Professional Documents

Culture Documents

3rd Quarter Pre-Post-Test Applied Math CH 7 9 10

Uploaded by

api-314402585Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3rd Quarter Pre-Post-Test Applied Math CH 7 9 10

Uploaded by

api-314402585Copyright:

Available Formats

Applied Math 3rd Quarter Pre/Post Test

Instructions: DO NOT WRITE ON THIS TEST. DO YOUR BEST.

1) Colin Scott received his charge account statement. It showed a previous balance of $74.22, a finance

charge of $1.11, new purchases of $351.38, a credit for $69.95, and a payment of $175.00. What is the

new balance?

a) $181.76 b) $547.99 c) $398.99 d) $281.76

2) Denise Shelbys account statement. Unpaid balance of $210.94. Periodic rate of 1.85 percent.

i) What is the finance charge?

ii) New purchases of $341.22. What is the new balance?

3) Sports car, base price is $19,015. Options: sport appearance package $1,224, power drivers seat

$246, premium sound system $319, removable hatch roof panels $905, destination charge is $600.

What is the sticker price?

a) $20,330 b) $20,349 c) $22,358 d) $22,309

4) A hatchbacks base price is $10,249. The options total $910. The destination charge is $495. Dealer

pays about 93.5 percent of base price and 77 percent of options. What is the dealers cost?

a) $10,778.52 b) $23,371.16 c) $10,371.20 d) $11,371.16

5) A four-wheel drive vehicle has an average retail price of $14,500. Add $150 for a tilt steering wheel.

Add $700 for air conditioning. Deduct $600 for manual transmission. Deduct $560 for excessive

mileage. What is the average retail price?

a) $12,190 b) $14,190 c) $14,329 d) $19,140

6) Kevin Mahans insurance policy has a $237.20 premium for bodily injury and property damage. The

collision premium is $146. Mahans driver rating factor is 2.7. What is his annual premium?

a) $1,034.64 b) $237.20 c) $383.20 d) $640.44

7) Kim Leung drove a SUV 11,500 miles. Fixed costs totaled $3,343. Variable costs totaled $1,511.

i) What was the total annual cost?

ii) What was the cost per mile?

8) Enrico recently leased a new car. His payments are $658 per month for 60 months. His deposit was

$6,000. He paid $105 title fee and a $80 license fee. What is his total lease cost?

a) $45,665 b) $56,000 c) $39,761 d) $59,718

9) Nydias total cost to rent a car was $400. The number of miles she drove was 1,000. What was the cost

per mile to rent the vehicle?

a) $0.20 b) $0.23 c) $0.40 d) $1.00

10) Home priced at $260,000. Down payment: 30 percent. What is the mortgage loan amount?

a) $182,000 b) $185,000 c) $18,200 d) $1,820

11) Bettys mortgage loan amount is $87,750. She financed her house for 30 years with monthly payments of

$725. At the end of 30 years, what will be the total amount of interest charged?

a) $116,115 b) $173,250 c) $163,500 d) $152,725

12) Sarah and her husband have agreed to purchase a house for $87,500. Washington Savings and Loan is

willing to finance the purchase but require a $5,000 down payment and closing costs of 3 percent of the

amount of the mortgage loan. What are the total closing costs?

a) $5,000 b) $2,475 c) $2,650 d) $3,000

13) Michael Moore obtained a 30-year, $90,000 mortgage with an interest rate of 8 percent. For the first

payment, what is the interest?

a) $400 b) $500 c) $600 d) $700

14) Jerrys new home has an estimated replacement value of $215,000. He has insured his home for 80

percent of its replacement value. What is the amount of coverage on the home?

