Professional Documents

Culture Documents

Gratuity Eligibility 4 Years 8 Months Service Gratuity Judgement 240 Days PDF

Uploaded by

Maddipatla Rajendra Durgapathi Naidu0 ratings0% found this document useful (0 votes)

233 views3 pagesOriginal Title

94783-gratuity-eligibility-4-years-8-months-service-gratuity-judgement-240-days (1).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

233 views3 pagesGratuity Eligibility 4 Years 8 Months Service Gratuity Judgement 240 Days PDF

Uploaded by

Maddipatla Rajendra Durgapathi NaiduCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

~r 1998 LLR 1072

MADRAS mGa COURT

:y

Hon~ble Mr. S.M. Abdul Wahab~ J.

W.P. No. 21350f1987

1,

1- Decided on 12.6.1996

I MetturBeardseU Ltd. (represented by Its

1. Personnel Manager), Madras

1- vs.

Regional Labour Commissioner (Central)

:0 (Authority under Payment of Gratuity Act).

1. Madras & Others

)r A. PAYMENT OF GRATUITY ACT~ 1972-

:0 Sections 2(a), 2(b), 2(c), 2(e) and 2A -

'Continuous serVice' -

Qualifying pe-

t-

:0

riod of service by an employee - En-

titlement of Gratuity - An employee

Ie rendering continuous service for a pe-

'e riod of 240 days in a year will be

d deemed to have continued in service

,e for 'one year as stipulated by section 2A

u

e

-

of the Act Thus an employee who has

P.ut in service for 10 months and 18

days for the fifth year subsequent to

y first 4 years should be deemed to have

g completed continuous s6rvice of five

11

I-

-

years His claim for gratuity is tenable.

. Para 5

g

S

1-

B. PAYMENT OF GRATUITY ACT, 1972 -

S Claim by an employee from the new

partnership firm for the service ren-

-

.

dered with previous firm Whether his

.-

claim for gratuity sustainable? Yes. .

e

d

1998 Mettur BeardseU Ltd.. Madras v. Regional Labour Commissioner (Central). Madras & Others 1073

HELD exceeding. Rs. 1.000. Hence. on these

Anemployee will be entitled to get gratuity for grounds the claim of the third respondent

the seroices rendered. with previous partner- must be rejected. The claim was entertained

ship.ftmt because at the time of entertrig into by the second respondent in P.G. Application

new partnership jU:m the petitlDner has rwt No. 49 of 1985 under S. 7(4) of the Payment of

taken any W1dertaking from the employees Gratuity Act. But it was dismissed on 15 April

that they will become employees of new part- 1986 on the ground that he was not an em-

nershipfirm. Para 5 ployee for a pertod of not less than five years

on wages not exceeding Rs. 1.000 within the

meaning of explanation 2(e) of the Payment of

CASES Rltl'BRRED

Gratuity Act.

1. P. Raghavulu and Sons v. Addfttonal Labour Court.

1985-1LLN612. . 2. As against the said order. the third re-

2. Surendra Kumar Verma v. Central Government In- spondent preferred an appeal to the first re-

dustrial Trfbunal-cum-labour Court. New Delhi & spondent under S. 7(7) of the Payment of Gra-

Anr.1980-11 LLN456. tuityAct in P.G. Appeal No. 58 of 1986. On 31

December 1986 the first respondent passed

ForPetitioner: Sh S. Ravindran. Advocate. orders holding that the third respondent's

wages crossed Rs. 1.000 only on 10 November

ForRespondents: Smt. Meera Gupta. Ms. R 1982 and he had put in four years 10 months

Vaigaiand Sh. Anna Mathew."Advocates. and 18 days service. Hence there was con-

tinuous semce under S; 2A of the Payment of

.JUDGMENT Gratuity Act. He must be deemed to have

This writ petition is for a writ of certiorCJrito completed continuous service of five years. In

quash the order. dated 31 December 1986. in the said view the first respondent allowed the

