Professional Documents

Culture Documents

R45 Private Equity Valuation Edited IFT Notes PDF

Uploaded by

Ayush JhunjhunwalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R45 Private Equity Valuation Edited IFT Notes PDF

Uploaded by

Ayush JhunjhunwalaCopyright:

Available Formats

R45 Private Equity Valuation IFT Notes

1. Introduction ............................................................................................................................. 2

2. Introduction to Valuation Techniques in Private Equity Transactions.................................... 4

2.1. How Is Value Created in Private Equity? ............................................................................ 6

2.2. Using Market Data in Valuation .......................................................................................... 7

2.3. Contrasting Valuation in Venture Capital and Buyout Settings .......................................... 7

2.4. Valuation Issues in Buyout Transactions ............................................................................. 9

2.5. Valuation Issues in Venture Capital Transactions ............................................................. 11

2.6. Exit Routes: Returning Cash to Investors .......................................................................... 12

2.7. Summary ............................................................................................................................ 13

3. Private Equity Fund Structures and Valuation ...................................................................... 13

3.1. Understanding Private Equity Fund Structures.................................................................. 13

3.2. What Are the Risks and Costs of Investing in Private Equity? ......................................... 16

3.3. Due Diligence Investigations by Potential Investors ......................................................... 17

3.4. Private Equity Fund Valuation........................................................................................... 18

3.5. Evaluating Fund Performance............................................................................................ 18

4. Concept in Action: Evaluating a Private Equity Fund .......................................................... 19

5. Appendix: A Note on Valuation of Venture Capital Deals ................................................... 19

6. Summary................................................................................................................................ 20

This document should be read in conjunction with the corresponding reading in the 2017 Level II

CFA Program curriculum. Some of the graphs, charts, tables, examples, and figures are

copyright 2016, CFA Institute. Reproduced and republished with permission from CFA Institute.

All rights reserved.

Required disclaimer: CFA Institute does not endorse, promote, or warrant the accuracy or

quality of the products or services offered by IFT. CFA Institute, CFA, and Chartered

Financial Analyst are trademarks owned by CFA Institute.

Copyright IFT. All rights reserved www.ift.world Page 1

R45 Private Equity Valuation IFT Notes

1. Introduction

Private equity includes the entire asset class of equity investments that are not quoted on the

stock market.

There are two perspectives on private equity valuation:

1. The perspective of an outside investor who is evaluating a fund sponsored by the private

equity firm.

2. The perspective of a private equity firm that is evaluating investments (portfolio

companies).

The two broad types of private equity firms are:

1. Venture capital firms: Involved in early stage financing. Buy companies that may not

have revenues, but have a potentially good idea or technology.

2. Buyout firms: Involved in later stage financing. Buy privately owned companies or a

particular division of an existing company.

Exhibit 1 from the curriculum provides a classification of private equity in terms of the stage and

types of financing of portfolio companies.

Broad Category Subcategory Brief Description

Seed stage Financing provided to research

business ideas, develop prototype

products, or conduct market

Venture capital research.

Start-up stage Financing to recently created

companies with well-articulated

business and marketing plans.

Copyright IFT. All rights reserved www.ift.world Page 2

R45 Private Equity Valuation IFT Notes

Broad Category Subcategory Brief Description

Expansion stage Financing to companies that have

started their selling effort and

may be already breaking even.

Financing may serve to expand

production capacity, product

development, or provide working

capital.

Replacement capital Financing provided to purchase

shares from other existing

venture capital investors or to

reduce financial leverage.

Acquisition capital Financing in the form of debt,

equity, or quasi-equity provided

to a company to acquire another

company.

Leverage buyout Financing provided by a LBO

Buyout

firm to acquire a company.

Management buyout Financing provided to the

management to acquire a

company, specific product line,

or division (carve-out).

Mezzanine finance Financing generally provided in

the form of subordinated debt

and an equity kicker (warrants,

equity, etc.) frequently in the

context of LBO transactions.

Special situations Distressed securities Financing of companies in need

of restructuring or facing

financial distress.

One-time opportunities Financing in relation to changing

industry trends and new

government regulations.

Copyright IFT. All rights reserved www.ift.world Page 3

R45 Private Equity Valuation IFT Notes

Broad Category Subcategory Brief Description

Others Other forms of private equity

financing are also possible (i.e.,

activist investing, etc.).

A unique feature of private equity investment is that it has a buy-to-sell orientation. Most private

equity fund investors expect to receive their money back, within 10 years of committing their

funds.

2. Introduction to Valuation Techniques in Private Equity

Transactions

The choice of an appropriate valuation methodology for private equity depends on the stage of

development of the portfolio company. Exhibit 2 from the curriculum provides an overview of

some of the main methodologies used.

Valuation Technique Brief Description Application

Income approach: Value is obtained by discounting Generally applies across the broad

Discounted cash flows expected future cash flows at an spectrum of company stages.

(DCF) appropriate cost of capital. Given the emphasis on expected cash

flows, this methodology provides the

most relevant results when applied to

companies with a sufficient operating

history. Therefore, most applicable to

companies operating from the

expansion up to the maturity phase.

Copyright IFT. All rights reserved www.ift.world Page 4

R45 Private Equity Valuation IFT Notes

Valuation Technique Brief Description Application

Relative value: Application of an earnings Generally applies to companies with a

Earnings multiples multiple to the earnings of a significant operating history and

portfolio company. The earnings predictable stream of cash flows.

multiple is frequently obtained May also apply with caution to

from the average of a group of companies operating at the expansion

public companies operating in a stage.

similar business and of comparable Rarely applies to early stage or start-up

size. companies.

Commonly used multiples include:

Price/Earnings (P/E), Enterprise

Value/EBITDA, Enterprise

Value/Sales.

Real option The right to undertake a business Generally applies to situations in

decision (call or put option). which the management or shareholders

Requires judgmental assumptions have significant flexibility in making

about key option parameters. radically different strategic decisions

(i.e., option to undertake or abandon a

high risk, high return project).

Therefore, generally applies to some

companies operating at the seed or

start-up phase.

