Professional Documents

Culture Documents

COGS: Income Statement (Expense) Inventory Systems

Uploaded by

Marc M0 ratings0% found this document useful (0 votes)

22 views1 pageACC100 Notes

Original Title

ACC 100

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACC100 Notes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views1 pageCOGS: Income Statement (Expense) Inventory Systems

Uploaded by

Marc MACC100 Notes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

ACC 100

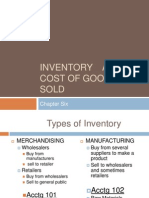

Anything you sell for a profit is inventory (merchandise)

o A company can buy and sell equipment as part of

inventory

o However, equipment that a business uses is always

equipment.

COGS: Income statement (expense)

o Sales COGS + Profit

Inventory Systems:

o Perpetual:

Constantly updating inventory/COGS

Gets updated every time there is an inflow/outflow of

inventory

o Periodic:

Only updated at a certain fiscal period

o Always make 2 transaction when selling inventory

FOB Shipping Point:

o Buyer pays and owns it in transit

o Cost added to inventory account

FOB Destination:

o Seller pays and owns it in transit

o Expensed as used to generate revenue

Sellers will prefer terms in which money is provided to them in

the shortest amount of time

Returns = Reverse: Reverse part or whole of the transaction

from when it was recorded depending on how much was returned

Gross Profit % = Gross Profit

Net Sales

= 43%

Profit % = Profit

Net Sales

= 36%

You might also like

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

- Chapter 3 Inventories and Cost of Goods SoldDocument84 pagesChapter 3 Inventories and Cost of Goods SoldSampanna Shrestha100% (1)

- Principles of Acc. II Lecture NoteDocument54 pagesPrinciples of Acc. II Lecture NoteJemal Musa83% (6)

- Accounting Cycle of A Merchandising BusinessDocument54 pagesAccounting Cycle of A Merchandising BusinessKim Flores100% (1)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Far Eastern University-Diliman: Department of Accounts and BusinessDocument8 pagesFar Eastern University-Diliman: Department of Accounts and BusinessJohn Paul PolicarpioNo ratings yet

- Chapter 5 WileyDocument28 pagesChapter 5 Wileyp876468No ratings yet

- Chapter 6 - Accounting For MerchandiseDocument30 pagesChapter 6 - Accounting For MerchandiseTrần Anh TuấnNo ratings yet

- Cpa Far Section 7Document12 pagesCpa Far Section 7Donielle RobertsNo ratings yet

- Cheat SheetDocument15 pagesCheat SheetJason wonwonNo ratings yet

- Acc Reviewer P2Document5 pagesAcc Reviewer P2Shane QuintoNo ratings yet

- Accounting NotesDocument12 pagesAccounting NotesKrystelle JalemNo ratings yet

- FINACTDocument15 pagesFINACTsheengaleria11No ratings yet

- Chapter InventoriesDocument38 pagesChapter InventoriesJustine ReyesNo ratings yet

- P2 Notes MerchandisingDocument14 pagesP2 Notes Merchandisingchen.abellar.swuNo ratings yet

- 10 Accounting Cycle of A Merchandizing BusinessDocument21 pages10 Accounting Cycle of A Merchandizing BusinessJames CorpuzNo ratings yet

- Chapter 7 - BookNotes - 07242021Document4 pagesChapter 7 - BookNotes - 07242021JulietNo ratings yet

- Accounting ReviewerDocument5 pagesAccounting ReviewerMeynard BatasNo ratings yet

- Chapter 8 - Merchandising Operations PDFDocument28 pagesChapter 8 - Merchandising Operations PDFCarlos Juliano ImportanteNo ratings yet

- Accounting For Merchandising CompanyDocument17 pagesAccounting For Merchandising Companyalfonsus.wardhana220No ratings yet

- Ebook Cornerstones of Financial Accounting 4Th Edition Rich Solutions Manual Full Chapter PDFDocument67 pagesEbook Cornerstones of Financial Accounting 4Th Edition Rich Solutions Manual Full Chapter PDFfreyahypatias7j100% (12)

- Chapter 5 Inventories and CGSDocument68 pagesChapter 5 Inventories and CGSAddisalem Mesfin100% (1)

- Merchandising OperationsDocument41 pagesMerchandising OperationsRogelio ParanNo ratings yet

- InventoriesDocument35 pagesInventoriesJay PinedaNo ratings yet

- Chapter 8 InventoryDocument11 pagesChapter 8 Inventorymarwan2004acctNo ratings yet

- Merchandising CompaniesDocument7 pagesMerchandising CompaniesGoogle UserNo ratings yet

- Wuolah Free Apuntes Unit 5 Gulag FreeDocument12 pagesWuolah Free Apuntes Unit 5 Gulag FreeNOA PEREZ FERRERNo ratings yet

- Chapter 6 PowerpointDocument34 pagesChapter 6 Powerpointapi-248607804No ratings yet

- MerchandisingDocument7 pagesMerchandisingtwice onceNo ratings yet

- Harrison Chapter 5 Student 6 CeDocument46 pagesHarrison Chapter 5 Student 6 CeAliyan AmjadNo ratings yet

- CH 10 InventoriesDocument25 pagesCH 10 InventorieslalaNo ratings yet

- Chapter 5 Inventories and CGSDocument68 pagesChapter 5 Inventories and CGSZemene HailuNo ratings yet

- 2020 CMA P1 A3 InventoryDocument54 pages2020 CMA P1 A3 InventoryLhenNo ratings yet

- Financial ManagementDocument7 pagesFinancial ManagementKevin Frederick AdrillanaNo ratings yet

- Inventories and Cost of Goods SoldDocument38 pagesInventories and Cost of Goods Soldakram ouk100% (1)