a) $172,000 b) $127,902 c) $145,900 d) $189,083

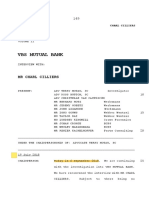

Homeowners Insurance Premiums

Annual Premiums for a Typical Homeowners Policy

Fire Protection Class

Amount of

Insurance Brick / Masonry Veneer Wood Frame

Coverage 1-6 7-8 9 10 11 1-6 7-8 9 10 11

$ 40,000 $ 166 $ 170 $ 225 $ 237 $ 270 $ 178 $ 183 $ 237 $ 248 $ 285

45,000 173 178 233 244 280 187 191 248 260 298

50,000 178 183 241 254 290 190 195 254 265 304

60,000 191 196 259 273 313 205 211 273 287 328

70,000 213 216 285 299 343 225 231 299 315 360

80,000 241 248 328 343 394 257 265 343 363 415

90,000 268 276 365 384 441 289 296 384 403 464

100,000 298 307 407 426 490 320 329 426 449 515

120,000 354 364 484 508 584 381 391 508 534 614

150,000 459 471 625 657 755 493 506 657 692 794

200,000 616 633 841 884 1,017 662 680 884 931 1,070

250,000 737 754 961 1,021 1,167 780 798 1,021 1,086 1,243

300,000 879 901 1,147 1,218 1,394 931 953 1,218 1,295 1,483

400,000 1,021 1,045 1,331 1,413 1,617 1,067 1,105 1,413 1,504 1,723

500,000 1,309 1,340 1,707 1,812 2,074 1,385 1,418 1,812 1,929 2,209

15) Use the figure above. Benitos home is insured for 90 percent of its $100,000 replacement value. The

home is of wood-frame construction and is rated in fire protection class 8. What is the annual insurance

premium?

a) $296 b) $305 c) $218 d) $673

16) Helgas net pay is $50,963. What is the maximum housing cost she can incur without exceeding FHA

guidelines of 35 percent of net pay?

a) $17,864.32 b) $23,101.25 c) $17,837.05 d) $22,789.00

ANSWER KEY

1) A $181.76

2) i) $3.90 ii) $556.06

3) i) $2.86 ii) $109.76

4) $220.39

5) C $3,429.74

6) D $575.45

7) C $563.50

8) A $43.56

9) B $3,553.11

10) B 12.25%

11) D $22,309

12) A $10,778.52

13) B $14.190

14) A $1,034.64

15) i) $4,854 ii) $0.42 per mile

16) A $45,665

17) $0.40

You might also like

- Roads Elemental CostingDocument47 pagesRoads Elemental Costingsarathirv6100% (2)

- Input: Excersise 10-1: Harley DavidsonDocument13 pagesInput: Excersise 10-1: Harley DavidsonMassahid BaedhowiNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- 2006 Business CalculationsDocument13 pages2006 Business CalculationsthatasianpersonNo ratings yet

- Fourth Form Quiz 3 (Consumer Arithmetic) Name: - ClassDocument4 pagesFourth Form Quiz 3 (Consumer Arithmetic) Name: - ClassChet AckNo ratings yet

- StepSmart Fitness ExlDocument9 pagesStepSmart Fitness ExlNishiGogia50% (2)

- Feasibility Study of Hospital With A Capital Budgeting ApproachDocument10 pagesFeasibility Study of Hospital With A Capital Budgeting ApproachInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Understanding the Role of Payment Gateways in Indonesia's Digital EconomyDocument23 pagesUnderstanding the Role of Payment Gateways in Indonesia's Digital EconomySolafide PasaribuNo ratings yet

- Borang Sg20 Dan KodDocument6 pagesBorang Sg20 Dan Kod9W2YABNo ratings yet

- New Automobile Depreciation: Years ValueDocument22 pagesNew Automobile Depreciation: Years Valueroyalb100% (4)

- Project On Demat AccountDocument62 pagesProject On Demat Accountsmruti bansod100% (1)

- MT 199 Deutsche 500.000 EuroDocument1 pageMT 199 Deutsche 500.000 Eurorasool mehrjoo100% (1)

- 3rd Quarter Pre-Post-Test Applied Math CHDocument3 pages3rd Quarter Pre-Post-Test Applied Math CHapi-314402585No ratings yet

