Professional Documents

Culture Documents

REST0004 - Assignment 1 - 2017

Uploaded by

Brian DeanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

REST0004 - Assignment 1 - 2017

Uploaded by

Brian DeanCopyright:

Available Formats

REST0004: Property Finance

Session 1 2017

Assignment 1

Due date: FRIDAY 28th April 2017

Individual assignment

Assignment assessment weighting: 40%

Assignment Topic

You have recently commenced a new role as Chief Financial Officer at a large

institutional property fund manager. Your CEO has decided it will create a new

unlisted property fund (The Fund) with a capital allocation of A$500 million for

investment in the Australian real estate market.

The Funds investment objectives are as follows:

a) The Funds investment time horizon is for at least 10 years.

b) The target total return for the Fund is inflation (CPI) + 9% with a variable risk

tolerance.

c) The target allocation to listed property is 30%, with the remaining to be

allocated between unlisted, direct and development structures.

d) The Fund will primarily invest in Core sectors but may have up to 30% of its

allocation in opportunistic, development or non-core sectors. The target sector

allocations are to 30% office, 30% retail and 10% industrial and 30% other.

e) Investments in listed property will be selected only from the REITs included in

the S&P/ASX 200 A-REIT index.

f) The Fund will not itself have borrowings although it may invest in vehicles that

are geared.

g) No investment in any underlying asset or fund will account for more than 25%

of total assets.

You are asked to prepare a discussion paper to be submitted to your CEO and

Board of Directors which outlines an investment strategy that will meet the Funds

investment objectives.

Content

Your paper needs to discuss and evaluate the following areas:

1. Property investment landscape

REST0004: Property & Investment Finance [1] Assignment 1 - 2017

Discuss the main forms of property investment & development in Australia. You will

need to explain the benefits and risks of investing in the respective sectors.

2. Property investment market and performance

a) Discuss the performance of the non-residential property investment market over

time. You will need to compare and contrast investment returns across the core

property sector markets of retail, office and industrial. You should highlight key

drivers of investment performance and your expectation for trends over the next 3-5

years.

b) Should you propose to allocate some of the Funds capital into any property

development, you will need to discuss how and why you intend to invest into this

sector and highlight the key risks, mitigants and likely returns.

3. Property portfolio construction

Given the Funds objectives and the factors identified in 1 & 2 above, you are

expected to explain how you would construct an investment strategy for The Fund

that would meet the objectives. You should highlight the merits of your approach and

implementation risks of your strategy and factors to be considered for the eventual

exit strategy.

Scope of Strategy

For the listed REIT allocation you may identify individual REITs, but rather the

criteria by which you would select appropriate REITs for your strategy.

You are not expected to explain how to finance this strategy in Assignment 1. You do

not need to address tax implications.

Submission requirements

Your paper should be set out in an easy to read, conversational style.

You may use headings, bullet points, tables or charts to highlight points.

Sources should be referenced as per UNSW standards.

Written assignment on A4 paper, bound/stapled. We will consider accepting

assignments by email by prior arrangement only if you travel for work. This will

not change the submission date and normal penalties for late submission will

apply.

Maximum word limit is 3,000 words but as a guide your paper should have at

least 2,500 words (excluding headings, diagrams etc.).

A cover page has been provided (see following).

Assignments that do not include the standard university plagiarism declaration

will not be marked until this is supplied.

REST0004: Property & Investment Finance [2] Assignment 1 - 2017

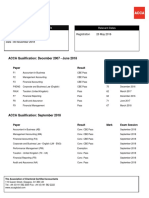

The University of New South Wales

Faculty of the Built Environment

REST0004 S1 2017 - Property Finance

ASSIGNMENT 1 COVERSHEET

DUE DATE: FRIDAY 28 APRIL 2017

STUDENT CHECK LIST (please tick)

Coversheet

plagiarism declaration

Discussion paper (Arial, Times New Roman or Verdana fonts only)

STUDENT NAME AND NUMBER:

Item Mark Value

Answers the question(s) asked 40%

Paper presentation and style 10%

Use of literature and referencing

5%

in the report

Use of tables, charts or data to

20%

support points

Report structure 15%

Conclusions 10%

TOTAL MARK /100%

Markers Comments (Optional):

REST0004: Property & Investment Finance [3] Assignment 1 - 2017

You might also like

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- MAIN PPT Business Ethics, Corporate Governance & CSRDocument24 pagesMAIN PPT Business Ethics, Corporate Governance & CSRrajithaNo ratings yet

- Marketing PlanningDocument31 pagesMarketing PlanningBrian DeanNo ratings yet

- Bank Reconciliation StatementDocument13 pagesBank Reconciliation StatementAli Hassan100% (1)

- Examhistorytranscript 2094016780317376121Document2 pagesExamhistorytranscript 2094016780317376121api-437577154No ratings yet

- Sample Complaint Affidavit For EstafaDocument5 pagesSample Complaint Affidavit For EstafaAlexander Cooley100% (1)

- 8513-Financial ManagementDocument7 pages8513-Financial ManagementSulaman SadiqNo ratings yet

- Cranson v. International Business Machines Corporation: 2 Line of CasesDocument2 pagesCranson v. International Business Machines Corporation: 2 Line of CasesDorothy PuguonNo ratings yet

- Law On Partnership and Corporation Study Guide de LeonDocument9 pagesLaw On Partnership and Corporation Study Guide de LeonLhorene Hope Dueñas0% (2)

- Week 3Document23 pagesWeek 3Brian Dean100% (2)

- ACC-ACF3100 Advanced Financial Accounting Research Assignment: Semester 1 2020Document3 pagesACC-ACF3100 Advanced Financial Accounting Research Assignment: Semester 1 2020haroon nasirNo ratings yet

- Assessment Brief: The University of NorthamptonDocument11 pagesAssessment Brief: The University of NorthamptonThara DasanayakaNo ratings yet

- AssessmentBriefSemBMainCWEFB1 1588309893Document4 pagesAssessmentBriefSemBMainCWEFB1 1588309893Rajiv RankawatNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)BakhtawarNo ratings yet

- FAM Assignment Jan 2020Document15 pagesFAM Assignment Jan 2020Anil KumarNo ratings yet

- Assessment Handout REAL660 AFBEDocument6 pagesAssessment Handout REAL660 AFBEManglam AgarwalNo ratings yet

- Module Code FIN 7001 Module Title: Financial ManagementDocument9 pagesModule Code FIN 7001 Module Title: Financial ManagementTitinaBangawaNo ratings yet

- Holmes Institute Faculty of Higher Education: HI5002 Finance For Business Group Assignment T3 2019Document9 pagesHolmes Institute Faculty of Higher Education: HI5002 Finance For Business Group Assignment T3 2019My Assignment GuruNo ratings yet

- Bcit Business Plan Project Proposal Template October 26 2009Document8 pagesBcit Business Plan Project Proposal Template October 26 2009Shoaib HasanNo ratings yet

- Project - Portfolio ConstructionDocument5 pagesProject - Portfolio ConstructionammendNo ratings yet

- DTU406 - 2023 Group Assignment-2Document2 pagesDTU406 - 2023 Group Assignment-2AK LHNo ratings yet

- Course OutlineDocument6 pagesCourse OutlineNancyNo ratings yet

- Heriot Watt Financial Analysis (Requirements)Document3 pagesHeriot Watt Financial Analysis (Requirements)varunabyNo ratings yet

- SO-D2FIN100-1 - SDocument25 pagesSO-D2FIN100-1 - SThenappan GanesenNo ratings yet

- Tender Response: Month, YearDocument15 pagesTender Response: Month, YearDstormNo ratings yet

- Assignment - Evening StudentsDocument3 pagesAssignment - Evening StudentsBimal KrishnaNo ratings yet

