Professional Documents

Culture Documents

2729 Content 1

Uploaded by

tavis80Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2729 Content 1

Uploaded by

tavis80Copyright:

Available Formats

Market Insight In Association with:

Business Intelligence for the Offshore Oil & Gas Industry

Decommissioning Analysis

Low Oil Prices, High Decom Costs & Expert Insight

With continued oil price uncertainty, the advent of deepwater decommissioning and

escalating abandonment costs, it has never been a more important time for the industry to

demystify one of the most overlooked parts of the offshore asset life-cycle: decommissioning

Philip Chadney, Project Director, DecomWorld

Latest Industry Controlling Rising New Industry

Trends Impacting Decommissioning Challenges Ahead

Decommissioning Costs

1,000ft

This exclusive decommissioning analysis has been created in conjunction with the 7th Annual

Decommissioning & Abandonment Summit (March 17-19, 2015 Houston, USA). The 7th Annual

Decommissioning & Abandonment Summit is the industry's largest and most influential business

conference & exhibition for the decommissioning industry. The 2015 Summit will bring together over 800

decommissioning, abandonment and offshore executives for 3 days of intensive decommissioning and

abandonment (D&A) insight, project case studies, networking and business development.

DecomWorld has compiled the following analysis in light of over 100 in-depth research calls with industry

executives from around the world.

2014 FC Business Intelligence

The information of this document was prepared by DecomWorld (part of FC Business Intelligence) and its partners. DecomWorld has no obligation to tell you when information in

this document changes. DecomWorld makes every effort to use reliable, comprehensible information, but we make no representation that it is accurate or complete. In no event

shall DecomWorld and its partners be liable for any damages, losses, expenses, loss of data or profit caused by the use of the material or contents of this document.

DecomWorld grants you a licence to make one free copy of the information contained herein for personal or non-commercial use only. Accordingly, no part of this document may

be copied, performed in public, broadcast or adapted without DecomWorlds prior written permission. Please contact Phil Chadney at pchadney@decomworld.com to request

permission.

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

When comparing global decommissioning and abandonment (D&A) progress, its undeniable that the Gulf of

Mexico has the most established track record in the industry. Extensive platform removal and well plugging

and abandonment activity has created a thriving supply chain for decommissioning in the region, ever since

the introduction of the 2010 Idle Iron NTL regulation.

Outside the Gulf of Mexico, less mature decommissioning regions are beginning to come to terms with the

emerging reality of decommissioning. National oil companies in the Asia-Pacific region are developing the

guidelines and regulation required to kick-start D&A programs, whilst the North Sea is on the cusp of a flourish

in activity.

The overarching D&A landscape is undergoing a shift, though, in light of several key industry developments

this, in turn, will impact decommissioning strategy in 2015 and beyond.

Three of the Biggest Unknowns Impacting Decommissioning in 2015 and Beyond:

1. OIL PRICE

UNCERTAINTY

$ 2. COST OF DECOMMISSIONING

COST ESTIMATION VS. ACTUAL COST

3. DEEPWATER

ABANDONMENT:

THE INEVITABLE RISE

Structures active in the Gulf of

Mexico in water depth greater

than 400ft (1978 c2013)

Source: Data from BOEM/BSEE, January 2014

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

Oil Price Uncertainty:

How will low oil prices impact the decommissioning market? To what

extent will low oil prices provide uncertainty for contractors relying on

abandonment revenue from operators? What strategy will operators

take in an emerging era of low oil prices? Weve already seen significant

consolidation in the market with key players like Halliburton, one of the

largest US oilfield service companies, acquiring Baker Hughes. Superior

Energy Services recent exit from the Gulf of Mexico decommissioning

market also highlights the challenging market environment for

contractors looking to maintain margins and differentiate their portfolio

of services.

Industry Perspectives

Low Oil Prices: Rise or Fall in Decommissioning?

