Professional Documents

Culture Documents

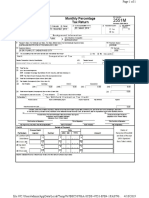

Monthly Percentage Tax Return

Uploaded by

romarcambriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly Percentage Tax Return

Uploaded by

romarcambriCopyright:

Available Formats

(To be filled up by the BIR)

DLN: PSIC:

BIR Form No.

Monthly Percentage

2551M

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Tax Return

September 2005 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 For the Calendar Fiscal 3 For the month 4 Amended Return 5 Number of sheets attached

2 Year ended 12 20 1 3 11 20 1 3

(MM/YYYY) (MM/YYYY) Yes x No

Part I Background Information

6 TIN 7 RDO Code 8 Line of Business/

008 540 312 000 052 5529-Restauran

Occupation

9 Taxpayer's Name (For Individual)Last Name, First Name, Middle Name/(For Non-individual) Registered Name 10 Telephone Number

THE ORIGINAL AL-SHAMS RESTAURANT, INC.

11 Registered Address 12 Zip Code

66 A. Aguirre St., Brgy. BF Homes, Dist II, Paranaque City

13 Are you availing of tax relief under Special Law

or International Tax Treaty? Yes No If yes, specify

Part II Computation of Tax

Taxable Transaction/ AT C Taxable Amount Tax Rate Tax Due

Industry Classification

Sales/Receipts PT 010 102,652.00 3% 3,079.56

14A 14B 14C 14D 14E

15A 15B 15C 15D 15E

16A 16B 16C 16D 16E

17A 17B 17C 17D 17E

18A 18B 18C 18D 18E

19 Total Tax Due 19

20 Less: Tax Credits/Payments

20A Creditable Percentage Tax Withheld Per BIR Form No. 2307 (See Schedule 1) 20A

20B Tax Paid in Return Previously Filed, if this is an Amended Return 20B

21 Total Tax Credits/Payments (Sum of Items 20A & 20B) 21

22 Tax Payable (Overpayment) (Item 19 less Item 21) 22

23 Add: Penalties Surcharge Interest Compromise

23A 23B 23C 23D

3,079.56

24 Total Amount Payable/(Overpayment) (Sum of Items 22 and 23D) 24

If overpayment, mark one box only: To be Refunded To be issued a Tax Credit Certificate

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25 26

President/Vice President/Principal Officer/Accredited Tax Agent/ Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

(Signature Over Printed Name)

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

Tax Agent Acc. No./Atty's Roll No.(if applicable) Date of Issuance Date of Expiry TIN of Signatory

Part III Details of Payment

Drawee Bank/ Date Stamp of

Particulars Agency Number MM DD YYYY Amount Receiving Office/AAB

27 Cash/Bank 27A 27B 27C 27D and Date of Receipt

Debit Memo (RO's Signature/

28 Check 28A 28B 28C 28D Bank Teller's Initial)

29 Tax Debit 29A 29B 29C

Memo

30 Others 30A 30B 30C 30D

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

BIR FORM 2551M (ENCS)-PAGE 2

Schedule 1 Tax Withheld Claimed as Tax Credit

Period Covered Name of Withholding Agent Income Payments Tax Withheld Applied

Total (To Item 20A)

ALPHANUMERIC TAX CODE (ATC)

ATC Percentage Tax On: Tax Rate ATC Percentage Tax On: Tax Rate

PT 010 Persons exempt from VAT under Sec. 109v (Sec. 116) 3% PT 103 3) On royalties, rentals of property, real or personal, profits 7%

PT 040 Domestic carriers and keepers of garages 3% from exchange and all other gross income

PT 041 International Carriers 3% PT 104 4) On net trading gains within the taxable year on foreign currency,

PT 060 Franchises on gas and water utilities 2% debt securities, derivatives, and other financial instruments 7%

PT 070 Franchises on radio/TV broadcasting companies whose Tax on Other Non-Bank Financial Intermediaries not performing quasi-banking functions

annual gross receipts do not exceed P 10 M 3% 1) On interest, commissions and discounts from lending activities

