Professional Documents

Culture Documents

Remedies of Taxpayer

Uploaded by

Hannah Beatriz Cabral0 ratings0% found this document useful (0 votes)

22 views2 pagesa

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenta

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesRemedies of Taxpayer

Uploaded by

Hannah Beatriz Cabrala

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

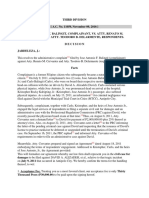

TAXATION LAW 1

De La Salle Lipa

TAXPAYERS

NIRC / NATIONAL LOCAL REAL PROPERTY

REMEDIES

Who issues

assessment?

Commissioner Local Treasurer City Assessor

Real property declared for the

first time shall be assessed for

taxes for the period during

which it would have been liable

but in no case for more than

Local taxes, fees, or charges

Within 3 years from the day ten (10) years prior to the date

Period to issue may be collected within five (5)

the return was filed. (Sec 203, of initial assessment:

assessment years from the date of by or

NIRC)

judicial action. (Sec. 194, LGC)

Provided, however, That such

taxes shall be computed on the

basis of the applicable schedule

of values in force during the

corresponding period

I. Taxpayer may make a

Before Assessment: I. Within 60 days from

written protest 15 days

- Question the the receipt of

from the receipt of

constitutionality of the assessment from the

Preliminary

ordinance. city assessor, taxpayer

Assessment Notice

may file a protest

before the

After Assessment: before Local Board of

Commissioner on

- Question the validity Assessment Appeals

Internal Revenue (CIR).

assessment (LBAA)

II. If not satisfied,

I. Taxpayer may make a II. After the lapse of 120

taxpayer may protest

written protest within days, if not decided, or

within 30 days from

Procedure of 60 days from the within 30 days upon

receipt Final

Protest receipt of assessment denial, taxpayer may

Assessment Notice.

before the local appeal Central Board of

treasurer. Assessment Appeals

III. If still unsatisfied,

(CBAA).

taxpayer may appeal in

II. After the lapse of 60

the Court of Tax

days, if not decided, or III. If adverse, appeal to

Appeals (CTA)

within 30 days upon Court of Tax Appels

denial, taxpayer may (CTA) En Banc.

IV. If still adverse or if the

appeal before the

CTA did not decide

court with competent IV. If still adverse, taxpayer

after the lapse of 180

jurisdiction. may appeal in the

days , taxpayer may

Supreme Court (SC

appeal in the Supreme

Court (SC)

(Sec. 195, LGC) (Sec. 226 230, LGC)

(Sec 228, NIRC)

TAXATION LAW 1

De La Salle Lipa

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Living and Non Living Things 1Document27 pagesLiving and Non Living Things 1Hannah Beatriz CabralNo ratings yet

- SOGIEDocument40 pagesSOGIEDon Villanueva Liongson88% (8)

- Legal Writing Lesson 9 Law Office MemoDocument18 pagesLegal Writing Lesson 9 Law Office MemoHannah Beatriz CabralNo ratings yet

- Estrada V DesiertoDocument4 pagesEstrada V DesiertoLiz LorenzoNo ratings yet

- 2015 Bar Q - MERCANTILE LAWDocument16 pages2015 Bar Q - MERCANTILE LAWLimVianesseNo ratings yet

- Quita Vs CA and DandanDocument6 pagesQuita Vs CA and DandanQuennieNo ratings yet

- Chanakya National Law University: (Faculty For Labour Law I)Document23 pagesChanakya National Law University: (Faculty For Labour Law I)anonymous67% (3)

- Motion To Reduce BailDocument2 pagesMotion To Reduce BailJC67% (3)

- Holy Child Catholic School v. Sto. Tomas TemplateDocument5 pagesHoly Child Catholic School v. Sto. Tomas TemplatekathrynmaydevezaNo ratings yet

- Cobarrubias Vs PeopleDocument2 pagesCobarrubias Vs PeopleMary Anne Guanzon VitugNo ratings yet