If low prices remain in place for the foreseeable future

the economic life of aging and low producing assets will

be brought forward. This, in turn, may accelerate close of

production (CoP), and decommissioning - but there will

be a drive to delay removal

Whether or not low oil prices will speed up

decommissioning depends on an operators ability to

remain economic when producing from aging facilities

or marginal fields. What may be non-economic for

one operator, for example a major, may not be for the

likes of another operator, for example an independent

operator. The recent trend for operators to offload their

aging assets onto the smaller independents already

demonstrates the variation in production economics

the big question is whether further reductions in oil

prices will cause an increase in CoP or just a production

slow down.

I think if the lower prices continue for some time it will

inevitably delay some decommissioning projects. I recall

seeing many years ago a graph of GoM decommissioning

activity versus oil price and when there was an oil price

slump there was significant drop in decommissioning

Join 800 top decommissining projects. At first a delay in decommissioning may seem

execs from Anadarko, counterintuitive but I again come back to the difference

BHP Billiton, BP, Chevron, between capital project thinking and decommissioning

ExxonMobil, Shell, Stone Energy thinking. Decommissioning is a drain on cash with

and many more! absolutely no income at the end of it. If oil prices drop

7th Annual Decommissioning

companies are more likely to be short of cash and hence

will, if at all possible, delay decommissioning and use

whatever cash they have to keep their ongoing capital

& Abandonment Summit 2015

projects alive.

March 17-19, Houston, Texas

Former Head of UK Decommissioning, Shell

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

According to Reuters, global oil and gas exploration

projects worth more than $150 billion are likely to

be put on hold next year. With low oil prices stopping

new projects from progressing, the price of marine

vessels will drop. Will this reduction in price provide the

incentive for operators to kick-start decommissioning

at a lower cost? In other words, could this mean that

decommissioning

Shift from Shallow to Deepwater in the

Gulf of Mexico:

Whilst the Gulf of Mexico has been working intensely to reduce

offshore liability over the last 5+ years, almost all of the activity has

been within the shallow water shelf area. As such, the arrival of

deepwater decommissioning prompts an entirely new set of challenges,

methodologies, technologies and strategies. With the skyrocketing

cost of subsea well P&A and deepwater structural abandonment,

its now a crucial time to develop cost estimation methodologies,

best practices and apply lessons learned from the limited number of

deepwater projects already completed. Anadarko set a benchmark for

deepwater decommissioning in mid-2014 with the deepest floating

production platform to date being successfully decommissioned the

Red Hawk Spar facility. Other regions, including Asia-Pacific, Northern

North Sea and South America have a significant portfolio of deepwater

decommissioning activity how will this impact the development of

rigless abandonment technologies and heavy lift vessels?

Deepwater fixed platorms in the Gulf of Mexico (2013)

Source: Data from BOEM/BSEE, January 2014

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

Floater structures in the Gulf of Mexico (2013

Source: Data from BOEM/BSEE, January 2014

Spiralling Decommissioning Costs:

Decommissioning cost estimation methodologies have come a long way

in the last few years, however, actual costs and timelines have almost

always exceeded original estimates. This has significant ramifications

for not only the operators but also contactors, too, who have struggled

to maintain margins due to unpredictability of decommissioning

programs. As such, its never been a more important time to minimize

the unknowns through rigorous planning and strategy.

Offshore Liability Changing Hands:

Independent operators are taking on ownership of aging facilities in the

Gulf of Mexico how will this impact decommissioning methodologies

and the funding of decommissioning programs? With independent

Join 800 top decommissining operators dedicating significantly fewer resources to decommissioning,

execs from Anadarko, it could mark a shift in the level of pre-engineering undergone and could

certainly set an industry benchmark for a more cost-effective approach

BHP Billiton, BP, Chevron,

to decommissioning.

ExxonMobil, Shell, Stone Energy

and many more!

7th Annual Decommissioning

& Abandonment Summit 2015

March 17-19, Houston, Texas

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

Recent M&A Activity Includes:

$200 m Stone Energy Corp has an agreement to sell its non-core Gulf of Mexico (GOM)

conventional shelf properties to Talos Energy Offshore LLC for $200 million

in cash and assumed future undiscounted abandonment liabilities

estimated at $117 million.

