Professional Documents

Culture Documents

2 (22) (E) - Deemed Div Discussion PDF

Uploaded by

ExcelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 (22) (E) - Deemed Div Discussion PDF

Uploaded by

ExcelCopyright:

Available Formats

DEEMED DIVIDEND

CA. Pramod Jain

B. Com (H), FCA, FCS, FCMA, LL.B. DISA, MIMA

This document would help in better understanding of critical issues of

Deemed Dividend under Section 2(22)(e) of the Income Tax Act, 1961.

19th August 2015 0

admin

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

CONTENTS

S. No Content Page No.

1 Statutory Summary 2-3

2 Advance for Business Transaction 3-4

3 Advance to Partnership Firm 4-5

4 Inter Corporate Deposits 5

5 Not to Shareholder 5-6

6 Extent of Accumulated Profit 6

7 Loan Repaid Instantly 7

8 Share Application Money 8

Business Expediency / Non Gratuitous

9 Advance 8-9

Others Important Pronouncements

10 9

Income Tax- Deemed Dividend u/s 2(22)(e) Page 1

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

DEEMED DIVIDEND

STATUTORY SUMMARY

Dividend is an income under the Income-tax Act, 1961. The term dividend is inclusively

defined in section 2(22), vide five clauses, (a) to (e). These clauses primarily provide for

treatment of certain distribution or payments, by the company, as dividend. Clause (e) provides

for payment of certain loans and advances by a company to a certain category of shareholders or

for the benefit of this category of shareholders, or to any concern in which such shareholder is a

member or a partner and in which he has a substantial interest (popularly referred to as deemed

dividend). We are covering deemed dividend under section 2(22)(e) of the Income Tax Act

1961 only in this document.

1. Applicable to all companies except co. in which public are substantially interested i.e.

applicable to a closely held company only.

2. Any payment of any sum by way of loan or advance to:

a. A shareholder who is a beneficial owner of not less than 10% of voting power.

b. Any concern in which such shareholder is a member/partner and in which he has

substantial interest.

c. Company Shareholder has at least 20% voting power.

d. A Concern (other than company) - Shareholder has at least 20% interest.

e. Any payment by such company on behalf or for the individual benefit of any such

shareholder.

3. Dividend would be - to the extent of accumulated profits.

4. Specific exclusions:

a. When given in ordinary course of business where lending is substantial part of

business.

b. Any dividend is paid which is set-off against previously paid amount and treated

as deemed dividend

Income Tax- Deemed Dividend u/s 2(22)(e) Page 2

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

5. Directorship is no basis to treat a payment as deemed dividend. Its the shareholding which

is to be considered.

6. Such dividend is not subject to the dividend distribution tax u/s.115-O, and is therefore a

taxable income, not exempt u/s. 10(34) of the Act.

7. However, there would be a liability to deduct tax u/s 194 of the Act.

ADVANCE FOR BUSINESS TRANSACTION

Any amount paid ahead of time when is due to be paid is an advance. Whether any advance

made for business transactions by a closely held company to its shareholder having required

interest would amount to deemed dividend? Certain judicial pronouncements on the issue are as

under:

1. Delhi High Court in case of CIT vs. Arvind Kumar Jain ITA No.589/2011 [2011-ITRV-

HC-DEL-270] has held that if the payments are made by a company to its shareholder

having substantial interest but are result of business transactions between the parties

(trade advances), the such payment cannot be treated as loan and advance and the money

so received cannot be treated as deemed dividend within the meaning of section 2(22)(e).

2. Calcutta High Court in the case of M.D. Jindal vs. CIT [1986] 28 Taxman 509 (Cal.) has

held that building material advanced to shareholder for construction advance to be set off

against purchase consideration when the company buys some flats from assessee later on-

value of advance in kind is also taxable as deemed dividend.

3. Chandigarh ITAT Bench in case of DCIT vs. Lakhra Brothers (2007) 106 TTJ (Chd.);

250/162 Taxman 170 (Mag.) has held that amount was advanced during the ordinary

course of business for business expediencies. So it cannot be said that there was intention

of the company to give a loan, the such advanced cannot be treated as loan and advance

and the money so received cannot be treated as deemed dividend within the meaning of

section 2(22)(e).

