Professional Documents

Culture Documents

11 PC Javier & Sons v. CA

Uploaded by

MlaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11 PC Javier & Sons v. CA

Uploaded by

MlaCopyright:

Available Formats

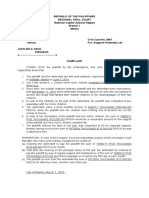

36 SUPREME COURT REPORTS ANNOTATED

P.C. Javier & Sons, Inc. vs. Court of Appeals

*

G.R. No. 129552. June 29, 2005.

P.C. JAVIER & SONS, INC., SPS. PABLO C. JAVIER, SR.

and ROSALINA F. JAVIER, petitioners, vs. HON. COURT

OF APPEALS, PAIC SAVINGS & MORTGAGE BANK,

INC., SHERIFFS GRACE BELVIS, SOFRONIO

VILLARIN, PIO MARTINEZ and NICANOR BLANCO,

respondents.

Corporation Law Banks Unless there is a law, regulation or

circular from the SEC or BSP requiring the formal notification of

all debtors of banks of any change in corporate name, such

remains to be a mere internal policy that banks may or may not

adopt.Their defense that they should first be formally notified

of the change of corporate name of First Summa Savings and

Mortgage Bank to PAIC Savings and Mortgage Bank, Inc., before

they will continue paying their loan obligations to respondent

bank presupposes that there exists a requirement under a law or

regulation ordering a bank that changes its corporate name to

formally notify all its debtors. After going over the Corporation

Code and Banking Laws, as well as the regulations and circulars

of both the SEC and the Bangko Sentral ng Pilipinas (BSP), we

find that there is no such requirement. This being the case, this

Court cannot impose on a bank that changes its corporate name to

notify a debtor of such change absent

_______________

* SECOND DIVISION.

37

VOL. 462, JUNE 29, 2005 37

P.C. Javier & Sons, Inc. vs. Court of Appeals

any law, circular or regulation requiring it. Such act would be

judicial legislation. The formal notification is, therefore,

discretionary on the bank. Unless there is a law, regulation or

circular from the SEC or BSP requiring the formal notification of

all debtors of banks of any change in corporate name, such

notification remains to be a mere internal policy that banks may

or may not adopt.

Same Same A change in the corporate name does not make a

new corporation, whether effected by a special act or under a

general law.A change in the corporate name does not make a

new corporation, whether effected by a special act or under a

general law. It has no effect on the identity of the corporation, or

on its property, rights, or liabilities. The corporation, upon such

change in its name, is in no sense a new corporation, nor the

successor of the original corporation. It is the same corporation

with a different name, and its character is in no respect changed.

Civil Law Unjust Enrichment The fundamental doctrine of

unjust enrichment is the transfer of value without just cause or

consideration It is commonly accepted that this doctrine simply

means that a person shall not be allowed to profit or enrich

himself inequitably at anothers expense.The fundamental

doctrine of unjust enrichment is the transfer of value without just

cause or consideration. The elements of this doctrine are:

enrichment on the part of the defendant impoverishment on the

part of the plaintiff and lack of cause. The main objective is to

prevent one to enrich himself at the expense of another. It is

commonly accepted that this doctrine simply means that a person

shall not be allowed to profit or enrich himself inequitably at

anothers expense.

PETITION for review on certiorari of the decision and

resolution of the Court of Appeals.

The facts are stated in the opinion of the Court.

Jose A. Suing for petitioners.

Yngson & Associates for respondent PSMB.

38

38 SUPREME COURT REPORTS ANNOTATED

P.C. Javier & Sons, Inc. vs. Court of Appeals

CHICONAZARIO, J.:

Before Us is an appeal by certiorari under Rule 451 of the

Rules of Court which seeks to set aside the decision of the

Court of Appeals dated 31 January 1997 which affirmed in

toto the decision of Branch 62 of the Regional Trial Court

(RTC) of Makati City, dismissing the complaint for

Annulment of Mortgage and Foreclosure with Preliminary

Injunction, Prohibition

2

and Damages filed by petitioners,

and its Resolution dated 20 June 1997 denying petitioners

motion for reconsideration.

3

A complaint for Annulment of Mortgage and

Foreclosure with Preliminary Injunction, Prohibition and

Damages was filed by petitioners P.C. Javier & Sons, Inc.

and spouses Pablo C. Javier, Sr. and Rosalina F. Javier

against PAIC Savings & Mortgage Bank, Inc., Grace S.

Belvis, Acting Ex Officio Regional Sheriff of Pasig, Metro

Manila and Sofronio M. Villarin, Deputy SheriffinCharge,

before Branch 62 of the RTC of Makati City, on 07 May

1984. The case was docketed as Civil Case No. 7184.

4

On 10 May 1984, a Supplemental Complaint was filed

to include additional defendants, namely: Pio Martinez,

Acting Ex Officio Regional Sheriff of Antipolo, Rizal, and

Nicanor D. Blanco, Deputy SheriffinCharge.

The facts that gave rise to the aforesaid complaint, as

found by Branch 62 of the RTC of Makati City, and adopted

by the respondent court, are as follows:

_______________

1 CA Rollo, pp. 107123 Penned by Associate Justice Minerva P.

GonzagaReyes (later Associate Justice of the Supreme Court) with

Associate Justices Ramon U. Mabutas, Jr. and Portia Alio

Hormachuelos, concurring.

2 Id., pp. 145147.

3 Records, Vol. I, pp. 115.

4 Id., pp. 2931.

39

VOL. 462, JUNE 29, 2005 39

P.C. Javier & Sons, Inc. vs. Court of Appeals

In February, 1981, Plaintiff P.C. Javier and Sons Services, Inc.,

Plaintiff Corporation, for short, applied with First Summa

Savings and Mortgage Bank, later on renamed as PAIC Savings

and Mortgage Bank, Defendant Bank, for short, for a loan

accommodation under the Industrial Guarantee Loan Fund

(IGLF) for P1.5 Million. On March 21, 1981, Plaintiff Corporation

through Plaintiff Pablo C. Javier, Plaintiff Javier for short, was

advised that its loan application was approved and that the same

shall be forwarded to the Central Bank (CB) for processing and

release (Exhibit A also Exhibit 8).

The CB released the loan to Defendant Bank in two (2)

tranches of P750,000 each. The first tranche was released to the

Plaintiff Corporation on May 18, 1981 in the amount of

P750,000.00 and the second tranche was released to Plaintiff

Corporation on November 21, 1981 in the amount of P750,000.00.

