Professional Documents

Culture Documents

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries

Uploaded by

Richard_del_rosarioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries

Uploaded by

Richard_del_rosarioCopyright:

Available Formats

THE CONVERGENCE OF NATIONAL ANTI-DUMPING LEGISLATION

AMONG ASEAN COUNTRIES

CHAPTER I

INTRODUCTION

A. Background of the Study

Since the 1990s, the Philippines has been opening up its economy more and more

to international trade, as seen in the joining of various bilateral, regional trade

agreements, not to mention the World Trade Organization (WTO) and in the increase in

the value of imports and exports to and from the Philippines which have increased four-

fold since 1992. However, international trade is not without risks, thus some countries

may choose to set up some non-tariff barriers to remedy unequal trading. Indeed it is

noted that several developing countries recently erected anti-dumping and other

contingent protection regimes, the Philippines and several of its Asian neighbors being

included in a group known as the "new users of anti-dumping" (Nakagawa, 2007; Das,

2005).

Another effect of increased economic integration is the "convergence" of policies

across countries. The theory of policy convergence works on the assumption that policy

regimes are rarely contiguous across countries. Policy convergence can be seen as an end

in itself as it facilitates trade between countries by providing similar rules and standards

across countries which reduce transaction costs and save time. Policy convergence is not

just seen as an end, it can also be seen as a process wherein there is "the tendency of

policies to grow more alike, in the form of increasing similarity in structures, processes,

and performances" (Drezner, 2001). So, policy convergence may be the result of the

conscious policy of governments acting in coordination with other governments to solve

common problems or; it may also occur as a result of an effort to cope with competitive

pressures emerging from international economic integration, in this case convergence

takes the form of a race to the bottom (Holzinger, Knill and Sommerer, 2008).

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 1

Convergence theory has received its share of criticism. Much of the criticism on

policy convergence studies are that they suffer from a deficit of empirical findings which

is partly a result of a heterogeneous and inconsistent theoretical literature (Knill, 2005).

Furthermore, much of the recent literature uses cross-country regressions in order to test

for the causes of convergence which the present author believes diminishes the usefulness

policy convergence studies since one does not actually see how the convergence

pressures involved are accounted for in the policy processes of countries.

This study seeks to test policy convergence theory by applying it in the anti-

dumping regimes of ASEAN countries. The author is interested in finding out to what

extent convergence has occurred and the mechanisms of such convergence in the area of

anti-dumping policy.

The anti-dumping regimes are normally codified into the anti-dumping laws of a

country and this provides a legal framework for its use by countries. This is in addition

to the anti-dumping and safeguards mechanism framework built into the GATT/WTO

framework, this means that countries still have the freedom to develop laws autonomous

to the WTO which justifies this study (Roque, 2006).

A country's anti-dumping regime is also expected to come under international

pressures that lead to convergence. For example, multinational companies may benefit

from a harmonization of anti-dumping laws and may thus lobby for some procedural

changes in a country's anti-dumping regime. The WTO also benefits from trying to

harmonize the anti-dumping regimes across countries. Yet again the fear of economic

retaliation from a major trading partner may cause a country to modify or develop an

anti-dumping regime that is stricter in its determination of dumping and injury as well as

in the implementation of its anti-dumping duties.

This study looks at the evolution of anti-dumping law in the Philippines and its

major ASEAN trading partners, specifically, Indonesia, Malaysia, Thailand and

Indonesia. The author chose these countries because they have all passed anti-dumping

laws between 1992 and 2000. Because of the short time span the countries had to

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 2

develop anti-dumping policies, the author suspects that convergence may have occurred

with regards to these anti-dumping laws. The author would like to find out if

convergence has indeed occurred and to what were the causal mechanisms that led to this

convergence.

B. Statement of the Problem

This study tries to answer the following questions in order to apply policy

convergence theory in the case of anti-dumping.

General Question: What are the causal factors behind the convergence of anti-dumping

law among ASEAN member states?

Specific Questions:

1. What is the current state of convergence in the anti-dumping regimes laws of

ASEAN member states?

2. What are the international pressures that governments and policy-makers faced

that may have led to policy convergence in anti-dumping policy?

C. Definition of Terms

Policy Convergence – development of similar or even identical policies across countries

over time both in terms of the process and substance of the policy (Knill, 2005).

Operationally, policy convergence refers to an increase in similarity in the methods and

strategies employed by governments to promote specific industries.

International Harmonization – this mechanism leads to convergence when the countries

involved comply with legal obligations under binding international agreements. Often

the agreements require their signatories to adopt similar policies as part of their

obligations (Holzinger and Knill, 2005).

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 3

Imposition – Conceptually, this is seen when informal pressures are exerted on

organizations by other organizations. Dependent organizations are likely to adopt

patterns of behavior sanctioned by organizations that control critical resources as these

resources can be used as an incentive or a penalty (Holzinger and Knill, 2005).

Operationally, this can involve pressures being exerted upon an organization within a

state by another organization from outside the state which the organization is forced to

submit to by virtue of the resources that the pressuring organization holds (i.e. an

international financial institution pressuring governments into adopting certain

"conditionalities" in exchange for loans).

Regulatory Competition – Regulatory competition causes convergence when countries

facing competitive pressure due to economic integration mutually adjust their policies

(Holzinger and Knill, 2005).

Transnational Communication – Transnational Communication refers to the tendency of

frequently interacting national bureaucracies to develop similar structures and concepts

over time. "Policy convergence results from organizations striving to increase their

social legitimacy by embracing forms and practices that are valued within the broader

institutional environment (Holzinger, Knill and Sommerer, 2008)."

Independent Problem Solving – Convergence may arise from "similar but independent

policy responses of political actors to parallel problem pressures (Holzinger and Knill,

2005)." The convergence that occurs in this case can be seen as merely a coincidence.

Anti-dumping – The 1994 GATT Agreement on Anti-Dumping defines dumping as the

practice whereby the products of one country are introduced into the commerce of

another country at less than the normal value of the product. Anti-dumping is the

instrument that allows an importing country to impose import restrictions when an

exporting country sells products at a lower price than domestic producers (Finger &

Nogues, 2007).

D. Objectives

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 4

In connection to the research questions posed in the statement of the problem, the

author specifically is interested in the following objectives.

1. To describe the current state of convergence in the anti-dumping regimes of the

Philippines, Indonesia, Thailand, Malaysia and Vietnam.

2. To determine the international causal mechanisms that led to the convergence in

Anti-dumping law.

E. Significance of the Study

This research is also be helpful in the field of convergence studies as Daniel

Drezner (2001) and Christoph Knill (2005) admitted that policy convergence studies is

hampered by a lack of empirical and descriptive data hence many hypotheses remain

unsolved. This thesis hopes to be a contribution to the theory that increased economic

integration leads to increased similarity in terms of policies.