SandRidge Energy Inc. sold its Gulf of Mexico properties to Riverstone

$1.1 n

2b

Holdings LLC-backed Fieldwood Energy LLC of Houston for

$1.12 billion, less than what it paid for them just two years ago.

Total SA is looking to sell its 17 percent stake in the Gulf of

.5 - 2 b n

Mexico's Tahiti oil field, which could fetch between

$1.5 billion and $2 billion in a deal, according to people

familiar with the matter.

$1

$2bn

Energy XXI (4th largest liability in GOM)

buys EPL Oil & Gas (5th largest liability) for

$2 billion. Significant new liability for

$16bn

Plains Exploration & Production is bought by Freeport-

McMoRan Copper & Gold Inc. for $16 billion

Integrating Decommissioning as Part of the Lifecycle:

Theres no denying that convincing the ExCo (Executive Committee)

level of any oil and gas operator of the significance of decommissioning

is a major industry hurdle. Individuals representing the ExCo level

are typically interested in pursuing the most cutting-edge new

development programs. How can we raise awareness for the significance

of decommissioning cost and convince those at the top of the chain to

Join 800 top decommissining devote resources to decommissioning at an earlier stage in consideration

execs from Anadarko, of long-term lifecycle goals? If we consider decommissioning at an

BHP Billiton, BP, Chevron, operations phase, and even address decommissioning at a design

ExxonMobil, Shell, Stone Energy phase, we can positively impact end-of-life costs.

and many more!

7th Annual Decommissioning

& Abandonment Summit 2015

March 17-19, Houston, Texas

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

Industry Collaboration:

Signs of industry collaboration are certainly on the horizon which

could mark a renaissance in the decommissioning market. Industry

discussions are progressing between operators and contractors which

would significantly reduce cost through multi-operator and multi-asset

campaigns (vs. standalone projects). The elephant in the room remains,

though: will operators work together to reduce cost or will successful

operators hold a tight grip on their finely tuned decommissioning

process to maintain competitive advantage?

Interview with Eric Faulds, Former Shell UK

Decommissioning Manager

Eric Faulds has had an extensive career in North

Sea projects commencing in the late 60s with the

installation of the first platforms for Shell in the

Southern North Sea through to Project Manager

of Brent Spar in the late 90s. During this period he

gained experience in project management, design,

underwater engineering, onshore and offshore

construction of both steel and concrete installations

as well as offshore decommissioning. After taking

early retirement from Shell in 1999 he set up Eric

Faulds Associates Ltd. to provide independent

advice on offshore decommissioning. The bulk of

his work has involved the generation or review of

decommissioning cost estimates.

Decommissioning activity in the North Sea is about to become an

altogether more serious proposition than it ever has been before,

according to one of the most experienced and knowledgeable observers

of the industry. What is less certain, however, is how well the industry

has organised its business practices to deal with the coming wave of

activity.

Eric Faulds, the Aberdeen-based founder of decommissioning

consultancy EFA, has worked in the North Sea offshore oil and gas

industry since the first production platforms were installed in the late

sixties. Faulds says that up to now, there has not been a great deal of

activity. Its been bumbling along at a low level for the past 10 years,

Join 800 top decommissining

with everyone anticipating a wave of projects, but Ive detected a big

execs from Anadarko, increase in activity in the past two years or so, and more project teams

BHP Billiton, BP, Chevron, are starting to be put together. I think well see a lot more activity in

ExxonMobil, Shell, Stone Energy the next five-to-seven years, particularly in the southern sector. There

and many more! are half a dozen significant projects being prepared in Aberdeen that I

know of.

7th Annual Decommissioning This is promising news for expert and specialists in the decommissioning

& Abandonment Summit 2015 industry, but Faulds says there still seems to be uncertainty among

March 17-19, Houston, Texas operators about what they need to do, how they need to do it and

what its going to cost them.

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

Whats the damage?