From the second tranche release, the amount of P250,000.00 was

deducted and deposited in the name of Plaintiff Corporation

under a time deposit.

Plaintiffs claim that the loan releases were delayed that the

amount of P250,000.00 was deducted from the IGLF loan of P1.5

Million and placed under time deposit that Plaintiffs were never

allowed to withdraw the proceeds of the time deposit because

Defendant Bank intended this time deposit as automatic

payments on the accrued principal and interest due on the loan.

Defendant Bank, however, claims that only the final proceeds of

the loan in the amount of P750,000.00 was delayed the same

having been released to Plaintiff Corporation only on November

20, 1981, but this was because of the shortfall in the collateral

cover of Plaintiffs loan that this second tranche of the loan was

precisely released after a firm commitment was made by Plaintiff

Corporation to cover the collateral deficiency through the opening

of a time deposit using a portion of the loan proceeds in the

amount of P250,000.00 for the purpose that in compliance with

their commitment to submit additional security and open time

deposit, Plaintiff Javier in fact opened a time deposit for

P250,000.00 and on February 15, 1983, executed a chattel

mortgage over some machineries in favor of Defendant Bank that

thereafter, Plaintiff Corporation defaulted in the payment of its

IGLF loan with Defendant Bank hence Defendant Bank sent a

demand letter dated November 22, 1983, reminding Plaintiff

Javier to make payments because their accounts have been long

overdue that on May 2, 1984, Defendant Bank sent another

demand letter to Plaintiff spouses informing them that since they

have defaulted in

40

40 SUPREME COURT REPORTS ANNOTATED

P.C. Javier & Sons, Inc. vs. Court of Appeals

paying their obligation, their mortgage will now be foreclosed

that when Plaintiffs still failed to pay, Defendant Bank initiated

extrajudicial foreclosure of the real estate mortgage executed by

Plaintiff spouses and accordingly the auction sale of the property

covered by TCT No. 473216

5

was scheduled by the ExOfficio

Sheriff on May 9, 1984.

The instant complaint was filed to forestall the

extrajudicial foreclosure sale of a piece of land6 covered by

Transfer Certificate of Title (TCT) No. 473216 mortgaged

by petitioner corporation in favor of First Summa Savings

and Mortgage Bank which bank was 7later renamed as

PAIC Savings and Mortgage Bank, Inc. It likewise asked

for the nullification of the Real Estate Mortgages it entered

into with First Summa Savings and Mortgage Bank. The

supplemental complaint added several defendants who

scheduled for public auction other real estate properties

contained in the same real estate mortgages and covered by

TCTs No. N5510, No. 426872, 8

No. 506346 and Original

Certificate of Title No. 10146.

Several extrajudicial foreclosures of the mortgaged

properties were scheduled but were temporarily

9

restrained

by the RTC notwithstanding the denial of petitioners 10

prayer for a writ of preliminary injunction. In an Order

dated 10 December 1990, the RTC ordered respondents

sheriffs to maintain the status quo and to desist from

further proceeding with the extrajudicial foreclosure of the

mortgaged properties.

Among the issues raised by petitioners at the RTC are

whether or not First Summa Savings and Mortgage Bank

and PAIC Savings and Mortgage Bank, Inc. are one and

the same entity, and whether or not their obligation is

already due and

_______________

5 Rollo, pp. 7778.

6 Records, Vol. II, p. 810.

7 Exh. 1, Id., p. 741.

8 Records, Vol. I, pp. 2728.

9 Id., pp. 105107.

10 Records, Vol. II, p. 536.

41

VOL. 462, JUNE 29, 2005 41

P.C. Javier & Sons, Inc. vs. Court of Appeals

demandable at the time respondent bank commenced to

extrajudicially foreclose petitioners properties in April

1984.

The RTC declared that First Summa Savings and

Mortgage Bank and PAIC Savings and Mortgage Bank,

Inc. are one and the same entity and that petitioner

corporation is liable to respondent bank for the unpaid

balance of its Industrial Guarantee Loan Fund (IGLF)

loans. The RTC further ruled that respondent bank was

justified in extrajudicially foreclosing the real estate

mortgages executed by petitioner corporation in its favor

because the loans were already due and demandable when

it commenced foreclosure proceedings in April 1984.

In its decision dated 06 July 1993, the RTC disposed of

the case as follows:

Premises considered, judgment is hereby rendered dismissing the

Complaint against Defendant Bank and ordering Plaintiffs to pay

Defendant Bank jointly and severally, the following:

1. The principal amount of P700,453.45 under P.N. No. 713

plus all the accrued interests, liquidated damages and

other fees due thereon from March 18, 1983 until fully

paid as provided in said PN

2. The principal amount of P749,879.38 under P.N. No. 841

plus all the accrued interests, liquidated damages and

other fees due thereon from September 1, 1982 until fully

paid as provided in such PN

3. The amount of P40,000.00 as actual damages

4. The amount of P30,000.00 as exemplary damages

5. The amount of P50,000.00 as attorneys fees plus

11

6. Cost of suit.

12

Petitioners

13

filed a Motion for Reconsideration which was

opposed by respondent bank. The motion was denied in an

Order dated 11 May 1994.

_______________

11 Id., p. 819.

12 Id., pp. 821830.

13 Id., pp. 833844.

42

42 SUPREME COURT REPORTS ANNOTATED

P.C. Javier & Sons, Inc. vs. Court of Appeals

Petitioners appealed the decision to the Court of Appeals.

The latter affirmed in toto the decision of the lower court. It

also denied petitioners motion for reconsideration.

Hence, this appeal by certiorari.

Petitioners assigned the following as errors:

a. PUBLIC RESPONDENT COURT GRAVELY

ERRED WHEN IT SUSTAINED THE DISMISSAL

OF PETITIONERS COMPLAINT AND IN

AFFIRMING THE RIGHT OF THE

RESPONDENT BANK TO COLLECT THE IGLF

LOANS IN LIEU OF FIRST SUMMA SAVINGS

AND MORTGAGE BANK WHICH ORIGINALLY

GRANTED SAID LOANS.

