Professional Documents

Culture Documents

Low GST Lawinfotext Blogspot Com

Uploaded by

Kapil Dev Saggi0 ratings0% found this document useful (0 votes)

66 views3 pagesList of low GST rates products in India

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentList of low GST rates products in India

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views3 pagesLow GST Lawinfotext Blogspot Com

Uploaded by

Kapil Dev SaggiList of low GST rates products in India

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

http://lawinfotext.blogspot.

com

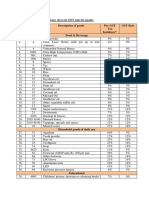

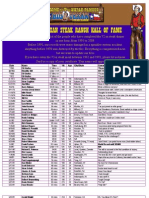

A list of such supplies, where the GST incidence is lower than the present combined indirect

tax rates are reflected as under:

S. Chapter / Heading / Description of goods

No. Sub-heading / Tariff

item

1 4 Milk powder

2 4 Curd, Lassi, Butter milk put up in unit container

3 4 Unbranded Natural Honey

4 0401 Ultra High Temperature (UHT) Milk

5 0405 Dairy spreads

6 0406 Cheese

7 801 Cashew nut

8 806 Raisin

9 9 Spices

10 9 Tea

11 10 Wheat

12 10 Rice

13 11 Flour

14 15 Soyabean oil

15 15 Groundnut oil

16 15 Palm oil

17 15 Sunflower oil

18 15 Coconut oil

19 15 Mustard Oil

20 15 Sunflower oil

21 15 Other vegetable edible oils

22 17 Sugar

23 1702 Palmyra jaggery

24 1704 Sugar confectionery

25 1902 Pasta, spaghetti, macaroni, noodles

26 20 Fruit and vegetable items and other food products

27 2001, 2004 Pickle, Murabba, Chutney

28 21 Sweetmeats

29 2103 Ketchup & Sauces

30 2103 30 00 Mustard Sauce

31 2103 90 90 Toppings, spreads and sauces

32 2106 Instant Food Mixes

33 2106 Other pulses bari (mungodi)

34 22 Mineral water

35 2201 90 10 Ice and snow

36 25 Cement

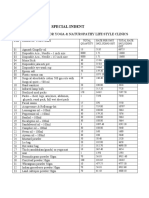

S. Chapter / Heading / Description of goods

No. Sub-heading / Tariff

item

37 27 Coal

38 27 Kerosene PDS

39 27 LPG Domestic

40 30 Insulin

41 33 Agarbatti

42 33 Tooth powder

43 33 Hair oil

44 33 Toothpaste

45 3304 20 00 Kajal [other than kajal pencil sticks]

46 34 Soap

47 37 X ray films for medical use

48 3822 Diagnostic kits and reagents

49 3926 90 99 Plastic Tarpaulin

50 4202 School Bag

51 4820 Exercise books and note books

52 4823 Kites

53 4903 Childrens' picture, drawing or colouring books

54 50 Silk fabrics

55 51 Woollen fabrics

56 52 Cotton fabrics not containing any other textile material

57 53 Other Vegetable yarn fabrics

58 54, 55 Manmade filament/fibre fabrics

59 61, 62, 63 Readymade garments and made up articles of textiles of sale

value not exceeding Rs. 1000 per piece

60 61, 62, 63 Readymade garments and made up articles of textiles of sale

value exceeding Rs. 1000 per piece

61 64 Footwear of RSP upto Rs. 500 per pair

62 64 Other footwear

63 65 Helmet

64 65 Headgear and parts thereof

65 68 Fly ash bricks and fly ash blocks

66 701510 Glasses for corrective spectacles and flint buttons

67 73 LPG Stove

68 76 Aluminium foils

69 8215 Spoons, forks, ladles, skimmers, cake servers, fish knives,

tongs

70 84 Fixed Speed Diesel Engines of power not exceeding 15HP

71 4011 Tractor rear tyres and tractor rear tyre tubes

72 8423 & 9016 Weighing Machinery [other than electric and electronic]

73 8443 Printers [other than multifunction printers]

74 8521 Recorder

S. Chapter / Heading / Description of goods

No. Sub-heading / Tariff

item

75 8525 CCTV

76 8452 Sewing Machine

77 8472 Staplers

78 8703 Car for Physically handicapped person

79 8715 Baby carriages

80 900140, 900150 Spectacles Lenses

81 9002 Intraocular lens

82 9004 Spectacles, corrective

83 91 Braille Watches

84 94 Medical furniture

85 94 LED

86 94 Kerosene pressure lantern

87 9403 Bamboo furniture

88 9506 Sports goods other than articles and equipments for general

physical exercise

89 96031000 Phul-jahroo

http://lawinfotext.blogspot.com

You might also like

- Govt Issues List of Goods On Which Tax Incidence Under GST Is Lower Than Existing LawDocument3 pagesGovt Issues List of Goods On Which Tax Incidence Under GST Is Lower Than Existing Lawsudhier9No ratings yet

