Professional Documents

Culture Documents

Trends of The Romanian Automotive Industry

Uploaded by

Jose ShawOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trends of The Romanian Automotive Industry

Uploaded by

Jose ShawCopyright:

Available Formats

Trends of the Romanian automotive industry

According to current data, the global market of automotive parts will increase from Euro 406 billion in

2010 to Euro 664 billion in 2025. Romania has more than 600 companies involved in the automotive

industry, with 203,600 employees. The cost of labour in the local manufacturing industry is Euro

4.9/hour. 158 international suppliers of auto parts own production facilities in our country, with some

of them also involved in research and development.

The current relative competitive advantages of the labour and utilities costs will gradually dwindle in

the future, so that new investments and capacity developments will be aimed at new products

competitive global technologies with high added value. The evolution of the Romanian automotive

component industry is obviously influenced by the international auto industry trends.

International trends

Globally, innovation-based manufacturers of auto parts are considered more lucrative than

companies specializing on limited number of technologies. This is because component innovation

allows the multiple use thereof for assemblies. Moreover, innovation allows the streamlining of

manufacturing and adaptation to new market requirements, as well as control over the upstream

value adding chains and hence on costs.

On the medium term, the international automotive industry which bears on the local parts

manufacturing will prioritize the following:

Focus on environment and safety;

Optimum positioning on the future integrated mobility matrix;

Overhaul of model ranges according to new demand data;

Strengthening of CDI for competitiveness on global markets;

Focusing of major investments on new products and technologies;

Sharing of risks through alliances and brand reinforcement;

Partnerships for product design and cost minimization over the supply chain, stepping up of

outsourcing;

Auto industry-wide implementation of new concepts such as numerical plant, Smart

automation, Industry 4.0;

New business solutions and new sources of profits.

Technological developments in the Romanian automotive industry

The Romanian automotive industry is more than assembling cars. Despite increases of investments

in auto parts industry, they are still far from reaching full potential. New investments have emerged

lately, such as:

The manufacturing of cutting edge energy-efficient engines at Dacia and Ford Craiova;

Manufacturing of cutting edge gearboxes for large international manufacturers: Daimler-at

Star Transmission Sebes/Cugir and the Renault Nissan alliance at Dacia;

Advanced microelectronics and mechatronics (including CD activities): Continental, Bosch,

Infineon, Delphi, Drxlmaier, Kendrion;

Complex technologies and auto parts of plastics, rubber and composite materials: many new

companies in Banat, Transylvania, Arges;

Expansion of robotics: Dacia starts a program to extend automation from 5% to 20% by

2020;

Emergence of new local companies specializing in the digitalization of the automotive

industry: Magic Engineering, Caelynx/Dassault, ADA Computers/Siemens, AS Systems, INAS,

etc.

According to the Romanian Automotive Manufacturers of Romania (ACAROM), the evolution of

Romanian automotive industry will also be directly influenced by the development lines of the two

large automotive manufacturers - Dacia and Ford, by the introduction of new concepts and manu-

facturing technologies, the ever growing interest for research and development (CDI), and the

access of auto manufacturers to funding.

Thus, the two manufacturers of Romania will consider the following:

DACIA:

Maintaining the current production pace;

Integration of new Renault complex assemblies into the Dacia manufacturing lines;

Increase of local integration;

Increase of automation for the key processes.

FORD:

Manufacturing of a second Ford model in Craiova;

Reaching the designed production pace and achieving local integration;

A research-development-innovation centre in Craiova.

It is most likely that other large automotive manufacturers will invest in Romania as well. Moreover,

new, large global suppliers will choose to manufacture their products in our country. Another trend

could be that of new manufacturing capacities for electric cars and the battery packs thereof.

As regards the digitalization of the automotive industry, this will be felt in the design of products,

optimization of technologies, logistics, lean manufacturing.

Furthermore, we will see the emergence of co-innovation on components for supply chains. New

research and development activities will appear in the automotive industry. Cooperation between the

public R&D and industry will be improved. A real support for applied R7D is expected from the

government.

As regards parts manufacturers, the local links of the supplier chain will be multiplied, and their

innovation force will increase. Easier access to loans by auto suppliers is expected.

More domestic capital will be invested in SMEs and the cooperation for innovation will increase

between SMEs and technical universities. Better access to European funds for competitiveness is

expected.

The automotive parts sector: current investment trends

New investments are mainly targeted at the Sibiu-Brasov-Cluj, Timis-Arad, Arges-Olt regions, but

new investments have recently been implemented in the east of the country.