COROLLARY TO THE ABOVE ARGUMENT, THE

PUBLIC RESPONDENT COURT ALSO GRAVELY

ERRED WHEN IT RULED THAT THE

PETITIONERS CANNOT WITHHOLD THEIR

PAYMENT TO THE RESPONDENT BANK

NOTWITHSTANDING THE ADMITTED

INABILITY OF THE RESPONDENT BANK TO

FURNISH THE PETITIONERS THE SAID

REQUESTED DOCUMENTS.

b. PUBLIC RESPONDENT COURT GRAVELY

ERRED WHEN IT SUSTAINED THE

COLLECTION OF THE ENTIRE PROCEEDS OF

THE IGLF LOANS OF P1,500,000.00 DESPITE

THE FACT THAT THE P250,000.00 OF THIS

LOAN WAS WITHHELD BY THE FIRST SUMMA

SAVINGS AND MORTGAGE BANK TO BECOME

PART OF THE COLLATERALS TO THE SAID

P1,500,000.00 LOAN.

c. PUBLIC RESPONDENT COURT GRAVELY

ERRED WHEN IT SUSTAINED THE DAMAGES

AWARDED TO THE RESPONDENT BANK

DESPITE THE ABSENCE OF MALICE OR BAD

FAITH ON THE PART OF THE PETITIONERS IN

FILING THIS CASE AGAINST THE

RESPONDENT BANK.

On the first assigned error, petitioners argue that they are

legally justified to withhold their amortized payments to

the respondent bank until such time they would have been

properly notified of the change in the corporate name of

First Summa Savings and Mortgage Bank. They claim that

they have never received any formal notice of the alleged

change of

43

VOL. 462, JUNE 29, 2005 43

P.C. Javier & Sons, Inc. vs. Court of Appeals

corporate name of First Summa Savings and Mortgage

Bank to PAIC Savings & Mortgage Bank, Inc. They further

claim that the only and first time they received formal

evidence of a change in the corporate name of First Summa

Savings and Mortgage Bank surfaced when respondent

bank presented its witness, Michael Caguioa, on 03 April

1990, where he presented the Securities and Exchange

Commission (SEC) Certificate of Filing of the Amended

Articles of Incorporation

14

of First Summa Savings and

Mortgage 15Bank, the Central Bank (CB) Certificate of

Authority to change the name of First Summa Savings

and Mortgage Bank to PAIC Savings16

and Mortgage Bank,

Inc., and the CB Circular Letter dated 27 June 1983.

Their argument does not hold water. Their defense that

they should first be formally notified of the change of

corporate name of First Summa Savings and Mortgage

Bank to PAIC Savings and Mortgage Bank, Inc., before

they will continue paying their loan obligations to

respondent bank presupposes that there exists a

requirement under a law or regulation ordering a bank

that changes its corporate name to formally notify all its

debtors. After going over the Corporation Code and

Banking Laws, as well as the regulations and circulars of

both the SEC and the Bangko Sentral ng Pilipinas (BSP),

we find that there is no such requirement. This being the

case, this Court cannot impose on a bank that changes its

corporate name to notify a debtor of such change absent

any law, circular or regulation requiring it. Such act would

be judicial legislation. The formal notification is, therefore,

discretionary on the bank. Unless there is a law, regulation

or circular from the SEC or BSP requiring the formal

notification of all debtors of banks of any change in

corporate name, such notification remains to be a mere

internal policy that banks may or may not adopt.

_______________

14 Exh. 1, Id., p. 741.

15 Exh. 2, Id., p. 754.

16 Exh. 3, Id., p. 755.

44

44 SUPREME COURT REPORTS ANNOTATED

P.C. Javier & Sons, Inc. vs. Court of Appeals

In the case at bar, though there was no evidence showing

that petitioners were furnished copies of official documents

showing the First Summa Savings and Mortgage Banks

change of corporate name to PAIC Savings and Mortgage

Bank, Inc., evidence abound that they had notice or

knowledge thereof.

17

Several documents establish this fact.

First, letter dated 16 July 1983 signed by Raymundo V.

Blanco, Accountant of petitioner corporation, addressed to

PAIC Savings and Mortgage Bank, Inc. Part of said letter

reads: In connection with your inquiry as to the utilization

of funds we obtained from the former First Summa Savings 18

and Mortgage Bank, . . . Second, Board Resolution of

petitioner corporation signed by Pablo C. Javier, Sr. on 24

August 1983 authorizing him to execute a Chattel

Mortgage over certain machinery in favor of PAIC Savings 19

and Mortgage Bank, Inc. Third, Secretarys Certificate

signed by Fortunato E. Gabriel, Corporate Secretary of

petitioner corporation, on 01 September 1983, certifying

that a board resolution was passed authorizing Mr. Pablo

C. Javier, Sr. to execute a chattel mortgage on the

corporations equipment that will serve as collateral to

cover the IGLF loan with PAIC Savings

20

and Mortgage

Bank, Inc. Fourth, undated letter signed by Pablo C.

Javier, Sr. and addressed to PAIC Savings and Mortgage

Bank, Inc., authorizing Mr. Victor F. Javier, General

Manager of petitioner corporation, to secure from PAIC

Savings and Mortgage Bank, Inc. certain documents for his

signature.

From the foregoing documents, it cannot be denied that

petitioner corporation was aware of First Summa Savings

and Mortgage Banks change of corporate name to PAIC

Savings and Mortgage Bank, Inc. Knowing fully well of

such change, petitioner corporation has no valid reason not

to pay because the IGLF loans were applied with and

obtained from First

_______________

17 Exh. 30, Id., p. 804.

18 Exh. 31, Id., p. 806.

19 Exh. 32, Rollo, p. 123.

20 Exh. 33, Records, Vol. II, p. 809.

45

VOL. 462, JUNE 29, 2005 45

P.C. Javier & Sons, Inc. vs. Court of Appeals

Summa Savings and Mortgage Bank. First Summa Savings

and Mortgage Bank and PAIC Savings and Mortgage

Bank, Inc., are one and the same bank to which petitioner

corporation is indebted. A change in the corporate name

does not make a new corporation, whether effected by a

special act or under a general law. It has no effect on the

identity of21 the corporation, or on its property, rights, or

liabilities. The corporation, upon such change in its name,

is in no sense a new corporation, nor the successor of the

original corporation. It is the same corporation with 22a

different name, and its character is in no respect changed.

