHow To Have A BEAUTIFUL MIND Edward de BTsaqofy Segaf100% (1)

- Humility Bible StudyDocument5 pagesHumility Bible Studyprfsc13No ratings yet

- B2B AssignmentDocument7 pagesB2B AssignmentKumar SimantNo ratings yet

- Determining Audience NeedsDocument5 pagesDetermining Audience NeedsOrago AjaaNo ratings yet

- Teaching Portfolio Showcases Skills and AchievementsDocument37 pagesTeaching Portfolio Showcases Skills and AchievementsIj CamataNo ratings yet

- CalendarDocument1 pageCalendarapi-277854872No ratings yet