Professional Documents

Culture Documents

Fs SP 500

Uploaded by

Thiago MedeirosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fs SP 500

Uploaded by

Thiago MedeirosCopyright:

Available Formats

Equity

S&P 500

Description

The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 7.8 trillion

benchmarked to the index, with index assets comprising approximately USD 2.2 trillion of this total. The index includes

500 leading companies and captures approximately 80% coverage of available market capitalization.

Index Attributes

Created in 1957, the S&P 500 was the first U.S. market-cap-weighted stock market index. Today, its the basis of many

listed and over-the-counter investment instruments. This world-renowned index includes 500 of the top companies in

leading industries of the U.S. economy.

The S&P 500 is part of a series of S&P Dow Jones U.S. equity indices that can be used as mutually exclusive building

blocks; the index does not overlap holdings with the S&P MidCap 400 or S&P SmallCap 600. Together, they constitute

the S&P Composite 1500.

Methodology Construction

Universe. All constituents must be U.S. companies.

Eligibility Market Cap. Companies with market cap of USD 6.1 billion or greater.

Public Float. At least 50% of shares outstanding must be available for trading.

Financial Viability. Companies must have positive as-reported earnings over the most recent quarter, as well as over

the most recent four quarters (summed together).

Adequate Liquidity and Reasonable Price. Consists of highly tradable common stocks, with active and deep

markets.

Quick Facts

WEIGHTING METHOD Float-adjusted market cap weighted

REBALANCING FREQUENCY Quarterly, after the close on the third Friday of the quarter-ending month

CALCULATION FREQUENCY Real time

CALCULATION CURRENCIES USD, AUD, BRL, CAD, CHF, EUR, GBP, HKD, JPY, MXN, SGD

LAUNCH DATE March 4, 1957

For more information, including the complete methodology document, please visit:

http://www.spindices.com/indices/equity/sp-500

All information for an index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested

performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index

methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general

and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than,

back-tested returns.

AS OF FEBRUARY 28, 2017 www.spdji.com index_services@spglobal.com BLOOMBERGSM SPX <GO>

Equity

S&P 500

Historical Performance

S&P 500

Performance

INDEX LEVEL RETURNS ANNUALIZED RETURNS

1 MO 3 MOS YTD 1 YR 3 YRS 5 YRS 10 YRS

TOTAL RETURNS

4,532.93 3.97% 8.04% 5.94% 24.98% 10.63% 14.01% 7.62%

PRICE RETURNS

2,363.64 3.72% 7.50% 5.57% 22.33% 8.33% 11.60% 5.33%

NET TOTAL RETURNS

4,083.43 3.90% 7.87% 5.83% 24.17% 9.94% 13.28% 6.92%

Calendar Year Performance

2016 2015 2014 2013 2012 2011 2010 2009 2008 2007

TOTAL RETURNS

11.96% 1.38% 13.69% 32.39% 16.00% 2.11% 15.06% 26.46% -37.00% 5.49%

PRICE RETURNS

9.54% -0.73% 11.39% 29.60% 13.41% 0% 12.78% 23.45% -38.49% 3.53%

NET TOTAL RETURNS

11.23% 0.75% 12.99% 31.55% 15.22% 1.47% 14.37% 25.55% -37.45% 4.90%

AS OF FEBRUARY 28, 2017 www.spdji.com index_services@spglobal.com BLOOMBERGSM SPX <GO>

Equity

S&P 500

Risk

ANNUALIZED RISK ANNUALIZED RISK-ADJUSTED RETURNS

3 YRS 5 YRS 10 YRS 3 YRS 5 YRS 10 YRS

STD DEV

10.40% 10.24% 15.30% 1.02 1.37 0.50

Risk is defined as standard deviation calculated based on total returns using monthly values.

Fundamentals

P/E [TRAILING] P/E [PROJECTED] P/B INDICATED DIV YIELD P/SALES P/CASH FLOW

24.34 18.11 2.82 2.02% 1.90 16.34

P/E (Projected) and Indicated Dividend Yield are as of February 28, 2017; P/E (Trailing), P/B, P/Sales, and P/Cash Flow are as of September 30, 2016.