Anent the second assigned error, this Court rules that

respondent court did not err when it sustained the

collection of the entire proceeds of the IGLF loans

amounting to P1,500,000.00 despite the withholding of

P250,000.00 to become part of the collaterals to the said

P1,500,000.00 IGLF loan.

Petitioners contend that the collaterals they submitted

were more than sufficient to cover the P1,500,000.00 IGLF

loan. Such contention is untenable. Petitioner corporation

was required to place P250,000.00 in a time deposit with

respondent bank for the simple reason that the collateral it

put up was insufficient to cover the IGLF loans it has

received. It admitted the shortfall of its collateral when it

authorized23 petitioner Pablo C. Javier, Sr., via a board

resolution, to execute a chattel mortgage over certain

machinery in favor of PAIC Savings and Mortgage24 Bank,

Inc. which was certified by its corporate secretary. If the

collateral it put up was sufficient, why then did it execute

another chattel mortgage?

_______________

21 Avon Dale Garments, Inc. v. National Labor Relations Commission,

G.R. No. 117932, 20 July 1995, 246 SCRA 733, 737.

22 Republic Planters Bank v. Court of Appeals, G.R. No. 93073, 21

December 1992, 216 SCRA 738, 745.

23 Exh. 31, Records, Vol. II, p. 806.

24 Exh. 32, Rollo, p. 123.

46

46 SUPREME COURT REPORTS ANNOTATED

P.C. Javier & Sons, Inc. vs. Court of Appeals

In his order dated 07 September 1984, Hon. Rafael T.

Mendoza found that the loanable value of the lands,

buildings, machinery and equipment amounted only to

P934,000.00. The order reads in part:

The terms and conditions of the IGLF loan extended to plaintiff

corporation are governed by the loan and security documents

evidencing said loan. Although the loan agreement was approved

by the defendant bank, the same has to be processed and be

finally approved by the Central Bank of the Philippines, in

pursuance to the IGLF program, of which the defendant bank is

an accredited participant. The defendant had to await Central

Banks advise (sic) regarding the final approval of the loan before

the release of the proceeds thereof. The proceeds of the loan was

released to the plaintiff on 6 April and November 20, 1981, and

the final proceeds was released only on November 20, 1981, on

account of short fall in the collateral covered by the lands and

buildings as well as the machineries and equipment then subject

of the existing mortgages in favor of the defendant bank, having

only a loanable value of P934,000.00, and only after a firm

commitment made by plaintiff corporation to the defendant bank

to correct the collateral deficiency thru the execution of a chattel

mortgage on additional machineries, equipment and tools and

thru the opening of a time deposit with PAIC Bank using a

portion of the loan proceeds in the amount of P250,000.00 to

answer for its obligation to the defendant bank under the IGLF

loan was the final proceeds of the loan released in favor of the

plaintiffs. The delay in the release of the final proceeds25 of the

IGLF loan was due to the aforestated collateral deficiency.

As declared by the respondent court, the finding in said

order was not disputed in the appeal before it. It said that

what was contained in petitioners brief was that their

loans were overcollateralized,

26

and fail to specify why or in

what manner it was so. Having failed to raise this issue

before the respondent court, petitioners thus cannot raise

this issue before this Court. Moreover, since the issue of

whether or not the collateral put up by petitioners is

sufficient is factual, the

_______________

25 Records, Vol. I, p. 107 CA Rollo, pp. 118119.

26 CA Rollo, p. 119.

47

VOL. 462, JUNE 29, 2005 47

P.C. Javier & Sons, Inc. vs. Court of Appeals

same is not proper for this Courts consideration. The basic

rule is that factual questions are beyond

27

the province of the

Supreme Court in a petition for review.

Petitioners maintain that to collect the P250,000.00

from them would be a clear case of unjust enrichment

because they have not availed or used said amount for the

same was unlawfully withheld from them.

We do not agree. The fundamental doctrine of unjust

enrichment is the transfer of value without just cause or

consideration. The elements of this doctrine are:

enrichment on the part of the defendant impoverishment

on the part of the plaintiff and lack of cause. The main

objective is 28to prevent one to enrich himself at the expense

of another. It is commonly accepted that this doctrine

simply means that a person shall not be allowed to29profit or

enrich himself inequitably at anothers expense. In the

instant case, there is no unjust enrichment to speak of. The

amount of P225,905.79 was applied as payment for

petitioner corporations loan which was taken from the

P250,000.00, together with its accrued interest, that was

placed in time deposit with First Summa Savings and

Mortgage Bank. The use of said amount as payment was

approved

30

by petitioner Pablo C. Javier, Sr. on 17 March

1983. As further found by the RTC in its decision, the 31

balance of the time deposit was withdrawn by petitioners.

Petitioner corporation faults respondent bank, then

known as First Summa Savings and Mortgage Bank, for

requiring it to put up as additional collateral the amount of

P250,000.00 inasmuch as the CB never required it to do so.

It added that

_______________

27 Sambar v. Levi Strauss & Co., G.R. No. 132604, 06 March 2002, 378

SCRA 364.

28 De Leon v. Santiago Syjuco, Inc., G.R. No. L3316, 31 October 1951,

90 Phil. 311, 331.

29 Soriano v. Court of Appeals, G.R. No. 78975, 07 September 1989, 177

SCRA 330, 336.

30 Exh. 23, Records, Vol. II, p. 793B.

31 Id., p. 817.

48

48 SUPREME COURT REPORTS ANNOTATED

P.C. Javier & Sons, Inc. vs. Court of Appeals

respondent bank took advantage of its urgent and

immediate need at the time for the proceeds of the IGLF

loans that it had no choice but to comply with respondent

banks requirement to put in time deposits the said amount

as additional collateral.

We agree with respondent court that the questioning of

the propriety

32

of the placing of the P250,000.00 in time

deposits with respondent bank as additional collateral

was belatedly made. As abovediscussed, the requirement

to give additional collateral was warranted because the

collateral petitioner corporation put up failed to cover its

IGLF loans. If petitioner corporation was really bent on

questioning the reasonableness of putting up the

aforementioned amount as additional collateral, it should

have done immediately after it made the time deposits on

26 November 1981. This, it did not do. It questioned 33the

placing of the time deposits only on 08 February 1984 or

long after defendant bank had already demanded full

payment of the loans, then amounting to P2,045,401.79 as

of 22 November 1983. It is too late in the day for petitioner

corporation to question the placing of the P250,000.00 in

time deposits after it failed to pay its loan obligations as

scheduled, making them due and demandable, and after a

demand for full payment has been made. We will not allow

petitioner corporation to have ones cake and eat it too.

