Professional Documents

Culture Documents

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation With Theft and Internal Control Deficiencies

Uploaded by

jocunningham0 ratings0% found this document useful (0 votes)

846 views3 pagesACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

Buy Solutions: http://hwsoloutions.com/downloads/acc-290-week-5-preparing-comprehensive-bank-reconciliation-with-theft-and-internal-control-deficiencies/

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

Purpose of Assignment

Reconciling bank accounts is a good way to help maintain internal controls over cash. With time lags and posting errors it is easy for cash transactions to be omitted, recorded in a different accounting period, or reflect incorrect amounts. This assignment with give you practical experience in reconciling the cash balance as noted on the company books to the bank’s records.

Assignment Steps

Resources: Financial Accounting: Tools for Business Decision Making

Scenario: Daisey Company is a very profitable small business. It has not, however given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and book-keeper. As a result, Bret Turrin handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations.

The balance per the bank statement on October 31, 2017, was $18,380. Outstanding checks were No. 62 for $140.75, No. 183 for $180, No. 284 for $253.25, No. 862 for $190.71, No. 863 for $226.80, and No. 864 for $165.28. Included with the statement was a credit memorandum of $185 indicating the collection of a note receivable for Daisey Company by the bank on October 25.

This memorandum has not been recorded by Daisey.

The company’s ledger showed one Cash account with a balance of $21,877.72. The balance included undepositied cash on hand. Because of the lack of internal controls, Bret took for personal use all of the undeposited receipts in excess of $3,795.51. He then prepared the following bank reconciliation in an effort to conceal his theft of cash:

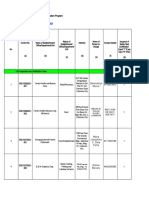

Cash balance per books, October 31 $21,877.72

Add: Outstanding checks

No. 862 $190.71

No. 863 226.80

No. 864 165.28 482.79

22,360.51

Less: Undeposited receipts 3,795.51

Unadjusted balance per bank, October 31 18,565.00

Less: Bank credit memorandum 185.00

Cash balance per bank statement, October 31 $18,380.00

Prepare a 1,050-word bank reconciliation report (hint: deduct the amount of the theft from the adjusted balance per books) including the following:

• Indicate the three ways that Bret attempted to conceal the theft and the dollar amount involved in each method.

• What principles of internal control were violated in this case?

Show all work in the Excel® spreadsheet and submit with the reconciliation report.

Click the Assignment Files tab to submit your assignment.

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

$18.00 – Purchase

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

Buy Solutions: http://hwsoloutions.com/downloads/acc-290-week-5-preparing-comprehensive-bank-reconciliation-with-theft-and-internal-control-deficiencies/

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

Purpose of Assignment

Reconciling bank accounts is a good way to help maintain internal controls over cash. With time lags and posting errors it is easy for cash transactions to be omitted, recorded in a different accounting period, or reflect incorrect amounts. This assignment with give you practical experience in reconciling the cash balance as noted on the company books to the bank’s records.

Assignment Steps

Resources: Financial Accounting: Tools for Business Decision Making

Scenario: Daisey Company is a very profitable small business. It has not, however given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and book-keeper. As a result, Bret Turrin handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations.

The balance per the bank statement on October 31, 2017, was $18,380. Outstanding checks were No. 62 for $140.75, No. 183 for $180, No. 284 for $253.25, No. 862 for $190.71, No. 863 for $226.80, and No. 864 for $165.28. Included with the statement was a credit memorandum of $185 indicating the collection of a note receivable for Daisey Company by the bank on October 25.

This memorandum has not been recorded by Daisey.

The company’s ledger showed one Cash account with a balance of $21,877.72. The balance included undepositied cash on hand. Because of the lack of internal controls, Bret took for personal use all of the undeposited receipts in excess of $3,795.51. He then prepared the following bank reconciliation in an effort to conceal his theft of cash:

Cash balance per books, October 31 $21,877.72

Add: Outstanding checks

No. 862 $190.71

No. 863 226.80

No. 864 165.28 482.79

22,360.51

Less: Undeposited receipts 3,795.51

Unadjusted balance per bank, October 31 18,565.00

Less: Bank credit memorandum 185.00

Cash balance per bank statement, October 31 $18,380.00

Prepare a 1,050-word bank reconciliation report (hint: deduct the amount of the theft from the adjusted balance per books) including the following:

• Indicate the three ways that Bret attempted to conceal the theft and the dollar amount involved in each method.