- Commodity ListDocument4 pagesCommodity ListDark loverNo ratings yet

- Cost of SaleDocument5 pagesCost of SaleKristine Mae CuaresmaNo ratings yet

- Table1 04 05Document16 pagesTable1 04 05Ally AbdullahNo ratings yet

- Agriculture Industry of India in Brief Till 2007Document18 pagesAgriculture Industry of India in Brief Till 2007Shashank PathakNo ratings yet

- Stock Market CapDocument364 pagesStock Market Capchanduanu2007No ratings yet

- Your Holding DetailsDocument4 pagesYour Holding DetailsSupriya KarmakarNo ratings yet

- All ExportsDocument4 pagesAll ExportsAyaz Ahmed KhanNo ratings yet

- College Expenses BreakdownDocument4 pagesCollege Expenses BreakdownKay Ann CastroNo ratings yet

- HSN Code Schedule AlphaDocument38 pagesHSN Code Schedule AlphadineshknpNo ratings yet

- Drama Production CostDocument8 pagesDrama Production CostsiddhaNo ratings yet

- Qatar Retail Sales Report2023-11-28-10-59-31Document2 pagesQatar Retail Sales Report2023-11-28-10-59-31thusanthnthusanthNo ratings yet

- 1 CGSTratesDocument489 pages1 CGSTratesSatya swaroop ReddyNo ratings yet

- I. Pre-GTS Tax Incidence Vis-À-Vis GST Rate For Goods: S. No. Description of Goods Pre-GST Tax Incidence GST RateDocument5 pagesI. Pre-GTS Tax Incidence Vis-À-Vis GST Rate For Goods: S. No. Description of Goods Pre-GST Tax Incidence GST RateVipinNo ratings yet

- Solving IAEDocument22 pagesSolving IAESamuel Grant ZabalaNo ratings yet

- Chennai Promotions Company DataDocument22 pagesChennai Promotions Company DataSK Business groupNo ratings yet

- Urban: Summary Comparison of Base Years For CPIDocument10 pagesUrban: Summary Comparison of Base Years For CPISaad PrachaNo ratings yet

- Laporan Pemakaian Obat Tertinggi Jan-Mei 2022Document16 pagesLaporan Pemakaian Obat Tertinggi Jan-Mei 2022Siti MuasarohNo ratings yet

- Laporan Obat Ciater April 2022Document125 pagesLaporan Obat Ciater April 2022Siti MuasarohNo ratings yet

- PMEGP Revised Projects (Mfg. & Service) Vol 1Document260 pagesPMEGP Revised Projects (Mfg. & Service) Vol 1Deepak KumarNo ratings yet

- All Custom Stations July-2016Document126 pagesAll Custom Stations July-2016Nassir CeellaabeNo ratings yet

- MorinoffeeptnalhhffDocument25 pagesMorinoffeeptnalhhffUsama AjmalNo ratings yet

- Statewise Estimates of Value Output PDFDocument319 pagesStatewise Estimates of Value Output PDFrgnath90No ratings yet

- Qatar Retail Sales Report2023-12-27-13-31-51Document2 pagesQatar Retail Sales Report2023-12-27-13-31-51thusanthnthusanthNo ratings yet

- Costing Cabcakestudio FinalDocument16 pagesCosting Cabcakestudio FinalHannah Gray FloresNo ratings yet

- RAW Material: No. Material Quantity Safety Stock Total Material Requirement Price/unit (RM) Total Price (RM)Document11 pagesRAW Material: No. Material Quantity Safety Stock Total Material Requirement Price/unit (RM) Total Price (RM)naurahimanNo ratings yet

- Uttar Pradesh export figures by HS code over 8 yearsDocument2 pagesUttar Pradesh export figures by HS code over 8 yearsTANVI ANIL ROHEKARNo ratings yet

- Quick Estimates May 2018Document4 pagesQuick Estimates May 2018harshadNo ratings yet

- Items Name Items Quantity Items Per Piece PriceDocument7 pagesItems Name Items Quantity Items Per Piece Pricesayma0farihaNo ratings yet