Take the issue of costs. There has been a huge growth in the notional

cost of decommissioning an offshore facility. Faulds says a well-plugging

estimate that came to 1.4m 10 years ago now comes to 30m. And

the cost of decommissioning a large North Sea platform that was put at

75m in 2004 comes to 300m today. There is some evidence that these

increases are starting to level out, but this may be more the result of the

increased sharing of bottom-ine numbers among companies.

Faulds knows whereof he speaks. He has worked in the offshore North

Sea industry since the first production platforms were installed in

the late sixties. He has spent most of his career with Shell, first in the

southern North Sea, and eventually as project manager of Brent Spar

in the late nineties. During this period he was involved with project

management, design, underwater engineering and the onshore and

offshore construction of steel and concrete installations.

After taking early retirement from Shell in 1999 he set up Eric Faulds

Associates to provide independent advice on offshore decommissioning.

As part of that process he has generated or reviewed hundreds of

operators estimates of the costs of decommissioning, which firms have

to compile to comply with regulatory and accounting rules. Indeed, over

the past five years, this has made up about 90% of his workload, and

enabled him to build up a formidable cost database.

Although the industry is perhaps coming to a consensus about what

the bottom line ought be on a pound per tonne basis something

around 7,000 probably isnt too wide of the mark for a large platform.

However, there are wide and sometimes wild variations in the

costs that different companies attach to the same items in the bill. For

example he says some bills for onshore disposal are as low as 80 a

tonne, not including the value of scrap, but he has also seen estimates

that put the price at more than 1,300 a tonne for the same work. To give

another example, one estimator put the price of hiring a heavy lifting

vessel at a not-unrealistic 600,000 a day, but another said it would be

only 375,000. Estimates can also include technical nonsense such as

the pulling up of piles when those piles are grouted into sleeves on the

Join 800 top decommissining jacket, or unrealistic lifting schemes, yet despite this doesnt stop the

execs from Anadarko, bottom lines conforming to general industry norms.

BHP Billiton, BP, Chevron,

ExxonMobil, Shell, Stone Energy

and many more!

7th Annual Decommissioning

& Abandonment Summit 2015

March 17-19, Houston, Texas

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

The suspicion is, of course, that the estimator began with the final cost

and worked backwards to reach it, stretching and squeezing the figure

to get them to fit. One reason that this is possible is the lack of reliable

datasets based on real-life projects. There has been limited work carried

out in the North Sea, and most of that has involved the smaller, lighter

steel structures in the southern quadrant. There have been a few high-

profile schemes, such as BPs dismantling of the NW Hutton platform,

but generally speaking there is a lack of precedents. And although

companies have a fair idea of the state of their kit above the water line,

what lurks beneath, particularly down the holes, is largely unknown.

A lack of experience?

Another part of the problem is that operators take an overly credulous

attitude to what they are told by some consultants. According to Faulds,

the lack of field experience means there can be a lack of expertise in

the oil companies, and as a result they dont challenge so-called expert

consultants. When theyre told something is a requirement, they need to

say But is it? Show me where it says that.

For example, operators may be advised that they must trace every

element of a decommissioned facility through to its final destination,

both hazardous and non-hazardous. The fact is that you dont, at least

not the non-hazardous materials, although you may choose to do so for

company reputation issues or they are advised that they must carry out

meticulous inventory studies which is not necessarily the case.

Another issue is the natural tendency for companies to apply to

decommissioning schemes the lessons theyve learned on capital

projects, even though the two belong to different categories.

Decommissioning project teams can get bogged down trying to fit in

with the fixed gates set out in company procedures, but there are major

differences between decommissioning and capital projects, says Faulds.

A couple of weeks ago at the Decom World conference in Aberdeen, I

saw slides being presented with a traditional capital project process of

front-end engineering design and then concept selection. But in most

cases the concept is selected before the project starts its total removal.

Join 800 top decommissining I dont understand why some companies seem to have a wish to then

execs from Anadarko, attempt to preselect the removal method. In most cases the removal

BHP Billiton, BP, Chevron, work should be tendered to a selection of contractors offering different

ExxonMobil, Shell, Stone Energy methods, because this will encourage innovative solutions.

and many more!