- 2016 SLC Business CalculationsDocument12 pages2016 SLC Business Calculationssslaa82No ratings yet

- Basic College Mathematics An Applied Approach 10Th Edition Aufmann Test Bank Full Chapter PDFDocument40 pagesBasic College Mathematics An Applied Approach 10Th Edition Aufmann Test Bank Full Chapter PDFTaylorHarveyawde100% (12)

- Modern Macrame Revenue & Expenses Year OneDocument93 pagesModern Macrame Revenue & Expenses Year OneSnehaNo ratings yet

- 4th Quarter Pre-Post Test Applied Math CH 11-12Document2 pages4th Quarter Pre-Post Test Applied Math CH 11-12api-314402585No ratings yet

- September 2009 Forecast of Alameda Point Revenues and ExpensesDocument1 pageSeptember 2009 Forecast of Alameda Point Revenues and ExpensesAction Alameda NewsNo ratings yet

- Screenshot 2024-02-16 at 1.57.38 PMDocument32 pagesScreenshot 2024-02-16 at 1.57.38 PMdarkwaflorence2No ratings yet

- Home Buying CalculatorDocument7 pagesHome Buying CalculatorDan CliffeNo ratings yet

- Answers For CH 3Document3 pagesAnswers For CH 301101994No ratings yet

- Checklist of Key Figures: Revenue RecognitionDocument3 pagesChecklist of Key Figures: Revenue Recognitioneagle1965No ratings yet

- 2nd Quarter Pre-Post-Test Applied Math CH 4-6Document3 pages2nd Quarter Pre-Post-Test Applied Math CH 4-6api-314402585No ratings yet

- CambMATHS9 5.1-5.2TRP 2ED Worksheet ANS 02Document1 pageCambMATHS9 5.1-5.2TRP 2ED Worksheet ANS 02olivia.vangeldNo ratings yet

- Common Excel Questions START - v2Document11 pagesCommon Excel Questions START - v2Mark SalvañaNo ratings yet

- E Street Development Waterfall - Fall 2020 Part 2 - MasterDocument38 pagesE Street Development Waterfall - Fall 2020 Part 2 - Masterapi-544095773No ratings yet

- Personal Finance 2nd Edition Walker Solutions ManualDocument14 pagesPersonal Finance 2nd Edition Walker Solutions Manualsmiletadynamia7iu4100% (21)

- Mathematics For Business 10Th Edition Salzman Test Bank Full Chapter PDFDocument37 pagesMathematics For Business 10Th Edition Salzman Test Bank Full Chapter PDFretailnyas.rjah100% (10)

- 1st Quarter Pre-Post Test Applied Math CHDocument2 pages1st Quarter Pre-Post Test Applied Math CHapi-314402585No ratings yet

- 2012-Noman TextileDocument3 pages2012-Noman TextileShahadat Hossain ShahinNo ratings yet

- Median Home Sales Price (1982 To 2007) : M-NCPPC 01+000 03+000 Research Technology Ce NterDocument4 pagesMedian Home Sales Price (1982 To 2007) : M-NCPPC 01+000 03+000 Research Technology Ce NterM-NCPPCNo ratings yet

- Unit Costs For Construction of Gravity Sewers (A) (B) (F)Document2 pagesUnit Costs For Construction of Gravity Sewers (A) (B) (F)mabrarahmedNo ratings yet

- Chapter Iv - Data Analysis and Interpretation: Property #1Document12 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- Chapter Iv - Data Analysis and Interpretation: Property #1Document32 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- Form Four Term Two Worksheet Three Consumer Arithmetic PDFDocument2 pagesForm Four Term Two Worksheet Three Consumer Arithmetic PDFmissy100% (1)

- Excel To Business Analys ExamDocument15 pagesExcel To Business Analys Examrhea23aNo ratings yet

- Annual profits and salaries from vehicle fleet operations over 40 yearsDocument9 pagesAnnual profits and salaries from vehicle fleet operations over 40 yearsLaika AerospaceNo ratings yet

