Professional Documents

Culture Documents

Microequities Deep Value Microcap Fund July 2010 Update

Uploaded by

Microequities Pty LtdCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microequities Deep Value Microcap Fund July 2010 Update

Uploaded by

Microequities Pty LtdCopyright:

Available Formats

MICROEQUITIES ASSET MANAGEMENT

DEEP VALUE MICROCAP FUND UPDATE, JULY 2010 PERFORMANCE UPDATE

Dear Investor,

Markets and Economy

Before jobs, must come profits. A historical perspective of the last two major US recessions (1974-75 and 1982-83) shows that

the unemployment rate peaked well after the recession was over. That may sound inherently wrong to some, after all, isn’t

employment the ultimate barometer of economic activity? It is, but it is not the first symptom of an economic recovery. Like a

sick patient recovering from the flu, the abolishment of all symptoms happens well after the immune system has activated the

recovery process. In market economies, job growth is principally driven by the turn in profits, as the recession enters full speed,

profits decline and management cut costs to improve the bottom line. After this defensive phase in which profits are stabilized

and ultimately recover, businesses and corporations are in a strategic position to refocus on growth via expansion of productive

capacity. They invest in capital and ultimately hire more staff. The order in which this happens is sequential; profit stabilization,

profit growth principally driven by cost containment, profit growth driven by demand recovery, and finally profit growth driven

by productive capacity expansion.

The US monthly job data will be published this Friday, it is unlikely that it will deliver fast employment creation that some

investors are awaiting. If it does not, it is not a signal of a “double dip” recession, merely a transitory phase that’s part of the

recovery cycle.

Microequities Deep Value Microcap Fund returned a positive +6.47% versus the All Ordinaries Accumulation Index 4.23% in

July; this brings the total return net of fees to 96.61% for the Fund compared to 51.98% for the All Ordinaries Accumulation

Index since inception in March 2009.

As we head into the reporting month of August, no month on month changes were made to our portfolio composition. For the

overall Australian equity market, analysts are estimating EPS growth of between 9% and 10%. We expect the companies in our

Deep Value Microcap Fund to deliver underlying EPS growth of between 25-30%. A substantial number of the companies in the

Fund have already provided earnings updates, and we remain pleased with the overall level of earnings growth visibility in our

selected businesses, and therefore, it is unlikely that the earnings season will provide any impetus for changes in our portfolio

constitution. We remain committed to our long term investment strategy.

Written by Carlos Gil, Chief Investment Officer.

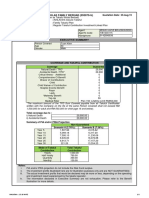

2.4% Cash

3.9%

Software & Services

Latest Unit Price

3.5%

12.8% Telecommunications Services $1.9101

Food Products Latest Fund Performance as at

4.6% Hotels Restaurants & Leisure 30/07/2010

39.2%

7.5% Consumer Durables Apparel 1 Month +6.47%

Media 3 Month -1.16%

Capital Goods

3.5% 6 Month +1.09%

Health Equipment & Services

12 Month +49.86%

8.2% 7.1% 8.1% Metals & Mining

Since

Technology Hardware & Equipment +96.61%

th Inception

*Deep Value Portfolio as of 30 of July 2010

(Net of Fees, including

distributions)

Suite 702, 109 Pitt Street Sydney NSW 2000 Office: +61 2 9231 6169 Fax: +61 2 9475 1156 invest@microequities.com.au

You might also like

- MT103 Netkom Solutions LTDDocument2 pagesMT103 Netkom Solutions LTDrasool mehrjoo100% (2)

- MENGES GROUP Assessment of Illinois Cost Trends Dec 5 2017Document8 pagesMENGES GROUP Assessment of Illinois Cost Trends Dec 5 2017Natasha KoreckiNo ratings yet

- 2016 Payroll Benchmarking Report: Annual Study Examining Trends, Efficiency and Costs of Payroll in AustraliaDocument25 pages2016 Payroll Benchmarking Report: Annual Study Examining Trends, Efficiency and Costs of Payroll in Australiaadhnan_rasheed100% (1)

