Professional Documents

Culture Documents

JUL 16 UniCredit Friday Notes

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JUL 16 UniCredit Friday Notes

Uploaded by

Miir ViirCopyright:

Available Formats

16 July 2010 Economics & FI/FX Research

Friday Notes

Contents

Germany: Moderate austerity measures Weekly Comment____________________________ 2

Research Notes _____________________________ 4

Data Monitor_______________________________ 14

■ Consolidation. The German government has finalized its austerity package. FI Outlook_________________________________ 20

It intends to reduce spending by a total of EUR 81.6bn or just over 3% of FX Outlook ________________________________ 22

GDP – albeit spread over four years. Furthermore, the government CIB View _________________________________ 24

CIB Forecasts _____________________________ 25

raised mandatory social security contributions. Calendar__________________________________ 28

■ Structure. At just over EUR 30bn, a large part of the cuts are to the welfare

CIB MACRO FORECASTS

budget. Business (incl. banks and the nuclear power industry) is to contribute

close to EUR 20bn. Administrative spending should be reduced by EUR 13bn, in % yoy 2009 2010 2011

while subsidy cuts total roughly EUR 10bn. GDP EMU -4.1 1.0 1.3

CPI EMU 0.3 1.5 1.8

■ Assessment. The German austerity package is quite balanced. It should

GDP Germany -4.9 1.8 1.5

be enough to successively lower the current record-high deficit and over

CPI Germany 0.3 1.1 1.6

the medium term help the government to comply with the ambitious debt

rule anchored in the Basic Law. On the other hand, it is moderate GDP Italy -5.1 0.9 1.0

enough, above all in the critical coming year, not to stifle the recovery of CPI Italy 0.8 1.6 1.9

domestic demand (pages 4-6 & chart below).

GDP US -2.4 3.0 2.4

■ Forecast. Nevertheless, German economic growth will lose momentum. CPI US -0.3 1.8 2.2

Next year, real GDP will expand by only 1.5% (2010: +2% unadjusted). CIB FI/FX FORECASTS

That is, however, primarily attributable to the phasing-out of the inventory

2010/11 30-Sept 31-Dec 31-Mar 30-Jun

cycle as well as the fiscal stimulus program. The global economic slowdown

EMU 3M (%) 0.95 1.20 1.28 1.35

will also be a burden.

EMU 10Y (%) 3.00 3.25 3.45 3.50

■ Criticism. The Achilles Heel of the consolidation is the questionable US 3M (%) 0.60 0.75 1.05 1.55

implementation of some of the measures, like the bank levy, as well as US 10Y (%) 3.40 3.80 4.20 4.30

the heightened economic risks and the possible liabilities stemming from

domestic & international guarantees. In any case, the government could EUR-USD 1.24 1.22 1.20 1.18

have been much more courageous in slashing subsidies. USD-JPY 91 95 100 106

Oil Price 78 85 80 80

■ Further topics:

– Weekly Comment: A startling comeback for the EUR (page 2).

– US: The next stimulus package – aid for the states (page 7).

– Crude oil: Market well supplied in 2011 as well (page 11).

– Data outlook: Purchasing managers become more cautious (p. 14).

– Market outlook: Euro to remain firm for the time being (page 22).

Global Head of Research & Chief Strategist

Thorsten Weinelt, CFA (UniCredit Bank)

GERMANY'S MODERATE AUSTERITY MEASURES

+49 89 378-15110

2011, in % of GDP thorsten.weinelt@unicreditgroup.de

Head of Economics & FI/FX Research

Marco Annunziata, Ph.D. (UniCredit Bank)

Greece

Chief Economist

+44 20 7826-1770

Spain marco.annunziata@unicreditgroup.eu

UK Editor

Nikolaus Keis (UniCredit Bank)

Portugal +49 89 378-12560

nikolaus.keis@unicreditgroup.de

France

Editorial deadline

Friday, 16. Jul., 12:00H

Italy

Bloomberg

Germany UCGR

0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 Internet

www. research.unicreditgroup.eu

Source: Thomson Datastream, UniCredit Research

UniCredit Research page 1 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

A startling comeback Be that as it may, we have a paradoxical situation where,

while the recovery is clearly more robust in the US than in

the eurozone, the Fed sounds more dovish whereas the ECB

The EUR has staged a remarkable rebound over the last

sounds cautiously more optimistic. Consequently, expectations

month, recovering from below 1.20 to the dollar to nearly 1.30.

of a Fed rate hike are likely to be pushed further into the future,

What is driving it? Will it strengthen further, consolidate, or

whereas short-term rates in the eurozone begin to edge up.

reverse trend? And should its appreciation be welcomed?

Remember that excess liquidity had pushed short-term rates

towards zero, un-anchoring them from the policy refi rate. If they

The euro’s appreciation against the US dollar this time is

now start converging to the refi, we have potentially close to

probably a tale of two economies: on the one hand, markets are

¾ of a percentage point in “stealth” tightening that can occur

perhaps starting to believe that, as ECB President Trichet

spontaneously without the need for the ECB to hike.

noted last week, the eurozone should not be underestimated.

Trichet pointed out that, while the ECB was not changing its

Moreover, investors are probably starting to get some

staff forecasts (which are very close to ours, cf. the table at

encouragement from the policy actions taken by European

the end of this publication), the incoming data did not in any

policymakers. Here the important role, in my view, is played

way support the pessimistic fears that the region might be

not so much by the actions of eurozone institutions, but

about to plunge back into recession. The ECB forecasts, like

rather by national governments, where significant steps have

ours, suggest a lackluster recovery, but Trichet was very

been taken towards fiscal consolidation and, at least in the

clear in indicating that risks to this outlook might perhaps be

case of Spain, structural reforms. Nothing earth-shattering so

skewed to the upside. Contrast this with the dovish tone of

far, but certainly enough to give pause and consider whether

the latest FOMC minutes, where several committee members

at least some eurozone governments might now finally realize

expressed concern that deflation risks might materialize, and

the need for long-overdue reforms.

suggested that the Fed should keep open the possibility of

stepping up its quantitative easing program. This stands in

A particularly encouraging sign in this regard has been the

sharp contrast to the attitude of the ECB, which has insisted

recent recovery in demand at some government bond auctions,

that its government bond purchases do not constitute quantitative

notably in the case of Spain, where China’s wealth manager

easing as they are fully sterilized, and has allowed its 12-month

SAFE showed concrete and substantial interest. This is

liquidity to expire, resulting in a substantial draining of excess

potentially a very positive sign. In the immediate aftermath of

liquidity from the system and an upward move in short-term

the Greece shock, large Asian investors stepped back in horror

market rates. President Trichet was careful in pointing

from a eurozone sovereign bond market which they no

out that this should not be seen as a sign of change in

longer recognized, and tried to come to terms with the need

the bank’s monetary policy stance, as the ECB continues to

to understand much better the idiosyncrasies of the different

offer unlimited liquidity at shorter maturities; he implicitly

national markets which for most of the eurozone’s history

acknowledged, however, that this might represent an early

had traded very close to each other. SAFE’s demand for

sign of normalization in financial markets, which the ECB

Spanish bonds suggests that perhaps the panic phase is

would be happy to accompany.

over, and Asian investors have now had time to do their

homework and more carefully assess individual countries’

The Fed’s deflation concerns are, in my view, exaggerated,

risk. And if they find that Spain’s risk is tolerable, then it

even though there is no doubt that the recovery is losing

might well mean that the risk of a systemic crisis is indeed

some momentum in the second half of the year as the push

quite moderate.

from fiscal stimulus and the inventory cycle wanes, in line

with our forecasts, and recent data revisions suggest that the

Next week, however, we have a crucial reality check with the

first half of this year was also weaker than previously

first release of the European stress test results, and preliminary

thought. The Fed itself is still forecasting growth of 3-3½%

indications are at best mixed. On the one hand, as I have

for this year, and even if 2H growth were to be somewhat

pointed out in the past, it is extremely encouraging that Spain

lower than our forecasts, say in a 2-2½% range, it would still

has taken the initiative and first announced it was going to

be a fairly respectable performance for an advanced economy

publish the results of its stress tests, regardless of what other

which is still licking its wounds after a very serious crisis. The

countries did, and then indicate it would extend the tests to

problem of course is unemployment, which remains at very

cover the large majority of its banking system. On the other

high levels, and which will decline only very slowly if GDP

hand, the Committee of European Banking Supervisors

growth remains weak. Unemployment is currently the major

(CEBS) has not yet been able to tell us much about the

political issue in the US, and unless and until its trend is more

assumptions used in the tests, raising concerns that at least

decisively reversed, whether by stronger private confidence or

on the crucial issue of sovereign bonds, individual countries

by another government stimulus program, the Fed cannot

might end up using different methodologies or assumptions.

afford a more hawkish stance.