• What principles of internal control were violated in this case?

Show all work in the Excel® spreadsheet and submit with the reconciliation report.

Click the Assignment Files tab to submit your assignment.

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

$18.00 – Purchase

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

846 views3 pagesACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation With Theft and Internal Control Deficiencies

Uploaded by

jocunninghamACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

Buy Solutions: http://hwsoloutions.com/downloads/acc-290-week-5-preparing-comprehensive-bank-reconciliation-with-theft-and-internal-control-deficiencies/

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

Purpose of Assignment

Reconciling bank accounts is a good way to help maintain internal controls over cash. With time lags and posting errors it is easy for cash transactions to be omitted, recorded in a different accounting period, or reflect incorrect amounts. This assignment with give you practical experience in reconciling the cash balance as noted on the company books to the bank’s records.

Assignment Steps

Resources: Financial Accounting: Tools for Business Decision Making

Scenario: Daisey Company is a very profitable small business. It has not, however given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and book-keeper. As a result, Bret Turrin handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations.

The balance per the bank statement on October 31, 2017, was $18,380. Outstanding checks were No. 62 for $140.75, No. 183 for $180, No. 284 for $253.25, No. 862 for $190.71, No. 863 for $226.80, and No. 864 for $165.28. Included with the statement was a credit memorandum of $185 indicating the collection of a note receivable for Daisey Company by the bank on October 25.

This memorandum has not been recorded by Daisey.

The company’s ledger showed one Cash account with a balance of $21,877.72. The balance included undepositied cash on hand. Because of the lack of internal controls, Bret took for personal use all of the undeposited receipts in excess of $3,795.51. He then prepared the following bank reconciliation in an effort to conceal his theft of cash:

Cash balance per books, October 31 $21,877.72

Add: Outstanding checks

No. 862 $190.71

No. 863 226.80

No. 864 165.28 482.79

22,360.51

Less: Undeposited receipts 3,795.51

Unadjusted balance per bank, October 31 18,565.00

Less: Bank credit memorandum 185.00

Cash balance per bank statement, October 31 $18,380.00

Prepare a 1,050-word bank reconciliation report (hint: deduct the amount of the theft from the adjusted balance per books) including the following:

• Indicate the three ways that Bret attempted to conceal the theft and the dollar amount involved in each method.

• What principles of internal control were violated in this case?

Show all work in the Excel® spreadsheet and submit with the reconciliation report.

Click the Assignment Files tab to submit your assignment.

ACC 290 WEEK 5 Preparing Comprehensive Bank Reconciliation with Theft and Internal Control Deficiencies

$18.00 – Purchase

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

ACC 290 WEEK 5 Preparing

Comprehensive Bank Reconciliation

with Theft and Internal Control

Deficiencies

Buy Solutions: http://hwsoloutions.com/downloads/acc-290-week-5-preparing-

comprehensive-bank-reconciliation-with-theft-and-internal-control-deficiencies/

ACC 290 WEEK 5 Preparing

Comprehensive Bank Reconciliation

with Theft and Internal Control

Deficiencies

ACC 290 WEEK 5 Preparing

Comprehensive Bank Reconciliation

with Theft and Internal Control

Deficiencies

Purpose of Assignment

Reconciling bank accounts is a good way to help maintain internal controls over cash. With time

lags and posting errors it is easy for cash transactions to be omitted, recorded in a different

accounting period, or reflect incorrect amounts. This assignment with give you practical

experience in reconciling the cash balance as noted on the company books to the banks records.

Assignment Steps

Resources: Financial Accounting: Tools for Business Decision Making

Scenario: Daisey Company is a very profitable small business. It has not, however given much

consideration to internal control. For example, in an attempt to keep clerical and office expenses

to a minimum, the company has combined the jobs of cashier and book-keeper. As a result, Bret

Turrin handles all cash receipts, keeps the accounting records, and prepares the monthly bank

reconciliations.

The balance per the bank statement on October 31, 2017, was $18,380. Outstanding checks were

No. 62 for $140.75, No. 183 for $180, No. 284 for $253.25, No. 862 for $190.71, No. 863 for

$226.80, and No. 864 for $165.28. Included with the statement was a credit memorandum of

$185 indicating the collection of a note receivable for Daisey Company by the bank on October

25.