- Revenue Regulations No. 02-40Document39 pagesRevenue Regulations No. 02-40saintkarri92% (12)

- Microequities Deep Value Microcap Fund March 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund March 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund August 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund August 2010 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund December 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund December 2010 UpdateMicroequities Pty LtdNo ratings yet

- Fund Update January 2010Document1 pageFund Update January 2010Microequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund February 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund February 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund January 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund January 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund September 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund September 2010 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund April 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund April 2011 UpdateMicroequities Pty LtdNo ratings yet

- Fund Update February 10Document1 pageFund Update February 10Microequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund Update Nov 2009 88% Return in 9 MonthsDocument1 pageMicroequities Deep Value Microcap Fund Update Nov 2009 88% Return in 9 MonthsMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund Update Dec 2009 89.62% Return in 9 MonthsDocument1 pageMicroequities Deep Value Microcap Fund Update Dec 2009 89.62% Return in 9 MonthsMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund Update May 2009Document1 pageMicroequities Deep Value Microcap Fund Update May 2009Microequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund Update June 2009Document1 pageMicroequities Deep Value Microcap Fund Update June 2009Microequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund Update July 2009Document1 pageMicroequities Deep Value Microcap Fund Update July 2009Microequities Pty LtdNo ratings yet

- Iw Philippines Report - Final 28augDocument29 pagesIw Philippines Report - Final 28augEllymar DuqueNo ratings yet

- Microequities Deep Value Microcap Fund Update September 2009Document1 pageMicroequities Deep Value Microcap Fund Update September 2009Microequities Pty LtdNo ratings yet

- FSISectoralFund MonthlyDocument1 pageFSISectoralFund MonthlyVNo ratings yet

- Americká Výsledková SezónaDocument12 pagesAmerická Výsledková SezónatomasberanekNo ratings yet

- 2018 Wage Survey Final Report (E) PDFDocument44 pages2018 Wage Survey Final Report (E) PDFMark KevinNo ratings yet

- Investor Letter November 2022Document3 pagesInvestor Letter November 2022koert.janssensNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- Budgeting Transparency in Public OrganizationDocument5 pagesBudgeting Transparency in Public OrganizationCharles OnyangoNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- Microequities Deep Value Microcap Fund December 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund December 2011 UpdateMicroequities Pty LtdNo ratings yet

- APRIL 2018: Dinasti Equity FundDocument2 pagesAPRIL 2018: Dinasti Equity FundAhmad RafiqNo ratings yet

- Industry Summary: Life Insurance ($2.5 Billion or More) - Asia-PacificDocument5 pagesIndustry Summary: Life Insurance ($2.5 Billion or More) - Asia-Pacificsagar.sg14No ratings yet

- Summary Prospectus Tradewale Managed Fund 022019Document8 pagesSummary Prospectus Tradewale Managed Fund 022019hyenadogNo ratings yet

- NAFA Pension Fund November 2016Document1 pageNAFA Pension Fund November 2016chqaiserNo ratings yet

- Microequities Deep Value Microcap Fund September 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund September 2011 UpdateMicroequities Pty LtdNo ratings yet

- Services Marketing - Lovelock - Chapter 1Document40 pagesServices Marketing - Lovelock - Chapter 1Mon BabiesNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- Financial ReportDocument23 pagesFinancial Reportusman.22.proNo ratings yet

- Philbin Financial GroupDocument13 pagesPhilbin Financial GroupakbarNo ratings yet

- Q2 2019 US Key NumbersDocument2 pagesQ2 2019 US Key NumbersCHRISS GONZALEZNo ratings yet

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDocument2 pagesInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNo ratings yet

- Implications For City FinancesDocument11 pagesImplications For City FinancesAnonymous Pb39klJNo ratings yet

- Tantallon India Fund - May 2020Document2 pagesTantallon India Fund - May 2020sujal_kumarNo ratings yet