Fundamentals are updated on approximately the fifth business day of each month.

Index Characteristics

NUMBER OF CONSTITUENTS 505

CONSTITUENT MARKET CAP [USD MILLION]

MEAN TOTAL MARKET CAP 42,280.21

LARGEST TOTAL MARKET CAP 730,473.56

SMALLEST TOTAL MARKET CAP 2,533.75

MEDIAN TOTAL MARKET CAP 20,141.35

WEIGHT LARGEST CONSTITUENT [%] 3.6

WEIGHT TOP 10 CONSTITUENTS [%] 18.3

Top 10 Constituents By Index Weight

CONSTITUENT SYMBOL SECTOR*

Apple Inc. AAPL Information Technology

Microsoft Corp MSFT Information Technology

Exxon Mobil Corp XOM Energy

Amazon.com Inc AMZN Consumer Discretionary

Johnson & Johnson JNJ Health Care

Berkshire Hathaway B BRK.B Financials

JP Morgan Chase & Co JPM Financials

Facebook Inc A FB Information Technology

General Electric Co GE Industrials

Wells Fargo & Co WFC Financials

*Based on GICS sectors

AS OF FEBRUARY 28, 2017 www.spdji.com index_services@spglobal.com BLOOMBERGSM SPX <GO>

Equity

S&P 500

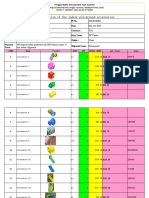

Sector* Breakdown

*Based on GICS sectors

The weightings for each sector of the index are rounded to the nearest tenth of a percent; therefore, the aggregate weights for the index may not equal

100%.

Country Breakdown

COUNTRY NUMBER OF CONSTITUENTS TOTAL MARKET CAP [USD MILLION] INDEX WEIGHT [%]

United States 505 21,351,504.00 100.0

Based on index constituents country of domicile.

Tickers

TICKER REUTERS

PRICE RETURNS SPX .spx

TOTAL RETURNS SPXT .SPXTR

NET TOTAL RETURNS SPTR500N .SPXNTR

AS OF FEBRUARY 28, 2017 www.spdji.com index_services@spglobal.com BLOOMBERGSM SPX <GO>

Equity

S&P 500

Related Products

This list includes investable products traded on certain exchanges currently linked to this selection of indices. While we have tried to include all such

products, we do not guarantee the completeness or accuracy of such lists. Please refer to the disclaimers at the end of this document or here

for more information about S&P Dow Jones Indices relationship to such third party product offerings.

PRODUCT NAME PRODUCT TYPE EXCHANGE TICKER

Amundi ETF S&P 500 UCITS ETF ETF EN Paris 500

AMUNDI ETF S&P 500 UCITS ETF - D ETF EN Paris 500D

AMUNDI INDEX S&P 500 - UCITS ETF DR ETF EN Paris S500

BetaShares S&P 500 Yield Maximiser Fund ETF ASE UMAX

BetaShares US Equities Strong Bear Hedge Fund - Currency Hedged ETF ASE BBUS

BMO S&P 500 ETF ETF Toronto ZSP

Bosera Standard and Poor's 500 ETF ETF Shanghai 513500

ComStage ETF S&P 500 UCITS ETF ETF Xetra ETF C012

CoreShares S&P 500 ETF ETF Johannesburg CSP500

CoreShares S&P 500 Exchange Traded Fund ETF SEM CSP500

db x-trackers S&P 500 UCITS ETF 1C ETF London XSPX

Direxion Daily S&P 500 Bear 3X Shares ETF NYSE Arca SPXS

Direxion Daily S&P 500 Bull 1.25X Shares ETF NYSE Arca LLSP

Direxion Daily S&P 500 Bull 2X Shares ETF NYSE Arca SPUU

Direxion Daily S&P 500 Bull 3X ETF NYSE Arca SPXL

Direxion Shares Etf Trust-Direxion Daily S&P 500 Bear 1x Shares ETF NYSE Arca SPDN