- Group Assignment 202009Document4 pagesGroup Assignment 202009CR7 الظاهرةNo ratings yet

- MA Brief 0217 RQFDocument9 pagesMA Brief 0217 RQFBrian DeanNo ratings yet

- SGP - IDN - Technical Proposal FormatDocument5 pagesSGP - IDN - Technical Proposal FormatLailan Syahri RamadhanNo ratings yet

- B291 TMA - Fall - 2022-2023Document5 pagesB291 TMA - Fall - 2022-2023Ghada YMNo ratings yet

- 2203 BIZ201 Assessment 3 BriefDocument8 pages2203 BIZ201 Assessment 3 BriefAkshita ChordiaNo ratings yet

- ACF734 Accounting and Finance 2019-2020: Full-Time MBA: Group Componenent of Assignment (Worth 75% of Mark) The ScenarioDocument11 pagesACF734 Accounting and Finance 2019-2020: Full-Time MBA: Group Componenent of Assignment (Worth 75% of Mark) The Scenariohimelhimel34No ratings yet

- Assessment 3 InstructionsDocument1 pageAssessment 3 InstructionsSaadNo ratings yet

- 8568Document9 pages8568unsaarshadNo ratings yet

- STIC Research Grants RFPDocument4 pagesSTIC Research Grants RFPAde La YusupNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document9 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)muhammad tahirNo ratings yet

- BT BriefingDocument8 pagesBT BriefingatirahzulkapliNo ratings yet

- ISD ECO101 (Approved)Document25 pagesISD ECO101 (Approved)danesh babaNo ratings yet

- Government of Punjab Punjab Higher Education Commission Punjab Innovation and Research Challenge AwardDocument12 pagesGovernment of Punjab Punjab Higher Education Commission Punjab Innovation and Research Challenge AwardShahid IqbalNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)haroonsaeed12No ratings yet

- 570 - ASM2 - Instruction - SU23Document7 pages570 - ASM2 - Instruction - SU23Nguyen Ngoc Quynh Anh (FGW HN)No ratings yet

- Fin204 Isd ElmDocument25 pagesFin204 Isd Elm黄于绮No ratings yet

- Property Fund and a-REIT Valuation Report DetailsDocument2 pagesProperty Fund and a-REIT Valuation Report DetailsMuumbi MutuaNo ratings yet

- Final Project Outline Fall 2022 SemesterDocument5 pagesFinal Project Outline Fall 2022 SemesterMana PlanetNo ratings yet

- FIVE - 5566-Accounting and FinanceDocument9 pagesFIVE - 5566-Accounting and FinancebeelahmedNo ratings yet

- Schemes and Syllabi For Written Examination (Descriptive) For All Posts in BS-18 & BS-19 Included in Consolidated Advertisement No. 12/2019Document3 pagesSchemes and Syllabi For Written Examination (Descriptive) For All Posts in BS-18 & BS-19 Included in Consolidated Advertisement No. 12/2019Jawad AminNo ratings yet

- Mgt489 Project Report GuidelineDocument6 pagesMgt489 Project Report GuidelineSyedSalmanRahmanNo ratings yet

- Resit MIB - 010 Assessment Deadline 7 AugustDocument6 pagesResit MIB - 010 Assessment Deadline 7 AugustHasan MahmoodNo ratings yet

- Year 1 2 3 4 5 Projected Sales Revenues in 000s 60 0 1000 1200 1000 800Document3 pagesYear 1 2 3 4 5 Projected Sales Revenues in 000s 60 0 1000 1200 1000 800NoorullahNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document9 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)Muhammad AbdullahNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document8 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)Falak FalakNo ratings yet

- FHEQ Level 7 Assessed Summative Assignment: Financial Markets, Institutions & Instruments (7fmi)Document3 pagesFHEQ Level 7 Assessed Summative Assignment: Financial Markets, Institutions & Instruments (7fmi)Bala Krishna ChinniahNo ratings yet

