Professional Documents

Culture Documents

Towncall Rural Bank Notes

Uploaded by

Judith CastroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Towncall Rural Bank Notes

Uploaded by

Judith CastroCopyright:

Available Formats

TOWNCALL RURAL BANK, INC.

G/F Towncall Building, Maharlika Highway, Cabanatuan City

NOTES TO FINANCIAL STATEMENTS

As of December 31,2016

Note 1: Corporate Organization/Information

The Towncall Rural Bank, Inc. was registered with the Securities and Exchange Commission

(SEC) on November 6, 1997 with Registration No. A1997-20695. Consequently, on November 28,

1997, the bank was authorized by the Bangko Sentral ng Pilipinas (BSP) to engage in rural

banking business, thus the bank opened its doors to public on December 8, 1997.

The Banks registered head office address is located at G/F Towncall Bldg., Maharlika Highway,

Cabanatuan City, Nueva Ecija. The Bank has 5 branches located at the municipalities of:

Branch

1.) Guimba, Nueva Ecija

2.) Talavera, Nueva Ecija

3.) Rizal, Nueva Ecija

4.) Victoria, Tarlac

5.) Urdaneta, Pangasinan

The banks products and services are traditional deposits such as: savings deposit, certificate of

time deposits, special savings deposits and demand deposits. The bank also offers various types

of loans such as commercial and agricultural loans.

The financial statements of the bank were approved and authorized for issue by the Board of

Directors on March 15, 2017.

Status of Operation

The bank is in the development stage, expanding its operation through additional capital infusion.

The financial statements were prepared on a going concern basis. The going concern basis

assumes that the bank will continue in operation for the foreseeable future and will be able to

realize its assets and discharge its liabilities and commitments in the normal course of business.

Note 2 : Summary of Significant Accounting Policies

The accounting and reporting policies of TOWNCALL RURAL BANK, INC. conform with the

generally accepted accounting principles in the Philippines (Philippine GAAP) and with

accounting and reporting guidelines prescribed by the Bangko Sentral ng Pilipinas Manual of

Rules and Regulations. The bank also adopts the Philippine Financial Reporting Standards (PFRS)

and Philippine Accounting Standards (PAS) in preparing its financial statements. However, in

cases of conflicts between the BSP regulation and the PFRS/PAS, the BSP regulation prevails.

Basis of Measurement in the Preparation of Financial Statements

The financial statements of the bank are carried at historical costs net of any accumulated

depreciation/amortization and impairment losses, except for those items specifically provided to be

carried at fair value under PAS 39.

Statement of Compliance with PFRS

The financial statements of the bank have been prepared in compliance with Philippine Financial

Reporting Standards (PFRS).

Page 9 of 42

AFS 2016 _ Towncall Rural Bank, Inc.

TOWNCALL RURAL BANK, INC.

G/F Towncall Building, Maharlika Highway, Cabanatuan City

SCHEDULE OF PFRS AND PAS

As of December 31,2016

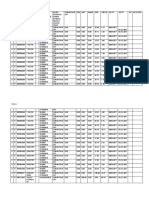

STANDARDS Adopted, Not Adopted

or Not Applicable

Philippine Financial Reporting Standards (PFRSs)

PFRS 1 First-time Adoption of Philippine Financial Reporting Standards Adopted

PFRS 2 Share-based Payments Not Applicable

PFRS 3 Business Combinations Not Applicable

PFRS 4 Insurance Contracts Not Applicable

PFRS 5 Non-current Assets Held for Sale and Discontinued Operations Adopted

PFRS 6 Exploration for and Evaluation of Mineral Resources Not Applicable

PFRS 7 Financial Instruments: Disclosures Adopted

PFRS 8 Operating Segments Not Applicable

Philippine Accounting Standards (PASs)

