Professional Documents

Culture Documents

Module09 PDF

Uploaded by

Gosaye DesalegnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module09 PDF

Uploaded by

Gosaye DesalegnCopyright:

Available Formats

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09intro.

htm

Module 9: Accounting for partnerships and corporations

Overview

In previous models, you studied accounting for sole proprietorships. In this module, you learn about partnerships and

corporations. Several important legal differences distinguish these three forms of business organizations, and each form has

significant advantages and disadvantages. Accountants provide services to all types of organizations, so you must understand

their unique characteristics.

For the most part, accounting for these three different types of business entities is the same. The asset and liability section of

the balance sheets are identical, as are the income statements.1 The differences are in how each type of business accounts

for the equity of its owners, known as owners equity for a sole proprietorship, partners equity for a partnership, and

shareholders equity for a corporation.

Test your knowledge

Begin your work on this module with a set of test-your-knowledge questions designed to help you gauge the depth of study

required.

Learning objectives

9.1 List the characteristics of a proprietorship and a partnership, and explain the importance of mutual

agency and unlimited liability in a partnership. (Level 2)

9.2 Allocate partnership earnings to partners (a) on a stated fractional basis, (b) in the partners capital

ratio, and (c) through the use of salary and interest allowances. (Level 1)

9.3 Explain the advantages, disadvantages, and organization of corporations. (Level 2)

9.4 Explain the differences in the financial statements for corporate and unincorporated organizations.

(Level 1)

9.5 Record the issuance of shares. (Level 1)

9.6 State the differences between common and preferred shares, and allocate dividends between

common and preferred shares. (Level 2)

9.7 Record cash dividends and explain their effects on the assets and shareholders equity of a

corporation. (Level 2)

9.8 Calculate book value per share and interpret and apply this ratio in decision-making scenarios.

(Level 2)

9.9 Record share dividends, share splits, and retirement of shares, and explain their effects on the

assets and shareholders equity. (Level 2)

9.10 Calculate earnings per share for companies with simple capital structures and interpret and apply

this ratio in decision-making scenarios. (Level 2)

9.11 Explain how the income effects of discontinued operations are reported. (Level 2)

9.12 Describe restrictions of retained earnings and accounting changes, and the disclosure of such items

in the financial statements. (Level 2)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09intro.htm (1 of 2) [12/07/2010 4:03:04 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09intro.htm

9.13 Explain the ethical issues around management incentive plans. (Level 1)

Module summary

Print this module

1 Corporations usually include a provision for income tax expense whereas proprietorships and partnerships

do not.

Assignment reminder

Assignment #3 is due this week (see Course Schedule). Please allocate time to complete and submit the

assignment by the deadline.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09intro.htm (2 of 2) [12/07/2010 4:03:04 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09tyk.htm

Module 9 Test your knowledge

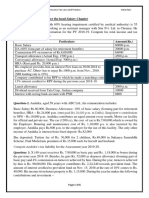

1. Total shareholders equity is $800,000. $100,000 of this total is 10,000 preferred shares. There are 100,000 common

shares authorized; 50,000 common shares issued, of which 48,000 shares are outstanding. What is the book value

per common share?

1. $14.00

2. $14.58

3. $16.00

4. $16.67

2. A corporations articles of incorporation establish the total number of shares that may be issued. What is the term

applied to these shares?

1. Outstanding shares

2. Issued shares

3. Common shares

4. Authorized shares

3. When a corporation issues common shares, what account are they credited to?

1. Current asset account

2. Intangible asset account

3. Long-term investment account

4. Equity account

4. What are shares that carry voting rights called?

1. Preferred shares

2. Voting shares

3. Common shares

4. Contributed capital

5. The retained earnings account had a debit balance of $3,000 at the beginning of 2010. During 2010, net income

totalled $12,000 and dividends of $8,000 were paid. During 2011, no dividends were paid and an economic slowdown

caused the business to lose $25,000. What was the balance of the retained earnings account at the end of 2011?

1. $18,000

2. $18,000 deficit

3. $24,000

4. $24,000 deficit

Solutions

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09tyk.htm [12/07/2010 4:03:06 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t01.htm

9.1 Characteristics of proprietorships and partnerships

Learning objective

List the characteristics of a proprietorship and a partnership, and explain the importance of mutual agency and unlimited

liability in a partnership. (Level 2)

Required reading

Chapter 14, pages 694-699

LEVEL 2

Proprietorship

A proprietorship is a business owned by one person, while a partnership is an association of two or more persons to

operate an unincorporated business for profit as co-owners. From an accounting perspective,

proprietorships and partnerships must comply with the business entity

principle that requires that business records must be kept separate and distinct from owners

personal records. From a legal perspective, proprietorships and partnerships are extensions of their owners.

Neither the proprietorship nor the partnership is subject to income taxes; rather, the individuals are required to report their

share of income from these businesses on their respective tax returns.

Advantages and disadvantages of a proprietorship

The primary advantage of a proprietorship is the ease with which it can be legally started with only a limited number of legal

filing requirements. As stated above, a proprietor is required to keep adequate records for determining income, which is then

taxable in the hands of the proprietor. The advantage of ease of ownership is counteracted by disadvantages that include the

following:

Limited life: Upon the death of the proprietor, the business entity ceases.

Unlimited liability: The proprietor is liable for all debts of the proprietorship to the full extent of his or her personal

wealth.

Difficulty of ownership transfer: Selling the business to another party may be more difficult than selling a

corporation.

Partnership

Individuals entering into a business partnership should seek accounting and legal advice before they start a business. CGAs in

public practice often provide their expertise to a new partnership by advising on financial and tax matters and reviewing the

partnership contract to ensure that it addresses unforeseen events. The partners should enter into a partnership agreement

that sets out the terms under which the affairs of the partnership will be conducted. This document should be prepared by

their legal counsel.

The text describes the characteristics of general partnerships on pages 695-697.

Textbook activities

Checkpoint Questions 1 and 2 on

page 697 (Solutions on page 717)

Quick Study 14-1 and 14-2 on page 721

(Solutions)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t01.htm (1 of 2) [12/07/2010 4:03:07 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t01.htm

Accounting for a partnership and sole proprietorship is basically the same, except for transactions that directly affect partners

equity. There is no distinction between contributed and earned capital when accounting for partnerships and proprietorships

because the categories are combined. Proprietorships employ one capital account and one withdrawals account. The capital

account is credited for owner investments and accumulated profits. The withdrawals account is closed to the capital account

at the end of each accounting period.

Accounting for partnerships is explained on page 698 of the text.

