Professional Documents

Culture Documents

AFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42

Uploaded by

Judith CastroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42

Uploaded by

Judith CastroCopyright:

Available Formats

a bank to any other bank, whether locally or abroad, shall be subject to the limits as herein prescribed or

P100 million, whichever is higher.

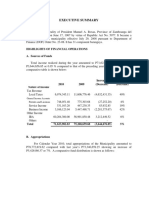

Note 6 : Loans and Receivables

Loans and Receivables are stated at amortized cost computed as the outstanding principal balances

reduced by loans and receivables discounts and related allowance for credit losses, broken down as

follows:

As Status Year 2016 Year 2015

Current P 113,469,284.40 81.74% 130,567,974.55 83.57%

Past Due 17,932,116.67 12.92% 18,409,197.27 11.78%

Items in Litigation 7,442,623.05 5.35% 7,266,402.84 4.65%

Total Loan Portfolio P 138,824,024.12 100.00% 156,243,574.66 100.00%

Allowance for Credit Losses (14,201,769.50) (16,765,557.08)

Loans and Receivables (Net) P 124,622,254.62 139,478,017.58

The above accounts earns interest of 6% for Hold-Out Deposits, 10% for loans secured by REM, 14% for

loans secured by CHM and 24% for Clean Loans. Maturity period of the above financial instruments is

presented in Note 4 of the Notes to Financial Statements.

The Allowance for Credit Losses of P 14,201,769.50 is composed of general and specific loan loss

provisions amounting to P 1,131,878.59 and P 13,069,890.91 respectively. The bank is required to set-up

loan loss provision in accordance with the BSP Manual of Regulations (Sec.X302.1 Appendix 18).

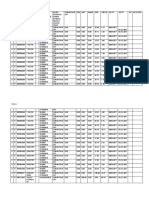

Below is the detailed computation of allowance for credit losses, both specific and general provision:

Specific Provision

Rate Load Balance Required Allowance

Unclassified 0% P 1,630,057.81 0.00

Loans Especially Mentioned 5% 3,649,000.00 182,450.00

Substandard Secured 10% 7,138,059.80 713,805.98

Substandard Unsecured 25% 2,203,644.08 550,911.02

Doubtful 50% 2,829,706.14 1,414,853.07

Loss 100% 10,207,870.84 10,207,870.24

Allowance for Credit Losses-Specific P 27,658,338.67 13,069,890.91

Booked Allowance 13,069,890.91

Excess/(Deficiency) P -

General Provision

Unclassified Restructed 5% P 0.00 0.00

Unclassified Other than Restructed 1% 111,165,685.45 1,111,656.85

Allowance for Credit Losses-General P 111,165,685.45 1,111,656.85

Booked Allowance 1,131,878.59

Excess/ (Deficiency) P 20,221.74

Total Allowance for Credit Losses P 138,824,024.12 14,181,547.76

Booked Allowance 14,201,769.50

Excess / (Deficiency) p 20,221.74

The following table presents the reconciliation of the movement of the allowance for credit losses for

loans and receivables:

AFS 2016_Towncall Rural Bank, Inc. Page 28 of 42

Year 2016 Year 2015

At January 1 P 16,765,557.08 14,794,309.54

Provision during the year 0.00 2,681,118.59

Accounts written off (2,203,349.95) 0.00

Adjustments (360,437.63) (709,871.05)

At December 31 P14,201,769.50 16,765,557.08

The management believes that the bank had substantially complied with the loan loss provisioning as

required by the Bangko Sentral ng Pilipinas.

As to Maturity Year 2016 Year 2015

Due within (1) year 116,554,906.69 83.96% 124,051,736.11 79.40%

Due beyond (1) year 22,269,117.43 16.04% 32,191,838.55 20.60%

Total Loan Portfolio 138,824,024.12 100.00% 156,243,574.66 100.00%

As to Security Year 2016 Year 2015

Secured 124,827,796.31 89.92% 137,940,875.43 88.29%

Unsecured 13,996,227.81 10.08% 18,302,699.23 11.71%

Total Loan Portfolio P 138,824,024.12 100.00% 156,243,574.66 100.00%

The total secured loans of the bank are further classified as follows:

Year 2016 Year 2015

Real Estate Mortgage P 116,072,931.13 92.99% 128,817,574.87 93.39%

Chattel Mortgage 7,124,807.37 5.71% 8,003,300.56 5.80%

Hold out on Deposits 1,630,057.81 1.31% 1,120,000.00 0.81%

Total Secured Loans P 124,827,796.31 100.00% 137,940,875.43 100.00%

As to Concentration of Credit to certain Industry / Economic Sector:

Year 2016 Year 2015

Agriculture , Hunting & Forestry P 56,415,250.57 40.64% 69,743,119.67 44.64%

Manufacturing 1,360,693.14 0.98% 506,027.40 0.32%

Mining and Quarrying 14,840.13 0.01% 617,691.45 0.40%

Electricity , Gas & Water 30,000.00 0.02% 486,018.12 0.31%

Construction 3,620,416.04 2.61% 2,573,036.03 1.65%

Transportation, Storage and

Communication 182,027.16 0.13% 237,877.38 0.15%

Wholesale & Retails Trade , 0.00%

Repair of Vehicles& Personal

Goods 50,601,248.03 36.45% 51,274,502.32 32.82%

Real Estate, Renting& Business

Activities 1,407,802.90 1.01% 2,447,079.44 1.57%

Financial Intermediation 10,391,383.69 7.49% 12,828,571.43 8.21%

Education 5,104.35 0.00% 0.00 0.00%

Other Service Activities 0.00 0.00% 13,655,297.17 8.74%

Private Households with

Employed Persons 1,095,538.56 0.79% 0.00 0.00%

Other Community, Social &

Personal Service 13,699,719.55 0.00

Individual Consumption 0.00 0.00% 1,874,354.25 1.20%

Total Loan Portfolio P 138,824,024.12 90.13% 156,243,574.66 100.00%

AFS 2016_Towncall Rural Bank, Inc. Page 28 of 42

AFS 2016_Towncall Rural Bank, Inc. Page 28 of 42

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- AFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Document3 pagesAFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Judith CastroNo ratings yet

- Bank of BarodaDocument22 pagesBank of BarodaShivane SivakumarNo ratings yet

- 7 Ifmis Cash Flow Statement - National ConsolidatedDocument1 page7 Ifmis Cash Flow Statement - National ConsolidatedNagesso BesayeNo ratings yet

- FA Balance SheetDocument15 pagesFA Balance SheetPrakash BhanushaliNo ratings yet

- VERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Document8 pagesVERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Touqeer HussainNo ratings yet

- Finman Step 5Document59 pagesFinman Step 5PETRUS CANISIUS AXELNo ratings yet

- It Dic 13 Eng - NDocument11 pagesIt Dic 13 Eng - NcoccobillerNo ratings yet

- State Bank of India: Balance SheetDocument9 pagesState Bank of India: Balance SheetKatta AshishNo ratings yet

- Submission#5 Company Assigned: UCO Bank 1) : Non-Current AssetsDocument2 pagesSubmission#5 Company Assigned: UCO Bank 1) : Non-Current AssetsKummNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- HDFC BankDocument4 pagesHDFC BankKshitiz BhandulaNo ratings yet

- SEFAM - AJMC Pages 8 14Document25 pagesSEFAM - AJMC Pages 8 14Shanzeh WaheedNo ratings yet

- Titan Company TemplateDocument18 pagesTitan Company Templatesejal aroraNo ratings yet

- Sbi Banlce SheetDocument1 pageSbi Banlce SheetANIKET VISHWANATH KURANENo ratings yet

- STI Education Systems Holdings Inc.: (Amount in Philippine Pesos)Document20 pagesSTI Education Systems Holdings Inc.: (Amount in Philippine Pesos)chenlyNo ratings yet

- SEFAM AJMC-RatiosDocument26 pagesSEFAM AJMC-RatiosShanzeh WaheedNo ratings yet

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446No ratings yet

- NPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Document11 pagesNPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Ali Hussain Al SalmawiNo ratings yet

- Twice Incorporated: Percentage of Recov For USC W/o 35%Document4 pagesTwice Incorporated: Percentage of Recov For USC W/o 35%Paolo LocquiaoNo ratings yet

- HDFC Bank - FM AssignmentDocument9 pagesHDFC Bank - FM AssignmentaditiNo ratings yet

- BF1 Package Ratios ForecastingDocument16 pagesBF1 Package Ratios ForecastingBilal Javed JafraniNo ratings yet

