Professional Documents

Culture Documents

Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, Trenholm

Uploaded by

Gurinder Pal SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, Trenholm

Uploaded by

Gurinder Pal SinghCopyright:

Available Formats

Weygandt, Kieso, Kimmel, Trenholm Accounting Principles Second Canadian Edition Rapid Review

VOLUME 2

CONCEPTUAL FRAMEWORK OF ACCOUNTING (Chapter 12) BONDS (Chapter 16)

Characteristics Assumptions Principles Constraints Premium Market Interest Rate < Contractual Interest Rate

Understandability Going concern Revenue recognition Cost-benefit Face Value Market Interest Rate Contractual Interest Rate

Relevance Monetary unit Matching Materiality Discount Market Interest Rate > Contractual Interest Rate

Reliability Economic entity Full disclosure

Comparability Time period Cost

Calculation of Bond Interest Expense

Interest expense Interest paid (payable) Amortization of discount (OR

SHAREHOLDERS EQUITY (Chapter 14) amortization of premium)

Comparison of Equity Accounts Amortization

Proprietorship Partnership Corporation Straight-line amortization Bond discount (premium)

Owner s equity Partners equity Shareholders equity Number of interest periods

Name, Capital Name, Capital Share capital

Name, Capital Retained earnings Effective-interest amortization Bond interest expense Bond interest paid

Carrying value of bonds Face amount of bonds x

at beginning of period x contractual interest rate

No Par Value vs. Stated (Par) Value Journal Entries market interest rate

No Par Value Stated (Par) Value INVESTMENTS (Chapter 17)

Cash Cash

Common shares Common shares (stated (par) value) Comparison of Long-Term Bond Investment and Liability Journal Entries

Contributed capital in excess of stated (par) value

Event Investor Investee

Purchase / issue of bonds Debt investment Cash

Premium on bonds Premium on bonds

Cash Bonds payable

DIVIDENDS (Chapter 15)

Interest receipt / payment Cash Interest expense

and amortization of premium Premium on bonds Premium on bonds

Comparison of Dividend Effects Interest revenue Cash

Cash Common Shares Retained Earnings Total Shareholder s

Equity Note: Bonds purchased or issued at a discount, would have a Discount on

Cash Dividend Decrease No effect Decrease Decrease Bonds account as a credit for the Investor and a debit for the Investee

Stock Dividend No effect Increase Decrease No effect in the initial entry.

Stock Split No effect No effect No effect No effect

Comparison of Cost and Equity Methods of

Accounting for Long-Term Equity Investments

Event Cost Equity

Debits and Credits to Retained Earnings

Acquisition Equity investment Equity investment

Cash Cash

Retained Earnings Investee reports earnings No entry Equity investment

Debits (Decreases) Credits (Increases) Investment revenue

1. Correction of a prior period error that 1. Correction of a prior period error that Investee pays dividends Cash Cash

overstated income understated income Dividend revenue Equity investment

2. Cumulative effect of a change 2. Cumulative effect of a change

in accounting principle that in accounting

decreased income principle that increased income CASH FLOW STATEMENT (Chapter 18)

3. Net loss 3. Net income

4. Cash dividends Cash flows from operating activities (indirect method)

5. Stock dividends Net income

Add: Decreases in current assets $X

Increases in current liabilities X

Amortization X

Losses on disposals of assets X

Presentation of Non-Typical Items Deduct: Increases in current assets ( X)

Decreases in current liabilities ( X)

Correction of prior period errors Statement of retained earnings (adjustment of Gains on disposals of assets ( X)

beginning retained earnings) Cash provided (used) by operating activities $X

Change in accounting principle Statement of retained earnings (adjustment of Cash flows from operating activities (direct method)

beginning retained earnings) Cash receipts

(Examples: from sales of goods and services to customers, from

Discontinued operations Income statement (presented separately after

receipts of interest and dividends on loans and investments) $X

income from continuing operations) Cash payments

Extraordinary items Income statement (presented separately after (Examples: to suppliers, for operating expenses, for interest, for taxes) ( X)

income before extraordinary items) Cash provided (used) by operating activities $X

