Professional Documents

Culture Documents

13.13. What Is The Price of A European Put Option On A Non-Dividend-Paying Stock

Uploaded by

chocolatedoggy120 ratings0% found this document useful (0 votes)

6 views1 pageThis is my homework for module 10.

Original Title

Module 10 Homework

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is my homework for module 10.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 page13.13. What Is The Price of A European Put Option On A Non-Dividend-Paying Stock

Uploaded by

chocolatedoggy12This is my homework for module 10.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Courtney Gilliam

4.5.2017

FIN 433

CRN: 27706

UIN: 00981224

FIN 433 HW (13.13 & 13.14)

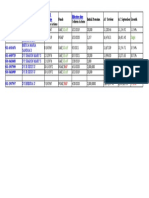

13.13. What is the price of a European put option on a non-dividend-paying stock

when the stock price is $52, the strike price is $50, the risk-free interest rate is 12%

per annum, the volatility is 30% per annum, and the time to maturity is three

months?

D1= ln (52/50) + (.12+.32/2).5 / .300.25 = .5365

D2= .5365 - .300.25 = .3865

52*.7042 - 50e-0.03 * .6504 = 5.06

13.14. What is the price of a European put option on a non-dividend-paying stock

when the stock price is $69, the strike price is $70, the risk-free interest rate is 5%

per annum, the volatility is 35% per annum, and the time to maturity is six months?

D1= ln (69/70) + (.05+.352/2).5 / .350.5 = .1666

D2= .1666 - .350.5 = .0809

70e-0.025 * .5323 - 69 * .4338 = 6.40

You might also like

- Case Study Fin376 Group 5Document21 pagesCase Study Fin376 Group 5Ping IceNo ratings yet

- All - Boards - FY'19 DisciplinaryDocument146 pagesAll - Boards - FY'19 DisciplinaryMoonwolf WilliamNo ratings yet

- Am 2022Document1 pageAm 2022Chris NolanNo ratings yet

- Kyambogo University Appeal List 2018-2019Document16 pagesKyambogo University Appeal List 2018-2019The Campus TimesNo ratings yet

- Detailed Sales Report-1696697087Document3 pagesDetailed Sales Report-1696697087Haitham GhosnNo ratings yet

- (PEANUT) fuel (CUSTOMER) (11)Document1 page(PEANUT) fuel (CUSTOMER) (11)P JohnsonNo ratings yet

- Si DR or MainDocument4 pagesSi DR or MainMary Joy Aquino PlatillaNo ratings yet

- At GRSM Rev 4 0309Document1 pageAt GRSM Rev 4 0309ASGHAR KHANNo ratings yet

- Debt FordDocument5 pagesDebt FordValentin Florin DrezaliuNo ratings yet

- Order and Shipment Status and Mor Number For 16 Styles StatusDocument5 pagesOrder and Shipment Status and Mor Number For 16 Styles StatusM.a. Hamid RealNo ratings yet

- Exercise 1: Calculate Forward Exchange Rate in 5 Following SituationsDocument4 pagesExercise 1: Calculate Forward Exchange Rate in 5 Following SituationsLê Hồng ThuỷNo ratings yet

- ABB Price Book 463Document1 pageABB Price Book 463EliasNo ratings yet

- Ddata Feng Tong PL Sea MSK GD Mex 2Document104 pagesDdata Feng Tong PL Sea MSK GD Mex 2Yuni ArtaNo ratings yet

- Obgyn 1-10 Maret 2017Document313 pagesObgyn 1-10 Maret 2017Ega JockerNo ratings yet

- UntitledDocument3 pagesUntitledJuliano EstadulhoNo ratings yet

- STTM Bca BLN FebDocument8 pagesSTTM Bca BLN FebFajar Putra JakartaNo ratings yet

- GMC & GPA Addition & DeletionDocument6 pagesGMC & GPA Addition & DeletionGokul RanghamannarNo ratings yet

- Makerere University Academic Registrar'S Department Private Admission For The Academic Year 2020/2021 Re-Advertised Direct Entry SchemeDocument53 pagesMakerere University Academic Registrar'S Department Private Admission For The Academic Year 2020/2021 Re-Advertised Direct Entry SchemeMwesigwa DaniNo ratings yet

- Gilliam FIN 435 HomeworkDocument3 pagesGilliam FIN 435 Homeworkchocolatedoggy12100% (1)