As regards the payments made by petitioner

corporation, respondent court has this to say:

The trial court held, based on plaintiffs own exhibits, that

plaintiff[s] made the following payments:

_______________

32 Certificate of Time Deposit No. 003712 in the amount of P200,000.00

and Certificate of Time Deposit No. 003713 in the amount of P50,000.00,

both dated 26 November 1981 Records, Vol. II, pp. 429430.

33 Exh. I, Records, Vol. II, p. 615.

49

VOL. 462, JUNE 29, 2005 49

P.C. Javier & Sons, Inc. vs. Court of Appeals

On Promissory Note No. 713:

Date Actual Date of

Amount

(Per PN Schedule) Payment

July 6, 1981 August 3, 1981 P 28,125.00

October 6, 1981 October 28, 1981 28,836.13

Date Actual Date of

Amount

(Per PN Schedule) Payment

January 6, 1982 January 22, 1982 29,227.38

March 17, 1983 225,905.79

TOTAL P 312,094.30

And on Promissory Note No. 841:

Date Actual Date of

Amount

(Per PN Schedule) Payment

February 20, 1982 April 13, 1982 P 28,569.30

May 20, 1982 July 7, 1982 29,254.31

August 20, 1982 August 31, 1982 36,795.44

TOTAL P 94,619.05

Plaintiffappellant[s] does not dispute the finding, which is

obvious from the foregoing summary, that plaintiff[s] stopped

payments on March 17, 1983 on Promissory Note No. 713, and on

August 31, 1982 on Promissory Note No. 841.

By simply looking at the amortization schedule attached to the

two promissory notes, it is clear that plaintiff[s] already defaulted

on its loan obligations when the defendant Bank gave notice of

the foreclosure proceedings on April 28, 1984. On amortization

payments alone, plaintiff[s] should have paid a total of P459,339

as of April 6, 1984 on Promissory [Note] No. 713, and a total of

P328,173.00 as of February 20, 1984 on Promissory Note [No.]

841. No extended computation is necessary to demonstrate that,

even without imputing the liquidated damages equivalent to 2% a

month on the delayed payments (see second paragraph of the

promissory notes), the plain

50

50 SUPREME COURT REPORTS ANNOTATED

P.C. Javier & Sons, Inc. vs. Court of Appeals

tiffs were grossly deficient in amortization payments, and already

in default when the foreclosure proceedings were commenced.

Further, we note that under the terms of the promissory note,

failure to pay an installment when due shall entitle the bank or

its assign to declare all the 34obligations as immediately due and

payable (second paragraph).

As to the third assigned error, petitioners argue that there

being no malice or bad faith on their part when they filed

the instant case, no damages should have been awarded to

respondent bank.

We cannot sustain such argument. The presence of

malice or bad faith is very evident in the case before us. By

the documents it executed, petitioner corporation was well

aware that First Summa Savings and Mortgage Bank

changed its corporate name to PAIC Savings and Mortgage

Bank, Inc. Despite knowledge that First Summa Savings

and Mortgage Bank and PAIC Savings and Mortgage

Bank, Inc., are one and the same entity, it pretended

otherwise. It used this purported ignorance as an excuse to

renege on its obligation to pay its loans after they became

due and after demands for payment were made, claiming

that it never obtained the loans from respondent bank.

No good faith was shown by petitioner corporation. If it

were in good faith in complying with its loan obligations

since it believed that respondent bank had no right to the

payment, it should have made a valid consignation in

court. This, it did not do. If petitioner corporation were at a

loss as to who should receive the payment, it could have

easily taken steps and inquired from the SEC, CB of the

Philippines or from the bank itself from which it received

the loans and to where it made previous payments.

Further, the fact that it was respondent bank that was

demanding payment for loans already due and demandable

and not First Summa Savings and Mortgage Bank is

sufficient to make petitioner corporation

_______________

34 CA Rollo, pp. 120121.

51

VOL. 462, JUNE 29, 2005 51

P.C. Javier & Sons, Inc. vs. Court of Appeals

wonder why this is so. It never took any initiative to clear

the matter. Instead, it paid no attention to the valid

demands of respondent bank.

The awarding of actual and compensatory damages, as

well as attorneys fees, is justified under the circumstances.

We quote with approval the reasons given by the RTC for

the grant of the same:

Considering that Defendant Bank had been prevented at least

four (4) times from foreclosing the mortgages (i.e., Temporary

Restraining Orders of May 9 and 19 and October 22, 1984 and

status quo order of December 10, 1990 enjoining the extrajudicial

foreclosure sales of May 9 and 16 and October 23, 1984 and

December 20, 1990, respectively), it is proper that Defendant

Bank be reimbursed its actual expenses. The amount of

P40,000.00 is reasonable reimbursement for the publication and

other expenses incurred in the four (4) extrajudicial foreclosures

which were enjoined by the Court. Considering the wanton and

reckless filing of this clearly unfounded and baseless legal action

and the fact that Defendant Bank had to defend itself against

such suit, attorneys fees in the amount of P50,000.00 should be

paid by the Plaintiffs to the Defendant Bank. Defendant Bank

failed to adduce indubitable proof on the moral and exemplary

damages that it seeks. Nevertheless, since such proof is not

absolutely necessary and primarily as an example for the public

good to deter others from filing a similar clearly unfounded legal

action, Defendant Bank35

should be entitled to an award of

exemplary damages.

This Court finds that petitioners failed to comply with

what is incumbent upon themto pay their loans when

they became due. The lame excuse they belatedly advanced

for their nonpayment cannot and should not prevent

respondent bank from exercising its right to foreclose the

real estate mortgages executed in its favor.

WHEREFORE, premises considered, the Court of

Appeals decision dated 31 January 1997 and its resolution

dated 20

_______________

35 Records, Vol. II, pp. 818819.

52

52 SUPREME COURT REPORTS ANNOTATED

Levi Strauss (Phils.), Inc. vs. Vogue Traders Clothing

Company

June 1997 are hereby AFFIRMED in toto. Costs against

petitioners.

SO ORDERED.

Puno (Chairman), AustriaMartinez, Callejo, Sr.

and Tinga, JJ., concur.

Judgment and resolution affirmed in toto.