Income Tax- Deemed Dividend u/s 2(22)(e) Page 3

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

4. Chennai ITAT in case of Farida Holding P. Ltd. vs. DCIT, 51 SOT 452 has held that

assessee company manages the financial affairs of its subsidiary company in its ordinary

course of business and assessee company involved in the activities of taking loan from

the subsidiaries and advancing it to other subsidiaries in ordinary course of business

cannot be treated as deemed dividend.

5. Apex court in case of Bombay Steam Navigation Company P. Ltd. vs. CIT (1965) 56 ITR

52 (SC) has held that every sale of goods on credit does not amount to a transaction of

loan. A loan contracted no doubt creates a debt but there may be a debt without contract a

loan.

6. Karnataka High Court in the case of Bagmane Constructions Pvt. Ltd. (ITA No.473/2013)

held that loan or advance given to shareholder or to any sister concern as a consideration

for the goods or for purchase of a capital asset, which indirectly would benefit the

company advancing the loan, the same cannot be treated as deemed dividend u/s 2(22)(e).

7. In CIT vs. P. K. Abukar (2003) 259 ITR 507 (Mad) it was held that where advance was

given to shareholder for construction of building which was to be let out to company and

advance was to be adjusted against future rent was covered u/s 2(22)(e).

ADVANCE TO PARTNERSHIP FIRM

A partnership firm is not a legal person hence it may hold shares in name of its partners. If a

company advances money to the firm in which partners hold shares of that company, would the

provisions of s. 2(22)(e) be triggered? Certain judicial pronouncements on the issue are as under:

1. Calcutta High Court in the case of Mukundray K. Shah vs. CIT (2005) 197 CTR (Cal) 563

has held that payment by company to a firm in which shareholder is partner for

repayment of advances in regular course of business cannot be deemed dividend under

section 2(22)(e).

Income Tax- Deemed Dividend u/s 2(22)(e) Page 4

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

2. Delhi High Court in CIT vs. National Travel Services [2011-ITRV-HC-DEL-224] has

held that for the purposes of deemed dividend u/s 2(22)(e), firm is shareholder though

shares are held in names of partners.

INTER CORPORATE DEPOSITS

The corporate having surplus funds would lend to another corporate in need of funds. Whether

the Inter corporate deposits would be deemed as deemed dividend in the hands of shareholder?

Judicial pronouncements on the issue are as under:

1. Kolkata ITAT Bench in case of IFB Agro Industries Ltd. vs. JCIT ITA No.1721/Kol/2012

[2013-ITRV-ITAT-KOL-172] has held interest on Inter Corporate Deposits is not an

interest on loan or advance and would be not includible in the chargeable interest under

the interest tax act. So, Inter-corporate deposits cannot be treated as a loan falling within

the preview of section 2(22)(e).

2. Bombay ITAT in Bombay Oil Industries Ltd Vs DCIT 2009-TIOL-297-ITAT-MUM;

(2009) 28 SOT 383 (Mum) has held that Inter-corporate deposits are not deemed dividend

under section 2(22)(e) of the Income Tax Act; It is clear there is distinction between

deposits vis -a- vis loans/advances.

NOT TO SHAREHOLDER

Deemed dividend is assessable in the hands of the shareholder only. Few judicial

pronouncements on the same are as under:

1. Bombay High Court in case of CIT vs. Jignesh P. Shah ITA No.197/2013 [2015-ITRV-

HC-MUM-108] has held that the provision of section 2(22)(e) cannot be invoked unless

the assessee itself is the shareholder of the company, who was lending money to him.

Income Tax- Deemed Dividend u/s 2(22)(e) Page 5

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

2. Delhi High Court in CIT vs. Ankitech P. Ltd. [2011-ITRV-HC-DEL-109] has held that S.

2(22)(e) deemed dividend not assessable if recipient is not shareholder.

3. Apex court in the case of L. Alagusundaram Chettiar vs. CIT [2001] 252 ITR 893 (SC)

has held that where Company advancing large amount to low-paid employee. Employee

advancing loan to assessee, the Managing Director of the said company. Deemed

dividend to be assessed in the hands of assessee.

4. Delhi High Court in case of CIT vs. Mcc Marketing Pvt. Ltd. ITA No. 599/2011 has held

that provision of section cannot be invoked in case of amount advance by one company to

another, who is not a shareholder of the company; shareholding of common director

cannot be taken into consideration for that purpose.

5. Bombay High Court in CIT vs. Impact Containers Pvt. Ltd [2014-ITRV-HC-MUM-112]

has held that the law laid down in Universal Medicare 324 ITR 263 (Bom) (approving

Bhaumik Colour 313 ITR 146 (SB)), that s. 2(22)(e) does not apply to a non-shareholder,

is a good law.

