Professional Documents

Culture Documents

32-Marubeni Corp. v. CIR G.R. No. 76573 March 7, 1990

Uploaded by

Jopan SJCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

32-Marubeni Corp. v. CIR G.R. No. 76573 March 7, 1990

Uploaded by

Jopan SJCopyright:

Available Formats

Marubeni Corp. v. CIR G.R. No.

76573 1 of 2

Republic of the Philippines

SUPREME COURT

Manila

THIRD DIVISION

G.R. No. 76573 September 14, 1989

MARUBENI CORPORATION (formerly Marubeni Iida, Co., Ltd.), petitioner,

vs.

COMMISSIONER OF INTERNAL REVENUE AND COURT OF TAX APPEALS, respondents.

Melquiades C. Gutierrez for petitioner.

The Solicitor General for respondents.

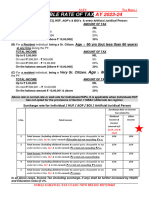

G.R. No. 76573 (Marubeni Corporation vs. Commissioner of Internal Revenue and the Court of Tax Appeals). - In

our decision dated September 14, 1989, we ruled that petitioner was a non-resident foreign corporation subject to

Section 24 (b) (1) of the National Internal Revenue Code of 1977 which states:

"Tax on foreign corporations. (1) Nonresident foreign corporations . . . (iii) On dividends received from a

domestic corporation liable to tax under this Chapter, the tax shall be 15% of the dividends received which shall be

collected and paid as provided in Section 53 (d) of this Code, subject to the condition that the country in which the

non-resident foreign corporation is domiciled shall allow a credit against the tax due from the non-resident foreign

corporation taxes deemed to have been paid in the Philippines equivalent to 20% which represents the difference

between the regular tax (35%) on corporations and the tax (15%) on the dividends provided in this section; . . . ."

"Based on this finding, we reversed the decision of respondent Court of Tax Appeals dated February 12, 1986

which affirmed the denial by respondent Commissioner of Internal Revenue of petitioner's claim for refund. We

thus ordered the Commissioner of Internal Revenue to refund or grant as tax credit in favor of petitioner the

amount of P144,452.40.

"On October 5, 1989, the Solicitor General, representing the public respondent, filed a motion for reconsideration

stating that although we correctly ruled that petitioner is a non-resident foreign corporation still petitioner could not

avail itself of the preferential tax rate of 15% under said Section 24(b)(1) because it failed to comply with the

requisites set forth thereunder.

"On October 9, 1989, petitioner similarly filed its motion for reconsideration remaining steadfast to its position that

it is a resident foreign corporation subject only to the ten percent (10%) final intercorporate dividend tax.

"We grant the motion for reconsideration filed by the Solicitor General.

"Section 24(b)(1) is explicit on the conditions for the availment of the preferential fifteen percent (15%) tax rate.

Under said provision, petitioner must show that Japan grants a tax credit to Marubeni, taxes deemed to have been

paid in the Philippines equivalent to at least twenty percent (20%) against the tax due from Marubeni. aisa dc

"Noteworthy is the recent case of Commissioner of Internal Revenue vs. Procter and Gamble PMC (G.R. No.

66835, April 15, 1988, 160 SCRA 560). In that case we denied Procter and Gamble's claim for refund for its parent

company in the United States since it failed to meet the following conditions necessary for the availment of the

preferential fifteen percent (15%) tax namely: (1) to show the actual amount credited by the U.S. Government

Marubeni Corp. v. CIR G.R. No. 76573 2 of 2

against the income tax due from PMC-USA on the dividends received from private respondent; (2) to present the

income tax return of its mother company for 1975 when the dividends were received; (3) to submit any

authenticated document showing that the US Government credited 20% of the tax deemed paid in the Philippines.

"In the case at bar, petitioner similarly failed to comply with the requisites set forth under Section 24(b)(1).

Petitioner reasons that it cannot furnish the Commissioner of Internal Revenue with the confidential income tax

return of Marubeni Japan since such a requirement is beyond the power of Philippine taxation laws. (Rollo, p. 238).

"Such reasoning finds no merit. Section 24(b)(i) of the National Internal Revenue Code of 1977 is clear and

explicit on the conditions for the availment of the preferential fifteen percent (15%) tax rate. Normally the

Philippines imposes a higher thirty five percent (35%) tax rate on corporations. But since the Philippines seeks to

lessen the impact of double taxation between countries, we impose only the lower tax rate of fifteen percent (15%)

on dividends subject to the condition that the country in which the non-resident foreign corporation is domiciled

allows a tax credit of twenty percent (20%). Such prerequisite must be strictly complied with because the fifteen

percent (15%) tax rate is a concession in the nature of a tax exemption vis-a-vis the normal rate of thirty five (35%)

on corporations.