Horizons BetaPro S&P 500 Bear Plus ETF ETF Toronto HSD

Horizons BetaPro S&P 500 Bull Plus ETF ETF Toronto HSU

Horizons BetaPro S&P 500 Inverse ETF ETF Toronto HIU

HSBC S&P 500 UCITS ETF (GBp) ETF London HSPX

iShares Core S&P 500 ETF ETF NYSE Arca IVV

iShares Core S&P 500 UCITS ETF ETF SIX Swiss Ex CSSPX

iShares S&P 500 AUD Hedged ETF ETF ASE IHVV

iShares S&P 500 Index ETF ETF Toronto XUS

iShares S&P 500 UCITS ETF Inc ETF London IUSA

It Now S&P500 TRN Fundo de Indice ETF BM&FBOVESPA SPXI11

Lyxor ETF S&P 500 ETF London LSPU

Lyxor S&P 500 UCITS ETF ETF Xetra ETF LYPS

LYXOR UCITS ETF PEA S&P 500 C-EUR ETF EN Paris PSP5

Nikko Listed Index Fund US Equity S&P500 ETF Tokyo 1547

ProShares Short S&P500 ETF NYSE Arca SH

ProShares Ultra S&P500 ETF NYSE Arca SSO

ProShares UltraPro S&P 500 ETF NYSE Arca UPRO

ProShares UltraPro Short S&P 500 ETF NYSE Arca SPXU

ProShares UltraShort S&P500 ETF NYSE Arca SDS

S&P 500 Source ETF ETF London SPXS

S&P 500 THEAM Easy UCITS ETF - C EUR ETF EN Paris ESE

S&P 500 THEAM Easy UCITS ETF - C USD ETF EN Paris ESD

AS OF FEBRUARY 28, 2017 www.spdji.com index_services@spglobal.com BLOOMBERGSM SPX <GO>