Copyright IFT. All rights reserved www.ift.world Page 5

R45 Private Equity Valuation IFT Notes

Valuation Technique Brief Description Application

Replacement cost Estimated cost to recreate the Generally applies to early (seed and

business as it stands as of the start-up) stage companies or

valuation date. companies operating at the

development stage and generating

negative cash flows.

Rarely applies to mature companies as

it is difficult to estimate the cost to

recreate a company with a long

operating history. For example, it

would be difficult to estimate the cost

to recreate a long established brand

like Coca-Cola, whereas the

replacement cost methodology may be

used to estimate the brand value for a

recently launched beverage (R&D

expenses, marketing costs, etc.).

Apart from these methods, there is one more method the venture capitalist method, which is

covered in the case study that follows this reading.

2.1. How Is Value Created in Private Equity?

Private equity has the following advantages over public equity:

1. The ability to re-engineer the firm to generate superior returns.

2. The ability to access credit markets on favorable terms.

3. A better alignment of interests between the private equity firm owners and the managers

of the firms they control.

Private equity firms are able to achieve better alignment of interests by:

Allowing managers to focus on the long term perspective, as compared to short term

quarterly earnings targets in public companies.

Effective structuring of investment terms:

o Tag-along, drag-along rights (any future acquirer has to extend acquisition offer

Copyright IFT. All rights reserved www.ift.world Page 6

R45 Private Equity Valuation IFT Notes

to all shareholders, including management of the company)

o Corporate board seats (ensures private equity control in case of a major corporate

event)

o Non-compete clause (prevents founders from restarting same activity during a

predefined period of time)

o Preferred dividend and liquidation preference (private equity firms are paid first,

before other shareholders)

o Reserved matters (some domains of strategic importance are subject to approval

by private equity firm)

o Earn-outs (mechanism linking the acquisition price paid by the private equity firm

to the companys future financial performance over a predetermined time horizon)

2.2. Using Market Data in Valuation

Generally market data cannot be applied directly in private equity valuation. However, most

valuation techniques indirectly use market data.

Multiples for comparable public companies such as EV/EBITDA are frequently used.

Relevant transaction data such as recent M&A transactions for comparable companies is

used.

Pure-play method to evaluate beta. is estimated for comparable companies and then

adjusted for financial and operating leverage.

In DCF valuation, forecasts are available only for a few years ahead. Hence it is

necessary to estimate a terminal value

o To do this we can apply a perpetual growth assumption.

o Or we can use multiple-based approach, take a multiple from public markets and

apply it to the last years forecast value.

2.3. Contrasting Valuation in Venture Capital and Buyout Settings

Exhibit 3 from the curriculum presents some of the key differences between venture capital and

buyout valuations.

Buyout Investments: Venture Capital Investments:

Copyright IFT. All rights reserved www.ift.world Page 7

R45 Private Equity Valuation IFT Notes

Steady and predictable cash flows Low cash flow predictability, cash flow

projections may not be realistic

Excellent market position (can be a niche player) Lack of market history, new market and possibly

unproven future market (early stage venture)

Significant asset base (may serve as basis for Weak asset base

collateral lending)

Strong and experienced management team Newly formed management team with strong

individual track record as entrepreneurs

Extensive use of leverage consisting of a large Primarily equity funded. Use of leverage is rare

proportion of senior debt and significant layer of and very limited

junior and/or mezzanine debt

Risk is measurable (mature businesses, long Assessment of risk is difficult because of new

operating history) technologies, new markets, lack of operating

history

Predictable exit (secondary buyout, sale to a Exit difficult to anticipate (IPO, trade sale,

strategic buyer, IPO) secondary venture sale)

Established products Technological breakthrough but route to market

yet to be proven

Potential for restructuring and cost reduction Significant cash burn rate required to ensure

company development and commercial viability

Low working capital requirement Expanding capital requirement if in the growth

phase

Buyout firm typically conducts full blown due Venture capital firm tends to conduct primarily a

diligence approach before investing in the target technology and commercial due diligence before

firm (financial, strategic, commercial, legal, tax, investing; financial due diligence is limited as

environmental) portfolio companies have no or very little

operating history

Buyout firm monitors cash flow management, Venture capital firm monitors achievement of

strategic, and business planning milestones defined in business plan and growth

management

Copyright IFT. All rights reserved www.ift.world Page 8

R45 Private Equity Valuation IFT Notes

Returns of investment portfolios are generally Returns of investment portfolios are generally

characterized by lower variance across returns characterized by very high returns from a limited

from underlying investments; bankruptcies are number of highly successful investments and a

rare events significant number of write-offs from low

performing investments or failures

Large buyout firms are generally significant Venture capital firms tend to be much less active

players in capital markets in capital markets

Most transactions are auctions, involving multiple Many transactions are proprietary, being the

potential acquirers result of relationships between venture capitalists

and entrepreneurs

Strong performing buyout firms tend to have a Venture capital firms tend to be less scalable

better ability to raise larger funds after they have relative to buyout firms; the increase in size of

successfully raised their first funds subsequent funds tend to be less significant

Variable revenue to the general partner (GP) at Carried interest (participation in profits) is

buyout firms generally comprise the following generally the main source of variable revenue to

three sources: carried interest, transaction fees, the general partner at venture capital firms;

and monitoring fees transaction and monitoring fees are rare in

practice

2.4. Valuation Issues in Buyout Transactions

Value is created in a typical leveraged buyout transaction from a combination of factors such as:

Earnings growth due to operational improvements and improved corporate governance

Multiple expansion depending on pre-identified potential exits

Debt reduction, repayment of part of debt with operational cash flows before the exit.

Exhibit 4 from the curriculum shows a typical leveraged buyout value creation chart.

Copyright IFT. All rights reserved www.ift.world Page 9

R45 Private Equity Valuation IFT Notes

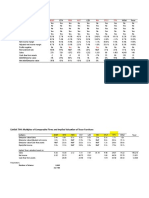

Exhibit 5 from the curriculum provides an example of a 5,000 (amounts in millions) investment

in private equity transaction. This is financed with 50 percent debt and 50 percent equity. The

2,500 equity investment is further broken into 2,400 of preference shares owned by the private

equity fund, 95 of equity owned by the private equity fund, and 5 of management equity. The

preference shares are promised a 12 percent rolled up dividend (paid at exit). The private equity

firm equity will receive 95 percent of the residual value of the firm after creditors and preference

shares are paid, and management equity holders will receive the remaining 5 percent.