Textbook activities

Checkpoint Question 3 on page 699

(Solution on page 717)

Quick Study 14-3 on page 721 (Solution)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t01.htm (2 of 2) [12/07/2010 4:03:07 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t02.htm

9.2 Division of partnership earnings

Learning objective

Allocate partnership earnings to partners (a) on a stated fractional basis, (b) in the partners capital ratio, and (c) through the

use of salary and interest allowances. (Level 1)

Required reading

Chapter 14, pages 699-704

LEVEL 1

Nature of partnership earnings

Profits and losses arising from the operation of a business may be shared in any manner that the partners agree on.

Typically, the partnership agreement stipulates how profit/losses are to be shared. The basis for profit/loss sharing is usually

based on a formula that takes into consideration the time and money each partner invests in a partnership. The profit sharing

may include a salary allowance; the allowance is a distribution of earnings, not an expense.

Accounting for the division of income is explained on pages 699-703 of the text.

Textbook activities

Checkpoint Questions 4 to 6 on

page 703 (Solutions on page 717)

Quick Study 14-4, 14-5, and 14-6 on

page 721 (Solutions)

Mid-Chapter Demonstration

Problem on pages 705-707

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t02.htm [12/07/2010 4:03:08 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t03.htm

9.3 Corporate organization

Learning objective

Explain the advantages, disadvantages, and organization of corporations. (Level 2)

Required reading

Chapter 15, pages 734-739

LEVEL 2

A corporation is a legal entity incorporated under federal or provincial laws such as the Canada

Business Corporations Act (CBCA) or the

Business Corporations Act of a particular province. The

characteristics of the corporate form and the process for organizing a company are described on pages 734-739.

Textbook activities

Checkpoint Question 1 on page 739

(Solution on page 756)

Quick Study 15-1 and 15-2 on page 764

(Solutions)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t03.htm [12/07/2010 4:03:08 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t04.htm

9.4 Corporate financial statements

Learning objective

Explain the differences in the financial statements for corporate and unincorporated organizations. (Level 1)

Required reading

Chapter 15, pages 739-741

Note: Delete section titled Statement of Retained Earnings on page 740 and replace with the reading titled Statement of

Changes in Equity below.

LEVEL 1

Income statement

The basic difference between the income statement of a corporation and that of an unincorporated business is the inclusion

of income tax expense, as highlighted in Exhibit 15.3 on page 739. Also, if the owner works for the corporation and is paid a

salary, then the amount earned would be expensed, not charged to the proprietor or partners capital account.

Statement of comprehensive income (non-examinable)

Entities are required to report comprehensive income. This requirement primarily applies to companies with complex financial

arrangements. Comprehensive net income is the total of net income and other comprehensive income. Other comprehensive

income includes items not covered in this course, such as unrealized gains and losses on translation of financial statements of

self-sustaining foreign operations, unrealized gains and losses on foreign currency hedges, and unrealized gains and losses

on financial assets that are available for sale. The starting point for the computation of comprehensive income is net income

computed in the same manner as before. This statement is non-examinable.

Statement of changes in equity

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t04.htm (1 of 3) [12/07/2010 4:03:10 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t04.htm

7 FRS 2009, IAS 1 , para. 10 and para. 106-110

Source: Larson and Jensen, Fundamental Accounting

Principles , 13th Canadian edition ( 2010 McGraw-Hill Ryerson), Exhibit 13.6, page 742.

Reproduced with permission.

Balance sheet

The equity section on the balance sheet is called Owners Equity and Partners Equity for sole proprietorships and

partnerships respectively. For corporations, the equity section is labelled Shareholders Equity or simply Equity. As explained

above, the types of activities summarized in the equity section are identical regardless of the type of business organization

owner investment, net income and losses, and distribution of net income (withdrawals or dividends). Refer to Exhibit 15.5 on

page 741, which contrasts the balance sheet of a sole proprietorship with that of a corporation.

On the corporate balance sheet, shareholders equity is composed of two main categories: contributed capital and retained

earnings.

Contributed capital is the portion of a corporations equity that represents investments in the company by its

shareholders.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t04.htm (2 of 3) [12/07/2010 4:03:10 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t04.htm

Retained earnings is the portion of a corporations equity that represents its cumulative net income less

net losses and dividends.

LEVEL 2

Contributed surplus

Contributed surplus is a third category (see page 794 in Chapter 16). The text uses the term contributed capital from

retirement of common shares. Contributed surplus from retirement of common shares is an alternate term with the same

meaning. This category will be explained in more detail in Topic 9.9.

Accumulated other comprehensive income (non-examinable)

Accumulated other comprehensive income is a fourth category in shareholders equity. Accounting for accumulated other

comprehensive income is beyond the scope of this

course and is covered in FA3 . This category is non-examinable.

Textbook activities

Checkpoint Questions 2, 3, and 5 on

page 741 (Solutions on pages 756-757)

Quick Study 15-3 to 15-7 on pages 764-

765 (Solutions)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t04.htm (3 of 3) [12/07/2010 4:03:10 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t05.htm

9.5 Issuance of shares

Learning objective

Record the issuance of shares. (Level 1)

Required reading

Chapter 15, pages 741-744

LEVEL 1

Sale of shares

A company acquires assets to earn profits for the owners. These assets are collectively paid for with a combination of debt

and equity. The primary reason that a company sells shares is to raise money to invest in assets. Sometimes, however, a

company uses the proceeds to pay down debt. Shares can be issued for cash, other noncash assets, or services. Selling

shares for cash is the norm.

Authorized, issued, and outstanding shares

A corporation normally authorizes the distribution of an unlimited number of shares. However, a company may choose to

place a limit on the number of shares it issues, including this maximum in its articles of incorporation. Some provincial

jurisdictions require that the corporate charter authorize the maximum number of shares that may be issued, rather than

allowing for an unlimited amount.

Make sure you can differentiate between the terms authorized, issued, and outstanding:

Authorized refers to the number of shares a corporation is permitted to issue.

Issued refers to the number of shares sold that have not yet been cancelled.

Outstanding refers to the number of shares that have been issued and are still held by shareholders.1

Exercise 15-1 on page 768 compares the entries between a partnership and a corporation.

Solution

Note that there are important differences in the types of accounts used for a partnership and a corporation. For a

partnership, any cash distribution is made through the partners withdrawal accounts, whereas a cash distribution from a

corporation uses a dividend account. Observe that the Income summary account for a partnership is closed to the partners

Capital accounts, while the Income summary account for a corporation is closed to the Retained earnings account. (Closing

entries for a corporation is covered in Topic 9.7.) Also note in the previous exercise that for both a partnership and a

corporation, a credit of $96,000 would have been recorded in the Income summary account when the revenue and expense

accounts were closed for the year. (See Topic 3.5 for a review of closing entries.)