P.G. Appeal No. 58 of 1986 on the file of the appeal of the third respondent. Therefore. the

first respondent. The cas~ of the petitioner is petitioner has preferred this writ petition un-

that on 23 December 1977 the third respon- der Art. 226 of the Constitution ofIndia.

dent was appointed as salesman and he was 3. The third respondent filed a counter. In

assigned to the thread division. From 1 Janu- the counter he has mainly stated that he has

ary 1983. Mettur Textiles (Private). Ltd.. came produced documentary evidence to show that

to be known as Mettur Textiles. Thus the from 23.November 1977 to 4 November 1982

third respondent became an employee of the he was paid less than Rs. 1.000 and the con-

MetturTextiles from 1 January 1983. Accord- tention that fiveyears calendar service is nec-

ing to the petitioner. he ceased to be an-em- essary is untenable. He also contended that

ployee of Mettur Textiles. Ltd.. with effect the transfer of service from the petitioner to

from 31 December 1982. On 31 January Mettur Textiles did not cut his length of ser-

1983 the. third respondent resigned from the vice. Further his resignation was accepted

services and relieved on the said date. He was only by the writ-petiti()ner. as is evidenced by

getting Rs. 1.335 as monthly salary. Since. Exhibit P-5.

according to the third respondent. his basic 4. Now I will examine the contentions raised

salary crossed Rs. 1.000 with effect from 10 . by the learned counsel for the petitioner. Sec-

November 1982. he made a claim on 3 Marchtion 2(e)of the Payment of Gratuity Act was as

1983 for gratuity from Mettur Textiles. Hav- follows. before the amendment: .

ing failed in his attempt to get gratuity from '''employee'means any person (other than

Mettur Textiles. he preferred a claim on 14 an apprentice) employed on wages. not

February 19~5 against Mettur Beardsell. the exceeding one thousand rupees per

petitioner herein. The claim.was after a delay mensem. in any establishment. factory.

of two years and one month. The claim was mine. oil field.. plantation. port. railway

resisted by the petitioner on the ground that company or shop. to do any skilled. semi-

he ceased to be an employee with them from skilled. or unskilled. manual. supervi"

31 I;>ecember 1982. Further. he was not em- sory. technical or clertcal work. whether

played for a period of five years on a wage not the terms of such employment are ex-

- 1

1074 Divisional Controller. G.S.R.C. v. C.J. Rana LLR I

press or implied. but does not include any tablishments Act. 1966. providing for treating I

such person who is employed in a mana- a fraction of a year exceeding six months as a

gerial or administrative capacity. or who year and a fraction of a year less than six

holds a civil post under the Central Gov- months as not a year. The contention that

ernment or a State Government. or who is was accepted by the learned Judge was that

subject to the Air Force Act. 1950 the the aforesaid explanation applies only for cal-

Army Act. 1950. or the Navy Act. 1957." culating the period for which gratuity is pay-

B. Section 2A defines continuous service. able and not applicable to the qualifying pe-

According to this section. if an employee ren- riod of years. The learned judge has probably

ders continuous service for a period of 240 relied upon the words. "for. which gratuity is

days in a year he will be deemed to have con- to be given." m. s. 40(1) of the Andhra Pradesh

, tinued in service for one year. This deeming Shops and Establishments Act. 1966. But

provision contained in S. ,2A must be applied this decision is not applicable to our case be-

in interpreting the period of five years men- cause as stated above the definitions of "one

tioned in S. 4(1). Section 2(b) also supports year." "completed year," "continuous year."

this interpretation because as per the said under Ss. 2(aJ. 2(b) and 2(c) go to show that

section completed year of sen1ce means con- whenever year is mentioned in the enact-

-tinuous service for one year. Therefore. these ment, it must be taken as the year defined in

provisions are emphatic in stating that if the the aforesaid provisions. Another contention

employee serves continuously for a period of raised by the learned counsel for the peti-

240 days in a year. he must be deemed to tioner is that the petitioner-company ceased

have continuously served for one year. In this to exist after it was merged with MeUur

case ~dmittedly ~e third respondent has Beardsell, Ltd.. with effect from 1 January

served for 4 years, 10 months and 18 days. 10 1983. But this contention is untenable be-

months and 18 days service is definitely more cause at the time of entennginto partnership

than 240 days. Therefore when the third re- the petitioner has not taken any undertaking

spondent was relieved from service he has from the employees that they will become em-

thus completed five years of service. In the de- ployees of the new partnership firm MeUur

cision reported in Surendra Kumar Verma v. Textiles. and cease to be employees of the

Central Government Industrial Tribunal-cum- MeUur Beardsell. Ltd. But. as found earlier.

