Professional Documents

Culture Documents

Austrian tax refund form

Uploaded by

Youdont Careatall0 ratings0% found this document useful (0 votes)

104 views2 pagesOriginal Title

ZS-RE1.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

104 views2 pagesAustrian tax refund form

Uploaded by

Youdont CareatallCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

pdfs

Inter-Steuern

ZS-RE1

9999

V_2

Lokales Speichern Importieren von Formulardaten

To the Tax Office

Bruck Eisenstadt Oberwart

Neusiedlerstrae 46

7001 Eisenstadt

CLAIM FOR REPAYMENT OF

AUSTRIAN WITHHOLDING TAX

under the tax treaties concluded by Austria Entry stamp

according to sec. 21 para. 1 subpara. 1a KStG 1988 of the Austrian tax authority

according to sec. 6 KStG 1988 (Exemption for foreign

pension funds)

File No.

of the Austrian tax authority:

for the year:

1. State

Please indicate here your State of residence

2. Information on the claimant

Tax Identification Number

of the claimants residence state or, if not

available, a similar identification number

Full name, date of birth

(in case of individuals)

Firm, trade register number or similar of

the claimants residence state

(in case of legal persons)

Legal form (in case of legal persons:

e.g. stock corporation, association)

Address

(post code, town, street, number)

telephone or fax number, e-mail-address

Representative (if any)

(name, address)

telephone or fax number, e-mail-address

mandate for cash receipts mandate for postal deliveries

power of attorney

To be filled in by the claimant

3. Computation of repayment amount (all amounts in Euro)

DIVIDENDS (according to Sheet A) Repayment under tax treaties

Repayment according to sec. 21 para. 1 subpara. 1a

KStG 1988

Repayment according to sec. 6 KStG 1988

www.bmf.gv.at

ROYALTIES (according to Sheet B)

OTHER INCOME (according to Sheet C)

REPAYMENT AMOUNT

4. Residence certificate of the foreign tax administration

For the purpose of obtaining tax relief in Austria the following is certified: Within the meaning of the Double Taxation Convention Austria has

concluded with the State indicated in Section 1, the claimant was a resident of that State on the date(s) when the income was received

(Section 3) and the information on the claimant (Section 2) is in accordance with our knowledge.

D

Date Stamp Signature

ZS-RE1-PDF Bundesministerium fr Finanzen ZS-RE1, Seite 1, Version vom 17.11.2014

5. Information concerning the transfer of the repayment amount

The claimant requests to transfer the repayment amount to the account

IBAN (International Bank Account Number)

account holder

financial institution BIC (Bank Identifier Code)

address (financial institution)

6. Declaration by the claimant

I declare that to the best of my knowledge the above-mentioned statements are correct and complete. I recognize that the statements will be verified

and incomplete or incorrect statements are punishable. In case I retrospectively recognize that the above-mentioned statements are incorrect or

incomplete, I will notify Tax Office without delay ( 139 Bundesabgabenordnung).

D

Place and Date Signature

7. Leave blank for the Austrian tax authority

repayment amount Euro Euro

+ interest Euro

total repayment amount Euro

date signature authorization

ZS-RE1, Seite 2, Version vom 17.11.2014

You might also like

- Certificate of Residence formDocument2 pagesCertificate of Residence formSânziana Cristina DobrovicescuNo ratings yet

- Annual Information Return for Withholding TaxesDocument2 pagesAnnual Information Return for Withholding TaxesTESSA SHINo ratings yet

- D100 EnglezaDocument7 pagesD100 EnglezaZsuzsa ANo ratings yet

- Appeal Filing Fee Form for Appellate TribunalDocument3 pagesAppeal Filing Fee Form for Appellate Tribunalmuhammad zaidNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument36 pagesCertificate of Creditable Tax Withheld at SourceProbinsyana KoNo ratings yet

- 1604 eDocument2 pages1604 eMay Angelica TenezaNo ratings yet

- Certificate of Payment of Foreign Death TaxDocument3 pagesCertificate of Payment of Foreign Death Taxdouglas jonesNo ratings yet

- Annual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesDocument4 pagesAnnual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesTennex TanquionNo ratings yet

- Certificate of Creditable Tax WithheldDocument1 pageCertificate of Creditable Tax WithheldKASHMIR PONSARANNo ratings yet

- 2307 Jan 2018 ENCS v3 - GLOBEDocument11 pages2307 Jan 2018 ENCS v3 - GLOBEpearlanncasem12No ratings yet