If we assume that the exit value after five years is 1.6 times the original cost, the payoffs to the

different stake holders will be:

Copyright IFT. All rights reserved www.ift.world Page 10

R45 Private Equity Valuation IFT Notes

The larger the exit multiple, the larger the upside potential for both the management equity

program and the equity held by private equity firm. Leverage is very important in buyout

transactions. As debt is gradually paid off, a larger proportion of operating cash flows is

available to equity investors. However, these high levels of debt significantly increase the risk to

equity investors. This increased risk should be taken into consideration, when comparing the

returns with other classes such as stock market.

A series of scenario analyses is conducted with different levels of cash exits, growth assumptions

and debt levels. Inputs used are the required rate of return for each stakeholder. This analysis

provides an understanding of the buyout firms flexibility in conducting the deal.

2.5. Valuation Issues in Venture Capital Transactions

Two important concepts in venture capital are:

PRE: Agreed value of a company prior to a round of financing or

POST: Value of a company after the financing or investing round

Copyright IFT. All rights reserved www.ift.world Page 11

R45 Private Equity Valuation IFT Notes

The relationship between the two is POST = PRE + I

The proportionate ownership of the venture capital investor is equal to I/POST.

Refer to Example 1 from the curriculum.

In a VC deal, both the pre-money valuation and the level of the venture capital investment are

subject to intense negotiation between the founders and the venture capital firm.

IN VC transactions, there is significant uncertainty regarding future cash flows. Hence, DCF

cannot be used. Also, start-ups are unique and it is difficult to find comparable companies.

Hence, comparable companies approach cannot be used. Generally, the appraisal of intangible

assets, comprising the founders know-how, experience, licenses, patents, and in progress

research and development, along with an assessment of the expected market potential of the

companys product or products in development form the basis for assessing a pre-money

valuation.

2.6. Exit Routes: Returning Cash to Investors

Private equity investors have the following exit routes for their investments:

Initial Public Offering (IPO): The key points are -

o Highest exit value relative to other methods

o High liquidity, access to capital, and attracts good management

o Less flexible, more costly, and complex

o Used when company has strong growth prospects, operating history, size

o Timing of IPO is an important consideration.

Secondary Market: Sale to other financial investors or strategic investors. The advantages

are

o Highest value in absence of an IPO

o Bring portfolio companies to next level by restructuring, merger, new market etc.

and sell them to a strategic investor or to other PE firm

Management Buyout: Firm is sold to management. Best alignment of interest, however if

significant leverage is used it can reduce the companys flexibility.

Liquidation: Sale of firms assets. This option is used if the company is no longer viable.

Copyright IFT. All rights reserved www.ift.world Page 12

R45 Private Equity Valuation IFT Notes

2.7. Summary

Since it is difficult to value private companies, a variety of alternative valuation methods are

typically used to provide guidance on the appropriate range of values.

Valuation serves a dual purpose:

1. Assessing a companys ability to generate superior cash flows from a distinctive

competitive advantage.

2. Serving as a benchmark for negotiations with the seller.

3. Private Equity Fund Structures and Valuation

Two distinctive characteristics of private equity are:

Investors commit a certain amount to the fund initially. This is subsequently drawn by the

fund.

Private equity firms usually show a J curve effect, where low or negative returns are

reported in the early years, followed by increased returns thereafter.

3.1. Understanding Private Equity Fund Structures

Most PE firms are structured as limited partnerships, where the fund manager is the general

partner (GP) and the funds investors are limited partners (LP). The GP has management control

over the fund and is jointly liable for all debts. The LPs have limited liability; they do not risk

more than the amount of their investment in the fund.

Two core functions of a PE firm are: (1) to raise funds and (2) To manage investments.

Therefore, PE firms start their marketing efforts well in advance of the launch of their funds to

ensure that the announced target fund size will be met successfully. Exhibit 6 from the

curriculum shows the funding stages for a private equity firm.

Copyright IFT. All rights reserved www.ift.world Page 13

R45 Private Equity Valuation IFT Notes

Fund terms are contractually defined in the fund prospectus. The objective is to ensure alignment

of interests between the GP and LPs and defining the GPs incentives.

Economic terms - The most significant economic terms are:

Management fees represent a percentage of committed capital paid annually to the GP.

Transaction fees are fees paid to GPs in their advisory capacity when they provide

investment banking services for a transaction (mergers and acquisitions, IPOs) benefiting

the fund.

Carried interest represents the general partners share of profits generated by a private

equity fund.

Ratchet is a mechanism that determines the allocation of equity between shareholders and

the management team of the private equity controlled company. A ratchet enables the

management team to increase its equity allocation depending on the companys actual

performance and the return achieved by the private equity firm.

Hurdle rate is the internal rate of return that a private equity fund must achieve before the

GP receives any carried interest.

Target fund size is expressed as an absolute amount in the fund prospectus or information

Copyright IFT. All rights reserved www.ift.world Page 14

R45 Private Equity Valuation IFT Notes

memorandum.

Vintage year is the year the private equity fund was launched. Reference to vintage year

allows performance comparison of funds of the same stage and industry focus.

Term of the fund is typically 10 years, extendable for additional shorter periods (by

agreement with the investors).

Corporate governance terms The most significant corporate governance terms are:

Key man clause: If a key executive leaves, the GP is prohibited from making new

investments until a new key executive is appointed.

Disclosure and confidentiality: Private equity firms have no obligations to disclose

publically their financial performance. Some terms limit the information available to

investors.

Clawback provision: If a fund makes profitable exits in early years, but the subsequent

exits are less profitable, then the GP has to pay back profits to ensure that the profit split

is in line with the fund prospectus. The two types of clawback provisions are

o Due on termination

o Annual reconciliation (true-up)

Distribution waterfall: Mechanism to ensure LPs are paid first before the GP receives

carried interest. The two main types are:

o Deal-by-deal waterfall Allowing distribution after each deal.

o Total return waterfall Distribution is calculated on the entire portfolio.