This memorandum has not been recorded by Daisey.

The companys ledger showed one Cash account with a balance of $21,877.72. The balance

included undepositied cash on hand. Because of the lack of internal controls, Bret took for

personal use all of the undeposited receipts in excess of $3,795.51. He then prepared the

following bank reconciliation in an effort to conceal his theft of cash:

Cash balance per books, October 31 $21,877.72

Add: Outstanding checks

No. 862 $190.71

No. 863 226.80

No. 864 165.28 482.79

22,360.51

Less: Undeposited receipts 3,795.51

Unadjusted balance per bank, October 31 18,565.00

Less: Bank credit memorandum 185.00

Cash balance per bank statement, October 31 $18,380.00

Prepare a 1,050-word bank reconciliation report (hint: deduct the amount of the theft from the

adjusted balance per books) including the following:

Indicate the three ways that Bret attempted to conceal the theft and the dollar amount

involved in each method.

What principles of internal control were violated in this case?

Show all work in the Excel spreadsheet and submit with the reconciliation report.

Click the Assignment Files tab to submit your assignment.

ACC 290 WEEK 5 Preparing

Comprehensive Bank Reconciliation

with Theft and Internal Control

Deficiencies

$18.00 Purchase

You might also like

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- 2012 AICPA Auditing QuestionsDocument61 pages2012 AICPA Auditing Questionsblackseth100% (1)

- CPAR - P2 - 7406 - Business Combination at Date of Acquisition With Answer PDFDocument6 pagesCPAR - P2 - 7406 - Business Combination at Date of Acquisition With Answer PDFAngelo Villadores100% (4)

- Bank Reconciliation StatementDocument7 pagesBank Reconciliation Statementsriram170No ratings yet

- Lanuza Et Al v. BF CorpDocument2 pagesLanuza Et Al v. BF CorpKylie Kaur Manalon DadoNo ratings yet

- Chapter 4 Financial AssetsDocument54 pagesChapter 4 Financial AssetsAddisalem MesfinNo ratings yet

- Ipsas 17 PpeDocument29 pagesIpsas 17 PpeEZEKIELNo ratings yet

- VP Global Compliance Officer in Houston TX Resume Robert WardDocument3 pagesVP Global Compliance Officer in Houston TX Resume Robert WardRobertWard2No ratings yet

- CHAPTER SIX - Doc Internal Control Over CashDocument7 pagesCHAPTER SIX - Doc Internal Control Over CashYared DemissieNo ratings yet

- Latihan Acca v02Document17 pagesLatihan Acca v02Indriyanti KrisdianaNo ratings yet

- Chapter 12 - Bank ReconciliationDocument29 pagesChapter 12 - Bank Reconciliationshemida100% (7)

- BHEL Rig SpecsDocument8 pagesBHEL Rig SpecsKavi JoshiNo ratings yet

- Retail Management Chapter 1 To Chapter 4Document129 pagesRetail Management Chapter 1 To Chapter 4Trisha TanglaoNo ratings yet

- Bank Reconciliation Statement - Process - Format - ExampleDocument5 pagesBank Reconciliation Statement - Process - Format - ExampleCykee100% (1)

- Review Questions For Test #1 ACC210Document14 pagesReview Questions For Test #1 ACC210Aaa0% (1)

- Hyundai 161127193648Document101 pagesHyundai 161127193648Kishor kumarNo ratings yet

- Ten Principles of Personal Financial LiteracyDocument20 pagesTen Principles of Personal Financial LiteracyARCHEL ORASANo ratings yet

- Agreed Upon Procedures vs. Consulting EngagementsDocument49 pagesAgreed Upon Procedures vs. Consulting EngagementsCharles B. Hall100% (1)

- Bank ReconciliationDocument17 pagesBank Reconciliationsudheenam100% (1)

- Refresher Course: Audit of Cash and Cash EquivalentsDocument4 pagesRefresher Course: Audit of Cash and Cash EquivalentsFery Ann100% (1)

- Enhancing Good Government Through Public Enterprise (Privatization) and Spatial Information Management (E-Government)Document36 pagesEnhancing Good Government Through Public Enterprise (Privatization) and Spatial Information Management (E-Government)Mond Ramos100% (6)

- Professional Diploma in Marketing: Reading List 2011 - 2012Document6 pagesProfessional Diploma in Marketing: Reading List 2011 - 2012yaqub19799141100% (1)