- Department of Public Works and Highways Executive Summary 2022Document14 pagesDepartment of Public Works and Highways Executive Summary 2022Stacy VeuNo ratings yet

- UBL Analysis 2018Document4 pagesUBL Analysis 2018Zara ImranNo ratings yet

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFutkarsh varshneyNo ratings yet

- BrelDocument5 pagesBrelAlfi NiloyNo ratings yet

- Kohinoor 181 11 5851 FacDocument37 pagesKohinoor 181 11 5851 FacSharif KhanNo ratings yet

- Calculation Group 10Document12 pagesCalculation Group 10HM FarhanNo ratings yet

- Queen SouthDocument16 pagesQueen SouthMohammad Sayad ArmanNo ratings yet

- Credit Memo For Gas Authority of IndiaDocument15 pagesCredit Memo For Gas Authority of IndiaKrina ShahNo ratings yet

- Common Size Analisis & Arus Kas 2015Document6 pagesCommon Size Analisis & Arus Kas 2015Muhammad Najibulloh ImadaNo ratings yet

- FM FS For GlobeDocument5 pagesFM FS For GlobeIngrid garingNo ratings yet

- Roxas ZDN ES2010Document7 pagesRoxas ZDN ES2010J JaNo ratings yet

- Balance GeneralDocument9 pagesBalance GeneralPool Lido Chaupis EnriquezNo ratings yet

- Horizontal Analysis 2017 2016 Increase (Decrease) % of Change AssetsDocument20 pagesHorizontal Analysis 2017 2016 Increase (Decrease) % of Change AssetschenlyNo ratings yet

- Phil HealthDocument9 pagesPhil Healthlorren ramiroNo ratings yet

- Facts and AssumptionsDocument4 pagesFacts and AssumptionsJbNo ratings yet

- Financial Analysis of Nepalese Commercial BankDocument4 pagesFinancial Analysis of Nepalese Commercial Bankशिशिर ढकालNo ratings yet

- The Balance Sheet Items For CIBDocument1 pageThe Balance Sheet Items For CIBKhalid Al SanabaniNo ratings yet

- Hira Textile Mill Horizontal Analysis 2014-13 1Document8 pagesHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqNo ratings yet

- Ppaper 3Document7 pagesPpaper 3Endalkachew GutetaNo ratings yet

- Ondo East 2022 Finalt BudgetDocument182 pagesOndo East 2022 Finalt Budgetojo bamideleNo ratings yet

- Ia FinDocument15 pagesIa FinMinh SuyNo ratings yet

- HORIZON Analytical Procedure AppendixDocument5 pagesHORIZON Analytical Procedure AppendixWinny PoeNo ratings yet

- Company Info - Print FinancialsDocument1 pageCompany Info - Print FinancialsjohnNo ratings yet

- Group 2 SBR 2 FRMDocument11 pagesGroup 2 SBR 2 FRMPooja JainNo ratings yet

- Sonali Bank Balancesheet 2019Document9 pagesSonali Bank Balancesheet 2019DHAKA COLLEGENo ratings yet

- BF Financial ReportDocument19 pagesBF Financial ReportEryllNo ratings yet

- Assignment of Accounting For ManagersDocument17 pagesAssignment of Accounting For ManagersGurneet KaurNo ratings yet

- FM Group 03Document25 pagesFM Group 03Mohammad IslamNo ratings yet

- Answer To The Question No 1 (I) ACI Group of Company Balance Sheet (Vertical Analysis) For The Years Ended June 30, 2019Document4 pagesAnswer To The Question No 1 (I) ACI Group of Company Balance Sheet (Vertical Analysis) For The Years Ended June 30, 2019Estiyak JahanNo ratings yet

- Case Assignment 8 - Diamond Energy Resources PDFDocument3 pagesCase Assignment 8 - Diamond Energy Resources PDFAudrey Ang100% (1)

- CDP Preparation Template Form 3c.1Document6 pagesCDP Preparation Template Form 3c.1Princess Hayria B. PiangNo ratings yet

- Adesoye, Adeniji-Scena - CorrectDocument11 pagesAdesoye, Adeniji-Scena - CorrectAdesoye AdenijiNo ratings yet

- United Bank Limited (UBL) : Balance SheetDocument7 pagesUnited Bank Limited (UBL) : Balance SheetZara ImranNo ratings yet

