Professional Documents

Culture Documents

Revnue Accounting - Sop - Revised

Uploaded by

Ehtesham QuraishiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revnue Accounting - Sop - Revised

Uploaded by

Ehtesham QuraishiCopyright:

Available Formats

Ackruti City Limited.

Revenue Accounting (SOP)

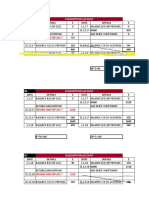

Code Chart of Accounts Case 1 Case 2 Case 3 Case 4 Case 5 Case 6 Total

331201 Milestone Debtors (Excluding debtors to the extent VAT & ST) A - - 50.00 50.00 - 50.00 150.00

231304 Advance from Customer (D.N) B 200.00 200.00 200.00 300.00 150.00 100.00 1,150.00

231305 Advance Unapplied C 150.00 50.00 - - 50.00 - 250.00

Process Revenue (income) as per Policy - Assumption D 300.00 220.00 300.00 200.00 200.00 - 1,220.00

Actual Cash Received (B+C-A) E 350.00 250.00 150.00 250.00 200.00 50.00 1,250.00

Process Demand Note + Amt Recd but unapplied - Milestone Debtors

(to know the Actual Money Received from Customer)

Money Received Against Demand Note only F 200.00 200.00 150.00 250.00 150.00 50.00 1,000.00

Process Demand Note - Milestone Debtors(B -A)

(to get maximum advance that can be adjusted against revenue and

to determine Total Revenue Debtors balance)

Maximum Advance that can be adjusted against

Revenue (What is recd. against demand) G 200.00 200.00 150.00 200.00 150.00 - 900.00

Process If F is greater than D then Ans=D, otherwise Ans =F

Total Revenue Debtors Balance (As per Policy) H 100.00 20.00 150.00 - 50.00 - 320.00

Process If D is greater than G then Ans=D-G, otherwise Ans=0

Unbilled Revenue I 100.00 20.00 100.00 - 50.00 - 270.00

Process If D is greater than zero and D is also greater than B then Ans=D-B,

Otherwise Zero.

Debtors to be Adjusted (H-I) J - - 50.00 - - - 50.00

Process Total Revenue Debtors - Unbilled Revenue

Process Unrealised Demand Notes K - - - 50.00 - 50.00 100.00

If B is greater than D and B is also greater than F then Ans=B-D,

otherwise zero

Note: The above working should be done for each flat and the entries should be passed in total (Building wise)

R.D. Kaphle Page 1 of Pages 2

Ackruti City Limited.

Revenue Accounting (SOP)

Consolidated Entry

331209-Debtors - Revenue Recognisition J Dr. 1,220.00

333253-Unbilled Revenue (Milestone Debtors in excess of Revenue Debtors) I Dr. 270.00

231306-Advance from Customers to be adjusted against Revenue Recognisition G Dr. 900.00

331295-Unbilled Revenue adjusted in Revenue Debtors 270.00

331296-Advance from Customers adjusted in Revenue Debtors 900.00

511103-Revenue from Incomplete Properties D Cr. 1,220.00

Trial Balance Line item total should tally with figures of this entry for all the debits & Credit on Cumulative basis.

231307-Unrealised Demand Notes K Dr. 100.00

331210-Milestone Debtors - Unrealised K Cr. 100.00

st

This entry has to be reversed on 1 Day of next accounting period.

R.D. Kaphle Page 2 of Pages 2

You might also like

- REP-148-AR TW A0501 Invoice VoidedDocument123 pagesREP-148-AR TW A0501 Invoice VoidedRipendra KumarNo ratings yet

- PT JayatamaDocument24 pagesPT Jayatamaputri apriliaNo ratings yet

- 0 MasterfileDocument598 pages0 MasterfileAngel VenableNo ratings yet

- GSTR9 33AAACA7962L1ZH 032022-FinalDocument8 pagesGSTR9 33AAACA7962L1ZH 032022-FinalVASUMATHY SURESHNo ratings yet

- R12 Budget & EncumbranceDocument29 pagesR12 Budget & EncumbranceHaslina HasanNo ratings yet