"Petitioner's motion for reconsideration merely reiterates the same arguments previously raised in its petition and

does not raise substantial issues not raised upon in our decision dated September 14, 1989. Accordingly, since

petitioner failed to comply with the conditions set forth under Section 24 (b)(1) of the National Internal Revenue

Code of 1977, we hereby modify the decision dated September 14, 1989 and rule that petitioner corporation is

subject to the twenty five percent (25%) tax rate on dividends pursuant to Article 10(2) of the Philippine-Japan Tax

Convention. The Commissioner of Internal Revenue is hereby ordered to recompute the tax due from petitioner

corporation using the correct tax base and rate." "

Very truly yours, (Sgd.) JULIETA Y. CARREON

You might also like

- 2008 CMU Tepper Case BookDocument91 pages2008 CMU Tepper Case Bookr_okoNo ratings yet

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- ERCResolutionNo19Seriesof2016 PDFDocument2 pagesERCResolutionNo19Seriesof2016 PDFJopan SJNo ratings yet

- Venture Life CycleDocument27 pagesVenture Life CycleRalph Gene Trabasas Flora100% (1)

- Tax CasesDocument65 pagesTax CasesMaria BethNo ratings yet

- Digest TaxDocument3 pagesDigest TaxAimee MilleteNo ratings yet

- CIR Vs PERFDocument2 pagesCIR Vs PERFKring-kring Peralta BiscaydaNo ratings yet

- Taganito Mining Corporation vs. CIRDocument10 pagesTaganito Mining Corporation vs. CIRAJ AslaronaNo ratings yet

- National Brewery and Allied Industries Labor Union of The Philippines (PAFLU) vs. San Miguel Brewery, Inc., G.R. No. L-19017, December 27, 1963 PDFDocument5 pagesNational Brewery and Allied Industries Labor Union of The Philippines (PAFLU) vs. San Miguel Brewery, Inc., G.R. No. L-19017, December 27, 1963 PDFKym AlgarmeNo ratings yet

- Arrival Under Stress and ShipwrecksDocument14 pagesArrival Under Stress and ShipwrecksKevin CastilloNo ratings yet

- Intel Technology Phils. Inc. vs. CIR GR No. 166732 - April 27, 2007 FactsDocument5 pagesIntel Technology Phils. Inc. vs. CIR GR No. 166732 - April 27, 2007 FactsCHow GatchallanNo ratings yet

- Abs-Cbn v. Cta and NPC v. CbaaDocument2 pagesAbs-Cbn v. Cta and NPC v. CbaaRyan BagagnanNo ratings yet

- City of Manila v. Coca-Cola BottlersDocument17 pagesCity of Manila v. Coca-Cola BottlersRo CheNo ratings yet

- CIR Vs TOLEDO POWER COMPANY - (08.10.2015) - BayogDocument3 pagesCIR Vs TOLEDO POWER COMPANY - (08.10.2015) - BayogDanica DepazNo ratings yet

- Fort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDocument28 pagesFort Bonifacio Development Corporation vs. Commissioner of Internal RevenueAriel AbisNo ratings yet

- 8 RCBC Vs CIR 2007Document9 pages8 RCBC Vs CIR 2007BLNNo ratings yet

- Cir vs. General Foods Inc.Document2 pagesCir vs. General Foods Inc.Dexter Lee GonzalesNo ratings yet

- Facts: Petitioners: Conwi, Et - Al. vs. CTA and CIRDocument3 pagesFacts: Petitioners: Conwi, Et - Al. vs. CTA and CIRBurn-Cindy AbadNo ratings yet

- Commissioner of Internal Revenue, Petitioner, Vs - Court of Appeals and Commonwealth Management and Services Corporation, Respondents.Document2 pagesCommissioner of Internal Revenue, Petitioner, Vs - Court of Appeals and Commonwealth Management and Services Corporation, Respondents.Jennilyn Gulfan YaseNo ratings yet

- Aboitiz Shipping Corp. v. General Accident Fire and Life Assurance Corp., LTDDocument2 pagesAboitiz Shipping Corp. v. General Accident Fire and Life Assurance Corp., LTDsophiaNo ratings yet

- Martin v. GuerreroDocument3 pagesMartin v. Guerrerolouis jansenNo ratings yet

- Deutsche Bank vs. CirDocument1 pageDeutsche Bank vs. CirDee WhyNo ratings yet

- 67 CIR V Procter GambleDocument2 pages67 CIR V Procter GambleNaomi QuimpoNo ratings yet