Note.Private respondents are estopped at this late

stage to deny the existence of corporate relationship with

petitioner. (Metro Manila Transit Corporation vs. Morales,

173 SCRA 629 [1989])

o0o

Copyright2017CentralBookSupply,Inc.Allrightsreserved.

You might also like

- CCC Insurance Vs CADocument11 pagesCCC Insurance Vs CATahani Awar Gurar100% (1)

- Lyceum VS CaDocument7 pagesLyceum VS CaWorstWitch TalaNo ratings yet

- 014 VILLAVICENCIO Oñate v. COADocument2 pages014 VILLAVICENCIO Oñate v. COASalve VillavicencioNo ratings yet

- Sales CasesDocument33 pagesSales CasesYulo Vincent Bucayu PanuncioNo ratings yet

- Pioneer Insurance Vs CA (G.R. No. 84197)Document8 pagesPioneer Insurance Vs CA (G.R. No. 84197)MarizPatanaoNo ratings yet

- RUBBERWORLD (PHILS.), INC., and JULIE YAO ONG vs. NLRCDocument4 pagesRUBBERWORLD (PHILS.), INC., and JULIE YAO ONG vs. NLRCRaquel DoqueniaNo ratings yet

- Islamic Directorate V CA - GR 117897 - May 14 1997 - 272 SCRA 454Document9 pagesIslamic Directorate V CA - GR 117897 - May 14 1997 - 272 SCRA 454Jeremiah ReynaldoNo ratings yet

- St. Martin Funeral Homes vs. National Labor Relations CommissionDocument2 pagesSt. Martin Funeral Homes vs. National Labor Relations CommissionCali Ey100% (1)

- Oriental Assurance Corporation vs. Court of AppealsDocument6 pagesOriental Assurance Corporation vs. Court of AppealsJaja Ordinario Quiachon-Abarca100% (1)

- Kwok Vs Phil Carpet 457 SCRA 465Document17 pagesKwok Vs Phil Carpet 457 SCRA 465Abigael DemdamNo ratings yet

- Filipino Merchants Insurance V Court of Appeals (179 SCRA 638)Document8 pagesFilipino Merchants Insurance V Court of Appeals (179 SCRA 638)Mcon RlordinarioNo ratings yet

- Cavite Development Bank Vs SpsDocument2 pagesCavite Development Bank Vs SpsJug HeadNo ratings yet

- Garma V People PDFDocument12 pagesGarma V People PDFJoyce KevienNo ratings yet

- G.R. No. L-45322 DigestDocument2 pagesG.R. No. L-45322 DigestyaneedeeNo ratings yet

- THE CITY OF DAVAO, REPRESENTED BY THE CITY TREASURER OF DAVAO CITY, Petitioner, v.THE INTESTATE ESTATE OF AMADO S. DALISAY, REPRESENTED BY SPECIAL ADMINISTRATOR ATTY. NICASIO B. PADERNA, Respondent.Document8 pagesTHE CITY OF DAVAO, REPRESENTED BY THE CITY TREASURER OF DAVAO CITY, Petitioner, v.THE INTESTATE ESTATE OF AMADO S. DALISAY, REPRESENTED BY SPECIAL ADMINISTRATOR ATTY. NICASIO B. PADERNA, Respondent.Pame PameNo ratings yet

- CORPO 1st Assignment - Atty. LiberatoDocument248 pagesCORPO 1st Assignment - Atty. LiberatoRainbow cloversNo ratings yet

- Jardine Davies Inc vs. JRB Realty Inc. 463 SCRA 555Document6 pagesJardine Davies Inc vs. JRB Realty Inc. 463 SCRA 555morningmindsetNo ratings yet

- 125.129 - AQCHAI v. Quezon City Govt. (2018) - Digest PDFDocument4 pages125.129 - AQCHAI v. Quezon City Govt. (2018) - Digest PDFJairus Charles Ma Ii PaguntalanNo ratings yet

- G.R. No. 170912Document12 pagesG.R. No. 170912Rene Valentos100% (1)

- Pleading - Case DigestDocument30 pagesPleading - Case DigestQuennieNo ratings yet

- Hall v. Piccio 86 Phil 603 (1950)Document3 pagesHall v. Piccio 86 Phil 603 (1950)gcantiverosNo ratings yet

- 2.-People's Air Cargo v. CA, 297 SCRA 170 (1998Document16 pages2.-People's Air Cargo v. CA, 297 SCRA 170 (1998Christine Rose Bonilla LikiganNo ratings yet

- NHA V BasaDocument3 pagesNHA V BasaKayeNo ratings yet

- Special CommercialDocument1 pageSpecial CommercialDrew MGNo ratings yet

- 9 Sta. Ana v. Commercial UnionDocument7 pages9 Sta. Ana v. Commercial UnionEmary Gutierrez100% (1)

- Enriquez Security Services, Inc. v. Cabotaje, 496 SCRA 169 (2006)Document13 pagesEnriquez Security Services, Inc. v. Cabotaje, 496 SCRA 169 (2006)inno KalNo ratings yet

- SMC vs. KhanDocument19 pagesSMC vs. KhanGuiller MagsumbolNo ratings yet

- Dulay Enterprises V CA G.R. No. 91889Document6 pagesDulay Enterprises V CA G.R. No. 91889Gen GrajoNo ratings yet

- DEVELOPMENT BANK OF THE PHILIPPINES , petitioner, vs. COURT OF APPEALS and the ESTATE OF THE LATE JUAN B. DANS, represented by CANDIDA G. DANS, and the DBP MORTGAGE REDEMPTION INSURANCE POOL, respondents..docxDocument3 pagesDEVELOPMENT BANK OF THE PHILIPPINES , petitioner, vs. COURT OF APPEALS and the ESTATE OF THE LATE JUAN B. DANS, represented by CANDIDA G. DANS, and the DBP MORTGAGE REDEMPTION INSURANCE POOL, respondents..docxWilliam AzucenaNo ratings yet

- Herrera Vs Mago Gr231120 15jan2020Document13 pagesHerrera Vs Mago Gr231120 15jan2020CJ0% (1)

- SJS Vs AtienzaDocument1 pageSJS Vs AtienzaclaudeNo ratings yet

- Vallido Vs PonoDocument3 pagesVallido Vs PonoNikki Joanne Armecin LimNo ratings yet