- Financial Accounting BMBA 140 Assignment #5 Name (First and Last Name)Document3 pagesFinancial Accounting BMBA 140 Assignment #5 Name (First and Last Name)Ednalyn PascualNo ratings yet

- Chapter 1 Cash and Internal ControlDocument57 pagesChapter 1 Cash and Internal ControlSampanna ShresthaNo ratings yet

- Bank ReconciliationDocument2 pagesBank Reconciliationsamm yuuNo ratings yet

- Cash SolutionsDocument6 pagesCash SolutionsPhương Thảo NguyễnNo ratings yet

- ACCT5013 M6 Workshop TemplatesDocument5 pagesACCT5013 M6 Workshop TemplatesgregNo ratings yet

- Question 3: Cash Management and Bank Reconciliation (25%)Document5 pagesQuestion 3: Cash Management and Bank Reconciliation (25%)Abdirizak AhmedNo ratings yet

- ch08 PDFDocument4 pagesch08 PDFRabie HarounNo ratings yet

- Bank Reconciliation Statement: Mushtaq NadeemDocument4 pagesBank Reconciliation Statement: Mushtaq NadeemMalik SalmanNo ratings yet

- Bank Reconciliation StatementsDocument3 pagesBank Reconciliation StatementsSenelwa AnayaNo ratings yet

- Pengauditan TiluDocument3 pagesPengauditan Tiluariena alifia sNo ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationFantayNo ratings yet

- Finals FABM2 Lesson 2 Bank ReconciliationDocument4 pagesFinals FABM2 Lesson 2 Bank ReconciliationJasmine VelosoNo ratings yet

- Chapter 5Document5 pagesChapter 5Abrha636No ratings yet

- Chapter 3 Bank Recon Lecture StudentDocument5 pagesChapter 3 Bank Recon Lecture StudentAshlene CruzNo ratings yet

- Topic 7 Cash Management & ControlDocument25 pagesTopic 7 Cash Management & ControlMd Jahid HossainNo ratings yet

- ACCA F3 Bank Recon and Errors 09 and Fixed AssetsDocument2 pagesACCA F3 Bank Recon and Errors 09 and Fixed AssetsAmos OkechNo ratings yet

- Account c5Document17 pagesAccount c5Asaye TesfaNo ratings yet

- Chapter 8 NotesDocument26 pagesChapter 8 NotesMohamed Afzal100% (1)

- Practice Questions # 4 Internal Control and Cash With AnswersDocument9 pagesPractice Questions # 4 Internal Control and Cash With AnswersIzzahIkramIllahiNo ratings yet

- Bank Reconciliation & Illustrative ProblemDocument6 pagesBank Reconciliation & Illustrative ProblemKyle Stephen EspañolNo ratings yet

- Cash and Cash Equivalent HandoutsDocument6 pagesCash and Cash Equivalent HandoutsMichael BongalontaNo ratings yet

- Audit of Cash PDFDocument11 pagesAudit of Cash PDFShaira UntalanNo ratings yet

- Bank Reconciliation StatementDocument17 pagesBank Reconciliation Statementyow jing pei100% (1)

- Gerald N. Roman Bsba FM 2-C Financial Analysis and ReportingDocument3 pagesGerald N. Roman Bsba FM 2-C Financial Analysis and ReportingGerald Noveda RomanNo ratings yet

- Unit - 3 HM 406Document14 pagesUnit - 3 HM 406Piyush KumarNo ratings yet

- Unit - 3 HM 406Document14 pagesUnit - 3 HM 406Piyush KumarNo ratings yet

- Ch. (8) : Bank Reconciliation Example:: Debit Memorandum: Credit MemorandumDocument2 pagesCh. (8) : Bank Reconciliation Example:: Debit Memorandum: Credit Memorandumyoussef walidNo ratings yet

- BUSI 1043 Unit 3 ExerciseDocument4 pagesBUSI 1043 Unit 3 ExerciseRichard MamisNo ratings yet

- AP Lesson 1Document15 pagesAP Lesson 1Joanne RomaNo ratings yet

- Cash and RecievablesDocument60 pagesCash and Recievablesአንተነህ የእናቱ100% (1)

- CH 08Document4 pagesCH 08flrnciairnNo ratings yet

- Essay A Essay B: Totals $569,000 $386,000Document4 pagesEssay A Essay B: Totals $569,000 $386,000Tosin YusufNo ratings yet