- 1604E Jan 2018 ENCS Final Annex BDocument2 pages1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Certificate of Creditable Tax WithheldDocument1 pageCertificate of Creditable Tax WithheldSheina Mae Asuncion Casem100% (1)

- Dizon V CTA G.R. No. 140944 April 30, 2008Document11 pagesDizon V CTA G.R. No. 140944 April 30, 2008Emil BautistaNo ratings yet

- Tax2 CasesDocument18 pagesTax2 CasesJanAndrianCaingatNo ratings yet

- Skyreign Travel & Tours Corp. - 03312021Document1 pageSkyreign Travel & Tours Corp. - 03312021Lhynette JoseNo ratings yet

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxMarites Valencia-AquiroNo ratings yet

- New Woreda 13 No Woreda-143 Yeka Addis Ababa EthiopiaDocument1 pageNew Woreda 13 No Woreda-143 Yeka Addis Ababa EthiopiaKalkidan NigussieNo ratings yet

- BIR Certificate of Creditable Tax WithheldDocument2 pagesBIR Certificate of Creditable Tax WithheldMdrrmo San MiguelNo ratings yet

- Serv Central 2307 November 2023Document1 pageServ Central 2307 November 2023andrea.begulbuilderscorpNo ratings yet

- Statement of Person Claiming Refund Due A Deceased Taxpayer: Purpose of Form Where To FileDocument2 pagesStatement of Person Claiming Refund Due A Deceased Taxpayer: Purpose of Form Where To FileIRS100% (2)

- Form 15 CA and 15 CBDocument6 pagesForm 15 CA and 15 CBscrana7480No ratings yet

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document2 pagesCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)RapRalph GalagalaNo ratings yet

- 2307 - CTT Synergy - CorporationDocument2 pages2307 - CTT Synergy - CorporationRACHEL DAMALERIONo ratings yet

- 2306 - 2307Document57 pages2306 - 2307Dearly EnzoNo ratings yet

- 2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFDocument11 pages2307 Jan 2018 ENCS v3 - L.U. MORNING STAR Oct2023 FGGFpearlanncasem12No ratings yet

- BIR FORM 2307 SampleDocument6 pagesBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.No ratings yet

- 2307 Creditable Tax Withheld at SourceDocument8 pages2307 Creditable Tax Withheld at SourceBarangay BugasNo ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- Petitioner Vs Vs Respondents: Third DivisionDocument16 pagesPetitioner Vs Vs Respondents: Third DivisionKing ForondaNo ratings yet

- 2306 Jan 2018 ENCS v3 Annex A PDFDocument2 pages2306 Jan 2018 ENCS v3 Annex A PDFHarold De Guzman SantosNo ratings yet

- Print CasesDocument222 pagesPrint CasesJayNo ratings yet

- Dizon v. CA (2008)Document17 pagesDizon v. CA (2008)enggNo ratings yet

- BIR Certificate of Creditable Tax WithheldDocument2 pagesBIR Certificate of Creditable Tax WithheldMark Patrics Comentan VerderaNo ratings yet

- 2307 Jan 2018 ENCS v3Document4 pages2307 Jan 2018 ENCS v3Jasmin Sheryl Fortin-CastroNo ratings yet

- 2307 WestmeridianDocument2 pages2307 WestmeridianRheddy RaymundoNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceRhecin Glenale BonalosNo ratings yet

- 1604e 2018Document2 pages1604e 2018FedsNo ratings yet

- 1105 Withholding On Payment Tax Declaration 1 2Document2 pages1105 Withholding On Payment Tax Declaration 1 2Maddahayota CollegeNo ratings yet

- December, 2021Document2 pagesDecember, 2021armand resquir jrNo ratings yet

- NeecoDocument5 pagesNeecoMagno AnnNo ratings yet

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document2 pagesCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Aida L.LangbisanNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document1 pageCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)dorieNo ratings yet

- 2307 NEW PLDTDocument2 pages2307 NEW PLDTdayneblazeNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internasmar corNo ratings yet

- Deposit Agreement for Lease of Real EstateDocument16 pagesDeposit Agreement for Lease of Real EstateVinpearl Resort & VillasNo ratings yet

- RMC No. 71-2023 Annex A.1Document2 pagesRMC No. 71-2023 Annex A.1Ron Andi RamosNo ratings yet

- BIR Form 1904 Application RegistrationDocument2 pagesBIR Form 1904 Application Registrationregine rose bantilanNo ratings yet

- 2306 Jan 2018 ENCS v4 (NEW FORMAT)Document145 pages2306 Jan 2018 ENCS v4 (NEW FORMAT)Theresa Faye De GuzmanNo ratings yet