- LITEX GLASS AND ALUMINUM SUPPLY AND/OR RONALD ONG-SITCO, Petitioners, vs. DOMINADOR B. SANCHEZ, Respondent.Document7 pagesLITEX GLASS AND ALUMINUM SUPPLY AND/OR RONALD ONG-SITCO, Petitioners, vs. DOMINADOR B. SANCHEZ, Respondent.Lizzette GuiuntabNo ratings yet

- 32 Florentino V Encarnacion (LAFORTEZA)Document2 pages32 Florentino V Encarnacion (LAFORTEZA)Malcolm CruzNo ratings yet

- 1 - BalingitDocument6 pages1 - BalingitHannah Beatriz CabralNo ratings yet

- Agenda: 128 Regular Session 13 June 2022, 9:00AMDocument2 pagesAgenda: 128 Regular Session 13 June 2022, 9:00AMHannah Beatriz CabralNo ratings yet

- Be It Ordained by The Municipality of Lemery, Batangas ThatDocument3 pagesBe It Ordained by The Municipality of Lemery, Batangas ThatHannah Beatriz CabralNo ratings yet

- L/epublit of Tfit"jbilippines Manila: CourtDocument7 pagesL/epublit of Tfit"jbilippines Manila: CourtAnonymous KgPX1oCfrNo ratings yet

- Ph020en PDFDocument30 pagesPh020en PDFHannah Beatriz CabralNo ratings yet

- Taxation Law 1 Taxation Law 1 Atty. Vicente V. Cañoneo Atty. Vicente V. CañoneoDocument3 pagesTaxation Law 1 Taxation Law 1 Atty. Vicente V. Cañoneo Atty. Vicente V. CañoneoHannah Beatriz Cabral0% (1)

- Development Bank of The Phils., V. Commission On Audit, 373 SCRA 356 (2002)Document33 pagesDevelopment Bank of The Phils., V. Commission On Audit, 373 SCRA 356 (2002)Hannah Beatriz CabralNo ratings yet

- Sponsorship/Solicitation MonitoringDocument9 pagesSponsorship/Solicitation MonitoringHannah Beatriz CabralNo ratings yet

- Remedies Nirc / National Local Real Property LevyDocument6 pagesRemedies Nirc / National Local Real Property LevyHannah Beatriz CabralNo ratings yet

- Homeroom ModuleDocument4 pagesHomeroom ModuleHannah Beatriz CabralNo ratings yet

- FULL STP Script Pub1.4 FINAL REV AUG 2016Document28 pagesFULL STP Script Pub1.4 FINAL REV AUG 2016Hannah Beatriz CabralNo ratings yet

- Govt vs. El HogarDocument73 pagesGovt vs. El HogarHannah Beatriz CabralNo ratings yet

- Final STP DeckDocument30 pagesFinal STP DeckHannah Beatriz CabralNo ratings yet

- What Is Strike, Picketing and Lockout?Document16 pagesWhat Is Strike, Picketing and Lockout?MichelleneChenTadleNo ratings yet

- Separation of Powers - An Indian Perspective: Authorities Cited Books and Article Referred AbbreviationsDocument49 pagesSeparation of Powers - An Indian Perspective: Authorities Cited Books and Article Referred AbbreviationsAbhay Jaiswal100% (1)

- Larry Marshak v. Michael Branch, D/B/A Insight Talent Agency, Inc., D/B/A Insight Talent Agency, & Third Party v. Willie B. Pinkney, Third Party Larry Marshak v. Michael Branch, D/B/A Insight Talent Agency, Inc., D/B/A Insight Talent Agency, & Third Party and Count Basie Theatre Michael McHarris L & M Productions Atlantis Casino Hotel Atlantis Cabaret Theatre Whoot Newspaper v. Willie B. Pinkney, Third Party, 980 F.2d 727, 3rd Cir. (1992)Document12 pagesLarry Marshak v. Michael Branch, D/B/A Insight Talent Agency, Inc., D/B/A Insight Talent Agency, & Third Party v. Willie B. Pinkney, Third Party Larry Marshak v. Michael Branch, D/B/A Insight Talent Agency, Inc., D/B/A Insight Talent Agency, & Third Party and Count Basie Theatre Michael McHarris L & M Productions Atlantis Casino Hotel Atlantis Cabaret Theatre Whoot Newspaper v. Willie B. Pinkney, Third Party, 980 F.2d 727, 3rd Cir. (1992)Scribd Government DocsNo ratings yet

