Professional Documents

Culture Documents

Juarez SA 2010 Income Statement and Balance Sheet

Uploaded by

Imran Amer0 ratings0% found this document useful (0 votes)

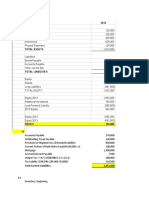

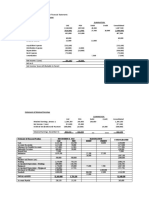

14 views2 pagesThis document summarizes the income statement and balance sheet for Temporal Method for 2010. The income statement shows revenues of $1,900, costs of $1,343, and net income of $225 in USD. The balance sheet lists total assets of $1,165 in USD, with liabilities and equity also totaling $1,165 in USD. A schedule provides additional details on the calculation of cost of goods sold and remeasurement gain/loss.

Original Description:

international accounting answer

Original Title

Juarez

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the income statement and balance sheet for Temporal Method for 2010. The income statement shows revenues of $1,900, costs of $1,343, and net income of $225 in USD. The balance sheet lists total assets of $1,165 in USD, with liabilities and equity also totaling $1,165 in USD. A schedule provides additional details on the calculation of cost of goods sold and remeasurement gain/loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesJuarez SA 2010 Income Statement and Balance Sheet

Uploaded by

Imran AmerThis document summarizes the income statement and balance sheet for Temporal Method for 2010. The income statement shows revenues of $1,900, costs of $1,343, and net income of $225 in USD. The balance sheet lists total assets of $1,165 in USD, with liabilities and equity also totaling $1,165 in USD. A schedule provides additional details on the calculation of cost of goods sold and remeasurement gain/loss.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Juarez, SA Temporal Method

Income Statement -2010

Exchange

Peso Rate USD

Sales 20,000 0.095 1,900

Cost of goods sold (14,000) Sched. A (1,343)

Gross profit 6,000 557

S, G & A (2,500) 0.095 (238)

Depreciation expense (1,000) 0.1 (100)

Interest expense (500) 0.095 (48)

Remeasurement gain (loss) - below 101

Income before tax 2,000 272

Income taxes (500) 0.095 (47)

Net income 1,500 225

Balance Sheet as at 31 December 2010

Cash 1,000 0.08 80

Account Receivables 2,000 0.08 160

Inventory 2,500 0.09 225

Fixed assets 8,000 0.1 800

Less: accumulated depreciation (1,000) 0.1 (100)

Total assets 12,500 1,165

Accounts payable 2,000 0.08 160

Long-term debt 6,000 0.08 480

Capital stock 3,000 0.1 300

Retained earnings 1,500 225

Total liabilities and stockholders' equity 12,500 1,165

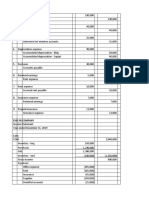

Schedule A. Exchange

Calculation of cost of goods sold ZAR Rate USD

Beginning inventory - -

Purchases 16,500 0.095 1,568

Ending inventory (2,500) 0.09 (225)

Cost of goods sold 14,000 1,343

Calculation of remeasurement gain (loss)

Exchange

ZAR Rate USD

Net monetary liabilities, 1/1/10 (5,000) 0.1 (500)

Increase in monetary assets

Sales 20,000 0.095 1,900

Decrease in monetary assets

Purchases of inventory (16,500) 0.095 (1,568)

S, G & A (2,500) 0.095 (238)

Interest expense (500) 0.095 (48)

Income taxes (500) 0.095 (47)

Net monetary liabilities, 31/12/10 (5,000) (501)

Net monetary liabilities, 31/12/10 at

current exchange rate (5,000) 0.08 (400)

Remeasurement gain (101)

You might also like

- Comptroller Steals $53 Million From City Funds: EthicsDocument4 pagesComptroller Steals $53 Million From City Funds: EthicsChess NutsNo ratings yet

- Cash Flow Statement Template in ExcelDocument5 pagesCash Flow Statement Template in ExcelOyewale OyelayoNo ratings yet

- Financial Statement Analysis Tools and TechniquesDocument6 pagesFinancial Statement Analysis Tools and TechniquesDondie ArchetaNo ratings yet

- Translation of Foreign Currency StatementDocument5 pagesTranslation of Foreign Currency StatementPea Del Monte AñanaNo ratings yet

- The Philippine Financial SystemDocument5 pagesThe Philippine Financial SystemReliza Salva Regana0% (1)

- Withdraw PayPal Money in Malaysia SolutionDocument16 pagesWithdraw PayPal Money in Malaysia Solutionafarz2604No ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Invoice for eSignature Standard Edition SubscriptionDocument1 pageInvoice for eSignature Standard Edition SubscriptionjhilikNo ratings yet

- Debt Policy and ValueDocument7 pagesDebt Policy and ValueMuhammad Nabil EzraNo ratings yet

- CREATIVE ACCOUNTING TECHNIQUES AND IMPLICATIONSDocument18 pagesCREATIVE ACCOUNTING TECHNIQUES AND IMPLICATIONSNurulain MD AnuarNo ratings yet