- Maceda V MacaraigDocument2 pagesMaceda V MacaraigbrendamanganaanNo ratings yet

- Gotamco Case CirDocument2 pagesGotamco Case Cirnil qawNo ratings yet

- Final Exam Study GuideDocument13 pagesFinal Exam Study GuideDakotaMontanaNo ratings yet

- Specpro Vs Ordinary Civil ActionDocument2 pagesSpecpro Vs Ordinary Civil ActionAnthony ReandelarNo ratings yet

- Spouses Genato v. ViolaDocument8 pagesSpouses Genato v. ViolaPam RamosNo ratings yet

- Meralco Vs CIRDocument22 pagesMeralco Vs CIRmifajNo ratings yet

- ALLIANCE FOR THE FAMILY FOUNDATION Vs GARIN, GR 217872Document1 pageALLIANCE FOR THE FAMILY FOUNDATION Vs GARIN, GR 217872Ronnie Garcia Del RosarioNo ratings yet

- Silkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Document3 pagesSilkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Vince LeidoNo ratings yet

- Abra Valley Inc. vs. Judge AquinoDocument3 pagesAbra Valley Inc. vs. Judge AquinoShai F Velasquez-NogoyNo ratings yet

- TCCP v. CMTADocument40 pagesTCCP v. CMTAIvan LuzuriagaNo ratings yet

- CIR v. PALDocument18 pagesCIR v. PALmceline19No ratings yet

- Cases For VatDocument18 pagesCases For VatAya AntonioNo ratings yet

- Allied Bank v. CIR Case DigestDocument4 pagesAllied Bank v. CIR Case DigestCareenNo ratings yet

- RMC No 17-2018Document6 pagesRMC No 17-2018fatmaaleahNo ratings yet

- CIR Vs Republic CementDocument22 pagesCIR Vs Republic Cementzatarra_12No ratings yet

- Torts - A29 - Fontanilla vs. Maliaman, 179 SCRA 685 (1989)Document11 pagesTorts - A29 - Fontanilla vs. Maliaman, 179 SCRA 685 (1989)John Paul VillaflorNo ratings yet

- JM Dominguez Agronomic Company, Inc. vs. Liclican, 764 SCRA 338, July 29, 2015Document14 pagesJM Dominguez Agronomic Company, Inc. vs. Liclican, 764 SCRA 338, July 29, 2015TNVTRLNo ratings yet

- CIR V AcesiteDocument2 pagesCIR V AcesiteAleli Joyce BucuNo ratings yet

- Manila International Airport Authority Vs Court of AppealsDocument2 pagesManila International Airport Authority Vs Court of AppealsEvangelyn EgusquizaNo ratings yet

- Wee Cruz Vs LimDocument6 pagesWee Cruz Vs LimCyber QuestNo ratings yet

- CIR V Tokyo ShippingDocument2 pagesCIR V Tokyo ShippingJerico GodoyNo ratings yet

- Bar Q and ADocument20 pagesBar Q and AshakiraNo ratings yet

- Cir v. John Gotamco - SonsDocument2 pagesCir v. John Gotamco - SonsLEIGH TARITZ GANANCIALNo ratings yet

- 17.MARK-monserrat Vs CeronDocument2 pages17.MARK-monserrat Vs CeronbowbingNo ratings yet

- CJH Development Corporation Vs Bureau of Internal Revenue Et AlDocument6 pagesCJH Development Corporation Vs Bureau of Internal Revenue Et AlThe ChogsNo ratings yet

- Corporation Law ReviewerDocument84 pagesCorporation Law ReviewerrickyNo ratings yet

- Income TaxDocument46 pagesIncome TaxCanapi AmerahNo ratings yet

- Labor 101Document9 pagesLabor 101RinielNo ratings yet

- Director of Lands v. IAC, 219 SCRA 339Document4 pagesDirector of Lands v. IAC, 219 SCRA 339FranzMordenoNo ratings yet

- Kasamahan Realty Development Corporation v. CIR, CTA Case No. 6204, February 16, 2005 PDFDocument25 pagesKasamahan Realty Development Corporation v. CIR, CTA Case No. 6204, February 16, 2005 PDFMary Fatima BerongoyNo ratings yet

- Saavedra vs. EstradaDocument2 pagesSaavedra vs. EstradaJayson Lloyd P. MaquilanNo ratings yet

- Tax April06Document120 pagesTax April06tal antonioNo ratings yet

- G.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.Document3 pagesG.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.carlo_tabangcuraNo ratings yet

