Professional Documents

Culture Documents

Limited Partnerships (Art. 1843) : Requirements For Formation of A Limited Partnership

Uploaded by

RonnieEngging0 ratings0% found this document useful (0 votes)

153 views2 pagessummary outline limited partnership

Original Title

Limited Partnership

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsummary outline limited partnership

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

153 views2 pagesLimited Partnerships (Art. 1843) : Requirements For Formation of A Limited Partnership

Uploaded by

RonnieEnggingsummary outline limited partnership

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Limited partnerships (Art.

1843)

o one where at least one partner is a general partner and

the others are limited partners

o one whose liability is limited only up to the extent of his

contribution

ART. 1843. A limited partnership is one formed by

two or more persons under the provisions of the

following article, having as members one or more

general partners and one or more limited partners.

The limited partners as such shall not be bound by

the obligations of the partnership

ART. 1845. The contributions of a limited

partner may be cash or other property, but not

services.

Requirements for formation of a limited partnership:

Under Article 1844, there are two essential requirements

for the formation of a limited partnership:

(1) The certificate or articles of the limited partnership

which states the matters enumerated in the

article, must be signed and sworn to;

(a) The name of the partnership, adding thereto

the word Limited;

(b) The character of the business;

(c) The location of the principal place of

business;

(d) The name and place of residence of each

member, general and limited partners being

respectively designated;

(e) The term for which the partnership is to

exist;

(f) The amount of cash and description of and the

agreed value of the other property contributed by

each limited partner;

(g) The additional contributions, if any, to be

made by each limited partner and the times at

which or events on the happening of which they

shall be made;

(h) The time, if agreed upon, when the

contribution of each limited partner is to be

returned;

(i) The share of the profits or the other compensation

by way of income which each limited partner shall

receive by reason of his contribution;

(j) The right, if given, of a limited partner to

substitute an assignee as contributor in his place,

and the terms and conditions of the substitution;

(k) The right, if given, of the partners to admit

additional limited partners;

(l) The right, if given, of one or more of the limited

partners to priority over other limited partners, as

to contributions or as to compensation by way of

income, and the nature of such priority;

(m) The right, if given, of the remaining general

partner or partners to continue the business on

the death, retirement, civil interdiction, insanity or

insolvency of a general partner; and

(n) The right, if given, of a limited partner to

demand and receive property other than cash in

return of his contribution.

(2) Such certificate must be filed for record in the SEC.

A limited partnership is formed if there has been

substantial compliance in good faith with the foregoing

requirements.

The purpose (filing of the certificate)

to give actual or constructive notice to potential

creditors or persons dealing with the partnership to

acquaint them with its essential features, foremost

among which is the limited liability of the limited

partners so that they may not be defrauded or misled.

EXECUTION OF THE PRESCRIBED CERTIFICATE

A prime requisite to the formation of a limited partnership,

under Article 1844, is the execution of the prescribed

certificate.

This document, as a rule, must contain the matters

enumerated in said article. Thus, a LIMITED PARTNERSHIP

CANNOT BE CONSTITUTED ORALLY.

You might also like

- 3.the Case Study "Billings Pharmaceuticals: Customer Vulnerability and Moral Equity"Document2 pages3.the Case Study "Billings Pharmaceuticals: Customer Vulnerability and Moral Equity"JAY MARK TANONo ratings yet

- Obligations and Contracts Part I & II Multiple Choice QuestionsDocument4 pagesObligations and Contracts Part I & II Multiple Choice Questionsrye736100% (1)

- Final Exam Taxation 101Document8 pagesFinal Exam Taxation 101Live LoveNo ratings yet

- CREATE Act implementation guidelinesDocument51 pagesCREATE Act implementation guidelinesTreb LemNo ratings yet

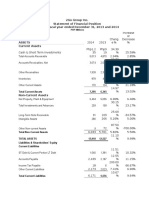

- Consolidated StatementsDocument4 pagesConsolidated StatementsRyan Joseph Agluba Dimacali100% (1)

- Dodd - For Whom Are Corporate Managers TrusteesDocument20 pagesDodd - For Whom Are Corporate Managers TrusteesPleshakov Andrey100% (1)

- LIMITED PARTNERSHIP DEFINITION AND REQUIREMENTSDocument3 pagesLIMITED PARTNERSHIP DEFINITION AND REQUIREMENTSiam McKoyNo ratings yet

- Partnership vs CorporationDocument3 pagesPartnership vs CorporationKaren LandichoNo ratings yet

- Articles of Partnership Limited June2015Document3 pagesArticles of Partnership Limited June2015Irene LumactodNo ratings yet

- Dissolution and Winding UpDocument7 pagesDissolution and Winding UpCrystelNo ratings yet

- Dissolution and Winding UpDocument110 pagesDissolution and Winding UpHahajaijaNo ratings yet