Tax on banks and non-bank financial intermediaries performing quasi as well as income from financial leasing, on the basis of remaining

banking functions maturities of instruments from which such receipts are derived

1) On interest, commissions and discounts from lending PT 113 Maturity period is five (5) years or less 5%

activities as well as income from financial leasing, on PT 114 Maturity period is more than five (5) years 1%

the basis of remaining maturities of instruments from PT 115 2) From all other items treated as gross income under the code 5%

which such receipts are derived PT 120 Life Insurance premium 5%

PT 105 Maturity period is five (5) years or less 5% Agents of Foreign Insurance Companies

PT 101 Maturity period is more than five (5) years 1% PT 130 a) Insurance Agents 10%

PT 102 2) On dividends and equity shares and net income of PT 132 b) Owners of property obtaining insurance directly

subsidiaries 0% with foreign insurance companies 5%

BIR Form No. 2551M Percentage Tax Return

Guidelines and Instructions

(To be filled up by the BIR)

DLN: PSIC:

BIR Form No.

Monthly Percentage

2551M

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Tax Return

September 2005 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 For the Calendar Fiscal 3 For the month 4 Amended Return 5 Number of sheets attached

2 Year ended

12 20 1 3 12 20 1 3

(MM/YYYY) (MM/YYYY) Yes x No

Part I Background Information

6 TIN 7 RDO Code 8 Line of Business/

008 540 312 000 052 5529-Restauran

Occupation

9 Taxpayer's Name (For Individual)Last Name, First Name, Middle Name/(For Non-individual) Registered Name 10 Telephone Number

THE ORIGINAL AL-SHAMS RESTAURANT, INC.

11 Registered Address 12 Zip Code

66 A. Aguirre St., Brgy. BF Homes, Dist II, Paranaque City

13 Are you availing of tax relief under Special Law

or International Tax Treaty? Yes No If yes, specify

Part II Computation of Tax

Taxable Transaction/ AT C Taxable Amount Tax Rate Tax Due

Industry Classification

Sales/Receipts PT 010 92,560.50 3% 2,776.82

14A 14B 14C 14D 14E

15A 15B 15C 15D 15E

16A 16B 16C 16D 16E

17A 17B 17C 17D 17E

18A 18B 18C 18D 18E

19 Total Tax Due 19

20 Less: Tax Credits/Payments

20A Creditable Percentage Tax Withheld Per BIR Form No. 2307 (See Schedule 1) 20A

20B Tax Paid in Return Previously Filed, if this is an Amended Return 20B

21 Total Tax Credits/Payments (Sum of Items 20A & 20B) 21

22 Tax Payable (Overpayment) (Item 19 less Item 21) 22

23 Add: Penalties Surcharge Interest Compromise

23A 23B 23C 23D

2,776.82

24 Total Amount Payable/(Overpayment) (Sum of Items 22 and 23D) 24

If overpayment, mark one box only: To be Refunded To be issued a Tax Credit Certificate

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25 26

President/Vice President/Principal Officer/Accredited Tax Agent/ Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

(Signature Over Printed Name)

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

Tax Agent Acc. No./Atty's Roll No.(if applicable) Date of Issuance Date of Expiry TIN of Signatory

Part III Details of Payment

Drawee Bank/ Date Stamp of

Particulars Agency Number MM DD YYYY Amount Receiving Office/AAB

27 Cash/Bank 27A 27B 27C 27D and Date of Receipt

Debit Memo (RO's Signature/

28 Check 28A 28B 28C 28D Bank Teller's Initial)

29 Tax Debit 29A 29B 29C

Memo

30 Others 30A 30B 30C 30D

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

BIR FORM 2551M (ENCS)-PAGE 2

Schedule 1 Tax Withheld Claimed as Tax Credit

Period Covered Name of Withholding Agent Income Payments Tax Withheld Applied

Total (To Item 20A)

ALPHANUMERIC TAX CODE (ATC)