- BS7601 Entrepreneurial FinanceDocument8 pagesBS7601 Entrepreneurial FinanceMuneeb AamirNo ratings yet

- RequirementDocument7 pagesRequirementRahul YadavNo ratings yet

- Essay - Markets in ActionDocument14 pagesEssay - Markets in ActionNima MoaddeliNo ratings yet

- AFDM+AY23 24+Assignment+Brief MainDocument8 pagesAFDM+AY23 24+Assignment+Brief Mainmjsjaved786No ratings yet

- MGT4100 - Assessment 1 Group Report AY 202324 DubaiDocument10 pagesMGT4100 - Assessment 1 Group Report AY 202324 DubaidonaNo ratings yet

- 8524Document7 pages8524KhurramRiaz100% (1)

- Final Examination Equivalent Project Semester I Session 2019/2020Document4 pagesFinal Examination Equivalent Project Semester I Session 2019/2020Ehsan DarwishmoqaddamNo ratings yet

- Alternative CF Final Assessment (Individual Report) Sep 20-Jan 21Document12 pagesAlternative CF Final Assessment (Individual Report) Sep 20-Jan 21Usman HussainNo ratings yet

- Syndicate Case Study Report DetailsDocument3 pagesSyndicate Case Study Report Detailscourtney.hodaNo ratings yet

- Aistrup - Phase II Proposal WritingDocument36 pagesAistrup - Phase II Proposal WritingVijay HanagandiNo ratings yet

- Business Capstone Project GuidelinesDocument4 pagesBusiness Capstone Project GuidelinesTishani HerathNo ratings yet

- Words: Academic Judgement of The Overall Submission Presented. Overall Submission PresentedDocument2 pagesWords: Academic Judgement of The Overall Submission Presented. Overall Submission PresentedUmair JilaniNo ratings yet

- Coursework Guidance: Dr. Haider ShahDocument6 pagesCoursework Guidance: Dr. Haider ShahKazi Mahbubur RahmanNo ratings yet

- School of Business & Economics Department of Accounting & FinanceDocument4 pagesSchool of Business & Economics Department of Accounting & FinanceMd JonaidNo ratings yet

- How to Have the Millionaire Mindset in Real Estate and Be the MillionaireFrom EverandHow to Have the Millionaire Mindset in Real Estate and Be the MillionaireNo ratings yet

- Vocabulary Teaching TableDocument3 pagesVocabulary Teaching TableBrian DeanNo ratings yet

- The Collapse of Soviet Control and The End of Communist Regimes in Eastern EuropeDocument12 pagesThe Collapse of Soviet Control and The End of Communist Regimes in Eastern EuropeBrian DeanNo ratings yet

- Lockean Theories of Property Justifications For Unilateral AppropriationDocument24 pagesLockean Theories of Property Justifications For Unilateral Appropriationthornapple25No ratings yet

- Gonorrhoea 4Document4 pagesGonorrhoea 4Brian DeanNo ratings yet

- Quiz 10 p2Document5 pagesQuiz 10 p2Brian Dean8% (13)

- NQF Resource 02 Guide To ECS Law RegsDocument182 pagesNQF Resource 02 Guide To ECS Law Regskenny0130% (1)

- TB ch2 Essentials of Statistics For Business and Economics 7th Edition by David R. AndersonDocument49 pagesTB ch2 Essentials of Statistics For Business and Economics 7th Edition by David R. AndersonBrian Dean100% (1)

- ECA COE Brochure 2016 PDFDocument2 pagesECA COE Brochure 2016 PDFJulie Andrews JnrNo ratings yet

- Linux CourseworkDocument2 pagesLinux CourseworkBrian DeanNo ratings yet

- Coursework2016 17Document6 pagesCoursework2016 17Brian DeanNo ratings yet

- MA Brief 0217 RQFDocument9 pagesMA Brief 0217 RQFBrian DeanNo ratings yet

- Exam 3 QuestionsDocument4 pagesExam 3 Questionscniraj743566No ratings yet

- Exam1 (523) KeyDocument5 pagesExam1 (523) KeyBrian DeanNo ratings yet

- CS 249 Project 3 Recursion: Unit TestingDocument4 pagesCS 249 Project 3 Recursion: Unit TestingBrian DeanNo ratings yet