Equity

S&P 500

PRODUCT NAME PRODUCT TYPE EXCHANGE TICKER

S&P 500 THEAM Easy UCITS ETF - C/D USD ETF EN Paris ESDD

Source S&P 500 UCITS ETF B ETF Xetra ETF D500

SPDR S&P 500 ETF Trust ETF NYSE Arca SPY

SPDR S&P 500 UCITS ETF ETF Xetra ETF SPY5

TD S&P 500 Index ETF ETF Toronto TPU

UBS ETFs plc - MAP Balanced 7 UCITS ETF SF ETF SIX Swiss Ex M7USAS

UBS ETFs plc - S&P 500 Index SF ETF SIX Swiss Ex S5USAS

UBS Irl ETF plc - S&P 500 UCITS ETF ETF BrsaItaliana SP5EUY

Vanguard S&P 500 ETF London VUSA

Vanguard S&P 500 ETF ETF NYSE Arca VOO

Vanguard S&P 500 Index ETF ETF Toronto VFV

Yuanta S&P 500 ETF ETF Taiwan 646

Barclays ETN+ Long B Leveraged ETN NYSE Arca BXUB

Barclays ETN+ Long C Leveraged ETN NYSE Arca BXUC

ETRACS MNTHLY RESET 2XS&P500 ETN NYSE Arca SPLX

HAREL SAL S&P 500 ETN Tel Aviv HRS&P25

HAREL SAL S&P INS ETN Tel Aviv HRSPX50

IPATH CBOE S&P 500 BUYWRITE ETN NYSE Arca BWV

IPATH LX S&P 500 ETN ETN NYSE Arca SFLA

KSM LEV S&P 500 PRX3 MTH 6DA ETN Tel Aviv KS50050

KSM LEV SHRT S&P500 PRX3 MTH ETN Tel Aviv KSSSNP53

KSM S&P 500 PR 4DA ETN Tel Aviv KSMSP

KSM S&P 500 PR ILS 40A ETN Tel Aviv KSMSPILS

KSM SHORT S&P500 3000 PR 6DA ETN Tel Aviv KSHORTSP

PSAGOT S&P SHORT X3 ETN Tel Aviv PSSP169

PSAGOT SAL S&P 500 ETN Tel Aviv PSP

PSAGOT SAL S&P 500 D2 ETN Tel Aviv MTVSP1

PSAGOT SAL S&P NIS ETN Tel Aviv PS50047

TACHLIT S&P 500 4DA ETN Tel Aviv TCSP4

TACHLIT S&P500 ILS 1 40A ETN Tel Aviv TSP5038

TACHLIT S&P500 ILS 2 40A ETN Tel Aviv INDSP18

E Fund S&P 500 Listed Open fund Shenzhen 161125

BTIC E-mini S&P 500 Index Futures Future CME EST

CBOE Volatility Index Futures Future CFE VIX

E-mini S&P 500 Index Futures Future CME ES

S&P 500 Index Futures Future CME SP

S&P 500 Variance Futures Future CBOE VA

CBOE Volatility Index Options Option CBOE VIX

E-mini S&P 500 End-of-Month Index Options Option CME EW

E-mini S&P 500 Index Options Option CME ES

E-mini S&P 500 Weekly Index Options Option CME EW*

Mini-SPX Index Options Option CBOE XSP

S&P 500 a-Flex Index Options Option CME XP

S&P 500 e-Flex Index Options Option CME YP

AS OF FEBRUARY 28, 2017 www.spdji.com index_services@spglobal.com BLOOMBERGSM SPX <GO>

Equity

S&P 500

PRODUCT NAME PRODUCT TYPE EXCHANGE TICKER

S&P 500 End-of-Month Index Options Option CME EV

S&P 500 Index Options Option CBOE SPX

S&P 500 Weekly Index Options Option CME EV*

SPXpm Index Options Option CBOE SPXPM

AS OF FEBRUARY 28, 2017 www.spdji.com index_services@spglobal.com BLOOMBERGSM SPX <GO>

Equity

S&P 500

Disclaimer

Source: S&P Dow Jones Indices LLC, a division of S&P Global.

The launch date of the S&P 500 was March 4, 1957.

All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The

back-test calculations are based on the same methodology that was in effect when the index was officially launched. Past performance is not an

indication or guarantee of future results. Please see the Performance Disclosure at http://www.spindices.com/regulatory-affairs-disclaimers/ for more

information regarding the inherent limitations associated with back-tested performance.

Copyright 2017 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Redistribution or reproduction in whole or in part are

prohibited without written permission. STANDARD & POORS and S&P are registered trademarks of Standard & Poors Financial Services LLC, a division

of S&P Global (S&P); DOW JONES is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been

licensed for use by S&P Dow Jones Indices LLC. S&P Dow Jones Indices LLC, Dow Jones, S&P and their respective affiliates (S&P Dow Jones Indices)

and third party licensors makes no representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class

or market sector that it purports to represent and S&P Dow Jones Indices and its third party licensors shall have no liability for any errors, omissions, or

interruptions of any index or the data included therein. Past performance of an index is not an indication or guarantee of future results. This document

does not constitute an offer of any services. Except for certain custom index calculation services, all information provided by S&P Dow Jones Indices is

general in nature and not tailored to the needs of any person, entity or group of persons. S&P Dow Jones Indices receives compensation in connection

with licensing its indices to third parties and providing custom calculation services. It is not possible to invest directly in an index. Exposure to an asset

class represented by an index may be available through investable instruments offered by third parties that are based on that index. S&P Dow Jones

Indices does not sponsor, endorse, sell, promote or manage any investment fund or other investment product or vehicle that seeks to provide an

investment return based on the performance of any Index. S&P Dow Jones Indices LLC is not an investment or tax advisor. S&P Dow Jones Indices

makes no representation regarding the advisability of investing in any such investment fund or other investment product or vehicle. A tax advisor

should be consulted to evaluate the impact of any tax-exempt securities on portfolios and the tax consequences of making any particular investment

decision. Credit-related information and other analyses, including ratings, are generally provided by licensors and/or affiliates of S&P Dow Jones

Indices. Any credit-related information and other related analyses and statements are opinions as of the date they are expressed and are not

statements of fact. S&P Dow Jones Indices LLC is analytically separate and independent from any other analytical department. For more information

on any of our indices please visit www.spdji.com.