- Agribusiness Accounting Guide for Non-AccountantsDocument39 pagesAgribusiness Accounting Guide for Non-AccountantsAlexander Kim Waing100% (1)

- Annual Report AnalysisDocument257 pagesAnnual Report AnalysisvinaymathewNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Uladzislau KharashkevichDocument7 pagesUladzislau KharashkevichHarry BurgeNo ratings yet

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- hw032 Question 1Document3 pageshw032 Question 1Mai Hương NguyễnNo ratings yet

- Mock Test (Final Exam) KeyDocument4 pagesMock Test (Final Exam) KeyKhoa TrầnNo ratings yet

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Prepare Financial StatementsDocument16 pagesPrepare Financial StatementsDayaan ANo ratings yet

- Answer Sheet Mock Test 23-2Document5 pagesAnswer Sheet Mock Test 23-2Nam Nguyễn HoàngNo ratings yet

- Acc 2 Nov 2020 SolDocument3 pagesAcc 2 Nov 2020 SolKimberly GondoraNo ratings yet

- Ujian 1 AdvDocument33 pagesUjian 1 AdvaraNo ratings yet

- Hebner, Gilingan, Hartzell, Cox, Edge, Watson, Kewell, Glenn financial analysisDocument3 pagesHebner, Gilingan, Hartzell, Cox, Edge, Watson, Kewell, Glenn financial analysisChristine Joy LanabanNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- Case 8 2 Palmerstown Company - CompressDocument4 pagesCase 8 2 Palmerstown Company - CompressPhương Nguyễn HàNo ratings yet

- AasffffDocument7 pagesAasffffDaddyNo ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- BAb X Buku Bu IInDocument16 pagesBAb X Buku Bu IInAditya Agung SatrioNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Financial Plan: Income StatementDocument3 pagesFinancial Plan: Income StatementKaleem AkhtarNo ratings yet

- Company Financial Statements - FORMAT LTDDocument5 pagesCompany Financial Statements - FORMAT LTDrumelrashid_seuNo ratings yet

- 13 02 23 Exercices Nº1Document3 pages13 02 23 Exercices Nº1Dani MagarzoNo ratings yet

- Solutions IAS 1 For SEPT ATTEMPT FinalDocument25 pagesSolutions IAS 1 For SEPT ATTEMPT FinalShehrozSTNo ratings yet

- Easters Company Ins PaidDocument10 pagesEasters Company Ins PaidNoeme LansangNo ratings yet

- Assignment 5 - AnswerDocument3 pagesAssignment 5 - AnswerSyahidatul FatimyNo ratings yet

- 0 MasterfileDocument598 pages0 MasterfileAngel VenableNo ratings yet

- Rameez Practice ExcelDocument14 pagesRameez Practice ExcelSaswat PanigrahiNo ratings yet

- Onen Diane Alheri Vu-Bcs-1909-0032 Coursework 3Document5 pagesOnen Diane Alheri Vu-Bcs-1909-0032 Coursework 3diane alheriNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Numbers Sheet Name Numbers Table NameDocument25 pagesNumbers Sheet Name Numbers Table NameDARSH SADANI 131-19No ratings yet

- Preparing WorksheetDocument4 pagesPreparing Worksheet6z5qstn8wsNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 5Document5 pagesEngineering Management 3000/5039: Tutorial Set 5SahanNo ratings yet

- ACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONDocument2 pagesACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONPravallika RavikumarNo ratings yet

- Annual Accounts - Wishlist Ltd.Document4 pagesAnnual Accounts - Wishlist Ltd.shreevarshashankarNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- Audit Liabilities and Bonds DiscountsDocument4 pagesAudit Liabilities and Bonds DiscountsKeikoNo ratings yet

- MercuryDocument6 pagesMercuryMrinmoy SahaNo ratings yet

- Jawaban Chapter 23 - Soal DikerjakanDocument2 pagesJawaban Chapter 23 - Soal Dikerjakanabd storeNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- 250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Document9 pages250,000 300,000 400,000 500,000 Cash Flow: Year 1 2 3 4Kai ZhaoNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Proforma StatmentsDocument4 pagesProforma StatmentsMehar AttaullahNo ratings yet

- Cash Flow Statement ExerciseDocument3 pagesCash Flow Statement ExerciseVikas YadavNo ratings yet

- From The Following Information, Prepare A Cash Flow StatementDocument2 pagesFrom The Following Information, Prepare A Cash Flow StatementAgANo ratings yet

- Film CompanyDocument1 pageFilm CompanyKathy PanilagNo ratings yet

- Working Paper Part 2Document3 pagesWorking Paper Part 2KEITH JEROME VIERNESNo ratings yet

- Yearly Ledger Changes: AssetsDocument8 pagesYearly Ledger Changes: AssetsMiguel OrjuelaNo ratings yet

- Consultation-7 28Document11 pagesConsultation-7 28Elaine Joyce GarciaNo ratings yet