ATC Percentage Tax On: Tax Rate ATC Percentage Tax On: Tax Rate

PT 010 Persons exempt from VAT under Sec. 109v (Sec. 116) 3% PT 103 3) On royalties, rentals of property, real or personal, profits 7%

PT 040 Domestic carriers and keepers of garages 3% from exchange and all other gross income

PT 041 International Carriers 3% PT 104 4) On net trading gains within the taxable year on foreign currency,

PT 060 Franchises on gas and water utilities 2% debt securities, derivatives, and other financial instruments 7%

PT 070 Franchises on radio/TV broadcasting companies whose Tax on Other Non-Bank Financial Intermediaries not performing quasi-banking functions

annual gross receipts do not exceed P 10 M 3% 1) On interest, commissions and discounts from lending activities

Tax on banks and non-bank financial intermediaries performing quasi as well as income from financial leasing, on the basis of remaining

banking functions maturities of instruments from which such receipts are derived

1) On interest, commissions and discounts from lending PT 113 Maturity period is five (5) years or less 5%

activities as well as income from financial leasing, on PT 114 Maturity period is more than five (5) years 1%

the basis of remaining maturities of instruments from PT 115 2) From all other items treated as gross income under the code 5%

which such receipts are derived PT 120 Life Insurance premium 5%

PT 105 Maturity period is five (5) years or less 5% Agents of Foreign Insurance Companies

PT 101 Maturity period is more than five (5) years 1% PT 130 a) Insurance Agents 10%

PT 102 2) On dividends and equity shares and net income of PT 132 b) Owners of property obtaining insurance directly

subsidiaries 0% with foreign insurance companies 5%

BIR Form No. 2551M Percentage Tax Return

Guidelines and Instructions

You might also like

- Legal FormsDocument385 pagesLegal FormsromarcambriNo ratings yet

- Loan Agreement With MortgageDocument4 pagesLoan Agreement With MortgageromarcambriNo ratings yet

- Bir Annual Income Tax ReturnDocument5 pagesBir Annual Income Tax ReturnAldwin MamiitNo ratings yet

- Notes Payable Test Bank PDFDocument5 pagesNotes Payable Test Bank PDFAB CloydNo ratings yet

- Basic Everyday Journal EntriesDocument2 pagesBasic Everyday Journal EntriesMary73% (15)

- Courier Company Business PlanDocument35 pagesCourier Company Business PlanAdina Banea100% (3)

- Tax DoctrinesDocument67 pagesTax DoctrinesMinang Esposito VillamorNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Mail To LornaDocument27 pagesMail To Lornaapi-3740993No ratings yet

- Libel ElementsDocument4 pagesLibel ElementsromarcambriNo ratings yet

- Diaz vs. People - Estafa Lending MisappropriationDocument14 pagesDiaz vs. People - Estafa Lending MisappropriationromarcambriNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- TTV Midterm 26 Aug - Sample - 3Document8 pagesTTV Midterm 26 Aug - Sample - 3Steven NimalNo ratings yet

- H2 Economics Concepts & Summaries GuideDocument41 pagesH2 Economics Concepts & Summaries GuideGabriel TanNo ratings yet

- Fernandez Hermanos vs. Cir and CtaDocument1 pageFernandez Hermanos vs. Cir and CtamwaikeNo ratings yet

- 267731702final PDFDocument5 pages267731702final PDFelmarcomonal100% (1)

- 1702 July 08Document7 pages1702 July 08Jchelle Lustre DeligeroNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- 1601 CDocument6 pages1601 CJose Venturina Villacorta100% (1)

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Tomato KetchupDocument9 pagesTomato Ketchupygnakumar100% (3)

- Remo vs. SOJ - Syndicated EstafaDocument8 pagesRemo vs. SOJ - Syndicated EstafaromarcambriNo ratings yet

- Ikea Strategy AssessmentDocument6 pagesIkea Strategy Assessmentc.enekwe8981100% (1)

