Professional Documents

Culture Documents

Berita 11 Januari 2017 (Asli)

Uploaded by

Puput0 ratings0% found this document useful (0 votes)

11 views2 pagesBerita Ekonomi

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBerita Ekonomi

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

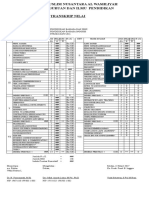

11 views2 pagesBerita 11 Januari 2017 (Asli)

Uploaded by

PuputBerita Ekonomi

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Portuguese private bank hikes capital, Chinese stake rises

LISBON, Jan. 9 (AFP)

Portugal's biggest private bank, BCP, on Monday announced a share sale of 1.33 billion euros

($1.41 billion) and said purchases by Fosun Industrial Holdings would see the Chinese

conglomerate nearly double its stake in the firm.

The cash injection will be used to pay off 700 million euros in debts to the state, the last

repayment in a three-billion-euro bailout dating to 2012. The funds will also be harnessed to

strengthen the balance sheet, bringing the bank's capital adequacy ratio to 11.4 percent, BCP said

in a statement.

Fosun, which became the BCP's biggest shareholder last November, has committed to buying

more shares that will see its holding rise from 16.7 percent of capital to 30 percent, it said.

Portugal's banking sector is saddled with debt and bad loans and has had to be rescued twice by

the state under a plan backed by the European Union and the International Monetary Fund

(IMF).

On November 20, Fosun and BCP said the Chinese firm paid nearly 175 million euros for its

stake and aimed to increase its shareholding to around 30 percent.

China's largest privately-owned conglomerate, Fosun is already present in Portugal with

stakes in the insurer Fidelidade and medical services group Luz Saude.

China's economy likely to grow 6.7 pct in 2016: top

economic planner

BEIJING, Jan. 10 (Xinhua)

China's economy is estimated to grow by about 6.7 percent in 2016, the top economic

planner said Tuesday. The economy would exceed 70 trillion yuan (about 10.1 trillion U.S.

dollars) last year, an increase of 5 trillion yuan, Xu Shaoshi, minister in charge of the National

Development and Reform Commission, told a news briefing.

Steady growth and the performance of new sectors have debunked predictions that China's

economy will collapse or face a hard landing, and the growth rate was remarkable among major

economies, he said.

Citing a report by the International Monetary Fund, he said that China may have contributed

1.2 percentage points, or over 30 percent, of the world's economic growth in 2016, while the

United States might account for 0.3 percentage points. This would mean China has been the top

engine of global growth for 10 years in a row.

China is confident in and capable of maintaining the reasonable growth rate thanks to its

economic structural reforms and emerging new sources of growth, Xu said. As China adapts to a

new normal of moderate-to-high growth, it has tried to shift from an export-and-investment

driven economy to one that is more sustainable and draws strength from consumption, services

and innovation.

In the first three quarters of 2016, the economy expanded 6.7 percent, well within the

government's target range of between 6.5 and 7 percent. During that period, the service sector

accounted for 52.8 percent of value-added industrial output, 13.3 percentage points higher than

secondary industry, while consumption accounted for 71 percent of the growth, up 13 percentage

points, Xu said.

The economy is in better shape for cleaner development, with a five-percent drop of energy

consumption per unit of GDP and continuous declines of major pollutant emissions, he added.

Besides, the country has exceeded its annual target for job creation, adding over 13 million new

jobs in 2016.