- NP EX 4 SunriseDocument13 pagesNP EX 4 SunriseakbarNo ratings yet

- PNB Peso Fixed Income Fund PDFDocument3 pagesPNB Peso Fixed Income Fund PDFJj PahudpodNo ratings yet

- Global Technology Fund A Acc: Janus HendersonDocument2 pagesGlobal Technology Fund A Acc: Janus Hendersondoc_oz3298No ratings yet

- Inflation Cools, But Stays High: For Personal, Non-Commercial Use OnlyDocument34 pagesInflation Cools, But Stays High: For Personal, Non-Commercial Use OnlyRazvan Catalin CostinNo ratings yet

- Background: Business Analysis Exercise - Instructions For ParticipantDocument9 pagesBackground: Business Analysis Exercise - Instructions For ParticipantQuỳnh AnhNo ratings yet

- Factsheet - 20 October 2023Document2 pagesFactsheet - 20 October 2023Shivani NirmalNo ratings yet

- Performance: Numerai's Relative Performance (Net of Costs and Fees)Document5 pagesPerformance: Numerai's Relative Performance (Net of Costs and Fees)Jagdeep MaviNo ratings yet

- Fund Fact Sheets - Prosperity World Equity Index Feeder FundDocument1 pageFund Fact Sheets - Prosperity World Equity Index Feeder FundAJ HiltiNo ratings yet

- CI American Value Corporate Class - Class AT8 SharesDocument4 pagesCI American Value Corporate Class - Class AT8 SharesMarcelo MedeirosNo ratings yet

- Market Haven Monthly 2011 JanuaryDocument10 pagesMarket Haven Monthly 2011 JanuaryMarketHavenNo ratings yet

- ConsumerDocument4 pagesConsumerBernewsAdminNo ratings yet

- Increment Trend 2017Document1 pageIncrement Trend 2017Raghavendra KNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- RPCF May 2014 (English)Document1 pageRPCF May 2014 (English)Anonymous fS6Znc9No ratings yet

- CI American Managers® Corporate ClassDocument4 pagesCI American Managers® Corporate ClassMarcelo MedeirosNo ratings yet

- Allard Growth Fund December 2016Document3 pagesAllard Growth Fund December 2016James HoNo ratings yet

- Performance Overview: As of Sep 14, 2023Document2 pagesPerformance Overview: As of Sep 14, 2023Tirthkumar PatelNo ratings yet

- Grand Videoke TKR-373MP SongbookDocument2 pagesGrand Videoke TKR-373MP Songbooktikki0219No ratings yet

- Eastspring Dinasti Equity FundDocument2 pagesEastspring Dinasti Equity FundGrab Hakim RazakNo ratings yet

- Financial Plan - RITY BAKERYDocument8 pagesFinancial Plan - RITY BAKERYfrankNo ratings yet

- Outsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessFrom EverandOutsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessNo ratings yet

- Microequities Deep Value Microcap Fund August 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund August 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities High Income Value Microcap Fund May 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund May 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities High Income Value Microcap Fund August 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund August 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities High Income Value Microcap Fund July 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund July 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund June 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund June 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund May 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund May 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund July 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund July 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities High Income Value Microcap Fund June 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund June 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund March 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund March 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities High Income Value Microcap Fund March 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund March 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund April 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities High Income Value Microcap Fund April 2012 UpdateDocument1 pageMicroequities High Income Value Microcap Fund April 2012 UpdateMicroequities Pty LtdNo ratings yet

- Rising Stars 2012 BookletDocument110 pagesRising Stars 2012 BookletMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund February 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund February 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund September 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund September 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund August 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund August 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund November 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund November 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund January 2012 UpdateDocument1 pageMicroequities Deep Value Microcap Fund January 2012 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund December 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund December 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund October 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund October 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund April 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund April 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund July 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund July 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund June 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund June 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund May 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund May 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund January 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund January 2011 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund November 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund November 2010 UpdateMicroequities Pty LtdNo ratings yet

- Microequities Deep Value Microcap Fund October 2010 UpdateDocument1 pageMicroequities Deep Value Microcap Fund October 2010 UpdateMicroequities Pty LtdNo ratings yet