Specifically in the field of policy convergence, this research attempts explain the

behavior of states in the making of policies which are governed by international rules or

compliance with international agreements. In this case it is national anti-dumping laws

versus the WTO anti-dumping agreement and how states try to formulate their laws

according to international guidelines.

Lastly, this research is also a welcome addition to literature on anti-dumping

especially in the legal analysis of anti-dumping law. Junji Nakagawa (2007) notes that

legal analysis in this area has been limited and most of the literature in this area do not

use a common framework for comparing anti-dumping laws across countries. This lack

of a comparative framework is hopefully adequately addressed in this study.

F. Scope and Limitations

This study is limited to describing the state of convergence in anti-dumping

policies between the Philippines and its neighbors Thailand, Vietnam, Malaysia and

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 5

Indonesia. This study will then look at the policy process that led to policy

convergence/divergence in the Philippines without describing the same process in other

countries.

According to Holzinger and Knill (2005), studies on policy convergence normally

distinguish between policy outputs (the policies that governments adopt) and policy result

(implementation and whether the policy has been effective or not). This study will only

look at policy output in terms of the characteristics of anti-dumping laws across

countries. Furthermore, this study will not look into the normative implications of this

convergence, i.e. whether convergence is good or bad for the economy, or whether all

countries benefit from convergence and the like.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 6

CHAPTER II

REVIEW OF RELATED LITERATURE

A. Introduction

This section is divided into two parts; the first discusses literature on policy

convergence. In this part, special attention will be paid to how each study determined

that convergence was taking place and the explanatory factors for such convergence, this

part also features literature that deal with the processes and actors that lead to policy

convergence. The second part looks at comparative studies of anti-dumping and

safeguard in order in order to show how these regimes may be examined in the present

study.

B. Policy Convergence

Empirical Studies on Convergence

Daniel Drezner (2001) attributes policy convergence to economic integration and

free trade. Economic integration and the increase in free trade are attributed to

globalization which he defined as "technological, economic, and political innovation that

have drastically reduced the barriers to economic, political, and cultural exchange."

From this definition, one can see that globalization also strengthens the market forces

borne by international trade, thus increasing pressures on states to adjust their policies or

"converge". Drezner tried to apply his framework in the case of labor standards and

environmental protection.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 7

Using a review of previous studies on labor standards and economic effects, he

found that in OECD countries, there has been convergence towards strict labor standards,

while in developing countries there was only a "slow drift" towards the enforcement of

core labor standards. Core standards being rights against child labor, slavery, non-

discrimination and to unionize, notwithstanding additional rights such as health, safety,

employment benefits, minimum wage, etc. Drezner claims that this is due to an elite

consensus more than anything else.

In environmental protection, Drezner identified that the literature covers a wide

array of policy areas from the protection of endangered species to global warming, most

of them saying that levels of environmental protection have increased over time. Drezner

looked at statistical evidence linking economic performance with environmental

protection. The evidence shows that varying levels of environmental protection do not

deter investment in a statistically significant way. A more compelling reason for the

"explosion" in environmental regulation is supplied by world society theory, in which

Drezner noted that as the number of environmental associations, treaties and

organizations grow and as scientific discourse becomes more rationalized, environmental

regulation becomes stricter. In the end, convergence in environmental regulation mirrors

that of labor standards, with OECD standards becoming stricter and developing countries

progress being erratic.

In the end, Drezner concludes that globalization as a phenomenon is not

deterministic—there is no way to predict the location of policy convergence.

Holzinger, Knill and Sommerer (2008) tried to statistically test three causal

mechanisms of convergence that were outlined in Knill (2005). This article tries to find

the answer to the question of whether one can actually observe convergence of policies at

all and under which conditions domestic policies are expected to converge (or diverge).

The authors specifically examined the convergence of environmental policy in EU from

1970 to 2000.

The authors of this study start with the assumption that diffusion of policies can

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 8

be expected to result in an increase of policy homogeneity among states, what is not clear

however, is the extent of convergence. Furthermore, the authors try to determine whether

an increase in economic and political linkages between nation-states lead to increasingly

similar policy measures across countries.

The authors put forth three international factors that may cause cross-national

policy convergence (in addition to domestic factors). These are: (1) International

harmonization; (2) Transnational communication and; (3) Regulatory competition. The

researcher has adopted in the present study to explain convergence in anti-dumping.

Using the adoption rates of environmental policies for countries and using

regression analysis, the authors found out that there has been substantial policy

convergence in the countries observed. In testing for the causes of convergence,

international harmonization and transnational communication seem to affect policy

convergence while regulatory competition does not seem to have an effect.

Nicoletti, Scarpeta and Lane (2003) found evidence against policy convergence

and the race to the bottom hypothesis in the liberalization and privatization in OECD

have caused their regulatory policies in product market regulation. The authors also

found out that the divergence in regulatory policies lines up with the divergent growth

performance of countries that make up the OECD, specifically that European countries

tended to perform poorly relative to the United States. The authors explained this

divergence through the fact that OECD countries all started from different levels of

productivity and the countries were also at different levels of technological progress.

The authors arrived at this conclusion through correlational statistics. The authors

made use of a large data set that included 12 OECD countries and that contains

information on how product market regulations for detailed manufacturing and service

industries have evolved from 1980 to 2000. The authors were concerned as to how

sweeping product market reforms like: (1) privatization; (2) liberalization of potentially

competitive markets; and (3) pro-competitive regulation of natural monopoly markets

affected growth in those sectors. To gauge the extent of these reforms, they used a set of

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 9

cross-country quantitative indicators of regulatory reform to reflect regulation in

particular areas that the authors constructed. Growth was measured according to multi-

factor productivity (MFP). As a whole, the indicators that these authors have constructed

have shown that restrictiveness has decreased steadily for the past twenty years. In order

to correlate the MFP growth per sector to the decrease in market regulations, the authors

had to use a series of regressions. Through this, the authors found out that there is a great

variation in the growth rates of the different OECD countries. Nicoletti et al attributed

this to the significant differences in the pace of reform across countries that, in the first

place, already had very different policy approaches at the beginning of the period. At the

same time, market integration, EC competition policies, and the EMU apparently did not

provide sufficient constraints and/or incentives to European governments for

harmonizing the regulations in their domestic markets, which remained largely under the

realm of domestic policies, often unfriendly to competition.

International Harmonization

International harmonization in relation to this thesis is a kind of process leading to

policy convergence which involves the coordination of national policies among states.

The studies discussed so far deal with international harmonization in terms of cross-

country regression analyses. Beth Simmons (2001) on the other hand, tried to examine

the political economy international harmonization in the case of capital market

regulations using a more qualitative methodology.