6. Ahmadabad ITAT Bench in case of Krupeshbhai N. Patel vs. DCIT (2013) 140 ITD

176(Ahd.) (Trib.) has held that Legal fiction created u/s 2(22)(e) does not extend further

for broadening concept of shareholder so as to tax loans and advances as deemed

dividend in hands of deeming shareholder.

7. Delhi High Court in case CIT vs. Gopal Clothing Co. Ltd. ITA No.333/2006 has held that

provision of section 2(22)(e) cannot be invoked in respect of the unsecured loan taken by

the assessee from the other company if the assessee does not possess the prescribed

voting rights in that company, shareholding of the common shareholder or director cannot

be taken into consideration for that purpose.

Income Tax- Deemed Dividend u/s 2(22)(e) Page 6

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

EXTENT OF ACCUMULATED PROFIT

The loan or advance would be deemed to be dividend to the extent of accumulated profits.

Judicial pronouncements on the same are as under:

1. Apex court in the case of Tarulata Shyam v. CIT [1997] 108 ITR 345 (SC) has held that

under section 2(22) the liability to tax attaches to any amount taken as loan by the

shareholder from a controlled company to the extent it possesses accumulated profits at

the moment the loan is borrowed and it is immaterial whether the loan is repaid before

the end of the accounting year.

2. It was held in CIT vs. G. Sarsinham (Died) (1999) 236 ITR 327 (SC) and ITO vs.

Gordhadas Khimji (1985) 11 ITD 158 (Cochin) that loans given in earlier years are to be

reduced to calculate accumulated profits.

LOAN REPAID INSTANTLY

If the closely held company had advanced loan to shareholder and the same had been repaid

during the same financial year, whether then also the provision of section 2(22)(e) would apply?

Judicial pronouncements on the same are as under:

1. In Tarulata Shyam & Ors. Vs CIT (SC)108 ITR 345 it was held that if loan advanced to a

shareholder was re-paid within 23 days it shall still be deemed as dividend u/s 2(22)(e). If

the assessee comes under the letter of law, he has to be taxed, however great the hardship

may appear to the judicial mind to be.

2. In Walchand & Co. P. Ltd vs. CIT (1993) 204 ITR 146 (Bom) it was held that loan taken

and repaid by declaration is also covered u/s 2(22)(e).

Income Tax- Deemed Dividend u/s 2(22)(e) Page 7

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

SHARE APPLICATION MONEY

If the assessee company has paid share application money, whether such share application can

also be treated as loans and advances u/s 2(22)(e) of the Act? The judicial pronouncement on the

same issue is as under:

1. Mumbai ITAT Bench in case of DCIT vs. Vikas Oberoi ITA No.4364/M/2011 [2013-

ITRV-ITAT-MUM-051] has held that as original intention of payment of share application

money is towards the allotment of shares of any kind, the same cannot be deemed as loan

and advance unless the mala fide intentions are exposed by AO with evidence.

BUSINESS EXPEDIENCY / NON-GRATUITOUS ADVANCE

1. Chennai ITAT bench in ACIT vs. Smt. G. Sreevidya [2012-ITRV-ITAT-CHE-276] has

held that there would be no s. 2(22)(e) Deemed Dividend if loan to shareholder is given

as quid pro quo. It was held that:

Every payment by a company to its shareholders may not be a loan/ advance so as to

come within the ambit of s. 2(22)(e). In the present case, the amount was withdrawn by

the assessee from the company only to meet her short term cash requirements. By virtue

of offering personal guarantee and collateral security for the benefit of the company, the

liquidity position of the assessee had gone down. In the strict sense, the amount

forwarded by the company to the assessee was not in the shape of advances or loans. The

arrangement between the assessee and the company was merely for the sake of

convenience arising out of business expediency

2. Calcutta High Court in Pradip Kumar Malhotra vs. CIT ITA No.219/2003 [2011-ITRV-

HC-KOL-274] has held that non-gratuitous advances to substantial shareholder is not

deemed dividend u/s 2(22)(e). It was held:

The phrase by way of advance or loan s. 2(22)(e) must be construed to mean those

advances or loans which a shareholder enjoys simply on account of being a person who is

Income Tax- Deemed Dividend u/s 2(22)(e) Page 8

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

the beneficial owner of shares. If such loan or advance is given to such share holder as a

consequence of any further consideration received from the shareholder, then such

advance or loan cannot be said to be deemed dividend u/s 2(22)(e). Thus, while

gratuitous loan or advance given by a company to a substantial shareholder comes

within the purview of s. 2(22)(e), a case where the loan or advance is given in return to

an advantage conferred upon the company by the shareholder does not. On facts, as the

advance was in lieu of the company being permitted to mortgage the assessees fault, it

was not gratuitous and so not assessable as deemed dividend.