- Sage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFDocument2 pagesSage X3 - Reports Examples 2008 - TRLBAL (Trial Balance) PDFcaplusincNo ratings yet

- LBO Model With DCF - TemplateDocument40 pagesLBO Model With DCF - TemplateZac VenosNo ratings yet

- Balance Sheet AUTO IND After q5Document29 pagesBalance Sheet AUTO IND After q5DARSH SADANI 131-19No ratings yet

- Ice NineDocument4 pagesIce NinePolene GomezNo ratings yet

- Golden Ltd's Profit and Loss AnalysisDocument10 pagesGolden Ltd's Profit and Loss AnalysisSheilla BonsuNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Jan 2008Document52 pagesUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Jan 2008MarcyNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Bài 4 - CMBCTC2Document2 pagesBài 4 - CMBCTC2Phan Thị Mỹ DuyênNo ratings yet

- Topic 1Document52 pagesTopic 1Imran AmerNo ratings yet

- Day Debi T Credit Water Consu ME Gree N TEA Skippin G Push UP Plank AND Other S Weig HT Wais T ThigDocument1 pageDay Debi T Credit Water Consu ME Gree N TEA Skippin G Push UP Plank AND Other S Weig HT Wais T ThigImran AmerNo ratings yet

- Far Standard SettingDocument4 pagesFar Standard SettingImran AmerNo ratings yet

- Imran HuraikanDocument4 pagesImran HuraikanImran AmerNo ratings yet

- By Roger SipherDocument3 pagesBy Roger SipherImran AmerNo ratings yet

- Just in Time (Jit) : Najihah BT Mohd Radzi Nurfartima Amira BT Zulkepli Mohamad Imran B AmerDocument9 pagesJust in Time (Jit) : Najihah BT Mohd Radzi Nurfartima Amira BT Zulkepli Mohamad Imran B AmerImran AmerNo ratings yet

- Caring AR15 FullDocument100 pagesCaring AR15 FullImran AmerNo ratings yet

- Far To PresentDocument8 pagesFar To PresentImran AmerNo ratings yet

- Backflush CostingDocument3 pagesBackflush CostingImran AmerNo ratings yet

- Maf Fjust in Time and BackflushinishDocument25 pagesMaf Fjust in Time and BackflushinishImran AmerNo ratings yet

- Unit 3Document54 pagesUnit 3MumbaiNo ratings yet

- The Decision-Making Process of Fiscal Policy in Viet NamDocument21 pagesThe Decision-Making Process of Fiscal Policy in Viet NamADBI EventsNo ratings yet

- Top 40 Property Management CompaniesDocument9 pagesTop 40 Property Management Companiessudeeksha dhandhaniaNo ratings yet

- Hedging With KLIBOR FuturesDocument14 pagesHedging With KLIBOR FuturesJayC'beth KimYongNo ratings yet

- Consolidation Worksheet for Less-than-Wholly Owned SubsidiaryDocument3 pagesConsolidation Worksheet for Less-than-Wholly Owned SubsidiaryDian Nur IlmiNo ratings yet

- Acme Shoe Rubber V Court of AppealsDocument3 pagesAcme Shoe Rubber V Court of AppealsPaolo BrillantesNo ratings yet

- Company Analysis of Infibeam AvenusDocument18 pagesCompany Analysis of Infibeam AvenusPratik WankhedeNo ratings yet

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- Chapter 1 5Document100 pagesChapter 1 5Bijaya DhakalNo ratings yet

- Budget and Budgetary ControlDocument3 pagesBudget and Budgetary ControlwubeNo ratings yet

- Depreciation 181008092040Document23 pagesDepreciation 181008092040kidest mesfinNo ratings yet

- RinggitPlus Financial Literacy Survey Full ReportDocument18 pagesRinggitPlus Financial Literacy Survey Full ReportMeng Chuan NgNo ratings yet

- Switzerland's Central Bank and Financial SystemDocument13 pagesSwitzerland's Central Bank and Financial SystemNikhilNo ratings yet

- Bollinger Band (Part 2)Document5 pagesBollinger Band (Part 2)Miguel Luz RosaNo ratings yet

- Prospectus - Optimal SA FundDocument45 pagesProspectus - Optimal SA FundMigle BloomNo ratings yet

- Classification of CostsDocument10 pagesClassification of CostsChristine Marie RamirezNo ratings yet

- Union Card Corporate Application FormDocument2 pagesUnion Card Corporate Application FormsantoshkumarNo ratings yet

- Creative Teaching PlatformDocument36 pagesCreative Teaching Platformardee esjeNo ratings yet

- 4 Chapter 1 - Executive SummaryDocument5 pages4 Chapter 1 - Executive Summaryleejay029No ratings yet

- Kick City Master Child Registration FormDocument2 pagesKick City Master Child Registration FormdanalbasNo ratings yet

- Breakfast For Leadership That Listens PACDocument2 pagesBreakfast For Leadership That Listens PACSunlight FoundationNo ratings yet