She started the article by establishing the fact that international capital flows have

increased steadily over the years and that this has caused problems for national financial

regulators and that efforts to enact capital market reforms unilaterally have become

difficult due to the increasingly complex nature of international finance (in the case of the

derivatives market alone, there are so many kinds of instruments that international

finance can get confusing). Simmons mentioned that efforts to coordinate international

capital markets have cropped up starting in the mid 80s and these have varied in their

degree of politicization and institutionalization.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 10

Simmons was interested in determining the causes of this variation focusing on

the mechanisms that encourage policy convergence. To that end, she developed a simple

framework which focuses on the strategic interactions between a dominant "regulatory

innovator" and the rest of the world. (The innovation is considered exogenous to the

framework.) According to her framework, it is then necessary to determine: (1) Whether

other countries have an incentive to emulate the reforms and; (2) whether the negative

externalities experienced by the dominant center are easily targeted or diverted. With

regard to the second condition, the presence of externalities in the dominant country is

essential because it helps determine whether the regulators of the dominant country have

an incentive to pressure other countries to conform, the use of political pressure in this

regard is necessary if harmonization is to occur. Furthermore in the case that

externalities are easily targeted or diverted, Simmons expects the dominant country to

invest heavily on international institutions allowing the institution to wield actual power

when otherwise it would be merely weak or symbolic.

In application, Simmons' framework (through international institutions)

adequately explains why a large number of national banking regulators have been willing

to adopt the capital adequacy standards in the Basel Accord. The framework also

explains why anti-money laundering reporting rules have been slow and highly

politicized. In this case, the United States has had high negative externalities because

money laundering is costly for them, yet smaller countries do not want to emulate the US

because increasing regulations in this area make them less competitive compared to

countries like Switzerland where banking secrecy is held in high regard. In the case of

accounting standards for public offerings, there was high incentive to emulate and low

negative externality for the US (which was the innovator), harmonization occurred

largely fueled by market forces with international institutions providing legitimacy.

In conclusion, the framework used here is attractive because it can be used for

other issue areas as in the present study. It may be interesting to find out if dominant

countries have had a role to play in the development of policy through the innovations

that they have enacted and whether they have actively tried to disseminate these

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 11

innovations. In this study, one can already see that developing countries already have an

incentive to emulate other countries in adopting anti-dumping laws thanks to the

economic liberalization brought about by the multilateral trading system of the WTO.

The United States (undoubtedly the most powerful proponent of the WTO but may also

include other traditional users such as the EU and Argentina) finds that it is not easy to

divert negative externalities brought about by anti-dumping investigations (such as

retaliations) which leads them to promote conformance to WTO anti-dumping rules.

Domestic Political Conditions Leading to Policy Convergence

Victoria Murillo (2002) contributed to the empirical body of knowledge in her

study that explored the role of domestic politics in the convergence of privatization

policies in Latin America.

In Latin America, it was the debt crisis that triggered the spread of new

economic ideas, privatization in particular. Traditional policies were seen to have

"failed" and this facilitated the emergence of a new policy consensus. One interesting

observation that Murillo made is that politicians took advantage of the privatization

process to distribute resources in such a way that allowed them to constitute and reinforce

political coalitions. In addition, the politician's prior beliefs influenced how they

processed the information regarding the state of the world and shaped their institutional

preferences. The combined effect of political coalition and beliefs is what Murillo calls

"political bias".

As applied in this study, convergence the similarity in the choice of regulatory

institutions in the period of privatization. This study examined the political/social

environment at the time in which the policies were implemented and used this to try to

explain the outcome. In order to demonstrate how this happened, the author examined

the case of public utility privatization in Argentina, Chile and Mexico.

In Chile, electricity and telecommunications were privatized. The Pinochet

administration was already receptive to neoliberal economic principles and government

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 12

had a low preference for state intervention so the government did not create independent

industry-specific regulatory agencies. Under the program of "popular capitalism", the

government created special pricing schemes in the utilities which benefited the

government's core constituencies and helped create a new class of property owners.

In Mexico, the government only privatized telecommunications. The government

placed restrictions to foreign management and put specific investment targets for new

providers. Mexico already had a high level of preference for state intervention which

explains the creation of an independent regulatory agency (the Cofetel). President

Salinas also tried to exploit the situation by building political coalitions. He used

privatization to reward allies and to raise funds for his political party.

In Argentina, there was a moderate level of economic nationalism which explains

why electricity and telecommunications privatization did not include limitations to

foreign capital and management while placing investment targets. The Peronist party

preferred high levels of state intervention and thus created an autonomous regulatory

agency for privatized firms. Menem used the situation to build coalitions by allying with

domestic business groups and labor unions. He even used privatization to reduce

outstanding financial obligations by swapping debt for privatized assets.

To sum up, Murillo's work is useful because it explains that the domestic situation

of a country can be useful in explaining the legal and institutional outcomes of new

policies. For example, the form of regulatory institution and legal framework adopted

can be explained by prevailing ideas at the time. This leads one to the case of

convergence in legal institutions. Furthermore, the domestic situation can explain

conformance or non-conformance of anti-dumping laws to the Anti-Dumping Agreement

since lawmakers within the country were willing to risk the possibility of dispute

settlements in order for them to please their constituencies with anti-dumping laws that

were easier for them to use or had a higher probability of a positive determination. Of

course, it can work the other way, meaning that the domestic environment may be more

indifferent or even supportive of economic liberalization which means that legislators are

more likely to comply with international agreements and even go beyond the minimum

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 13

requirements of the agreement.

Pistor and Wellons (1998) wrote a book describing the development of the legal

framework and legal institutions in Asia and their role in economic development. This

study looks at the role of legal framework in the economic development of Asian

countries. The authors of this book wanted to answer the questions: Does law matter for

economic development? Is Asia different? To address these questions, the authors

presented these hypotheses.

1. Convergence hypothesis. Defined as when laws and legal institutions

converge with economic development. This is said to occur across

economies as "domestic economic development interacts with the growing

internationalization of markets to produce law and legal institutions that, if

not identical on paper, perform largely similar functions" (21).

2. Divergence hypothesis. In this case, each economy follows its own

idiosyncratic development of legal institutions which may or may not be

conducive to economic development.

3. Differentiation hypothesis. Different parts of an economy's legal system

behave differently in response to economic development—some parts may

converge, others may diverge.

This study made use of a historical descriptive methodology. The authors

described the development of business governance, financial policies and dispute

settlement in the countries of: China, Taiwan, India, Japan, Korea and Malaysia.

The authors examined the development of these laws according to their allocative

dimension and procedural dimension. In Pistor and Wellons study, the allocative

dimension refers to the degree in which the state controls resources while the procedural

dimension refers to the legal processes by which states exercise control over resources.