- 6 TAÑEDO vs. CA, 12 EQUITORIAL vs. MAYFAIRDocument3 pages6 TAÑEDO vs. CA, 12 EQUITORIAL vs. MAYFAIRRomnick JesalvaNo ratings yet

- RP V Cortez and AMA Land V Wack-WackDocument9 pagesRP V Cortez and AMA Land V Wack-WackAlan BuenaventuraNo ratings yet

- Tax Review DoctrinesDocument18 pagesTax Review DoctrinesGrace Robes HicbanNo ratings yet

- Collector of Internal Revenue Vs Club Filipino, Inc. de Cebu 5 SCRA 321 (1962)Document4 pagesCollector of Internal Revenue Vs Club Filipino, Inc. de Cebu 5 SCRA 321 (1962)KarlNo ratings yet

- DEUTSCHE KNOWLEDGE SERVICES PTE LTD. v. COMMISSIONER OF INTERNAL REVENUEDocument11 pagesDEUTSCHE KNOWLEDGE SERVICES PTE LTD. v. COMMISSIONER OF INTERNAL REVENUEChennieNo ratings yet

- Tiongco vs. Director of LandsDocument1 pageTiongco vs. Director of LandsLesterNo ratings yet

- Ryes Vs RTCDocument2 pagesRyes Vs RTCJanine FabeNo ratings yet

- Phil. Veterans Bank V CADocument8 pagesPhil. Veterans Bank V CAApril DiolataNo ratings yet

- Philam Care Health System Vs CADocument6 pagesPhilam Care Health System Vs CAAnonymous geq9k8oQyONo ratings yet

- Rule 87 (Sec. 1 To 10)Document13 pagesRule 87 (Sec. 1 To 10)Joseph Dimalanta DajayNo ratings yet

- Bautista v. Auto Plus TradersDocument12 pagesBautista v. Auto Plus TraderseieipayadNo ratings yet

- 29 - Laya Vs CA - GR 205813, 2018Document5 pages29 - Laya Vs CA - GR 205813, 2018Nadia ZialcitaNo ratings yet

- International Vs LittonDocument9 pagesInternational Vs LittonMazaya VillameNo ratings yet

- Mateo Cariño vs. Insular GovernmentDocument1 pageMateo Cariño vs. Insular GovernmentPrinston Del CampoNo ratings yet

- Petitioner vs. vs. Respondents: First DivisionDocument7 pagesPetitioner vs. vs. Respondents: First DivisionKarl OdroniaNo ratings yet

- Obligations and ContractsDocument12 pagesObligations and ContractsJULIUS L. LEVENNo ratings yet

- Dionio v. Transglobal Maritime Agency, Inc.,GR No. 217362: Student Name: Mereria, Aldrin Carlos Niño ADocument14 pagesDionio v. Transglobal Maritime Agency, Inc.,GR No. 217362: Student Name: Mereria, Aldrin Carlos Niño AOL VRNo ratings yet

- Framers of The Organic Law and of The People Adopting It Light and Understanding of Prior and Existing Laws and With Reference To ThemDocument75 pagesFramers of The Organic Law and of The People Adopting It Light and Understanding of Prior and Existing Laws and With Reference To ThemJohndale de los SantosNo ratings yet

- SPL Cases 2Document174 pagesSPL Cases 2Minnie chanNo ratings yet

- 10 Bergonio Vs SEAAirDocument4 pages10 Bergonio Vs SEAAirMadz Rj MangorobongNo ratings yet

- ALFONSO S. TAN, Petitioner vs. Securities and Exchange Commission G.R. No. 95696 March 3, 1992Document2 pagesALFONSO S. TAN, Petitioner vs. Securities and Exchange Commission G.R. No. 95696 March 3, 1992vivivioletteNo ratings yet

- Iglesia Evangelica V Bishop LazaroDocument10 pagesIglesia Evangelica V Bishop Lazaroarianna0624No ratings yet

- PHILEX MINING Vs REYESDocument2 pagesPHILEX MINING Vs REYESMariz GalangNo ratings yet

- Ching vs. Subic Bay GolfDocument16 pagesChing vs. Subic Bay GolfKrizia FabicoNo ratings yet

- RP vs. CosalanDocument14 pagesRP vs. CosalannvmndNo ratings yet

- SEbastian v. BPIDocument8 pagesSEbastian v. BPIvivivioletteNo ratings yet

- Sps Ong V BPI Family SavingsDocument9 pagesSps Ong V BPI Family SavingsNika RojasNo ratings yet

- Besa, Galang and Medina For Petitioner. de Santos and Delfino For RespondentsDocument23 pagesBesa, Galang and Medina For Petitioner. de Santos and Delfino For RespondentsJohn Ceasar Ucol ÜNo ratings yet

- 01 Mun of San Narciso v. MEndezDocument13 pages01 Mun of San Narciso v. MEndezMlaNo ratings yet

- Leobrera V CADocument12 pagesLeobrera V CAMlaNo ratings yet

- 06 Drilon v. LimDocument12 pages06 Drilon v. LimMlaNo ratings yet

- 03 Limbona v. MangelinDocument17 pages03 Limbona v. MangelinMlaNo ratings yet

- 07 Atienza v. VillarosaDocument27 pages07 Atienza v. VillarosaMlaNo ratings yet

- 95 Francisco v. CADocument15 pages95 Francisco v. CAMlaNo ratings yet

- 07 Atienza v. VillarosaDocument27 pages07 Atienza v. VillarosaMlaNo ratings yet

- 09 QC v. BayantelDocument20 pages09 QC v. BayantelMlaNo ratings yet

- 11 NPC v. CasionanDocument19 pages11 NPC v. CasionanMlaNo ratings yet

- 16 Ramos v. CADocument49 pages16 Ramos v. CAMlaNo ratings yet

- 2 Garcia-Rueda v. PascasioDocument14 pages2 Garcia-Rueda v. PascasioMlaNo ratings yet

- 28 Candano v. SugataDocument21 pages28 Candano v. SugataMlaNo ratings yet

- 7 Phil Rabbit v. IACDocument20 pages7 Phil Rabbit v. IACMlaNo ratings yet

- 10 Africa v. CaltexDocument17 pages10 Africa v. CaltexMlaNo ratings yet

- 9 Fortune Insurance v. CADocument15 pages9 Fortune Insurance v. CARay Maynard BacusNo ratings yet

- 17 Biagtan V Insular LifeDocument19 pages17 Biagtan V Insular LifeMlaNo ratings yet