7th Annual Decommissioning

& Abandonment Summit 2015

March 17-19, Houston, Texas

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

I also think there will have to be a cultural change to accept that, in

large complex platforms, decommissioning cost estimates with the

same accuracy as capital projects will not be feasible. Management

needs to accept this and live with the uncertainty.

The next stage

Given Faulds impressive experience with the North Sea industry so far,

how does he see decommissioning developing in the future?

One thing he is not expecting is that the co-operative spirit that

the recent Wood Review called for will make much of a difference

in decommissioning, even though a collective approach to the all-

important issue of equipment hiring might reduce everyones cost

base. He says: Its been talked about for years, but although firms form

joint ventures, oil is a very competitive business. My experience is that

companies are reluctant to share and if they do they want it on their

own terms; there was a great debate about common conditions for

fabrication contracts many years ago, and it was agreed in principle, but

firms only wanted to do it if their contracts were used as the basis. Also,

the US operators tend to be sensitive to anti-trust laws.

Another issue is the present fall in the price of oil. Although some

have argued that this is making more fields uneconomical to run, and

therefore promoting their decommissioning, Faulds argues that this will

not happen if the low price is sustained: operators who are strapped for

cash spend what they have on schemes that will generating income. Its

counter-intuitive, I know. And firms are obliged to decommission when

they stop producing, but they can stall and stall, or go on producing at a

loss. I saw a graph of oil price versus decommission activity in the Gulf of

Mexico many years ago, and that showed the two rose and fell together.

Low oil price equals low income equals lack of cash equals delayed

decommissioning. Of course any cash-rich firms may consider that its a

buyers market and decommission at a better price.

If decommissioning activity does indeed pick up in the next seven years,

many of the problems that Faulds highlights will be solved, because

Join 800 top decommissining the industry will learn from experience. However, this can be a painful

execs from Anadarko, way to gain knowledge, and the better prepared that operators are, the

BHP Billiton, BP, Chevron, faster they can adapt to this new challenge.

ExxonMobil, Shell, Stone Energy

and many more!

7th Annual Decommissioning

& Abandonment Summit 2015

March 17-19, Houston, Texas

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

Addressing the Most Critical

Decommissioning Challenges:

To address all of these industry challenges and opportunities impacting

the decommissioning market, the 7th Annual Decommissioning &

Abandonment Summit exists to facilitate the most crucial D&A debates.

By bringing together industry pioneering thought-leaders from the

worlds most active decommissioning operators, contractors, service

providers and regulators, the Summit tackles your highest priority issues

and developments.

Leading experts from Anadarko, BHP Billiton, BP, Chevron, Shell, Stone

Energy, BSEE, BOEM, Versabar, Baker Hughes and many more share the

latest case studies, best practices and lessons learned.

GLOBAL DECOMMISSIONING PERSPECTIVES:

Assess the state of D&A across the globe, with

critical regulator and operator case studies from

Gulf of Mexico, North Sea, Asia-Pacific, South

America and Alaska to build a complete picture of

the size of the prize

STRATEGIES TAILORED TO WATER DEPTH &

FACILITY TYPE: Get cutting-edge approaches to

decommissioning TLPs, SPARs, FPSOs and fixed

structures in deepwater and address existing

complexities in shallower water

COST ESTIMATION & EFFICIENCY: Accurately

and reliably develop cost estimates for your

offshore portfolio that will reflect the true cost of

decommissioning by implementing robust cost

estimation methodologies and techniques

WELL PLUGGING & ABANDONMENT & SUBSEA

INFRASTRUCTURE DECOM: Check out the latest

technology to maximize well P&A efficiency and

ensure regulation is being met for your suspended

wells and subsea infrastructure

LIFECYCLE APPROACH TO D&A: Revolutionize

your D&A strategy by looking at it as part of an

Join 800 top decommissining all-encompassing approach to end of field life

execs from Anadarko, management to discover the tools, from design

BHP Billiton, BP, Chevron, to end of life, that can be used to improve cost

ExxonMobil, Shell, Stone Energy efficiency

and many more!