- Earthquake Drill Evaluation Form 1Document2 pagesEarthquake Drill Evaluation Form 1ibaanNo ratings yet

- AsdasdasdasdDocument43 pagesAsdasdasdasdbarrystarr1No ratings yet

- 272 - City of Iriga Vs CASURECODocument3 pages272 - City of Iriga Vs CASURECOanon_614984256No ratings yet

- Spouses Tan Vs Atty VallejoDocument2 pagesSpouses Tan Vs Atty VallejoBhenz Bryle TomilapNo ratings yet

- 264480-2020-Tumaodos v. San Miguel Yamamura PackagingDocument10 pages264480-2020-Tumaodos v. San Miguel Yamamura PackagingRomel OdroniaNo ratings yet

- Hontiveros v. AltavasDocument2 pagesHontiveros v. AltavasmisterdodiNo ratings yet

- DEUTSCHE BANK AG MANILA BRANCH Vs CIRDocument5 pagesDEUTSCHE BANK AG MANILA BRANCH Vs CIRBruno GalwatNo ratings yet

- Marubeni Corp. vs. CIR, G.R. No. 76573, March 7, 1990Document1 pageMarubeni Corp. vs. CIR, G.R. No. 76573, March 7, 1990Jacinto Jr Jamero0% (1)

- Res 18 S 2005 PDFDocument2 pagesRes 18 S 2005 PDFJopan SJNo ratings yet

- Resolution+No +15,+series+of+2015 PDFDocument2 pagesResolution+No +15,+series+of+2015 PDFJopan SJNo ratings yet

- Resolution+No +13,+series+of+2018 PDFDocument4 pagesResolution+No +13,+series+of+2018 PDFJopan SJNo ratings yet

- Res. 17 S. 2010 - ERC-ODRC-ValuationHandbook-FINAL PDFDocument59 pagesRes. 17 S. 2010 - ERC-ODRC-ValuationHandbook-FINAL PDFJopan SJNo ratings yet

- New Annual Report ERC Form DU AO1 1Document97 pagesNew Annual Report ERC Form DU AO1 1Jopan SJNo ratings yet

- ResolutionNo 21, Seriesof2014 PDFDocument8 pagesResolutionNo 21, Seriesof2014 PDFJopan SJNo ratings yet

- Decision+ERC+Case+No.+2007-088+RC DECORP&GNPOWER 10.4.07Document19 pagesDecision+ERC+Case+No.+2007-088+RC DECORP&GNPOWER 10.4.07Jopan SJNo ratings yet

- Annex A Definition and Boundaries OF Transmission Connection AssetsDocument17 pagesAnnex A Definition and Boundaries OF Transmission Connection AssetsJopan SJNo ratings yet

- Res +39,+s +2006+8+of+8Document16 pagesRes +39,+s +2006+8+of+8Jopan SJNo ratings yet

- ERC Res - No.19 S2006Document2 pagesERC Res - No.19 S2006Jopan SJNo ratings yet

- Amended Rules Implementing Section 28Document11 pagesAmended Rules Implementing Section 28Jopan SJNo ratings yet

- Decision+ERC+Case+No.+2006-078 CEPALCO 9.7.07Document37 pagesDecision+ERC+Case+No.+2006-078 CEPALCO 9.7.07Jopan SJNo ratings yet

- 19-Macalintal v. COMELEC GR No. 157013 July 10, 2003Document19 pages19-Macalintal v. COMELEC GR No. 157013 July 10, 2003Jopan SJNo ratings yet

- 13-Galido v. COMELEC G.R. No. 95346 January 18, 1991Document4 pages13-Galido v. COMELEC G.R. No. 95346 January 18, 1991Jopan SJNo ratings yet

- 15-Maquiling v. COMELEC G.R. No. 195649 April 16, 2013Document16 pages15-Maquiling v. COMELEC G.R. No. 195649 April 16, 2013Jopan SJNo ratings yet

- 17-Penera v. COMELEC G.R. No. 181613 November 25, 2009Document7 pages17-Penera v. COMELEC G.R. No. 181613 November 25, 2009Jopan SJNo ratings yet

- Supreme Court: Reyes v. COMELEC G.R. No. 207264Document9 pagesSupreme Court: Reyes v. COMELEC G.R. No. 207264Jopan SJNo ratings yet

- 08-Quinto v. COMELEC G.R. No. 189698 February 22, 2010Document24 pages08-Quinto v. COMELEC G.R. No. 189698 February 22, 2010Jopan SJNo ratings yet

