Professional Documents

Culture Documents

Donor'S Tax: A. Deductions/Exemptions

Uploaded by

ChaMcband0 ratings0% found this document useful (0 votes)

11 views1 pagedonor tax

Original Title

DONOR tax

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdonor tax

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageDonor'S Tax: A. Deductions/Exemptions

Uploaded by

ChaMcbanddonor tax

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

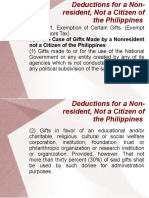

DONORS TAX

A. Deductions/Exemptions

1. Donation by reason of Marriage or dowry up to the maximum amount

of 10,000.00 for each parent on their legitimate, illegitimate and

adopted child, given before the celebration of marriage or within one

(1) year from celebration of marriage.

- If both parents donate a property which is community/conjugal, two

separate computations with the parents sharing the gross donation

equally. Each can avail the 10,000.00 deduction.

- Cannot be availed by a non-resident alien donor.

2. Gifts to government

- Available to all donors

3. Gifts to educational, charitable, etc.

- Available to all donors

- Observe the 30% rule

4. Gifts with encumbrances assumed by donee e.g. unpaid mortgage or

unpaid taxes.

- Available to all donors

Ex: X donate a land with a Fair Market Value 100,000.00 to Y.

The

land has an existing unpaid mortgage of 40,000.00 to be

assumed by Y. The net donation is 60,000.00.

Gross Gift 100,000.00

Less: Unpaid Mortgage (40,000.00)

Net Gift 60,000.00

=========

You might also like

- Lecture 3 - Donor's TaxDocument6 pagesLecture 3 - Donor's TaxLady Chen GordoveNo ratings yet

- Transfer Taxes (Donor'S Tax) : Jhoniel Sells To Ruzby His Land For An Amount of P5,000,000 (Current FMV) Which He Bought atDocument8 pagesTransfer Taxes (Donor'S Tax) : Jhoniel Sells To Ruzby His Land For An Amount of P5,000,000 (Current FMV) Which He Bought atKristina Casandra FernandezNo ratings yet

- Module 1 - Lesson 2 - Taxable Net Gift and Computation of Donor's Tax DueDocument6 pagesModule 1 - Lesson 2 - Taxable Net Gift and Computation of Donor's Tax Dueohmyme sungjaeNo ratings yet

- Donors TaxDocument6 pagesDonors TaxMachi KomacineNo ratings yet

- 91 12 Donors TaxDocument4 pages91 12 Donors TaxEl Gene Lois MontesNo ratings yet

- Module 1 Lesson 5Document6 pagesModule 1 Lesson 5Rich Ann Redondo VillanuevaNo ratings yet

- TAXATION 2 Chapter 7 Donors Tax PDFDocument6 pagesTAXATION 2 Chapter 7 Donors Tax PDFKim Cristian MaañoNo ratings yet

- Chapter 2 - Donor's Tax (Notes)Document8 pagesChapter 2 - Donor's Tax (Notes)Angela Denisse FranciscoNo ratings yet

- Business TaxDocument19 pagesBusiness TaxMichael AquinoNo ratings yet

- Donors Tax Quiz Answers and SolutionsDocument14 pagesDonors Tax Quiz Answers and SolutionsRalph Lawrence Francisco BatangasNo ratings yet

- Donation ReviewerDocument6 pagesDonation ReviewerronaldNo ratings yet

- Donor's TaxDocument29 pagesDonor's TaxPETERWILLE CHUANo ratings yet

- Module 1 Lesson 2Document8 pagesModule 1 Lesson 2Rich Ann Redondo VillanuevaNo ratings yet

- Tax 2 Reviewer LectureDocument12 pagesTax 2 Reviewer LectureHazel Rocafort TitularNo ratings yet

- Business Tax Activity 1Document10 pagesBusiness Tax Activity 1Michael AquinoNo ratings yet

- Concepts of Donation and DonorDocument7 pagesConcepts of Donation and DonorbeverlyrtanNo ratings yet

- Ch08 Donor's TaxDocument8 pagesCh08 Donor's TaxHazel CruzNo ratings yet

- Donor's TaxDocument5 pagesDonor's TaxVernnNo ratings yet

- 1111 Sheet1Document2 pages1111 Sheet1Ruella Mae FlojemonNo ratings yet

- Demo FinalDocument25 pagesDemo FinalVannesa Ronquillo CompasivoNo ratings yet

- Community Tax and Donor's TaxDocument27 pagesCommunity Tax and Donor's TaxMa.annNo ratings yet

