Professional Documents

Culture Documents

Fire Insurance Policies

Uploaded by

Rohit JainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fire Insurance Policies

Uploaded by

Rohit JainCopyright:

Available Formats

Fire Insurance

A fire insurance is a contract under which the insurer in return for a consideration (premium) agrees to

indemnify the insured for the financial loss which the latter may suffer due to destruction of or damage to

property or goods, caused by fire, during a specified period. The contract specifies the maximum amount ,

agreed to by the parties at the time of the contract, which the insured can claim in case of loss. This amount

is not , however , the measure of the loss. The loss can be ascertained only after the fire has occurred. The

insurer is liable to make good the actual amount of loss not exceeding the maximum amount fixed under the

policy.

A fire insurance policy cannot be assigned without the permission of the insurer because the insured must

have insurable interest in the property at the time of contract as well as at the time of loss. The insurable

interest in goods may arise out on account of (i) ownership, (ii) possession, or (iii) contract. A person with a

limited interest in a property or goods may insure them to cover not only his own interest but also the

interest of others in them. Under fire insurance, the following persons have insurable interest in the subject

matter:-

Owner

Mortgagee

Pawnee

Pawn broker

Official receiver or assignee in insolvency proceedings

Warehouse keeper in the goods of customer

A person in lawful possession e.g. common carrier, wharfinger, commission agent.

The term 'fire' is used in its popular and literal sense and means a fire which has 'broken bounds'. 'Fire'

which is used for domestic or manufacturing purposes is not fire as long as it is confined within usual limits.

In the fire insurance policy, 'Fire' means the production of light and heat by combustion or burning. Thus,

fire, must result from actual ignition and the resulting loss must be proximately caused by such ignition. The

phrase 'loss or damage by fire' also includes the loss or damage caused by efforts to extinguish fire.

The types of losses covered by fire insurance are:-

Goods spoiled or property damaged by water used to extinguish the fire.

Pulling down of adjacent premises by the fire brigade in order to prevent the progress of flame.

Breakage of goods in the process of their removal from the building where fire is raging e.g.

damage caused by throwing furniture out of window.

Wages paid to persons employed for extinguishing fire.

The types of losses not covered by a fire insurance policy are:-

loss due to fire caused by earthquake, invasion, act of foreign enemy, hostilities or war, civil strife,

riots, mutiny, martial law, military rising or rebellion or insurrection.

loss caused by subterranean (underground) fire.

loss caused by burning of property by order of any public authority.

loss by theft during or after the occurrence of fire.

loss or damage to property caused by its own fermentation or spontaneous combustion e.g.

exploding of a bomb due to an inherent defect in it.

loss or damage by lightening or explosion is not covered unless these cause actual ignition which

spread into fire.

A claim for loss by fire must satisfy the following conditions:-

The loss must be caused by actual fire or ignition and not just by high temperature.

The proximate cause of loss should be fire.

The loss or damage must relate to subject matter of policy.

The ignition must be either of the goods or of the premises where goods are kept.

The fire must be accidental, not intentional. If the fire is caused through a malicious or deliberate

act of the insured or his agents, the insurer will not be liable for the loss.

Types of Fire Insurance Policies:-

Specific policy:- is a policy which covers the loss up to a specific amount which is less than the

real value of the property. The actual value of the property is not taken into consideration while

determining the amount of indemnity. Such a policy is not subject to 'average clause'. 'Average

clause' is a clause by which the insured is called upon to bear a portion of the loss himself. The main

object of the clause is to check under-insurance, to encourage full insurance and to impress upon

the property owners to get their property accurately valued before insurance. If the insurer has

inserted an average clause, the policy is known as "Average Policy".

Comprehensive policy:- is also known as 'all in one' policy and covers risks like fire, theft,

burglary, third party risks, etc. It may also cover loss of profits during the period the business

remains closed due to fire.

Valued policy:- is a departure from the contract of indemnity. Under it the insured can recover a

fixed amount agreed to at the time the policy is taken. In the event of loss, only the fixed amount is

payable, irrespective of the actual amount of loss.

Floating policy:- is a policy which covers loss by fire caused to property belonging to the same

person but located at different places under a single sum and for one premium. Such a policy might

cover goods lying in two warehouses at two different locations. This policy is always subject to

'average clause'.