Labour Court. New Delhi. and Another the third respondent was relived only by the

(1980(2) LLN 456]. their Lordships have ob- petitioner. Therefore. I am not convinced with

served as follows. in Para. 13. at page 462: the contentions raised by the learned counsel

... It is sufficient for the purpose of S. for the petitioner. Hence the writ petition fails

25B(2)(a)(ti) that he has actually worked and it is dismissed. However, there will be no

for not less than 240 days. It is no longer order as to costs.

necessary fora workman to show that he

has been in employment during a preced-

ing period of twelve calendar months in

order to qualify within the terms of S.

258..." 1998LLR 1074

The learned counsel for the petitioner relied GUJARATmGB COURT

upon a case reported in P. Raghuvulu W1Sons

v. Additional Labour Court (1985 (1)LLN612). Hon"ble Mr. R. A. Mehta, J.

A Single Judge of the Andhra Pradesh High Special CivilApplication No. 11407 of 1994

Court has held the service rendered for 4 Decided on 3.3.1998.

years and 11 months and 10 days will not en-

able an employee to avail gratuity. The said Divisional Controller, G.B.R.C.

case arises under the Andhra Pradesh Shops VS.

and Establishments Act. 1966. The question

was whether as per Cl. (d)of explanation to S. C.J. Rana

40(1) of the Andhra Pradesh Shops and Es-

You might also like

- 4 - Odd Hours - Dean KoontzDocument261 pages4 - Odd Hours - Dean KoontzJustinSnow80% (5)

- Wrongful TerminationDocument49 pagesWrongful TerminationSudeep SharmaNo ratings yet

- Dr. Berg's Favorite HEALTHY JUNK FOODS & Other AlternativesDocument23 pagesDr. Berg's Favorite HEALTHY JUNK FOODS & Other Alternativesprashant_padte100% (8)

- All Act Statutory Compliances Xls Download Statutory ComplianceDocument29 pagesAll Act Statutory Compliances Xls Download Statutory ComplianceAditya Mishra100% (1)

- Statement of Claim in Labour CourtDocument16 pagesStatement of Claim in Labour Courtiona_hegdeNo ratings yet

- Chapter 8 Money Markets Multiple Choice QuestionsDocument9 pagesChapter 8 Money Markets Multiple Choice QuestionsMei YunNo ratings yet

- Medical PhysicsDocument81 pagesMedical Physicsroni roniNo ratings yet

- Statutory Check List in ExcelDocument160 pagesStatutory Check List in ExcelShweta Singh50% (2)

- NHAI PPT EditedDocument16 pagesNHAI PPT EditedArunjeet Singh100% (1)

- Key Features of EPF Act 1952Document3 pagesKey Features of EPF Act 1952Fency Jenus67% (3)

- Maharashtra ResultDocument228 pagesMaharashtra ResultVIJAY VADGAONKAR0% (1)

- No Objection Certificate (Noc) : To Whomsoever It May ConcernDocument1 pageNo Objection Certificate (Noc) : To Whomsoever It May Concernjmpnv00733% (3)

- Reply to notice unable to provide CCTV footageDocument1 pageReply to notice unable to provide CCTV footageAbhishek YadavNo ratings yet

- Sample Gratuity-Nomination-Form-FDocument2 pagesSample Gratuity-Nomination-Form-FAnkit0% (1)

- Form For Registration of New Firm Centeral Police CanteenDocument24 pagesForm For Registration of New Firm Centeral Police Canteenanon_38851431173% (15)

- Factories Act - Final For PrintDocument21 pagesFactories Act - Final For PrintRamesh Kumar RNo ratings yet

