Professional Documents

Culture Documents

Microfinance Assignment

Uploaded by

Sukriti DangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microfinance Assignment

Uploaded by

Sukriti DangCopyright:

Available Formats

Microfinance Assignment

Review: Grameen Bank of Bangladesh

Section B Group 18

Shruti Nadagouda (F1403) | Sukriti Dang (P36165) | Sumeet Saurav (P36166)

Introduction

The paper reviews Grameen Bank of Bangladesh in three sections. The first talks about

the school of thought on which Grameen Bank was conceived. The second about the financial

analysis of the case provided and the third section is about the present state of Grameen Bank.

Grameen Bank is a Nobel Peace Prize winning micro finance organization and a

community development bank founded in Bangladesh. It was brought to life in 1976 by

Professor Muhammad Yunus. He was doing a research project at the University of Chittagong to

design a credit delivery system to provide banking services to the rural poor. The results of the

research project laid the foundation for the design of the bank. In October 1983 the Grameen

Bank was authorised by national legislation as an independent bank.

Microfinance: School of thought

Prof. Yunus was inspired during the Bangladesh famine of 1974 to make a small loan of

US$27 to a group of 42 families as start-up money so that they could make items for sale an

escape the predatory lenders i.e. not pay exorbitantly high interest rates. He believed that making

such loans available to a larger population could stimulate businesses and reduce the widespread

rural poverty in Bangladesh. His thinking can be classified under the Development school of

Microfinance. This school of thought lays emphasis on increasing outreach first, followed by

sustainability and then impact.

As the case states that the grameen bank lends only to the poorest of the poor and the

bank seeks to extends its services to the entire country subsequently, the first step of the Social

development way i.e. Outreach has been at the thrust of operations of the Bank. The image of

the bank is also that of Bankers on Bikes and 90% of the staff works at the branch level. This

is further a testament of how the bank has been working on the aspect of outreach. Further, the

members are free to use their loan for any productive activity they wish, which gives them

greater opportunities to prosper.

The bank issues loans without any collateral or legal instruments or group-guarantee or

Joint Liability. Despite this method of lending the recovery rate is 96.67%. The entire loan

amount is financed from the banks deposits. Deposits amount to 145% of the outstanding loans,

which is an achievement for a microfinance institute. The deposits have been growing in eight

zones out of the forty zones in which the bank operates. Thus the second step of the development

way i.e. sustainability has also been achieved by the bank.

This is further substantiated by the fact that in 1995, the Grameen Bank decided not to

receive anymore fresh funds from the donors. The banks existing resources combined with the

growing deposits were enough to run and expand the credit program and repay the existing loans.

Not just sustainability, Grameen Bank has also been making profits since it came into existence.

It had made profit in all years since the beginning except for three years. They have transparent

financials and their accounts are available online.

The next step in the development way is that of the impact. Grameen Bank set the record

for the highest cash dividend declared by any bank in Bangladesh. The banks interest rate is

lower than the government rate, a factor which directly works for upliftment of the members.

The bank also has beggars as its members, nearly 20000 of whom have left begging and become

door to door sales persons. The overall impact of the bank on the Bangladeshi economy has been

tremendous as stated by the following facts:

As of January 2011, the total borrowers of the bank number 8.4 million, and 97% of those

are women.

The number of borrowers has more than doubled since 2003, when the bank had

3.12 million members.

As of October 2007, the Bank has a staff of more than 24,703 employees; its 2,468

branches provide services to 80,257 villages, up from the 43,681 villages covered in

2003.

The bank has distributed BDT 1.437 trillion (USD 20.92 billion) in loans.

The Grameen Bank is 95% owned by the local poor and 5% by the government.

Thus, it is evident that Grameen Bank has been proactive in reaching out to the poor and very

poor at affordable interest rates. The scaling-up was not limited and it also gained independence

from funding agencies to achieve sustainability. To sum it up, Prof. Yunuss belief in

Developmental approach of Microfinance proves to be beneficial in efficient delivering of

microfinance.