Replacement or Re-instatement policy:- is a policy in which the insurer inserts a re-instatement

clause, whereby he undertakes to pay the cost of replacement of the property damaged or

destroyed by fire. Thus, he may re-instate or replace the property instead of paying cash. In such a

policy, the insurer has to select one of the two alternatives, i.e. either to pay cash or to replace the

property, and afterwards he cannot change to the other option.

You might also like

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!From EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Rating: 5 out of 5 stars5/5 (1)

- Fire Insurance PoliciesDocument3 pagesFire Insurance PoliciesRohit JainNo ratings yet

- Fire InsuranceDocument3 pagesFire Insuranceprithviraj yadavNo ratings yet

- Fire InsuranceDocument4 pagesFire InsurancesanyassandhuNo ratings yet

- Insurance Law ProjectDocument6 pagesInsurance Law ProjectMagrothiya SatakshiNo ratings yet

- Fire Insurance Definition - Docx New - Docx NavnathDocument13 pagesFire Insurance Definition - Docx New - Docx Navnathnavnath50% (2)

- Fire InsuranceDocument22 pagesFire InsuranceShivam Mani TripathiNo ratings yet

- Special Doctrines Under Fire Insurance Law: Submitted To:-Mrs. Dipender Gill (Assistant Professor of Law)Document11 pagesSpecial Doctrines Under Fire Insurance Law: Submitted To:-Mrs. Dipender Gill (Assistant Professor of Law)RashmiPandeyNo ratings yet

- Fire InsuranceDocument27 pagesFire Insurancedevashish_bajajNo ratings yet

- Unit 7 InsuranceDocument3 pagesUnit 7 InsuranceKanishkaNo ratings yet

- Fire InsuranceDocument27 pagesFire InsuranceKanika KambojNo ratings yet

- Fire InsuranceDocument5 pagesFire InsuranceTanvi SadekarNo ratings yet

- Nature and Scope of Fire InsuranceDocument3 pagesNature and Scope of Fire InsuranceDrShiva Prasad100% (2)

- Fire InsuranceDocument4 pagesFire Insuranceজাহিদ হৃদয়No ratings yet

- Fireinsurance 191003145042 2 15Document14 pagesFireinsurance 191003145042 2 15AlexNo ratings yet

- Fire InsuranceDocument5 pagesFire Insurancerahulhaldankar0% (1)

- Fire InsuranceDocument6 pagesFire InsuranceJitu RawatNo ratings yet

- Fire InsuranceDocument20 pagesFire InsuranceAnkush Sharma100% (1)

- Introduction To InsuranceDocument62 pagesIntroduction To InsuranceRamesh SharmaNo ratings yet

- Banking Ombudsman Scheme: Freddy Savio D'Souza Insurance Roll No. 45Document13 pagesBanking Ombudsman Scheme: Freddy Savio D'Souza Insurance Roll No. 45Freddy Savio D'souzaNo ratings yet

- A Critical Evaluation of The Dual Doctrines of SubrogationDocument15 pagesA Critical Evaluation of The Dual Doctrines of SubrogationSaurabh Kumar100% (1)

- Home InsuranceDocument16 pagesHome InsuranceShashank TiwariNo ratings yet

- Fire Insurance: Issues For DiscussionDocument6 pagesFire Insurance: Issues For DiscussionMd. Sariful Islam Khan 192-11-879100% (1)

- Fire Insurance: Issues For DiscussionDocument6 pagesFire Insurance: Issues For DiscussionIshtiaq S EmonNo ratings yet

- What Is Fire InsuranceDocument8 pagesWhat Is Fire Insurancesomya srivastavaNo ratings yet

- Fire Insurance 1Document15 pagesFire Insurance 1Kushal RastogiNo ratings yet

- Fire Insurance: - Isha Chugh Assistant Professor Gargi College University of DelhiDocument22 pagesFire Insurance: - Isha Chugh Assistant Professor Gargi College University of DelhiSunit ShandilyaNo ratings yet

- Bajaj Allianz Fire InsuranceDocument44 pagesBajaj Allianz Fire InsuranceDinesh RominaNo ratings yet

- Fire, Casualty, Surety and LifeDocument7 pagesFire, Casualty, Surety and LifeZyra C.No ratings yet

- Chapter 07 RMIDocument20 pagesChapter 07 RMISudipta BaruaNo ratings yet

- Fire InsuranceDocument12 pagesFire InsuranceMenaal Khan100% (2)

- Ambition Learning Solutions: General InsuranceDocument18 pagesAmbition Learning Solutions: General InsurancePratik RambhiaNo ratings yet