The evidence discovered by the authors seemed to support the convergence

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 14

hypothesis. They see that economic development (i.e. economic performance) has

converged and with it legal convergence. The authors also found out that convergence is

stronger along the allocative dimension of the law than on the procedural dimension

which indicated that states basically retained the same institutional framework while

changing in policy goals. Trade protection, especially anti-dumping, while not discussed

in Pistor and Wellons, is procedural in nature, i.e. it reduces the determination of the

allocation of protection to firms into a legal process.1

Role of Non-State Actors in Policy Convergence

According to the framework of this present study, one of the important sources of

policy convergence is the academe, i.e. universities, think tanks, international

organizations. Sylvia Ostry's (1991) edited volume deals with precisely that.

Her volume was about the role of research and the academe in the liberalization

efforts of countries in East Asia. The book looks at the experience of Thailand, Malaysia,

Korea, China, Philippines, Indonesia, Australia and New Zealand in economic policy

research. It attempts to connect research with economic liberalization and to determine

the qualities for successful policy research.

Some generalizations can be made from the set of countries examined. One is

Universities are important actors in the research and hence policy process. Universities

are also the source of consultants by other research organizations within a country. The

book also examines the changing role of bureaucracies as a country develops. Basically

as an economy increases in complexity, research agencies increase in number and

complexity. At first, it is enough for a government bureaucracy to act as a "one-stop

shop" for policy research. But as the passing of policies begins to require broad political

cohesion behind them, research efforts are extended to universities and think tanks. The

private sector will also participate at this point by funding think tanks and other research

1

Practice may contradict this since some of the literature say that the state still retains much of the power to

determine whether or not to apply a dumping duty. Having an anti-dumping law only makes a final

determination seem to just be following a procedure when in reality negotiations between the anti-dumping

authority and interested parties are occurring (see Aggarwal, 2007).

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 15

facilities in order to protect their own interests. Policy issues also become more complex

(from relatively simple bottleneck debates such as ISI vs export orientation to complex,

sector specific ones).

Basically, what is significant in this study is that it confirms that epistemic

communities (i.e. universities, think tanks etc.) are important sources of policy and that

their contributions to economic policies must be studied.

In another study, Waarden and Drahos (2002) conclude that in their that

convergence has been the result of the gradual and largely implicit pressure and

possibilities for mutual modeling arising from the development of a multi-level split

legal system (what the authors call case law), which, however, has been channeled

between the levels through the lines of communication and exchange created by the

development of a multi-level epistemic community of legally trained officials; i.e. a

combined effect of institutionalism and the epistemic community approach.

Before deciding as to whether lesson drawing was indeed the reason for the

convergence, the authors had to determine whether convergence took place. They

compared the competition policies of Netherlands, Austria and Germany in two

periods, 1950 and 2000. They compared policy across seven dimensions which were:

(1) Goals and basic principles; (2) Application: what organizational arrangements are

in place for the application of the law?; (3) Scope: how broad is the scope of the law?;

(4) The treatment of horizontal restraints of trade, i.e. the classic 'hard' cartels; (5) The

treatment of vertical agreements; (6) The regulation of abuse of a dominant market

position and; (7) Merger control.

The similarities among the countries were assessed using an objective index

created by the authors. The authors used the 2000 EU competition law as the point-

of-reference. They found out that Netherlands differed the least from the EU law,

followed by Germany. Austria was the most divergent from the EU law of the three.

All-in-all, the countries have converged to EU significantly compared to their

measurement in 1950.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 16

Given these differences, the authors then tried to explain the causes of this

convergence. They explored three causes: Institutionalism, or pressure from EU;

Neo-functionalism, or pressure from international business (analogous to this study's

regulatory competition) and; Epistemic communities. Of these three, only in the

epistemic community approach did van Waarden and Drahos find a convincing

explanation. They explained that there was an internationalization of the practice of

competition law which lawyers all over Europe somehow became familiar with the

"European model". Given this epistemic community (the lawyers) that are in the

forefront of law-making, it comes to no surprise that competition policies converged

through them.

This study is striking in that multi-level split legal system and the multi-level

epistemic community seems to describe the WTO Committee on Anti-Dumping

Practices. This angle is further explored in Chapter VI of this study.

Maher Dabbah's article (2003) looked at the internationalization of competition

law with specific reference to the role of multinational enterprises (MNEs) as non-

state actors in the process. By internationalization, Dabbah is referring to the

increasing acceptance of competition law in many countries whether free market or

not. Dabbah also uses it to refer to harmonizing the competition law all over the

world and that governments should essentially adopt the same laws in order to

facilitate trade and law enforcement.

Dabbah cites the following examples of how one can bring about the

internationalization of competition law:

1. Bilateral cooperation – this takes the form of formal agreements between

the domestic competition authorities to allow for the sharing of

information and comity.

2. Harmonization and convergence – The idea that domestic competition

laws can converge towards sine common points and standards.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 17

3. International competition code – This involves creating a detailed

international competition law which can be adopted by countries.

4. International system of competition law – This involves establishing an

international system of competition law within a framework of

autonomous international institutions.

Of course, in the internationalization of competition policy, one could not neglect

the role of multinational enterprises. For one, MNEs have been crucial in the

development of competition laws in developing countries. MNEs have lobbying capacity

and economic power. MNEs also have interests in the internationalization of competition

policy. For one, MNEs want uniformity in the way that competition cases are decided in

different countries. They are also concerned with the length of time it takes to

accomplish a bureaucratic procedure in a country, they want competition authorities in

different countries to reach decision in more or less the same amount of time.

MNEs as actors in the policy process, is also important in the study of policy

convergence. This study explains and applies it in the case of competition policy. It is

not hard to imagine MNEs and MNCs as actors in the development of anti-dumping and

safeguards regimes.

C. Anti-Dumping Laws

Comparative Studies of Anti-Dumping Law and Use

It was only recently that legal analysis of anti-dumping regimes became popular

(Nakayama, 2007). For this reason, there are only a few serious books and studies that the

author is able to review compared with studies on policy convergence. Most of them deal

with the legal systems of the "traditional" anti-dumping users, the US and EU. These do

not necessarily deal specifically with convergence; rather they go into the policy

experiences and policy developments in this policy area. The two studies surveyed in

this section is important in understanding the dynamics in anti-dumping and safeguards

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 18

as well as differences in the implementation of these per country which can go far in

helping the author compare anti-dumping and safeguards regimes.

The most notable study that the author reviewed is that of Messerlin and Reed

(1995). This study deals with the increasing similarity (convergence) of the anti-

dumping regimes of the US and the European Community since the 1980s. The authors

noted that the anti-dumping regimes became more similar in 3 crucial areas: their

relationship with competition policy; their role in trade policy and; in their political

economy dimension. In terms of the anti-dumping – competition policy relationship, the

authors noted that since the 1920s, the US has been treating anti-dumping as the

"international form" of anti-trust. They were once even procedures that used an

economic approach to anti-dumping which looked at the costs and benefits of dumping (a

feature that was shared with US anti-trust policy which determines the legality of a

monopoly based on economic benefit). Eventually, the US began using the GATT

framework for anti-dumping which had a much less profound connection with

competition policy, thus making American anti-dumping policy more similar with EC

anti-dumping policy which also lacked a profound connection with competition policy.

