Professional Documents

Culture Documents

Daily Market Report

Uploaded by

Smitha Mohan0 ratings0% found this document useful (0 votes)

11 views1 pagecrude pricing

Original Title

9-9-2016

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcrude pricing

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageDaily Market Report

Uploaded by

Smitha Mohancrude pricing

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Contact: anujjain@bharatpetroleum.

in

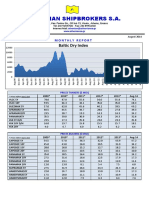

Daily Market Report

International Trade & Risk Management Friday, 09 September 2016

Market Commentary

Crude Crude oil futures surged on Thursday after data showed a massive drop in U.S. oil stockpiles,

Front Month Futures ($/bbl) reflecting the impact of an Atlantic storm which threatened the Gulf Coast refining hub last

week.

NYMEX WTI 47.62 2.12 Gasoline consumption in the first half of 2016 averaged 9.3 mnbpd, an increase of 2.5% y/y

compared to same period last year. Consumption is expected to increase an additional 171

ICE Brent 49.99 2.01 kbpd to 9.33 mnbpd in 2016, surpassing the previous high of 9.29 mnbpd set in 2007.

The ECB held interest rates at record lows and kept the door open to more stimulus on but

Spot ($/bbl) gave few hints about its next move, disappointing markets that had priced in a decisively

dovish tone.

Dated Brent 49.32 2.52

China's crude imports rose to their second highest level ever in Aug16 at 7.8 mnbpd, as

Dubai 44.81 1.10 independent refiners continued their buying of low priced crude before their import quotas

expire in Dec16. Separately, refined oil product exports rose 19.3% y/y to 3.71 MMT,

Tapis 50.24 1.10 compared with 4.57 MMT in Jul16.

China has finished construction of 19 mn barrels of new crude tanks in Aug16 for its state

crude oil reserves in Aoshan Island and expects to begin filling them later this year reflecting

Products (Spot) roughly 3 days of import requirements.

Russias daily oil production approached close to 11 mnbpd in the period of 1-7 Sep. For the

Singapore ($/bbl) month of Aug16 output averaged 10.71 mnbpd, lower than the 10.85 mnbpd produced in

Jul16.

Naphtha 43.14 1.11

EIA weekly inventory data (million barrels)

Gasoline 57.10 2.46 2-Sep w/w y/y 2-Sep w/w y/y

Crude 511.4 -14.5 53.4 Distillate 158.1 3.4 7.2

Jet/Kero 56.06 1.10 Gasoline 227.8 -4.2 13.2 Runs (%) 93.7 0.9 1.5

Gasoil 55.96 1.28

Bullish

Major OPEC and Non OPEC producers discussing to take action to stabilize oil markets

FO 180 ($/T) 261.12 5.38 Bullish EIA weekly inventory data

Increase in China Crude oil imports in Aug16

ECB held interest rates low

Spot Cracks Bearish

Talks on possibility of rate hike by US Fed

Singapore against Dubai ($/bbl) Expectation of higher exports from Russia, Iran and Iraq

Naphtha -1.67 0.01

Gasoline 12.29 1.36

Jet/Kero 11.25 0.28

Gasoil 11.15 -0.10

FO 180 -3.69 -0.25

Refining Margins

Dubai - Singapore ($/bbl)

Crack 6.10 5.23# 3.89@

Hydro 1.70 1.15# 0.11@

# 15 days average / @ Previous Month

Freight

World Scale - AG East

VLCC TD3 34 -0.4

Aframax-TD8 62 0.1

Clean MR TC5 98 -1.9

All prices are closing prices of last business day. Price source: Platts, Reuters, indications from counterparties. Market information source: Reuters, Bloomberg, counterparties, shipping brokers. While

due care has been exercised in preparation of this communication it is advisable to reconfirm the information while taking any decision due to unexpected errors / inherent volatile nature of markets.

You might also like

- Coal, Gas and Electricity: Reviews of United Kingdom Statistical SourcesFrom EverandCoal, Gas and Electricity: Reviews of United Kingdom Statistical SourcesNo ratings yet

- RDocument34 pagesRJhoel HuanacoNo ratings yet

- Ihs Markit Is SectorsDocument2 pagesIhs Markit Is SectorsKapilanNavaratnamNo ratings yet

- Drimcgrawhill - Platts - Oilgram Price Report Nov 96Document12 pagesDrimcgrawhill - Platts - Oilgram Price Report Nov 96Cristhian AymaNo ratings yet

- Platts 2020 Outlook Report PDFDocument21 pagesPlatts 2020 Outlook Report PDFKamal ShayedNo ratings yet