- Fire Insurance (Chapter 07)Document9 pagesFire Insurance (Chapter 07)Abu Muhammad Hatem TohaNo ratings yet

- Fire InsuranceDocument9 pagesFire InsuranceshreyaNo ratings yet

- InsuranceDocument2 pagesInsuranceJan Kenrick SagumNo ratings yet

- A Life Insurance Policy May Pass by Transfer, Will or Succession To Any Person, Whether He Has Insurable Interest or NotDocument2 pagesA Life Insurance Policy May Pass by Transfer, Will or Succession To Any Person, Whether He Has Insurable Interest or NotJan Kenrick SagumNo ratings yet

- Jovila NotesDocument5 pagesJovila NotesDivya RathodNo ratings yet

- Fire InsuranceDocument16 pagesFire InsuranceSandeep Mishra100% (1)

- Untitled DocumentDocument4 pagesUntitled DocumentSiladitta PalNo ratings yet

- Insurance Law - FINALS: Intentional Acts Are Not CoveredDocument1 pageInsurance Law - FINALS: Intentional Acts Are Not CoveredJuliefer Ann GonzalesNo ratings yet

- Fire Insurance ContractDocument2 pagesFire Insurance ContractAnil YadavNo ratings yet

- Presentation ON Fire InsuranceDocument20 pagesPresentation ON Fire InsuranceS. M. Faysal 172-11-5575No ratings yet

- Fire Insurance: - Isha Chugh Assistant Professor Gargi College University of DelhiDocument22 pagesFire Insurance: - Isha Chugh Assistant Professor Gargi College University of Delhiadarsh walavalkarNo ratings yet

- A Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceDocument88 pagesA Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceNinad Patil50% (2)

- Chapter 6Document33 pagesChapter 6Yebegashet AlemayehuNo ratings yet

- Insurance Law ProjectDocument21 pagesInsurance Law ProjectRajdeep DuttaNo ratings yet

- Features of FireDocument4 pagesFeatures of Firevipul sutharNo ratings yet

- Chaper 3. Types of Property Insurance PoliciesDocument14 pagesChaper 3. Types of Property Insurance Policiesrahulhaldankar100% (2)

- L7 BS Law of InsuaranceDocument10 pagesL7 BS Law of InsuaranceIan MutukuNo ratings yet

- Fire InsuranceDocument20 pagesFire Insurancesanuja dashNo ratings yet

- Explain The Necessity of Fire InsuranceDocument36 pagesExplain The Necessity of Fire InsuranceAnirudh MhatreNo ratings yet

- Non LiFe InSurAncE GeNeRal InsuRanCeDocument25 pagesNon LiFe InSurAncE GeNeRal InsuRanCesonu sahNo ratings yet

- Property Insurance HandbookDocument12 pagesProperty Insurance HandbookPriyanka TiwariNo ratings yet

- Business LawDocument2 pagesBusiness LawMarrNo ratings yet

- (Calculation of Fire Ins) Fire Insurance HistoryDocument12 pages(Calculation of Fire Ins) Fire Insurance Historythegodfather111No ratings yet

- Chapter 2Document15 pagesChapter 2mark sanadNo ratings yet

- Insurance As A Risk Man ToolDocument46 pagesInsurance As A Risk Man ToolBLUE TOOTHNo ratings yet

- Fire InsuranceDocument9 pagesFire InsuranceNisarg KhamarNo ratings yet

- CERTIFICAT1Document1 pageCERTIFICAT1Rohit JainNo ratings yet

- General Insurance DefinitionDocument2 pagesGeneral Insurance DefinitionRohit JainNo ratings yet

- Fra - Basics Fixed Income - Practical Portfolio Management Derivatives Corporate Finance QM - Technical Analysis & Time Value of MoneyDocument3 pagesFra - Basics Fixed Income - Practical Portfolio Management Derivatives Corporate Finance QM - Technical Analysis & Time Value of MoneyRohit JainNo ratings yet

- Unit 1Document25 pagesUnit 1Rohit JainNo ratings yet

- Cfa Exam VenueDocument1 pageCfa Exam VenueRohit JainNo ratings yet

- New DOA Format.Document2 pagesNew DOA Format.Rohit JainNo ratings yet

- Project Finance SchemeDocument7 pagesProject Finance SchemeRohit JainNo ratings yet

- London School of Commerce MB For Executives: Capital Investment BudgetingDocument5 pagesLondon School of Commerce MB For Executives: Capital Investment BudgetingRohit JainNo ratings yet