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12Document2 pagesMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12PingLomaadEdulanNo ratings yet

- 2551MDocument2 pages2551MAlexiss Mace JuradoNo ratings yet

- 02 2551 UnlockedDocument3 pages02 2551 Unlockedvg.aspirinNo ratings yet

- BIR Form 2551M Monthly Percentage TaxDocument3 pagesBIR Form 2551M Monthly Percentage TaxBaby BoyNo ratings yet

- 2551Document2 pages2551Mariluz BeltranNo ratings yet

- How To Fill Up Form 2307Document2 pagesHow To Fill Up Form 2307Emily Taguba LicatanNo ratings yet

- Return of Percentage Tax Payable Under Special Laws: Maria Belinda Nitura/ Coleen Duran TTH 9:30-11:00Document2 pagesReturn of Percentage Tax Payable Under Special Laws: Maria Belinda Nitura/ Coleen Duran TTH 9:30-11:00Anonymous 5wXJMHCNo ratings yet

- BIR Form 2551M Monthly Percentage Tax ReturnDocument1 pageBIR Form 2551M Monthly Percentage Tax ReturnLorraine Steffany BanguisNo ratings yet

- BIR Form 1601 c1Document2 pagesBIR Form 1601 c1Clarysse Faye VidalloNo ratings yet

- 2550 MDocument2 pages2550 MJose Venturina Villacorta100% (3)

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument3 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationKatherine OlidanNo ratings yet

- Improperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaDocument3 pagesImproperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaTrisha Mae Mendoza MacalinoNo ratings yet

- Quarterly Value-Added Tax Return: DLN: PsicDocument2 pagesQuarterly Value-Added Tax Return: DLN: PsicKaila Mae Tan DuNo ratings yet

- Annual Income Tax Return: A B C A B C A B C B C A B C A B C A B ADocument9 pagesAnnual Income Tax Return: A B C A B C A B C B C A B C A B C A B ArootspacificNo ratings yet

- BIR Form 1601-C GuideDocument2 pagesBIR Form 1601-C GuideDeebees Marie Erazo TumulakNo ratings yet

- TIPCO ESTATES QUARTERLY TAX RETURNDocument3 pagesTIPCO ESTATES QUARTERLY TAX RETURNJa'maine ManguerraNo ratings yet

- Monthly Value-Added Tax DeclarationDocument1 pageMonthly Value-Added Tax DeclarationGen ElloNo ratings yet

- 1702Q SGC - 2nd QTR 2019 FOR EMAILDocument31 pages1702Q SGC - 2nd QTR 2019 FOR EMAILJaylou BobisNo ratings yet

- 1702 QDocument3 pages1702 Qappipinnim50% (2)

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument3 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationJonNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument16 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationAnonymous KcI919LNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument2 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationVincent John RigorNo ratings yet

- Bir Form No. 1601 CDocument14 pagesBir Form No. 1601 CKatherine OlidanNo ratings yet

- MarioeFPS Home - EFiling and Payment SystemDocument2 pagesMarioeFPS Home - EFiling and Payment SystemEdward Roy “Ying” AyingNo ratings yet

- VAT Form Explains August 2020 Tax PositionDocument2 pagesVAT Form Explains August 2020 Tax PositionJa'maine ManguerraNo ratings yet

- 1701qjuly2008 (ENCS) q22019Document5 pages1701qjuly2008 (ENCS) q22019Andrew AndalNo ratings yet

- 1601c FormDocument8 pages1601c FormPingLomaadEdulanNo ratings yet

- 2000 XHTMLDocument2 pages2000 XHTMLJanniza RoceroNo ratings yet

- 2551Q Jan 2018 ENCS Final Rev 3Document2 pages2551Q Jan 2018 ENCS Final Rev 3MIS MijerssNo ratings yet

- Easterbloom 2550M - 082022Document2 pagesEasterbloom 2550M - 082022Reyes Accounting Law OfficeNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment Systemmelanie venturaNo ratings yet