- Lecture Session 9 - Forecasting Exchange RatesDocument10 pagesLecture Session 9 - Forecasting Exchange Ratesapi-19974928No ratings yet

- CGTMSEDocument4 pagesCGTMSEPrasath KumarNo ratings yet

- Vocabulary - MoneyDocument2 pagesVocabulary - MoneyMiss Marina GimenezNo ratings yet

- Esquire Products Inc Expects The Following Monthly SalesDocument1 pageEsquire Products Inc Expects The Following Monthly SalesAmit PandeyNo ratings yet

- Insurance ThesisDocument2 pagesInsurance ThesisMinh LêNo ratings yet

- Contemporary Issues Facing The Filipino Entrepreneur: MODULE 10 - Applied EconomicsDocument5 pagesContemporary Issues Facing The Filipino Entrepreneur: MODULE 10 - Applied EconomicsAstxilNo ratings yet

- Accounting Rate of ReturnDocument7 pagesAccounting Rate of ReturnMahesh RaoNo ratings yet

- DK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookDocument51 pagesDK Goel Solutions For Class 11 Accountancy Chapter 11 Books of Original Entry - Cash BookjigyasuNo ratings yet

- JAVA MicroprojectDocument31 pagesJAVA Microprojectᴠɪɢʜɴᴇꜱʜ ɴᴀʀᴀᴡᴀᴅᴇ.No ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- FAQs On Disclosures & Reporting in Form 3CD - Tax Audit - A.Y. 2021-22Document33 pagesFAQs On Disclosures & Reporting in Form 3CD - Tax Audit - A.Y. 2021-22itr bbcNo ratings yet

- Strategic Business Management July 2017 Mark PlanDocument23 pagesStrategic Business Management July 2017 Mark PlanWong AndrewNo ratings yet

- FIN 103 - V. Financial Planning and ForecastingDocument6 pagesFIN 103 - V. Financial Planning and ForecastingJill Roxas100% (1)

- Module Fs AnalysisDocument12 pagesModule Fs AnalysisCeejay RoblesNo ratings yet

- CFA Level II 2019-2020 Program ChangesDocument1 pageCFA Level II 2019-2020 Program ChangesMohsin Ul Amin KhanNo ratings yet

- Equity Research (Titan Biotech Limited)Document9 pagesEquity Research (Titan Biotech Limited)Dhruv ThakkarNo ratings yet

- APU All IncludedDocument69 pagesAPU All IncludedEnxzol KehhNo ratings yet

- Takaful Ikhlas Family Berhad (593075-U) : Takaful Participant Azan Age 35 Gender Female 1 0Document1 pageTakaful Ikhlas Family Berhad (593075-U) : Takaful Participant Azan Age 35 Gender Female 1 0Mohd Hafiz ZakiuddinNo ratings yet

- Project On HondaDocument68 pagesProject On HondaPraveen Kumar Hc50% (2)

- CH 6 13Document148 pagesCH 6 13林韋丞No ratings yet

- Payment and Settlement Systems in IndiaDocument23 pagesPayment and Settlement Systems in IndiagopubooNo ratings yet

- Zoya ProjectDocument60 pagesZoya Projectanas khanNo ratings yet

- Digital Assets GuideDocument22 pagesDigital Assets GuideProject Erch64No ratings yet

- Dimaampao Tax NotesDocument63 pagesDimaampao Tax Notesnia coline mendozaNo ratings yet

- Chinmay Kadam Roll No. 21 Black BookDocument55 pagesChinmay Kadam Roll No. 21 Black BookShubh shahNo ratings yet

- Hes Private Equity Class SyllabusDocument8 pagesHes Private Equity Class SyllabuseruditeaviatorNo ratings yet

- Chapter 4 The Internal AssessmentDocument26 pagesChapter 4 The Internal AssessmentKrisKettyNo ratings yet

- Corporate Finance Current Papers of Final Term PDFDocument35 pagesCorporate Finance Current Papers of Final Term PDFZahid UsmanNo ratings yet