OTHER IMPORTANT PRONOUNCEMENTS

1. Chandigarh ITAT Bench in case of DCIT vs. Radhe Shyam Jain (2013) 140 ITR

244(Chandigarh) (Trib.) has held that credit balance in capital account and non

encashment of cheque the amount is credited back to company account cannot be

assessed as deemed dividend.

2. Bombay High Court at Goa in CIT vs. Parle Plastics Ltd [2010-ITRV-HC-MUM-098]

has held that S. 2(22)(e) applicable only to loans given in the year. S. 2(22)(e) is not

applicable if lending is not trivial part of business.

I hope this document would be of use to you. I thank Harshit Arora in assisting me to compile

this document.

Best Regards

CA. Pramod Jain

pramodjain@lunawat.com

+91 9811073867

(Disclaimer: Though full efforts have been made to state the interpretations and case laws

correctly, yet the author is not responsible / liable for any loss or damage caused to anyone due

to any mistake / error / omissions)

Income Tax- Deemed Dividend u/s 2(22)(e) Page 9

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 8-Civics-NCERT-Chapter (3) Meritnation - NOTES PDFDocument2 pages8-Civics-NCERT-Chapter (3) Meritnation - NOTES PDFExcelNo ratings yet

- 8-Civics-NCERT-Chapter (4) Meritnation - NOTES PDFDocument1 page8-Civics-NCERT-Chapter (4) Meritnation - NOTES PDFExcelNo ratings yet

- 8-Civics-NCERT-Chapter (7) Meritnation - NOTES PDFDocument2 pages8-Civics-NCERT-Chapter (7) Meritnation - NOTES PDFExcelNo ratings yet

- PEASS - Reassessment Could Be Made If Investigation Wing Revealed Bogus Entries Provided by Entry OperatorsDocument9 pagesPEASS - Reassessment Could Be Made If Investigation Wing Revealed Bogus Entries Provided by Entry OperatorsExcelNo ratings yet

- ShatangayurmantrahDocument3 pagesShatangayurmantrahExcelNo ratings yet

- 8-Civics-NCERT-Chapter (9) Meritnation - NOTESDocument2 pages8-Civics-NCERT-Chapter (9) Meritnation - NOTESExcelNo ratings yet

- Instruction 1914Document3 pagesInstruction 1914ExcelNo ratings yet

- Bhaja GovindamDocument32 pagesBhaja GovindamExcelNo ratings yet

- SangacchadhvamDocument1 pageSangacchadhvamExcelNo ratings yet

- Samkara Againt Buddhism - Daniel IngallsDocument21 pagesSamkara Againt Buddhism - Daniel IngallsExcelNo ratings yet

- Vector Shipping Supreme CourtDocument1 pageVector Shipping Supreme CourtExcelNo ratings yet

- Gujarat Royalty and Indian Ornithology: Lavkumar KhacharDocument2 pagesGujarat Royalty and Indian Ornithology: Lavkumar KhacharExcelNo ratings yet

- Running Ageing and Human Potential - BortzDocument9 pagesRunning Ageing and Human Potential - BortzExcelNo ratings yet

- Carpet Mahal NK Proteins Bogus PurchasesDocument15 pagesCarpet Mahal NK Proteins Bogus PurchasesExcelNo ratings yet

- Mayank Diamonds PVT Limited - Tax Appeal 200 of 2003Document5 pagesMayank Diamonds PVT Limited - Tax Appeal 200 of 2003ExcelNo ratings yet

- Transfer Pricing MethodsDocument41 pagesTransfer Pricing MethodsExcel100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Case StudyDocument7 pagesCase StudyRintan Agitya UmamiNo ratings yet

- Coinify Inwallet Buy - SellDocument2 pagesCoinify Inwallet Buy - SellmehocayNo ratings yet