- Maintain Inventory Records IVDocument16 pagesMaintain Inventory Records IVIsrael KifleNo ratings yet

- Inventories Basic PrinciplesDocument7 pagesInventories Basic PrinciplesSandia EspejoNo ratings yet

- CH 04Document61 pagesCH 04natiman090909No ratings yet

- Periodic and Perpetual Inventory SystemsDocument17 pagesPeriodic and Perpetual Inventory SystemsMichael Brian TorresNo ratings yet

- 05 Accounting For Merchandising OperationsDocument33 pages05 Accounting For Merchandising OperationsoriboiNo ratings yet

- Inventories P1Document8 pagesInventories P1Shane CalderonNo ratings yet

- Accounting For Merchandising Operations: Lecture-4Document11 pagesAccounting For Merchandising Operations: Lecture-4Nirjon BhowmicNo ratings yet

- FINACCDocument3 pagesFINACCFaith Nina JauodNo ratings yet

- Chapter 5 - 6 - Inventory Accounting and ValuationDocument61 pagesChapter 5 - 6 - Inventory Accounting and ValuationNaeemullah baig100% (1)

- CA01 VariableCostingFDocument114 pagesCA01 VariableCostingFVenise BaliaNo ratings yet

- Formula SheetDocument6 pagesFormula Sheethas choNo ratings yet

- Chapter 7 Inventories InventoriesDocument24 pagesChapter 7 Inventories InventoriesharumanNo ratings yet

- Chapter InventoriesDocument38 pagesChapter Inventoriesangellachavezlabalan.cpalawyerNo ratings yet

- FFA Lecture Part DDocument102 pagesFFA Lecture Part Dleopardking77No ratings yet

- Discussion - InventoriesDocument3 pagesDiscussion - InventoriesVel JuneNo ratings yet

- Inventory ManagementDocument23 pagesInventory ManagementSrujana GantaNo ratings yet

- Chapter 6-Accounting For Merchandising TransactionsDocument30 pagesChapter 6-Accounting For Merchandising Transactions05 Phạm Hồng Diệp12.11No ratings yet

- Accounting For Merchandising OperationsDocument7 pagesAccounting For Merchandising OperationsRakibul HasanNo ratings yet

- sheet (6) ازهر E1Document10 pagessheet (6) ازهر E1magdy kamelNo ratings yet

- P2 - New Ch2Document10 pagesP2 - New Ch2mulugetaNo ratings yet

- Accounting For Training Merchandising BusinessDocument109 pagesAccounting For Training Merchandising BusinessIsa NgNo ratings yet

- Lesson 1 - Accounting Cycle of A Merchandising BusinessDocument27 pagesLesson 1 - Accounting Cycle of A Merchandising Businessdenise andalocNo ratings yet

- Arun LamsalDocument50 pagesArun LamsalSmith TiwariNo ratings yet

- COGS & Inv.Document33 pagesCOGS & Inv.Aquarious AquaNo ratings yet

- Financial Reporting Standards (Pas # 2) : Inventory Accounting Recognition, Measurement and DisclosuresDocument51 pagesFinancial Reporting Standards (Pas # 2) : Inventory Accounting Recognition, Measurement and DisclosuresKylieNo ratings yet

- ECN Midterm ReviewDocument3 pagesECN Midterm ReviewMarc MNo ratings yet

- FIN300 Notes - Class 1Document1 pageFIN300 Notes - Class 1Marc MNo ratings yet

- FIN300 Notes - Class 3Document1 pageFIN300 Notes - Class 3Marc MNo ratings yet

- FIN300 Notes Class 2Document1 pageFIN300 Notes Class 2Marc MNo ratings yet

- ECN 204 Notes Class 2Document3 pagesECN 204 Notes Class 2Marc MNo ratings yet

- Learning Objectives:: Larger Slice of Sales ResultDocument2 pagesLearning Objectives:: Larger Slice of Sales ResultMarc MNo ratings yet

- CMN279 Notes - Class 3Document2 pagesCMN279 Notes - Class 3Marc MNo ratings yet

- CMN279 Notes - Class 4Document1 pageCMN279 Notes - Class 4Marc MNo ratings yet

- Chapter 3 Objectives: Define Tort:: o Intentional TortsDocument4 pagesChapter 3 Objectives: Define Tort:: o Intentional TortsMarc MNo ratings yet

- CMN279 Notes - Class 2Document3 pagesCMN279 Notes - Class 2Marc MNo ratings yet

- CH 5 Law 122Document2 pagesCH 5 Law 122Marc MNo ratings yet

- CH 4 Law 122Document3 pagesCH 4 Law 122Marc MNo ratings yet

- CMN279 Notes - Class 1Document2 pagesCMN279 Notes - Class 1Marc MNo ratings yet

- PCS 181 Notes Class 2Document2 pagesPCS 181 Notes Class 2Marc MNo ratings yet

- PCS181 Class 3Document2 pagesPCS181 Class 3Marc MNo ratings yet

- PCS 181 Notes Class 1Document1 pagePCS 181 Notes Class 1Marc MNo ratings yet

- ACC 100 Notes Sep 23Document1 pageACC 100 Notes Sep 23Marc MNo ratings yet

- PCS181 Notes Class 4Document3 pagesPCS181 Notes Class 4Marc MNo ratings yet

- PCS181 Notes Class 5Document1 pagePCS181 Notes Class 5Marc MNo ratings yet

- PCS181 Notes Class 7Document2 pagesPCS181 Notes Class 7Marc MNo ratings yet

- PCS181 Notes Class 6Document3 pagesPCS181 Notes Class 6Marc MNo ratings yet