- MultiplechoicesDocument8 pagesMultiplechoicesBAYBAY, Avin Dave D.No ratings yet

- Mathematics For Business 10th Edition Salzman Test BankDocument16 pagesMathematics For Business 10th Edition Salzman Test Bankbrandoncook07011996ogy100% (34)

- 20BM61K28 - Tanmoy Mandal Quiz 1 Part CDocument8 pages20BM61K28 - Tanmoy Mandal Quiz 1 Part CSudipto MukherjeeNo ratings yet

- Total Sum After Vat BIRR $ 3,511,853.05: Grand SummaryDocument23 pagesTotal Sum After Vat BIRR $ 3,511,853.05: Grand SummarygetNo ratings yet

- 3019 Assignment 2 - ABC CLASSIFICATIONDocument2 pages3019 Assignment 2 - ABC CLASSIFICATIONloneloneNo ratings yet

- 2.4 Calculating A Percentage: HomeworkDocument1 page2.4 Calculating A Percentage: HomeworkAjay LakshmananNo ratings yet

- Week3 SolutionDocument3 pagesWeek3 SolutionRiski -No ratings yet

- 2003 RLC Business CalcDocument9 pages2003 RLC Business Calcbob smithNo ratings yet

- 1st Quarter Pre-Post Test Applied Math RevisedDocument2 pages1st Quarter Pre-Post Test Applied Math Revisedapi-314402585No ratings yet

- 3420 Clandara Ave, Las Vegas, 89121 RentalDocument4 pages3420 Clandara Ave, Las Vegas, 89121 RentalLarry RobertsNo ratings yet

- Pages From Area of Triangles Using Sine Q3-2Document7 pagesPages From Area of Triangles Using Sine Q3-2aftabNo ratings yet

- Northstar Pr#4D1817Document8 pagesNorthstar Pr#4D1817karri410No ratings yet

- Practical Financial Management Appendix BDocument16 pagesPractical Financial Management Appendix Bitumeleng10% (1)

- Tannous1e_SSM_Chapter_1Document6 pagesTannous1e_SSM_Chapter_1Shikha NandNo ratings yet

- Cost estimation questionsDocument7 pagesCost estimation questionsOwais Khan KhattakNo ratings yet

- Class 2 Mark Up Mark Down DiscountsDocument5 pagesClass 2 Mark Up Mark Down DiscountsPrableen kaurNo ratings yet

- E 06 H 1 MortgageDocument6 pagesE 06 H 1 MortgageMintNo ratings yet

- Test 1 ReviewDocument12 pagesTest 1 Reviewkyte walkerNo ratings yet

- Photovoltaic Solar Energy Project (PDFDrive)Document229 pagesPhotovoltaic Solar Energy Project (PDFDrive)Mbotake LawsonNo ratings yet

- A Recap of Everything We Have Done On Percentages!Document3 pagesA Recap of Everything We Have Done On Percentages!Sivanathan AnbuNo ratings yet

- 2023 (ASSIGNMENT) Mathematics in Practical SituationsDocument16 pages2023 (ASSIGNMENT) Mathematics in Practical Situationsalibabagoat1No ratings yet

- Nguyen Huong A 12Document8 pagesNguyen Huong A 12Quỳnh Hương NguyễnNo ratings yet

- UVA-S-F-1210.XLS Version 2.0: StudentDocument5 pagesUVA-S-F-1210.XLS Version 2.0: StudentwhatNo ratings yet

- Chapter 6 Practice Questions PDFDocument7 pagesChapter 6 Practice Questions PDFleili fallahNo ratings yet

- Affordable Housing Scheme A) Castle Gardens at Katamanso D) Heavens Creek at AfienyaDocument2 pagesAffordable Housing Scheme A) Castle Gardens at Katamanso D) Heavens Creek at Afienyaengsam777No ratings yet

- Bac DCFDocument7 pagesBac DCFVivek GuptaNo ratings yet

- H8U4 1 02 Inventory ExcerciseDocument3 pagesH8U4 1 02 Inventory Excercisegustavo1234567713No ratings yet