- 12-Flores v. Comelec G.R. No. 89604 April 20, 1990Document6 pages12-Flores v. Comelec G.R. No. 89604 April 20, 1990Jopan SJNo ratings yet

- 07-Atong Paglaum, Inc. v. COMELEC G.R. No. 203766 April 2, 2013Document31 pages07-Atong Paglaum, Inc. v. COMELEC G.R. No. 203766 April 2, 2013Jopan SJNo ratings yet

- 06-Banat v. Comelec G.R. No. 179271 July 8, 2009Document11 pages06-Banat v. Comelec G.R. No. 179271 July 8, 2009Jopan SJNo ratings yet

- 08-Quinto v. COMELEC G.R. No. 189698 December 1, 2009Document16 pages08-Quinto v. COMELEC G.R. No. 189698 December 1, 2009Jopan SJNo ratings yet

- Chapter 26 - AnswerDocument3 pagesChapter 26 - Answerlooter198No ratings yet

- Laporan Keuangan WIKA Per 31 Maret 2019-DikonversiDocument170 pagesLaporan Keuangan WIKA Per 31 Maret 2019-DikonversiRatna ShafaNo ratings yet

- Business Finance - Midterm Exams Problem 3Document2 pagesBusiness Finance - Midterm Exams Problem 3Rina Lynne BaricuatroNo ratings yet

- Work Sheet AnalysisDocument7 pagesWork Sheet AnalysisMUHAMMAD ARIF BASHIRNo ratings yet

- Business Taxation Solman Tabag@garcia PDFDocument42 pagesBusiness Taxation Solman Tabag@garcia PDFJoey AbrahamNo ratings yet

- Chapter 04 - Credit RatingDocument58 pagesChapter 04 - Credit RatingLoyvini RockzzNo ratings yet

- Example of Accounting ConceptsDocument3 pagesExample of Accounting ConceptsGio BurburanNo ratings yet

- Sapm Unit 1Document49 pagesSapm Unit 1Alavudeen ShajahanNo ratings yet

- AKIJ Capital LTDDocument9 pagesAKIJ Capital LTDRafat SafayetNo ratings yet

- RegressionDocument49 pagesRegressionSahauddin ShaNo ratings yet

- E Waste RecyclingDocument49 pagesE Waste RecyclingaskmeeNo ratings yet

- Studying Different Systematic Value Investing Strategies On The Eurozone MarketDocument38 pagesStudying Different Systematic Value Investing Strategies On The Eurozone Marketcaque40No ratings yet

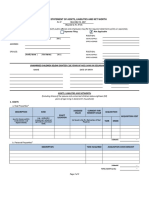

- Saln TemplateDocument6 pagesSaln TemplateAllan TomasNo ratings yet

- The Economy of Andhra Pradesh PDFDocument326 pagesThe Economy of Andhra Pradesh PDFurike rajNo ratings yet

- Flybe Group PLC Annual Report 2012 13Document55 pagesFlybe Group PLC Annual Report 2012 13djokouwmNo ratings yet

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Document109 pages1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliNo ratings yet

- Vendor Evaluation FormDocument8 pagesVendor Evaluation FormSamrat SarkarNo ratings yet

- Permanent Establishment and Transfer PricingDocument27 pagesPermanent Establishment and Transfer PricingTimothy Jevon LieanderNo ratings yet

- Components of A Compensation PlanDocument13 pagesComponents of A Compensation PlanBarbara GatumutaNo ratings yet

- Fringe Benefits TaxDocument7 pagesFringe Benefits TaxRaymond JhulyanNo ratings yet

- Kamarajar Port Limited: Tender Procedure ManualDocument59 pagesKamarajar Port Limited: Tender Procedure Manualadhikosh002No ratings yet

- Nike Cost of CapitalDocument23 pagesNike Cost of CapitalSaahil Ledwani100% (1)

- Commissioner vs. Algue 158 SCRA 9Document6 pagesCommissioner vs. Algue 158 SCRA 9eieipayadNo ratings yet

- Interest Rate and Security ValuationDocument16 pagesInterest Rate and Security ValuationMUYCO RISHELNo ratings yet

- Latihan Alk Gayuh Nata Imahdi Al AfghaniDocument14 pagesLatihan Alk Gayuh Nata Imahdi Al AfghaniYoga Arif PratamaNo ratings yet

- INSABA BW Fresh Fruit Juice Business - 20070809Document9 pagesINSABA BW Fresh Fruit Juice Business - 20070809Ngọc TrânNo ratings yet

- Home Budget WorksheetDocument6 pagesHome Budget WorksheetAJOY DUTTANo ratings yet