UniCredit Research page 2 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

All we will learn in a week’s time will be the aggregate results

by country, whereas the results for individual financial institutions,

which are the ones investors need to separate the sheep

from the goats, will only follow with a 2-3 week delay. We

should at least hope that the announcement on the overall

results and on the assumptions used is sufficiently detailed

and convincing, or it might undo the good work done so far.

What does this all mean for the euro? I think the upside

potential at this stage has probably been exhausted, as the

fact that the stress test results will be disclosed in two

rounds, with the second taking place when the summer holiday

period is in full swing in Europe, suggests that the chances of

a very positive surprise are slim. On the other hand, with US

growth losing steam and the Fed toying with the idea of a

new wave of quantitative easing, it will take a major negative

surprise in the eurozone to knock EUR-USD back below 1.20

and at this point this seems extremely unlikely over the coming

few months – with the greatest risk lying, in my view, in the

stress test exercise, which has become a very high stakes

game. The exchange rate therefore seems most likely to

remain stable for a while, and this probably suits both the

eurozone and the US, neither one of which would welcome a

significant appreciation in this new nervous climate where

countries suspect each other of engineering competitive

devaluations to pursue export-led growth.

Marco Annunziata, Ph.D. (UniCredit Bank)

44 20 7826-1770

marco.annunziata@unicreditgroup.eu

UniCredit Research page 3 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

PLANNED BUDGET CONSOLIDATION IN 2011, IN % OF GDP

German budget: Appropriate

consolidation plan

Greece

■ In the current year, new public debt will hit a new record Spain

level of presumably over EUR 100bn. That should, however,

UK

also clearly mark the peak with a deficit ratio of roughly 4½%.

Portugal

■ The federal government has reached agreement to start

France

the budget consolidation next year. The results of the austerity

discussions as well as the agreement to raise social security Italy

contributions are – together with the economic recovery –

Germany

to successively lower the deficit.

0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5

■ Even though the uncertainties concerning the budget remain

high, the plans appear appropriate: No precipitous deficit Source: National statistics, UniCredit Research

reduction that chokes the domestic economy, at the same

time, adequate cuts to comply with the stipulations of the

Implementation of the consolidation package also remains

debt rule.

very vague on some key items. The extension of the operating

life of nuclear power plants, which via an additional levy is to

Consolidation starts next year generate revenues from next year of EUR 2.3bn annually,

When, after the coalition government’s austerity meeting a remains controversial. There is as yet no concrete concept

few weeks ago, Chancellor Merkel extolled to the public the for the levy. At the moment, there is even discussion of an

virtues of an ambitious consolidation package totaling more auction process similar to the auction of the mobile phone

than EUR 80bn or more than 3% of GDP, there was initially licenses. Above all, the participation of the banking sector in

confusion about the high level of the resolved austerity the costs of the financial market crisis also remains uncertain.

measures. The details of the plans do, however, reveal the From 2012, this is to generate annual revenues for the federal

expected and - compared to many other EU countries - more budget of EUR 2.0bn. According to Finance Minister

moderate size of the consolidation package. In contrast to Schäuble, however, it makes no sense for Germany to go it alone

the cited cumulative amount for the coming four years, the with a capital market levy. And the recent G-20 summit in

budget deficit is to be reduced during the current legislative Canada did not reveal any willingness for a uniform international

period by a total of "only" EUR 27.6bn (see table). agreement. In contrast, the need for approval for the austerity

plans from the Bundesrat (Upper Chamber), in which the coalition

parties no longer have a majority since the election defeat in

RESULTS OF THE AUSTERITY MEASURES, IN EUR BN

North Rhine-Westphalia, is only limited to just a few measures.

2011 2012 2013 2014

Record high deficit in 2010

Subsidy cuts 2.0 2.5 2.5 2.5

Corporate participation 3.3 5.3 5.3 5.3 Together with the tax projection in May, the draft budget recently

Welfare adjustments 3.0 7.0 9.4 10.9 approved by the cabinet for 2011 and the medium-term fiscal

Armed forces reform - - 1.0 3.0 plan up to 2014, the information situation on the expected

Administrative savings 2.3 3.3 3.9 3.9 development of the budget has improved substantially despite

Other measures 0.6 1.1 1.7 2.0 the still persisting uncertainties. After a federal deficit last

Total 11.2 19.1 23.7 27.6 year of 3.1% of GDP, it was originally feared the deficit would

81.6 balloon this year to as much as 6%. The recently very brisk

Source: Federal Ministry of Finance, UniCredit Global Research recovery in industry and especially the related still surprisingly

solid situation on the labor market have, however, improved

the prospects of a tangibly lower deficit. And this is despite

The planned consolidation volume for the 2011 budget totals the Growth Acceleration Act passed by the new federal

EUR 11.2bn or 0.4% of GDP. In numerous other EU countries, government, which since the beginning of this year increases

the austerity plans for the coming year are many times the budget gap by a further roughly EUR 8.5bn per year.

higher (cf. chart next column). The direct negative impact on

growth as a result of the German austerity program should,

therefore, be relatively limited.

UniCredit Research page 4 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

For 2010, the government now assumes a federal budget WELFARE CONTRIBUTIONS EXCEED 40% LEVEL AGAIN

deficit of EUR 65.2bn. At the middle of last year, the Grand

Coalition still expected a deficit of EUR 86bn. Furthermore, Nursing

45 Unemployment

the recently still robust economic data and the ongoing decline Pension

40

in unemployment mean a further downward revision of the Health

35

deficit forecast for this year is likely. Nevertheless, the deficit

30

should be at a record-high level. And together with the

25

expected high deficits of the states, local authorities and also

the welfare system, the overall budget deficit this year will 20

probably still climb to over EUR 100bn or close to 4½% of 15

GDP (cf. chart). 10

OVERALL BUDGET BALANCE, IN EUR BN 0

1970 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010

Federal government States

60 Source: Federal government, UniCredit Research

Local authorities Welfare system

40 Total

20

In addition to the austerity measures, the current economic

0

recovery should also have a clearly positive impact on the

-20 budget from next year. The incremental spending and reduced

-40 revenues because of the economy will, on the assumption that

-60 the global economy and therefore also the export-oriented

-80 German economy will not slide into a double-dip recession,

-100 successively decline. Based on its tax estimate, the federal

-120

government expects the budget to improve by a total of more

1992 1994 1996 1998 2000 2002 2004 2006 2008 2010p than EUR 10bn by 2013. The states and local authorities will

also profit from this. The clear trend reversal in the monthly

Source: Ministry of Finance, Städte- und Gemeindetag, UniCredit Research revenues from the corporation tax (see chart) also points to

an end of the decline in revenues from the communal business

tax (Gewerbesteuer), by far the most important source of

New debt clearly lower in 2011 revenue for local authorities. All in all, we expect a sizeable

From the coming year, however, the deficit should clearly decline in the overall deficit ratio to 3.3% of GDP next year.

decline again. In addition to the planned consolidation measures And in 2012, the budget could already comply again with the

in the federal budget resulting from the austerity agreement, Maastricht criteria.

the government has also agreed on steps to reduce the gaps

in the welfare system. Alongside a rise of the contribution TAX REVENUES, IN % YOY, SMOOTHED

rate for unemployment insurance from 2.8% to 3.0%, the

contribution rate for statutory health insurance will be raised Wage and income tax

60

at the beginning of 2011 from 14.9% back to 15.5% of gross Corporation tax

40

income. Both contribution rates had previously been lowered Value added tax

during the crisis as part of the economic stimulus program at 20

the expense of federal subsidies. As a result, a large part of 0

the current gap in the welfare system is being closed. In return,

-20

however, the factor labor is being taxed more heavily again.