- Common Excel Questions START v2Document10 pagesCommon Excel Questions START v2Apple StarkNo ratings yet

- Ptep Form B - 1 Sy1819Document2 pagesPtep Form B - 1 Sy1819api-314402585No ratings yet

- Ptep Form B Sy 17-18Document3 pagesPtep Form B Sy 17-18api-314402585No ratings yet

- Ptep Form B - 1 Sy1819Document2 pagesPtep Form B - 1 Sy1819api-314402585No ratings yet

- Parent Perception Survey - Applied MathDocument2 pagesParent Perception Survey - Applied Mathapi-314402585No ratings yet

- Applied Math Perception Survey Results Sy1718Document1 pageApplied Math Perception Survey Results Sy1718api-314402585No ratings yet

- Ptep Goal 1 Sy1718 - BataclanDocument2 pagesPtep Goal 1 Sy1718 - Bataclanapi-314402585No ratings yet

- Applied Math Parent Perception Results Sy1718Document1 pageApplied Math Parent Perception Results Sy1718api-314402585No ratings yet

- Results q1 Pre Post Test Sy1718 6th PDDocument1 pageResults q1 Pre Post Test Sy1718 6th PDapi-314402585No ratings yet

- 2nd Quarter Pre-Post-Test Applied Math CH 4-6Document3 pages2nd Quarter Pre-Post-Test Applied Math CH 4-6api-314402585No ratings yet

- Results q1 Pre Post Test Sy1718 4th PDDocument1 pageResults q1 Pre Post Test Sy1718 4th PDapi-314402585No ratings yet

- Student Perception Sy16-17Document1 pageStudent Perception Sy16-17api-314402585No ratings yet

- 1st Quarter Pre-Post Test Applied Math CHDocument2 pages1st Quarter Pre-Post Test Applied Math CHapi-314402585No ratings yet

- Results q1 Pre Post Test Sy1718 3rd PDDocument1 pageResults q1 Pre Post Test Sy1718 3rd PDapi-314402585No ratings yet

- Results q1 Pre Post Test Sy1718 5th PDDocument1 pageResults q1 Pre Post Test Sy1718 5th PDapi-314402585No ratings yet

- Results q1 Pre Post Test Sy1718Document1 pageResults q1 Pre Post Test Sy1718api-314402585No ratings yet

- Ap Math 4th QTR Unit Plan Sy1718Document6 pagesAp Math 4th QTR Unit Plan Sy1718api-314402585No ratings yet

- Igp Service Learning Sy1718Document1 pageIgp Service Learning Sy1718api-314402585No ratings yet

- Standard/Skill: NCTM1 Numbers and Operations: Do Not Write On Quiz. Show Your Work On Separate Paper.Document2 pagesStandard/Skill: NCTM1 Numbers and Operations: Do Not Write On Quiz. Show Your Work On Separate Paper.api-314402585No ratings yet

- Progress Report Worksheet SamplesDocument3 pagesProgress Report Worksheet Samplesapi-314402585No ratings yet

- Guam Department of Education Mail - Elden IoanisDocument2 pagesGuam Department of Education Mail - Elden Ioanisapi-314402585No ratings yet

- Professional Educator Certificate HorizontalDocument1 pageProfessional Educator Certificate Horizontalapi-314402585No ratings yet

- Applied Math 1st Quarter Unit PlanDocument6 pagesApplied Math 1st Quarter Unit Planapi-314402585No ratings yet

- Guam Department of Education Mail - Savanna Blas Make-Up WorkDocument1 pageGuam Department of Education Mail - Savanna Blas Make-Up Workapi-314402585No ratings yet

- Applied Math 3rd Quarter Unit PlanDocument7 pagesApplied Math 3rd Quarter Unit Planapi-314402585No ratings yet

- Applied Math 2nd Quarter Unit PlanDocument7 pagesApplied Math 2nd Quarter Unit Planapi-314402585No ratings yet