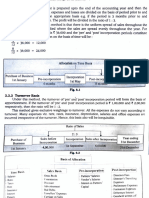

USING THE INFORMATION IN THE FINANCIAL STATEMENTS (Chapter 19)

Chapter Ratio Formula Purpose or Use

Liquidity Ratios

4 Current ratio Current assets Measures short-term debt-paying ability.

Current liabilities

9 Acid test or quick ratio Cash + temporary investments + receivables (net) Measures immediate short-term liquidity.

Current liabilities

18 Cash current Net cash provided by operating activities Measures short-term debt-paying ability (cash basis).

debt coverage Average current liabilities

9 Receivables turnover Net credit sales Measures liquidity of receivables.

Average net receivables

9 Collection period 365 days Measures number of days receivables are outstanding.

Receivables turnover

5 Inventory turnover Cost of goods sold Measures liquidity of inventory.

Average inventory

5 Days sales in inventory 365 days Measures number of days stock is on hand.

Inventory turnover

Profitability Ratios

5 Profit margin Net income Measures net income generated by each dollar of sales.

Net sales

5 Gross profit margin Gross profit Measures gross profit generated by each dollar of sales.

Net sales

18 Cash return on sales Net cash provided by Measures the net cash flow generated by each

operating activities dollar of sales.

Net sales

10 Asset turnover Net sales Measures how efficiently assets are used to

Average total assets generate sales.

10 Return on assets Net income Measures overall profitability of assets.

Average total assets

14 Return on common Net income Measures profitability of shareholders investment.

shareholders equity Average common

shareholders equity

14 Book value per share Total shareholders equity Measures the equity in net assets of each

Number of common shares common share.

18 Cash flow per share Net cash provided by all activities Measures the amount of cash flow generated

Number of common shares by each common share.

15 Earnings per share (EPS) Net income Measures net income earned on each common share.

Number of common shares

15 Price-earnings (PE) ratio Share price Measures ratio of the market price per

Earnings per share share to earnings per share.

15 Payout ratio Cash dividends Measures percentage of earnings distributed in

Net income the form of cash dividends.

15 Dividend yield Cash dividends per share Measures rate of return earned from dividends.

Share price

Solvency Ratios

16 Debt to total assets Total debt Measures percentage of total assets

Total assets provided by creditors.

16 Interest coverage Income before interest expense Measures ability to meet interest payments as

and income tax expense (EBIT) they come due.

Interest expense

16 Cash interest coverage Income before interest expense, income tax

expense, and amortization expense (EBITDA) Measures ability to meet interest payments as they

Interest expense come due (cash basis).

18 Cash total debt coverage Net cash provided by Measures the long-term debt paying ability

operating activities (cash basis).

Average total liabilities

You might also like

- Accounting for Bonds Payable ExplainedDocument31 pagesAccounting for Bonds Payable ExplainedJon Christian Miranda100% (2)

- AFAR - Sir BradDocument36 pagesAFAR - Sir BradOliveros JaymarkNo ratings yet

- Account Titles Account Titles: Accounting (Cagayan State University) Accounting (Cagayan State University)Document6 pagesAccount Titles Account Titles: Accounting (Cagayan State University) Accounting (Cagayan State University)Sherry OcampoNo ratings yet

- Accounting Equation - Part 1Document11 pagesAccounting Equation - Part 1Krrish Bosamia100% (1)

- Adm Bca Fin Lista Terminos TraduccionDocument2 pagesAdm Bca Fin Lista Terminos TraduccionVictor ClementeNo ratings yet

- Accounting Equation - Part 2Document48 pagesAccounting Equation - Part 2Krrish BosamiaNo ratings yet