- AustriaDocument2 pagesAustriafrankNo ratings yet

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilNo ratings yet

- Winternitz Associates Insurance Brokers Corporation v. CIRDocument11 pagesWinternitz Associates Insurance Brokers Corporation v. CIRPrincess FaithNo ratings yet

- Custom Search: Create PDF in Your Applications With The PdfcrowdDocument19 pagesCustom Search: Create PDF in Your Applications With The Pdfcrowdthelionleo1No ratings yet

- Europai Fiezetsi Meghagyas Angol NyelvenDocument3 pagesEuropai Fiezetsi Meghagyas Angol NyelvenebenbryNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- Summer Solstice PDFDocument7 pagesSummer Solstice PDFYoudont CareatallNo ratings yet

- G-Minor Natal PDFDocument2 pagesG-Minor Natal PDFYoudont CareatallNo ratings yet

- EET5KB Kiss PDFDocument1 pageEET5KB Kiss PDFYoudont CareatallNo ratings yet

- Vishaka Nakshatra 20.6.10Document6 pagesVishaka Nakshatra 20.6.10Anthony Writer100% (5)

- Do Not Destroy P60 End of Year Certificate: Tax Year To 5 AprilDocument1 pageDo Not Destroy P60 End of Year Certificate: Tax Year To 5 AprilYoudont CareatallNo ratings yet

- Mathematics of AstrologyDocument37 pagesMathematics of Astrologyxkaliberlord100% (15)

- Pentagrams Hexagram Sand Sacred GeometryDocument3 pagesPentagrams Hexagram Sand Sacred GeometryfuturegrandNo ratings yet

- The Significance of Traditional Pulse Diagnosis in The Modern Practice of Chinese Medicine PDFDocument8 pagesThe Significance of Traditional Pulse Diagnosis in The Modern Practice of Chinese Medicine PDFYoudont Careatall100% (1)

- ZS Re1a PDFDocument2 pagesZS Re1a PDFYoudont CareatallNo ratings yet

- Medical astrology and the Zodiac signs' link to body partsDocument11 pagesMedical astrology and the Zodiac signs' link to body partsYoudont Careatall100% (1)

- Max Heindel - The Web of Destiny PDFDocument32 pagesMax Heindel - The Web of Destiny PDFYoudont CareatallNo ratings yet

- Application PDFDocument4 pagesApplication PDFYoudont CareatallNo ratings yet

- Dane Rudhyar - Progressions PDFDocument26 pagesDane Rudhyar - Progressions PDFAdalberto LoaizaNo ratings yet

- Two Separate Apartments Next Door To Each Other To Let Near The Medical FacultyDocument1 pageTwo Separate Apartments Next Door To Each Other To Let Near The Medical FacultyYoudont CareatallNo ratings yet

- Astrology Transits and ProgressionsDocument8 pagesAstrology Transits and ProgressionslearlearNo ratings yet

- Gergely Kiss CV Hungarian Adult EducatorDocument2 pagesGergely Kiss CV Hungarian Adult EducatorYoudont CareatallNo ratings yet

- Indian Medicinal Plants For Cosmetics and ToiletriesDocument21 pagesIndian Medicinal Plants For Cosmetics and ToiletriesAbuAbdur-RazzaqAl-Misri100% (3)

- Do Not Destroy P60 End of Year Certificate: Tax Year To 5 AprilDocument1 pageDo Not Destroy P60 End of Year Certificate: Tax Year To 5 AprilYoudont CareatallNo ratings yet

- Job DescriptionDocument7 pagesJob DescriptionYoudont CareatallNo ratings yet

- BlondeDocument119 pagesBlondeYoudont CareatallNo ratings yet

- Bad WeatherDocument1 pageBad WeatherYoudont CareatallNo ratings yet

- Mr. Kiss PDFDocument6 pagesMr. Kiss PDFYoudont CareatallNo ratings yet

- Elements of Solar ArchitectureDocument27 pagesElements of Solar ArchitectureNirali JainNo ratings yet

- The (1) 14 Carat RoadsterDocument150 pagesThe (1) 14 Carat RoadsterAnna TamásiNo ratings yet

- Constructing A Solar Heated Lumber DryerDocument13 pagesConstructing A Solar Heated Lumber DryerYoudont CareatallNo ratings yet

- Solar Distillation InstallationDocument17 pagesSolar Distillation InstallationYoudont CareatallNo ratings yet

- Pakistans Potential For Solar Powered IrrigationDocument52 pagesPakistans Potential For Solar Powered IrrigationYoudont CareatallNo ratings yet