- Bank ReconcilliationDocument22 pagesBank ReconcilliationAli BhattiNo ratings yet

- Chapter 04Document39 pagesChapter 04Li ANo ratings yet

- Long QuizDocument6 pagesLong QuizRinconada Benori ReynalynNo ratings yet

- Bank ReconciliationDocument27 pagesBank Reconciliationnaruto uzumakiNo ratings yet

- Tutorial 1 and 2 Tutor Accy 112Document7 pagesTutorial 1 and 2 Tutor Accy 112mei100% (1)

- Topic 7 Bank ReconcilliationDocument10 pagesTopic 7 Bank ReconcilliationannahkaupaNo ratings yet

- How To Prepare A Bank ReconciliationDocument6 pagesHow To Prepare A Bank ReconciliationMk Fisiha100% (1)

- Stupendous Company Is A Very Profitable Small Business It HasDocument1 pageStupendous Company Is A Very Profitable Small Business It HasAmit PandeyNo ratings yet

- Chapter - 8: Fraud, Internal Control & CashDocument14 pagesChapter - 8: Fraud, Internal Control & CashMohammed Merajul IslamNo ratings yet

- Module 1 - Cash and Cash EquivalentsDocument13 pagesModule 1 - Cash and Cash EquivalentsAlliah Mae RaizNo ratings yet

- Ch8 AR Test 9902Document7 pagesCh8 AR Test 9902ايهاب غزالةNo ratings yet

- Bank ReconciliationDocument26 pagesBank ReconciliationQuennie Kate RomeroNo ratings yet

- F.A.B.M PortfolioDocument28 pagesF.A.B.M PortfolioLjoy Vlog SurvivedNo ratings yet

- Summary Notes 2022 Chap 6 - Student VerDocument52 pagesSummary Notes 2022 Chap 6 - Student VerThương ĐỗNo ratings yet

- Accounting For Cash and ReceivableDocument7 pagesAccounting For Cash and ReceivableAbrha GidayNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Zerodha FormDocument35 pagesZerodha FormNeal CaffereyNo ratings yet

- Report-on-Safety-Seal-Certification-2021 (October 21-27, 2021)Document4 pagesReport-on-Safety-Seal-Certification-2021 (October 21-27, 2021)Mecs NidNo ratings yet

- R03Document2 pagesR03cutiemocha1No ratings yet

- Chap015 With AnswerDocument2 pagesChap015 With AnswerSharonLargosaGabriel0% (1)

- Accounts - How To Clear The Historical Balancing AccountDocument2 pagesAccounts - How To Clear The Historical Balancing AccountSatwika AdhiNo ratings yet

- Ia04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1Document11 pagesIa04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1Saumya PandeyNo ratings yet

- Rural Godown SchemeDocument26 pagesRural Godown Schemelakshmi10110% (1)

- Bse Copy 31012018Document148 pagesBse Copy 31012018PrashantNo ratings yet

- 6th Sep 2017 Share DetailsDocument148 pages6th Sep 2017 Share DetailsMadhana Gopal PNo ratings yet

- An Extraordinary Company-HDFCDocument35 pagesAn Extraordinary Company-HDFCPrachi JainNo ratings yet

- RIMO - Annual Report - 2017 PDFDocument153 pagesRIMO - Annual Report - 2017 PDFichaNo ratings yet

- ADMS 2510 Sample Final ExamDocument11 pagesADMS 2510 Sample Final ExamGrace 'Queen' IfeyiNo ratings yet

- People Over Profit - ConceptDocument3 pagesPeople Over Profit - ConceptAlex AlegreNo ratings yet

- SISDocument21 pagesSISVarun GargNo ratings yet

- MarketLine Hyflux ReportDocument32 pagesMarketLine Hyflux ReportPatrick Liu100% (1)

- PerpetualLicTransForm (EMEA) (ENG) (Jul2014) (CR)Document5 pagesPerpetualLicTransForm (EMEA) (ENG) (Jul2014) (CR)Eliandro CardosoNo ratings yet

- PROGRAMDocument40 pagesPROGRAMchee pin wongNo ratings yet

- Oral Presentation What It Is: Amazon GoDocument2 pagesOral Presentation What It Is: Amazon GoJuliana MorenoNo ratings yet