- IA - Bonds Payable Other ConceptsDocument2 pagesIA - Bonds Payable Other ConceptsJhunnie LoriaNo ratings yet

- Bonds Payable Related Standards: Pfrs 9 - Financial InstrumentsDocument4 pagesBonds Payable Related Standards: Pfrs 9 - Financial InstrumentsJulie Mae Caling MalitNo ratings yet

- Account ClassificationDocument3 pagesAccount ClassificationUsama MukhtarNo ratings yet

- Account Titles: Accounting (Cagayan State University)Document6 pagesAccount Titles: Accounting (Cagayan State University)Keith Anthony AmorNo ratings yet

- PARTNERSHIPDocument8 pagesPARTNERSHIPShayne BenaweNo ratings yet

- Dissolution Partnership FirmDocument8 pagesDissolution Partnership FirmanuhyaextraNo ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceDocument4 pagesAccount Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceGurusamy KNo ratings yet

- Finance NotesDocument23 pagesFinance NoteschamilasNo ratings yet

- Analyze Bank PerformanceDocument28 pagesAnalyze Bank PerformanceKovida GunawardanaNo ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement Normal Balance ADocument3 pagesAccount Classification and Presentation: Account Title Classification Financial Statement Normal Balance AJanine Bernadette C. Bautista3180270No ratings yet

- Liquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Document3 pagesLiquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Akinola WinfulNo ratings yet

- advacc-bookDocument4 pagesadvacc-book20220633No ratings yet

- Fair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair ValueDocument6 pagesFair Value Reduction To Fair Value Amortized Cost Fair Value Expensed Immediately Fair Valuedump acctNo ratings yet

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Career Certificate In Business & HR ModulesDocument81 pagesCareer Certificate In Business & HR ModulesMuhamad Fadli HarunNo ratings yet

- Dayag Notes Partnership FormationDocument3 pagesDayag Notes Partnership FormationGirl Lang AkoNo ratings yet

- DCF Valuation: Formula: 3 MethodsDocument1 pageDCF Valuation: Formula: 3 Methodsmadhav madhavNo ratings yet

- 5 BcomDocument14 pages5 BcomdmangiginNo ratings yet

- Chart of Accounts PDFDocument2 pagesChart of Accounts PDFMwangi Josphat67% (9)

- Financial English 5.12Document2 pagesFinancial English 5.12thuminh07112003No ratings yet

- Valuation Of Banks Under 40 CharactersDocument30 pagesValuation Of Banks Under 40 CharactersRonak ChoudharyNo ratings yet

- Balance Sheet TemplateDocument19 pagesBalance Sheet TemplateNgiroNo ratings yet

- Problems On Profit Prior To IncorporationDocument18 pagesProblems On Profit Prior To Incorporationcsneha0803No ratings yet

- 1 Accounts-Debit or CreditDocument1 page1 Accounts-Debit or CreditPeter GeorgesNo ratings yet

- Reporting and Analyzing Cash FlowsDocument39 pagesReporting and Analyzing Cash FlowslolokoNo ratings yet

- Ilovepdf MergedDocument10 pagesIlovepdf MergedDivyam RohillaNo ratings yet

- ACCOUNTING FOR DISSOLUTION OF FIRMDocument2 pagesACCOUNTING FOR DISSOLUTION OF FIRMSimer preet kaurNo ratings yet

- Rps Bahan Ajar 9Document62 pagesRps Bahan Ajar 9GundamSeedNo ratings yet

- Account ClassificationDocument2 pagesAccount ClassificationAzeemAkram100% (1)

- PARTNERSHIPDocument7 pagesPARTNERSHIPoneddd439No ratings yet

- CAMEL Rating Toolkit 7.4Document34 pagesCAMEL Rating Toolkit 7.4Setiawan GunadiNo ratings yet

- Earnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesDocument6 pagesEarnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesHassleBustNo ratings yet