Refer to Example 3 from the curriculum. The highlights are:

In a deal-by-deal mechanism carried interest is distributed to GP after every deal.

In the first alternative of total return, GP receives carried interest only after the

fund has returned entire committed capital to LPs.

In the second alternative of total return, GP receives carried interest on any

distribution as long as the value of the investment portfolio exceeds a certain

threshold above invested capital.

Under a clawback provision with annual true-up, supposing that the deal-by-deal

method applies; if we incur losses on subsequent deals, the GP has to pay back

carried interest to LPs.

Copyright IFT. All rights reserved www.ift.world Page 15

R45 Private Equity Valuation IFT Notes

Tag-along, drag along rights: Any future acquirer has to extend acquisition offer to all

shareholders, including the management of the company.

No-fault divorce: A GP may be removed without cause, if a super majority of LPs

approve that removal.

Removal for cause: Allows removal of GP or early termination of fund for causes such

as gross negligence, key person event, felony conviction, bankruptcy, or material

breach of the fund prospectus.

Investment restrictions: Minimum level of geographic or sector diversification, or limits

on borrowing.

Co-investment: LPs have the first right of co-investing along with the GP if the GP

launches a new fund.

3.2. What Are the Risks and Costs of Investing in Private Equity?

The risks associated with investing in private equity are:

Illiquidity of investments: Since private equity investments are not traded on any

securities market, we may not be able to exit investments on a timely basis.

Unquoted investments: Investing in unquoted securities is risky compared to investing in

securities quoted on a regulated securities exchange.

Competition for attractive investment opportunities: Competition for finding investment

opportunities on attractive terms may be high.

Reliance on the management of investee companies (agency risk): There is no assurance

that the management of the investee companies will run the company in the best interests

of the private equity firm. This is a concern in earlier stage deals in which the

management may retain a controlling stake in the company and enjoy certain private

benefits of control.

Loss of capital: High business and financial risks may result in substantial loss of capital.

Government regulations: Investee companies product and services may be subject to

changes in government regulations that adversely impact their business model.

Taxation risk: Tax treatment of capital gains, dividends, or limited partnerships may

change over time.

Copyright IFT. All rights reserved www.ift.world Page 16

R45 Private Equity Valuation IFT Notes

Valuation of investments: Valuation of private equity investments is subject to significant

judgment and therefore may be subject to biases.

Lack of investment capital: Investee companies may require additional future financing

which may not be available.

Lack of diversification: Investment portfolios may be highly concentrated and may,

therefore, be exposed to significant losses.

Market risk: Changes in general market conditions (interest rates, currency exchange

rates) may adversely affect private equity investments.

The costs associated with investing in private equity are:

Transaction fees: Related to due diligence, bank financing costs, legal fees for arranging

acquisition, and sale transactions in investee companies

Investment vehicle fund setup costs: Includes legal costs for the setup of the investment

vehicle

Administrative costs: Custodian, transfer agent, and accounting costs

Audit costs: A fixed annual fee

Management and performance fees: A 2 percent management fee and a 20 percent

performance fee are common in the private equity industry.

Dilution: Dilution may come from stock option plans granted to the management and to

the private equity firm and from additional rounds of financing.

Placement fees: Fundraising fees may be charged up front or by means of a trailer fee. A

trailer fee is charged annually on the amount invested by limited partners. An upfront

placement fee of 2 percent is common in private equity.

3.3. Due Diligence Investigations by Potential Investors

Due diligence is important because:

Private equity funds show a strong persistence of returns over time. This means that top

performing funds tend to continue to outperform and poor performing funds tend to

continue to perform poorly.

Difference between performances of funds is extremely large. For example, the

difference between top quartile and third quartile fund IRRs can be about 20 percentage

Copyright IFT. All rights reserved www.ift.world Page 17

R45 Private Equity Valuation IFT Notes

points.

Liquidity in private equity is low and LPs are locked for the long term. On the other

hand, when private equity funds exit an investment, they return the cash to the investors

immediately. Therefore, the duration of an investment is typically shorter than the

maximum life of the fund.

3.4. Private Equity Fund Valuation

The value of a fund is based on NAV. The funds assets are valued by GPs in the following

ways:

At cost with significant adjustments for subsequent financing events or deterioration

At lower of cost or market value

By a revaluation of a portfolio company whenever a new financing round involving new

investors takes place.

At cost with no interim adjustment until the exit

With a discount for restricted securities

More rarely, marked to market by reference to a peer group of public comparables and

applying illiquidity discounts

3.5. Evaluating Fund Performance

Analysis of private equity funds financial performance includes the following:

Gross IRR: Relates to cash flows between the fund and its portfolio companies. It is

considered a good measure of the investment management teams track record in creating

value.

Net IRR: Relates to cash flows between the fund and LPs. It measures the returns to

investors.

PIC (paid in capital): The ratio of paid in capital to date divided by committed capital.

DPI (distributed to paid in): Cumulative distributions paid out to LPs as a proportion of

the cumulative invested capital. DPI is presented net of management fees and carried

interest.

RVPI (residual value to paid in): Value of LPs shareholding held with the private equity

fund as a proportion of the cumulative invested capital. RVPI is presented net of

Copyright IFT. All rights reserved www.ift.world Page 18

R45 Private Equity Valuation IFT Notes

management fees and carried interest.

TVPI (total value to paid in): The portfolio companies distributed and undistributed

value as a proportion of the cumulative invested capital. TVPI is the sum of DPI and

RVPI. TVPI is presented net of management fees and carried interest.

Refer to Example 4 from the curriculum. The highlights are:

Vintage year can provide hints for a funds success or failure. It signifies the economic

environment that the portfolio companies were subject to.

4. Concept in Action: Evaluating a Private Equity Fund

Refer to Section 4 from the curriculum. The highlights are:

High distributed value, high residual value, rank in the top quartile, high gross and net

IRR represent good performance.

If a fund is not performing, it is likely that the fund is experiencing a J curve effect.