- 1707 SunerDocument2 pages1707 SunerGSAFINNo ratings yet

- Problem 5-1 QuarterDocument6 pagesProblem 5-1 QuarterAlexis KingNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument4 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNo ratings yet

- Value Added Tax (Quarterly)Document6 pagesValue Added Tax (Quarterly)Kaisha CastroNo ratings yet

- Bir GinaDocument1 pageBir GinaApril ManjaresNo ratings yet

- Group 7 - Project No. 3 - BIR Form No. 1801Document2 pagesGroup 7 - Project No. 3 - BIR Form No. 1801Shane Nicole PepitoNo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- Quarterly Income Tax Return: 12 - December 056Document2 pagesQuarterly Income Tax Return: 12 - December 056Cha GomezNo ratings yet

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnFrancis M. TabajondaNo ratings yet

- Monthly Percentage Tax Return: 12 - December 04 - AprilDocument1 pageMonthly Percentage Tax Return: 12 - December 04 - AprilTamara HamiltonNo ratings yet

- 1801 SilvozaDocument1 page1801 SilvozaKate Hazzle JandaNo ratings yet

- Quarterly Value-Added Tax Return: (Cumulative For 3 Months)Document1 pageQuarterly Value-Added Tax Return: (Cumulative For 3 Months)Games NathanNo ratings yet

- 2550-M October-2022Document2 pages2550-M October-2022Jing ReyesNo ratings yet

- BIR Form 2551 - PDFDocument1 pageBIR Form 2551 - PDFMichael LaquianNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Polon Plantation vs. Inson GR No. 189162Document26 pagesPolon Plantation vs. Inson GR No. 189162Heberdon LitaNo ratings yet

- Degayo v. Dinglasan Full Text Word FileDocument7 pagesDegayo v. Dinglasan Full Text Word FileCinNo ratings yet

- Use of Falsified Docs by LawyersDocument5 pagesUse of Falsified Docs by LawyersromarcambriNo ratings yet

- For2017 Gis Revised Foreign 01Document4 pagesFor2017 Gis Revised Foreign 01Regine Mae SandajanNo ratings yet

- Sticker PlannerDocument1 pageSticker PlannerromarcambriNo ratings yet

- Certiorari Vs Appeal, Remedy of Dismissal of MTD - Madrigal vs. LapandayDocument8 pagesCertiorari Vs Appeal, Remedy of Dismissal of MTD - Madrigal vs. LapandayromarcambriNo ratings yet

- Right of First Refusal - Tanay vs. FaustoDocument13 pagesRight of First Refusal - Tanay vs. FaustoromarcambriNo ratings yet

- Chavez Vs PEADocument49 pagesChavez Vs PEAromarcambriNo ratings yet

- Garcia vs. Ombudsman - Sec.3 (E) RA 3019Document12 pagesGarcia vs. Ombudsman - Sec.3 (E) RA 3019romarcambriNo ratings yet

- CIR vs. Metro Star SuperamaDocument18 pagesCIR vs. Metro Star SuperamapaokaeNo ratings yet

- Tenenglian vs. Lorenzo - Ancestral DomainDocument34 pagesTenenglian vs. Lorenzo - Ancestral DomainromarcambriNo ratings yet

- Malabanan v. RepublicDocument9 pagesMalabanan v. RepublicelizbalderasNo ratings yet

- Active Woods DoctrineDocument17 pagesActive Woods DoctrineromarcambriNo ratings yet

- SC Internal RulesDocument27 pagesSC Internal RulesromarcambriNo ratings yet

- COMELEC Ruling on Philippine Mayoral Candidate's EligibilityDocument11 pagesCOMELEC Ruling on Philippine Mayoral Candidate's EligibilityromarcambriNo ratings yet

- Venue 9262Document9 pagesVenue 9262Faye Jennifer Pascua PerezNo ratings yet

- Buyer in Good Faith Calma vs. LachicaDocument8 pagesBuyer in Good Faith Calma vs. LachicaromarcambriNo ratings yet