- Intermediate Accounting, Part 1Document7 pagesIntermediate Accounting, Part 1dfsdfdsfNo ratings yet

- Reaction PaperDocument2 pagesReaction PaperMai Xiao50% (2)

- Partnership Part 1Document3 pagesPartnership Part 1James EscosuraNo ratings yet

- Obicon FinalDocument32 pagesObicon FinalJessNo ratings yet

- Dissolution and Winding UpDocument8 pagesDissolution and Winding UpregenNo ratings yet

- Answers 7Document3 pagesAnswers 7Xiv NixNo ratings yet

- Partnership - Chapter 3Document6 pagesPartnership - Chapter 3TtlrpqNo ratings yet

- Obligations of The Partners NotesDocument7 pagesObligations of The Partners NotesRenz Francis LimNo ratings yet

- The Law On Partnership: Co-Ownership Co-Possession Corporation AgencyDocument3 pagesThe Law On Partnership: Co-Ownership Co-Possession Corporation AgencyNatalie SerranoNo ratings yet

- CHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)Document35 pagesCHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)abigael severino100% (1)

- Chapter 3 Dissolution and Winding UpDocument10 pagesChapter 3 Dissolution and Winding UpNoel Diamos Allanaraiz100% (1)

- BSA BL2 Prelims 2022Document6 pagesBSA BL2 Prelims 2022Joy Consigene100% (1)

- Intro Corp AcctDocument8 pagesIntro Corp AcctRichard LeightonNo ratings yet

- Art 1544Document8 pagesArt 1544jayhandarwinNo ratings yet

- Articles of Partnership TemplateDocument4 pagesArticles of Partnership TemplateRuhjen Santos OsmeñaNo ratings yet

- At 3Document8 pagesAt 3Ley EsguerraNo ratings yet

- How Defective Contracts Are ClassifiedDocument2 pagesHow Defective Contracts Are Classifiedaccounts 3 lifeNo ratings yet

- LAW Title IXDocument4 pagesLAW Title IXNavsNo ratings yet

- Securities Regulations Code - Activity 1Document3 pagesSecurities Regulations Code - Activity 1Chloe Oberlin100% (1)

- Gross IncomeDocument24 pagesGross IncomeMariaCarlaMañagoNo ratings yet

- NolcoDocument2 pagesNolcoVirgilio Tiongson Jr.No ratings yet

- 50 Multiple choice questions on Obligations and ContractsDocument9 pages50 Multiple choice questions on Obligations and ContractsChichay PotpotNo ratings yet

- Dissolution and Winding UpDocument16 pagesDissolution and Winding Upma.catherine merillenoNo ratings yet

- Philippine Taxation Review QuestionsDocument4 pagesPhilippine Taxation Review QuestionsJane TuazonNo ratings yet

- Scope and Limits of Security AnalysisDocument6 pagesScope and Limits of Security AnalysisElizabeth T. UnabiaNo ratings yet

- Oblicon General Provisions - ReviewDocument51 pagesOblicon General Provisions - ReviewTrinca DiplomaNo ratings yet

- Understanding Unenforceable ContractsDocument37 pagesUnderstanding Unenforceable ContractsRichard LamagnaNo ratings yet

- Distinctions Between Partnership and CorporationDocument2 pagesDistinctions Between Partnership and CorporationMiane Karyle UrolazaNo ratings yet

- CHAPTER 5 (Arts. 1370-1379)Document3 pagesCHAPTER 5 (Arts. 1370-1379)Kaye RabadonNo ratings yet

- FS Overview: Cash and Cash EquivalentsDocument14 pagesFS Overview: Cash and Cash EquivalentsRommel estrellado100% (1)

- 2go Group IncDocument7 pages2go Group IncSheenah FerolinoNo ratings yet

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoNo ratings yet

- Except in Case of Fraud On The: Partnership, Committed by or With The Consent of That PartnerDocument3 pagesExcept in Case of Fraud On The: Partnership, Committed by or With The Consent of That PartnerRoji Belizar HernandezNo ratings yet

- Business Law ReviewerDocument38 pagesBusiness Law ReviewercharleengraceNo ratings yet

- Powers of CorporationsDocument4 pagesPowers of CorporationsSeffirion69No ratings yet

- Law on Negotiable InstrumentsDocument15 pagesLaw on Negotiable InstrumentsJude Thaddeus DamianNo ratings yet

- Insurance Code: Republic Act No. 10607Document14 pagesInsurance Code: Republic Act No. 10607John ReyNo ratings yet

- Philippine Partnership Law DefinitionsDocument10 pagesPhilippine Partnership Law DefinitionsTom YbanezNo ratings yet

- Business Taxation MeaningDocument4 pagesBusiness Taxation MeaningSheila Mae AramanNo ratings yet