- Pharmacy Bill Format in ExcelDocument1 pagePharmacy Bill Format in ExcelselvapdmNo ratings yet

- Tax Invoice: Roltech InfotechDocument1 pageTax Invoice: Roltech InfotechSunil PatelNo ratings yet

- Partnership DeedDocument2 pagesPartnership DeedSafal Visa71% (7)

- Apollo Medicine InvoiceOct 13 2022-19-37Document1 pageApollo Medicine InvoiceOct 13 2022-19-37mani kandanNo ratings yet

- Draft ReplyDocument4 pagesDraft ReplyAakash Garg100% (1)

- Sample Fir Format For Stolen MobileDocument1 pageSample Fir Format For Stolen Mobilekobi kafu0% (1)

- The Minimum Wages Act: Key Provisions ExplainedDocument40 pagesThe Minimum Wages Act: Key Provisions ExplainedAyisha Patnaik50% (2)

- Ritu Sharma ResumeDocument3 pagesRitu Sharma Resumekundan_khatu82% (44)

- Labour Court Ruling on Worker's Application for BenefitsDocument10 pagesLabour Court Ruling on Worker's Application for BenefitsAbdul Jabbar ShaikhNo ratings yet

- HSN Code & GST Tax Rate List For General Store and Kirana ItemsDocument9 pagesHSN Code & GST Tax Rate List For General Store and Kirana ItemsNirmal jainNo ratings yet

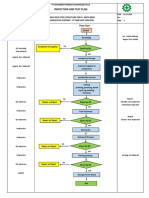

- Inspection and Test Plan: Flow Chart Start IncomingDocument1 pageInspection and Test Plan: Flow Chart Start IncomingSinden AyuNo ratings yet

- DD Covering LetterDocument1 pageDD Covering LetterKarthik Gopika67% (6)

- Tax invoice broadband planDocument1 pageTax invoice broadband planvijaya lakshmiNo ratings yet

- Workman Under Industrial Dispute ActDocument22 pagesWorkman Under Industrial Dispute ActHanu Mittal80% (5)

- OEM Certification Letter for Unbranded Product Model Mgr09Document1 pageOEM Certification Letter for Unbranded Product Model Mgr09Hussain Shaikh67% (3)

- Form IV - Annual ReturnDocument2 pagesForm IV - Annual Returnhdpanchal86No ratings yet

- Contract Labour Rules - MaharashtraDocument11 pagesContract Labour Rules - Maharashtravenkateswarant100% (1)

- Chapter 5A and 5B of Industrial Disputes Act 1947-Applicability - Dr. G.PDocument6 pagesChapter 5A and 5B of Industrial Disputes Act 1947-Applicability - Dr. G.PSamir MishraNo ratings yet

- Steps To Setup An Industry in GujaratDocument2 pagesSteps To Setup An Industry in GujaratIndustrialpropertyinNo ratings yet

- School of Law Faculty of Mittal School of Business Name of The Faculty Member DR. FAROZE AHMAD CHOPANDocument4 pagesSchool of Law Faculty of Mittal School of Business Name of The Faculty Member DR. FAROZE AHMAD CHOPANKathuria Aman50% (2)

- Trademark NOC FormatDocument1 pageTrademark NOC FormatVIBHOR100% (1)

- Statement in Lieu of ProspectusDocument1 pageStatement in Lieu of ProspectusYashJainNo ratings yet

- ONGC v Saw Pipes arbitration award overturnedDocument9 pagesONGC v Saw Pipes arbitration award overturnedAkshayMankar100% (1)

- Cost Analysis Sheet DaburDocument11 pagesCost Analysis Sheet DaburrohitNo ratings yet

- Presentation On Case Law - Vishaka & Ors Vs State of Rajasthan & OrsDocument24 pagesPresentation On Case Law - Vishaka & Ors Vs State of Rajasthan & OrsDishant Doshi DoshiNo ratings yet

- An Application For Fixation of Standard RentDocument2 pagesAn Application For Fixation of Standard RentPalash Banerjee100% (1)