- Fringe BenefitDocument2 pagesFringe Benefitbcbi2010No ratings yet

- Account Summary Payment Information: New Balance: $261.55Document6 pagesAccount Summary Payment Information: New Balance: $261.55AriadnaUrsachi100% (2)

- Lalaine Mae L. Balmes September 26, 2021 201812779 BGMT 28A: "Likas Na". ButDocument3 pagesLalaine Mae L. Balmes September 26, 2021 201812779 BGMT 28A: "Likas Na". ButLalaine BalmesNo ratings yet

- Part I: Multiple - Choise Questions Choose The Only One Right Answer For Each QuestionDocument7 pagesPart I: Multiple - Choise Questions Choose The Only One Right Answer For Each QuestionHa TranNo ratings yet

- BiziMobile Inc.-2021 PDFDocument5 pagesBiziMobile Inc.-2021 PDFtahjinNo ratings yet

- Part IVa - Member Bank Interface v5.3 - HIGHLIGHTEDDocument550 pagesPart IVa - Member Bank Interface v5.3 - HIGHLIGHTEDAbdul MajidNo ratings yet

- 03 Bank ReconliationDocument4 pages03 Bank Reconliationsharielles /No ratings yet

- AXIS BANK Statement For February 2021-1Document5 pagesAXIS BANK Statement For February 2021-1Vijay ShanigarapuNo ratings yet

- Solved in 2002 Florence Purchased 30 Acres of Land She HasDocument1 pageSolved in 2002 Florence Purchased 30 Acres of Land She HasAnbu jaromiaNo ratings yet

- Ticket 2021 Mathematics Challenge For Young Australians (MCYA)Document3 pagesTicket 2021 Mathematics Challenge For Young Australians (MCYA)Michael ChenNo ratings yet

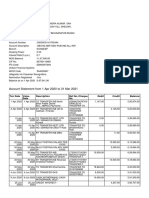

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAbhay RajNo ratings yet

- ChallanDocument2 pagesChallanHoshen MollaNo ratings yet

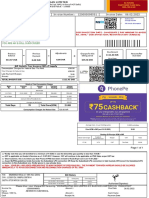

- Postpaid Monthly Statement: This Month's SummaryDocument4 pagesPostpaid Monthly Statement: This Month's SummaryJinesh JadavNo ratings yet

- Oct Evolve and TrustDocument2 pagesOct Evolve and TrustSafeBit ProsNo ratings yet

- CIR V CTA Smith Kilne & Fresh OverseasDocument2 pagesCIR V CTA Smith Kilne & Fresh OverseasGRNo ratings yet

- Haroon Sharif S/O M. Sharif Bhatti 152-Pak Block A I Town: Web Generated BillDocument1 pageHaroon Sharif S/O M. Sharif Bhatti 152-Pak Block A I Town: Web Generated BillHamza KhanNo ratings yet

- MATERI KASUS Mengisi REGISTRATION FORM-GUEST CARD-BREAKFAST COUPONDocument2 pagesMATERI KASUS Mengisi REGISTRATION FORM-GUEST CARD-BREAKFAST COUPON15Dwi CiptayasaNo ratings yet

- Kepco Philippines Corporation v. CIRDocument17 pagesKepco Philippines Corporation v. CIRAronJamesNo ratings yet

- Taxation Law-IDocument18 pagesTaxation Law-IMahamaya GautamiNo ratings yet

- Fastag StatementDocument2 pagesFastag StatementmenakadevieceNo ratings yet

- Eps-Topik Test Fee PDFDocument1 pageEps-Topik Test Fee PDFarshe khanNo ratings yet

- Reminders:: - The Allowed Maximum Amount of Benefit ForDocument1 pageReminders:: - The Allowed Maximum Amount of Benefit ForKeish ShuneNo ratings yet

- Handbook of VATDocument66 pagesHandbook of VATMd SelimNo ratings yet

- Quimpo V MendozaDocument7 pagesQuimpo V Mendozadar0800% (1)

- Abhi Gas BillDocument1 pageAbhi Gas Billritik chawlaNo ratings yet

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

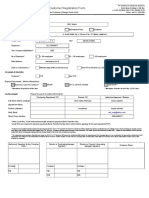

- International and Local Company - Registration FormDocument6 pagesInternational and Local Company - Registration FormWisnu NugrohoNo ratings yet

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocument1 pageEarnings Statement Earnings Statement Earnings Statement Earnings StatementDana HamiltonNo ratings yet