Professional Documents

Culture Documents

Draft Tax Reform Plan

Uploaded by

Matthew Kish0 ratings0% found this document useful (0 votes)

2K views1 pageOn Tuesday, Oregon lawmakers started discussing LC 3549. The bill would eliminate Oregon's corporate income tax, starting in the 2018 tax year, and replace it with a business tax on sales, or gross receipts. Here's a handout provided to lawmakers with the main provisions.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOn Tuesday, Oregon lawmakers started discussing LC 3549. The bill would eliminate Oregon's corporate income tax, starting in the 2018 tax year, and replace it with a business tax on sales, or gross receipts. Here's a handout provided to lawmakers with the main provisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views1 pageDraft Tax Reform Plan

Uploaded by

Matthew KishOn Tuesday, Oregon lawmakers started discussing LC 3549. The bill would eliminate Oregon's corporate income tax, starting in the 2018 tax year, and replace it with a business tax on sales, or gross receipts. Here's a handout provided to lawmakers with the main provisions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

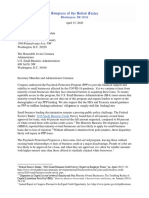

DRAFT TAX REFORM PLAN

1. COMMERCIAL ACTIVITY TAX(1-1-18)

APPLIES TO ALL ENTITY TYPES

OHIO BASE INCLUDING FIT

FILING THRESHOLD $150,000 IN SALES

FLAT $250 FOR BUSINESSES WITH SALES LESS THAN $3 MILLION

.85% RATE FOR SERVICES

.35% RATE FOR RETAIL TRADE

.25% RATE FOR WHOLESALE/WAREHOUSING

.48% RATE FOR ALL OTHER

25% CAT CREDIT FOR PASS THROUGHS

2. NEW PERSONAL INCOME TAX RATE STRUCTURE: (2018 TAX YEAR)

4.5%, 6.5%, 8.75%, 9.9%

CURRENT BRACKETS STILL APPLY

REPEAL PASS THROUGH SPECIAL RATE (2017 TAX YEAR)

3. ELIMINATE CORPORATE INCOME TAX(2018 CORPORATE TAX YEAR)

REVENUE IMPACT ESTIMATES

(MILLIONS) 2017-19 2019-21 2021-23

COMMERCIAL ACTIVITY TAX $ 1,789 $ 2,690 $ 2,955

25% CAT CREDIT FOR PASS THROUGHS $ (112) $ (168) $ (185)

PERSONAL INCOME TAX RATE REDUCTIONS $ (345) $ (527) $ (575)

REPEAL PASS THROUGH SPECIAL RATE $ 282 $ 277 $ 332

CORPORATE INCOME TAX $ (660) $ (1,054) $ (1,107)

NET REVENUE IMPACT $ 954 $ 1,218 $ 1,420

LRO: 5-22-17F

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- BOLI InvestigationDocument40 pagesBOLI InvestigationMatthew KishNo ratings yet

- OBI Letter To Gov. Brown About American Rescue Plan FundingDocument4 pagesOBI Letter To Gov. Brown About American Rescue Plan FundingMatthew KishNo ratings yet

- PPP Racial Disparities LetterDocument5 pagesPPP Racial Disparities LetterMatthew KishNo ratings yet

- House Bill 4033 - 2 AmendmentsDocument11 pagesHouse Bill 4033 - 2 AmendmentsMatthew KishNo ratings yet

- Banks and Credit Unions Still Accepting PPP Applications in OregonDocument3 pagesBanks and Credit Unions Still Accepting PPP Applications in OregonMatthew KishNo ratings yet

- LC 241 Draft 2020 Regular SessionDocument11 pagesLC 241 Draft 2020 Regular SessionMatthew KishNo ratings yet

- Oregon Banks Still Accepting PPP ApplicationsDocument1 pageOregon Banks Still Accepting PPP ApplicationsMatthew KishNo ratings yet

- Gov. Kate Brown Letter To Congressional Leaders Seeking More Covid ReliefDocument3 pagesGov. Kate Brown Letter To Congressional Leaders Seeking More Covid ReliefMatthew KishNo ratings yet

- Washington Post, Et Al. v. U.S. Small Business AdministrationDocument38 pagesWashington Post, Et Al. v. U.S. Small Business AdministrationMatthew KishNo ratings yet

- SBA Inspector General Report: Small Business Administration's Implementation of The Paycheck Protection Program RequirementsDocument40 pagesSBA Inspector General Report: Small Business Administration's Implementation of The Paycheck Protection Program RequirementsMatthew KishNo ratings yet

- Oregon Joint Special Committee On Coronavirus Response Draft ProposalDocument4 pagesOregon Joint Special Committee On Coronavirus Response Draft ProposalMatthew KishNo ratings yet

- Oregon Legislature Coronavirus Bailout FrameworkDocument12 pagesOregon Legislature Coronavirus Bailout FrameworkMatthew KishNo ratings yet

- City of Portland Special Election NoticeDocument3 pagesCity of Portland Special Election NoticeMatthew KishNo ratings yet

- Concordia University Class Action LawsuitDocument8 pagesConcordia University Class Action LawsuitMatthew KishNo ratings yet

- Salazar AAA Decision 1Document140 pagesSalazar AAA Decision 1Matthew KishNo ratings yet

- Nike v. SkechersDocument15 pagesNike v. SkechersMatthew KishNo ratings yet

- Avenatti MotionDocument50 pagesAvenatti MotionCody100% (1)

- Jazz Lyles v. Nike Inc. and Mainz Brady GroupDocument32 pagesJazz Lyles v. Nike Inc. and Mainz Brady GroupMatthew KishNo ratings yet

- Kawhi Leonard v. Nike Answer and CounterclaimsDocument29 pagesKawhi Leonard v. Nike Answer and CounterclaimsMatthew KishNo ratings yet

- SEC Cease-And-Desist Order Against Fieldstone Financial Management Group and Kristofor BehnDocument9 pagesSEC Cease-And-Desist Order Against Fieldstone Financial Management Group and Kristofor BehnMatthew KishNo ratings yet

- Gov. Kate Brown 2019 Kicker ProposalDocument1 pageGov. Kate Brown 2019 Kicker ProposalMatthew KishNo ratings yet

- Job Creation AgreementDocument12 pagesJob Creation AgreementMatthew KishNo ratings yet

- FDRA Letter To President TrumpDocument5 pagesFDRA Letter To President TrumpMatthew KishNo ratings yet

- Olaf Janke Plea Agreement LetterDocument11 pagesOlaf Janke Plea Agreement LetterMatthew KishNo ratings yet

- Ahmer Inam v. Nike - Nike AnswerDocument18 pagesAhmer Inam v. Nike - Nike AnswerMatthew KishNo ratings yet

- United States of America v. David ReichertDocument5 pagesUnited States of America v. David ReichertMatthew KishNo ratings yet

- Kawhi Leonard Lawsuit Against Nike Over Logo UseDocument9 pagesKawhi Leonard Lawsuit Against Nike Over Logo UseRJ Marquez100% (1)

- Avenatti Indictment - NikeDocument23 pagesAvenatti Indictment - NikeThe Conservative TreehouseNo ratings yet

- Nike Unredacted Shareholder LawsuitDocument64 pagesNike Unredacted Shareholder LawsuitMatthew Kish100% (1)

- Aequitas Management Receiver's ReportDocument174 pagesAequitas Management Receiver's ReportMatthew Kish100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)