- Royalty AccountsDocument5 pagesRoyalty AccountsRobert Henson100% (2)

- Bajaj Auto Limited Vs Ashok Dnyanoba Dhumal and OrM050923COM946114Document7 pagesBajaj Auto Limited Vs Ashok Dnyanoba Dhumal and OrM050923COM946114nivruthi0411No ratings yet

- Supreme Court Rules on Layoff Compensation DisputeDocument12 pagesSupreme Court Rules on Layoff Compensation DisputeYogesh MahajanNo ratings yet

- EOBI Production of RecordDocument10 pagesEOBI Production of RecordSaddy MehmoodbuttNo ratings yet

- NM Mehta Vs Coromandal Fertilizers LTD and Ors 080A760207COM627373Document11 pagesNM Mehta Vs Coromandal Fertilizers LTD and Ors 080A760207COM627373Shreya ModiNo ratings yet

- Alchemist LTD Vs Dinesh Chandra Tripathi and Ors 0UP2019170120155449324COM901174Document19 pagesAlchemist LTD Vs Dinesh Chandra Tripathi and Ors 0UP2019170120155449324COM901174ranjanjhallbNo ratings yet

- Labour LawDocument9 pagesLabour LawFarisya HanisNo ratings yet

- ESI Act extension to shops upheldDocument2 pagesESI Act extension to shops upheldanks12345No ratings yet

- Case Law - Gratuity (Defined Continuos Employment)Document5 pagesCase Law - Gratuity (Defined Continuos Employment)sineth amarasingheNo ratings yet

- In The Maharashtra Administrative Tribunal MumbaiDocument8 pagesIn The Maharashtra Administrative Tribunal MumbaiTanuja Sawant 50No ratings yet

- PART 1 Page 1 To 240Document163 pagesPART 1 Page 1 To 240Krishna KanthNo ratings yet

- Mercidar Fishing Corp vs. NLRCDocument2 pagesMercidar Fishing Corp vs. NLRCMj BrionesNo ratings yet

- High Court of Jammu & Kashmir and Ladakh at Jammu: Reserved On: 28.08.2023 Pronounced On: 09.11.2023Document32 pagesHigh Court of Jammu & Kashmir and Ladakh at Jammu: Reserved On: 28.08.2023 Pronounced On: 09.11.2023KooksNo ratings yet

- MTIz NTM0 Y2 Ztcy 1 K YzgzDocument10 pagesMTIz NTM0 Y2 Ztcy 1 K YzgzMuhammad SheryarNo ratings yet

- Labour Court Upholds Workman's ReinstatementDocument4 pagesLabour Court Upholds Workman's ReinstatementHusen AliNo ratings yet

- HRM Case PDFDocument4 pagesHRM Case PDFHusen AliNo ratings yet

- Judgment Cadila Healthcare 488902Document12 pagesJudgment Cadila Healthcare 488902venkatNo ratings yet

- Oswal Case StudyDocument7 pagesOswal Case StudyayeshaNo ratings yet

- Union of India (Uoi) Vs Tata Engineering & Locomotive Co (1) - ... On 7 February, 1989Document4 pagesUnion of India (Uoi) Vs Tata Engineering & Locomotive Co (1) - ... On 7 February, 1989sangram singhNo ratings yet

- Buiser vs. Leogardo, G. R. No. L-63316, July 31, 1984Document8 pagesBuiser vs. Leogardo, G. R. No. L-63316, July 31, 1984almond 13No ratings yet

- 2022 S C M R 1171Document7 pages2022 S C M R 1171faisalpro584No ratings yet

- For The Claimants - Mohan Ramakrishnan & Santhini Thanapalan M/s Ramakrishnan & AssociatesDocument15 pagesFor The Claimants - Mohan Ramakrishnan & Santhini Thanapalan M/s Ramakrishnan & AssociatesHanenFamNo ratings yet

- NLRC OverturnedDocument5 pagesNLRC OverturneddondzNo ratings yet

- Sources Of Water ExplainedDocument11 pagesSources Of Water ExplainedhiteshvNo ratings yet