- Taxes: Gift and EstateDocument3 pagesTaxes: Gift and EstateEl-Sayed MohammedNo ratings yet

- CTT - Donor's TaxDocument8 pagesCTT - Donor's TaxMary Ann GalinatoNo ratings yet

- Donor's Tax (AutoRecovered)Document2 pagesDonor's Tax (AutoRecovered)Jan ernie MorillaNo ratings yet

- Donors TaxDocument3 pagesDonors TaxJude TanNo ratings yet

- Donors TaxDocument8 pagesDonors Taxmaxine claire cutingNo ratings yet

- Online Seatwork - Donors TaxDocument12 pagesOnline Seatwork - Donors TaxVirginia PalisukNo ratings yet

- CH06 - DonationDocument22 pagesCH06 - DonationyhamhesuNo ratings yet

- Determine The Donor's Tax Due AnswerDocument3 pagesDetermine The Donor's Tax Due AnswerAllen KateNo ratings yet

- Basic Concept of Donation and Donor's TaxDocument20 pagesBasic Concept of Donation and Donor's TaxKarl BasaNo ratings yet

- DONORs TAXDocument3 pagesDONORs TAXUbalda AbuboNo ratings yet

- B) in The Case of Gifts Made by A Nonresident Not A Citizen of The PhilippinesDocument23 pagesB) in The Case of Gifts Made by A Nonresident Not A Citizen of The PhilippinesNissi JonnaNo ratings yet

- AIR - Donor's TaxDocument5 pagesAIR - Donor's TaxRaz Jisryl100% (1)

- Module 1 - Lesson 3 - Donor's Tax CreditDocument6 pagesModule 1 - Lesson 3 - Donor's Tax Creditohmyme sungjaeNo ratings yet

- TH THDocument12 pagesTH THmariyha PalangganaNo ratings yet

- 2donor's Tax LectureDocument23 pages2donor's Tax LectureJohn Paulo CalubNo ratings yet

- Donors Tax QADocument3 pagesDonors Tax QADan Di0% (2)

- Govern The Imposition of The Donor's TaxDocument5 pagesGovern The Imposition of The Donor's TaxjuliNo ratings yet

- Donor's Tax Post QuizDocument12 pagesDonor's Tax Post QuizMichael Aquino0% (1)

- Lecture 6 - Donor TaxDocument4 pagesLecture 6 - Donor Taxsujulove foreverNo ratings yet

- Tax 2 Reviewer LectureDocument13 pagesTax 2 Reviewer LectureShiela May Agustin MacarayanNo ratings yet

- Question #1: Taxation - Donors Tax (Average)Document8 pagesQuestion #1: Taxation - Donors Tax (Average)Rey PerosaNo ratings yet

- A. Condonation or Remission of A DebtDocument3 pagesA. Condonation or Remission of A DebtTk KimNo ratings yet

- Problems 3 Prelim TaskDocument8 pagesProblems 3 Prelim TaskJohn Francis Rosas100% (2)

- Problems 3 PRELIM TASKDocument8 pagesProblems 3 PRELIM TASKJohn Francis RosasNo ratings yet

- SEC. 98. Imposition of TaxDocument15 pagesSEC. 98. Imposition of TaxAybern BawtistaNo ratings yet

- Net Gift and Donor's TaxDocument16 pagesNet Gift and Donor's TaxKj Banal100% (2)

- AssignmentDocument2 pagesAssignmentLois JoseNo ratings yet

- Donor's Tax HandoutDocument14 pagesDonor's Tax HandoutJamesiversonNo ratings yet

- DonorsDocument11 pagesDonorsboniglai50% (1)

- HO.15 - Donation and Donors TaxationDocument3 pagesHO.15 - Donation and Donors TaxationAngelica Jem Ballesterol CarandangNo ratings yet

- Introduction To Donor's TaxDocument7 pagesIntroduction To Donor's TaxHazel Jane EsclamadaNo ratings yet

- DonorDocument2 pagesDonoryes it's kaiNo ratings yet

- Acp and CPG QuizDocument6 pagesAcp and CPG QuizCarina Mae Valdez Valencia0% (1)

- CHAPTER 6 - Donor's Tax ReportDocument58 pagesCHAPTER 6 - Donor's Tax ReportheyheyNo ratings yet