- G.R. No. 183871 February 18, 2010 LOURDES D. RUBRICO, JEAN Rubrico Apruebo vs. Gloria Macapagal-Arroyo FactsDocument8 pagesG.R. No. 183871 February 18, 2010 LOURDES D. RUBRICO, JEAN Rubrico Apruebo vs. Gloria Macapagal-Arroyo FactsKhayzee AsesorNo ratings yet

- Law of Breach of InjunctionDocument6 pagesLaw of Breach of Injunctionsandeep kumarNo ratings yet

- Twin Ace Holding v. Rufina and CompanyDocument10 pagesTwin Ace Holding v. Rufina and CompanySecret SecretNo ratings yet

- Ella Pettis v. U.S. West Communications, Inc., Gretchen Hedge, 153 F.3d 728, 10th Cir. (1998)Document5 pagesElla Pettis v. U.S. West Communications, Inc., Gretchen Hedge, 153 F.3d 728, 10th Cir. (1998)Scribd Government DocsNo ratings yet

- Myers Press Release: CHILD WELFARE AGENCY SUED OVER TAKING FOSTER CHILDREN'S ASSETSDocument1 pageMyers Press Release: CHILD WELFARE AGENCY SUED OVER TAKING FOSTER CHILDREN'S ASSETSBeverly TranNo ratings yet

- Larkins vs. NLRC 241 SCRA 598Document2 pagesLarkins vs. NLRC 241 SCRA 598Glenda Mae GemalNo ratings yet

- Arbitration As A Means of Dispute Resolution in Aviation SectorDocument2 pagesArbitration As A Means of Dispute Resolution in Aviation SectorRAJAT SHARMANo ratings yet

- Chamber Judgment Moreno Gomez v. Spain 16.11.04Document3 pagesChamber Judgment Moreno Gomez v. Spain 16.11.04Antonia NicaNo ratings yet

- Lawyer File #10Document9 pagesLawyer File #10Frank GallagherNo ratings yet

- Scope and Difference Between Section 226 Vs 227Document5 pagesScope and Difference Between Section 226 Vs 227Prasen TiwaryNo ratings yet

- United States Court of Appeals For The Federal CircuitDocument18 pagesUnited States Court of Appeals For The Federal CircuitScribd Government DocsNo ratings yet

- Paradigm of Liberty & Accountability: The Unknown Guardian of The ConstitutionDocument18 pagesParadigm of Liberty & Accountability: The Unknown Guardian of The ConstitutionGaurav HoodaNo ratings yet

- Callanta v. NLRC PDFDocument9 pagesCallanta v. NLRC PDFCamille CruzNo ratings yet

- Supplementary: Impact of Insolvency and Bankruptcy Code 2016 On The Companies Act, 2013Document23 pagesSupplementary: Impact of Insolvency and Bankruptcy Code 2016 On The Companies Act, 2013arhagarNo ratings yet

- Cases 39 45 PDFDocument11 pagesCases 39 45 PDFYvette Marie VillaverNo ratings yet

- 2.2 CD - Republic Vs Sayo - FinalDocument1 page2.2 CD - Republic Vs Sayo - FinalVina CagampangNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument2 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Judicial Department - Art - Viii - 5 - 19 PDFDocument85 pagesJudicial Department - Art - Viii - 5 - 19 PDFJassy BustamanteNo ratings yet

- Real Estate Sale Agreement Confirming Party DraftDocument10 pagesReal Estate Sale Agreement Confirming Party DraftSravya0% (1)