PAS 1 Presentation of Financial Statements Adopted

PAS 7 Cash Flow Statements Adopted

PAS 8 Accounting Policies, Changes in Accounting Estimates and Errors Adopted

PAS 10 Events after the Balance Sheet Date Adopted

PAS11 Construction Contracts Not Applicable

PAS 12 Income Taxes Adopted

PAS 16 Property, Plant and Equipment Adopted

PAS 17 Leases Adopted

PAS 18 Revenue Adopted

PAS 19 Employee Benefits Adopted

PAS 20 Accounting for Government Grants and Disclosure of Government Not Applicable

Assistance

PAS 21 The Effects of Changes in Foreign Exchange Rates Not Applicable

PAS 23 Borrowing Costs Adopted

PAS 24 Related Party Disclosures Adopted

PAS 26 Accounting and Reporting by Retirement Benefit Plans Adopted

PAS 27 Consolidated and Separate Financial Statements Not Applicable

PAS 28 Investments in Associates Not Applicable

PAS 29 Financial Reporting in Hyperinflationary Economies Not Applicable

PAS 30 Disclosures in the Financial Statements of Banks and Similar Adopted

Financial Institutions

PAS 31 Interests in Joint Venture Not Applicable

PAS 32 Financial Instruments: Presentation Adopted

PAS 33 Earnings per Share Adopted

PAS 34 Interim Financial Reporting Adopted

PAS 36 Impairment of Assets Adopted

PAS 37 Provisions, Contingent Liabilities and Contingent Assets Adopted

PAS 38 Intangible Assets Adopted

PAS 39 Financial Instruments: Recognition and Measurements Adopted

PAS 40 Investment Property Adopted

PAS 41 Agriculture Not Applicable

Page 8 of 42

AFS 2016 _ Towncall Rural Bank, Inc.

Below are the specific accounting policies and procedures adopted by the bank

PAS 1 Presentation of Financial Statements. The objective of the standard is to prescribe the

basis for presentation of general purpose financial statements of previous periods and with

the financial statements of other entities. To achieve this objective, the standard sets out

overall requirements for the presentation of financial statements, guidelines for their

structure and minimum requirements for their content. The recognition, measurement and

disclosure of specific transactions and other events are dealt with in other standards and

interpretations.

PAS 7 Cash Flow Statements. The objective of the standard is to require the provision of

information about the historical changes in cash and cash equivalents of an entity by means

of cash flow statement which classifies cash flow during the period from operating, investing

and financing activities.

PAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. The objective of

the standard is to prescribe the criteria for selecting and changing accounting policies,

together with the accounting treatment and disclosure of changes in accounting policies,

changes in accounting estimates and correction of errors. Tine standard is intended to

enhance the relevance and reliability of an entitys financial statements and the comparability

of those financial statements over time and with the financial statements of other entities.

PAS 10 Events After the Balance Sheet Date. The objective of the standard is to prescribe

when an entity should adjust its financial statements for events after the balance sheet date;

and the disclosures that an entity should give about the date when the financial statements

were authorized for issue and about events after the balance sheet date.

PAS 12 Income Taxes. The objective of the standard is to prescribe the accounting treatment

for income taxes. The major issue in this standard is on how to account for the current and

future tax consequence of: (a) the future recovery (settlement) of the carrying amount of

assets (liabilities) that are recognized in an entitys balance sheet; and (b) transactions and

other events of the current period that are recognized in an entitys financial statements.

PAS 16 Property, Plant & Equipment. This standard prescribes the accounting treatment

for property, plant and equipment so that users of the financial statements can discern

information about the entitys investment in its plant, property & equipment and the changes

in such investment. This standard provides the accounting for the recognition of assets, the

determination of their carrying amounts and the depreciation charges and impairment

losses to be recognized in relation to them.

PAS 17 Leases. Under this standard, an entity shall adopt the accounting for leases for

lessors and lessees including appropriate disclosures thereon. This standard requires an

entity to classify its lease contract whether an operating lease or finance lease. Proper

accounting treatment for operating and finance lease shall be governed under this standard.

PAS 18 Revenue. This standard provides the guidelines in determining when to recognize

revenue. Revenue is recognized when it is probable that future economic benefits will flow to

the entity and these benefits can be measured reliably. This standard identifies the

circumstances in which these criteria will be met and, therefore, revenue will be recognized.