- Right To EcologyDocument24 pagesRight To EcologyromarcambriNo ratings yet

- July 26, 2017 G.R. No. 220458 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee ROSARIO BALADJAY, Accused-Appellant Decision Velasco, JR., J.Document11 pagesJuly 26, 2017 G.R. No. 220458 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee ROSARIO BALADJAY, Accused-Appellant Decision Velasco, JR., J.romarcambriNo ratings yet

- Suhuri Vs Comelec Full CaseDocument11 pagesSuhuri Vs Comelec Full CaseStella MarianitoNo ratings yet

- Arias DoctrineDocument20 pagesArias DoctrineromarcambriNo ratings yet

- Maquiling vs. ComelecDocument17 pagesMaquiling vs. ComelecLodi DisasterNo ratings yet

- 24Document5 pages24ReemNo ratings yet

- Qualified TheftDocument5 pagesQualified TheftromarcambriNo ratings yet

- Buyer in Good FaithDocument11 pagesBuyer in Good FaithromarcambriNo ratings yet

- Types of CompensationDocument9 pagesTypes of CompensationthuybonginNo ratings yet

- Problem No. 1: Accounting For Partnership Do-It - Yourself: Problem SetsDocument3 pagesProblem No. 1: Accounting For Partnership Do-It - Yourself: Problem Setstide podsNo ratings yet

- MBA82034568rAccrDr - MCQ With Solution Accounting Concepts and ConventionsDocument5 pagesMBA82034568rAccrDr - MCQ With Solution Accounting Concepts and ConventionsRamNo ratings yet

- City of Hamilton Cemeteries Business Plan Strateg - PW15075AppADocument26 pagesCity of Hamilton Cemeteries Business Plan Strateg - PW15075AppAThe Hamilton SpectatorNo ratings yet

- Phuket CaseDocument4 pagesPhuket Casejperez1980100% (1)

- Me Assignment 1 Bbce3013Document8 pagesMe Assignment 1 Bbce3013Murugan RS100% (1)

- Sheikh Nadeem AhmedDocument19 pagesSheikh Nadeem Ahmednira_110No ratings yet

- Pre Merger and Post Merger Position of ICICI BankDocument44 pagesPre Merger and Post Merger Position of ICICI BankKrutika sutar0% (1)

- IMF Report Sri LankaDocument95 pagesIMF Report Sri LankaGayan Nayanapriya Heva MasmullaNo ratings yet

- Ebook College Accounting 12Th Edition Slater Solutions Manual Full Chapter PDFDocument60 pagesEbook College Accounting 12Th Edition Slater Solutions Manual Full Chapter PDFkhucly5cst100% (10)

- Budgeting Process On OngcDocument78 pagesBudgeting Process On Ongcvipul tandonNo ratings yet

- ICAP MSA 1 AdditionalPracticeQuesDocument34 pagesICAP MSA 1 AdditionalPracticeQuesAsad TariqNo ratings yet

- 138Document12 pages138Steve LyjuNo ratings yet

- Working Capital Mangament FM AssignmntDocument11 pagesWorking Capital Mangament FM AssignmntHimanshu PaliwalNo ratings yet

- Process of Fundamental Analysis PDFDocument8 pagesProcess of Fundamental Analysis PDFajay.1k7625100% (1)

- Group Project & Presentation InstructionsDocument7 pagesGroup Project & Presentation InstructionsftnNo ratings yet

- Maddox Fine Art - MayfairDocument21 pagesMaddox Fine Art - MayfairGuy WilkinsonNo ratings yet

- CAPITALISM 2 Business Simulation GuidelinesDocument4 pagesCAPITALISM 2 Business Simulation GuidelinesAnthonyTiuNo ratings yet

- Balance Sheet InformationDocument13 pagesBalance Sheet InformationBRAINSTORM Haroon RasheedNo ratings yet

- ACCA P7 Workbook Q&A InsightsDocument80 pagesACCA P7 Workbook Q&A InsightsLorena BallaNo ratings yet