You might also like

- Comparing Microfinance Models PDFDocument15 pagesComparing Microfinance Models PDFlotdonNo ratings yet

- Management - Learning Lecture NotesDocument19 pagesManagement - Learning Lecture NotesweirdwolfvortexNo ratings yet

- Types of PlansDocument8 pagesTypes of Plansshivani100% (2)

- 110 - Principles of ManagementDocument2 pages110 - Principles of Managementabhilashr50No ratings yet

- FM Class Notes Day1Document5 pagesFM Class Notes Day1febycvNo ratings yet

- Strategy PPT Ch7Document38 pagesStrategy PPT Ch7yordiNo ratings yet

- Human Resource Management: An Asian PerspectiveDocument44 pagesHuman Resource Management: An Asian PerspectiveSiThuNo ratings yet

- Quiz (Functions, Roles and Skills of A Manager)Document1 pageQuiz (Functions, Roles and Skills of A Manager)Mylene SantiagoNo ratings yet

- Strategic Human Resource Mgmt. CH 1 Pulak DasDocument15 pagesStrategic Human Resource Mgmt. CH 1 Pulak DasPareen Joshi100% (2)

- HBC2111 Management Maths IiDocument74 pagesHBC2111 Management Maths IiOloo PunditNo ratings yet

- Questions Related To Planning (Chapter 4)Document14 pagesQuestions Related To Planning (Chapter 4)Wilson AdrikoNo ratings yet

- Report On Micro FinanceDocument54 pagesReport On Micro Financemohsinmalik07100% (1)

- Unit I Intro VJ MGMT NewDocument80 pagesUnit I Intro VJ MGMT NewVijay SbNo ratings yet

- Strategy Evaluation and ControlDocument41 pagesStrategy Evaluation and ControlVaibhav GuptaNo ratings yet

- Corporate Governance SyllabusDocument7 pagesCorporate Governance SyllabusDiana SaidNo ratings yet

- Leadership Chapter 1Document226 pagesLeadership Chapter 1KubaNo ratings yet

- Directorate of Marketing and Inspection: Agricultural Marketing Policies in IndiaDocument2 pagesDirectorate of Marketing and Inspection: Agricultural Marketing Policies in India5zy 555No ratings yet

- Chapter 02 Charting A Company's Direction-Its Vision, Mission, & ObjectivesDocument61 pagesChapter 02 Charting A Company's Direction-Its Vision, Mission, & ObjectivesKamruzzaman FahimNo ratings yet

- Engaging BRICS: Challenges and Opportunities For Civil SocietyDocument36 pagesEngaging BRICS: Challenges and Opportunities For Civil SocietyOxfamNo ratings yet

- Process & Limitations Environmental Analysis 1Document11 pagesProcess & Limitations Environmental Analysis 1Rishab Jain 2027203No ratings yet

- Introduction To Strategic Management and Business PolicyDocument14 pagesIntroduction To Strategic Management and Business PolicyAnonymous 8SNpyXNo ratings yet

- Assignment, Conflict Management & NegotiationDocument5 pagesAssignment, Conflict Management & NegotiationDiba SenNo ratings yet

- Module I Intro To IMCDocument31 pagesModule I Intro To IMCalex_daniel81No ratings yet

- Business Environment Case StudyDocument19 pagesBusiness Environment Case Studyradha4460% (5)

- Ghana - Rural BankDocument53 pagesGhana - Rural BankNeerajNo ratings yet

- 2 2 Stakeholder MappingDocument13 pages2 2 Stakeholder MappingSrilekha RoyNo ratings yet

- Effect of Organizational StructureDocument6 pagesEffect of Organizational Structurebayissa biratuNo ratings yet

- Contemporary Management - NotesDocument6 pagesContemporary Management - NotesMahmoud NassefNo ratings yet

- Understanding Strategy and Strategic ManagementDocument138 pagesUnderstanding Strategy and Strategic ManagementShivam JadhavNo ratings yet