- Sales analysis of agricultural products from 2011-2014Document5 pagesSales analysis of agricultural products from 2011-2014Nidheesh KNo ratings yet

- Turon v2Document9 pagesTuron v2Glorden Mae Ibañez SalandananNo ratings yet

- Popular Buffet and Fried Chicken Drive ProfitsDocument15 pagesPopular Buffet and Fried Chicken Drive ProfitsdewanapanjiNo ratings yet

- Yoga & Naturopathy Materials ListDocument4 pagesYoga & Naturopathy Materials ListVijay KumarNo ratings yet

- FTS Uptobhadra 2079 80Document368 pagesFTS Uptobhadra 2079 80Eva TangNo ratings yet

- ALBA List ExampleDocument2 pagesALBA List ExampleChinwai HoNo ratings yet

- 20 Market Leading Companies - IndiaDocument4 pages20 Market Leading Companies - IndiaKuldeep NegiNo ratings yet

- Business PlanDocument59 pagesBusiness PlanHazel Anne PepitoNo ratings yet

- 14 06 23accbDocument81 pages14 06 23accbtonderainderereNo ratings yet

- Import of Goods by Commodity and Services by Type: 3 State Bank of PakistanDocument4 pagesImport of Goods by Commodity and Services by Type: 3 State Bank of PakistanMuhammad IrfanNo ratings yet

- 2016 Description: Mexico Export Statistics To JapanDocument2 pages2016 Description: Mexico Export Statistics To Japanonepagetop10No ratings yet

- S.No Sector Symbols: AlnrsDocument12 pagesS.No Sector Symbols: AlnrsMuhammad AliNo ratings yet

- MCTC Requisition Form RF11 BR09 (54) - Standrt ReqDocument152 pagesMCTC Requisition Form RF11 BR09 (54) - Standrt ReqЕвгений ШматковNo ratings yet

- Planilha Controle de EstoqueDocument57 pagesPlanilha Controle de EstoqueNayanne LisboaNo ratings yet

- Inventory Group CategoriesDocument70 pagesInventory Group CategoriesZaki Rizqi FadhlurrahmanNo ratings yet

- PM FME Scheme Application for Tomato Pulp Manufacturing UnitDocument11 pagesPM FME Scheme Application for Tomato Pulp Manufacturing UnitShilpa RNo ratings yet

- FAOSTAT Data Central African Republic 2014Document6 pagesFAOSTAT Data Central African Republic 2014Anson ToNo ratings yet

- Sr. No Listed Company BrandDocument3 pagesSr. No Listed Company BrandSahil SawantNo ratings yet

- Pakistan &: AustraliaDocument5 pagesPakistan &: AustraliaMuhammad AbubakarNo ratings yet

- India's Top Agricultural Exports in 2010-2011Document9 pagesIndia's Top Agricultural Exports in 2010-2011Naveen KhatakNo ratings yet

- Somido BatulaDocument7 pagesSomido BatulaJayvee SomidoNo ratings yet

- Ethiopia Import Sample ReportDocument5 pagesEthiopia Import Sample ReportYimer AliNo ratings yet

- Export of Goods by Commodity and Services by Type: 3 State Bank of PakistanDocument4 pagesExport of Goods by Commodity and Services by Type: 3 State Bank of PakistanAli FrazNo ratings yet

- Barkonsult Catalogue 2019Document142 pagesBarkonsult Catalogue 2019Xan MaigNo ratings yet

- Project of Industrial Traning 'Document17 pagesProject of Industrial Traning 'Ritesh shuklaNo ratings yet

- Web Table July 2020Document2 pagesWeb Table July 2020faryab fatimaNo ratings yet

- Price Per Scoop: Sell Price 18% GST Profit 9.92 55.08Document9 pagesPrice Per Scoop: Sell Price 18% GST Profit 9.92 55.08prince2venkatNo ratings yet

- RCM PRODUCTS PRICE LIST 2020Document4 pagesRCM PRODUCTS PRICE LIST 2020Bidyut PramanikNo ratings yet

- Decree 43Document10 pagesDecree 43PortukNo ratings yet

- InformationDocument17 pagesInformationBenjamin LeeNo ratings yet

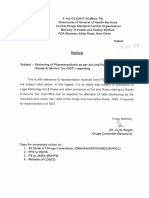

- CDSCO Notice GSTDocument1 pageCDSCO Notice GSTKapil Dev SaggiNo ratings yet

- Modi Govt. AchievementsDocument22 pagesModi Govt. AchievementsKapil Dev SaggiNo ratings yet