-40

In 2011, the combined burden on employees and employers

will, therefore, again exceed the 40% mark (cf. chart -60

next column). -80

-100

Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10

Source: Federal ministry of finance, UniCredit Research

UniCredit Research page 5 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

Consolidation plan appropriate

The consolidation path adopted by the federal government

remains fraught with substantial uncertainties with respect to its

ability to implement some key measures and with respect to

the economy, and not least because of the existing guarantees

for the banking system and EMU high-risk countries.

Furthermore, a stronger focus on reducing subsidies would

have been desirable. The extent of the planned measures

does, however, appear appropriate. There is no precipitous

reduction of the deficits that could choke off the recovery of

the domestic economy, also in the context of substantially

higher austerity programs in many neighboring countries. At

the same time, the measures are almost enough to comply

with the stipulations of the debt rule anchored in the Basic

Law, according to which the federal government must limit its

structural deficit to 0.35% of GDP by 2016.

Alexander Koch, CFA (UniCredit Bank)

+49 89 378-13013

alexander.koch1@unicreditgroup.de

UniCredit Research page 6 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

The next stimulus measure: Accordingly, the Federal Reserve Bank of San Francisco

wrote in a current report, "in many respects, fiscal conditions

More aid for the states [of states] are likely to get worse before they get better.”2

■ For most US states, fiscal 2011 started at the beginning Revenues have plummeted

of July. It will presumably be even more difficult for them

than in the previous year to adhere to balanced-budget laws. The primary cause of the states’ budgetary plight is plummeting

tax revenues. They fell 8¾% between the beginning of 2008

■ First, state budgets remain under pressure due to the still and 2009 (cf. chart). The only other decline in state & local tax

high unemployment rate, which keeps state tax receipts receipts reported in the last 60 years occurred in 2001/2002

low and increases demand for health care and other and was a much more moderate 1¾%. When interpreting the

essential services that states provide. data, it must be borne in mind that it already includes measures

implemented to ensure a balanced budget – such as tax

■ Second, in the past two years it was still possible to partly increases. Without these steps, the decline in tax revenues

close the budget shortfalls by tapping into state reserves would have been much stronger.

and through federal aid provided in the American Recovery

and Reinvestment Act. But both sources have now been DRAMATIC SLUMP IN TAX REVENUES

virtually depleted.

State & local authority tax receipts, in % yoy

■ States have to close a USD 140bn budget gap in the current 20

fiscal year. Without further aid from Washington, the

necessary cutbacks could shave close to one percentage 15

point off GDP growth and eliminate close to one million jobs.

10

States’ budget plight will continue 5

to deteriorate initially 0

On 1 July, fiscal 2011 began in 46 of the 50 US states. And

-5

even though the recession already ended at mid-2009, the

states’ fiscal problems will continue into the next fiscal year -10

and likely beyond. Following previous recessions, state fiscal I/50 I/55 I/60 I/65 I/70 I/75 I/80 I/85 I/90 I/95 I/00 I/05 I/10

recovery lagged behind the economic improvement: While,

for example, the recession of the early 90s ended in March 1991, Source: BEA, Thomson Datastream, UniCredit Research

the states reported their largest budget deficits in fiscal 1992.

And while the recession in the early part of the current decade As already mentioned, the expenditures of the state and local

ended in November 2001, state fiscal distress persisted into authorities also increase at times of crisis. The most important

fiscal 2005.1 The main reason for this time lag is that the items are rising unemployment benefits and ballooning

unemployment rate continued to climb after the recession health care (Medicaid) costs for residents who lost their jobs,

ended and then remained high for a considerable period of income, and health insurance. The Center on Budget and

time after that. That hampers the ability of state revenues to Policy Priorities (CBPP) estimates that in fiscal 2009 and

recover strongly, as high unemployment reduces both 2010 the states had to plug budget shortfalls of USD 110bn

income and consumption tax revenues. At the same time, and USD 200bn, respectively (cf. chart next page).3 The

the higher demand for Medicaid and other essential social number for 2010 is equivalent to close to 1½% of US GDP.

services increases states’ expenditures. The problem is that

every state save Vermont has some sort of balanced-budget

law. In the last two years, the states were still able to close

part of their shortfall by tapping into state reserves or through

federal aid to states provided in the American Recovery and

Investment Act (ARRA). Both sources have, however, now

been virtually depleted. That means that the need for spending

cuts and/or tax increases is rising further.

2

Gerst, J. and D. Wilson, Fiscal Crises of the States: Causes and

Consequences, FRBSF Economic Letter 2010-20, 28. June 2010.

1 3

Additional Federal Fiscal Relief needed to help States address Recession’s Recession Continues to batter State Budgets; State Responses could

Impact, Center on Budget and Policy Priorities, 1 March 2010. slow Recovery, Center on Budget and Policy Priorities, 27 May 2010.

UniCredit Research page 7 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

HUGE BUDGET GAPS AUSTERITY MEASURES HURT GROWTH

State budget shortfalls, in USD bn Consumption and investment expenditures of states & local

authorities, growth contributions in percentage points

250

Budget gaps offset by ARRA 1.2

Remaining budget gaps after ARRA

200 1.0

0.8

150 0.6

0.4

100 0.2

0.0

50

-0.2

-0.4

0

2009 2010 2011 2011 -0.6

I/00 I/01 I/02 I/03 I/04 I/05 I/06 I/07 I/08 I/09 I/10

Source: CBPP, UniCredit Research

Source: BEA, Thomson Datastream, UniCredit Research

In the last two fiscal years, federal aid provided in the American

Recovery and Reinvestment Act has allowed states to close The austerity measures have also left their mark on the labor

about a third of their budget gaps. The funds have been market. Since mid-2008, the states and local authorities have

channeled primarily into the budgets for education, health eliminated a quarter of a million jobs (cf. chart). The pace of

and public safety. Without this massive support, the states the job cuts accelerated strongly in mid-2009.

would have been forced to slash their expenditures even

more drastically and to raise their tax rates even more A QUARTER OF A MILLION FEWER JOBS

strongly than they have already done. In addition, the states

have thus far been able to tap into reserves (rainy day funds), State & local authority employees;

cumulative change since August 2008, in thousands

which they had accumulated in preceding years. According

to the CBPP, these reserves totaled 11.5% of annual state 0

spending before the onset of the crisis, making them the

largest reserves on record. But the unusual severity and -50

length of the recession means that even these reserves have

now been largely depleted. Hence, the states now have to -100

plug their budget gaps even more strongly via adjustments to

their current revenues and expenditures. The latest GDP -150

numbers provide a foretaste of the possible ramifications.

They show that the consumption and investment expenditures -200

of the states and local authorities have fallen in five of the

last six quarters. At the beginning of 2010, they shaved as -250

Aug-08 Dec-08 Apr-09 Aug-09 Dec-09 Apr-10 Aug-10

much as half a percentage point off GDP growth (cf. chart

next column).

Source: BLS, Thomson Datastream, UniCredit Research

As stated, all these steps were necessary in the past months

despite the aid from Washington and despite the possibility

to tap reserves. Furthermore, the above statistics only reflect

the direct impact of the states’ austerity measures. They neither

include the public-sector orders not awarded to businesses

and suppliers nor the second-round effects on capex spending

and consumption.

