Professional Documents

Culture Documents

Revenue Reform and Education Stability Act of 2017

Uploaded by

Matthew KishCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue Reform and Education Stability Act of 2017

Uploaded by

Matthew KishCopyright:

Available Formats

Revenue Reform and Education Stability Act of 2017 (RRESA)

DRAFT PROPOSAL (SIM 13) 6/7/17

GOALS:

Support economic growth, especially small businesses

Reform the states revenue structure for budget stability

Dedicate 75% of new revenue to education

STRATEGY:

Next biennium, stabilize budgets and strategically increase education investments through temporarily

increasing the corporate income tax and eliminating the pass-through tax break.

Eliminate the current corporate income tax and establish a tiered commercial activity tax (CAT) for all

business entities effective January 1, 2019, helping small businesses who have less than $3 million in

Oregon sales (approximately 92% of businesses would pay a $250 minimum or less). Delaying the start

of the new CAT allows for further review in 2018 Session and time for implementation.

Create the Education Strategic Investment Fund to ensure new revenue goes to increasing investments

in education, from early childhood through college. New revenue in 2017-19 would fund the State

School Fund at $8.5 billion, fully fund Measure 98 (CTE/graduation) and Measure 99 (outdoor school),

and maintain/improve investments in early childhood and higher education ($668 million total).

REVENUE IMPACT ESTIMATES ($ millions)

2017-19 2019-21 2021-23 2023-25

Commercial Activity Tax (CAT) (effective 1/1/19)

Applies to all entities, based on Ohio model 539 2,515 2,763 3,023

Filing threshold $150,000 in receipts

$250 minimum for receipts less than $3 million

Rates applied to receipts above $3 million:

o 0.75% for services

o 0.35% for retail trade

o 0.25% for wholesale

o 0.15% for agriculture/forestry/fishing

o 0.48% for all other

Credit on CAT for Pass Throughs (67) (198) (173) (189)

(50% credit in 2019, 25% credit starting in 2021)

New Personal Income Tax Rate Structure (68) (353) (379) (407)

(effective 2019 tax year)

4.5%, 6.5%, 8.75% for taxable income <$25K (single)/<$50K (joint),

9.0%, 9.9%

[current brackets are 5%, 7.0%, 9.0%, 9.9%]

Repeal Pass Through Special Rate (effective 1/1/17) 282 277 332 398

Corporate Income Tax 204 (1,076) (1,122) (1,171)

Temporary rate increase (2017 and 2018) to 8% and 9%

[current rates are 6.6% (first $1 million) and 7.6% (above $1

million)]

Eliminate corporate income tax structure (2019)

NET REVENUE IMPACT 890 1,165 1,421 1,654

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- PPP Racial Disparities LetterDocument5 pagesPPP Racial Disparities LetterMatthew KishNo ratings yet

- OBI Letter To Gov. Brown About American Rescue Plan FundingDocument4 pagesOBI Letter To Gov. Brown About American Rescue Plan FundingMatthew KishNo ratings yet

- Gov. Kate Brown Letter To Congressional Leaders Seeking More Covid ReliefDocument3 pagesGov. Kate Brown Letter To Congressional Leaders Seeking More Covid ReliefMatthew KishNo ratings yet

- BOLI InvestigationDocument40 pagesBOLI InvestigationMatthew KishNo ratings yet

- Washington Post, Et Al. v. U.S. Small Business AdministrationDocument38 pagesWashington Post, Et Al. v. U.S. Small Business AdministrationMatthew KishNo ratings yet

- Oregon Legislature Coronavirus Bailout FrameworkDocument12 pagesOregon Legislature Coronavirus Bailout FrameworkMatthew KishNo ratings yet

- SBA Inspector General Report: Small Business Administration's Implementation of The Paycheck Protection Program RequirementsDocument40 pagesSBA Inspector General Report: Small Business Administration's Implementation of The Paycheck Protection Program RequirementsMatthew KishNo ratings yet

- Banks and Credit Unions Still Accepting PPP Applications in OregonDocument3 pagesBanks and Credit Unions Still Accepting PPP Applications in OregonMatthew KishNo ratings yet

- Oregon Banks Still Accepting PPP ApplicationsDocument1 pageOregon Banks Still Accepting PPP ApplicationsMatthew KishNo ratings yet

- Salazar AAA Decision 1Document140 pagesSalazar AAA Decision 1Matthew KishNo ratings yet

- Oregon Joint Special Committee On Coronavirus Response Draft ProposalDocument4 pagesOregon Joint Special Committee On Coronavirus Response Draft ProposalMatthew KishNo ratings yet

- House Bill 4033 - 2 AmendmentsDocument11 pagesHouse Bill 4033 - 2 AmendmentsMatthew KishNo ratings yet

- Concordia University Class Action LawsuitDocument8 pagesConcordia University Class Action LawsuitMatthew KishNo ratings yet

- LC 241 Draft 2020 Regular SessionDocument11 pagesLC 241 Draft 2020 Regular SessionMatthew KishNo ratings yet

- Jazz Lyles v. Nike Inc. and Mainz Brady GroupDocument32 pagesJazz Lyles v. Nike Inc. and Mainz Brady GroupMatthew KishNo ratings yet

- City of Portland Special Election NoticeDocument3 pagesCity of Portland Special Election NoticeMatthew KishNo ratings yet

- Nike v. SkechersDocument15 pagesNike v. SkechersMatthew KishNo ratings yet

- Avenatti Indictment - NikeDocument23 pagesAvenatti Indictment - NikeThe Conservative TreehouseNo ratings yet

- Avenatti MotionDocument50 pagesAvenatti MotionCody100% (1)

- Job Creation AgreementDocument12 pagesJob Creation AgreementMatthew KishNo ratings yet