- Formulas & TablesDocument2 pagesFormulas & Tablesapi-314402585No ratings yet

- Exit Ticket 1Document1 pageExit Ticket 1api-314402585No ratings yet

- PLC Meeting Notes Applied Math Sy1718Document11 pagesPLC Meeting Notes Applied Math Sy1718api-314402585No ratings yet

- PLC NotesDocument2 pagesPLC Notesapi-314402585No ratings yet

- CDP Preparation Template Form 1d - InstitutionalDocument2 pagesCDP Preparation Template Form 1d - Institutionalvincentcotoron.phdNo ratings yet

- Analisis Rasio Likuiditas Dan Rasio ProfitabilitasDocument14 pagesAnalisis Rasio Likuiditas Dan Rasio Profitabilitasindah06No ratings yet

- Money Mischief Chapter 1Document3 pagesMoney Mischief Chapter 1Enzo MolinariNo ratings yet

- (+92) 333-5861417 Aly Bin Zahid Executive Profile:: Head of Business, Muscat, OmanDocument3 pages(+92) 333-5861417 Aly Bin Zahid Executive Profile:: Head of Business, Muscat, Omanfaiza minhasNo ratings yet

- Maximize EPSDocument19 pagesMaximize EPSPrashant SharmaNo ratings yet

- Hyperinflation in ZimbabweDocument16 pagesHyperinflation in ZimbabweAmber HamzaNo ratings yet

- Financial Analysis of Britannia and DaburDocument8 pagesFinancial Analysis of Britannia and DaburBiplab MondalNo ratings yet

- Forex Hedging Handout 1Document9 pagesForex Hedging Handout 1Sheira Mae GuzmanNo ratings yet

- IFM 2023 24 Session 1 SlidesDocument20 pagesIFM 2023 24 Session 1 SlidesAaryan SarupriaNo ratings yet

- End of StatementDocument1 pageEnd of Statementbrazil server0No ratings yet

- Test #5 Part CDocument2 pagesTest #5 Part CJohn PickleNo ratings yet

- Market Place Lending Due DiligenceDocument14 pagesMarket Place Lending Due DiligenceCedric TiuNo ratings yet

- Transcription - Charl Cilliers (06.09.18)Document86 pagesTranscription - Charl Cilliers (06.09.18)Leila DouganNo ratings yet

- Visa Direct General Funds Disbursement Sellsheet PDFDocument2 pagesVisa Direct General Funds Disbursement Sellsheet PDFPablo González de PazNo ratings yet

- Foreign Exchange Market Chapter Explains Key ConceptsDocument33 pagesForeign Exchange Market Chapter Explains Key ConceptsShantanu ChoudhuryNo ratings yet

- Mishkin CH 01Document23 pagesMishkin CH 01Hồng LêNo ratings yet

- ABdiDocument27 pagesABdiferewe tesfayeNo ratings yet

- Corporate ValuationDocument42 pagesCorporate ValuationPrasannakumar SNo ratings yet

- Finance Final222Document7 pagesFinance Final222Mohamed SalamaNo ratings yet

- PP For Chapter 6 - Financial Statement Analysis - FinalDocument67 pagesPP For Chapter 6 - Financial Statement Analysis - FinalSozia TanNo ratings yet

- Topic Wise Test Branch AccountsDocument4 pagesTopic Wise Test Branch AccountsChinmay GokhaleNo ratings yet

- Cash FiowDocument31 pagesCash FiowDr. Mohammad Noor AlamNo ratings yet

- EC334 Assessment Instructions: Please Complete All ProblemsDocument4 pagesEC334 Assessment Instructions: Please Complete All ProblemsMiiwKotiramNo ratings yet

- JOURNAL, LEDGER AND TRIAL BALANCEDocument6 pagesJOURNAL, LEDGER AND TRIAL BALANCEZargham Durrani50% (2)

- The Era of Management Report on Biti's CompanyDocument20 pagesThe Era of Management Report on Biti's CompanyViet HungNo ratings yet