- Unit III Financial Reporting in Hyperinflationary EcnomiesDocument7 pagesUnit III Financial Reporting in Hyperinflationary EcnomiesKristine TuzonNo ratings yet

- Lecture 1 - Fundamentals and Accounting CycleDocument3 pagesLecture 1 - Fundamentals and Accounting CyclecoyNo ratings yet

- Parcor ActgDocument7 pagesParcor Actgoneddd439No ratings yet

- Financial InstrumentDocument62 pagesFinancial InstrumentNoor fatimaNo ratings yet

- Basic Financial Accounting Notes Very Helpfull Must SeeDocument5 pagesBasic Financial Accounting Notes Very Helpfull Must SeeBabar AbbasNo ratings yet

- Basic Financial Accounting Notes.Document6 pagesBasic Financial Accounting Notes.Babar AbbasNo ratings yet

- Ch8 Circular Reference - DVDocument42 pagesCh8 Circular Reference - DVElf CanNo ratings yet

- Financial Analysis GlossaryDocument6 pagesFinancial Analysis GlossarySergio OlarteNo ratings yet

- Level Up-CMPC 131 ReviewerDocument6 pagesLevel Up-CMPC 131 ReviewerazithethirdNo ratings yet

- Formulas: Volkswagen GroupDocument23 pagesFormulas: Volkswagen GroupMian MafeezNo ratings yet

- FSAPreRead 210728 102848Document42 pagesFSAPreRead 210728 102848Anuj PrajapatiNo ratings yet

- Notes Payable With Debt RestructuringDocument3 pagesNotes Payable With Debt RestructuringZehra LeeNo ratings yet

- Account ClassificationDocument22 pagesAccount ClassificationBenicel Lane De VeraNo ratings yet

- Accounting for partnership firms fundamentalsDocument1 pageAccounting for partnership firms fundamentalsJazaNo ratings yet

- Mergers Acquisitions Fact Sheet (Digital)Document2 pagesMergers Acquisitions Fact Sheet (Digital)Emperor OverwatchNo ratings yet

- Accounting Basic TermsDocument3 pagesAccounting Basic TermsHel LoNo ratings yet

- Asset Liabilities Equity Revenue Expense: Depreciation Expense Maintenance and Repair ExpensDocument3 pagesAsset Liabilities Equity Revenue Expense: Depreciation Expense Maintenance and Repair ExpensediwowNo ratings yet

- Acctg Terms and Debit CreditDocument3 pagesAcctg Terms and Debit CreditHel LoNo ratings yet

- Financial Statement OverviewDocument3 pagesFinancial Statement OverviewHel LoNo ratings yet

- Acctg Terms and Debit CreditDocument3 pagesAcctg Terms and Debit CreditHel LoNo ratings yet

- FPGA Selection for Analog Signal Conversion and Ethernet Data TransferDocument6 pagesFPGA Selection for Analog Signal Conversion and Ethernet Data TransferGurinder Pal SinghNo ratings yet

- AR# 57819 - Zynq-7000 SoC - Can We Use Common Supply Voltage Rail For VCCINT and VCCPINT - Also, For VCCAUX and VCCPAUXDocument2 pagesAR# 57819 - Zynq-7000 SoC - Can We Use Common Supply Voltage Rail For VCCINT and VCCPINT - Also, For VCCAUX and VCCPAUXGurinder Pal SinghNo ratings yet

- Homework 1Document1 pageHomework 1Gurinder Pal SinghNo ratings yet

- Math 125Document47 pagesMath 125ShailendraPatelNo ratings yet

- KX Driver 6.2.0827 Release NoteDocument2 pagesKX Driver 6.2.0827 Release NoteGurinder Pal SinghNo ratings yet

- 04 - SystemC Operators - Verification GuideDocument4 pages04 - SystemC Operators - Verification GuideGurinder Pal SinghNo ratings yet