- Recording Accounting InformationDocument38 pagesRecording Accounting InformationJanelle Dela cruz100% (1)

- Vertical Format Final Accounts - SolutionsDocument6 pagesVertical Format Final Accounts - SolutionsASHIFNo ratings yet

- Post Closing P2 JayatamaDocument1 pagePost Closing P2 JayatamaShula KinantiNo ratings yet

- Wca CaseDocument8 pagesWca CaseAum RaoNo ratings yet

- Problem 7 ACCA101Document26 pagesProblem 7 ACCA101Nicole Fidelson100% (1)

- Audit Report of CYGNUS COR 2020Document20 pagesAudit Report of CYGNUS COR 2020Friends Law ChamberNo ratings yet

- Caecilia FahiraDocument6 pagesCaecilia FahiraMuhammad Fajar Al AminNo ratings yet

- ACCT 4342-F13 Final AIS Project Spreadsheet (Printable 2)Document30 pagesACCT 4342-F13 Final AIS Project Spreadsheet (Printable 2)chrismg89No ratings yet

- BE20210216Document4 pagesBE20210216Garrett Clyde MaislingNo ratings yet

- B. 13 BULAN ABDULLAH SHAHABDocument2 pagesB. 13 BULAN ABDULLAH SHAHABHizba SabilillahNo ratings yet

- Evi15 104951Document2 pagesEvi15 104951Al QadriNo ratings yet

- IrrecoverablwDocument11 pagesIrrecoverablwgunasekarasugeethaNo ratings yet

- Grade 10 Provincial Exam Accounting (English) November 2017 Possible Answers - 050233Document11 pagesGrade 10 Provincial Exam Accounting (English) November 2017 Possible Answers - 050233hobyanevisionNo ratings yet

- Materi Setelah UTS Prak AK RemedDocument14 pagesMateri Setelah UTS Prak AK Remedannisa rochmahNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- Bacc210 Assig 1Document6 pagesBacc210 Assig 1TarusengaNo ratings yet

- Chapter 7 Class ExerciseDocument23 pagesChapter 7 Class ExerciseTiffany ChanceNo ratings yet

- Irma15 104936Document2 pagesIrma15 104936Al QadriNo ratings yet

- BASTDocument6 pagesBASTsyamsir nurNo ratings yet

- GL, TB - D. MaputimDocument11 pagesGL, TB - D. MaputimJasmine Acta67% (3)

- Ledger Posting With OE GL UTB SamplesDocument46 pagesLedger Posting With OE GL UTB SamplesZamantha OliverosNo ratings yet

- MB2001-FA-2025-Week4B-Accounting For Receivables-Practice ExercisesDocument31 pagesMB2001-FA-2025-Week4B-Accounting For Receivables-Practice Exercisesjonathan christiandriNo ratings yet

- Test Sheet-Accounts v1Document6 pagesTest Sheet-Accounts v1Minaketan DasNo ratings yet

- Lesson34 2Document10 pagesLesson34 2Sami UllahNo ratings yet

- Chapter 7 Class Exercise-B2Document25 pagesChapter 7 Class Exercise-B2Tiffany ChanceNo ratings yet

- Pt. Balqis Istana Furnitures Balance Sheet As On December 31, 2010 Account No Description Debet CreditDocument8 pagesPt. Balqis Istana Furnitures Balance Sheet As On December 31, 2010 Account No Description Debet CreditKim JunNo ratings yet

- Quiz 3 and 4Document11 pagesQuiz 3 and 4Irish AnnNo ratings yet

- Fnawn - TB 2021Document4 pagesFnawn - TB 2021John Bryan HernandoNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- FHC Fee Schedule 2023Document7 pagesFHC Fee Schedule 2023Darren RobinsonNo ratings yet

- Dino Miranda 2022Document7 pagesDino Miranda 2022Sander D. PeraNo ratings yet

- Trial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing BalanceDocument4 pagesTrial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing Balancesushilo_2No ratings yet