The second area—that anti-dumping increasingly became a part of trade policy—

resulted from changes in the international trading system. As non-tariff barriers (NTBs)

were reduced in both the US and EC, as a result of multilateral negotiations (namely

GATT and, in the case of EC, the common market), anti-dumping was turned to more

and more frequently for the protection of domestic industries.

Finally, in the political economic dimension, the justification for the use of anti-

dumping policy became largely political, i.e. before the 1980s, EC rhetoric on anti-

dumping has rarely invoked notions of "fairness" or "restoring a level playing field". The

US however has been making use of these justifications, thus making the use of anti-

dumping favorable on their part. Since then, the EC has emulated US rhetoric thus

making anti-dumping increasingly the instrument of choice.

Aside from these three crucial areas, convergence has also occurred in terms of

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 19

anti-dumping use. Messerlin and Reed examined anti-dumping cases lodged in between

1979 to 1989 for their study. They found that in terms of the number of cases lodged and

the rate of success of anti-dumping investigations, the US and EC have had very similar

outcomes (US has a success rate of 61% and the EC has 75% for the given period).

Outcomes between these two have also been very similar in terms of which industries

have lodged the most number of cases (four industries in particular: chemicals; primary

and fabricated metals; non-electrical machinery and; electric and electronic equipment,

represent 76% and 72% of total anti-dumping cases filed in the US and EC respectively

for the said period).

Messerlin and Reed conclude that the convergence between the US and EC is a

result of a "protection engineering process". This is because the tariff reduction process

within the GATT is a lengthy, complex and expensive process which is rarely resorted to.

Anti-dumping is a much more convenient way to protect domestic industries from foreign

competition.

Jean-Christophe Maur (1998) wrote an article that deals with the echoing of anti-

dumping cases. Echoing is similar to policy convergence, however the similarity does

not lie with the structures in policy. It refers to the increase in similarity of the use of a

particular policy. In this study, echoing refers to when a state initiates anti-dumping

procedures for a certain good and for a certain producing state and within a very short

time span a similar action was undertaken in another state for the same good and

producer. Maur investigated the role played by multinational enterprises (MNEs) in

initiating these anti-dumping filings and he found that these companies are in the best

position to imitate anti-dumping filings and to benefit from this echoing. Maur calls this

regulatory competition among MNEs. What this study reveals is that the implementation

of anti-dumping policies may converge across countries and may be brought about by

MNEs. This is interesting because MNEs by definition are not loyal to one state. MNEs

may facilitate communication among states and thus facilitate policy convergence much

like what happened in the case of competition policy as seen in the study of Dabbah

(2003).

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 20

Finger and Nogues (2006) in an edited volume, go into the development and

history of anti-dumping and safeguards in Latin America. The book is composed of case

studies of the history, politics and evolution of policies. Since each of the chapters are

written by a different author, there is hardly any unity in the book aside from the common

topic. Some generalizations can be gleaned from the book however. One is that the

application of anti-dumping and safeguards mechanisms goes hand-in-hand with trade

liberalization. These measures can be used as tools for long-term policy management by

government and thus the instruments can be manipulated in order to further long-term

policy goals. Institutional mechanisms for administering the trade defense regime are

idiosyncratic to each country depending on the "selling conditions" of that country (from

Murillo, 2002). Discipline may also vary across countries, given that WTO rules are

already generous in the area of trade defense, some countries chose to make their own

safeguards and anti-dumping regime stricter than the minimum provided in WTO.

Susanta Das (2005) examined the evolution of anti-dumping and safeguards

measures in the United States, European Union and Japan. Specifically he focused on the

politics that led to their adoption. In the case of the United States, the author noted that

its development was characterized by an "executive-legislative tug-of-war". Learning

from US experience prior to World War II (when US congress passed the Smoot-Hawley

Act), the executive branch learned to treat trade protectionism as an instrument of foreign

policy, thus trade policy came under executive control. The EU case was similar to the

United States as it also encountered the same set of economic problems and political

forces and thus their pattern of their protectionist programs were similar. One important

difference however is the institutional set-up. The EU is only "trying to be a state" unlike

the US, which made political unity higher on EU's agenda than the US. Among the

major concerns the EU had at the outset was producing sustainable growth, employment,

promoting social cohesion, the common agricultural policies (CAP) and the environment

among others. This resulted in EU liberalizing under a most favored nation (MFN) basis

while opposing liberalization in traditional sectors such as textiles and agriculture and

anti-dumping became the preferred method of dealing with cheap imports Under the

Treaty of Rome. In the case of Japan an anti-dumping law has been in place since the

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 21

1920s, but the Japanese were never a people that relied on judicial procedures and so

anti-dumping was never really used as a policy in Japan. Das concluded that domestic

political economy is a significant influence on the protectionist policies a country

undertakes, in the case of anti-dumping and safeguards, a seemingly innocent 'safety

valve' mechanism becomes a major trade protection mechanism.

From these studies, one can see that anti-dumping and safeguards can take

different forms and be used for purposes other than what they were originally planned for

in the GATT/WTO conventions. One can say that these policies may converge or

diverge in a group of countries and that it would be interesting to discover the reasons for

such an outcome.

Anti-Dumping Laws in Southeast Asia

There are only a few studies dealing with the anti-dumping laws and practices of

Southeast Asian countries and the researcher has yet to encounter any that deals with

anti-dumping laws from a comparative perspective. However, two studies are

noteworthy: Yoshida and Ito's case study of Thailand included in the volume of Junji

Nakagawa (2007) and Thi Thuy Van Le and Sarah Tong's (2009) case study of Vietnam.

These two case studies both used a historical descriptive methodology for describing the

history and evolution of the anti-dumping laws of Thailand and Vietnam. In these two

studies, their authors discussed the legal bases for anti-dumping and the changes of these

laws, whether it is by amendment or by being replaced with another law. Another

common theme in these studies is the international background behind the changes in the

laws which are commonly attributed in these cases are to conformance with the WTO or

to address inefficiencies in the laws. The key features and improvements of each

succeeding law or amendment are also discussed as well as the institutions that govern

anti-dumping.

Yoshida and Ito's case study on Thailand makes use of communication between

Thailand and other countries through the WTO in order to show which directions the

international community was trying to push Thai anti-dumping laws in terms of

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 22

procedures. The researcher believes that it is also beneficial to use the same technique as

this communication itself can be seen as a mechanism of convergence either as

transnational communication or as international harmonization.