Textbook activities

Checkpoint questions 6 and 7 on

page 744 (Solutions on page 757)

Quick Study 15-8 and 15-9 on page 766

(Solutions)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t05.htm (1 of 2) [12/07/2010 4:03:11 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t05.htm

1 The number of issued and outstanding shares will usually be the same. The only time they differ is when

the firm holds treasury shares, described in Appendix 16A, pages 811-813. This is infrequent, as treasury

shares are no longer allowed by the CBCA. The topic of treasury shares is beyond the scope of this

course and is non-examinable.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t05.htm (2 of 2) [12/07/2010 4:03:11 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t06.htm

9.6 Classes of shares and special features of preferred shares

Learning objective

State the differences between common and preferred shares, and allocate dividends between common and preferred shares.

(Level 2)

Required reading

Chapter 15, pages 744-747 and 750-754

LEVEL 2

The Canada Business Corporations Act

(CBCA) does not distinguish between common and preferred shares. The Act, however, does allow for more than one class of

shares. Because of the predominant usage of the terms common and preferred to distinguish classes of shares, this

terminology is used throughout the text and these module notes.

Common shares

Common shares are known as the residual class because common shareholders claims to assets and profits of a business

rank behind those of creditors and preferred shareholders. The five basic rights of the common shareholder are summarized

in Exhibit 15.10 on page 746.

Preferred shares

A company may issue nonvoting shares,known as preferred shares.1 Preferred shares differ from common shares in terms

of the rights and privileges related to dividends, liquidation, and conversion. Preferred shares usually include a preference for

payment of dividends and for distribution of assets in liquidation. The dividend preference simply means that preferred

shareholders are entitled to dividends before common shareholders.

Preferred dividends are generally limited to a fixed amount and must be paid to preferred shareholders before common

shareholders receive dividends. Preferred shareholders are usually less concerned with growth in the future earning potential

of the company than common shareholders because preferred dividends are generally fixed in amount and do not vary with

earnings. The equity section on the balance sheet or accompanying notes discloses the dividend as a stated amount per

share or as a percentage of the issue price. Refer to Exhibit 15.8 on page 745, where the dividend preference per preferred

share is $3.

Study the format of the shareholders equity section of the balance sheet presented in Exhibit 15.8. Note that it is classified

and shows preferred shares and common shares under the heading Contributed capital.

Special features of preferred shares

Much like bonds, preferred shares are governed by an agreement between the corporation and investor. This contract can

make provision for any number of terms; some of the more common ones are described on pages 750-754.

Textbook activities

Checkpoint Questions 8 and 9 on

page 747 (Solutions on page 757)

Quick Study 15-10 on page 766 (Solution)

Judgement Call on page 747 (Solution on page 756)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t06.htm (1 of 2) [12/07/2010 4:03:12 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t06.htm

Mid-Chapter Demonstration

Problem on pages 747-748.

Remember to record the issuance of shares that are exchanged for noncash assets and services.

1 Preferred shares sometimes have voting privileges, usually in narrowly defined circumstances such as

default under the terms of the preferred indenture. This footnote regarding preferred shares is provided

for information only and is non-examinable.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t06.htm (2 of 2) [12/07/2010 4:03:12 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t07.htm

9.7 Cash dividends and closing entries for a corporation

Learning objective

Record cash dividends and explain their effects on the assets and shareholders equity of a corporation. (Level 2)

Required reading

Chapter 15, pages 749-750 and 754-755

LEVEL 2

Cash dividends

Determining when a company should pay a dividend and how much it should pay is beyond the

scope of this course . A corporation faces two practical considerations when

considering paying a dividend:

1. Is it legally permitted to pay a dividend?

Most provinces prohibit the paying of cash dividends unless a corporation has a sufficient credit balance in its retained

earnings account. For corporations incorporated under the Canada Business

Corporations Act , a corporation is not permitted to declare or pay dividends

if

a. The corporation is, or would after the payment be, unable to pay its liabilities as they become due, or

b. The realizable value of the corporations assets would thereby be less than the aggregate of its liabilities and

stated capital of all classes.

2. Does it have the money to pay the dividend?

A company may have sufficient retained earnings but little or no available cash. Recall that retained earnings are a

component of shareholders equity that reflects retained profitability. It is entirely possible to have a large balance in

this account, but little cash, because the company reinvested its profits in other assets such as inventory and

equipment.

A company is not obligated to declare dividends. The decision to declare dividends is the board of directors responsibility.

Once a cash dividend has been declared, however, it becomes a binding obligation, and, as such, it is necessary to record a

liability. The manner in which this obligation is recognized is set out on page 749. Note that on the declaration date,

Dividends declared (a temporary contra equity account) is debited and Dividends payable (a current liability account) is

credited.1 Alternatively, Retained earnings may be debited directly instead of Dividends declared.

Closing entries for a corporation

The closing entries for a corporation are based on the same principles as for a sole proprietorship and partnership. The

difference is into which account the income summary and the distribution of income (either as withdrawals or as dividends)

are closed. The closing process for a sole proprietorship and a corporation are contrasted in Example 9-1.

Textbook activities

Checkpoint Questions 10 to 13 on

page 752 and question 14 on page 755

(Solutions on page 757)

Quick Study 15-11 to 15-16 on pages 766-

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t07.htm (1 of 3) [12/07/2010 4:03:13 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t07.htm

767 ( Note: For Quick Study 15-14 to 15-

16, in part b for each, replace

Prepare a statement of retained

earnings with Prepare a

statement of changes in equity . The part

b solutions for each of Quick Study 15-14 to 15-16 are shown below)

Demonstration Problem on pages 757-

759 (NOTE: Replace part 2 of the required with Prepare statements of changes in equity for the years ended

December 31, 2011 and 2012. The revised solution to part 2 is shown below).

Review the Required and Planning the Solution closely before attempting the question. Ingraining this process of

determining what is required and how to approach the problem through repetition will serve you well when you write

your final examination.

Part b solutions to Quick Study 15-14 to 15-16:

Quick Study 15-14, Part b solution:

PETER PUCK INC.

Statement of Changes in Equity

For Year Ended May 31, 2011

Preferred Common Retained

Shares Shares Earnings Total Equity

Balance, June 1 $ 7,000 $ 13,000 $ 29,000 $ 49,000

Issuance of shares -0- -0- -0-

Net income (loss) 34,000 34,000

Dividends (3,500) (3,500)

Balance, May 31 $ 7,000 $ 13,000 $ 59,500 $ 79,500

NOTE: Because no shares were issued during the year ended May 31, 2011, the Issuance of shares line in the Statement

of Changes in Equity could be omitted.

Quick Study 15-15, Part b solution:

MORRIS INC.