- Petty Cash CycleDocument5 pagesPetty Cash CycleMahmoud Abed ElbestawyNo ratings yet

- Neraca Saldo AwalDocument5 pagesNeraca Saldo AwalSilvia WulandariNo ratings yet

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- Date Account Title P.R. Debit 2015Document24 pagesDate Account Title P.R. Debit 2015ARABELLA CLARICE JIMENEZNo ratings yet

- Accounting MCQ UpdatedDocument10 pagesAccounting MCQ UpdatedEttore De CarloNo ratings yet

- Homework 2-Solution: CIVE 629: Construction Business ManagementDocument18 pagesHomework 2-Solution: CIVE 629: Construction Business ManagementAbed FilNo ratings yet

- Clubs and Societies Questions 2020 BatchDocument13 pagesClubs and Societies Questions 2020 BatchAejaz MohamedNo ratings yet

- Worksheet To FSDocument29 pagesWorksheet To FSChelsea TengcoNo ratings yet

- Bacayo 07 Activity 1 EntrepDocument3 pagesBacayo 07 Activity 1 EntrepDavid GutierrezNo ratings yet

- LA017617 - Assn2 - BSBSMB406A - Ed5 1Document28 pagesLA017617 - Assn2 - BSBSMB406A - Ed5 1Leesa JaneNo ratings yet

- GSTR9 07balps3408q1z0 032023Document4 pagesGSTR9 07balps3408q1z0 032023RINKOO SHARMANo ratings yet

- Accounting CycleDocument18 pagesAccounting CycleIris Joy JobliNo ratings yet

- ObiasGrpLtd WorksheetDocument24 pagesObiasGrpLtd WorksheetRuann Albete FernandezNo ratings yet

- Lembar Kerja Akuntansi (Tim B SMK Karya Bahana Mandiri 2)Document9 pagesLembar Kerja Akuntansi (Tim B SMK Karya Bahana Mandiri 2)Su MiniNo ratings yet

- O: +1 410-737-8677 F: +1 410-737-8688 3610 Commerce Drive - Suite 817 Baltimore, MD 21227 USADocument14 pagesO: +1 410-737-8677 F: +1 410-737-8688 3610 Commerce Drive - Suite 817 Baltimore, MD 21227 USASiddiq KhanNo ratings yet

- Perilla Geriqjoedn 1Document20 pagesPerilla Geriqjoedn 1Geriq Joeden PerillaNo ratings yet

- Micro Payslip - May, 2022 (Emp Code00111500)Document1 pageMicro Payslip - May, 2022 (Emp Code00111500)chagusahoo170No ratings yet

- Advance Payment RecoupmentDocument5 pagesAdvance Payment RecoupmentmanNo ratings yet

- Materi Sebelum UTS Praktikum Akuntansi RemedDocument51 pagesMateri Sebelum UTS Praktikum Akuntansi Remedannisa rochmahNo ratings yet

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoNo ratings yet

- 1120 Sample TranscriptDocument3 pages1120 Sample TranscriptEmily KnightNo ratings yet

- Pre Counseling Notice Jexpo Voclet17Document2 pagesPre Counseling Notice Jexpo Voclet17Shilak BhaumikNo ratings yet

- L Final Endorsement Letter To SLMB Constitution Without National FedDocument8 pagesL Final Endorsement Letter To SLMB Constitution Without National FedJerson AgsiNo ratings yet

- DMT280H редукторDocument2 pagesDMT280H редукторkamran mamedovNo ratings yet

- Weekly: Join in Our Telegram Channel - T.Me/Equity99Document6 pagesWeekly: Join in Our Telegram Channel - T.Me/Equity99Hitendra PanchalNo ratings yet

- Ebecryl-4175 en A4Document1 pageEbecryl-4175 en A4I Love MusicNo ratings yet

- Auditing Gray 2015 CH 15 Assurance Engagements Internal AuditDocument46 pagesAuditing Gray 2015 CH 15 Assurance Engagements Internal AuditAdzhana AprillaNo ratings yet

- Tax Invoice UP1222304 AA46663Document1 pageTax Invoice UP1222304 AA46663Siddhartha SrivastavaNo ratings yet