This same technique was not possible for Le and Tong's case study of Vietnam

since as of now, there are hardly any communications between WTO members and

Vietnam regarding its anti-dumping law as of now. What the Vietnam study does use

however are anti-dumping cases that it initiated and were initiated against it. It highlights

Vietnam's increasing awareness and proficiency in the application of anti-dumping laws

on both the part of the government and of the domestic industries themselves. Seeing as

experience in handling anti-dumping cases may influence the anti-dumping laws, the

researcher believes that looking at some cases and dispute settlements may be beneficial

in understanding policy convergence.

Harry Roque (2006) presented a paper on Philippine anti-dumping and other

contingent protection measures in the context of the WTO agreement. This is basically a

descriptive paper which describes Philippine anti-dumping laws as being largely GATT

consistent although some compromises had to be made with certain provisions (for

example, on the giving of dumping duties to the dumping party, which exceeds what was

prescribed in the GATT ). This is very different from the first two studies dealing with

Southeast Asia as the focus was not so much on the anti-dumping laws themselves but on

WTO conformance. What is interesting in the paper was the methodology which used

lobbying by domestic groups and writings of advocates of both trade and protectionism

as the explanation for the inconsistencies of Philippine anti-dumping law vis-à-vis the

GATT agreement. This study also hopes to do the same using the causal mechanisms in

policy convergence.

D. Summary of the Review

The first part of part B of this review focused on empirical studies on policy

convergence. The value of this section is that it shows how other authors operationalize

concepts such as regulatory competition, international harmonization and transnational

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 23

communication. The studies examined in this part make up the basis of this study's

theoretical framework. The succeeding parts look at the specific mechanisms from a

more qualitative basis. Part C looks into literature on anti-dumping, the first section of

this part looks at comparative studies of anti-dumping laws and the history of these laws.

The main purpose of this section was to show that anti-dumping laws undergo changes

over the course of history and the reasons that bring this about. The next section

examines some of the history of anti-dumping laws in Southeast Asia, the focus of this

study. This section helps the author determine appropriate methods for examining the

history of these laws.

Looking at the works presented in this literature review, one can find plenty of

justification for the conducting of this present study. One can see that the theory of

policy convergence and related concepts has very good explanatory power and that there

are a myriad of ways in which one can study this phenomenon. This study would like to

approach the case at hand from a qualitative perspective from which there is no shortage

of explanations the mechanism of convergence. A very convincing mechanism is the one

presented by Waarden and Drahos which explained convergence as occurring within a

multi-level epistemic community which in turn exists within an institution such as the

EU. Another mechanism of convergence is domestic conditions as expounded by

Murillo as this can help explain some of the amendments that anti-dumping laws faced

over the years. Noticeably lacking are literature on anti-dumping laws from a

comparative perspective. Most of the studies of anti-dumping laws are country-specific

case studies which by their nature stand alone. The volume of Finger and Nogues (2006)

and Nakayama (2007) are collections of these case studies and no attempt at a conclusion

or integration is made at the end of each volume. The researcher needs to correct the lack

of such literature.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 24

CHAPTER III

THEORETICAL FRAMEWORK

A. Introduction

The umbrella thesis for this study is the "policy convergence thesis" which states

that given participation in international organizations, economic integration and

transnational communication of epistemic communities policies tend to become more

similar across states (Holzinger, Knill & Sommerer, 2008). This study will employ a

convergence framework that was articulated in Knill (2005) and Holzinger & Knill

(2005), in order to show that policies have converged in the countries selected and the

reasons for this. This same framework will be used to explain how international

pressures figured in the development of Philippine anti-dumping policy and how it

converged with the anti-dumping regimes of other countries.

B. Policy Convergence

According to the theory, policy convergence is defined as the increase in the

similarity of policy characteristics across countries over a span of time. Policy

characteristics can refer to policy settings, policy instruments, policy objectives. With

respect to the degree of convergence, Holzinger and Knill (2005) do not provide any

objective criteria. Instead he says "we first of all have to clarify the criteria on the basis

of which we judge whether policies across countries are similar or not." This means that

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 25

one must provide his own criteria to say whether policies have converged or not (usually

comparative literature on the specific policy should give sufficient points of comparison).

For example, looking at the case of competition policy: convergence in policy

setting is said to occur when laws begin to cover similar elements of intra-firm

competition such as mergers, abuses of market power, horizontal agreements, horizontal

agreements, vertical agreements and unfair trading provisions; Policy instruments can

refer to the tests and thresholds employed when government authorities study

competition cases and also whether they use judiciary or administrative based

enforcement systems and; policy objectives which in competition policy would be either

to ban monopolies altogether or to ban them only when they case harm to the public

(Bollard and Vautier, 1998).

Christoph Knill's theory on policy convergence is not just concerned with policy

similarity, it is also concerned with the following questions: What explains the adoption

of similar policies across countries over time?; Under which conditions can we expect

that domestic policies converge or rather develop further apart?; Why do countries

converge on some policies, but not on others? and; What is the direction of policy

convergence?; Do national policies converge at the regulatory top or bottom, and why?

Direction of Convergence

One important element of Knill's framework is how one looks at convergence.

He lists four kinds of convergence according to the direction of the convergence of policy

characteristics:

1. Sigma (σ) Convergence – If there is a decrease in the variation of policies among

the countries under consideration within a span of time.

2. Beta (β) Convergence – When laggard countries (in terms of policy

characteristics) catch up with the leaders over time.

3. Gamma (γ) Convergence – Refers to changes in country ranking with respect to a

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 26

certain policy area.

4. Delta (δ) Convergence – Refers to "distance changes" (increase/decrease in

similarity) of a country's policies with respect to an exemplary model.

Given these different kinds of convergence, convergence can either be seen as a

gradual process that involve a gradual change towards policy similarity where all

countries unilaterally change their policies without any clearly defined plan within a

specific time span (sigma convergence). It can also mean developing countries make

their policies more similar with more developed nations by imitating their policies (delta

convergence). For beta and gamma convergence, one can imagine indices of economic

openness wherein it is possible to rank countries according to what they have achieved in

terms of economic openness. For this reason, beta and gamma convergence do not seem

applicable in the case of anti-dumping policy as ranking of policies is not possible.

Holzinger and Knill (2005) relies on the concept of Sigma Convergence to

measure similarity change aside from using it to indicate the direction of convergence.

These kinds of convergence may be difficult to use in this study because the authors use

changes in standard deviation (i.e. it is used in quantitative assessments of policy

convergence).

The direction of convergence is usually related to the extent of state intervention

or to the strictness of a regulation. Lax standards or laissez-faire policies are identified

with the 'bottom', strict standards or interventionist policies with the 'top' (Drezner, 2001).

