Professional Documents

Culture Documents

GST

Uploaded by

Chelladurai KrishnasamyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST

Uploaded by

Chelladurai KrishnasamyCopyright:

Available Formats

GST

Preparation & Transition

Sailesh Bhandari & Associates

Chartered Accountants

Topics

o GST General Overview

o Registration Process

o Major Changes to Compliance Procedures

o Impact analysis on Supply Chain

o Key Business Decisions to taken before GST

CA Sailesh Bhandari 2 www.sbaa.in

Goods & Services Tax Act - Why?

Widen the Tax Base

Reduce the number of Laws & Procedures

Standardization of Practices across India

Eliminate the Cascading Effect of Tax

Boost to Investments & E-commerce

CA Sailesh Bhandari 3 www.sbaa.in

GST

By

When?

CA Sailesh Bhandari 4 www.sbaa.in

Central State

Laws Laws

Service

Tax

VAT

CST Entertainment

What Tax

Entry Tax

Will GST Customs

(Partial)

Replace? Purchase

Central Tax

Excise

GST Luxury

Tax

Major Portion of Customs Duty will Remain same

Property Tax is outside preview of GST

Alcohol & Petroleum Products have been kept out of GST

CA Sailesh Bhandari 5 www.sbaa.in

Will GST lead to Inflation?

CA Sailesh Bhandari 6 www.sbaa.in

Registration Under GST

Automatic Provisional Migration

6 Months Validity

Existing

Assesses Final Certificate of Registration

Online Registration

New One Registration for One State

Assesses Separate Registration for each Business Vertical

CA Sailesh Bhandari 7 www.sbaa.in

Who are Required to Register?

Taxable Supply > 9 lacs in a Financial Year

( > 4 lacs for Northern Eastern States)

Any person making Inter State Supply

E-commerce Operators & their Suppliers

Casual & Non- Resident Taxable Persons

Agents

Others

CA Sailesh Bhandari 8 www.sbaa.in

Registration Number Under GST

CA Sailesh Bhandari 9 www.sbaa.in

Major Changes for Assesse

Compliance Perspective

Transition of Existing Affairs to GST

Input Tax Credit System

Returns to be filed

Invoices, Debit & Credit Notes

Accounts & Audit

CA Sailesh Bhandari 10 www.sbaa.in

Transition of Existing Affairs

Input Credit under Excise/ Service Tax / VAT

To the extent allowed under New Act

Amount to be reflected in prior Return filed

Special Focus on Carry Forward credit on Capital

Goods

Input Credit on Stock in Trade

Composition Scheme

CA Sailesh Bhandari 11 www.sbaa.in

Input Tax Credit

Tax credit only after the Vendor has filed return

Cross Utilization (Btw Goods & Services) Allowed

Delay or deferred Credit

Difference in Input tax credit

CA Sailesh Bhandari 12 www.sbaa.in

Returns to be Filed

37

Returns

5

Returns

CA Sailesh Bhandari 13 www.sbaa.in

Changes to Business Practices

Business Contracts & Agreements

Pricing

Accounting Procedures

Vendor Management

Dealing with MSME

Business Model

CA Sailesh Bhandari 14 www.sbaa.in

Understanding Current Supply Chain

CA Sailesh Bhandari 15 www.sbaa.in

Key Business Decisions before GST

Impact Analysis on Vendors & Upward Chain

Impact Analysis on Customers & Downward Chain

Compare cost to Decide on:

Job Work / Outsource

Insource

New Products / Services

New Markets

Expansion Plans or Further Investment Strategy

Stock in Hand - Position

CA Sailesh Bhandari 16 www.sbaa.in

Contact Us

CA Sailesh Bhandari

Sailesh Bhandari & Associates

New 36/ Old 22, Reddy Raman Street,

George Town, Chennai -79

98403 01007

sailesh@sbaa.in

www.sbaa.in

Questions

You might also like

- Book 02 - Speech Generation & Flow Production PDFDocument48 pagesBook 02 - Speech Generation & Flow Production PDFChelladurai Krishnasamy100% (1)

- Book 01 - Idea Units and Fluency PDFDocument47 pagesBook 01 - Idea Units and Fluency PDFChelladurai KrishnasamyNo ratings yet

- Time: 2 Hours Maximum Marks: 50 (Weightage 70%) Note: Attempt Any Four Questions Including Question No. 1 Which Is CompulsoryDocument4 pagesTime: 2 Hours Maximum Marks: 50 (Weightage 70%) Note: Attempt Any Four Questions Including Question No. 1 Which Is CompulsoryChelladurai KrishnasamyNo ratings yet

- India Market Report-2013Document15 pagesIndia Market Report-2013Chelladurai KrishnasamyNo ratings yet