- Performa Estimation/Quotation DateDocument2 pagesPerforma Estimation/Quotation DateRohit JainNo ratings yet

- Rohit Jain (Resume) FormatDocument2 pagesRohit Jain (Resume) FormatRohit JainNo ratings yet

- HUL Corproate PresentationDocument52 pagesHUL Corproate PresentationsmbhattaNo ratings yet

- Coursera Financial Aid Answers (Sal) AdDocument2 pagesCoursera Financial Aid Answers (Sal) AdAnkit SarkarNo ratings yet

- Handout 018Document1 pageHandout 018Caryl May Esparrago MiraNo ratings yet

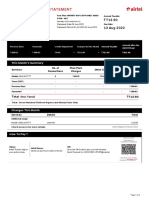

- Postpaid Monthly Statement: This Month's SummaryDocument6 pagesPostpaid Monthly Statement: This Month's SummaryShri KanthNo ratings yet

- Resume - Aansh DesaiDocument2 pagesResume - Aansh Desaisiddhant jainNo ratings yet

- Annex F WaiverDocument2 pagesAnnex F WaiverMaela Maala Mendoza82% (11)

- ArundelDocument6 pagesArundelArnab Pramanik100% (1)

- SITXFIN004 PresentationDocument37 pagesSITXFIN004 PresentationKomalben ChaudharyNo ratings yet

- Tugas 7 - ELRISKA TIFFANI - 142200111Document8 pagesTugas 7 - ELRISKA TIFFANI - 142200111Elriska Tiffani50% (2)

- Finance Problem Set 1Document4 pagesFinance Problem Set 1Hamid Yaghoubi0% (1)

- Money, Banking, and Monetary Policy: ObjectivesDocument9 pagesMoney, Banking, and Monetary Policy: ObjectivesKamalpreetNo ratings yet

- Assignment 1Document2 pagesAssignment 1georgeNo ratings yet

- Illustration On AFN (FE 12)Document39 pagesIllustration On AFN (FE 12)Jessica Adharana KurniaNo ratings yet

- Richard Ellson ConsultingDocument4 pagesRichard Ellson Consultingnrhuron13No ratings yet

- Moody's On US Bank RisksDocument13 pagesMoody's On US Bank RisksTim MooreNo ratings yet

- Corporate ValuationDocument9 pagesCorporate ValuationSwapnil KolheNo ratings yet

- Bdo Cash It Easy RefDocument2 pagesBdo Cash It Easy RefJC LampanoNo ratings yet

- Chap 018Document27 pagesChap 018Xeniya Morozova Kurmayeva100% (3)

- NPO StandardsDocument9 pagesNPO Standardsbngo01No ratings yet

- Financial Analysis - WalmartDocument3 pagesFinancial Analysis - WalmartLuka KhmaladzeNo ratings yet

- Account Statement From 1 Apr 2020 To 25 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Apr 2020 To 25 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShubham NamdevNo ratings yet

- Solutions To Chapter 8 (20ebooks - Com)Document18 pagesSolutions To Chapter 8 (20ebooks - Com)T. MuhammadNo ratings yet

- IILM Graduate School of ManagementDocument15 pagesIILM Graduate School of ManagementMd. Shad AnwarNo ratings yet

- Rotomac Fraud CaseDocument11 pagesRotomac Fraud CaseShashank Shankar33% (3)

- Chapter 13 SolutionsDocument26 pagesChapter 13 SolutionsMathew Idanan0% (1)

- 2020 Beximco and Renata Ratio AnalysisDocument18 pages2020 Beximco and Renata Ratio AnalysisRahi Mun100% (2)

- Colgate AR 2020.indd - PDFDocument100 pagesColgate AR 2020.indd - PDFali khanNo ratings yet

- Compensation Options For Early Contributors Wolfpackbot: OriginalDocument1 pageCompensation Options For Early Contributors Wolfpackbot: OriginalMohamed FathiNo ratings yet

- Metadvantageplus BrochureDocument6 pagesMetadvantageplus BrochureyatinthoratscrbNo ratings yet

- Personal Finance SyllabusDocument5 pagesPersonal Finance SyllabusRaymond DiazNo ratings yet

- Strategy #1 - Stochastic Oscillator + RSI + Triple EMA: Entering A TradeDocument3 pagesStrategy #1 - Stochastic Oscillator + RSI + Triple EMA: Entering A Tradegurdev singh0% (1)