Statement of Changes in Equity

For Year Ended November 30, 2011

Common Retained

Preferred Shares Shares Earnings Total Equity

Balance, December 1 $ 10,000 $ 48,000 $ 42,000 $ 100,000

Issuance of shares -0- -0- -0-

Net income (loss) (9,000) (9,000)

Dividends (14,000) (14,000)

Balance, November 30 $ 10,000 $ 48,000 $ 19,000 $ 77,000

NOTE: Because no shares were issued during the year ended November 30, 2011, the Issuance of shares line in the

Statement of Changes in Equity could be omitted.

Quick Study 15-16, Part b solution:

VELOR LTD.

Statement of Changes in Equity

For Year Ended August 31, 2011

Preferred Common

Shares Shares Retained Earnings/(Deficit) Total Equity

Balance, September 1 $ 10,000 $ 48,000 $ 12,000 $ 70,000

Issuance of shares -0- -0- -0-

Net income (loss) (18,000) (18,000)

Dividends -0- -0-

Balance, August 31 $ 10,000 $ 48,000 $ (6,000) $ 52,000

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t07.htm (2 of 3) [12/07/2010 4:03:13 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t07.htm

NOTE: Because no shares were issued and no dividends were declared during the year ended August 31, 2011, the

Issuance of shares and Dividends lines in the Statement of Changes in Equity could be omitted.

Part 2 solution to Demonstration Problem:

1 The text uses the terminology cash dividends rather than dividends declared.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t07.htm (3 of 3) [12/07/2010 4:03:13 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t08.htm

9.8 Book value per share

Learning objective

Calculate book value per share and interpret and apply this ratio in decision-making scenarios. (Level 2)

Required reading

Appendix 15A, pages 760-761

LEVEL 2

Book value per share measures shareholders equity on a per share basis and represents the worth of each share if the

company were to be liquidated, based on balance sheet values. As balance sheet amounts are based on cost and not current

values, the book value per share provides little practical information.

Note:

Appendix 15A on pages 760-761 demonstrates how book value per share is calculated. Pay particular attention to Exhibit

15A.4 on page 761, where cumulative dividends in arrears are deducted from common shareholder equity to determine the

book value per share.

Textbook activities

Judgement Call on page 762 (Solution on page 762)

Checkpoint Questions 15 and 16 on

page 762 (Solutions on page 762)

Quick Study 15-17 on page 768 (Solution)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t08.htm [12/07/2010 4:03:14 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t09.htm

9.9 Additional share transactions

Learning objective

Record share dividends, share splits, and retirement of shares, and explain their effects on the assets and shareholders

equity. (Level 2)

Required reading

Chapter 16, pages 788-794

LEVEL 2

Share dividends

Paying cash dividends requires cash that the company may not have. A company with good investment opportunities may

prefer to reinvest its cash assets in future expansion projects. Therefore, a company may decide to distribute a dividend in

the form of shares. This is known as a share dividend (or stock dividend ); it increases the number of shares

outstanding. Accounting for this form of dividend is illustrated on pages 789-791.

Exercise 16-1 on page 817 shows the effect of a share dividend on contributed capital and retained earnings. Notice that the

total amount of shareholders equity does not change.

Solution

Share splits

A share split (or stock split ) occurs when a company issues more than one new share for each share previously

outstanding. In a two-for-one split, each existing shareholder would own twice as many shares as before the split. However,

because all shareholders receive a proportionate increase, their percentage ownership remains the same.

Accounting for share splits is explained on page 792.

Exercise 16-2 on page 817 shows the effect of a share split on shareholders equity. In particular, notice the effect the share

split has on the amount of shares outstanding.

Solution

Textbook activities

Checkpoint Questions 1 to 3 on

page 793 (Solutions on page 808)

Quick Study 16-1 and 16-2 on page 815

(Solutions)

Repurchase of shares

Companies frequently buy back their own shares and retire them. Why? Perhaps a company has surplus cash and sees its

own stock as the best investment it can make, or it may want to improve earnings per share (EPS). Whatever the reason,

when a company repurchases its own shares for immediate retirement, all capital items related to the shares are removed

from the accounts. The difference between the average price the shares were sold for, and the price paid to re-acquire them,

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t09.htm (1 of 2) [12/07/2010 4:03:15 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t09.htm

results in a gain or a loss. This gain or loss flows directly to equity it is never recorded on the income statement.

Accounting for the redemption (or repurchase) of shares is outlined on pages 793-794.

Textbook activities

Checkpoint Question 4 on page 794

(Solution on page 808)

Quick Study 16-3 and 16-4 on page 815

(Solutions)

Mid-Chapter Demonstration

Problem on pages 795-797

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t09.htm (2 of 2) [12/07/2010 4:03:15 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t10.htm

9.10 Earnings per share

Learning objective

Calculate earnings per share for companies with simple capital structures and interpret and apply this ratio in decision-making

scenarios. (Level 2)

Required reading

Chapter 16, pages 797-800 (Note: The section titled Earnings Per Share and Extraordinary Items on pages 801-802 and all

subsequent references to extraordinary items have been omitted. Extraordinary items are not recognized under IFRS).

LEVEL 2

The earnings per share (EPS) figure conveys how much of a company's earnings "belong" to each outstanding common

share. Earnings that "belong" to or are available to common shareholders is net income for the year less the

amount that must be paid to preferred shareholders for the current year.

EPS is a widely followed and quoted financial performance statistic that public companies report on their income statement.

Companies with simple capital structures

The outstanding share capital of companies with a simple capital

structure consists solely of common shares, or common and non-convertible preferred shares. Public

companies with a simple capital structure report basic EPS. The computation of basic EPS is outlined on pages 797-800.

Public companies with capital structures that are not simple (known as complex capital structures) will be covered in FA3 .

Textbook activities

Checkpoint Questions 5, 6, and 7 on

page 801 (Solutions on page 808)

Quick Study 16-5 to 16-10 on pages 815-

816 (Solutions)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t10.htm [12/07/2010 4:03:16 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t11.htm

9.11 Reporting income

Learning objective

Explain how the income effects of discontinued operations are reported. (Level 2)

Required reading

The following reading replaces pages 802-804 of Chapter 16 in the textbook.

LEVEL 2

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t11.htm (1 of 3) [12/07/2010 4:03:17 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t11.htm

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t11.htm (2 of 3) [12/07/2010 4:03:17 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t11.htm

Source: Larson and Jensen, Fundamental Accounting

Principles , 13th Canadian edition ( 2010 McGraw-Hill Ryerson), pages 799-801. Reproduced with

permission.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t11.htm (3 of 3) [12/07/2010 4:03:17 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm

9.12 Retained earnings

Learning objective

Describe restrictions of retained earnings and accounting changes, and the disclosure of such items in the financial

statements. (Level 2)

Required reading

The following reading replaces pages 805-807 of Chapter 16 in the textbook.