And the direction, to quote Holzinger and Knill (2005):

[C]an only be measured whenever the policies under consideration come

in degrees, which can be associated with a normative judgment on the

quality of an intervention. Typical examples are the levels of

environmental and consumer protection or labor standards. However, it is

not always easy to identify what the top and the bottom are in a policy,

because there may be different value judgments…Moreover, when policy

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 27

instruments are compared it does not make much sense to speak of

directions of convergence. Only in rare cases can a certain instrument be

assumed to provide stricter (or less strict) regulation than another one. In

many cases, it is therefore impossible to formulate hypotheses on the

direction of convergence.

This study has experienced this same sort of difficulty described in the above

passage since it does not make sense to speak of anti-dumping in terms of "strictness".

The author instead analyzes the direction of convergence in terms of whether the law

intends to make anti-dumping easier (in initiation for the domestic industry and in

application by the government) or to discourage it (by making initiation and investigation

costly for those seeking to use it or by making the laws so technical and sophisticated that

an anti-dumping measure becomes easily justified in the international community). This

is in keeping with Vermulst's (1997) framework of comparing anti-dumping laws.

Mechanisms of Convergence

Another important element of Knill's framework, and a concern of this study, is

determining the causes of convergence. Table 1 lists down those causal mechanisms and

looks at the stimuli and the corresponding responses. One can see that the mechanisms

for convergence can range from coercion to independent problem solving with varying

degrees of coercion and independence in between.

Table 1. Causal Mechanisms of Policy Convergence

Mechanism Stimulus Response

Imposition Political Demand or Pressure Submission

International Legal obligation through Compliance

Harmonization international law

Regulatory Competition Competitive pressure Mutual Adjustment

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 28

Transnational

Communication

Lesson Drawing Problem pressure Transfer of model found

elsewhere

Transnational Problem- parallel problem pressure Adoption of commonly

Solving developed model

Emulation Desire for conformity Copying of widely used

model

International Policy Legitimacy pressure Adoption of recommended

Promotion model

Independent Problem parallel problem pressure Independent similar response

Solving

Source: Holzinger & Knill (2005)

This study is interested in finding out how anti-dumping policies converged in the

said countries given these causal mechanisms. Were anti-dumping policies the result of

an imposition by another country? Did countries simply discover the usefulness of anti-

dumping on their own? Or did they learn from each other? This can be understood more

clearly by examining the policy-making process for evidence of these causal mechanisms

at work.

C. Operational Framework

The policy convergence framework believes that as time passes and as the

international and domestic situation changes, the anti-dumping laws become more

similar. We see the increase in similarity by looking at past legislation and subsequent

amendments where each amendment is seen as an incremental change to be examined in

light of other countries' legislation and from these changes, one can get an idea as to the

direction of convergence.

These probable causal mechanisms can be determined by examining the history of

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 29

the political and economic environment. Certainly, one mechanism may seem to provide

greater motivation to a country to amend its laws to a certain direction more than another.

Thus, the mechanism of convergence will have to be examined in light of the direction of

convergence and as to what procedures became more similar. For example, if the number

of steps needed to initiate an anti-dumping investigation decreased among several

countries, one would tend believe that it is more possible that the pressure that resulted to

this change is largely from regulatory competition (brought about by competitive

pressure) as this decrease is an indicator of a move towards a regulatory bottom. Thus,

by examining the points in which anti-dumping laws converge, the researcher may be

able to more accurately pin-point the mechanism of convergence.

Earlier, the researcher mentioned that the direction of convergence will be

analyzed in terms of whether the law makes anti-dumping easier in use (by governments

and by interested parties) or by discouraging it by including many technical procedures.

Also useful is convergence toward the direction of similarity with the ADA.

Ease of Use – When procedures converge toward the direction of ease of

use/application, the researcher would place more weight on the "more voluntary"

mechanisms of regulatory competition and independent problems solving than the "more

coercive" mechanisms such as international harmonization and imposition.

Harmonization with ADA – If laws seem to converge towards provisions in the

GATT Anti-Dumping Agreement in terms of wording, policy instruments, thresholds,

methodologies and tests, the researcher will automatically ascribe international

harmonization as the mechanism unless there is good reason or evidence to believe

otherwise.

For this study, the researcher examined the relevant laws and procedures of the

countries and tried to look for areas in which they converge. This also involves looking

at past legislation on anti-dumping in order to see what kinds of changes took place in the

countries' anti-dumping regime. The purpose of this exercise is to roughly determine the

mechanism of convergence that may have caused that aspect to become similar (Chapter

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 30

V of this study).

In order to be informed more clearly of the causes of convergence, the author also

looked closely at the case of the Philippines especially the policy process that led to the

adoption of an anti-dumping framework and its specific elements. The author looked for

evidence of the causal mechanisms of policy convergence at work (for example, visits or

complaints from powerful countries regarding the anti-dumping situation in the

Philippines and a resulting change in policy may suggest convergence through

imposition) and which aspects of the law contain converged with other countries' anti-

dumping systems. Therefore, if laws converged with one another, it is within this law-

making process wherein one will find the causes of this convergence.

The mechanisms of convergence may already be evident in the international

environment and history. The author will use the following criteria in order to identify

the mechanism of convergence:

Political Demand or Pressure – Is the mechanism that leads to the convergence of

policy through the imposition of laws from another power. The evidence that the author

will keep an eye out for is whether representatives from another state have approached

the leaders and legislators of the state in question to in order to persuade them to enact

anti-dumping laws or to make changes to existing legislation. Political pressure can also

exist when other countries try to bring a country into compliance with international

agreements (in this case, WTO-ADA) with threats to use force.

International Legal Obligation – This is the stimulus that leads to policy convergence

through compliance with international law and other agreements. Holzinger, Knill and

Sommerer (2008) in their empirical study use the ordinal metric of ascension to an

international organization. In this study, the main international agreement that the

countries being studied are members of is the WTO. Therefore, the extent to which

international obligation is a factor in this study depends on how much WTO agreements

are followed.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 31

Competitive Pressure – is the stimulus that leads countries to adopt similar policies

because the country wants to be more competitive relative to other countries. What the

author is looking for is evidence that a country adopted a law or a provision based on the

intention of economic benefit, to simplify application of the instrument or as a retaliatory

measure. Competitive pressure may have taken place if the change in its law is meant to

increase efficiency of the investigation or the effectiveness of a duty. Another change

that may have resulted from competitive pressure are the presence of provisions that by

their nature indicate that government wishes to lessen the negative impact of anti-

dumping on its producers or to discourage nuisance initiations. Competitive pressure is

closely linked with domestic pressures since the lobbying of domestic groups may be

triggered by poor trade outcomes but may be distinguished from domestic pressure by the

fact that reform was initiated by government itself.

Transnational Communication – Under policy convergence theory this may come in

the form of lesson drawing, through transnational problem solving, emulation and

international policy promotion. The author believes that all of these occur in one form or

another. For example, the author believes that the WTO Trade Review Mechanism and

the Committee on Anti-Dumping Practices are examples of lesson drawing. 2 Under the

Committee on Anti-Dumping Practices, countries may send questions and clarifications

to that body with regard to anti-dumping practices and procedures who would then try to

reply as soon as possible with a solution that is consistent with the WTO.