You might also like

- Kunci Gitar Chord Lirik Ed Sheeran - PerfectDocument2 pagesKunci Gitar Chord Lirik Ed Sheeran - PerfectPuputNo ratings yet

- Grammar and Punctuation RulesDocument2 pagesGrammar and Punctuation RulesPuputNo ratings yet

- Over 100 Questions English 3 in 1 (Primary 1)Document8 pagesOver 100 Questions English 3 in 1 (Primary 1)PuputNo ratings yet

- Little MixDocument15 pagesLittle MixPuputNo ratings yet

- BBC - Learning English - Vocabulary NotebookDocument12 pagesBBC - Learning English - Vocabulary NotebookLauraRosanoNo ratings yet

- FisikDocument1 pageFisikPuputNo ratings yet

- Translate of News PaperDocument2 pagesTranslate of News PaperPuputNo ratings yet

- Practice Oral & Listening Comprehention 2Document10 pagesPractice Oral & Listening Comprehention 2PuputNo ratings yet

- EPB Comprehension Revision 1Document7 pagesEPB Comprehension Revision 1PuputNo ratings yet

- Mexico To File WTO Complaint Over US Tariffs: MinistryDocument1 pageMexico To File WTO Complaint Over US Tariffs: MinistryPuputNo ratings yet

- Formal Informal EnglishDocument8 pagesFormal Informal EnglishTeofilo AlvarezNo ratings yet

- QuizzesDocument8 pagesQuizzesgojianNo ratings yet

- MODULE 1INTRODUCING LITERATURE Kak HalimahDocument76 pagesMODULE 1INTRODUCING LITERATURE Kak HalimahPuputNo ratings yet

- Full CaseDocument6 pagesFull CasePuputNo ratings yet

- B. InggrisDocument3 pagesB. InggrisPuputNo ratings yet

- Bahan Berita 6 OktoberDocument2 pagesBahan Berita 6 OktoberPuputNo ratings yet

- Euro Zone Sentiment Rises in October, Inflation Expectations DropDocument2 pagesEuro Zone Sentiment Rises in October, Inflation Expectations DropPuputNo ratings yet

- Lang MediaDocument12 pagesLang MediaLoredana ȚicleteNo ratings yet

- Bahan Berita 12 OktoberDocument2 pagesBahan Berita 12 OktoberPuputNo ratings yet

- Stocks Rally With Crude Before Payrolls As China Nerves SubsideDocument2 pagesStocks Rally With Crude Before Payrolls As China Nerves SubsidePuputNo ratings yet

- ECB Stimulus Pressure Rises as Euro Area Inflation Turns NegativeDocument2 pagesECB Stimulus Pressure Rises as Euro Area Inflation Turns NegativePuputNo ratings yet

- Bahan Berita 15 OktoberDocument2 pagesBahan Berita 15 OktoberPuputNo ratings yet

- Bahan Berita 5 OktoberDocument2 pagesBahan Berita 5 OktoberPuputNo ratings yet

- Bahan Berita 12 OktoberDocument2 pagesBahan Berita 12 OktoberPuputNo ratings yet

- d-494 - Wed - 20 DEC 2017Document8 pagesd-494 - Wed - 20 DEC 2017PuputNo ratings yet

- Full CaseDocument6 pagesFull CasePuputNo ratings yet

- Fed awaited evidence global slowdown not derailing US economyDocument2 pagesFed awaited evidence global slowdown not derailing US economyPuputNo ratings yet

- Translate of News PaperDocument2 pagesTranslate of News PaperPuputNo ratings yet

- Improving Vocabulary Using Word Games TechniqueDocument9 pagesImproving Vocabulary Using Word Games TechniquePuputNo ratings yet

- HL 3 November 2017 (Asli)Document2 pagesHL 3 November 2017 (Asli)PuputNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Strategic Planning and Program Budgeting in Romania RecentDocument6 pagesStrategic Planning and Program Budgeting in Romania RecentCarmina Ioana TomariuNo ratings yet

- Who Are The Prosperity Gospel Adherents by Bradley A KochDocument46 pagesWho Are The Prosperity Gospel Adherents by Bradley A KochSimon DevramNo ratings yet

- NQC User ManualDocument6 pagesNQC User ManualgarneliNo ratings yet

- TDS Tetrapur 100 (12-05-2014) enDocument2 pagesTDS Tetrapur 100 (12-05-2014) enCosmin MușatNo ratings yet