CONTACT US

www.spdji.com NEW YORK BEIJING DUBAI S&P DOW JONES CUSTOM INDICES

index_services@spglobal.com 1 212 438 2046 86.10.6569.2770 971 (0)4 371 7131 customindices@spglobal.com

1 877 325 5415

HONG KONG LONDON SYDNEY

852 2532 8000 44 207 176 8888 61 2 9255 9802

TOKYO

81 3 4550 8564

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Forex para Principiantes - AvaTrede - Es (English) PDFDocument17 pagesForex para Principiantes - AvaTrede - Es (English) PDFAlb GerardNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Valuation ParableDocument7 pagesValuation ParableVico Ahmad RisyadNo ratings yet

- Phase Test 2017 - 18Document15 pagesPhase Test 2017 - 18AKSHIT SHUKLANo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ey Global Ipo Trends q2 2019Document37 pagesEy Global Ipo Trends q2 2019Luis BazzoliNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- HammerDocument2 pagesHammerkosurugNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Tsla Vs FordDocument5 pagesTsla Vs Fordapi-314942529No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Interest Rate Derivatives Beginners ModuleDocument70 pagesInterest Rate Derivatives Beginners ModuleKarthick100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Price List of The Indoor Playground Accessories From BettaplayDocument8 pagesThe Price List of The Indoor Playground Accessories From BettaplayЯрослав ЗолотовNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Bond Type Risk Level: (Considering of Tenor and Credit Rating of Instrument)Document4 pagesBond Type Risk Level: (Considering of Tenor and Credit Rating of Instrument)ee56054No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Technical Analysis of Market Black BookDocument8 pagesTechnical Analysis of Market Black Bookakash mauryaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 2024 L1 Book 4drDocument62 pages2024 L1 Book 4drbayanidashboardsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Marketing Strategies and MorphDocument31 pagesMarketing Strategies and MorphChris Claro MarfilNo ratings yet

- Convertible Debentures: Convert Debt Into EquityDocument4 pagesConvertible Debentures: Convert Debt Into EquityPrateek MishraNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- JPM Retail Trading Radar - Dec 8 2022Document26 pagesJPM Retail Trading Radar - Dec 8 2022LuanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Chapter 12 - Marketing Mix ProductDocument2 pagesChapter 12 - Marketing Mix ProductShayna ButtNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- CCRC Benchmarks and 2009 Medians-BB&T-Jan 2010Document8 pagesCCRC Benchmarks and 2009 Medians-BB&T-Jan 2010api-26406608No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- SBI DFHI Limited in IndiaDocument41 pagesSBI DFHI Limited in IndiaIndependent Evaluation at Asian Development BankNo ratings yet

- Perfomance BTW NBC and CRDB 2010Document7 pagesPerfomance BTW NBC and CRDB 2010Moud KhalfaniNo ratings yet

- The Philippine Financial SystemDocument14 pagesThe Philippine Financial SystemAnonymous gJ6QEiNo ratings yet

- Answer Paper 2 SFM May 17Document22 pagesAnswer Paper 2 SFM May 17Ekta Saraswat VigNo ratings yet

- TESLADocument15 pagesTESLAThảo NgânNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- TB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and Convertibles PDFDocument24 pagesTB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and Convertibles PDFsky dela cruzNo ratings yet

- CIBOP BrochureDocument6 pagesCIBOP BrochureArpita BhansaliNo ratings yet

- Sowing Bean Internship JDDocument10 pagesSowing Bean Internship JDStock TraderNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Oil and Gas Asset Backed SecuritizationsDocument9 pagesOil and Gas Asset Backed SecuritizationsCDNo ratings yet

- CPAR Cost of CapitalDocument12 pagesCPAR Cost of CapitalCarlito B. BancilNo ratings yet

- Walt DisneyDocument10 pagesWalt DisneystarzgazerNo ratings yet

- Fiinratings Monthly Report January 2024Document7 pagesFiinratings Monthly Report January 2024ducnguyentcbNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Case Mexico City - Grupo 3Document141 pagesCase Mexico City - Grupo 3Brisa LinaresNo ratings yet

- Government Influence On Exchange RatesDocument3 pagesGovernment Influence On Exchange RatesReza RaharjoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)