- Chapter 17 Donor's TaxDocument7 pagesChapter 17 Donor's TaxHazel Jane Esclamada100% (3)

- Tax Oo2Document2 pagesTax Oo2HURLY BALANCARNo ratings yet

- A Stiptick for a Bleeding Nation A safe and speedy way to restore publick credit, and pay the national debtsFrom EverandA Stiptick for a Bleeding Nation A safe and speedy way to restore publick credit, and pay the national debtsNo ratings yet

- Notary Spa SampleDocument1 pageNotary Spa SampleChaMcbandNo ratings yet

- Mipuri V CADocument3 pagesMipuri V CAChaMcbandNo ratings yet

- Marawi Compensation BoardDocument2 pagesMarawi Compensation BoardChaMcband100% (1)

- 2019 Syllabus Pol PilDocument126 pages2019 Syllabus Pol PilChen PlatonNo ratings yet

- Daily Time RecordDocument2 pagesDaily Time RecordCarlo Fernando PadinNo ratings yet

- RemlawwordDocument6 pagesRemlawwordChaMcbandNo ratings yet

- Comelec BSKE RulesDocument10 pagesComelec BSKE RulesChaMcbandNo ratings yet

- Manly Sportswear V Dadodette EnterprisesDocument2 pagesManly Sportswear V Dadodette EnterprisesChaMcbandNo ratings yet

- San Agustin V CIR DigestDocument2 pagesSan Agustin V CIR DigestChaMcbandNo ratings yet

- 2000 Three Boys MusicDocument8 pages2000 Three Boys MusicChaMcbandNo ratings yet

- Skechers, U.S.A. vs. Inter Pacific Industrial Trading Corporation, Et - Al. (GR No. 164321, March 23, 2011)Document1 pageSkechers, U.S.A. vs. Inter Pacific Industrial Trading Corporation, Et - Al. (GR No. 164321, March 23, 2011)Shariqah Hanimai Indol Macumbal-YusophNo ratings yet

- Filipino Society of Composers v. TanDocument3 pagesFilipino Society of Composers v. TanChaMcbandNo ratings yet

- REFUGEES Right To FoodDocument2 pagesREFUGEES Right To FoodChaMcbandNo ratings yet

- Judicial Affidavit RuleDocument4 pagesJudicial Affidavit RuleCaroline DulayNo ratings yet

- Special Agreement: Jointly Notified To The Court On 12 September 2016Document22 pagesSpecial Agreement: Jointly Notified To The Court On 12 September 2016len_dy010487No ratings yet

- Judicial Affidavit RuleDocument4 pagesJudicial Affidavit RuleCaroline DulayNo ratings yet

- Nego Cases DigestDocument4 pagesNego Cases DigestChaMcbandNo ratings yet

- Article 31: 1967 Protocol Relating To The Status of RefugeesDocument2 pagesArticle 31: 1967 Protocol Relating To The Status of RefugeesChaMcbandNo ratings yet

- PROPERTYDocument2 pagesPROPERTYChaMcband100% (1)

- PIL Case List 2016 PDFDocument1 pagePIL Case List 2016 PDFChaMcbandNo ratings yet

- Surigao Electric Vs Mun. of SurigaoDocument4 pagesSurigao Electric Vs Mun. of SurigaoMutyaAlmodienteCocjinNo ratings yet

- Property Case DigestsDocument10 pagesProperty Case DigestsMonica Cajucom100% (6)

- Taxation Full Text CasesDocument880 pagesTaxation Full Text CasesChristine LarogaNo ratings yet

- Mayor of Parañaque Vs EbioDocument2 pagesMayor of Parañaque Vs EbioChaMcbandNo ratings yet

- Mayor of Parañaque Vs EbioDocument2 pagesMayor of Parañaque Vs EbioChaMcbandNo ratings yet

- Argumentum Ad Hominem: Simple IllustrationDocument2 pagesArgumentum Ad Hominem: Simple IllustrationKazumi ShioriNo ratings yet

- Ang Yu Asuncion Et Al. vs. Court of Appeals and Buen Realty CorpDocument23 pagesAng Yu Asuncion Et Al. vs. Court of Appeals and Buen Realty CorpChaMcbandNo ratings yet

- PNB Vs de Jesus Case DigestDocument4 pagesPNB Vs de Jesus Case DigestChaMcband0% (1)

- RULE 110 Case DigestsDocument6 pagesRULE 110 Case DigestsChaMcbandNo ratings yet