UniCredit Research page 8 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

Even more austerity measures needed What cannot be quantified is the impact on the general quality

of life, since the layoffs affect such important positions as

The ARRA funding is scheduled to expire at the end of 2010, teachers, firefighters, police officers, and waste management

i.e. right in the middle of the current fiscal year. Implicitly, personnel. Furthermore, the spending cuts affect primarily

however, the states had hoped that at least the payments for the poor and needy.

the Medicaid program (Federal Medical Assistance Percentages

(FMAP)) would be extended for another six months. According

to the Congressional Budget Office, this extension would have

The (multi) trillion dollar gap

saved the states about USD 16bn.4 30 states had firmly The analysis thus far does not take into account the problems

integrated these funds into their budget plans, since the of the state-sponsored pension plans. According to estimates

House had already voted in favor of extending the FMAP, of the highly-respected PEW Center on the States, the state

and President Obama included the additional funds in his pension funds reported assets of USD 2.35 trillion at mid-2009.

budget. At the end of June, however, the Senate voted against This compared with liabilities (promised healthcare and other

this plan! That means the states will have to impose additional retirement benefits) totaling USD 3.35 trillion. The states’

cuts to eliminate the new shortfalls. At least 45 states have pension funds, therefore, have a gap of one trillion USD!7

already reduced services since the recession began. Many of The PEW Center emphasizes that the investment losses during

them have particular ramifications for vulnerable populations:5 the Great Recession account for only a portion of this shortfall.

Many states fell behind on their payments even before the

– At least 30 states have implemented cuts that restrict

crisis, as they preferred to use the funds to cover current

low-income children’s or families’ eligibility for health care

expenditures, e.g. for education, health care, public safety

insurance or reduce their access to health care services.

and other critical needs. Professors Robert Novy-Marx and

– At least 25 states are cutting programs for the elderly and Joshua Rauh estimate that the states’ pension funding gap even

disabled (e.g. medical, rehabilitative or home care services). totals more than three trillion USD. They argue that the present

value of future liabilities is clearly underestimated, as it is

– At least 30 states are cutting aid to K-12 schools and

calculated using an unreasonable discount rate of 8%.8 If

various education programs.

instead a risk-free interest rate, like the interest rate on

– At least 41 states have cut assistance to public colleges T-Bills or bonds is used, the present value of the

and universities, resulting in reductions in faculty and already-promised pension liabilities of the 50 states amounts

staff, in addition to tuition increases. to more than 5 trillion USD (cf. chart next page)!

At the same time, many states are attempting to boost Since the underfunding of pension plans is now becoming more

their revenues: obvious while at the same time more and more baby-boomers

are nearing retirement, the first states were compelled to

– Since the beginning of the crisis, more than 30 states

tackle the problem. Ten states have so far raised the retirement

have raised taxes, sometimes quite significantly.

age or lowered the benefits for new employees, while ten

Increases have been enacted or are under consideration

other states increased the contributions that current and future

in personal income, business, sales and excise taxes.

employees make to their own benefit system. These

– Furthermore, many states are planning to increase taxes increases are – as David Rosenberg, former Chief Economist

on cigarettes or beverages. of Merrill Lynch emphasizes – a de facto tax hike that will

slow the recovery of household spending. If, however, the

These and further measures are necessary as the states’

states refrained from further contribution increases, they

cumulative budget shortfall (after deducting the ARRA funds)

would have to offset the pension gaps from the current

will likely reach USD 140bn in the current fiscal year. That is

budget, which in turn would entail spending cuts elsewhere

the largest gap on record and translates into close to 1% of

and/or tax increases. The states are, therefore, in a tricky

nominal GDP! According to a rule of thumb used by the

situation that will probably get worse in the coming years.

Council of Economic Advisers, each percentage point of

Ultimately, there will presumably be no alternative but to also

GDP translates into roughly one million public and private

cut the benefits promised to existing employees – even though

sector jobs.6

the constitution of many states currently does not allow such

a step.

4

What States and the Economy lost when the Senate Jobs Bill failed,

Center on Budget and Policy Priorities, 24 June 2010.

5 7

An Update on States Budget Cuts, Center on Budget and Policy Priori- The Trillion Dollar Gap – Underfunded State Retirement Systems and

ties, 25 May 2010. the Roads to Reform, PEW Center on the States, February 2010.

6 8

Romer, C. and J. Bernstein, The Job Impact of the American Recovery Novy-Marx, R. and J.D. Rauh (2009), The Liabilities and Risks of State-

and Reinvestment Plan, 9 January 2009. Sponsored Pension Plans, Journal of Economic Perspectives, 23(4), 191-210.

UniCredit Research page 9 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

MASSIVE UNDERFUNDING OF STATE PENSION PLANS The risk for this outlook is, however, clearly skewed to the

downside. First, the recent Senate resolution against extending

State pension funds: Assets and liabilities in USD trillion

unemployment benefits and the FMAP demonstrated that

6.0 resistance to the ballooning federal debt is increasing in

Assets Liabilities

Washington. Second, the budget problems of the states (on

5.0

top of that, there are the problems facing local authorities)

4.0 could be substantially greater than estimated so far. Spending

3.2tr

cuts and layoffs would then trigger a downward spiral that

3.0

1.0tr would choke the fragile recovery. Finally, potential bankruptcies

2.0 of some local authorities could bring further writedowns. The

resulting tensions on financial markets would, in turn, have

1.0 the potential to hurt growth via a negative feedback loop.

0.0

PEW Center on the States Novy-Marx and Rauh (market-based

Dr. Harm Bandholz, CFA (UniCredit Bank)

discount rate) +1 212 672-5957

harm.bandholz@us.unicreditgroup.eu

Source: PEW Center, Novy-Marx and Rauh, UniCredit Research

Hopes pinned on Washington

After making considerable cuts in the past two years, the

states must again plug a USD 140bn budget gap in the current

fiscal year. Without further aid from Washington, the necessary

steps could shave close to one percentage point off GDP

growth and, in the process, eliminate close to one million jobs.

The administration in Washington has stressed repeatedly in

recent weeks and months that the stabilization of the economy

and the creation of jobs have absolute priority. Against this

backdrop, further massive transfers to the states are arguably

the easiest, quickest and most efficient stimulus the federal

government can launch. With mid-term congressional elections

looming in November, it probably won’t be easy for the

opposition to oppose such a bill, since with an unemployment

rate running at close to 10% most voters will undoubtedly

give preference to the prospect of more jobs over reducing

the federal debt. Furthermore, extending the transfers to the

states does not even have to be labeled a "stimulus". In our base

scenario, we therefore assume that further funds will flow to

the states. We even assume that government expenditures

as a whole (federal plus states & local authorities) will

increase by ¾% in the current year after ½% in 2010. This is,

of course, still substantially less than in the last three years,

when public-sector expenditures increased on average by

more than 2%.

UniCredit Research page 10 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

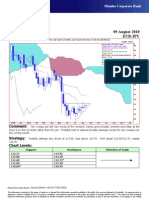

IEA CONSUMPTION ESTIMATE REVISED UP BY ALMOST 3 MB/D!

Crude oil market well supplied

94

■ The International Energy Agency (IEA) indicates that demand 2009 MTOMR

2010 MTOMR

for oil is adequately covered up to and including 2015. 92

Nevertheless, it is not possible to sound the all-clear for

90

the oil market.

mb/d

88

■ Demand estimates were raised by 3 mb/d compared to

the previous year. The primary reasons for this are the 86

strong growth in emerging markets.

84

■ OPEC’s free production capacity remains very high. It is 82

adequate to offset the decline in the output of exhausted 2009 2010 2011 2012 2013 2014 2015

fields, cover the growth of emerging markets and smooth

out short-term delivery disruptions. Source: IEA MTOMR 2010, UniCredit Research

■ The report does, however, also reveal three weak spots.