- Gear Case For 2018 Suzuki DF350A - General Export No.1 (P01) Sales Region, Pearl Nebular Black Cool White (YAY Y5S), 17017317-864696Document15 pagesGear Case For 2018 Suzuki DF350A - General Export No.1 (P01) Sales Region, Pearl Nebular Black Cool White (YAY Y5S), 17017317-864696riqtorresNo ratings yet

- Archivo Iess 202010Document47 pagesArchivo Iess 202010Andrés Arellano VallejosNo ratings yet

- KWUST Bachelors Degree Placement ListDocument7 pagesKWUST Bachelors Degree Placement ListJOSEPH MWANGINo ratings yet

- Account Statement-1604904976585Document1 pageAccount Statement-1604904976585Fanny Ardhitunggal HakimNo ratings yet

- Laporan Harian Timbangan TBSDocument10 pagesLaporan Harian Timbangan TBSSolehan SiswantoNo ratings yet

- Unit Statement: PSRV82110031101204 Comp/July/Int/1273Document3 pagesUnit Statement: PSRV82110031101204 Comp/July/Int/1273shirinNo ratings yet

- QUERYDocument2 pagesQUERYSmilet NoelNo ratings yet

- Laporan Rekap Klaim - Rs Nahdlatul Ulama BanyuwangiDocument1 pageLaporan Rekap Klaim - Rs Nahdlatul Ulama BanyuwangiLukman Hakim AgoesNo ratings yet

- PGP 2021-23 Term 3 Financial Derivatives: An Assignment OnDocument12 pagesPGP 2021-23 Term 3 Financial Derivatives: An Assignment Onnischal mathurNo ratings yet

- PG Asst Vacant DetailsDocument6 pagesPG Asst Vacant DetailsValar MathiNo ratings yet

- Detalle PDFDocument4 pagesDetalle PDFCarlos Santiago Huamani MarcosNo ratings yet

- (PEANUT) fuel (CUSTOMER) (12)Document1 page(PEANUT) fuel (CUSTOMER) (12)P JohnsonNo ratings yet

- Calculo de InteresesDocument4 pagesCalculo de InteresesChiclayo CosemselamNo ratings yet

- SL. No. Bill Tracking No. Date Vendor Name Vendor Code Bill No. Bill DateDocument1 pageSL. No. Bill Tracking No. Date Vendor Name Vendor Code Bill No. Bill DateAbhishek RanjanNo ratings yet

- Freedam 04-18-2017 Load CurveDocument1 pageFreedam 04-18-2017 Load CurveMassimo LatourNo ratings yet

- Customer A/C Reference Documenttext Doc - Date Amt in Doc. Cu CurrDocument8 pagesCustomer A/C Reference Documenttext Doc - Date Amt in Doc. Cu Currcris gerard trinidadNo ratings yet

- SSA End of Day - July 28 2010Document3 pagesSSA End of Day - July 28 2010chibondkingNo ratings yet

- KIA Ticket Recap ReportDocument12 pagesKIA Ticket Recap Reportirfan haddy ridwantoNo ratings yet

- Kyambogo Direct Entry Scheme Admission List 2018/2019Document588 pagesKyambogo Direct Entry Scheme Admission List 2018/2019The Campus TimesNo ratings yet

- Graduate 2018-2019Document122 pagesGraduate 2018-2019Mary GraceNo ratings yet

- Orodha Mpya Ya Wanafunzi Wa Samia SkolashipuDocument2 pagesOrodha Mpya Ya Wanafunzi Wa Samia SkolashipuJoseph MushiNo ratings yet

- Key Less Start For 2018 Suzuki DF350A - General Export No.1 (P01) Sales Region, Pearl Nebular Black Cool White (YAY Y5S), 17017309-864696 PDFDocument12 pagesKey Less Start For 2018 Suzuki DF350A - General Export No.1 (P01) Sales Region, Pearl Nebular Black Cool White (YAY Y5S), 17017309-864696 PDFriqtorresNo ratings yet

- Keeneland: Asserting BearDocument3 pagesKeeneland: Asserting Bearapi-117968563No ratings yet

- KSSSA Term II Games Team ListDocument2 pagesKSSSA Term II Games Team ListHillary RonohNo ratings yet

- (2019)Document2 pages(2019)rofika.setiariniNo ratings yet

- New ProductDocument1 pageNew Productjaishreekrishnafoodproducts9No ratings yet

- Razão Da Conta Contábil 2019Document46 pagesRazão Da Conta Contábil 2019MartinsH AyresNo ratings yet

- Student ID List 2021Document3 pagesStudent ID List 2021J Benson TemboNo ratings yet