- Urea Weekly Market Report 6 Sept17Document18 pagesUrea Weekly Market Report 6 Sept17Victor VazquezNo ratings yet

- Intermodal Weekly 01-2012Document8 pagesIntermodal Weekly 01-2012Wisnu KertaningnagoroNo ratings yet

- Intermodal Weekly Market Report 3rd February 2015, Week 5Document9 pagesIntermodal Weekly Market Report 3rd February 2015, Week 5Budi PrayitnoNo ratings yet

- Polymerscan: Americas Polymer Spot Price AssessmentsDocument29 pagesPolymerscan: Americas Polymer Spot Price AssessmentsmcontrerjNo ratings yet

- Oil Gram Price ReportDocument15 pagesOil Gram Price ReportIppo MakunouchiNo ratings yet

- EY Natural Gas Pricing in India PDFDocument12 pagesEY Natural Gas Pricing in India PDFJyoti DasguptaNo ratings yet

- Shipping Market Report 17082011Document18 pagesShipping Market Report 17082011bleuwinzNo ratings yet

- Platts LPG Gaswire 23082013Document6 pagesPlatts LPG Gaswire 23082013udelmarkNo ratings yet

- CRSL Presentation 2nd October 2013 FinalDocument41 pagesCRSL Presentation 2nd October 2013 FinalWilliam FergusonNo ratings yet

- Tankers Dry Bulk: Published by Fearnresearch 18. September 2013Document3 pagesTankers Dry Bulk: Published by Fearnresearch 18. September 2013SimmarineNo ratings yet

- Po 20140910Document30 pagesPo 20140910mcontrerjNo ratings yet

- Container Market PDFDocument3 pagesContainer Market PDFDhruv AgarwalNo ratings yet

- AMR SummaryDocument37 pagesAMR SummaryChatkamol KaewbuddeeNo ratings yet

- Daily Market Report: Poten & PartnersDocument1 pageDaily Market Report: Poten & PartnersalgeriacandaNo ratings yet

- Vam PricesDocument28 pagesVam PricesMandar J DeshpandeNo ratings yet

- Worldyards May 2007 NewsletterDocument20 pagesWorldyards May 2007 Newsletternestor mospanNo ratings yet

- Willis Energy Market Review 2013 PDFDocument92 pagesWillis Energy Market Review 2013 PDFsushilk28No ratings yet

- Opr 20181205Document32 pagesOpr 20181205rojovies24No ratings yet

- SSY Chemical WeeklyDocument3 pagesSSY Chemical WeeklyBeytullah KokoçNo ratings yet

- Euro Gas DailyDocument8 pagesEuro Gas DailyJose DenizNo ratings yet

- Monthly Oil Market Report - Feb 2023Document24 pagesMonthly Oil Market Report - Feb 2023asaNo ratings yet

- SeaIntel Sunday Spotlight Issue 100Document31 pagesSeaIntel Sunday Spotlight Issue 100Alan Roos MurphyNo ratings yet

- SRJ Aug Sep 2009Document76 pagesSRJ Aug Sep 2009majdirossrossNo ratings yet

- CD4855 - Ammonia - Urea - Markets - in - Latin - America - January - 2009 - (UPDATED - 9th - Jan) - Final BRITISH 02 PDFDocument60 pagesCD4855 - Ammonia - Urea - Markets - in - Latin - America - January - 2009 - (UPDATED - 9th - Jan) - Final BRITISH 02 PDFgabydel74No ratings yet

- Argus LPG World PDFDocument16 pagesArgus LPG World PDFAlexander SeminarioNo ratings yet

- Oil Gram Price Report 101911Document21 pagesOil Gram Price Report 101911Khurram KhaliqNo ratings yet

- Market ScanDocument23 pagesMarket ScanGhasem2010No ratings yet

- Complete Reference ListDocument10 pagesComplete Reference ListdocdumpsterNo ratings yet

- Course On LNG Business: Session-2 World Gas ScenarioDocument27 pagesCourse On LNG Business: Session-2 World Gas ScenarioRahul Atodaria100% (1)

- Platts PCA PageDocument15 pagesPlatts PCA PageandyangkpNo ratings yet

- AbtngDocument5 pagesAbtngSushant PaiNo ratings yet

- Chemical Business FocusDocument34 pagesChemical Business FocusAtikah Abu BakarNo ratings yet

- CNPC Annual Report 2010Document68 pagesCNPC Annual Report 2010alecnomiNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.08.15Document17 pagesAthenian Shipbrokers - Monthy Report - 14.08.15georgevarsasNo ratings yet