- Concept NoteDocument3 pagesConcept NoteKaushal DhakanNo ratings yet

- New Enterprise ManagementDocument2 pagesNew Enterprise ManagementAnsheena AshaNo ratings yet

- Management Theories and PracticeDocument175 pagesManagement Theories and PracticeKidistMollaNo ratings yet

- Case Study No. 1 Gardeners+Document2 pagesCase Study No. 1 Gardeners+Angelee GarciaNo ratings yet

- Management Practices in Indian VedasDocument13 pagesManagement Practices in Indian Vedasanshuman bhattacharya100% (1)

- HRM in Microfinance: Building Effective WorkforcesDocument26 pagesHRM in Microfinance: Building Effective WorkforcesJennifer Azul MacedaNo ratings yet

- Chapter IIIDocument4 pagesChapter IIIDilip MargamNo ratings yet

- Functional Areas of IBDocument27 pagesFunctional Areas of IBAbhinav KumarNo ratings yet

- Consumer Behavior and Marketing Concept RelationshipDocument3 pagesConsumer Behavior and Marketing Concept RelationshipTazul IslamNo ratings yet

- Norman PPT Sa StramaDocument10 pagesNorman PPT Sa StramaCha PeñalozaNo ratings yet

- Economic Significance of Retailing in India & WorldwideDocument15 pagesEconomic Significance of Retailing in India & WorldwideModassar Nazar91% (11)

- Performance Management Unit 1Document23 pagesPerformance Management Unit 1Bhuvana GanesanNo ratings yet

- Presentation On DepartmentationDocument17 pagesPresentation On DepartmentationharshitaNo ratings yet

- EDP helps develop entrepreneurial abilities and skillsDocument4 pagesEDP helps develop entrepreneurial abilities and skillsShivraj ghodeswarNo ratings yet

- The Theory and Practice of Corporate GovernanceDocument25 pagesThe Theory and Practice of Corporate GovernanceMadihaBhatti100% (1)

- Sources of Finance SummaryDocument42 pagesSources of Finance SummaryTyson Texeira100% (1)

- BBA Core Principles of ManagementDocument14 pagesBBA Core Principles of ManagementSubrataTalapatraNo ratings yet

- Unit 7 Groups and Teams in OrganizationDocument26 pagesUnit 7 Groups and Teams in OrganizationIshworNeupaneNo ratings yet

- Mba 301Document26 pagesMba 301Akash skillsNo ratings yet

- The Practice of Strategy Formation - PHD ThesisDocument227 pagesThe Practice of Strategy Formation - PHD ThesisShirinda PradeeptiNo ratings yet

- Human Resource Management in Bangladesh - Exim BankDocument57 pagesHuman Resource Management in Bangladesh - Exim BankShohidullah Kaiser100% (2)

- Social Entrepreneurs Play The Role of Change Agents in The Social SectorDocument3 pagesSocial Entrepreneurs Play The Role of Change Agents in The Social SectorPriya DarshiniNo ratings yet

- OB AssignmentDocument48 pagesOB Assignmentsemetegna she zemen 8ተኛው ሺ zemen ዘመንNo ratings yet

- Maf5102 Fa Cat 2 2018Document4 pagesMaf5102 Fa Cat 2 2018Muya KihumbaNo ratings yet

- Mainstreaming Ethics and Professionalism in The Civil Service Week 6 SlidesDocument50 pagesMainstreaming Ethics and Professionalism in The Civil Service Week 6 Slidestilahunthm100% (1)

- Introduction To Financial ManagementDocument46 pagesIntroduction To Financial ManagementChethan KumarNo ratings yet

- Chapter 2 ADocument15 pagesChapter 2 AShi JingNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- International Strategic Management A Complete Guide - 2020 EditionFrom EverandInternational Strategic Management A Complete Guide - 2020 EditionNo ratings yet

- Theory and Estimation of CostDocument27 pagesTheory and Estimation of CostGaurav BharadwajNo ratings yet

- Use The Following Information in Answering Questions 130 and 131Document1 pageUse The Following Information in Answering Questions 130 and 131Joanne FernandezNo ratings yet