First, the production of conventional petroleum from already

Adequate oil supply up

exhausted fields declines considerably – a heavy burden The second important finding is that global crude oil production

for increasing global crude oil production going forward. capacity will be more than adequate to meet the high

consumption growth. In its 2010 MTOMR, the IEA assumes

■ Second, the non-OPEC countries can no longer offset the that the free production capacity will increase from 91.0 mb/d

decline in output from conventional oil fields, thereby in 2009 to 96.5 mb/d in 2015. The bulk of this capacity

increasing dependence on OPEC. The production increase expansion comes from OPEC. Here, the crude oil production

comes primarily from the increase in the production of biofuels, capacity is expected to increase by 1.9 mb/d. On top of that,

NGL and non-conventional petroleum. there is an increase in the NGLs (= Natural Gas Liquids such

as, for example, propane, butane) of 2.6 mb/d. The free

■ We are retaining our target price for 2010 of USD 80 production capacity of the non-OPEC states, in contrast,

per barrel, but we are lowering our target price for 2011 increases by only 1.0 mb/d. Over the entire period, the free

from USD 90 to USD 80 per barrel (in each case calendar production capacity of OPEC remains relatively high. 5.8 mb/d

year averages). are expected for 2010. But this already marks the peak. By 2015,

it is expected to decline again towards 4 mb/d (cf. chart).

Demand for crude oil expected to

increase strongly FREE PRODUCTION CAPACITY OF OPEC REMAINS HIGH

Every year at the end of June, the International Energy

7

Agency (IEA) publishes its MTOMR. It discusses the prospects OPEC spare capacity

5.8

for the petroleum and natural gas market for the next five 6

5.3

5.5

years. The report is then updated each December. An initial 5

4.4

important finding of the 20110 MTOMR is the again substantially 4.2

4 3.5 3.6

higher growth now projected for petroleum consumption. Up

mb/d

to and including 2014, demand is expected to increase from 3

84.77 mb/d to 90.99 mb/d (cf. chart next column). That is an

2

increase of roughly 3 mb/d compared to the 2009 MTOMR, which

was, however, written under the impact of the financial crisis, 1

when the DAX, for example, was still trading at 4,600 points. 0

2009 2010 2011 2012 2013 2014 2015

Source: IEA MTOMR 2010, UniCredit Research

The scenario does, however, have one important weak spot:

A strong decline in production from old, already exhausted

fields must be permanently replaced.

UniCredit Research page 11 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

This becomes very visible for non-OPEC countries, where CHANGE IN NON-OPEC OIL PRODUCTION BY 2015

capacity expansion is covered almost entirely from

non-conventional sources. 1

Non-OPEC: composition of the additional supply up to and including 2015

0.8

0.8 0.7

0.6

Decline in production from exhausted 0.4

0.4

fields is a major strain 0.2 0.1

0

mb/d

Forecasting oil production is very difficult and depends on -0.2

three important assumptions. First, naturally, it depends on the -0.4

-0.6

development of already discovered oil fields. That problems -0.8

can repeatedly arise here is demonstrated by the Kaschagan -1

-1

oil field, with estimated reserves of 9-16bn barrels one of the -1.2

Conventional Biofuels Other NGLs Refinery

last major discoveries, where the start of production had to be crude supply unconventional processing

postponed from 2005 to 2012. Second, the crude oil price is sources gains

decisive, since it is only with a high oil price that the development

of more expensive deposits becomes feasible. Third, and going Source: IEA MTOMR 2010, UniCredit Research

forward perhaps even more importantly, the IEA must make

an assumption of the decline in output from exhausted fields.

But this increase has its price. Just over 50% of this year’s

Depending on the oil field, the decline in production can be

corn harvest is being used to produce bioethanol. On the

between -1% and up to -30% (!!) per year in offshore fields.

other hand, the US wheat acreage has fallen from 28mn hectares

The 2010 MTOMR assumes a decline of 5.1% per year. In

in 1990 to now 19mn hectares. The wheat price has,

the 2009 MTOMR, the assumption had still been -5.8%. The

nevertheless, not increased, because the Eastern European

improvement is, however, attributable solely to the higher oil

countries were to some extent able to fill this gap by expanding

price, lower costs and resumed capital spending. This means

their wheat production. The other components are the

a decline in production of the non-OPEC countries of 1.9

production of NGL, which by 2015 is to increase by 0.4 mb/d,

mb/d and for OPEC of 1.2 mb/d. Offsetting the decline in

and the production of petroleum from non-conventional

production totaling 3.1 mb/d per year presents the petroleum

sources, e.g. from deep water. Above all, this part could become

industry with an enormous challenge. Above and beyond

problematic in the coming years. If the Deepwater Horizon

that, the production capacity is also to be increased from

disaster in the Gulf of Mexico were to result in delays or even

91.0 mb/d in 2009 to 96.5 mb/d in 2015 to satisfy demand

the complete abandonment of projects, by 2015 production

growth from emerging markets! The sensitivity of petroleum

must be expected to decline by between 300 kb/d and 800

production to the decline in mature fields is enormous. If the

kb/d. A further problem is that the increase in non-OPEC oil

decline in production were only 0.5 percentage points higher

production is in the years 2010 and 2011. By 2015, production

per year than estimated, the projected petroleum production

is then expected to merely stagnate.

of the non-OPEC states in 2015 would be 1.0 mb/d lower.

OPEC surplus holds oil price in check

Unconventionals must fill the gap

For us, the 2010 MTOMR highlights that the high free

The IEA expects that by 2015 the non-OPEC countries can

production capacity of OPEC will keep the oil price in check

increase their crude oil production by roughly 1.0 mb/d. The

up to the end of 2011 (cf. chart next page). With 5.8 mb/d, it

2009 MTOMR still expected a decline (!) of 0.4 mb/d. The

is high enough to offset the decline in production from

non-OPEC countries do not, however, succeed here via the

exhausted fields, cover the growth of emerging markets, and

production of conventional petroleum. Quite the contrary:

balance out short-term delivery disruptions. This applies all

The decline in output from the exhausted oil fields is already

the more since the non-OPEC contributions to global oil

so strong that it can no longer be neutralized even by new

production will come to market primarily in 2010/2011. The

projects in the conventional field. By 2015, conventional

decline in production of conventional petroleum in the

petroleum production will decline by 1.0 mb/d. The main support

non-OPEC countries does, however, remain problematic.

for the increase is production is instead the increase of

This can be offset only by biofuels, NLGs and deepwater oil.

biofuel production, which in turn can be attributed primarily to

All three alternatives are, however, problematic. We are

US ethanol production (cf. chart next column).

pessimistic primarily when it comes to further deepwater projects.

Many believe that the oil catastrophe in the Gulf of Mexico

will do to deepwater oil production what the Chernobyl disaster

did to the nuclear industry. This increases the dependence

on OPEC.

UniCredit Research page 12 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

OPEC’s unofficial target price is USD 70-80 per barrel, and

we expect OPEC will have no difficulty in defending this target.

The remaining imponderables are geopolitical tensions and

an acceleration of the decline in output from exhausted

fields. We are lowering our target price for 2011 from

USD 90 to USD 80 per barrel, but we are retaining our target

price for 2010 unchanged at USD 80 per barrel (in each case

calendar year averages).

OPEC’S HIGH FREE PRODUCTION CAPACITY KEEPS OIL

PRICE IN CHECK

8 160

Free production capacity of OPEC Crude oil, Brent (RS)

7 140

6 120

USD per barrel

5 100

mb/d

4 80

3 60

2 40

1 20

0 0

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Source: Bloomberg, UniCredit Research

Jochen Hitzfeld (UniCredit Bank)

+49 89 378-18709

jochen.hitzfeld@unicreditgroup.de

UniCredit Research page 13 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

Data Monitor Europe – Preview of the coming week

Thursday, 22 July

EMU, PMIs PMIS: (MODERATE) EASING TREND

July CIB Cons. June May 65

Expansion

Manufacturing PMI 54.9 55.2 55.6 55.8

60

Services PMI 55.0 55.0 55.5 56.2

55

The moderate softening trend of the PMIs should continue

50

in July. In manufacturing, the new orders-to-stock ratio is

off its peak, but doesn’t hint at a collapse in activity further 45

down the road. For July, we expect the factory PMI to 40 Manufacturing PMI

ease to 54.9. The services index should follow suit and

Services PMI

settle at 55. After a strong 2Q, GDP growth momentum 35

Critical level

Contraction

is bound to slow in 2H 2010. 30

01/99 01/01 01/03 01/05 01/07 01/09

Source: Thomson DataStream, UniCredit Research

FRANCE, BUSINESS CONFIDENCE THE PEAK SHOULD BE BEHIND US

July CIB Cons. June May 120 40

95 95 95 97

110 20

Manufacturing confidence is likely to move sideways in July,

100 0

after the moderate decline recorded in June. Manufacturers

have been revising downward production expectations 90 -20

at industry and in-plant level, in line with our projections

for a deceleration in the pace of industrial activity in 3Q. 80 -40

We will watch closely developments in foreign orders to Business confidence

70 -60

gauge the pace at which this deceleration is likely to Production outlook (RS)

unfold in the coming months. 60 -80

01/02 01/03 01/04 01/05 01/06 01/07 01/08 01/09 01/10

Source: INSEE, UniCredit Research

UK, RETAIL SALES A STRONG 2Q

June CIB Cons. May Apr 4

in % mom 0.6 0.6 0.6 0.0 3

2

Surveys of retail sector activity remained strong in June.