As we already pointed out above, Dacia decided to initiate a wide-ranging program for manufactur -

ing automation until 2020.

Continental, Bosch, Delphi, Schaeffler, Yazaki, Hella transfer their own R&D activities in Romania,

while other companies invest in such capabilities. Renault Technologie Roumanie was a pioneer in

this field.

Domestic suppliers, such as GIC, Ronera, Elba, COMPA, ELJ, Componente Auto, Metaplast, Delta

Invest, etc. began investing in product innovation and technological upgrades.

Most of the investments or capacity building activities were subject to state aid. After 2009, state aid

in amount of Euro 182 million was approved for 18 large automotive projects worth Euro 350 million.

The new 2014-2020 state aid scheme has been approved by the Government.

Domestically-owned companies invested in expansion with state aid, by SOP IEC or ROP/ADRs.

Bank loan levels remain low.

The total amount of investments in the automotive parts business is higher than in other Central and

Eastern European countries (e.g.: Euro 951 million in 2012), but not enough to fully tap into the

development potential of this sector.

http://www.ttonline.ro/sectiuni/english-section/articole/13660-trends-romanian-

automotive-industry

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- To Open The Console in Age of WondersDocument1 pageTo Open The Console in Age of WondersJose ShawNo ratings yet

- Documented Briefing (Implementing Best Purchasing and Supply Management Practices)Document230 pagesDocumented Briefing (Implementing Best Purchasing and Supply Management Practices)Krisnadi N. WahyudiNo ratings yet

- Alumimyb 02 RDocument18 pagesAlumimyb 02 RJose ShawNo ratings yet

- Bearings MarketDocument12 pagesBearings MarketJose ShawNo ratings yet

- FZ7060 TEF en BG Bs HR Ro SL SR PDFDocument70 pagesFZ7060 TEF en BG Bs HR Ro SL SR PDFJose ShawNo ratings yet

- SKF 2018Document168 pagesSKF 2018Jose ShawNo ratings yet

- Manual PioneerDocument116 pagesManual PioneerJose ShawNo ratings yet

- PDFDocument50 pagesPDFJose ShawNo ratings yet

- Manual PioneerDocument116 pagesManual PioneerJose ShawNo ratings yet

- Timken 2018Document128 pagesTimken 2018Jose ShawNo ratings yet

- A brief history of bearings from ancient Egypt to the modern eraDocument3 pagesA brief history of bearings from ancient Egypt to the modern eraJose ShawNo ratings yet

- Capsim Expert GuideDocument3 pagesCapsim Expert GuideJose ShawNo ratings yet

- Bearings MarketDocument12 pagesBearings MarketJose ShawNo ratings yet

- 2202E All PDFDocument411 pages2202E All PDFLazzarus Az GunawanNo ratings yet

- 2202E All PDFDocument411 pages2202E All PDFLazzarus Az GunawanNo ratings yet

- To Open The Console in Age of WondersDocument1 pageTo Open The Console in Age of WondersJose ShawNo ratings yet

- Excel VBADocument490 pagesExcel VBAJose ShawNo ratings yet

- Capsim Expert GuideDocument3 pagesCapsim Expert GuideJose ShawNo ratings yet

- Kusadas IDocument1 pageKusadas IJose ShawNo ratings yet

- Excel VBADocument490 pagesExcel VBAJose ShawNo ratings yet

- Rainfall - Pivot TableDocument3 pagesRainfall - Pivot TableJose ShawNo ratings yet

- Capsim Expert GuideDocument61 pagesCapsim Expert Guideniroson88% (8)

- Catan RulebookDocument4 pagesCatan RulebookSurvival Horror Downloads0% (1)

- B2B - Prestige Tours 2Document1 pageB2B - Prestige Tours 2Jose ShawNo ratings yet

- 276986Document25 pages276986RamnthNo ratings yet

- B2B - Prestige Tours 2Document1 pageB2B - Prestige Tours 2Jose ShawNo ratings yet

- Thesis Templthesis TemplatateDocument12 pagesThesis Templthesis Templatateh1183433No ratings yet

- Online Data Sheet DT60-P111B en 20150819 0915Document7 pagesOnline Data Sheet DT60-P111B en 20150819 0915Jose ShawNo ratings yet

- BS PlanDocument12 pagesBS PlanJose ShawNo ratings yet

- 3590 - Precision Potentiometer: FeaturesDocument4 pages3590 - Precision Potentiometer: FeaturesJose ShawNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidaat Alem The Medical Rights and Reform Act of 2009 University of Maryland University CollegeDocument12 pagesHidaat Alem The Medical Rights and Reform Act of 2009 University of Maryland University Collegepy007No ratings yet