- SEC Cease-And-Desist Order Against Fieldstone Financial Management Group and Kristofor BehnDocument9 pagesSEC Cease-And-Desist Order Against Fieldstone Financial Management Group and Kristofor BehnMatthew KishNo ratings yet

- Kawhi Leonard v. Nike Answer and CounterclaimsDocument29 pagesKawhi Leonard v. Nike Answer and CounterclaimsMatthew KishNo ratings yet

- Gov. Kate Brown 2019 Kicker ProposalDocument1 pageGov. Kate Brown 2019 Kicker ProposalMatthew KishNo ratings yet

- Olaf Janke Plea Agreement LetterDocument11 pagesOlaf Janke Plea Agreement LetterMatthew KishNo ratings yet

- Ahmer Inam v. Nike - Nike AnswerDocument18 pagesAhmer Inam v. Nike - Nike AnswerMatthew KishNo ratings yet

- FDRA Letter To President TrumpDocument5 pagesFDRA Letter To President TrumpMatthew KishNo ratings yet

- Kawhi Leonard Lawsuit Against Nike Over Logo UseDocument9 pagesKawhi Leonard Lawsuit Against Nike Over Logo UseRJ Marquez100% (1)

- Nike Unredacted Shareholder LawsuitDocument64 pagesNike Unredacted Shareholder LawsuitMatthew Kish100% (1)

- United States of America v. David ReichertDocument5 pagesUnited States of America v. David ReichertMatthew KishNo ratings yet

- Aequitas Management Receiver's ReportDocument174 pagesAequitas Management Receiver's ReportMatthew Kish100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- GST Registration ThresholdsDocument5 pagesGST Registration ThresholdsShubakar ReddyNo ratings yet

- Oakland County Candidate and Proposals ListDocument21 pagesOakland County Candidate and Proposals ListpkampeNo ratings yet

- Paxum Personal Account FeesDocument5 pagesPaxum Personal Account FeesFarid PrimadiNo ratings yet

- Tax Invoice: Risi Spice Industries PVT LTD 16 13-Jun-2020Document2 pagesTax Invoice: Risi Spice Industries PVT LTD 16 13-Jun-2020Risi Spice industriesNo ratings yet

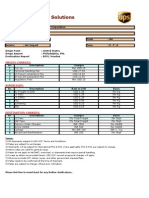

- UPS QuoteDocument1 pageUPS QuoteSwarup DoshiNo ratings yet

- Yeni Microsoft Word BelgesiDocument2 pagesYeni Microsoft Word Belgesibircan basalNo ratings yet

- Waleed Mohammed Elhasan Elmubarak: 2072020: 0233120720200001: Saving Plus:: 31-01-2022Document8 pagesWaleed Mohammed Elhasan Elmubarak: 2072020: 0233120720200001: Saving Plus:: 31-01-2022knoor33No ratings yet

- EPCR06768-0®2023080514092®®®®79.199t : Electricity BillDocument1 pageEPCR06768-0®2023080514092®®®®79.199t : Electricity BillBasith McNo ratings yet

- GermanDocument28 pagesGermanVaibhavi SinghNo ratings yet

- 27 Septiembre Al 03 Octubre 2021Document18 pages27 Septiembre Al 03 Octubre 2021Jose AlcantarNo ratings yet

- PWSI Customer Info Sheet - UpdatedDocument2 pagesPWSI Customer Info Sheet - UpdatedAbseiling BMSNo ratings yet

- Alcan Pakaging Starpack Corporation vs. The City Treasurer of Manila PDFDocument3 pagesAlcan Pakaging Starpack Corporation vs. The City Treasurer of Manila PDFJuralexNo ratings yet

- W-8BEN: Donald ChristophDocument1 pageW-8BEN: Donald ChristophpaulNo ratings yet

- Energy Credit VoucherDocument1 pageEnergy Credit VoucherRammReads (RammReads)No ratings yet

- Companies Office of JamaicaDocument2 pagesCompanies Office of JamaicaLindel VitaliNo ratings yet

- Ingles IIDocument6 pagesIngles IIReport JunglaNo ratings yet

- Invoice 317854Document3 pagesInvoice 317854Catalina MititelNo ratings yet

- AV Tech 04 2023 Invoice Kaviyarasan.Document1 pageAV Tech 04 2023 Invoice Kaviyarasan.Director LMNo ratings yet

- Refining Corporation v. Court of Appeals, Et Al, 246 SCRA 667)Document35 pagesRefining Corporation v. Court of Appeals, Et Al, 246 SCRA 667)UsixhzkaBNo ratings yet

- General JournalDocument4 pagesGeneral JournalSaad KhanNo ratings yet

- SSGC Duplicate Bill20210123 090016Document1 pageSSGC Duplicate Bill20210123 090016Ghulam Baqir MazariNo ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- Swiggy Order 43333379786Document2 pagesSwiggy Order 43333379786Bhargav VekariaNo ratings yet

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- Taxation 11 Attempts Compilation M24 - UnlockedDocument710 pagesTaxation 11 Attempts Compilation M24 - Unlockedthakursumit851No ratings yet

- Cir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Document2 pagesCir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Crisbon ApalisNo ratings yet

- Fee Payment Form - Application For Permanent Residence: Protected When CompletedDocument1 pageFee Payment Form - Application For Permanent Residence: Protected When CompletedWaheed MirzaNo ratings yet

- Use of Ridacards Is Subject To These TermsDocument2 pagesUse of Ridacards Is Subject To These TermsziovelvetNo ratings yet

- Combined Application Form SummaryDocument14 pagesCombined Application Form SummaryprastacharNo ratings yet

- Nitronne Trade invoice receipt templateDocument2 pagesNitronne Trade invoice receipt templateNicholson Vhenz UyNo ratings yet