Retail sales therefore are likely to post another strong 1

gain in June (our forecast is 0.6% mom). For the quarter 0

as a whole, retail sales should mark a sizeable rebound

-1

after the sluggish performance reported in 1Q. Prospects

-2

for the second half of the year, however, are cloudier as

Retail sales (in % mom)

the announced austerity measures should weigh on -3

Retail sales (3M rate of change, in %, smoothed)

consumer sentiment. -4

01/99 01/01 01/03 01/05 01/07 01/09

Source: ONS, UniCredit Research

UniCredit Research page 14 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

Friday, 23 July

GERMANY, IFO BUSINESS CLIMATE EXPECTATIONS HAVE PEAKED

July CIB Cons. June May Ifo indices (2000=100)

Index 101.5 101.5 101.8 101.5 120

Overall climate

115

Expectations

In the previous month, the forward-looking business Current conditions

110

expectations posted their second decline after sixteen

105

consecutive gains. The global trend reversal in the leading

100

indicators also points to a further cooling off of the prospects

95

for German businesses. The strong order situation at the

moment could, however, even improve the situation for 90

the time being. Overall, we expect only a moderate pullback 85

in the Ifo index as a whole at the beginning of the second 80

half of the year. 75

1995 1997 1999 2001 2003 2005 2007 2009

Source: Ifo, UniCredit Research

FRANCE, CONSUMER SPENDING AUTOS DROP OUT OF THE PICTURE

June CIB Cons. May Apr 4.0 8.5

% mom 0.8 0.4 0.7 -1.3 3.0 7.0

2.0 5.5

Spending is likely to show a further acceleration in June,

1.0 4.0

thanks to a revival in expenditures on clothing (due to

the start of the holiday season) and autos (as hinted by a 0.0 2.5

firm increase in car registrations). Our forecast, if confirmed, -1.0 1.0

would leave spending on manufactured goods barely flat -2.0 -0.5

on the previous quarter, underpinning only a moderate -3.0 -2.0

acceleration in overall private consumption in 2Q, following -4.0 consumer spending (in % mom) -3.5

the stagnation recorded in 1Q. consumer spending (in % yoy, RS)

-5.0 -5.0

01/06 01/07 01/08 01/09 01/10

Source: Thomson DataStream, UniCredit Research

UniCredit Research page 15 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

UK, REAL GDP UPBEAT GDP READING, TEMPORARILY

II/10 CIB Cons. I/10 IV/09 2.0 6.0

CIB forecast

in % qoq 0.7 0.6 0.3 0.4 1.5 4.8

1.0 3.6

2Q GDP should mark a decent acceleration, rising 0.7% qoq. 0.5 2.4

The likely acceleration in industrial production and high 0.0 1.2

level of services sector figures, together with a likely -0.5 0.0

rebound in retail sales (see above), underpin our forecast. -1.0 -1.2

However, we expect 2Q to be a peak of the current cycle -1.5 -2.4

and growth is expected to slow in 2H, though we don’t -2.0 -3.6

GDP (in % qoq)

see a double-dip recession. -2.5 -4.8

GDP (in % yoy, RS)

-3.0 -6.0

I/00 I/01 I/02 I/03 I/04 I/05 I/06 I/07 I/08 I/09 I/10

Source: Thomson DataStream, UniCredit Research

Tullia Bucco (UniCredit Bank Milan) Chiara Corsa, (UniCredit Bank Milan)

+39 02 8862-2079 +39 02 8862-2209

tullia.bucco@unicreditgroup.de chiara.corsa@unicreditgroup.de

Alexander Koch, CFA (UniCredit Bank) Chiara Silvestre (UniCredit Bank Milan)

+49 89 378-13013 chiara.silvestre@unicreditgroup.de

alexander.koch1@unicreditgroup.de

Marco Valli (UniCredit Bank Milan)

+39 02 8862-8688,

marco.valli@unicreditgroup.de

UniCredit Research page 16 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

Data Monitor US - Preview of the coming week

Tuesday, 20 July

HOUSING STARTS & BUILDING PERMITS ANOTHER DECLINE IN HOUSING STARTS

June CIB Cons. May Apr 2400

Housing starts, in k (annualized) 565 577 593 659 2200

Building permits, in k (annualized) 580 570 574 610 2000

1800

Housing starts fell by 10% in May after the expiration of 1600

the tax credit for homebuyers, which boosted construction 1400

and sales in preceding months. For June, we expect another, 1200

albeit somewhat more moderate drop in starts. This is, 1000

among others, indicated by the back-to-back decline in Housing starts (in thousands, saar)

800

Building permits (in thousands, saar)

building permits in April and May. Permits declined in 600

May to the lowest level since October. They are 400

expected to remain at these benign levels as the still 01/00 01/02 01/04 01/06 01/08 01/10

huge oversupply of unsold homes continues to weigh on

Source: Thomson Datastream, UniCredit Research

construction activity for the time being.

Thursday, 22 July

INITIAL JOBLESS CLAIMS BOUNCE AFTER GM-RELATED IMPROVEMENT

17 July CIB Cons. 20 Jul 3 Jul In thousands

in thousands 445 460 429 458 700

Jobless claims (thousands, weekly)

650

Initial jobless claims dropped significantly in the week 4-week moving average

600

ending July 10. Behind this decline to the lowest level

550

since August 2008 was the fact that General Motors did

500

not shut down its plants for the annual retooling that

usually occurs in the week of the Independence Day 450

holiday (i.e. in the week ending July 10). That kept both 400

GM employees and related suppliers employed, 350

whereas they had been eligible to file jobless claims in 300

previous years. As this, however, was a one-off effect, 250

claims likely bounced back in the week ending July 17 to 01/00 01/02 01/04 01/06 01/08 01/10

their disappointing range of 440-490k, where they had

been since November 2009. Source: Thomson Datastream, UniCredit Research

UniCredit Research page 17 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

INDEX OF LEADING INDICATORS FIRST DECLINE IN 15 MONTHS

June CIB Cons. May Apr In % yoy

in % mom -0.2 -0.3 0.4 0.0 20 50.0

OECD Conference Board (RS) ECRI (RS)

15 37.5

The Conference Board’s Index of Leading Indicators

10 25.0

(LEI) has considerably lost momentum in the last few

months. The index was flat in April after rising in the previous 5 12.5

twelve months, and the annualized 3M change slowed to 0 0.0

7¼% in May. That is only half as much as in mid-2009

-5 -12.5

and the lowest number since April 2009. In June, the LEI

-10 -25.0

probably even declined again. That would be the

first monthly drop in 15 months. The largest negative -15 -37.5

contributions likely came from a decline in the average -20 -50.0

workweek, faster vendor deliveries and the drop in the 01/99 01/01 01/03 01/05 01/07 01/09

S&P 500. The yield spread and a higher real money

Source: Thomson Datastream, UniCredit Research

supply, in contrast, boosted the LEI in June.

EXISTING HOME SALES PLUNGE AFTER THE EXPIRATION OF THE TAX CREDIT

June CIB Cons. May Apr 50

In mn annualized 4.50 5.20 5.66 5.79 Total home sales (in % yoy)

40

6-month moving average

30

A bit surprisingly, existing home sales eased 2.2% in May.