- Corporate Finance Corporate Finance: 2020-22 - By: Purvi Jain JSW Steel Ltd. JSW Steel LTDDocument11 pagesCorporate Finance Corporate Finance: 2020-22 - By: Purvi Jain JSW Steel Ltd. JSW Steel LTDpurvi jainNo ratings yet

- Accounts Term PaperDocument508 pagesAccounts Term Paperrohit_indiaNo ratings yet

- HDFC Bank: PrintDocument1 pageHDFC Bank: PrintBHATT BANSINo ratings yet

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- Final N Tlga KkaninDocument1 pageFinal N Tlga KkaninJudith CastroNo ratings yet

- Hall 5e TB Ch12Document12 pagesHall 5e TB Ch12Patricia Ann GuetaNo ratings yet

- Final N Tlga KkaninDocument1 pageFinal N Tlga KkaninJudith CastroNo ratings yet

- Marrion Jacob BDocument7 pagesMarrion Jacob BJudith CastroNo ratings yet

- Branches of GovernmentDocument1 pageBranches of GovernmentJudith CastroNo ratings yet

- Aud. Rep Basis FormatDocument2 pagesAud. Rep Basis FormatJudith CastroNo ratings yet

- Chapter 9 - Shareholder's EquityDocument12 pagesChapter 9 - Shareholder's EquityLouie De La Torre50% (4)

- Account Name K1 K2 A1 A2 A5 F1 F2 F3 B5 B 3 N Total Cs. Payment Utang ProfitDocument2 pagesAccount Name K1 K2 A1 A2 A5 F1 F2 F3 B5 B 3 N Total Cs. Payment Utang ProfitJudith CastroNo ratings yet

- RESA Final Preboard P1Document10 pagesRESA Final Preboard P1rjn191% (11)

- MarchDocument2 pagesMarchJudith CastroNo ratings yet

- Sample Moa 3 19 14Document3 pagesSample Moa 3 19 14Judith CastroNo ratings yet

- 2.agency Problem Principal-AgentDocument6 pages2.agency Problem Principal-AgentJudith Castro100% (1)

- OJT RequirementsDocument1 pageOJT RequirementsJudith CastroNo ratings yet

- TypeDocument3 pagesTypeJudith CastroNo ratings yet

- WaiverDocument1 pageWaiverJudith CastroNo ratings yet

- January. DoxDocument3 pagesJanuary. DoxJudith CastroNo ratings yet

- Ojt Performance Evaluation Form: General Impressions and Observations of The TraineeDocument1 pageOjt Performance Evaluation Form: General Impressions and Observations of The TraineeJudith CastroNo ratings yet

- February DoxDocument3 pagesFebruary DoxJudith CastroNo ratings yet

- Endorsement Letterbsa HimherDocument2 pagesEndorsement Letterbsa HimherJudith CastroNo ratings yet

- Towncall Rural Bank, Inc.: To Adjust Retirement Fund Based On Retirement Benefit Obligation BalanceDocument1 pageTowncall Rural Bank, Inc.: To Adjust Retirement Fund Based On Retirement Benefit Obligation BalanceJudith CastroNo ratings yet

- Page 1 To 5Document6 pagesPage 1 To 5Judith CastroNo ratings yet

- 5.takeover GGSRDocument9 pages5.takeover GGSRJudith CastroNo ratings yet

- Pages 891027Document9 pagesPages 891027Judith CastroNo ratings yet

- Page32 34 38 39Document4 pagesPage32 34 38 39Judith CastroNo ratings yet

- Page 18 To 19Document2 pagesPage 18 To 19Judith CastroNo ratings yet

- Financial Assets Recognized in Balance SheetsDocument2 pagesFinancial Assets Recognized in Balance SheetsJudith CastroNo ratings yet

- GGSR Question Chapter 5 DoxDocument3 pagesGGSR Question Chapter 5 DoxJudith CastroNo ratings yet

- Towncall Rural Bank, Inc.: To Adjust Retirement Fund Based On Retirement Benefit Obligation BalanceDocument1 pageTowncall Rural Bank, Inc.: To Adjust Retirement Fund Based On Retirement Benefit Obligation BalanceJudith CastroNo ratings yet

- Page 11 To 14Document6 pagesPage 11 To 14Judith CastroNo ratings yet

- Equicapita Signs Agreement With ATB Corporate Financial Services For Acquisition FacilityDocument2 pagesEquicapita Signs Agreement With ATB Corporate Financial Services For Acquisition FacilityEquicapita Income TrustNo ratings yet