- 06 - SystemC Jump Statements - Verification GuideDocument2 pages06 - SystemC Jump Statements - Verification GuideGurinder Pal SinghNo ratings yet

- Assgn 3Document1 pageAssgn 3Gurinder Pal SinghNo ratings yet

- Solutions Assignment No. 2Document4 pagesSolutions Assignment No. 2Gurinder Pal SinghNo ratings yet

- Math 123Document47 pagesMath 123ShailendraPatelNo ratings yet

- 08 - SystemC Functions Argument Passing - Verification GuideDocument3 pages08 - SystemC Functions Argument Passing - Verification GuideGurinder Pal SinghNo ratings yet

- KX Driver 6.2.0827 Release NoteDocument13 pagesKX Driver 6.2.0827 Release NoteepalpaNo ratings yet

- ContentsDocument2 pagesContentsAnshuman SinghNo ratings yet

- 07 - SystemC Functions - Verification GuideDocument3 pages07 - SystemC Functions - Verification GuideGurinder Pal SinghNo ratings yet

- 05 - SystemC Statement and Flow Control - Verification GuideDocument4 pages05 - SystemC Statement and Flow Control - Verification GuideGurinder Pal SinghNo ratings yet

- Source Publication List For Web of Science: Science Citation Index ExpandedDocument143 pagesSource Publication List For Web of Science: Science Citation Index ExpandedGarima GuptaNo ratings yet

- Design, Construction and Testing of The Digital Hadron Calorimeter (DHCAL) ElectronicsDocument20 pagesDesign, Construction and Testing of The Digital Hadron Calorimeter (DHCAL) ElectronicsGurinder Pal SinghNo ratings yet

- vzj2011 0060br PDFDocument2 pagesvzj2011 0060br PDFGurinder Pal SinghNo ratings yet

- House ComparisonDocument1 pageHouse ComparisonGurinder Pal SinghNo ratings yet

- 037 RSM CapacitorsDocument15 pages037 RSM CapacitorsManuel NolascoNo ratings yet

- IC Holders (DIL Sockets) : Removing An IC From Its HolderDocument1 pageIC Holders (DIL Sockets) : Removing An IC From Its HolderGurinder Pal SinghNo ratings yet

- Electronic Response and Bandstructure Modulation of Carbon Nanotubes in A Transverse Electrical FieldDocument8 pagesElectronic Response and Bandstructure Modulation of Carbon Nanotubes in A Transverse Electrical FieldGurinder Pal SinghNo ratings yet

- Toner Transfer ExpDocument8 pagesToner Transfer ExpIsmael 8877No ratings yet

- Digilent Embedded Linux Guide PDFDocument23 pagesDigilent Embedded Linux Guide PDFultimatekp144100% (1)

- Temp Toe EssDocument2 pagesTemp Toe EssAshish BhardwajNo ratings yet

- DFT ServicesDocument2 pagesDFT ServicesGurinder Pal SinghNo ratings yet

- Archive: DatasheetDocument4 pagesArchive: DatasheetGurinder Pal SinghNo ratings yet

- Gate Oxide Breakdown Failures Highlight Industry Need For New Electrical Rule Checking Tools - Mentor GraphicsDocument2 pagesGate Oxide Breakdown Failures Highlight Industry Need For New Electrical Rule Checking Tools - Mentor GraphicsGurinder Pal SinghNo ratings yet

- A Novel Robust exclusive-OR Function Implementation in QCA Nanotechnology With Energy Dissipation AnalysisDocument11 pagesA Novel Robust exclusive-OR Function Implementation in QCA Nanotechnology With Energy Dissipation AnalysisGurinder Pal SinghNo ratings yet

- Predictive Model For HCI (Beta Version) : Exp Exp) (+ 2) 2 (Document1 pagePredictive Model For HCI (Beta Version) : Exp Exp) (+ 2) 2 (Gurinder Pal SinghNo ratings yet

- NILEX List 0f Member FirmsDocument5 pagesNILEX List 0f Member Firmstahiliani9No ratings yet