As they only occur with the closing of a sales contract 20

(not with the signing), it was expected that existing home 10

sales in May still benefited from the homebuyer tax credit

0

that ended in April. For June, we expect a significant

-10

decline to a 4½ million units annual rate. Such a plunge

has been indicated by significant declines in the most -20

important leading indicators, such as the Pending Home -30

Sales Index or mortgage applications. 01/00 01/02 01/04 01/06 01/08 01/10

Source: Thomson Datastream, UniCredit Research

Dr. Harm Bandholz, CFA (UniCredit Bank)

+1 212 672 5957

harm.bandholz@us.unicreditgroup.eu

UniCredit Research page 18 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

US Review As a result, the annualized 3M change fell to -1½%. Apart

from the severe declines during the Great Recession, that is

the second fastest drop over such a period since statistics

Wary Fed debates further stimulus began in 1992 (cf. chart).

The minutes of the June 22/23 FOMC meeting confirmed

that the majority of Fed officials became more worried about LOSING MOMENTUM

the strength of the US recovery. While all participants continued

to forecast a moderate recovery in economic activity, “most Retail sales ex cars, gasoline and building materials,

participants revised down slightly their outlook for economic annualized 3M change in %

growth, and about one-half of the participants judged the 15

balance of risks to growth as having moved to the downside”

(cf. table). This is partly due to the fact that financial markets 10

have become “less supportive of economic growth, largely

reflecting international spillovers from European fiscal 5

strains.” In addition, the minutes emphasized that businesses

were still cautious about hiring or investing, given uncertainties 0

about the outlook for the economy, developments in global

financial markets and legislative changes. So far, the -5

changes to the outlook “were viewed as relatively modest

and as not warranting policy accommodation beyond that already -10

Jan-92 Jan-95 Jan-98 Jan-01 Jan-04 Jan-07 Jan-10

in place. However, members noted that […] the Committee

would need to consider whether further policy stimulus might

become appropriate if the outlook were to worsen appreciably.” Source: Census Bureau, Thomson Datastream, UniCredit Research

In other words, the Fed spent quite some time in its June

meeting debating a potential expansion of its credit easing policy. Wider trade deficit poses downside

risk to 2Q GDP growth

ECONOMIC PROJECTIONS OF THE FEDERAL RESERVE

The US trade deficit unexpectedly widened in May to USD 42.3bn

Central tendency 2010 2011 2012

from USD 40.3bn. That is the biggest gap in 18 months

Real GDP growth 3.0% - 3.5% 3.5% - 4.2% 3.5% - 4.5%

April projection 3.2% - 3.7% 3.4% - 4.5% 3.5% - 4.5% (November 2008). While exports were up USD 3.5bn (+2.4%),

Unemployment rate 9.2% - 9.5% 8.3% - 8.7% 7.1% - 7.5% imports increased even faster. They rose USD 5.5bn (+2.9%),

April projection 9.1% - 9.5% 8.1% - 8.5% 6.6% - 7.5%

as a 9.5% decline in crude oil imports was more than offset

PCE inflation 1.0% - 1.1% 1.1% - 1.6% 1.0% - 1.7%

April projection 1.2% - 1.5% 1.1% - 1.9% 1.2% - 2.0% by strong increases in imports of consumer goods (+10.4%)

Core PCE inflation 0.8% - 1.0% 0.9% - 1.3% 1.0% - 1.5% and autos (+12.8%). The real deficit of goods widened to

April projection 0.9% - 1.2% 1.0% - 1.5% 1.2% - 1.6% USD 46.0bn, which is the largest since January 2009.

Source: Federal Reserve, UniCredit Research In April and May combined, the real goods deficit was USD 2.8bn

wider than the 1Q average. If this increase is confirmed by

the upcoming June report, net exports would subtract again

Retail sales fell for the second straight almost one percentage point from GDP growth in the second

month in June quarter (after -0.8pp in 1Q). That drag is about half a percent

US retail sales fell another 0.5% in June, after dropping 1.1% point larger than we had assumed so far. Hence, there are now

in May. It was the first back-to-back decline since the first downside risks to our 3% GDP forecast for the second quarter.

quarter of 2009. As expected, most of the decrease in June

Dr. Harm Bandholz, CFA (UniCredit Bank)

was caused by a weaker car sales and a drop in (nominal) +1 212 672 5957

gasoline sales, which in turn was caused by lower gas harm.bandholz@us.unicreditgroup.eu

prices. Sales of building materials declined another 1.0%

after dropping 9.0% in May. This correction is probably still

due to the end of the “cash for appliances” program. In addition,

sales in the less volatile core group, which excludes cars,

gasoline and building material, have visibly lost momentum

in the second quarter. After declining by 0.4% and 0.2% in

April and May, they edged up by a mere 0.2% in June.

UniCredit Research page 19 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

Fixed Income Outlook Equities, specifically in the financial sector, skyrocketed in

the days immediately preceding the publication of the stress

tests. During the 4 weeks before and the 4 after the publication,

■ There was hardly any activity on government bond markets

the S&P 500 sub-index "Investment Banks & Brokerage"

this week reflecting a wait-and-see attitude ahead of the

added 18.6%, while the sub-index "Diversified Banks" even

publication of the stress tests of European banks next Friday.

gained 19.4%. Government bond market reactions can

also be interpreted as having expressed faith: 10Y US yields

■ Core bond market reactions should come under moderate

rose 90bp, while 10Y euro zone yields added 47bp.

pressure after the release of the stress test and we would

neutralize the active duration exposure.

BOND MARKETS AND TRADE-WEIGHTED USD

Hardly any activity this week

10Y UST (LS) 10Y Bunds (LS) USD-Index (RS)

6 90

The last few days saw no activity in core bond markets. 10Y release US stress test

85

Bunds were basically unchanged at least compared to the

previous week (+1 bp). There are several explanations for 5 80

this. On the one hand, there were no relevant data releases; 75

on the other, the ECB has probably thinned out the periphery 4 70

markets to such an extent that there is hardly any serious 65

selling interest. This is suggested by the extremely low volume 3 60

of the ECB purchases in the preceding weeks (only EUR 1bn). 55

But there was also hardly any market reaction to Moody’s 2 50

downgrade of Portugal’s country rating by 2 notches from

1/1/08

3/1/08

5/1/08

7/1/08

9/1/08

11/1/08

1/1/09

3/1/09

5/1/09

7/1/09

9/1/09

11/1/09

1/1/10

3/1/10

5/1/10

7/1/10

Aa2 to A1. A further argument may be a wait-and-see attitude

ahead of the publication of the stress tests for European banks.

Source: Bloomberg, UniCredit Research

Stress test then in the US ...

If there is one highlight of the coming week, then it is the ... and now in Europe

publication of the results of the stress tests of European How many of the 91 tested banks will be declared stress

banks on 23 July (next Friday). There has been much speculation resistant? It is expected that the percentage will be higher

on the positive and negative aspects, stress criteria and than for the banks tested in the US (47% of the banks tested

ramifications. To assess the possible reactions, we briefly reflect had no capitalization requirement). This must not necessarily

on the release of the stress test of US banks, the results of be a reason for jubilation if conspiracy theories do the

which were published at the beginning of May 2009. At that rounds. But let’s assume that despite diverse prophecies of

time, 19 banks were tested, of which 9 banks were deemed doom and gloom (even the WSJ and the FT speculated on

to require no additional capital and 10 banks were deems to irregularities with the US stress test) there is a huge

need capitalization totaling USD 74.6bn, which was to be opportunity here. Under this premise, the relevant question

covered within roughly four weeks. Interesting at the time for us in this section about the reaction on the bond markets

was the reaction of the individual asset classes: The USD-Index should also be clear. The hardest of all “core“ markets, i.e.

was under pressure even before the publication of the stress Germany, Finland and the Netherlands, should tend to come

tests. The index fell 3.9% during the 20 trading sessions under moderate pressure. Bund yields should, therefore, add

ahead of the publication date. And there was no change to a few basis points. The bond markets in the Southern periphery

this situation in the four weeks after: a minus of a further countries on the other hand should survive any perceived

2.3%. Overall, therefore, a setback of more than 6%! EUR-USD recapitalization requirement. To the extent that there is any

rose 6.7% during this timeframe. One cannot, therefore, say pressure in these markets as a result of the stress test, the

that the USD profited from the US stress tests. Or was it the ECB will probably expand its purchase volumes again

case that the confidence-building measure for the US banks strongly and rapidly stabilize the markets, especially after

was, at the same time, a confidence-boosting measure at the Trichet’s comment at the most recent press conference “Do

global level. As a result, the combination “rising appetite for not underestimate the euro zone“.

risk = weaker USD = strength of other currencies“ would apply.