- QNNPJG lSUK0kSccrTSStqeIPoUAJF27yLdQCcaJFO0Document1 pageQNNPJG lSUK0kSccrTSStqeIPoUAJF27yLdQCcaJFO0Viktoria PrikhodkoNo ratings yet

- Fido Client To Authenticator Protocol v2.1 RD 20191217Document133 pagesFido Client To Authenticator Protocol v2.1 RD 20191217euophoria7No ratings yet

- Sample Compromise AgreementDocument3 pagesSample Compromise AgreementBa NognogNo ratings yet

- Mississippi Medical Cannabis LawsuitDocument34 pagesMississippi Medical Cannabis LawsuitMarijuana MomentNo ratings yet

- Clado-Reyes V LimpeDocument2 pagesClado-Reyes V LimpeJL A H-DimaculanganNo ratings yet

- Harvey Vs Defensor Santiago DigestDocument5 pagesHarvey Vs Defensor Santiago DigestLeo Cag0% (1)

- Executive Summary: Source of Commission: PMA Date of Commission: 16 March 2009 Date of Rank: 16 March 2016Document3 pagesExecutive Summary: Source of Commission: PMA Date of Commission: 16 March 2009 Date of Rank: 16 March 2016Yanna PerezNo ratings yet

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDocument25 pagesTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNo ratings yet

- Avdanced Accounting Dayag 2 - Solution Chapter 16 Part 2Document3 pagesAvdanced Accounting Dayag 2 - Solution Chapter 16 Part 2Patricia Adora AlcalaNo ratings yet

- LA Cream Air Freshener GelDocument1 pageLA Cream Air Freshener GelWellington SilvaNo ratings yet

- Certification: Barangay Development Council Functionality Assessment FYDocument2 pagesCertification: Barangay Development Council Functionality Assessment FYbrgy.sabang lipa city100% (4)

- (ORDER LIST: 592 U.S.) Monday, February 22, 2021Document39 pages(ORDER LIST: 592 U.S.) Monday, February 22, 2021RHTNo ratings yet

- Stevens V University of Birmingham (2016) 4 All ER 258Document25 pagesStevens V University of Birmingham (2016) 4 All ER 258JYhkNo ratings yet

- Vocabulary Monologue Your JobDocument2 pagesVocabulary Monologue Your JobjoseluiscurriNo ratings yet

- Dwnload Full Managerial Accounting Tools For Business Decision Making Canadian 4th Edition Weygandt Solutions Manual PDFDocument36 pagesDwnload Full Managerial Accounting Tools For Business Decision Making Canadian 4th Edition Weygandt Solutions Manual PDFzojerdknanio100% (10)

- 2015-08-24 065059 4.blood RelationsDocument20 pages2015-08-24 065059 4.blood Relationsჯონ ფრაატეეკNo ratings yet

- (Azizi Ali) Lesson Learnt From Tun Daim E-BookDocument26 pages(Azizi Ali) Lesson Learnt From Tun Daim E-BookgabanheroNo ratings yet

- Keys of The Kingdom-EbookDocument18 pagesKeys of The Kingdom-EbookBernard Kolala0% (1)

- Tort Outline .. Internet SourceDocument43 pagesTort Outline .. Internet SourceColeman HengesbachNo ratings yet

- DDR5 SdramDocument2 pagesDDR5 SdramRayyan RasheedNo ratings yet

- ISLAMIC MISREPRESENTATION - Draft CheckedDocument19 pagesISLAMIC MISREPRESENTATION - Draft CheckedNajmi NasirNo ratings yet

- Metode Al-Qur'An Dalam Memaparkan Ayat-Ayat HukumDocument24 pagesMetode Al-Qur'An Dalam Memaparkan Ayat-Ayat HukumAfrian F NovalNo ratings yet

- Flash Cards & Quiz: Berry Creative © 2019 - Primary PossibilitiesDocument26 pagesFlash Cards & Quiz: Berry Creative © 2019 - Primary PossibilitiesDian CiptaningrumNo ratings yet