- CC - 60 of 2019Document13 pagesCC - 60 of 2019Kapil Dev SaggiNo ratings yet

- Impact of GST On Unsold Stock of Pre-Packaged CommoditiesDocument2 pagesImpact of GST On Unsold Stock of Pre-Packaged CommoditiesKapil Dev SaggiNo ratings yet

- Companies Accounts Second Amendment Rules 2015Document27 pagesCompanies Accounts Second Amendment Rules 2015Kapil Dev SaggiNo ratings yet

- Diarmuiid P MeagherDocument333 pagesDiarmuiid P MeagherKapil Dev SaggiNo ratings yet

- List of CasesDocument24 pagesList of CasesKapil Dev SaggiNo ratings yet

- Ceiling Prices of 761 Formulations On Account of GST Implementation.Document49 pagesCeiling Prices of 761 Formulations On Account of GST Implementation.Kapil Dev SaggiNo ratings yet

- Genetic Evidence On The Origins of Indian Caste Populations: Michael BamshadDocument11 pagesGenetic Evidence On The Origins of Indian Caste Populations: Michael BamshadKapil Dev SaggiNo ratings yet

- GMP in Pharmaceutical IndustryDocument35 pagesGMP in Pharmaceutical IndustrygarcaldecnoNo ratings yet

- NOTICEDocument19 pagesNOTICEPoonkuzhali ManiNo ratings yet

- CBEC Issues Clarification Relating To Waiver of Issuance of SCN and Conclusion of Proceedings in Service Tax and Central ExciseDocument3 pagesCBEC Issues Clarification Relating To Waiver of Issuance of SCN and Conclusion of Proceedings in Service Tax and Central ExciseKapil Dev SaggiNo ratings yet

- Indian Food Code (25-06-2012)Document60 pagesIndian Food Code (25-06-2012)harry_bccNo ratings yet

- LLP Amendment Rules 2016Document4 pagesLLP Amendment Rules 2016Kapil Dev SaggiNo ratings yet

- Home Remedies EbookDocument357 pagesHome Remedies EbookAbhishek Singh100% (3)

- Status Report On Start Up IndiaDocument2 pagesStatus Report On Start Up IndiaKapil Dev SaggiNo ratings yet

- Issue of Shares Under ESOS and Sweat Equity Shares To Persons Resident Outside IndiaDocument8 pagesIssue of Shares Under ESOS and Sweat Equity Shares To Persons Resident Outside IndiaKapil Dev SaggiNo ratings yet

- Guidance Note On SEBI Prohibition of Insider Trading Regulations 2015Document3 pagesGuidance Note On SEBI Prohibition of Insider Trading Regulations 2015Kapil Dev SaggiNo ratings yet

- Format of Regulation 31 of SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011Document3 pagesFormat of Regulation 31 of SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011Shyam SunderNo ratings yet

- FAQs Secretarial AuditDocument19 pagesFAQs Secretarial AuditSaurabh J.No ratings yet

- Ministry of Railways-Achievements & Initiatives An Ebook by Suresh PrabhuDocument44 pagesMinistry of Railways-Achievements & Initiatives An Ebook by Suresh PrabhuKapil Dev SaggiNo ratings yet

- CBEC Issues Clarification Relating To Waiver of Issuance of SCN and Conclusion of Proceedings in Service Tax and Central ExciseDocument3 pagesCBEC Issues Clarification Relating To Waiver of Issuance of SCN and Conclusion of Proceedings in Service Tax and Central ExciseKapil Dev SaggiNo ratings yet

- CBDT Notification No. 022015 Dated 13th July 2015Document3 pagesCBDT Notification No. 022015 Dated 13th July 2015Kapil Dev SaggiNo ratings yet

- SEBI Specifies Additional Disclosure Requirement by Cos Under Share Based Employee Benefits NormsDocument13 pagesSEBI Specifies Additional Disclosure Requirement by Cos Under Share Based Employee Benefits NormsKapil Dev SaggiNo ratings yet

- RBI Issues SARFAESI Act 2002 Guidelines and Directions As Amendment Upto 30th June 2015Document26 pagesRBI Issues SARFAESI Act 2002 Guidelines and Directions As Amendment Upto 30th June 2015Kapil Dev SaggiNo ratings yet

- Master Circular Disclosure in Financial Statements Notes To Accounts'Document40 pagesMaster Circular Disclosure in Financial Statements Notes To Accounts'Kapil Dev SaggiNo ratings yet

- Bank Finance To Non Banking Financial CompaniesNBFCsDocument13 pagesBank Finance To Non Banking Financial CompaniesNBFCsKapil Dev SaggiNo ratings yet