Under this premise and presuming a half-way satisfactory

stress test of European banks, the EUR should be able to

firm, and the USD will slide across the board.

UniCredit Research page 20 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

Strategy

In the outlook for 3Q10 last week, we recommended a

moderately long duration. This is still our preference looking

to the end of September. For the coming one or two weeks,

we would, however, temporarily "immunize" the active duration.

Michael Rottmann (UniCredit Bank)

+49 89 378 15121

michael.rottmann1@unicreditgroup.de

UniCredit Research page 21 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

Forex Outlook EUR-USD: bullish but addicted to risk

The EUR again put in a strong weekly performance as risk

■ View: The USD might still remain under siege due to Fed appetite remained healthy, mainly due to the positive kick-off

speeches and economic data during the next week. of the US earnings season, relatively well received Spanish

and Portuguese bond and T-bill auctions and the apparently

■ EUR: The EUR is still on a bullish trend, but is in desperate reduced liquidity needs of the EU banking sector. As noted in

need of rising equities, while risk of friendly fire from the our chart, the positive correlation of EUR-USD and the Dow

EU bank stress test is non-negligible. Jones since May is relatively evident and the fact that equities

at least managed to defend last week’s levels, notwithstanding

■ GBP: If risk appetite holds up well, next week’s UK data a further weakening in economic data on both sides of the

releases should again prove rather sterling-positive. Atlantic, helped the EUR again during the week. Hence,

negative news like Moody’s downgrade of the Portuguese

USD to still remain under siege credit rating by two notches was shrugged off relatively easily

for the moment.

The corporate earnings season kicked off very well in the US

and the consequent easing of equity volatility contributed as

well to generate stronger risk momentum in FX. Accordingly, DOW JONES & EUR-USD SPOT

the classical defensive currencies, the CHF and the JPY, lost

12000 1.6

some ground, before, however, recovering towards the end Dow Jones

of the week when markets became more worried about the 11000 EUR-USD (RS) 1.5

extent of the USD weakness. Indeed, in the end, it was again

mainly the USD which weakened against other FX majors, 10000 1.4

following downbeat US data and the dovish FOMC minutes

9000 1.3

published this week. In Europe, the reduced liquidity needs

of the EMU banking sector, as emerged from this week’s 8000 1.2

ECB tender operations, has added to the positive picture and

the market currently is characterized as well by a rather 7000 1.1

benevolent assessment of the EU bank stress test.

6000 1.0

01/09 04/09 07/09 10/09 01/10 04/10 07/10

The positive market sentiment surrounding the stress test is

bound to prevail at least until the disclosure of the first results

Source: Bloomberg, UniCredit Research

on a country-by-country basis on July 23. However, as market

chatter already conjectures about which banks have performed

in the stress test in a certain manner, notwithstanding the However, we would not bank too much on a further happy

fact that speculation on the details and on the methodologies cohabitation between poor macroeconomic data releases

applied are still ongoing, there seems to be some inconsistency and positive equity markets. Indeed, the momentum of equity

in the current benevolent assessment of the stress test, has already weakened this week and the correlation between

which could be a potential factor of market uncertainty, once the the Dow Jones and EUR-USD might be weakening now, as the

bank-by-bank results will be published at the beginning of August. latest EUR-USD rally seemed to be fuelled more by generalized

USD weakness than by rallying equity markets. Data

Next week, however, the risk picture should still continue to releases during the next week should deliver more of the

remain shaped mainly by the full unfolding of the US corporate same in the eurozone – the PMIs and the German Ifo are

earnings season, US data releases mainly referring to the expected to soften and as such will do little to help EUR-USD

housing market and the Fed’s Bernanke semi-annual testimony to recover further. Having said that, from a chart-technical

in Congress. A further weakening in the US housing market perspective, EUR-USD still remains on a bullish trend and

combined with a very cautious outlook on the US economy relatively well positioned to target the 1.2960 and 1.31 levels

by Bernanke should again keep the CHF and the JPY on bid if the US earnings season continues to provide mainly positive

and the USD on offer. surprises and equity markets continue to digest disappointing

US economic data rather well. Another key precondition for a

possible EUR-USD return to levels of 1.30 and above is

however still that the EU bank stress test does not turn out to

be a boomerang regarding the fulfillment of its initial goal of

providing further guidance on the real state of health of the

EU banking sector.

UniCredit Research page 22 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

GBP: firm UK data to help again

Sterling again strengthened amid strong inflation and core

inflation readings, as well as a declining jobless numbers and

good risk appetite. Regarding BoE speakers Miles and Sentance,

the market preferred Sentence’s hawkish position on rates,

contributing to a GBP-USD rise to 1.54 from 1.5050 at the

end of last week, while EUR-GBP range-traded in the 0.83-0.84

band as the positive sterling momentum was matched by the

single currency’s own strength.

Next week, sterling will still be mainly under the influence of

UK data and BoE events. The BoE minutes will show how

the monetary policy stance of the MPC’s members could

have changed following the strong budget cuts inherent to

the June 22 emergency budget. As such, the minutes could

slow down the cable rally if BoE members should have seen see

strong repercussions of the budget cuts on the monetary policy

stance. On the other hand, the retail sales release and the

first estimate of 2Q GDP should prove rather sterling-positive.

This week’s strong cable rally might represent as well some

danger for a temporary pullback, but we still favor cable

higher in the medium term. The 15D moving average has

now breached the 60D and the 100D moving averages and a

break above the key resistance level at 1.5525 would send

out another bullish signal and bring the 200D line at 1.56 on

the radar screen.

Dr. Stephan Maier (UniCredit Bank Milan)

+39 02 8862 8604

stephan.maier@unicreditgroup.eu

UniCredit Research page 23 See last pages for disclaimer.

16 July 2010 Economics & FI/FX Research

Friday Notes

CIB View – Our Global Picture ■ Taking into account the recent escalation of the sovereign

debt crisis together with the weak foundation of the current

Global economy recovery, the ECB should leave its key interest rate

unchanged at currently 1% well into next year. We expect

■ The Great Recession has run its course last autumn. Real

the first hike in 4Q11 (25 bp). But the central bank will continue

worldwide GDP growth even accelerated in 4Q09. And

the now halted removal of excess liquidity again at a measured

most economic indicators still point north. It is, however,

pace once financial woes in Europe have abated.

so far no more than a technical rebound after the preceding

economic collapse that is already facing the threat of another

setback during 2H10 before economic growth should Government bond markets

re-accelerate in the course of next year. ■ The expected US monetary tightening in early 2011 in

conjunction with growing risk appetite will send government

■ For 2010, we expect real GDP to rise 4.4% on a PPP basis US bond yields higher (again) later this year, albeit moderately.

(2011: +4.2%; 2009: -1%). That remains, however, below Combined with the growing supply of Treasuries, long-term

trend. Economic activity in industrialized countries should US yields (10Y) should reach 3.80% level at the end of

post only a modest of 2.4% (2011: +2.1%) after having this year and 4.30% by end-June 2011. 10Y Bund yields

contracted by 3.1% in 2009. China and Emerging Asia, should barely rise over the next couple of months, reaching

which were the first to achieve a trend reversal last year, 3¼% at the end of this year and 3.50% six months later.

will clearly remain at the top of the growth league also in 2010.

Exchange rates

US ■ The debt crisis should continue to weigh on the euro. We