7th Annual Decommissioning

& Abandonment Summit 2015

March 17-19, Houston, Texas

Decommissioning Analysis

Business Intelligence for the Offshore Oil & Gas Industry

Following the success of the 2014 D&A Summit in which 700 offshore

executives gathered for 3 days of ground breaking decommissioning

intelligence (not to mention the packed 60+ exhibition hall) the 2015

Summit will be pulling out all the stops to make it bigger and better

than ever before.

Exclusive Industry-First Case Studies: Anadarkos Red Hawk

Deepwater Spar Decommissioning project case study will be top

of the agenda providing a multi-stakeholder perspective with

InterMoor and Versabar presenting alongside the operator!

Brand New DecomWorld Gala Dinner on the Opening Night:

Cement your relationships with global D&A leaders over a 3 course

meal and entertainment whilst hearing from John Hofmeister,

Former President of Shell, during a not-to-miss keynote address.

Expanded track sessions, packed workshop agenda day,

plus regulator and operator super-panels: Youre guaranteed

to hone in on your biggest challenges and meet the specialists

during focused deepwater, cost estimation, well P&A, subsea

infrastructure, pipeline and rigs to reefs debates

Have your say in the biggest live polling event in the

decommissioning calendar: put forward your viewpoint

and get expert panel commentary on the findings to the most

controversial decommissioning topics

Put this alongside the leading-edge keynotes from the Bureau of

Safety & Environmental Enforcement (BSEE), Bureau of Ocean Energy

Management (BOEM), Anadarko, BHP Billiton, BP, Chevron and Shell

giving you all the latest strategies for you to tackle offshore liability in

2015 and beyond! Theres certainly no better place to secure your D&A

business and meet the entire global industry all under one roof!

Secure your place as early as possible to benefit from the advanced

booking savings, plus join the online networking suite to pre-arrange

Join 800 top decommissining all your meetings over the course of the Summit this is the only

execs from Anadarko, place to do D&A business! Simply complete and return the included

BHP Billiton, BP, Chevron, Registration form (found at the back of this brochure) or register online at

ExxonMobil, Shell, Stone Energy www.decomworld.com/decommissioning

and many more! With over 800 of the leading names expected in 2015 alongside over 60

exhibitors showcasing the latest D&A technologies and services, it has

7th Annual Decommissioning never been more important for you to maximize this unique opportunity.

& Abandonment Summit 2015 For that very reason we are pleased to announce that group discounts

March 17-19, Houston, Texas are now available so that your entire team can make the most of the

Summit. To learn more simply contact info@decomworld.com

As you have downloaded this whitepaper, save an extra $50 on your pass with discount code 2629WP50.

Just enter it here now: http://www.decomworld.com/decommissioning/register.php

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- ABB Offshore Oil and Gas Decommissioning 2015 PDFDocument62 pagesABB Offshore Oil and Gas Decommissioning 2015 PDFtavis80No ratings yet

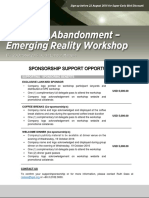

- 17WM06 - Sponsorship Support OpportunitiesDocument1 page17WM06 - Sponsorship Support Opportunitiestavis80No ratings yet

- Interview - Well Intervention Market Dynamics in Asia Pacific - Offshore Energy TodayDocument4 pagesInterview - Well Intervention Market Dynamics in Asia Pacific - Offshore Energy Todaytavis80No ratings yet

- 01 Overview of Offshore PlatformDocument25 pages01 Overview of Offshore Platformtavis80No ratings yet

- 09otc TocDocument19 pages09otc Toctavis80No ratings yet

- 01 - Rig SelectionDocument65 pages01 - Rig Selectionzunuwanus93% (15)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PEH Q3 Long QuizDocument1 pagePEH Q3 Long QuizBenedict LumagueNo ratings yet

- 3rd Quarter Exam (Statistics)Document4 pages3rd Quarter Exam (Statistics)JERALD MONJUANNo ratings yet

- Rekomendasi AnimeDocument11 pagesRekomendasi Animeosvaldo manurungNo ratings yet