LEVEL 2

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm (1 of 8) [12/07/2010 4:03:20 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm (2 of 8) [12/07/2010 4:03:20 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm (3 of 8) [12/07/2010 4:03:20 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm

Source: Larson and Jensen, Fundamental Accounting

Principles , 13th Canadian edition ( 2010 McGraw-Hill Ryerson), pages 803-805. Reproduced with

permission.

Reinforcement activities

Question 1

Answer the questions about each of the following items related to a company's activities for the year:

1. After using an expected useful life of seven years and no residual value to depreciate its office equipment over the

preceding three years, the company decided early this year that the equipment would last only two more years. How

should the effects of this decision be reported in the current financial statements?

2. An account receivable in the amount of $180,000 was written off two years ago. It was recovered this year. The

president believes this should be reported as an error. How should the proceeds be reported in the current year's

financial statements?

Source: Larson and Jensen, Fundamental Accounting

Principles , 13th Canadian edition ( 2010 McGraw-Hill Ryerson), page 813. Reproduced with

permission.

Solution:

1. This change in the predicted useful life is a change in an accounting estimate. The current year depreciation should

be modified to reflect the change and be reported on the income statement as part of income from continuing

operations.

2. This is not an error. It should be treated as a normal recovery of an account previously written off. Therefore, it does

not impact the current income statement or prior retained earnings. The recovery affects only balance sheet accounts.

Source: Larson and Jensen, Solutions Manual to

Fundamental Accounting Principles , 13th

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm (4 of 8) [12/07/2010 4:03:20 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm

Canadian edition ( 2010 McGraw-Hill Ryerson), page 250. Reproduced with permission.

Question 2:

Barton Inc. changed the method of calculating depreciation on its equipment from straight-line to double-declining-balance

during 2011. The cumulative effect of the change is an additional expense of $46,000 related to prior years. The tax benefit

is $13,000. Record the entry on December 31, 2011.

Source: Larson and Jensen, Fundamental Accounting

Principles , 13th Canadian edition ( 2010 McGraw-Hill Ryerson), page 813. Reproduced with

permission.

Solution:

2011

Dec. 31 Retained Earnings 33,000

Income Tax Payable 13,000

Accumulated Depreciation, Equipment 46,000

To record change in method of calculating depreciation.

Replace the Demonstration Problem

on pages 809-810 with the following:

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm (5 of 8) [12/07/2010 4:03:20 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm (6 of 8) [12/07/2010 4:03:20 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm (7 of 8) [12/07/2010 4:03:20 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm

Source: Larson and Jensen, Fundamental Accounting

Principles , 13th Canadian edition ( 2010 McGraw-Hill Ryerson), pages 807-808. Reproduced with

permission.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t12.htm (8 of 8) [12/07/2010 4:03:20 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t13.htm

9.13 Ethics Insider trading

Learning objective

Explain the ethical issues around management incentive plans. (Level 1)

Required reading

ERH , Unit A8, Making moral choices good enough for real-life circumstances

LEVEL 1

Throughout this course, full-disclosure and fairness in reporting have been emphasized. Accountants have a responsibility to

ensure that financial reports are designed not to deceive stakeholders. Consider the following case. Then refer to ERH ,

Unit A8, to apply a method of thinking through ethical choices when analyzing this case.

Falcon Corporations board of directors and officers have been meeting to discuss and plan the agenda for the corporations

2008 annual shareholders meeting. The first item considered by the directors and officers was whether to report a large

government contract that Falcon has just obtained. Although this contract will significantly increase income and cash flows in

2008 and beyond, management decided that there is no need to reveal the news at the shareholders meeting. After all,

one officer said, the meeting is intended to be the forum for describing the past years activities, not the plans for the next

year.

After concluding that the contract will not be mentioned, the group moved on to the next topic for the shareholders meeting.

This topic is a motion for the shareholders to approve a compensation plan that will award the managers the rights to acquire

large quantities of shares over the next several years. According to the plan, the managers will have a three-year option to

buy shares at a fixed price that equals the market value of the shares as measured 30 days after the upcoming shareholders

meeting. In other words, the managers will be able to buy shares in 2009, 2010, or 2011 by paying the 2008 market value.

Obviously, if the shares increase in value over the next several years, the managers will realize large profits without having to

invest any cash. The financial vice-president asks the group whether they should reconsider the decision about the

government contract in light of its possible relevance to the vote on the share option plan.

Identify the legal and ethical issues involved in this case. Then click on the link for an in-depth analysis.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t13.htm [12/07/2010 4:03:21 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09summary.htm

Module 9 summary

Accounting for partnerships and corporations

List the characteristics of a proprietorship and a partnership, and explain the importance

of mutual agency and unlimited liability in a partnership.

A sole proprietorship has one owner.

A partnership is an association between the partners (two or more owners) to operate a business for profit.

All partners in a general partnership are personally liable for all the debts of the partnership.

The risk of becoming a partner results in part from the fact that partnership characteristics include mutual agency

and unlimited liability.

Mutual agency means that you are responsible for your partners actions.

The partners are jointly and severally liable for all debts incurred by the partnership. Each of the partners has

unlimited liability.

Allocate partnership earnings to partners (a) on a stated fractional basis, (b) in the

partners capital ratio, and (c) through the use of salary and interest allowances.

A partnerships net income or losses are allocated to the partners according to the partnership agreement.

The agreement may specify that each partner will receive a given fraction, or that the allocation of income and losses

will reflect salary allowances and/or interest allowances.

When salary and/or interest allowances are granted, the residual net income or loss is usually allocated equally or on

a stated fractional basis.

Explain the advantages, disadvantages, and organization of corporations.

Advantages of the corporate form of business include

separate legal entity

limited liability

continuity

no mutual agency

Disadvantages include

strict government regulations

corporations are subject to various taxes that other business entities are not, including income taxes

Explain the differences in the financial statements for corporate and unincorporated

organizations.

The equity section on the balance sheet is called owners equity and partners' equity for sole proprietorships and

partnerships respectively. For corporations, the equity section is labelled shareholders equity.

Shareholders equity consists of

contributed capital

retained earnings

Record the issuance of shares.

When shares are issued, the proceeds are credited to a share capital account which forms part of contributed capital.

State the differences between common and preferred shares, and allocate dividends

between common and preferred shares.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09summary.htm (1 of 3) [12/07/2010 4:03:22 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09summary.htm

The Canada Business Corporations

Act (CBCA) allows for more than one class of shares.

Common shares are known as the residual class because common shareholders claims to assets and profits of a

business rank behind those of creditors and preferred shareholders.