- Understanding Learning Theories and Knowledge AcquisitionDocument38 pagesUnderstanding Learning Theories and Knowledge AcquisitionKarl Maloney Erfe100% (1)

- Fill in The BlanksDocument38 pagesFill in The Blanksamit48897No ratings yet

- Dealer DirectoryDocument83 pagesDealer DirectorySportivoNo ratings yet

- Senarai Syarikat Berdaftar MidesDocument6 pagesSenarai Syarikat Berdaftar Midesmohd zulhazreen bin mohd nasirNo ratings yet

- 02 Activity 1 (4) (STRA)Document2 pages02 Activity 1 (4) (STRA)Kathy RamosNo ratings yet

- Vipinesh M K: Career ObjectiveDocument4 pagesVipinesh M K: Career ObjectiveJoseph AugustineNo ratings yet

- Adverbs of Frequency Board GameDocument1 pageAdverbs of Frequency Board GameIsmi PurnamaNo ratings yet

- Karnataka PUC Board (KSEEB) Chemistry Class 12 Question Paper 2017Document14 pagesKarnataka PUC Board (KSEEB) Chemistry Class 12 Question Paper 2017lohith. sNo ratings yet

- Term2 WS7 Revision2 PDFDocument5 pagesTerm2 WS7 Revision2 PDFrekhaNo ratings yet

- Principles of DisplaysDocument2 pagesPrinciples of DisplaysShamanthakNo ratings yet

- The Magic Limits in Harry PotterDocument14 pagesThe Magic Limits in Harry Potterdanacream100% (1)

- Emergency Order Ratification With AmendmentsDocument4 pagesEmergency Order Ratification With AmendmentsWestSeattleBlogNo ratings yet

- Introduction To Alternative Building Construction SystemDocument52 pagesIntroduction To Alternative Building Construction SystemNicole FrancisNo ratings yet

- Https WWW - Gov.uk Government Uploads System Uploads Attachment Data File 274029 VAF4ADocument17 pagesHttps WWW - Gov.uk Government Uploads System Uploads Attachment Data File 274029 VAF4ATiffany Maxwell0% (1)

- MEE2041 Vehicle Body EngineeringDocument2 pagesMEE2041 Vehicle Body Engineeringdude_udit321771No ratings yet

- Shahin CVDocument2 pagesShahin CVLubainur RahmanNo ratings yet

- Marikina Polytechnic College Graduate School Scientific Discourse AnalysisDocument3 pagesMarikina Polytechnic College Graduate School Scientific Discourse AnalysisMaestro Motovlog100% (1)

- Bo's Coffee AprmDocument24 pagesBo's Coffee Aprmalliquemina100% (1)

- SHS Track and Strand - FinalDocument36 pagesSHS Track and Strand - FinalYuki BombitaNo ratings yet

- Voluntary Vs MandatoryDocument5 pagesVoluntary Vs MandatoryGautam KumarNo ratings yet

- Adkins, A W H, Homeric Values and Homeric SocietyDocument15 pagesAdkins, A W H, Homeric Values and Homeric SocietyGraco100% (1)

- Henry VII Student NotesDocument26 pagesHenry VII Student Notesapi-286559228No ratings yet

- Miss Daydreame1Document1 pageMiss Daydreame1Mary Joy AlbandiaNo ratings yet

- Derivatives 17 Session1to4Document209 pagesDerivatives 17 Session1to4anon_297958811No ratings yet

- AReviewof Environmental Impactof Azo Dyes International PublicationDocument18 pagesAReviewof Environmental Impactof Azo Dyes International PublicationPvd CoatingNo ratings yet

- Tentative Seat Vacancy For CSAB Special Rounds-202Document92 pagesTentative Seat Vacancy For CSAB Special Rounds-202Praveen KumarNo ratings yet

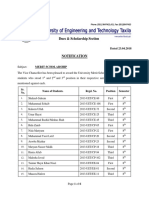

- Dues & Scholarship Section: NotificationDocument6 pagesDues & Scholarship Section: NotificationMUNEEB WAHEEDNo ratings yet

- ANA Stars Program 2022Document2 pagesANA Stars Program 2022AmericanNumismaticNo ratings yet

- jvc_kd-av7000_kd-av7001_kd-av7005_kd-av7008_kv-mav7001_kv-mav7002-ma101-Document159 pagesjvc_kd-av7000_kd-av7001_kd-av7005_kd-av7008_kv-mav7001_kv-mav7002-ma101-strelectronicsNo ratings yet