- Companies (Amendment) Bill, 2014Document2 pagesCompanies (Amendment) Bill, 2014Kapil Dev SaggiNo ratings yet

- Nestle OrderDocument8 pagesNestle OrderNDTVNo ratings yet

- AnnouncementDocument6 pagesAnnouncementhendriNo ratings yet

- Brand Positioning ProcessDocument39 pagesBrand Positioning Processanindya_kundu100% (1)

- Usage Instructions - Hengro PoolProtect 1 - 5Document3 pagesUsage Instructions - Hengro PoolProtect 1 - 5Brian VisserNo ratings yet

- Consumer Buying Behaviour As Regards CosmeticsDocument39 pagesConsumer Buying Behaviour As Regards Cosmeticssinghpriti850% (1)

- 72oz Steak EatersDocument33 pages72oz Steak EatersZenon JaskólaNo ratings yet

- Barrier Properties PackagingDocument2 pagesBarrier Properties PackagingAnonymous qpseKclzjNo ratings yet

- Industrial Training On Pratibha SyntexDocument11 pagesIndustrial Training On Pratibha Syntexmadhur ChauhanNo ratings yet

- Canned PumpDocument1 pageCanned Pumpvk1234No ratings yet

- All Clean Natural China Catalog For Adult DiaperDocument11 pagesAll Clean Natural China Catalog For Adult DiaperHester NguyenNo ratings yet

- Masterbuilt Dual Fuel Smoker Model 20050412 W RecipesDocument12 pagesMasterbuilt Dual Fuel Smoker Model 20050412 W RecipesMR XNo ratings yet

- Drafting Basic Set in SleeveDocument9 pagesDrafting Basic Set in SleeveArgelyn Magsayo Lpt100% (1)

- Dogtor CrochetDocument7 pagesDogtor CrochetSalma RodriguezNo ratings yet

- IBDP Chapter 1 - Key Terms To RememberDocument3 pagesIBDP Chapter 1 - Key Terms To RememberIndrajeet AcharjeeNo ratings yet

- Packaging Developments - An Historical PerspectiveDocument6 pagesPackaging Developments - An Historical PerspectivemarcosantosNo ratings yet

- Vendors Do Not Compete With Brick-And-mortarsDocument1 pageVendors Do Not Compete With Brick-And-mortarsStreet Vendor ProjectNo ratings yet

- Operation Joining Collar Panels Location Ie Asin Factory Operator - Charted by - Date 21 May 2020 L/H Process R/H ProcessDocument1 pageOperation Joining Collar Panels Location Ie Asin Factory Operator - Charted by - Date 21 May 2020 L/H Process R/H Processsanchit gumberNo ratings yet

- QuestionnaireDocument13 pagesQuestionnaireAakash KhuranaNo ratings yet

- Easy Homemade Dish SoapDocument5 pagesEasy Homemade Dish Soapcimbrum50% (2)

- Operating instructions for dishwashersDocument68 pagesOperating instructions for dishwashersmaddog59100% (1)

- Oriental CuisineDocument12 pagesOriental CuisineJulien NarjinaryNo ratings yet

- BakingDocument289 pagesBakingIoana Grosuleac89% (9)

- Toolkit Visual Merchandising - FactsheetDocument21 pagesToolkit Visual Merchandising - Factsheetapi-273561459No ratings yet

- Lucky Cement Private Limited: TH THDocument44 pagesLucky Cement Private Limited: TH THosaidahmedNo ratings yet

- Chinese Dipping SauceDocument11 pagesChinese Dipping Sauceb.dutta100% (1)

- IELTS 5 - 6.5 SB Review Unit 7 and 8Document2 pagesIELTS 5 - 6.5 SB Review Unit 7 and 8Rohmad SiswantoNo ratings yet

- Cafetera Oster 35 Tazas - BVSTDC3390 - IBDocument22 pagesCafetera Oster 35 Tazas - BVSTDC3390 - IBAlexis MayerNo ratings yet

- 2017 VF Product Safety ManualDocument78 pages2017 VF Product Safety Manualdesly raini mutiara dewiNo ratings yet

- Sales Call 2Document31 pagesSales Call 2Soumya ChoudhuryNo ratings yet

- Hindustan Lever Limited-Case StudyDocument4 pagesHindustan Lever Limited-Case StudyMahesh GuptaNo ratings yet

- Supply Chain ManagementDocument25 pagesSupply Chain ManagementLino Gabriel100% (1)