It also provides practical guidelines on the application of these criteria.

PAS 19 Employee Benefits. The objective of this standard is to prescribe the accounting

and disclosure for employee benefits. The standard requires an entity to recognize: (a) a

liability when an employee has provided services in exchange for employee benefits to be

paid in the future; and (b) an expense when the entity consumes the economic benefit

arising from services provided by an employee in exchange for employee benefits.

PAS 23 Borrowing Costs. The objective of this Standard is to prescribe the accounting

treatment for borrowing cost. This standard generally requires the immediate expensing of

borrowing cost. However, the Standard permits, as an allowed alternative treatment, the

capitalization of borrowing costs that are directly attributable to the acquisition, construction

or production of a qualifying asset.

Page 10 of 42

AFS 2016 _ Towncall Rural Bank, Inc.

4,675,000.00

4,675,000.00

Accrued Expenses and Other Liabilities

Carrying Values P 3,214,965.94 3,208,991.02

Fair Values 3,214,965.94 3,208,991.02

Since the fair values of financial assets and financial liabilities are not readily measurable due to lack of

available and/or published quotations, the fair values of the financial assets and financial liabilities are

simply measured through the yearly provisions of credit losses and periodic impairment testing.

Note 5 : Cash and Cash Equivalents

This account consists of following:

Due from Bangko Sentral ng Pilipinas represents the balance of the deposit account maintained against

deposit liabilities. This is the accumulated total required reserves paid by the bank against its deposit

liabilities.

Year 2016 Year 2015

Cash on Hand P 3,845,216.41 3,217,542.97

Checks and Other Cash Items 0.00 0.00

Due from Bangko Sentral ng Pilipinas 7,678,733.30 7,721,961.61

Due from Other Banks 119,726,686.15 91,298,840.67

Total P 131,250,635.86 102,238,345.25

The Due from Other Banks account consists of deposits to various depository banks which are used for

the banks operations. The breakdown of which are as follows:

Year 2016 Year 2015

Name of Bank

Amount % Amount %

Land Bank of the Philippines P 173,966.52 0.15% 128,999.24 0.14%

Rizal Commercial Banking Corp. 22,564,611.10 18.85% 22,045,156.97 24.15%

Banco de Oro 995,763.16 0.83% 1,000,299.64 1.10%

China Bank 3,074,798.50 2.57% 3,294,726.28 3.61%

China Bank Saving 3,436,895.22 2.87% 12,082,894.80 13.23%

Union Bank 116,582.96 0.10% 240,835.62 0.26%

Planters Bank 0.00 0.00% 2,584,999.11 2.83%

PBCom 5,073,472.22 4.24% 9,161,924.74 10.04%

Cabanatuan City Rural Bank 334,766.00 0.28% 325,381.72 0.36%

Security Bank 0.00 0.00% 0.00 0.00%

Bank of Commerce 27,319,905.36 22.82% 10,086,883.25 11.05%

Producers Bank 4,198,465.08 3.51% 1,764,941.69 1.93%

Philippine National Bank Savings 22,232,780.17 18.57% 0.00 0.00%

Philippine National Bank 671,930.54 0.56% 665,570.67 0.73%

Eastwest Bank 18,783,288.84 15.69% 17,205,106.87 18.84%

Maybank 10,749,460.48 8.98% 10,711,120.07 11.73%

Totals P 119,726,686.15 100.00% 91,298,840.67 88.27%

As of December 31, 2016, the banks SBL was registered at P18,413,950.00 and as per BSP Manual of

Regulations Sec X303, banks are exempted on the ceiling of single borrowers limit (SBL) of 25% on

deposit/investment placements to government banks, however excess of SBL on private banks are being

considered if the accounts are used for check clearing in connection with its business operations and as per

BSP Circular No. 734, Loans and other credit accommodations as well as deposits and usual guarantees b

Page 27 of 42

AFS 2016 _ Towncall Rural Bank, Inc.