5. Appendix: A Note on Valuation of Venture Capital Deals

Refer to the Appendix section form the curriculum. The highlights are:

The general case formulae are:

General Case/Formula

1. Post-Money Valuation POST = V/(1 + r)t

2. Pre-Money Valuation PRE = POST I

3. Ownership Fraction F = I/POST

4. Number of Shares Y = x [ F / (1 F) ]

5. Price of Share P1 = I/y

Sensitivity analysis shows how the value of a company changes if we change our

assumptions.

IRR and NPV method give the same answer as the venture capital method.

Terminal value is typically estimated by multiple of earnings. Sometimes multiples of

sales or assets are also used. In principle, better methods would be to use NPV, CAPM,

Copyright IFT. All rights reserved www.ift.world Page 19

R45 Private Equity Valuation IFT Notes

APT or whatever equilibrium valuation model fits the available data best.

The different methods to account for risk include:

o Using a very high discount rate

o Using a normal discount rate but assume a probability of failure for each year

o Allowing a variety of scenarios and then taking a probability weighted terminal

value

Cases with multiple rounds of financing can be solved using the same approach but be

careful about dilution and number of shares.

The actual deal is not really driven by the valuation method, but rather by the outcome of

bargaining power between the entrepreneurs and the venture capitalists.

6. Summary

LO.a: Explain sources of value creation in private equity.

The sources of value creation in private equity are:

1. The ability to re-engineer the firm to generate superior returns.

2. The ability to access credit markets on favorable terms.

3. A better alignment of interests between the private equity firm owners and the managers

of the firms they control.

LO.b: Explain how private equity firms align their interests with those of the managers of

portfolio companies.

Private equity firms are able to achieve better alignment of interests by:

Allowing managers to focus on the long term perspective, as compared to short term

quarterly earnings targets in public companies.

Effective structuring of investment terms:

o Tag-along, drag-along rights (any future acquirer has to extend acquisition offer

to all shareholders, including management of the company)

o Corporate board seats (ensures private equity control in case of a major corporate

event)

o Non-compete clause (prevents founders from restarting same activity during a

Copyright IFT. All rights reserved www.ift.world Page 20

R45 Private Equity Valuation IFT Notes

predefined period of time)

o Preferred dividend and liquidation preference (private equity firms are paid first,

before other shareholders)

o Reserved matters (some domains of strategic importance are subject to approval

by private equity firm)

o Earn-outs (mechanism linking the acquisition price paid by the private equity firm

to the companys future financial performance over a predetermined time horizon)

LO.c: Distinguish between the characteristics of buyout and venture capital investments.

Buyout Investments: Venture Capital Investments:

Steady and predictable cash flows Low cash flow predictability, cash flow

projections may not be realistic

Excellent market position (can be a niche player) Lack of market history, new market and possibly

unproven future market (early stage venture)

Significant asset base (may serve as basis for Weak asset base

collateral lending)

Strong and experienced management team Newly formed management team with strong

individual track record as entrepreneurs

Extensive use of leverage consisting of a large Primarily equity funded. Use of leverage is rare

proportion of senior debt and significant layer of and very limited

junior and/or mezzanine debt

Risk is measurable (mature businesses, long Assessment of risk is difficult because of new

operating history) technologies, new markets, lack of operating

history

Predictable exit (secondary buyout, sale to a Exit difficult to anticipate (IPO, trade sale,

strategic buyer, IPO) secondary venture sale)

Established products Technological breakthrough but route to market

yet to be proven

Potential for restructuring and cost reduction Significant cash burn rate required to ensure

company development and commercial viability

Low working capital requirement Expanding capital requirement if in the growth

phase

Copyright IFT. All rights reserved www.ift.world Page 21

R45 Private Equity Valuation IFT Notes

Buyout firm typically conducts full blown due Venture capital firm tends to conduct primarily a

diligence approach before investing in the target technology and commercial due diligence before

firm (financial, strategic, commercial, legal, tax, investing; financial due diligence is limited as

environmental) portfolio companies have no or very little

operating history

Buyout firm monitors cash flow management, Venture capital firm monitors achievement of

strategic, and business planning milestones defined in business plan and growth

management

Returns of investment portfolios are generally Returns of investment portfolios are generally

characterized by lower variance across returns characterized by very high returns from a limited

from underlying investments; bankruptcies are number of highly successful investments and a

rare events significant number of write-offs from low

performing investments or failures

Large buyout firms are generally significant Venture capital firms tend to be much less active

players in capital markets in capital markets

Most transactions are auctions, involving multiple Many transactions are proprietary, being the

potential acquirers result of relationships between venture capitalists

and entrepreneurs

Strong performing buyout firms tend to have a Venture capital firms tend to be less scalable

better ability to raise larger funds after they have relative to buyout firms; the increase in size of

successfully raised their first funds subsequent funds tend to be less significant

Variable revenue to the general partner (GP) at Carried interest (participation in profits) is

buyout firms generally comprise the following generally the main source of variable revenue to

three sources: carried interest, transaction fees, the general partner at venture capital firms;

and monitoring fees transaction and monitoring fees are rare in

practice

LO.d: Describe valuation issues in buyout and venture capital transactions.

Buyout transaction:

Value is created in a typical leveraged buyout transaction from a combination of factors such as:

Earnings growth due to operational improvements and improved corporate governance

Multiple expansion depending on pre-identified potential exits

Debt reduction, repayment of part of debt with operational cash flows before the exit.

Copyright IFT. All rights reserved www.ift.world Page 22

R45 Private Equity Valuation IFT Notes

Leverage is very important in buyout transactions. As debt is gradually paid off, a larger

proportion of operating cash flows is available to equity investors. However, these high levels of

debt significantly increase the risk to equity investors. This increased risk should be taken into

consideration, when comparing the returns with other classes such as stock market.

Venture capital transaction:

In a VC deal, both the pre-money valuation and the level of the venture capital investment are

subject to intense negotiation between the founders and the venture capital firm. There is

significant uncertainty regarding future cash flows. Hence, DCF cannot be used. Also, start-ups

are unique and it is difficult to find comparable companies. Hence, comparable companies

approach cannot be used.