- Marketing 2Document12 pagesMarketing 2Saul Martinez MolinaNo ratings yet

- Argus: Coal Daily InternationalDocument15 pagesArgus: Coal Daily InternationalUmang KadivarNo ratings yet

- LW 20180731Document10 pagesLW 20180731Victor FernandezNo ratings yet

- Caprolactam (Europe) 22 Feb 2017Document3 pagesCaprolactam (Europe) 22 Feb 2017Andrés JiménezNo ratings yet

- Solvents WireDocument9 pagesSolvents Wirerbrijeshgbiresearch100% (1)

- Aldorf Presentation 5th World LNG August 31Document29 pagesAldorf Presentation 5th World LNG August 31stavros7No ratings yet

- DynaLiners Weekly 49-2015Document12 pagesDynaLiners Weekly 49-2015Somayajula SuryaramNo ratings yet

- LPGDocument15 pagesLPGMilkiss SweetNo ratings yet

- Coal Outlook ReportDocument51 pagesCoal Outlook ReportSterios SouyoutzoglouNo ratings yet

- LNG 20150116Document11 pagesLNG 20150116Rajeshkumar ElangoNo ratings yet

- EuropeLPGReport Sample02082013Document5 pagesEuropeLPGReport Sample02082013Melody CottonNo ratings yet

- Argus PolymersDocument11 pagesArgus PolymersIvan PavlovNo ratings yet

- 2014 PTQ q1Document156 pages2014 PTQ q1Milind ShahNo ratings yet

- Fixation of JLPL & VSPL Tariff by PNGRB: An Overview of Gail'S Submissions To The BoardDocument10 pagesFixation of JLPL & VSPL Tariff by PNGRB: An Overview of Gail'S Submissions To The BoardSanjai bhadouriaNo ratings yet

- Views - Could Greenflation Stall The Electric Vehicle RevolutionDocument5 pagesViews - Could Greenflation Stall The Electric Vehicle RevolutionQuyet Doan TienNo ratings yet

- Oil Products Price Forecast Mid-Month Update April 2023Document7 pagesOil Products Price Forecast Mid-Month Update April 2023kkkkk100% (1)

- Argus Coalindo Indonesian Coal Index ReportDocument2 pagesArgus Coalindo Indonesian Coal Index ReportTya KusumahNo ratings yet

- Surging Liquefied Natural Gas TradeDocument28 pagesSurging Liquefied Natural Gas TradeThe Atlantic CouncilNo ratings yet

- Shipping Intelligence 26.novDocument20 pagesShipping Intelligence 26.novleejingsongNo ratings yet

- Crude PricingDocument1 pageCrude PricingSmitha MohanNo ratings yet

- Nomura - Oil & Gas, Chemicals 30 Sept 2010Document21 pagesNomura - Oil & Gas, Chemicals 30 Sept 2010ppt46No ratings yet

- Fixed Assets: Name: Sudhir Jain M. No.: 213157Document48 pagesFixed Assets: Name: Sudhir Jain M. No.: 213157nagesh99No ratings yet

- Project Summary: Existing Capacity of TSDF Is 50000 MT /annum in 50 Acre Land. The Proposed Plant Capacity IsDocument2 pagesProject Summary: Existing Capacity of TSDF Is 50000 MT /annum in 50 Acre Land. The Proposed Plant Capacity IsSmitha MohanNo ratings yet

- API MPMS CatalogoDocument24 pagesAPI MPMS CatalogoLionelinskiNo ratings yet

- StandardsDocument4 pagesStandardsSmitha MohanNo ratings yet

- Audit ScopeDocument1 pageAudit ScopeSmitha MohanNo ratings yet

- Refinery Information SystemDocument1 pageRefinery Information SystemSmitha MohanNo ratings yet

- Crude Oil Asseys of Selected CrudesDocument54 pagesCrude Oil Asseys of Selected CrudesSmitha MohanNo ratings yet

- Daily Market ReportDocument1 pageDaily Market ReportSmitha MohanNo ratings yet

- 14 9 2016Document1 page14 9 2016Smitha MohanNo ratings yet

- Crude PricingDocument1 pageCrude PricingSmitha MohanNo ratings yet

- PSA 50 Paper PDFDocument5 pagesPSA 50 Paper PDFpalluraviNo ratings yet

- Crude PricingDocument1 pageCrude PricingSmitha MohanNo ratings yet

- Bonny Light Crude AssayDocument2 pagesBonny Light Crude AssaySmitha MohanNo ratings yet