Preferred shares differ from common shares in terms of the rights and privileges related to dividends, liquidation, and

conversion.

Preferred dividends are generally limited to a fixed amount and must be paid to preferred shareholders before

common shareholders receive dividends.

Record cash dividends and explain their effects on the assets and shareholders equity of

a corporation.

A company is not obligated to declare dividends. The decision to declare dividends rests with the board of directors.

Once a cash dividend has been declared, it becomes a legal obligation and a liability must be established.

Cash dividends transfer corporate assets to the shareholders, reducing a companys assets and equity.

Calculate book value per share and interpret and apply this ratio in decision-making

scenarios.

Book value per share measures shareholders equity on a per share basis based on balance sheet values.

As balance sheet amounts are based on cost as opposed to current values, the book value per share provides little

practical information.

Record share dividends, share splits, and retirement of shares, and explain their effects

on the assets and shareholders equity.

A share dividend occurs when a company makes a pro rata distribution of additional common shares to existing

shareholders.

A share split occurs when a company issues more than one new share for each share previously outstanding.

For both share dividends and share splits, because all shareholders receive the same proportionate increase in

shares, their percentile ownership of the company remains unchanged.

Neither a share dividend nor a share split affect assets or total shareholder equity.

Share dividends transfer monies from retained earnings to share capital.

When a company repurchases its own shares for immediate retirement, all capital items related to the shares are

removed from the accounts. The gain or loss flows directly to equity.

Calculate earnings per share for companies with simple capital structures and interpret

and apply this ratio in decision-making scenarios.

Earnings per share (EPS) conveys how much of a companys earnings "belong" to each outstanding common share.

Earnings that "belong" to or are available to common shareholders is net income for the year less the

amount that must be paid to preferred shareholders for the current year.

EPS is calculated by dividing net income less dividends to preferred shares by the weighted-average number of

common shares outstanding.

Explain how the income effects of discontinued operations are reported.

Discontinued operations are the operations of a business segment that has been sold, abandoned, shut down, or

otherwise disposed of, or that is the subject of a formal plan of disposal.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09summary.htm (2 of 3) [12/07/2010 4:03:22 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09summary.htm

The net income or loss from operating the segment and the gain or loss on disposal are separately reported

on the income statement below income from continuing operations and are reported net of tax.

Describe restrictions of retained earnings and accounting changes, and the disclosure of

such items in the financial statements.

Retained earnings can be restricted so as to inform shareholders that the full amount of retained earnings is not

available for distribution by way of dividends.

Restrictions are disclosed in the notes to the financial statements.

Accounting changes include:

changes in accounting policy or principle, which require retroactive restatement of financial statements

A change in accounting policy occurs when an entity adopts a policy different from the one previously used.

In order for users of the financial statements to understand the effects of a change in accounting policy:

previous years results must normally be restated, and

the nature and justification for the change must be disclosed

correction of errors in prior financial statements, which requires restatement of the prior years financial

statements, but has no effect on the current years operating results

change in estimate, which is accounted for in period of change and future

Explain the ethical issues around management incentive plans.

Management may desire to prepare misleading financial reports to ensure that they receive performance-based

bonuses.

Accountants have a responsibility to ensure that financial reports are designed not to deceive stakeholders.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09summary.htm (3 of 3) [12/07/2010 4:03:22 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09tyksol.htm

Module 9 Test your knowledge solutions

a.

1. Incorrect. ($800,000 $100,000) 50,000 = $14.00; however, the denominator is supposed to be based on the

number of common shares outstanding (48,000) and not the number of common shares issued.

2. Correct. The book value per common share is $14.58, calculated as $800,000 $100,000 = $700,000 48,000

outstanding common shares = $14.58.

3. Incorrect. $800,000 50,000 = $16.00; however, the $100,000 contributed capital belonging to the preferred

shareholders was not subtracted in the numerator. Also the denominator should be based on the number of common

shares outstanding (48,000) and not the number of common shares issued.

4. Incorrect. $800,000 48,000 = $16.67; however, the $100,000 contributed capital belonging to the preferred

shareholders was not subtracted in the numerator.

b.

1. Incorrect. Outstanding shares are shares that have been issued and are actually held by shareholders.

2. Incorrect. Issued shares are shares that have been sold.

3. Incorrect. Common shares have voting rights and are held by the residual owners of a corporation.

4. Correct. Authorized shares is the term applied to the total number of shares that may be issued as established by

the corporations articles of incorporation.

c.

1. Incorrect. Common shares issued by a corporation are not recorded by that corporation as current assets.

2. Incorrect. Common shares issued by a corporation are not recorded by that corporation as intangible assets.

3. Incorrect. Common shares issued by a corporation are not recorded by that corporation as part of a long-term

investment account.

4. Correct. Common shares issued by a corporation are recorded by that corporation as an equity account.

d.

1. Incorrect. Preferred shares do not have voting rights.

2. Incorrect. Voting shares is not the term normally used to describe shares with voting rights.

3. Correct. Common shares have voting rights.

4. Incorrect. Contributed capital is a category in Shareholders equity on a corporate balance sheet.

e.

1. Incorrect. The balance was a deficit rather than a credit balance.

2. Incorrect. $3,000 + $12,000 $8,000 $25,000 = ($18,000) deficit. However, the $3,000 beginning balance should

be subtracted and not added because it is a debit balance.

3. Incorrect. The balance was a deficit rather than a credit balance.

4. Correct. The balance of the Retained earnings account at the end of 2011 was a $24,000 deficit, calculated as

$3,000 + $12,000 $8,000 $25,000 = $24,000.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09tyksol.htm [12/07/2010 4:03:23 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t05sol.htm

Exercise 15-1 solution

a. Suppose Tom and Joans company is organized as a partnership, the following entries would be prepared to record

the business start-up and its operations:

b. Suppose the company is organized as a corporation that issued 1,000 common shares, the following entries would

record the business start-up:

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t05sol.htm [12/07/2010 4:03:24 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m03t05.htm

3.5 Closing entries

Learning objective

Prepare closing entries for a service business. (Level 1)

Required reading

Chapter 5, pages 196-201

LEVEL 1

Accounts are either permanent or temporary in nature. Balance sheet accounts are permanent accounts, while income

statement accounts are temporary.

Permanent accounts are continuous accounts their balances are carried forward from one

accounting period to the next. Using cash as an example, the cash account balance fluctuates during the accounting period

as deposits and payments are made. The ending cash balance from one period becomes the beginning cash balance for the

next period; therefore, the account continues from one period to the next.

Temporary accounts are periodic accounts , and at the end of each accounting

period, their balances are closed (transferred) to owners equity. The revenue account, for example, is a

temporary account. The revenue account for each accounting period begins with a zero balance.