LO.e: Explain alternative exit routes in private equity and their impact on value.

Private equity investors have the following exit routes for their investments:

Initial Public Offering (IPO): The key points are:

o Highest exit value relative to other methods

o High liquidity, access to capital, and attracts good management

o Less flexible, more costly, and complex

o Used when company has strong growth prospects, operating history, size

o Timing of IPO is an important consideration

Secondary Market: Sale to other financial investors or strategic investors. The advantages

are

o Highest value in absence of an IPO

o Bring portfolio companies to next level by restructuring, merger, new market etc.

and sell them to a strategic investor or to other PE firm.

Management Buyout: Firm is sold to management. Best alignment of interest, however if

significant leverage is used it can reduce the companys flexibility.

Liquidation: Sale of firms assets. This option is used if the company is no longer viable.

LO.f: Explain private equity fund structures, terms, valuation, and due diligence in the

context of an analysis of private equity fund returns.

Copyright IFT. All rights reserved www.ift.world Page 23

R45 Private Equity Valuation IFT Notes

Fund structure:

Most PE firms are structured as limited partnerships, where the fund manager is the general

partner (GP) and the funds investors are limited partners (LP). The GP has management control

over the fund and is jointly liable for all debts. The LPs have limited liability; they do not risk

more than the amount of their investment in the fund.

Terms:

The most significant economic terms are:

Management fees

Transaction fees

Carried interest

Ratchet

Hurdle rate

Target fund size

Vintage year

Term of the fund

The most significant corporate governance terms are:

Key man clause

Disclosures and confidentiality

Clawback provision

Distribution waterfall

Tag-along, drag along rights

No-fault divorce

Removal for cause

Investment restrictions

Co-investment

Valuation:

The value of a fund is based on NAV. The funds assets are valued by GPs in the following

Copyright IFT. All rights reserved www.ift.world Page 24

R45 Private Equity Valuation IFT Notes

ways:

1. At cost with significant adjustments for subsequent financing events or deterioration

2. At lower of cost or market value

3. By a revaluation of a portfolio company whenever a new financing round involving new

investors takes place

4. At cost with no interim adjustment until the exit

5. With a discount for restricted securities

6. More rarely, marked to market by reference to a peer group of public comparables and

applying illiquidity discounts

Due diligence:

Due diligence is important because:

PE funds show strong persistence of returns over time.

Difference between performances of funds is extremely large.

Duration of an investments is typically shorter that the maximum life of the fund.

LO.g: Explain risks and costs of investing in private equity.

The risks are:

Illiquidity of investments

Unquoted investments

Competition for attractive investment opportunities

Reliance on management of investee companies

Loss of capital

Government regulations

Taxation risk

Valuation of investments

Lack of investment capital

Lack of diversification

Market risk

The costs are:

Copyright IFT. All rights reserved www.ift.world Page 25

R45 Private Equity Valuation IFT Notes

Transaction fees

Investment vehicle fund setup costs

Administrative costs

Audit costs

Management and performance fees

Dilution

Placement fees

LO.h: Interpret and compare financial performance of private equity funds from the

perspective of an investor.

Analysis of private equity funds financial performance includes the following:

Gross IRR: Relates to cash flows between the fund and its portfolio companies. It is

considered a good measure of the investment management teams track record in creating

value.

Net IRR: Relates to cash flows between the fund and LPs. It measures the returns to

investors.

PIC (paid in capital): The ratio of paid in capital to date divided by committed capital.

DPI (distributed to paid in): Cumulative distributions paid out to LPs as a proportion of

the cumulative invested capital. DPI is presented net of management fees and carried

interest.

RVPI (residual value to paid in): Value of LPs shareholding held with the private equity

fund as a proportion of the cumulative invested capital. RVPI is presented net of

management fees and carried interest.

TVPI (total value to paid in): The portfolio companies distributed and undistributed

value as a proportion of the cumulative invested capital. TVPI is the sum of DPI and

RVPI. TVPI is presented net of management fees and carried interest

LO.i: Calculate management fees, carried interest, net asset value, distributed to paid in

(DPI), residual value to paid in (RVPI), and total value to paid in (TVPI) of a private

equity fund.

Copyright IFT. All rights reserved www.ift.world Page 26

R45 Private Equity Valuation IFT Notes

Refer to Section 4 from the curriculum.

LO.j: Calculate pre-money valuation, post-money valuation, ownership fraction, and price

per share applying the venture capital method 1) with single and multiple financing rounds

and 2) in terms of IRR.

Refer to the appendix section from the curriculum. The highlights are:

The general case formulae are-

General Case/Formula

1. Post-Money Valuation POST = V/(1 + r)t

2. Pre-Money Valuation PRE=POST I

3. Ownership Fraction F = I/POST

4. Number of Shares Y = x [ F / (1 F) ]

5. Price of Share P1= I/y

IRR and NPV method give the same answer as the venture capital method.

Cases with multiple rounds of financing can be solved using the same approach but be

careful about dilution and number of shares.

LO.k: Demonstrate alternative methods to account for risk in venture capital.

The different methods to account for risk include:

Using a very high discount rate

Using a normal discount rate but assume a probability of failure for each year

Allowing a variety of scenarios and then taking a probability weighted terminal value

Copyright IFT. All rights reserved www.ift.world Page 27

You might also like

- VCMethod PDFDocument10 pagesVCMethod PDFMichel KropfNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Private EquityDocument26 pagesPrivate EquityinaNo ratings yet

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- Lecture 5 - A Note On Valuation in Private EquityDocument85 pagesLecture 5 - A Note On Valuation in Private EquitySinan DenizNo ratings yet

- Venture Capital .FundsDocument44 pagesVenture Capital .Fundskeshav_26No ratings yet

- VC Framework Evaluating Start Ups KaplanDocument60 pagesVC Framework Evaluating Start Ups Kaplanerigonatti9102100% (1)

- Asian Financial Statement Analysis: Detecting Financial IrregularitiesFrom EverandAsian Financial Statement Analysis: Detecting Financial IrregularitiesNo ratings yet