- Training Manual Stock ManagementDocument12 pagesTraining Manual Stock ManagementBrian DeanNo ratings yet

- Leadership EssayDocument3 pagesLeadership EssayBrian DeanNo ratings yet

- PROCEDURE Supporting and Reporting Client Behaviours of ConcernDocument11 pagesPROCEDURE Supporting and Reporting Client Behaviours of ConcernBrian DeanNo ratings yet

- Legal Risks of NursesDocument7 pagesLegal Risks of NursesBrian DeanNo ratings yet

- Article QuestionsDocument2 pagesArticle QuestionsBrian DeanNo ratings yet

- Week 1 AssignmentDocument6 pagesWeek 1 AssignmentBrian DeanNo ratings yet

- Running Head: Respondeat SuperiorDocument2 pagesRunning Head: Respondeat SuperiorBrian DeanNo ratings yet

- Legalization of MarijuanaDocument6 pagesLegalization of MarijuanaBrian DeanNo ratings yet

- Project On TitanDocument74 pagesProject On TitanMona Vyas0% (1)

- Solution Manual12Document46 pagesSolution Manual12wansurNo ratings yet

- China in Burma Update 2008 - BurmeseDocument67 pagesChina in Burma Update 2008 - Burmese33koko97100% (1)

- 9Document16 pages9Asal IslamNo ratings yet

- IpoDocument33 pagesIposangeethadurjatiNo ratings yet

- AP Check Register FY 2016Document532 pagesAP Check Register FY 2016adeNo ratings yet

- Cheque Collection PolicyDocument5 pagesCheque Collection Policymuraligm2003No ratings yet

- MIT CASE Competition 2014 PresentationDocument15 pagesMIT CASE Competition 2014 PresentationJonathan D SmithNo ratings yet

- Financial Statement Analysis For Cash Flow StatementDocument5 pagesFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- Director of Human ResourcesDocument3 pagesDirector of Human Resourcesapi-121656428No ratings yet

- Kotak Mahindra Mutual FundDocument30 pagesKotak Mahindra Mutual FundSandeep KhatwaniNo ratings yet

- Ticket GarudaDocument1 pageTicket GarudaaansubhanNo ratings yet

- Fin e 393 2019Document8 pagesFin e 393 2019velxerox4123No ratings yet

- Paint Industry Analysis of 2013Document15 pagesPaint Industry Analysis of 2013Shashi KumarNo ratings yet

- ListDocument6 pagesListArjun KohliNo ratings yet

- Brita LifeTime Value of CustomerDocument10 pagesBrita LifeTime Value of Customerrhuria@rediffmail.comNo ratings yet

- Who Is An "NRI" (Introduction)Document9 pagesWho Is An "NRI" (Introduction)Glen F. PreiraNo ratings yet

- Fin Stat Ilustrasi, PT Indonesia 2016Document173 pagesFin Stat Ilustrasi, PT Indonesia 2016CorneliusNo ratings yet

- Organized DataDocument381 pagesOrganized DatajomelvirayNo ratings yet

- Mini Case - Chapter 10Document6 pagesMini Case - Chapter 10mfitani75% (4)

- IT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsDocument106 pagesIT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsnarayanan630% (1)

- Columbia FANE Sample AgendaDocument1 pageColumbia FANE Sample AgendaAbdul RehmanNo ratings yet

- Schedule of Filing of ReturnsDocument4 pagesSchedule of Filing of Returnszubair_z0% (1)

- Brown Wins BIG With Beko: Letters Winner Acknowledges His MotherDocument4 pagesBrown Wins BIG With Beko: Letters Winner Acknowledges His MotherMotibhai GroupNo ratings yet