Bills Payable P 4,760,000.00

Carrying 4,760,000.00

Values Fair

Values

You might also like

- IPSAS Detil StandardDocument94 pagesIPSAS Detil StandardMaya IndriNo ratings yet

- IPSAS 1 Overview: Public Sector Financial Reporting StandardDocument93 pagesIPSAS 1 Overview: Public Sector Financial Reporting StandardNur AsniNo ratings yet

- Making A List of IAS and IFRS As Adopted by BangladeshDocument9 pagesMaking A List of IAS and IFRS As Adopted by BangladeshAbir Hasan ApurboNo ratings yet

- Group 3 - ReportDocument104 pagesGroup 3 - ReportRenelle HabacNo ratings yet

- Accounting Standards: RTI, Jaipur 1Document24 pagesAccounting Standards: RTI, Jaipur 1Shubham M PariharNo ratings yet

- ASP (Kelompok 6)Document19 pagesASP (Kelompok 6)Analeya DewiNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate Governanceroman empireNo ratings yet

- Montenegro Tabular Schedule of Standards and Interpretations 2019Document6 pagesMontenegro Tabular Schedule of Standards and Interpretations 2019Kathleen LeynesNo ratings yet

- BalanceSheetDisclosures AnIFRS PFRSComplianceReportofTenPubliclyListedCompaniesintheFoodIndustryDocument17 pagesBalanceSheetDisclosures AnIFRS PFRSComplianceReportofTenPubliclyListedCompaniesintheFoodIndustryMikx LeeNo ratings yet

- Course Module - Chapter 1 - Overview of Government AccountingDocument13 pagesCourse Module - Chapter 1 - Overview of Government Accountingssslll2No ratings yet

- Philippine Financial Accounting StandardsDocument2 pagesPhilippine Financial Accounting Standardsr2radie100% (1)

- Ppsas 1Document87 pagesPpsas 1neo14No ratings yet

- List of Pfrs 2018Document5 pagesList of Pfrs 2018Myda Rafael100% (1)

- 1.3) Accounting StandardsDocument15 pages1.3) Accounting StandardsF93 SHIFA KHANNo ratings yet

- SH Co. NotesDocument15 pagesSH Co. NotesJojo GumacalNo ratings yet

- PFRSDocument6 pagesPFRSVrix Ace MangilitNo ratings yet

- USJ-R Business School Updates on PFRS StandardsDocument4 pagesUSJ-R Business School Updates on PFRS StandardsLee Suarez100% (1)

- Accounting Standards: RTI, Jaipur 1Document24 pagesAccounting Standards: RTI, Jaipur 1GeetikaNo ratings yet

- SH CO. NOTES-konti Na LangDocument15 pagesSH CO. NOTES-konti Na LangDare QuimadaNo ratings yet

- The Professional CPA Review School: Advanced Financial Accounting & Reporting Summary Notes On Government AccountingDocument14 pagesThe Professional CPA Review School: Advanced Financial Accounting & Reporting Summary Notes On Government Accountingjohn francisNo ratings yet

- 01 - Company A - IFRS Conversion 2018Document62 pages01 - Company A - IFRS Conversion 2018Nguyen Binh MinhNo ratings yet

- TOA DLSU Revdevt Lecture 1 - Intro To PFRS (2TAY1415)Document12 pagesTOA DLSU Revdevt Lecture 1 - Intro To PFRS (2TAY1415)Nonami AbicoNo ratings yet

- Updates From The PRBoADocument68 pagesUpdates From The PRBoAJofritz ValleNo ratings yet

- Accounting Standards for Non Going Concern Entities 1709923353Document36 pagesAccounting Standards for Non Going Concern Entities 1709923353Bilal Ahmed KhanNo ratings yet

- Overview Obnbn PPSASDocument44 pagesOverview Obnbn PPSASJenofDulwn0% (1)

- Notes To Philippine Financial Reporting Standards and Philippine Accounting StandardDocument97 pagesNotes To Philippine Financial Reporting Standards and Philippine Accounting StandardLuduvina PerloraNo ratings yet