- PSA 50 Paper PDFDocument5 pagesPSA 50 Paper PDFpalluraviNo ratings yet

- MAK Techno Bite - Issue 54 On Emission Control TechniquesDocument1 pageMAK Techno Bite - Issue 54 On Emission Control TechniquesSmitha MohanNo ratings yet

- Union Budget 2019-20Document15 pagesUnion Budget 2019-20Smitha MohanNo ratings yet

- Opr 20181205Document32 pagesOpr 20181205rojovies24No ratings yet

- Group 13 - IB - Assignment - Regional Economic - IntegrationDocument46 pagesGroup 13 - IB - Assignment - Regional Economic - IntegrationArefin RidwanNo ratings yet

- COVID-19 and Its Impact On The International EconomyDocument17 pagesCOVID-19 and Its Impact On The International EconomyGeetika Khandelwal100% (7)

- Sipchem Gih251008Document44 pagesSipchem Gih251008maitaniNo ratings yet

- Energy Security Gas OPECDocument3 pagesEnergy Security Gas OPECRenee WestraNo ratings yet

- NNPC Mpe CBT QuestionsDocument23 pagesNNPC Mpe CBT QuestionsJoseph NyamNo ratings yet

- Ramady M Mahdi W Opec in A Shale Oil World Where To Next PDFDocument293 pagesRamady M Mahdi W Opec in A Shale Oil World Where To Next PDFBalanuța IanaNo ratings yet

- Middle East Chronology - 1986-04-16 - 1986-07-15Document34 pagesMiddle East Chronology - 1986-04-16 - 1986-07-15rinaldofrancescaNo ratings yet

- The New International Economic OrderDocument7 pagesThe New International Economic Ordererparveenkaur86100% (1)

- Salary InformationDocument4 pagesSalary InformationVikas VermaNo ratings yet

- 201806290521342834814ReadyReckonerJune2018web PDFDocument94 pages201806290521342834814ReadyReckonerJune2018web PDFahabasiNo ratings yet

- Lesson 2 RegionalizationDocument50 pagesLesson 2 Regionalizationave sambranaNo ratings yet

- 2 BlackbookDocument53 pages2 BlackbookIshita SinghNo ratings yet

- BP and The Consolidation of The Oil Industry - Group 9Document8 pagesBP and The Consolidation of The Oil Industry - Group 9Shruti BhargavaNo ratings yet

- Opec's Organizational Structures, Its Strategic Aims & Objectives, Production Quota, Incohesion Within Opec.Document23 pagesOpec's Organizational Structures, Its Strategic Aims & Objectives, Production Quota, Incohesion Within Opec.Clifford Ogbeide100% (10)

- ConclusionDocument1 pageConclusionNiyati VaidyaNo ratings yet

- MBA OG - III Group No 7 - Global Oil and Gas Industry 2010Document6 pagesMBA OG - III Group No 7 - Global Oil and Gas Industry 2010Rajagopalan IyerNo ratings yet

- Module 3 Contemporary WorldDocument10 pagesModule 3 Contemporary WorldMeljon AbasolaNo ratings yet

- Practice MCQ Ch3Document11 pagesPractice MCQ Ch3ahmedfeqi0% (1)

- 2019-2021 Mtef - FSP UpdatedDocument45 pages2019-2021 Mtef - FSP UpdatediranadeNo ratings yet

- Commodity Markets OutlookDocument82 pagesCommodity Markets OutlookStéphane Villagómez CharbonneauNo ratings yet

- Annual Report 2015-42 E PDFDocument314 pagesAnnual Report 2015-42 E PDFSohini ChatterjeeNo ratings yet

- Suzanne Weyn - Empty 37Document107 pagesSuzanne Weyn - Empty 37lexsanchez0% (1)

- 1nc Compiled MasterfileDocument246 pages1nc Compiled MasterfileYichen SunNo ratings yet

- Alberta Economic Outlook February 2018Document9 pagesAlberta Economic Outlook February 2018CTV CalgaryNo ratings yet

- Compressor Tech 01 2015Document76 pagesCompressor Tech 01 2015Tiffany JohnsonNo ratings yet

- OPEC and The Seven SistersDocument2 pagesOPEC and The Seven SistersrioesvaldinoNo ratings yet

- Introduction World Oil GasDocument160 pagesIntroduction World Oil Gasbali100% (3)

- US Energy Superpower Status and A New US Energy DiplomacyDocument16 pagesUS Energy Superpower Status and A New US Energy DiplomacyHoover InstitutionNo ratings yet

- The Rapid Change of International Business PDFDocument29 pagesThe Rapid Change of International Business PDFJames BirnbaumNo ratings yet