- Regulatory Framework and Legal Issues in Business Activity 1Document4 pagesRegulatory Framework and Legal Issues in Business Activity 1x xNo ratings yet

- LUCAS FME111 InsuranceRiskMngmtDocument6 pagesLUCAS FME111 InsuranceRiskMngmtJohnVerjoGeronimoNo ratings yet

- Income Taxation - Chapter 1 DefinitionDocument3 pagesIncome Taxation - Chapter 1 DefinitionAntonioGloriaComiqueNo ratings yet

- Cost Accounting CycleDocument4 pagesCost Accounting CycleM Ali Mustafa100% (1)

- Reaction Paper On GRP 12Document2 pagesReaction Paper On GRP 12Ayen YambaoNo ratings yet

- Transfer Taxes ExplainedDocument65 pagesTransfer Taxes ExplainedElaineNo ratings yet

- Concept of Delay: General Rule: No Demand, No Delay ExceptionsDocument8 pagesConcept of Delay: General Rule: No Demand, No Delay ExceptionsDarlene Faye Cabral RosalesNo ratings yet

- Corp Vs PartnershipDocument4 pagesCorp Vs PartnershipCha EstanislaoNo ratings yet

- Document 1Document31 pagesDocument 1sofiaNo ratings yet

- CHAPTER 4 Limited PartnershipDocument8 pagesCHAPTER 4 Limited Partnershipjacelshyene.payotNo ratings yet

- Limited Partnership Nos 1-5Document2 pagesLimited Partnership Nos 1-5Bryan Bab BacongolNo ratings yet

- Limited Partnership 1Document10 pagesLimited Partnership 1davemarklazaga179No ratings yet

- LP Module - Rights & RequisitesDocument11 pagesLP Module - Rights & RequisitesNathan Kurt LeeNo ratings yet

- Railroad's Preferential Routing Agreements Violate Sherman ActDocument1 pageRailroad's Preferential Routing Agreements Violate Sherman ActRonnieEnggingNo ratings yet

- IDPA Shooting Discipline ExplainedDocument23 pagesIDPA Shooting Discipline ExplainedRonnieEnggingNo ratings yet

- Railroad's Preferential Routing Agreements Violate Sherman ActDocument1 pageRailroad's Preferential Routing Agreements Violate Sherman ActRonnieEnggingNo ratings yet

- Railroad's Preferential Routing Agreements Violate Sherman ActDocument1 pageRailroad's Preferential Routing Agreements Violate Sherman ActRonnieEnggingNo ratings yet

- SECURITIES FRAUD CASEDocument2 pagesSECURITIES FRAUD CASERonnieEngging100% (1)

- Framework Convention On Tobacco Control - FCTC EnglishDocument42 pagesFramework Convention On Tobacco Control - FCTC EnglishIndonesia TobaccoNo ratings yet

- 1 Socrates Vs Sandigan Case DigestDocument1 page1 Socrates Vs Sandigan Case DigestRonnieEnggingNo ratings yet

- Pearl & Dean v. Shoemart (CASE DIGEST)Document3 pagesPearl & Dean v. Shoemart (CASE DIGEST)RonnieEnggingNo ratings yet

- 1 Crim Proc Case Lagon DigestDocument3 pages1 Crim Proc Case Lagon DigestRonnieEnggingNo ratings yet

- THERAVADADocument22 pagesTHERAVADARonnieEnggingNo ratings yet

- THERAVADADocument22 pagesTHERAVADARonnieEnggingNo ratings yet

- SECURITIES FRAUD CASEDocument2 pagesSECURITIES FRAUD CASERonnieEngging100% (1)

- 2 Alonzo Vs Conception Case DigestDocument3 pages2 Alonzo Vs Conception Case DigestRonnieEnggingNo ratings yet

- Joint MC Inter AgencyDocument7 pagesJoint MC Inter AgencyRonnieEnggingNo ratings yet

- Fundamentals of MusicDocument1 pageFundamentals of MusicRonnieEnggingNo ratings yet

- How to Write an Effective AffidavitDocument4 pagesHow to Write an Effective AffidavitRonnieEngging100% (1)

- Changgong TVDocument6 pagesChanggong TVRonnieEnggingNo ratings yet

- IDPA Shooting Discipline ExplainedDocument23 pagesIDPA Shooting Discipline ExplainedRonnieEnggingNo ratings yet

- People vs Tumambing G.R. No. 191261 Ruling on Proper IdentificationDocument10 pagesPeople vs Tumambing G.R. No. 191261 Ruling on Proper IdentificationRonnieEnggingNo ratings yet