- Indian Accounting StandardsDocument26 pagesIndian Accounting StandardsISHANJALI MADAAN 219005No ratings yet

- Basic of AS & AS 1Document19 pagesBasic of AS & AS 1Harsh JainNo ratings yet

- Akuntansi Sektor Publik Ipsas Dan SapDocument107 pagesAkuntansi Sektor Publik Ipsas Dan SapVincenttio le Cloud100% (1)

- Toa Pas 1 Financial StatementsDocument14 pagesToa Pas 1 Financial StatementsreinaNo ratings yet

- Important Dates:: The Nature and Operations of IASBDocument11 pagesImportant Dates:: The Nature and Operations of IASBMohamed DiabNo ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsBobby VisitacionNo ratings yet

- Electronic Way Bill Under GSTDocument46 pagesElectronic Way Bill Under GSTDeepak WadhwaNo ratings yet

- Philippine Financial Reporting Standards: Number TitleDocument3 pagesPhilippine Financial Reporting Standards: Number TitleMariaNo ratings yet

- ICAI accounting standards overviewDocument13 pagesICAI accounting standards overviewprash1820No ratings yet

- D' St. Patrick Lending Services CorporationDocument6 pagesD' St. Patrick Lending Services CorporationMax LopezNo ratings yet

- Volume I GAMDocument85 pagesVolume I GAMEL YzNo ratings yet

- The PPSAS and The Revised Chart of AccountsDocument98 pagesThe PPSAS and The Revised Chart of AccountsDaniel Salmorin87% (15)

- SBR Study Notes - 2018 - FinalDocument293 pagesSBR Study Notes - 2018 - Finalprerana pawar100% (2)

- Accounting Standards, Gaap, Ifrs: 1 Dr. Varadraj BapatDocument42 pagesAccounting Standards, Gaap, Ifrs: 1 Dr. Varadraj BapatAbdullah AminNo ratings yet

- Accounting Standards S.ClementDocument109 pagesAccounting Standards S.Clementabhi_chess22No ratings yet

- GSIS SIF Notes - To - FS 2006Document24 pagesGSIS SIF Notes - To - FS 2006marielNo ratings yet

- Accounting StandardsDocument109 pagesAccounting StandardsJugal Shah100% (1)

- Accounting Standards Tanmay AroraDocument133 pagesAccounting Standards Tanmay AroratanmayaroraNo ratings yet

- IFRS Standard to Reform Bangladesh AccountingDocument10 pagesIFRS Standard to Reform Bangladesh AccountingHasiba Binte HannanNo ratings yet

- Financial Management & Administrative Policy Manual: NasblaDocument32 pagesFinancial Management & Administrative Policy Manual: NasblaSyed Fawad AhmadNo ratings yet

- SBR Revision NotesDocument294 pagesSBR Revision Notesbubbly100% (2)

- IPSAS Accrual Standards Issued To Date Based On IFRSs - 14.03.2019Document8 pagesIPSAS Accrual Standards Issued To Date Based On IFRSs - 14.03.2019EmekaNo ratings yet

- ASFR - Unit 2 - 2024Document89 pagesASFR - Unit 2 - 2024vishalsingh9669No ratings yet

- Income ChecklistDocument17 pagesIncome ChecklistbanglauserNo ratings yet

- Chapter 1: Framework of AccountingDocument3 pagesChapter 1: Framework of AccountingMhae DuranNo ratings yet

- SOCPA IFRS Transition ProjectDocument51 pagesSOCPA IFRS Transition ProjectArslan Zafar0% (1)

- GAM-govacco NotesDocument3 pagesGAM-govacco NoteshoxhiiNo ratings yet

- Panma Oil Ltd.Document46 pagesPanma Oil Ltd.Shagor AhmedNo ratings yet

- As PDFDocument158 pagesAs PDFShivam GuptaNo ratings yet

- Kế Toán Quốc Tế 1: Nguyễn Đình Hoàng UyênDocument56 pagesKế Toán Quốc Tế 1: Nguyễn Đình Hoàng UyênHồ Đan ThụcNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Marrion Jacob BDocument7 pagesMarrion Jacob BJudith CastroNo ratings yet