- LEK - Valuation TechniquesDocument42 pagesLEK - Valuation TechniquesCommodityNo ratings yet

- Investment Leadership and Portfolio Management: The Path to Successful Stewardship for Investment FirmsFrom EverandInvestment Leadership and Portfolio Management: The Path to Successful Stewardship for Investment FirmsNo ratings yet

- Demystifying Venture Capital Economics Part 2Document4 pagesDemystifying Venture Capital Economics Part 2Tarek FahimNo ratings yet

- Finance Placement Preparation GuideDocument14 pagesFinance Placement Preparation GuideYash NyatiNo ratings yet

- Private Equity Valuation - BrochureDocument5 pagesPrivate Equity Valuation - BrochureJustine9910% (1)

- Corporate Finance Fundamentals - Course PresentationDocument85 pagesCorporate Finance Fundamentals - Course PresentationAngie WandyNo ratings yet

- 04 - VC Fund PerformanceDocument22 pages04 - VC Fund Performancejkkkkkkkkkretretretr100% (1)

- 06 12 LBO Model Quiz Questions Basic PDFDocument16 pages06 12 LBO Model Quiz Questions Basic PDFVarun AgarwalNo ratings yet

- The Handbook of Financing GrowthDocument6 pagesThe Handbook of Financing GrowthJeahMaureenDominguezNo ratings yet

- Disstressed AnalysisDocument5 pagesDisstressed Analysisrafael castro ruiz100% (1)

- 2024 L1 CorpIssuersDocument73 pages2024 L1 CorpIssuershamna wahabNo ratings yet

- Axial - 7 MA Documents DemystifiedDocument23 pagesAxial - 7 MA Documents DemystifiedcubanninjaNo ratings yet

- PWC Valuing Consumer Product BrandsDocument12 pagesPWC Valuing Consumer Product BrandsPranav PanchalNo ratings yet

- Training The Street PrimersDocument30 pagesTraining The Street PrimersRyan MarloweNo ratings yet

- (BIWS) Quick Reference - Purchase Price AllocationDocument7 pages(BIWS) Quick Reference - Purchase Price AllocationgreenpostitNo ratings yet

- Final Countdown Level 1Document132 pagesFinal Countdown Level 1Mani Manandhar100% (1)

- R41 Valuation of Contingent Claims IFT Notes PDFDocument28 pagesR41 Valuation of Contingent Claims IFT Notes PDFZidane Khan100% (1)

- Concepts in A VC TransactionDocument2 pagesConcepts in A VC TransactionStartup Tool KitNo ratings yet

- Venture Capital Private Equity Multiples-Based Valuation Discounted Cash FlowDocument7 pagesVenture Capital Private Equity Multiples-Based Valuation Discounted Cash FlowSarah DetoitoNo ratings yet

- Lecture 2 Venture CapitalDocument40 pagesLecture 2 Venture Capitalw_fib100% (1)

- Private Equity Case StudyDocument11 pagesPrivate Equity Case StudyAmineBekkalNo ratings yet

- Inv 3 Investment Committee MemorandumDocument4 pagesInv 3 Investment Committee MemorandumvelquerNo ratings yet

- Venture Debt QsDocument1 pageVenture Debt QsLenny LiNo ratings yet

- Equity - Valuation Introduction PDFDocument17 pagesEquity - Valuation Introduction PDFhukaNo ratings yet

- NB Private Equity Partners Ltd.Document68 pagesNB Private Equity Partners Ltd.ArvinLedesmaChiong100% (1)

- Unit Economics - 1Document11 pagesUnit Economics - 1Sai TejaNo ratings yet

- Paper LBODocument2 pagesPaper LBOAljon Del Rosario0% (1)

- Leveraged Buyout Analysis - Street of Walls PDFDocument13 pagesLeveraged Buyout Analysis - Street of Walls PDFWeijing LiNo ratings yet

- DA4399 CFA Level III Quick SheetDocument9 pagesDA4399 CFA Level III Quick SheetJackNo ratings yet

- Cheat Sheet (Bloomberg's Level I CFA (R) Exam Prep) PDFDocument7 pagesCheat Sheet (Bloomberg's Level I CFA (R) Exam Prep) PDFCriminal Chowdhury100% (1)

- Investment Process at VC FirmsDocument60 pagesInvestment Process at VC FirmsEvgeniy Shlieffier100% (1)

- Reading 45-Private Equity Valuation-QuestionDocument20 pagesReading 45-Private Equity Valuation-QuestionThekkla Zena100% (1)

- Wso CoverletterDocument1 pageWso CoverletterJack JacintoNo ratings yet

- Private Equity and Pricing Value CreationDocument12 pagesPrivate Equity and Pricing Value CreationANUSHKA GOYALNo ratings yet

- LBO TutorialDocument8 pagesLBO Tutorialissam chleuhNo ratings yet

- Michael Mauboussin - Long-Term Investing in A Short Term World 5-18-06Document17 pagesMichael Mauboussin - Long-Term Investing in A Short Term World 5-18-06Phaedrus34No ratings yet

- DCF Model TemplateDocument6 pagesDCF Model TemplateHamda AkbarNo ratings yet

- AMT - Valuation IssuesDocument60 pagesAMT - Valuation Issuesalexander ThielNo ratings yet

- Technical Interview Questions - IB and S&TDocument5 pagesTechnical Interview Questions - IB and S&TJack JacintoNo ratings yet

- Lecture 2 VC Valuation ESSEC PDFDocument16 pagesLecture 2 VC Valuation ESSEC PDFmerag76668No ratings yet

- Merits of CFROIDocument7 pagesMerits of CFROIfreemind3682No ratings yet

- Debt Service Coverage Ratio DSCR Net Income/ DebtDocument10 pagesDebt Service Coverage Ratio DSCR Net Income/ DebtAlvaroDeCampsNo ratings yet

- Lecture 4 Leveraged Buyouts 1Document34 pagesLecture 4 Leveraged Buyouts 1w_fibNo ratings yet

- IB Interview Guide, Module 3: Deal Discussion Example - ADT (Leveraged Buyout)Document3 pagesIB Interview Guide, Module 3: Deal Discussion Example - ADT (Leveraged Buyout)Sofia MouraNo ratings yet