- PROMISSORY NOTE FOR OUTSTANDING INSURANCE PREMIUMSDocument2 pagesPROMISSORY NOTE FOR OUTSTANDING INSURANCE PREMIUMSGoyo VitoNo ratings yet

- Room Wise Time TableDocument1 pageRoom Wise Time TableSheraNo ratings yet

- Rentaequipos Colombia rent and transport equipmentDocument1 pageRentaequipos Colombia rent and transport equipmentSantiago MoranthNo ratings yet

- 23 Error Handing 19052019Document35 pages23 Error Handing 19052019javier valeroNo ratings yet

- Laminator - 18.11.2019 - RDocument1 pageLaminator - 18.11.2019 - RfraanjoNo ratings yet

- General Ledger DTDocument1 pageGeneral Ledger DTIchwan HumaidiNo ratings yet

- TIE40-Optical Glass For Precision MoldingDocument12 pagesTIE40-Optical Glass For Precision Molding侯涛No ratings yet

- RMC Grade M-10: Sno. Date Challan No. Unit QTY AmountsDocument36 pagesRMC Grade M-10: Sno. Date Challan No. Unit QTY AmountsNitin SharmaNo ratings yet

- Meesho 32360 Previouspayment 21-10-22Document28 pagesMeesho 32360 Previouspayment 21-10-22Pritam SahuNo ratings yet

- Utstarajgtn : Jan Samuh PartyDocument5 pagesUtstarajgtn : Jan Samuh Partyprateekbunty81No ratings yet

- Final Sheet (Rolled Size) - 24122019Document17 pagesFinal Sheet (Rolled Size) - 24122019sourajpatelNo ratings yet

- Stock Valuation Terrence Breezeway Case StudyDocument5 pagesStock Valuation Terrence Breezeway Case StudyTrisha Lionel100% (1)

- Cultural Interview PaperDocument6 pagesCultural Interview Paperchocolatedoggy12No ratings yet

- Journal Entry (Mod 2)Document1 pageJournal Entry (Mod 2)chocolatedoggy12No ratings yet

- Module 1 DiscussionDocument1 pageModule 1 Discussionchocolatedoggy12No ratings yet

- Sample Options Test QuestionsDocument5 pagesSample Options Test Questionschocolatedoggy12No ratings yet

- General ElectricDocument7 pagesGeneral Electricchocolatedoggy12No ratings yet

- FIN 433 HomeworkDocument1 pageFIN 433 Homeworkchocolatedoggy12No ratings yet

- Tasty Foods (B)Document1 pageTasty Foods (B)chocolatedoggy12No ratings yet

- Siam Cement foreign exchange lossDocument2 pagesSiam Cement foreign exchange losschocolatedoggy120% (1)

- Module 6 Program AssignmentDocument3 pagesModule 6 Program Assignmentchocolatedoggy120% (1)

- Gilliam FIN 435 HomeworkDocument3 pagesGilliam FIN 435 Homeworkchocolatedoggy12100% (1)

- Module 11 HomeworkDocument1 pageModule 11 Homeworkchocolatedoggy12No ratings yet

- Document 7Document1 pageDocument 7chocolatedoggy12No ratings yet

- Module 12 HomeworkDocument1 pageModule 12 Homeworkchocolatedoggy12No ratings yet

- Journal Entry (Mod 1)Document1 pageJournal Entry (Mod 1)chocolatedoggy12No ratings yet

- Chapter 5-7 Risk Management NotesDocument97 pagesChapter 5-7 Risk Management Noteschocolatedoggy12No ratings yet

- FIN 323 Exam 3 Study GuideDocument3 pagesFIN 323 Exam 3 Study Guidechocolatedoggy12No ratings yet

- Human Services SyllabusDocument6 pagesHuman Services Syllabuschocolatedoggy12No ratings yet

- Assignment 4Document1 pageAssignment 4chocolatedoggy12No ratings yet

- Assignment 1Document1 pageAssignment 1chocolatedoggy12No ratings yet

- Assignment 2Document1 pageAssignment 2chocolatedoggy12No ratings yet

- Assignment 5Document2 pagesAssignment 5chocolatedoggy12No ratings yet

- Fin 439 SyllabusDocument4 pagesFin 439 Syllabuschocolatedoggy12No ratings yet

- Investment Properties AssignmentDocument2 pagesInvestment Properties Assignmentchocolatedoggy12No ratings yet

- Maximize Profit by Optimizing Sandwich ProductionDocument2 pagesMaximize Profit by Optimizing Sandwich Productionchocolatedoggy12No ratings yet