- Final N Tlga KkaninDocument1 pageFinal N Tlga KkaninJudith CastroNo ratings yet

- Chapter 12—Electronic Commerce SystemsDocument12 pagesChapter 12—Electronic Commerce SystemsPatricia Ann GuetaNo ratings yet

- MarchDocument2 pagesMarchJudith CastroNo ratings yet

- Final N Tlga KkaninDocument1 pageFinal N Tlga KkaninJudith CastroNo ratings yet

- OJT RequirementsDocument1 pageOJT RequirementsJudith CastroNo ratings yet

- RESA Final Preboard P1Document10 pagesRESA Final Preboard P1rjn191% (11)

- Aud. Rep Basis FormatDocument2 pagesAud. Rep Basis FormatJudith CastroNo ratings yet

- Branches of GovernmentDocument1 pageBranches of GovernmentJudith CastroNo ratings yet

- Chapter 9 - Shareholders' Equity ReviewDocument12 pagesChapter 9 - Shareholders' Equity ReviewLouie De La Torre50% (4)

- January. DoxDocument3 pagesJanuary. DoxJudith CastroNo ratings yet

- Account statement summary reportDocument2 pagesAccount statement summary reportJudith CastroNo ratings yet

- Ojt Performance Evaluation Form: General Impressions and Observations of The TraineeDocument1 pageOjt Performance Evaluation Form: General Impressions and Observations of The TraineeJudith CastroNo ratings yet

- CBA-Wesleyan University OJT AgreementDocument3 pagesCBA-Wesleyan University OJT AgreementJudith CastroNo ratings yet

- Endorsement Letterbsa HimherDocument2 pagesEndorsement Letterbsa HimherJudith CastroNo ratings yet

- WaiverDocument1 pageWaiverJudith CastroNo ratings yet

- February DoxDocument3 pagesFebruary DoxJudith CastroNo ratings yet

- TypeDocument3 pagesTypeJudith CastroNo ratings yet

- 2.agency Problem Principal-AgentDocument6 pages2.agency Problem Principal-AgentJudith Castro100% (1)

- Types of Corporate Takeovers ExplainedDocument9 pagesTypes of Corporate Takeovers ExplainedJudith CastroNo ratings yet

- Bank's Risk Management ProcessDocument2 pagesBank's Risk Management ProcessJudith CastroNo ratings yet

- Page 1 To 5Document6 pagesPage 1 To 5Judith CastroNo ratings yet

- Towncall Rural Bank, Inc.: To Adjust Retirement Fund Based On Retirement Benefit Obligation BalanceDocument1 pageTowncall Rural Bank, Inc.: To Adjust Retirement Fund Based On Retirement Benefit Obligation BalanceJudith CastroNo ratings yet

- Towncall Rural Bank, Inc.: To Adjust Retirement Fund Based On Retirement Benefit Obligation BalanceDocument1 pageTowncall Rural Bank, Inc.: To Adjust Retirement Fund Based On Retirement Benefit Obligation BalanceJudith CastroNo ratings yet

- Page 18 To 19Document2 pagesPage 18 To 19Judith CastroNo ratings yet

- Chapter 5 Regulatory Agencies and Corporate Governance MCQDocument3 pagesChapter 5 Regulatory Agencies and Corporate Governance MCQJudith CastroNo ratings yet

- Page32 34 38 39Document4 pagesPage32 34 38 39Judith CastroNo ratings yet

- Page 11 To 14Document6 pagesPage 11 To 14Judith CastroNo ratings yet

- Bank loan allowance provisionsDocument3 pagesBank loan allowance provisionsJudith CastroNo ratings yet

- Annex 30 - BRSDocument1 pageAnnex 30 - BRSLikey PromiseNo ratings yet

- Bdo Service Slip Final 1Document1 pageBdo Service Slip Final 1Ivy Maril De Guzman-ViernesNo ratings yet