- Values and Stress Management: by Michael HendersonDocument1 pageValues and Stress Management: by Michael HendersonChelladurai KrishnasamyNo ratings yet

- Principles of Management NotesDocument178 pagesPrinciples of Management NotesChelladurai Krishnasamy100% (1)

- Rural Market in India Some Opportunities and ChallengesDocument15 pagesRural Market in India Some Opportunities and ChallengesChelladurai KrishnasamyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Essentials of Federal Income Taxation For Individuals and BusinessDocument860 pagesEssentials of Federal Income Taxation For Individuals and BusinessAbhisek chudalNo ratings yet

- CPA Review - VAT Quizzer - 2019Document11 pagesCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDeepak ShrigadiNo ratings yet

- Philippine School of Business AdministrationDocument39 pagesPhilippine School of Business Administrationnorhana lucmanNo ratings yet

- Pay Slip AugDocument1 pagePay Slip Augvictor.savioNo ratings yet

- Topic 3. Customs Regimes and Customs DestinationsDocument4 pagesTopic 3. Customs Regimes and Customs DestinationsOleg Dontu100% (4)

- TPS - Tax Forms Done Tax ReturnDocument42 pagesTPS - Tax Forms Done Tax ReturnLuis Castro100% (1)

- Principles of Taxation - OdtDocument4 pagesPrinciples of Taxation - OdtEuphrasia MiyobaNo ratings yet

- Proscenium Sample Computation - TPR - 3 BR - 57C - 268sqm - PENTHOUSE PDFDocument1 pageProscenium Sample Computation - TPR - 3 BR - 57C - 268sqm - PENTHOUSE PDFValerie Santiago Gayoba100% (1)

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeWenjunNo ratings yet

- InvoiceDocument1 pageInvoiceAfnanNo ratings yet

- Chapter 2Document2 pagesChapter 2Vượng TạNo ratings yet

- Guide Notes On Donor'S Tax Donor'S Tax: Tax 2 Syllabus Associate Dean Lily K. Gruba S/Y 2017-201Document10 pagesGuide Notes On Donor'S Tax Donor'S Tax: Tax 2 Syllabus Associate Dean Lily K. Gruba S/Y 2017-201Jet GarciaNo ratings yet

- Assignment 2 PGDMDocument2 pagesAssignment 2 PGDMniftamNo ratings yet

- Ticket 20856854518Document2 pagesTicket 20856854518Shashwat MishraNo ratings yet

- I.t.challan BlankDocument4 pagesI.t.challan Blankmaliktariq78100% (1)

- Business Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp TaxDocument7 pagesBusiness Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp TaxJessaNo ratings yet

- File and Pay Electronically: Electronic Filing and Payment System (EFPS)Document26 pagesFile and Pay Electronically: Electronic Filing and Payment System (EFPS)mmeeeowwNo ratings yet

- 403b PlansDocument2 pages403b Plansapi-246909910No ratings yet

- viewNitPdf 4133031Document4 pagesviewNitPdf 4133031Praveen RajNo ratings yet

- Template Payslip: Total Pay To Date: (Insert Taxable Pay To Date: (Insert Tax Paid To Date: (InsertDocument1 pageTemplate Payslip: Total Pay To Date: (Insert Taxable Pay To Date: (Insert Tax Paid To Date: (InsertFrancis Joe OnamembaNo ratings yet

- Financial Management Horizontal AnalysisDocument4 pagesFinancial Management Horizontal AnalysisMy QweNo ratings yet

- Dimensional Service Corporation 2307Document3 pagesDimensional Service Corporation 2307Randy RosasNo ratings yet

- 2012 Comp Topics TB Ch13Document24 pages2012 Comp Topics TB Ch13justmeNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipNilesh SurvaseNo ratings yet

- Max Bill1Document3 pagesMax Bill1sravyaNo ratings yet

- Tax Template Student - JUNE 2016Document4 pagesTax Template Student - JUNE 2016HAFIZUl ASYRAF BIN ABD MALIKNo ratings yet

- Final Examination Academic Year: 2021-2022: SVKM'S NmimsDocument3 pagesFinal Examination Academic Year: 2021-2022: SVKM'S NmimsSanjam SinghNo ratings yet

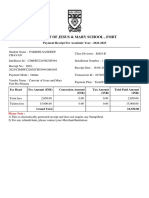

- Convent of Jesus & Mary School, Fort: Payment Receipt For Academic Year - 2022-2023Document2 pagesConvent of Jesus & Mary School, Fort: Payment Receipt For Academic Year - 2022-2023KDNo ratings yet

- Uands Doc Od EngDocument30 pagesUands Doc Od EngIlya SytinNo ratings yet