- Plans For A Glass and Concrete Solar StillDocument23 pagesPlans For A Glass and Concrete Solar StillYoudont CareatallNo ratings yet

- Design: Solar Heating of Buildings and Domestic Hot WaterDocument167 pagesDesign: Solar Heating of Buildings and Domestic Hot WaterPlainNormalGuy2100% (6)

- L13LLB183031Document29 pagesL13LLB183031Debasis MisraNo ratings yet

- MD 360 News Old Age Pension, Disability Pension, Widow Pension Application Form PDFDocument2 pagesMD 360 News Old Age Pension, Disability Pension, Widow Pension Application Form PDFCHAUGACHHA DGSKNo ratings yet

- Research Proposal ExampleDocument8 pagesResearch Proposal Examplemboniyy100% (8)

- ACT 183 (Handout 4) - Co-Ownership Estates and TrustsDocument3 pagesACT 183 (Handout 4) - Co-Ownership Estates and TrustsHafida TOMAWISNo ratings yet

- VAT, Tax Calculation for Company & Individual ActivitiesDocument5 pagesVAT, Tax Calculation for Company & Individual ActivitiesNguyễn ThươngNo ratings yet

- GSIS-Reviewer - (EMMA Group)Document17 pagesGSIS-Reviewer - (EMMA Group)Abbie Kwan100% (2)

- 1099-G unemployment benefitsDocument1 page1099-G unemployment benefitsKristine McVeighNo ratings yet

- Income Tax Quesion BankDocument22 pagesIncome Tax Quesion BankPaatrickNo ratings yet

- Are World Bank Salaries Tax Free: Click Here To DownloadDocument3 pagesAre World Bank Salaries Tax Free: Click Here To Downloadkovi mNo ratings yet

- Investment Validation Guidelines 2020-1 PDFDocument7 pagesInvestment Validation Guidelines 2020-1 PDFravi kumarNo ratings yet

- Cpa Review School of The Philippines ManilaDocument9 pagesCpa Review School of The Philippines ManilaAbraham Marco De Guzman100% (4)

- 4133104Document1 page4133104Ann BenjaminNo ratings yet

- Calculate fringe benefit tax on condo, car, rental housing benefitsDocument6 pagesCalculate fringe benefit tax on condo, car, rental housing benefitsRonald SaludesNo ratings yet

- 2024-04 ogle-lee newsletter email version for approvalDocument5 pages2024-04 ogle-lee newsletter email version for approvalapi-506744489No ratings yet

- Test 7 TranscriptDocument4 pagesTest 7 TranscriptHân DiệpNo ratings yet

- Notification For Engagement of Part-Time Consultants in DVCDocument7 pagesNotification For Engagement of Part-Time Consultants in DVCSomu SenNo ratings yet

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamNo ratings yet

- This Study Resource Was: Simran Arora Professor Rudolph MGT 424 November 17, 2019 Case Study 2 2G RoboticsDocument5 pagesThis Study Resource Was: Simran Arora Professor Rudolph MGT 424 November 17, 2019 Case Study 2 2G RoboticsAryan GargNo ratings yet

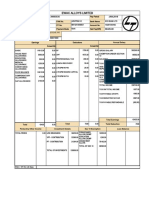

- Ewac Alloys Limited: Uan No Aadhar NoDocument1 pageEwac Alloys Limited: Uan No Aadhar NoNapoleon DasNo ratings yet

- Ke Government Gazette Dated 2022 07 27 No 145Document11 pagesKe Government Gazette Dated 2022 07 27 No 145Galgallo RobaNo ratings yet

- IAS4Sure Government Schemes Notes For Prelims 2022Document198 pagesIAS4Sure Government Schemes Notes For Prelims 2022Kranthi KumarNo ratings yet

- F86407Document2 pagesF86407Abhishek PawarNo ratings yet

- AP Long Test 3 - LiabilitiesDocument9 pagesAP Long Test 3 - LiabilitiesjasfNo ratings yet

- Epfo Upsc NotesDocument3 pagesEpfo Upsc NotesHemant SharmaNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument10 pagesFORM 16 TAX DEDUCTION CERTIFICATESnehal RanawareNo ratings yet

- 3.2 Business Profit TaxDocument53 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Taxation Notes MergedDocument227 pagesTaxation Notes MergedPRANARITA BHOLNo ratings yet

- Inbound Paper SA1 Form With Instruction - SignedDocument3 pagesInbound Paper SA1 Form With Instruction - SignedKushal SharmaNo ratings yet

- Week 8 (Prior To Tutorial) QsDocument10 pagesWeek 8 (Prior To Tutorial) Qsalexandra0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)