Closing entries transfer the balances in the temporary accounts (revenue, expense, and withdrawals accounts) to a balance

sheet equity account (owners capital for a sole proprietorship). The closing process is described and illustrated on pages 196-

201. Work through the example in Exhibits 5.10 to 5.13 and check your understanding of the subject.

Textbook activity

Checkpoint Questions 4 and 5 on

page 201 (Solutions on page 210)

Quick Study 5-5 to 5-7 on pages 220-221

(Solutions)

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m03t05.htm [12/07/2010 4:03:24 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t07example9-1.htm

Example 9-1

Note that if cash dividends are debited directly to the Retained earnings account (instead of being debited to the Cash

dividends declared account), there is no need to close the Cash dividends declared account.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t07example9-1.htm [12/07/2010 4:03:25 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09tt09sol.htm

Exercise 16-1 solution

1 This account is a contra equity account; it is not a liability.

2 Share dividends are recorded using the market/fair value on the date of declaration.

3 Notice that no assets are being distributed to the shareholders as a result of a share dividend, unlike a cash dividend where

cash, an asset, is distributed to shareholders.

Analysis component:

The market price of Delwares shares decreased as a result of the 5% share dividend because given that the number of shares

issued and outstanding increased with no additional asset investment by shareholders, the value will decrease per share

(assuming no changes other than the share dividend). Since the share price is recovering after the declaration of the share

dividend (as evidenced by the market price increase from January 20 to January 30 of $13.50 to $14.25), it can be assumed that

shareholders have a positive future outlook for this company.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09tt09sol.htm [12/07/2010 4:03:27 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t09sol2.htm

Exercise 16-2 solution

Analysis component:

The market price of Stingrays shares decreased by about 2/3 as a result of the 3:1 share split because although the number

of shares tripled, no new assets were contributed by the shareholders as a result of the share split. If the number of shares

triples with no assets contributed, it is logical that the market value per share would decrease by a ratio equivalent to the

increase in the number of shares.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t09sol2.htm [12/07/2010 4:03:28 PM]

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t13analysis.htm

Analysis

A reasonable approach to this case is to start by identifying the facts and the operational issues. The facts are clearly stated

in the case. It is important to recognize, however, the conflict between the managers fiduciary responsibility to the

shareholders and their apparent desire to increase their personal wealth through the share option plan. If the information

about the new contract can be kept private until after the option plan is approved and the options are priced, the managers

will stand to make much more money when they eventually exercise those options. The officers suggestion that annual

meetings are only about the companys past activities is misleading because shareholders are being asked to vote on the

three-year stock option plan for managers. Moreover, the general point of annual meetings is to provide an opportunity for

the board to be accountable to shareholders.

This case raises both legal and moral issues. It is against the law to mislead the capital markets by distributing false

information or by withholding relevant information. The managers decision to withhold the news is objectionable because of

the share option plan. The financial vice-president should impress upon the officers and directors that withholding

information about the contract would be unethical.

Some economists and philosophers argue that rules against insider trading dont work and that markets would be more

efficient if there were no prohibitions of insider trading. So while there would not be a level playing field for investors (insider

investors would know far more than investors on the outside), the market would respond more quickly and efficiently to new

information and the rest of the market would learn the information quickly. Moreover, these critics claim that with no rules

against insider trading, other investors (outsiders) would factor in their relative lack of knowledge in making investment

decisions by hiring more knowledgeable investment experts, for example.

It is important to realize that the argument about which type of market arrangements would be more efficient one with

restrictions on insider trading and one with no restrictions is a theoretical one. It is

not an argument that under our current arrangements (which strongly restrict insider trading), it is acceptable to act

in violation of the securities regulations and to take advantage of uninformed investors, who trust that investments will

generally be made on the basis of publicly available knowledge.

You can rightly argue that rules against insider trading should be weakened or even abolished. But it is definitely wrong to

engage in insider trading in a market that has rules against it. This is to take unfair advantage of others. This is like driving

on the left-hand side of the road in Canada and justifying this by claiming that it is required to drive on that side in Japan. In

other words, it is one thing to argue about whether one set of rules is more desirable than another, but quite another to act

on that belief when the general rule in place is the opposite.

For human interactions (including economic interactions) to work well, we have to agree on certain ground rules and trust

that they are in place. Once the ground rules are in place (whether these permit or forbid insider trading), it is unfair to act

as if those rules do not exist. Moreover, to act in such an unfair way undermines the trust that makes productive human

interactions possible.

The ethical bottom line in this case is then crystal clear. The managers are acting unethically in withholding this information

from the shareholders, and they are undermining the trust that is essential to capital markets.

file:////cgafs2/VOL1/Courses/2010-11/CGA/FA1/06course/m09t13analysis.htm [12/07/2010 4:03:29 PM]

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Using The Data in The Student Spreadsheet File P G XLSX ToDocument1 pageUsing The Data in The Student Spreadsheet File P G XLSX ToLet's Talk With HassanNo ratings yet

- Zakat Calculation Form: (Copies of This Form May Be Made For Distribution)Document4 pagesZakat Calculation Form: (Copies of This Form May Be Made For Distribution)Hasan Irfan SiddiquiNo ratings yet

- Chapter 5 An Introduction To Cost Terms and PurposesDocument4 pagesChapter 5 An Introduction To Cost Terms and PurposesGosaye DesalegnNo ratings yet

- Dart GuideDocument29 pagesDart GuideMark CheneyNo ratings yet

- PR 19 1004 Russian Military Thought Concepts ElementsDocument188 pagesPR 19 1004 Russian Military Thought Concepts ElementsGosaye Desalegn100% (1)

- Joint Concepts JcoieDocument62 pagesJoint Concepts JcoieGosaye DesalegnNo ratings yet

- Joint Publication 1 Doctrine GuideDocument176 pagesJoint Publication 1 Doctrine GuideAkaje HuamedabNo ratings yet

- Deterrence Operations Joint Operating Concept: December 2006Document80 pagesDeterrence Operations Joint Operating Concept: December 2006Gosaye DesalegnNo ratings yet

- Chairman of The Joint Chiefs of Staff InstructionDocument52 pagesChairman of The Joint Chiefs of Staff InstructionGosaye DesalegnNo ratings yet

- Military Operating Concept DevelopmentDocument88 pagesMilitary Operating Concept DevelopmentGosaye DesalegnNo ratings yet

- National Defense University Policy: Joint Staff WASHINGTON, D.C. 20318Document56 pagesNational Defense University Policy: Joint Staff WASHINGTON, D.C. 20318Gosaye DesalegnNo ratings yet