- General Ethics: The Importance of EthicsDocument2 pagesGeneral Ethics: The Importance of EthicsLegendXNo ratings yet

- XSI Public Indices Ocean Freight - January 2021Document7 pagesXSI Public Indices Ocean Freight - January 2021spyros_peiraiasNo ratings yet

- Protein Synthesis: Class Notes NotesDocument2 pagesProtein Synthesis: Class Notes NotesDale HardingNo ratings yet

- AC & Crew Lists 881st 5-18-11Document43 pagesAC & Crew Lists 881st 5-18-11ywbh100% (2)

- Effective Instruction OverviewDocument5 pagesEffective Instruction Overviewgene mapaNo ratings yet

- Case Digest in Special ProceedingsDocument42 pagesCase Digest in Special ProceedingsGuiller MagsumbolNo ratings yet

- STD Symptoms, Causes and PreventionDocument3 pagesSTD Symptoms, Causes and PreventionSakshi TyagiNo ratings yet

- Oxfordhb 9780199731763 e 13Document44 pagesOxfordhb 9780199731763 e 13florinaNo ratings yet

- Bhojpuri PDFDocument15 pagesBhojpuri PDFbestmadeeasy50% (2)

- IB Diploma Maths / Math / Mathematics IB DP HL, SL Portfolio TaskDocument1 pageIB Diploma Maths / Math / Mathematics IB DP HL, SL Portfolio TaskDerek Chan100% (1)

- SPACES Nepal - Green Schools Building The FutureDocument3 pagesSPACES Nepal - Green Schools Building The FutureBimal ThapaNo ratings yet

- Donut FenderDocument5 pagesDonut FenderMaria Angelin NaiborhuNo ratings yet

- Focus 4 Unit 2 Grammar Quiz 2.5 A GrupaDocument1 pageFocus 4 Unit 2 Grammar Quiz 2.5 A GrupaЕвгения КоноваловаNo ratings yet

- Agriculture Term Paper TopicsDocument5 pagesAgriculture Term Paper Topicsfuhukuheseg2100% (1)

- General Physics 1: Activity Title: What Forces You? Activity No.: 1.3 Learning Competency: Draw Free-Body DiagramsDocument5 pagesGeneral Physics 1: Activity Title: What Forces You? Activity No.: 1.3 Learning Competency: Draw Free-Body DiagramsLeonardo PigaNo ratings yet

- MyiasisDocument29 pagesMyiasisihsanNo ratings yet

- Midland County Board of Commissioners Dec. 19, 2023Document26 pagesMidland County Board of Commissioners Dec. 19, 2023Isabelle PasciollaNo ratings yet

- Jason Payne-James, Ian Wall, Peter Dean-Medicolegal Essentials in Healthcare (2004)Document284 pagesJason Payne-James, Ian Wall, Peter Dean-Medicolegal Essentials in Healthcare (2004)Abdalmonem Albaz100% (1)

- Identification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceanDocument80 pagesIdentification Guide To The Deep-Sea Cartilaginous Fishes of The Indian OceancavrisNo ratings yet

- What is your greatest strengthDocument14 pagesWhat is your greatest strengthDolce NcubeNo ratings yet

- 001 Joseph Vs - BautistacxDocument2 pages001 Joseph Vs - BautistacxTelle MarieNo ratings yet

- Mitanoor Sultana: Career ObjectiveDocument2 pagesMitanoor Sultana: Career ObjectiveDebasish DasNo ratings yet

- Infinitive Clauses PDFDocument3 pagesInfinitive Clauses PDFKatia LeliakhNo ratings yet

- Amadora V CA Case DigestDocument3 pagesAmadora V CA Case DigestLatjing SolimanNo ratings yet

- Soap - WikipediaDocument57 pagesSoap - Wikipediayash BansalNo ratings yet

- BAFINAR - Midterm Draft (R) PDFDocument11 pagesBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)