- BEC Notes Chapter 3Document6 pagesBEC Notes Chapter 3cpacfa90% (10)

- Capital and Revenue Income and ExpenditureDocument31 pagesCapital and Revenue Income and ExpenditureMahesh Chandra Sharma100% (2)

- Mers RulesDocument43 pagesMers RulessnrdadNo ratings yet

- Financial Accounting: Hoggett Edwards MedlinDocument14 pagesFinancial Accounting: Hoggett Edwards MedlinGEBRE BAYOUNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (3)

- Stock Market - A Complete Guide BookDocument43 pagesStock Market - A Complete Guide BookParag Saxena100% (1)

- Examples TransferpricingDocument15 pagesExamples Transferpricingpam7779No ratings yet

- Bitcoin Prospectus PDFDocument8 pagesBitcoin Prospectus PDFShazin Shahabudeen100% (1)

- BKSL 2012 ArDocument202 pagesBKSL 2012 ArPanama TreasureNo ratings yet

- Financial Accounting A Managerial Perspective PDFDocument3 pagesFinancial Accounting A Managerial Perspective PDFAtaur Rahman HashmiNo ratings yet

- Term Sheet For Intercreditor Agreement 1.21Document4 pagesTerm Sheet For Intercreditor Agreement 1.21Helpin HandNo ratings yet

- Tesco Case StudyDocument8 pagesTesco Case StudyWenuri KasturiarachchiNo ratings yet

- Basic Underwriting (ATG)Document402 pagesBasic Underwriting (ATG)dwrighte1No ratings yet

- Section - 54B Income-Tax Act 1961 - FA 2022 Capital Gain On Transfer of Land Used For Agricultural Purposes Not To Be Charged in Certain CasesDocument2 pagesSection - 54B Income-Tax Act 1961 - FA 2022 Capital Gain On Transfer of Land Used For Agricultural Purposes Not To Be Charged in Certain CasesSolution PointNo ratings yet

- Chapter 12-Portfolio Returns - Efficient Frontier PDFDocument48 pagesChapter 12-Portfolio Returns - Efficient Frontier PDFEnis ErenözlüNo ratings yet

- MCQs On Taxation LawDocument18 pagesMCQs On Taxation LawAli Asghar RindNo ratings yet

- General Tyre Annual Report June 30 2020 1Document112 pagesGeneral Tyre Annual Report June 30 2020 1M.TalhaNo ratings yet

- FA2e Chapter12 Solutions ManualDocument78 pagesFA2e Chapter12 Solutions Manual齐瀚飞No ratings yet

- The Wall Street Journal LetterDocument1 pageThe Wall Street Journal LetterVovan VovanNo ratings yet

- Nov 2018 RTP PDFDocument21 pagesNov 2018 RTP PDFManasa SureshNo ratings yet

- Chapter 10 in Class Problems DAY 2 SolutionsDocument2 pagesChapter 10 in Class Problems DAY 2 SolutionsAbdullah alhamaadNo ratings yet

- ايميلات شركات كتير فى الكويتDocument40 pagesايميلات شركات كتير فى الكويتahmed HOSNYNo ratings yet

- YES Securities (India) LimitedDocument22 pagesYES Securities (India) LimitedVenu MadhavNo ratings yet

- AAEL - PDD - Ver 05.5 - 2014 - 05 - 06 - TC - CleanDocument39 pagesAAEL - PDD - Ver 05.5 - 2014 - 05 - 06 - TC - CleanAnirudh AgarwallaNo ratings yet

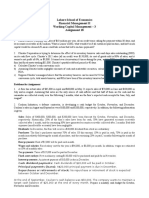

- Lahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18Document2 pagesLahore School of Economics Financial Management II Working Capital Management - 3 Assignment 18SinpaoNo ratings yet

- Study Questions 12 Risk and Return SolutionsDocument4 pagesStudy Questions 12 Risk and Return SolutionsAlif SultanliNo ratings yet

- Vat Bar ExamDocument4 pagesVat Bar Examblue_blue_blue_blue_blueNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFSudip MukherjeeNo ratings yet

- Corporate IssuersDocument55 pagesCorporate IssuersKirti MeenaNo ratings yet