- Presentation On 4G TechnologyDocument23 pagesPresentation On 4G TechnologyFresh EpicNo ratings yet

- Shandong Baoshida Cable Co, LTD.: Technical ParameterDocument3 pagesShandong Baoshida Cable Co, LTD.: Technical ParameterkmiqdNo ratings yet

- Harmonics PatternsDocument4 pagesHarmonics PatternsIzzadAfif1990No ratings yet

- Table Equivalent Schedule 40 Steel PipeDocument1 pageTable Equivalent Schedule 40 Steel PipeorisNo ratings yet

- JC Series Jaw Crusher PDFDocument8 pagesJC Series Jaw Crusher PDFgarrybieber100% (1)

- Immigrant Italian Stone CarversDocument56 pagesImmigrant Italian Stone Carversglis7100% (2)

- Why Are Solids Are Floating On My Secondary Clarifier - Biological Waste TreatmDocument6 pagesWhy Are Solids Are Floating On My Secondary Clarifier - Biological Waste TreatmIsaac FernándezNo ratings yet

- Kinematics in One DimensionDocument4 pagesKinematics in One DimensionAldrin VillanuevaNo ratings yet

- Solutions GoldsteinDocument10 pagesSolutions GoldsteinAnyiNo ratings yet

- Cost Analysis - Giberson Art GlassDocument3 pagesCost Analysis - Giberson Art GlassSessy Saly50% (2)

- Logic NotesDocument19 pagesLogic NotesCielo PulmaNo ratings yet

- Liver: Anatomy & FunctionsDocument18 pagesLiver: Anatomy & FunctionsDR NARENDRANo ratings yet

- NF en Iso 5167-6-2019Document22 pagesNF en Iso 5167-6-2019Rem FgtNo ratings yet

- JKJKJDocument3 pagesJKJKJjosecarlosvjNo ratings yet

- Astm C892 - 00Document5 pagesAstm C892 - 00reneeNo ratings yet

- Douluo Dalu Volume 05 - Star Dou Forest PDFDocument141 pagesDouluo Dalu Volume 05 - Star Dou Forest PDFRay Joseph LealNo ratings yet

- Assignment 1Document3 pagesAssignment 1farhang_tNo ratings yet

- Catalogo GatesDocument255 pagesCatalogo GatesBenjamin HedoneweNo ratings yet

- C.Abdul Hakeem College of Engineering and Technology, Melvisharam Department of Aeronautical Engineering Academic Year 2020-2021 (ODD)Document1 pageC.Abdul Hakeem College of Engineering and Technology, Melvisharam Department of Aeronautical Engineering Academic Year 2020-2021 (ODD)shabeerNo ratings yet

- GP1 Q1 Week-1Document18 pagesGP1 Q1 Week-1kickyknacksNo ratings yet

- GCSE AstronomyDocument30 pagesGCSE Astronomyharris123mc100% (1)

- PIX4D Simply PowerfulDocument43 pagesPIX4D Simply PowerfulJUAN BAQUERONo ratings yet

- Amnaya Sutra (English)Document458 pagesAmnaya Sutra (English)Assam Bhakti SagarNo ratings yet

- The FOA Reference For Fiber Optics - Fiber Optic TestingDocument19 pagesThe FOA Reference For Fiber Optics - Fiber Optic TestingvsalaiselvamNo ratings yet

- Study The Effect of Postharvest Heat Treatment On Infestation Rate of Fruit Date Palm (Phoenix Dactylifera L.) Cultivars Grown in AlgeriaDocument4 pagesStudy The Effect of Postharvest Heat Treatment On Infestation Rate of Fruit Date Palm (Phoenix Dactylifera L.) Cultivars Grown in AlgeriaJournal of Nutritional Science and Healthy DietNo ratings yet

- PPT DIARHEA IN CHILDRENDocument31 pagesPPT DIARHEA IN CHILDRENRifka AnisaNo ratings yet

- Midterm Exam Gor Grade 11Document2 pagesMidterm Exam Gor Grade 11Algelle AbrantesNo ratings yet