- Regions Bank StatementDocument2 pagesRegions Bank StatementGalarraga H AbrahamNo ratings yet

- Study On Corporate Salary and Its Services Of: "HDFC Bank"Document77 pagesStudy On Corporate Salary and Its Services Of: "HDFC Bank"sahil malhotraNo ratings yet

- Form S: Deposit Slip Withdrawal Slip Deposit Slip Personal ChequeDocument4 pagesForm S: Deposit Slip Withdrawal Slip Deposit Slip Personal ChequeNathalia LeonadoNo ratings yet

- Banking Basics: Understanding Commercial BanksDocument136 pagesBanking Basics: Understanding Commercial BanksAppleNo ratings yet

- Study Material Question Bank and Answer Key Economics: Money and CreditDocument14 pagesStudy Material Question Bank and Answer Key Economics: Money and CreditsaanviNo ratings yet

- Bank DOCUMENTSDocument30 pagesBank DOCUMENTSHoity ToityNo ratings yet

- Internship Report BankDocument28 pagesInternship Report BankHumera TariqNo ratings yet

- VPBank AR 2018 ENGDocument69 pagesVPBank AR 2018 ENGNguyễn Gia Phương AnhNo ratings yet

- Bahan Uas English Definisi WadiahDocument3 pagesBahan Uas English Definisi WadiahVarul EfandiNo ratings yet

- What Is An Agent Bank?Document6 pagesWhat Is An Agent Bank?hossain al fuad tusharNo ratings yet

- United States v. Wilson, 4th Cir. (2006)Document5 pagesUnited States v. Wilson, 4th Cir. (2006)Scribd Government DocsNo ratings yet

- Anderson Nat. Bank v. Luckett - Deposits Are Debtor Obligations of BankDocument121 pagesAnderson Nat. Bank v. Luckett - Deposits Are Debtor Obligations of Bankgoldilucks0% (1)

- Financial Institutions AssignmentDocument22 pagesFinancial Institutions AssignmentProbortok Somaj80% (5)

- Affidavait IndemnityDocument3 pagesAffidavait Indemnitynagarajan vmNo ratings yet

- Bank Financial Statements: Format of Bank Balance SheetDocument10 pagesBank Financial Statements: Format of Bank Balance SheetMannavan ThiruNo ratings yet

- Fundamentals of Banking and Finance NC BF ModuleDocument62 pagesFundamentals of Banking and Finance NC BF ModuleLiliosa MutsauriNo ratings yet

- Section 5 To Section 13Document12 pagesSection 5 To Section 13Leogen TomultoNo ratings yet

- FORM 16 TITLEDocument5 pagesFORM 16 TITLEPunitBeriNo ratings yet

- Icici BankDocument56 pagesIcici BankvishwanathvrNo ratings yet

- BFN 405-LendingDocument207 pagesBFN 405-Lendingjoshua omondiNo ratings yet

- The Mauritius Deposit Insurance Scheme Act 2019 - An OverviewDocument1 pageThe Mauritius Deposit Insurance Scheme Act 2019 - An OverviewAshvin RamgoolamNo ratings yet

- Fees and ChargesDocument59 pagesFees and ChargesgivamathanNo ratings yet

- LANDBANK iAccess FAQs: Everything You Need to Know About LANDBANK's Online Banking ServiceDocument13 pagesLANDBANK iAccess FAQs: Everything You Need to Know About LANDBANK's Online Banking ServiceallanjulesNo ratings yet

- RM ONB - Basic BankingDocument62 pagesRM ONB - Basic BankingAAKASH SINGHNo ratings yet

- Introducing RenmoneyDocument1 pageIntroducing RenmoneyfolushoNo ratings yet

- Document BackupDocument2 pagesDocument BackupgarrettloehrNo ratings yet

- Unit 3 Financial Services: An Introduction: ObjectivesDocument19 pagesUnit 3 Financial Services: An Introduction: ObjectivesKashif UddinNo ratings yet

- BankerSecretHandBook IIDocument350 pagesBankerSecretHandBook IIMelissaAndrews100% (7)