- Technical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEDocument30 pagesTechnical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEJayant Sharma100% (1)

- Vault GuideDocument414 pagesVault Guidethum_liangNo ratings yet

- Answering Why Private EquityDocument5 pagesAnswering Why Private Equityjobsfor karthikanNo ratings yet

- Common Errors in DCF ModelsDocument12 pagesCommon Errors in DCF Modelsrslamba1100% (2)

- Export Trade and DocumentationDocument248 pagesExport Trade and DocumentationSaudiDiesel SdecNo ratings yet

- Internship Report On The Bank of PunjabDocument91 pagesInternship Report On The Bank of PunjabArslan73% (22)

- Paper f5 Mnemonics Sample Download v2Document54 pagesPaper f5 Mnemonics Sample Download v2jkjiwaniNo ratings yet

- Generally Accepted Accounting Principles (GAAP)Document7 pagesGenerally Accepted Accounting Principles (GAAP)Laxmi GurungNo ratings yet

- Sole Proprietor-Wps OfficeDocument11 pagesSole Proprietor-Wps OfficeSHIVAM PANCHALNo ratings yet

- IndramaniDocument1 pageIndramaniBalraj BawaNo ratings yet

- Serbian Aerospace Industry 2015 PDFDocument36 pagesSerbian Aerospace Industry 2015 PDFDalia MuraddNo ratings yet

- Total Old Paper Final Eco401Document49 pagesTotal Old Paper Final Eco401Syed Faisal Bukhari100% (1)

- Railway Service Pension Rules 1993 PDFDocument149 pagesRailway Service Pension Rules 1993 PDFAnil100% (1)

- Trial Balance (QUEEN TOYS)Document1 pageTrial Balance (QUEEN TOYS)Arum AnnisaNo ratings yet

- Tutorial 8 - CIT Problems - Sample AnswerDocument13 pagesTutorial 8 - CIT Problems - Sample Answerhien cungNo ratings yet

- Portfolio Management SumsDocument4 pagesPortfolio Management SumsPratik Rambhia0% (1)

- Elements. Chapter 10 Market FailuresDocument15 pagesElements. Chapter 10 Market FailuresJoshuaReynaldoNo ratings yet

- UntitledDocument39 pagesUntitledManuel CeciNo ratings yet

- Teuer B DataDocument41 pagesTeuer B DataAishwary Gupta100% (1)

- Free Automotive Repair Shop Business Plan: For Raising Capital From Investors, Banks, or Grant Companies!Document10 pagesFree Automotive Repair Shop Business Plan: For Raising Capital From Investors, Banks, or Grant Companies!mramkumaNo ratings yet

- The Companies Act (Cap .85) : Eastern African Fine Coffees Association (Eafca)Document14 pagesThe Companies Act (Cap .85) : Eastern African Fine Coffees Association (Eafca)Nakul Chandak0% (1)

- Inflation With Capital BudgetingDocument10 pagesInflation With Capital BudgetingRUMA AKTERNo ratings yet

- LGU PRIMER For Local HousingDocument60 pagesLGU PRIMER For Local HousingDon Vincent Busto100% (2)

- HomeSoft Business Plan PDFDocument30 pagesHomeSoft Business Plan PDFSiddarth BhusanshettyNo ratings yet

- Opportunity ScreeningDocument83 pagesOpportunity ScreeningHannah Patricia PerezNo ratings yet

- Questions A B C D EDocument9 pagesQuestions A B C D EMhelveneNo ratings yet

- HW - AFM - E7-25, E7-28, P7-42 - Kelompok 8Document7 pagesHW - AFM - E7-25, E7-28, P7-42 - Kelompok 8swear to the skyNo ratings yet

- Types of Strategies SalimDocument62 pagesTypes of Strategies SalimAshLee0% (1)

- Tax - Sababan's NotesDocument120 pagesTax - Sababan's NotesfranceheartNo ratings yet

- Cost Allocation: Joint Products and ByproductsDocument54 pagesCost Allocation: Joint Products and ByproductsMicka EllahNo ratings yet

- Cash ManagementDocument5 pagesCash ManagementPYNJIMENEZNo ratings yet

- Managerial Accounting Chapter 1 ExercisesDocument3 pagesManagerial Accounting Chapter 1 ExercisesAngelica Lorenz100% (2)

- Five ForcesDocument2 pagesFive ForcesJavaid NasirNo ratings yet

- E0012 Payslip Template With CalculatorDocument2 pagesE0012 Payslip Template With CalculatorPTO Zamboanga del SurNo ratings yet

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldFrom EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldRating: 4.5 out of 5 stars4.5/5 (55)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyFrom EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyRating: 4 out of 5 stars4/5 (51)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziFrom Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNo ratings yet

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldFrom EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldRating: 4.5 out of 5 stars4.5/5 (107)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The AI Advantage: How to Put the Artificial Intelligence Revolution to WorkFrom EverandThe AI Advantage: How to Put the Artificial Intelligence Revolution to WorkRating: 4 out of 5 stars4/5 (7)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- YouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelFrom EverandYouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelRating: 4.5 out of 5 stars4.5/5 (48)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (709)

- An Ugly Truth: Inside Facebook's Battle for DominationFrom EverandAn Ugly Truth: Inside Facebook's Battle for DominationRating: 4 out of 5 stars4/5 (33)

- Four Battlegrounds: Power in the Age of Artificial IntelligenceFrom EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceRating: 5 out of 5 stars5/5 (5)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingFrom EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingRating: 4.5 out of 5 stars4.5/5 (41)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesFrom EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesRating: 4.5 out of 5 stars4.5/5 (13)

- Artificial Intelligence & Generative AI for Beginners: The Complete GuideFrom EverandArtificial Intelligence & Generative AI for Beginners: The Complete GuideRating: 5 out of 5 stars5/5 (1)

- How to Do Nothing: Resisting the Attention EconomyFrom EverandHow to Do Nothing: Resisting the Attention EconomyRating: 4 out of 5 stars4/5 (421)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)