- 1 Ching v. Hon. Jansen RodriguezDocument17 pages1 Ching v. Hon. Jansen RodriguezMlaNo ratings yet

- 2 Garcia-Rueda v. PascasioDocument14 pages2 Garcia-Rueda v. PascasioMlaNo ratings yet

- 2 Capili v. CardanaDocument12 pages2 Capili v. CardanaMlaNo ratings yet

- 2 Natcher v. CADocument13 pages2 Natcher v. CAMlaNo ratings yet

- 27 Median v. MetropolitanDocument12 pages27 Median v. MetropolitanMlaNo ratings yet

- 2 Dizon-Rivera v. DizonDocument17 pages2 Dizon-Rivera v. DizonMlaNo ratings yet

- 8 Ople vs. Torres 293 SCRA 141 July 23 1998Document50 pages8 Ople vs. Torres 293 SCRA 141 July 23 1998Raiya AngelaNo ratings yet

- 28 Remitere v. YuloDocument7 pages28 Remitere v. YuloMlaNo ratings yet

- 29 PSE v. Manila Banking CorpDocument12 pages29 PSE v. Manila Banking CorpMlaNo ratings yet

- 26 People v. MusaDocument18 pages26 People v. MusaMlaNo ratings yet

- 26 Sari-Sari v. PiglasDocument26 pages26 Sari-Sari v. PiglasMlaNo ratings yet

- 30 PBC v. TrazoDocument18 pages30 PBC v. TrazoMlaNo ratings yet

- 21 Negros v. TengDocument16 pages21 Negros v. TengMlaNo ratings yet

- 4 Samar II v. SeludoDocument14 pages4 Samar II v. SeludoMlaNo ratings yet

- World Justice Project 2016Document199 pagesWorld Justice Project 2016acastro2008No ratings yet

- Glass StirringDocument4 pagesGlass StirringAdonis GaleosNo ratings yet

- English HDocument2 pagesEnglish HBea BautistaNo ratings yet

- Bi Ai PT PP Pres. PT Makna NyaDocument3 pagesBi Ai PT PP Pres. PT Makna NyaRofi ArifNo ratings yet

- Murray McleodDocument3 pagesMurray Mcleodgrumpyutility4632No ratings yet

- United States v. Ronald Kirk Merkley, 988 F.2d 1062, 10th Cir. (1993)Document4 pagesUnited States v. Ronald Kirk Merkley, 988 F.2d 1062, 10th Cir. (1993)Scribd Government DocsNo ratings yet

- The Role of Indian Judiciary in Achieving Social JusticeDocument21 pagesThe Role of Indian Judiciary in Achieving Social JusticeShivani SinghNo ratings yet

- Caterisirea Lui Ciprian de Oropos - 1986 PDFDocument11 pagesCaterisirea Lui Ciprian de Oropos - 1986 PDFVio VioletNo ratings yet

- All About IASDocument6 pagesAll About IASAnant SharmaNo ratings yet

- People Vs VinecarioDocument1 pagePeople Vs VinecarioLois Anne GabrielNo ratings yet

- 16 DEC 2019 EZS1438 08:35 6E 09:05 Ez3Dfsv S619: (BEG) Belgrade (GVA) GenevaDocument1 page16 DEC 2019 EZS1438 08:35 6E 09:05 Ez3Dfsv S619: (BEG) Belgrade (GVA) GenevaRahul PeddiNo ratings yet

- The History of VIRGIL A. STEWART In Capturing and Exposing the Great "Western Land Pirate" and His Gang, In Connexion With the Evidence; Also of the Trials, Confessions, and Execution of A Number of Murrell's Associates In the State of Mississippi During the Summer of 1835Document298 pagesThe History of VIRGIL A. STEWART In Capturing and Exposing the Great "Western Land Pirate" and His Gang, In Connexion With the Evidence; Also of the Trials, Confessions, and Execution of A Number of Murrell's Associates In the State of Mississippi During the Summer of 1835axissixaNo ratings yet

- Criminal Essay - 2005 1Document2 pagesCriminal Essay - 2005 1Tekani Trim100% (1)

- SSG Appendix G - Panel Terms of Reference - v1Document11 pagesSSG Appendix G - Panel Terms of Reference - v1Tuna MadalinNo ratings yet

- Love Is Not All You Need Psychology TodayDocument4 pagesLove Is Not All You Need Psychology TodayKAW100% (2)

- 219 Order On Motion For Summary JudgementDocument21 pages219 Order On Motion For Summary JudgementThereseApelNo ratings yet

- This Graduation SpeechDocument2 pagesThis Graduation SpeechBry CunalNo ratings yet

- Summary of The FRIA LawDocument13 pagesSummary of The FRIA LawKulit_Ako1100% (3)

- Kinds & How Equitable Remedies GrantedDocument4 pagesKinds & How Equitable Remedies GrantedMuhammad Abdullah KhanNo ratings yet

- Details of Assembly Segment of PCDocument1,698 pagesDetails of Assembly Segment of PCDhawal VasavadaNo ratings yet

- Form No. 46 SUPPORT PENDENTE LITEDocument2 pagesForm No. 46 SUPPORT PENDENTE LITEKristianne SipinNo ratings yet

- CasesDocument10 pagesCasesJhay Jhay Tugade AquinoNo ratings yet

- The Truth in Lending Act and The Equal Credit Opportunity ActDocument5 pagesThe Truth in Lending Act and The Equal Credit Opportunity ActMercy LingatingNo ratings yet

- Prevention of Money Laundering ActDocument1 pagePrevention of Money Laundering ActGargi VaishNo ratings yet

- Cal 25-2 Owners ManualDocument49 pagesCal 25-2 Owners ManualRobert LordNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyPaolo Jamer100% (1)

- Jurisdiction of Chennai IIDocument4 pagesJurisdiction of Chennai IISushant SaxenaNo ratings yet

- Tolbert v. Hart Et Al - Document No. 13Document7 pagesTolbert v. Hart Et Al - Document No. 13Justia.comNo ratings yet

- United States Court of Appeals: PublishedDocument15 pagesUnited States Court of Appeals: PublishedScribd Government DocsNo ratings yet

- 85 120126 Jadie Hall Affidavit About Assault and RetaliationDocument89 pages85 120126 Jadie Hall Affidavit About Assault and RetaliationNevada CureNo ratings yet