- Prime HR & Security Solutions PVT LTD: SUB: Appointment As HR ExecutiveDocument3 pagesPrime HR & Security Solutions PVT LTD: SUB: Appointment As HR ExecutivesayalikNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesTXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceEllis DavisNo ratings yet

- Paul Slomski Resume 2009.1Document2 pagesPaul Slomski Resume 2009.1Paul SlomskiNo ratings yet

- CTM Tutorial 3Document4 pagesCTM Tutorial 3crsNo ratings yet

- Mcom Cbcs LatestDocument45 pagesMcom Cbcs Latestanoopsingh19992010No ratings yet

- Book Building Process and Types ExplainedDocument15 pagesBook Building Process and Types ExplainedPoojaDesaiNo ratings yet

- 7 Marketing Strategies of India Automobile CompaniesDocument7 pages7 Marketing Strategies of India Automobile CompaniesamritNo ratings yet

- High Capacity Stacker-F1-G1-H1 Safety Guide en - USDocument14 pagesHigh Capacity Stacker-F1-G1-H1 Safety Guide en - UShenry lopezNo ratings yet

- Proposal HydrologyDocument4 pagesProposal HydrologyClint Sunako FlorentinoNo ratings yet

- Measuring Efficiency of Islamic Banks: Evidence From IndonesiaDocument9 pagesMeasuring Efficiency of Islamic Banks: Evidence From IndonesiaJEKINo ratings yet

- CIR Vs MirantDocument2 pagesCIR Vs MirantMoon BeamsNo ratings yet

- List of Maharashtra Pharrma CompaniesDocument6 pagesList of Maharashtra Pharrma CompaniesrajnayakpawarNo ratings yet

- CxtimetableDocument225 pagesCxtimetableJa Daniels100% (1)

- Critique Paper BA211 12 NN HRM - DacumosDocument2 pagesCritique Paper BA211 12 NN HRM - DacumosCherBear A. DacumosNo ratings yet

- Annotated BibliographyDocument9 pagesAnnotated Bibliographyapi-309971310100% (2)

- Measuring Elasticity of SupplyDocument16 pagesMeasuring Elasticity of SupplyPetronilo De Leon Jr.No ratings yet

- 2011 - PSEP 01 Main Report PDFDocument204 pages2011 - PSEP 01 Main Report PDFNaveed ChandioNo ratings yet

- Minglanilla FinalDocument23 pagesMinglanilla FinalCrystal Laine Abad MarabulasNo ratings yet

- PDFDocument16 pagesPDFAnil KhadkaNo ratings yet

- Managerial EconomicsDocument16 pagesManagerial EconomicsHarshitPalNo ratings yet

- Economics Notes For - Test - NovemberDocument2 pagesEconomics Notes For - Test - NovemberWai HponeNo ratings yet

- Sustainability Template August2012Document25 pagesSustainability Template August2012amitjain310No ratings yet

- Rajasthan Board ResultsDocument8 pagesRajasthan Board ResultsPrabhat AgarwalNo ratings yet

- Ride Details Bill Details: Thanks For Travelling With Us, KarthickDocument3 pagesRide Details Bill Details: Thanks For Travelling With Us, KarthickKarthick P100% (1)

- Data Link Institute of Business and TechnologyDocument6 pagesData Link Institute of Business and TechnologySonal AgarwalNo ratings yet

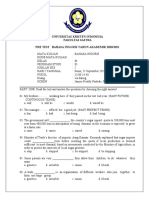

- Pre Test of Bahasa Inggris 21 - 9 - 2020Document5 pagesPre Test of Bahasa Inggris 21 - 9 - 2020magdalena sriNo ratings yet

- Talent Corp - Final Report (Abridged) PDFDocument211 pagesTalent Corp - Final Report (Abridged) PDFpersadanusantaraNo ratings yet

- 2 Ricardian ModelDocument51 pages2 Ricardian Modelkeshni_sritharan100% (1)