- Nasa Guide3 5Document138 pagesNasa Guide3 5hiteshvNo ratings yet

- Capital Market Regulatory Insight - P.S.rao & AssociatesDocument43 pagesCapital Market Regulatory Insight - P.S.rao & AssociateshiteshvNo ratings yet

- Dabur India - Working Capital and Cost ManagementDocument15 pagesDabur India - Working Capital and Cost ManagementhiteshvNo ratings yet

- VERALLIA WHITE-BOOK EN March2022 PDFDocument48 pagesVERALLIA WHITE-BOOK EN March2022 PDFEugenio94No ratings yet

- Risk Management in Educational InstitutionsDocument8 pagesRisk Management in Educational InstitutionsBhoxszKurtjusticePascualNo ratings yet

- Edna Adan University ThesisDocument29 pagesEdna Adan University ThesisAbdi KhadarNo ratings yet

- Delta C200 Series AC Drives PDFDocument5 pagesDelta C200 Series AC Drives PDFspNo ratings yet

- Density of Aggregates: ObjectivesDocument4 pagesDensity of Aggregates: ObjectivesKit Gerald EliasNo ratings yet

- Dar Breathing Filter Hme SellsheetDocument2 pagesDar Breathing Filter Hme SellsheetmangkunegaraNo ratings yet

- Assessing Inclusive Ed-PhilDocument18 pagesAssessing Inclusive Ed-PhilElla MaglunobNo ratings yet

- ENGLISH TEST 9 SMPDocument4 pagesENGLISH TEST 9 SMPMariatul afniNo ratings yet

- SmithfieldDocument11 pagesSmithfieldandreea143No ratings yet

- IOSA Self Evaluation Form - 31 October 2014Document45 pagesIOSA Self Evaluation Form - 31 October 2014pknight2010No ratings yet

- G. Metals and NonmetalsDocument26 pagesG. Metals and NonmetalsKyzer Calix LaguitNo ratings yet

- Regulation of Body FluidsDocument7 pagesRegulation of Body FluidsRuth FamillaranNo ratings yet

- Ethnobotany Manual 14th September 2016Document54 pagesEthnobotany Manual 14th September 2016Rahul0% (1)

- Genset Ops Manual 69ug15 PDFDocument51 pagesGenset Ops Manual 69ug15 PDFAnonymous NYymdHgy100% (1)

- Kootenay Lake Pennywise October 17, 2017Document40 pagesKootenay Lake Pennywise October 17, 2017Pennywise PublishingNo ratings yet

- Oxihalide AcisDocument8 pagesOxihalide AcisDina Ikrama PutriNo ratings yet

- Electrolyte AE 11 - MSDSDocument8 pagesElectrolyte AE 11 - MSDSShinta Nugraha MughniNo ratings yet

- Specialized Connective TissueDocument15 pagesSpecialized Connective TissueSebNo ratings yet

- Refresher 2 (Pipe)Document12 pagesRefresher 2 (Pipe)Kira YagamiNo ratings yet

- Reading 1Document2 pagesReading 1Marcelo BorsiniNo ratings yet

- Limetas Maximos ResidualesDocument27 pagesLimetas Maximos ResidualesXjoelx Olaya GonzalesNo ratings yet

- Rainer M. Holm-Hadulla, Alina Bertolino: Use of Drugs by Jazz MusiciansDocument3 pagesRainer M. Holm-Hadulla, Alina Bertolino: Use of Drugs by Jazz MusiciansTitikshaNo ratings yet

- Disha Symbiosis 20th JulyDocument2 pagesDisha Symbiosis 20th JulyhippieatheartbalewadiNo ratings yet

- Gsis - Ra 8291Document33 pagesGsis - Ra 8291RoySantosMoralesNo ratings yet

- Lesson 8 - Philippine Disaster Risk Reduction and Management SystemDocument11 pagesLesson 8 - Philippine Disaster Risk Reduction and Management SystemMary Joy CuetoNo ratings yet

- Smart Goals ExerciseDocument2 pagesSmart Goals Exerciseapi-594661640No ratings yet