2

Using state – international organization correspondence as a gauge of transnational communication is

consistent with the methodology of Holzinger, Knill and Sommerer (2008) who used the metric of

"communicative potential" or the frequency with which an international organization communicates to its

member states in the form of meetings, forums and correspondence. This study is expounded on in Chapter

VII of this study.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 32

CHAPTER IV

RESEARCH METHODS

The general strategy for this study is that of a case study of policy convergence.

Specifically, the author will examine the convergence of anti-dumping regimes and

related policies in the Philippines, Vietnam, Indonesia, Thailand and Malaysia.

This is a descriptive study that uses document analysis as its main method in order

to show the points of convergence in anti-dumping policy among the said countries. This

study is historical in examining the policy process that went on in the Philippines that

resulted in convergence.

The countries were selected on their basis of geographical proximity, similarity in

economy and trade relations. Furthermore, the majority of these countries have enacted

some sort of anti-dumping law in the early 1990s which indicates that they have all come

under similar problem pressures for this to happen which also increases the chances that

convergence can be observed.

The data needed for this study will be qualitative and they will come in the form

of laws and policies that were put in place between 1992 and those in place in 2008

translated into English if not already in English. The following is a list of anti-dumping

laws that the author examined for the procedures and institutions that they created and the

background in which they were created:

Indonesia:

The Customs Law of the Republic of Indonesia of 1995

No. 34 - "Anti-dumping and Countervailing Duty Act of 1996"

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 33

Decree No. 136/MPP/KEP/6/1996 of the Ministry of Trade and

Industry Regarding the Anti-Dumping Committee

Decree No. 172/MPP/KEP/7/1996 of the Ministry of Trade and

Industry Regarding the Organization and the Working

Procedure of the Anti-Dumping Taskforce

Malaysia:

Act 504 – "Countervailing and Anti-dumping duties act"

Countervailing and Anti-Dumping Duties Regulations 1994

Act A 1046 – "Countervailing and Anti-Dumping Duties

(Amendment) Act 1998"

Countervailing and Anti-Dumping Duties (Amendment)

Regulations 1999

Philippines:

Republic Act 7843 – "Anti-dumping act of 1994"

Republic Act 8752 – "Anti-dumping act of 1999"

Thailand:

Ministry of Commerce Notification on Principal and Procedure to

Collect Surcharge on Unfairly Priced Imports and Subsidized Imports,

B.E. 2534 (1991 MOC Notification)

B.E. 2542 – "Anti-dumping and Subsidized Import Act, B.E. 2542

(1999)"

Vietnam:

Ordinance No. 20/2004/PL-UBTVQH11 - "Ordinance Against

Dumping of Imported Goods into Vietnam (2004)"

Decree No. 90-2005-ND-CP - "Decree making detailed provisions for

implementation of Ordinance Against Dumping of Imported Goods

into Vietnam (2005)"

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 34

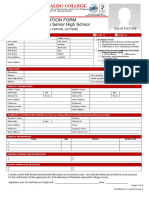

The specific sections of these laws were coded according to whether they

contained provisions relating to: General Applications; Dumping Margins; Domestic

Industries; Product (and related concepts such as volume of introduction, de minimis

prices and volumes); injury (definition and determination); Price (normal values, exports

prices and how these are constructed) Price Undertakings; Institutions and Agencies

Involved in Investigation and Determination; Filing and Initiation of an Investigation;

Treatment of Evidence and Confidential Information; Dumping Duties and Margins and;

Reviews. These codes were then compared among countries and described in tabular

form. The author also took into account past legislation and the changes that took place.

Comparison of the laws (past and present and across countries) will constitute the

description of the state of convergence in anti-dumping laws for ASEAN.

For information regarding the possible mechanisms of convergence, the author

relied largely on secondary sources that described the pressures that may influence policy

making. Secondary sources were also relied upon by the author that described the

evolution of a country's anti-dumping regime and some problems and procedures that are

present in its current and past regimes.

The chapter detailing the policy process that went into Philippine anti-dumping

law was written primarily to corroborate the discussion on the direction and mechanisms

of convergence and to inform the thesis of the process of convergence as it may actually

occur in policy making. For this section, transcripts of deliberations in the Philippine

Senate and the Lower House of the bills that would become anti-dumping laws were

studied.

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 35

CHAPTER V

POLICY CONVERGENCE IN ANTI-DUMPING

One of the objectives of this thesis is to describe the state of convergence in the

anti-dumping regimes in the selected countries and the points in which their anti-dumping

policies diverge from each other. The policy convergence framework that the researcher

adopted from Christoph Knill (2005) states that policy can become similar in their policy

settings, policy instruments and policy objectives. This section presents the convergence

of anti-dumping policy by first, going over the changes in the anti-dumping policy for

each specific country and saying in general terms the changes that took place with each

change in anti-dumping legislation and some general characteristics and innovations they

contained as well as their role in the larger context of economic policy and then to discuss

specific procedures and aspects of anti-dumping laws. Next, the researcher will examine

the institutional structures of the countries and then show that convergence takes place at

this level. Lastly, the researcher will examine convergence at the procedural level.

A. Legal Bases of Anti-Dumping

This section will discuss the history of laws in anti-dumping in Indonesia,

Malaysia, the Philippines, Thailand and Vietnam. Convergence is seen in the patterns of

adoption between 1990 and 2000—i.e. the story behind how a country comes up with its

current anti-dumping regime is usually the following:

A country would start with a trade and customs code within which contains some

provision that bans the practice of dumping. This code would hardly be invoked and

almost never resulted in a definitive duty on dumped products and the effectiveness and

The Convergence of National Anti-Dumping Legislation Among ASEAN Countries 36

utility of the provision would thus be dubious as it may lack implementing regulations or

provisions. This was not important since trade policy in the 1980s would still make use

of traditional protectionist measures such as tariffs. In the early 1990s, towards the end of

the Uruguay round which formally established the WTO, countries began amending their

anti-dumping legislation ostensibly to prepare their economies and industries for the

lowering of trade barriers and removal of traditional protectionist measures. In the late

1990s, an amendment or a new anti-dumping law would be enacted as a response to

perceived inefficiencies inherent in the law as well as to keep the laws GATT consistent.

The process is summarized in the timeline in figure 1.

Figure 1. Evolution of Anti-Dumping Laws

Given this story, the author will present the evolution of anti-dumping laws for

each of the countries' anti-dumping regime.

Indonesia

Until late 1995, Indonesia had no anti-dumping legislation. The Customs Law of

the Republic of Indonesia of 1995 was the first law to provide such a basis. In fact, the

English translation of this law contains preliminary statements which state that the law