- Ms 111: Military Science I: Introduction To LeadershipDocument1 pageMs 111: Military Science I: Introduction To LeadershipGosaye DesalegnNo ratings yet

- The Evolution Of: Joint WarfareDocument9 pagesThe Evolution Of: Joint WarfareGosaye DesalegnNo ratings yet

- The Just War or Just A War A Proposal For Ethical Joint Doctrine of WarDocument114 pagesThe Just War or Just A War A Proposal For Ethical Joint Doctrine of WarGosaye DesalegnNo ratings yet

- USMC Law of War HandoutDocument28 pagesUSMC Law of War HandoutMDSBACK UPFILESNo ratings yet

- St. Marry Universty School of Graduate Studies Mba ProgramDocument80 pagesSt. Marry Universty School of Graduate Studies Mba ProgramGosaye DesalegnNo ratings yet

- Arn18138 - Adp 1-01 Final WebDocument44 pagesArn18138 - Adp 1-01 Final WebGosaye DesalegnNo ratings yet

- Adp3 90Document108 pagesAdp3 90MacaroonNo ratings yet

- 20110519ADP Army Doctrine PrimerpdfDocument131 pages20110519ADP Army Doctrine PrimerpdfGosaye DesalegnNo ratings yet

- Unit Thre Project Feasibility StudyDocument14 pagesUnit Thre Project Feasibility StudyGosaye DesalegnNo ratings yet

- Rocket Battalion Training Meeting AgendaDocument45 pagesRocket Battalion Training Meeting AgendaGosaye DesalegnNo ratings yet

- REL-MOD: Focused Logistics Key to Joint Ops Success in Modern WarfareDocument8 pagesREL-MOD: Focused Logistics Key to Joint Ops Success in Modern WarfareGosaye DesalegnNo ratings yet

- Once Again, The Challenge To The U.S. Army During A Defense Reduction: To Remain A Military ProfessionDocument46 pagesOnce Again, The Challenge To The U.S. Army During A Defense Reduction: To Remain A Military ProfessionGosaye DesalegnNo ratings yet

- Mis PDFDocument273 pagesMis PDFKumar RajNo ratings yet

- Planning For Leadership With Army Education Services Officers and Leadership CompetenciesDocument13 pagesPlanning For Leadership With Army Education Services Officers and Leadership CompetenciesGosaye DesalegnNo ratings yet

- Strengthening Moral Competence Through Military Ethics EducationDocument24 pagesStrengthening Moral Competence Through Military Ethics EducationGosaye DesalegnNo ratings yet

- Ad A T M: Isciplined Pproach To Raining AnagementDocument6 pagesAd A T M: Isciplined Pproach To Raining AnagementGosaye DesalegnNo ratings yet

- Investment Evaluation Methods for Capital Budgeting DecisionsDocument10 pagesInvestment Evaluation Methods for Capital Budgeting DecisionsGosaye Desalegn100% (1)

- Strengthening Moral Competence Through Military Ethics EducationDocument24 pagesStrengthening Moral Competence Through Military Ethics EducationGosaye DesalegnNo ratings yet

- Chapt 7Document138 pagesChapt 7Gosaye DesalegnNo ratings yet

- General Overview To Supply Chain ManagementDocument16 pagesGeneral Overview To Supply Chain ManagementGosaye DesalegnNo ratings yet

- Project Ideas.Document8 pagesProject Ideas.Gosaye DesalegnNo ratings yet

- Investment in Secondary Market, Transaction Procedure and IndexDocument30 pagesInvestment in Secondary Market, Transaction Procedure and IndexChintan JoshiNo ratings yet

- Nepal Budget 2076-77 (2019-20)Document38 pagesNepal Budget 2076-77 (2019-20)Menuka SiwaNo ratings yet

- The Financial Statement Analysis: PGDM Executive 2018-2019Document42 pagesThe Financial Statement Analysis: PGDM Executive 2018-2019Sanchit GuptaNo ratings yet

- 6.annexure F-HFMN330-1-JAN-JUN2023-FA1-GT-V3-31012023-3Document7 pages6.annexure F-HFMN330-1-JAN-JUN2023-FA1-GT-V3-31012023-3Katlego MosehleNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- UntitledDocument27 pagesUntitledSartoriNo ratings yet

- Chapter 20Document14 pagesChapter 20negalamadnNo ratings yet

- AC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and CommentariesDocument69 pagesAC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and Commentaries전민건No ratings yet

- Dividend: Cash vs. Stock RepurchaseDocument3 pagesDividend: Cash vs. Stock RepurchaseGanesh PhapaleNo ratings yet

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisyukiNo ratings yet

- Balance Sheet Ratio Analysis FormulaDocument9 pagesBalance Sheet Ratio Analysis FormulaAbu Jahid100% (1)

- Organic Chemistry 3rd Edition Klein Solutions ManualDocument35 pagesOrganic Chemistry 3rd Edition Klein Solutions Manualeffusiveflooder936r8o100% (21)

- CA Final DT Q MTP 1 May 23Document10 pagesCA Final DT Q MTP 1 May 23Mayur JoshiNo ratings yet

- ProblemSet Cash Flow EstimationQA-160611 - 021520Document25 pagesProblemSet Cash Flow EstimationQA-160611 - 021520Jonathan Punnalagan100% (2)

- Accounts of Holding Companies PDFDocument6 pagesAccounts of Holding Companies PDFAnshu GauravNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- C C 2021 Cfa® E: Ritical Oncepts For The XamDocument6 pagesC C 2021 Cfa® E: Ritical Oncepts For The XamGonzaloNo ratings yet

- Test Bank - Chapter18 FS AnalysisDocument87 pagesTest Bank - Chapter18 FS AnalysisAiko E. LaraNo ratings yet

- Capital Allocation Outside The U.SDocument83 pagesCapital Allocation Outside The U.SSwapnil GorantiwarNo ratings yet

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- P8 - Financial AnalysisDocument20 pagesP8 - Financial AnalysisNhlanhla2011No ratings yet

- Chapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document21 pagesChapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Business Finance ABM StrandDocument107 pagesBusiness Finance ABM StrandMiss Anonymous23No ratings yet

- CFI5104201205 Investment AnalysisDocument7 pagesCFI5104201205 Investment AnalysisNelson MrewaNo ratings yet

- Finance For ProcurementDocument3 pagesFinance For ProcurementAlex MuhweziNo ratings yet

- A Five-State Financial Distress Prediction ModelDocument13 pagesA Five-State Financial Distress Prediction ModelGhina AlifahNo ratings yet

- Investment in AssociateDocument10 pagesInvestment in AssociateJan Paul GalopeNo ratings yet

- Quiz 549Document16 pagesQuiz 549Haris NoonNo ratings yet