- Jay Bangkal BayoDocument1 pageJay Bangkal BayoRonnieEnggingNo ratings yet

- CSCDOH - JMC2010 - 01 - 1 Tobacco Industry Interfrence PDFDocument7 pagesCSCDOH - JMC2010 - 01 - 1 Tobacco Industry Interfrence PDFHammurabi BugtaiNo ratings yet

- Rodriguez vs. BorjaDocument1 pageRodriguez vs. BorjaXing Keet LuNo ratings yet

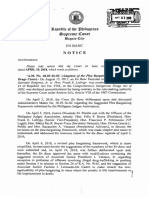

- Supreme Court 2018: Plea Bargaining in Drugs Cases FrameworkDocument8 pagesSupreme Court 2018: Plea Bargaining in Drugs Cases FrameworkNami Buan80% (5)

- Rule 110 Sec 14Document4 pagesRule 110 Sec 14AllenMarkLuperaNo ratings yet

- Batas Pil 1902Document3 pagesBatas Pil 1902RonnieEnggingNo ratings yet

- Windows 10 (All Editions) Activation Text File (Updated)Document2 pagesWindows 10 (All Editions) Activation Text File (Updated)RonnieEnggingNo ratings yet

- HdcloneDocument76 pagesHdcloneNico DavidNo ratings yet

- Organizational Behaviour Syllabus PDFDocument6 pagesOrganizational Behaviour Syllabus PDFAmorsolo EspirituNo ratings yet

- Crim Pro CompileDocument242 pagesCrim Pro CompileRonnieEnggingNo ratings yet

- Jail Integration Act HB01129Document8 pagesJail Integration Act HB01129RonnieEnggingNo ratings yet

- Cfas Mock Test PDFDocument71 pagesCfas Mock Test PDFRose Dumadaug50% (2)

- Annual-Report-13-14 AOP PDFDocument38 pagesAnnual-Report-13-14 AOP PDFkhurram_66No ratings yet

- Manish ProjectDocument45 pagesManish ProjectManishKumarNabhaitesNo ratings yet

- Exhibitor List Inapa 2017Document24 pagesExhibitor List Inapa 2017Pandi Indra KurniaNo ratings yet

- MusharkaDocument33 pagesMusharkaDaniyal100% (1)

- Assessment Task 2 - Workbook SP53 2020Document16 pagesAssessment Task 2 - Workbook SP53 2020Minh Y VoNo ratings yet

- Call Center Business Plan ExampleDocument33 pagesCall Center Business Plan ExamplemeozenemyNo ratings yet

- BCO 11 Block 03Document70 pagesBCO 11 Block 03Al OkNo ratings yet

- Economic Thought of Ibn KhaldunDocument15 pagesEconomic Thought of Ibn KhaldunSajjeevAntonyNo ratings yet

- Top Federal Tax Rates Since 1916Document1 pageTop Federal Tax Rates Since 1916Ephraim DavisNo ratings yet

- AFM Practice QuestionDocument8 pagesAFM Practice QuestionAmjad AliNo ratings yet

- Garrison12ce PPT Ch04Document78 pagesGarrison12ce PPT Ch04snsahaNo ratings yet

- JWM - The Value of Tax EffInvestmentsDocument8 pagesJWM - The Value of Tax EffInvestmentsbrettpevenNo ratings yet

- Balakrishnan 2011Document67 pagesBalakrishnan 2011novie endi nugrohoNo ratings yet

- Project Report On "Cash Flow Statement at Thinknext Technologies Pvt. LTD"Document54 pagesProject Report On "Cash Flow Statement at Thinknext Technologies Pvt. LTD"Sat NamNo ratings yet

- Key Concepts of Strategic ManagementDocument12 pagesKey Concepts of Strategic ManagementY.h. TariqNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument12 pagesCambridge International General Certificate of Secondary EducationSamiksha MoreNo ratings yet

- Indian Premier League - A RevolutionDocument12 pagesIndian Premier League - A RevolutionsidbatNo ratings yet

- Structural Rates 2015Document3 pagesStructural Rates 2015Raghu Ram100% (1)

- How To Write A Traditional Business Plan: Step 1Document5 pagesHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanNo ratings yet

- Ce Investing in Ce 2014 PDFDocument132 pagesCe Investing in Ce 2014 PDFSomnath DasguptaNo ratings yet

- ARTO Bank Report: Development, Shareholders, DividendsDocument3 pagesARTO Bank Report: Development, Shareholders, DividendsAfterneathNo ratings yet

- Employee W-2 Form DetailsDocument6 pagesEmployee W-2 Form DetailsNEKRONo ratings yet

- Mj12e TB Ch13Document29 pagesMj12e TB Ch13George Edwards0% (1)

- Lembar Kerja UkkDocument46 pagesLembar Kerja UkkAmalia YuniarsihNo ratings yet

- A Brown vs. CIRDocument11 pagesA Brown vs. CIRKwini RojanoNo ratings yet