- Capital BudgettingDocument9 pagesCapital BudgettingRussel BarquinNo ratings yet

- Test Bank Accounting 25th Editon Warren Chapter 13 Corporations orDocument103 pagesTest Bank Accounting 25th Editon Warren Chapter 13 Corporations orRoland Ron Bantilan0% (1)

- Final-Term Quiz Mankeu Roki Fajri 119108077Document4 pagesFinal-Term Quiz Mankeu Roki Fajri 119108077kota lainNo ratings yet

- Capsim Final-Stockholders DebriefDocument27 pagesCapsim Final-Stockholders DebriefShama RoshanNo ratings yet

- Financial Reporting and Analysis QuestionsDocument16 pagesFinancial Reporting and Analysis QuestionsPareshNo ratings yet

- Story of Demat ScamDocument66 pagesStory of Demat Scamapi-3701467No ratings yet

- Gil Alana2010Document21 pagesGil Alana2010DANY CREATIONSNo ratings yet

- Accounting QuizDocument3 pagesAccounting Quizmarygrace carbonelNo ratings yet

- Derivative Markets Report on Capital and Futures MarketsDocument3 pagesDerivative Markets Report on Capital and Futures MarketsJoel PangisbanNo ratings yet

- PFRSDocument4 pagesPFRSMarion Tamani Jr.No ratings yet

- Finance Accelerator: Macro ResearchDocument4 pagesFinance Accelerator: Macro ResearchSEETHALNo ratings yet

- AC305 AssetAccountingDocument248 pagesAC305 AssetAccountingfungayingorima100% (1)

- What Is FCCB?: Foreign Currency Convertible Bond Is A Type of ConvertibleDocument8 pagesWhat Is FCCB?: Foreign Currency Convertible Bond Is A Type of ConvertiblesbghargeNo ratings yet

- Instant Download Ebook PDF Financial and Managerial Accounting 8th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial and Managerial Accounting 8th Edition PDF Scribdmaurice.nesbit229100% (38)

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Value Investing - Aswath DamodaranDocument43 pagesValue Investing - Aswath Damodaranapi-3821333100% (1)

- Study On Working Capital Management At Bank Of IndiaDocument28 pagesStudy On Working Capital Management At Bank Of IndiaSonu MallickNo ratings yet

- Om 11Document19 pagesOm 11Omari KhvedianeliNo ratings yet

- 5 Internal ReconstructionDocument31 pages5 Internal ReconstructionHariom PatidarNo ratings yet

- Implementing Fusion Erp AnalyticsDocument1,133 pagesImplementing Fusion Erp AnalyticsSreekumar SasikumarNo ratings yet

- Accounting and Taxation AspectsDocument25 pagesAccounting and Taxation Aspectsankit varunNo ratings yet

- P.o.M 4.3 Market PosDocument4 pagesP.o.M 4.3 Market PosMaze ZeeNo ratings yet

- ACCAF7 CourseNotes2015 2ndhalfDocument174 pagesACCAF7 CourseNotes2015 2ndhalfMayank Gupta100% (1)

- Mutual Fund About SMCDocument61 pagesMutual Fund About SMCshaileshNo ratings yet

- Business Finance Xii SP New SyllabusDocument21 pagesBusiness Finance Xii SP New SyllabusSanthosh Kumar100% (1)

- Accounting Assignment: Company Name:-Bajaj AutoDocument5 pagesAccounting Assignment: Company Name:-Bajaj Autonand bhushanNo ratings yet

- Freedom SIP New Tenure PDFDocument1 pageFreedom SIP New Tenure PDFgsa7090No ratings yet

- Goldman Sachs India Financials 2020Document38 pagesGoldman Sachs India Financials 2020sidNo ratings yet

- Orascom Telecom ResearchDocument12 pagesOrascom Telecom ResearchHesham TabarNo ratings yet