Professional Documents

Culture Documents

Capital Investment Decisions Answers To End of Chapter Exercises

Uploaded by

Jay BrockOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Investment Decisions Answers To End of Chapter Exercises

Uploaded by

Jay BrockCopyright:

Available Formats

1

Chapter 4

Capital Investment Decisions

Answers to End of Chapter Exercises

Q 4.1 Happy Ltd.

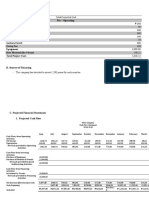

Year Disc. Fact. Present value 000 Payback

0 -5000 1 -5000.0

1 1600 0.8696 1391.4 -3400

2 1700 0.7561 1285.4 -1700

3 1660 0.6575 1091.4 -40

4 2400 0.5718 1372.3 2360

5 1400 0.4972 696.0

Net present value 836.5

Payback 3 years

Accounting rate of return

Average profit = 3,760,000/5 = 752,000

ARR = 752,000/5,000 = 15.04%

NPV = 836,481

Q 4.2

a) 14% 10%

Present value

Year Disc. Fact. 000 D. Factor Present value Payback

0 -600 1 -600.00 1 -600

1 160 0.8772 140.35 0.909091 145.45 -440

2 160 0.7695 123.11 0.826446 132.23 -280

3 160 0.6750 108.00 0.751315 120.21 -120

4 160 0.5921 94.73 0.683013 109.28 40

5 160 0.5194 83.10 0.620921 99.35

200

-50.71 6.53

Payback 3 years 9 months

Accounting rate of return

Average rate of profit = 200,000/5 = 40,000

ARR = 40,000/600,000 = 6.67%

NPV = -50,710

IRR = 10% + (6.53/57.24 x 4) = 10% + 0.11% = 10% to nearest 0.5%

b) Organisations use different measures. If cash flow is important then payback money may be

used. Theoretically the criterion to use is net present value, as this is consistent with

maximising shareholder value.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

2

Q 4.3

Annual cash saving

Old New Cash Saving

Labour 30,000 20,000 10,000

Material 720,000 690,000 30,000

Power 9000 4,000 5,000

Maintenance 15,000 10,000 5,000

774,000 724,000 50,000

Net cash

year Capital saving flow disc factor Present value

0 -160,000 -160,000 1 -160000

1 50,000 50,000 0.9091 45455

2 50,000 50,000 0.8264 41322

3 50,000 50,000 0.7513 37566

4 50,000 50,000 0.6830 34151

5 50,000 50,000 0.6209 31046

6 50,000 50,000 0.5645 28224

7 50,000 50,000 0.5132 25658

8 50,000 50,000 0.4665 23325

9 50,000 50,000 0.4241 21205

10 50,000 50,000 0.3855 19277

147228

Therefore the purchase of a new machine would lead to a positive net present value of

147,228 and therefore the purchase would be worthwhile.

Q 4.4

a)

'000 '000 '000 '000 '000

Net

Lost Cost cash

Year Capital contribution Training saving flow

-

0 -4000 -4000 1.0000 4000.00

1 -400 -20 1400 980 0.8772 859.65

2 1400 1400 0.7695 1077.25

3 1400 1400 0.6750 944.96

4 1400 1400 0.5921 828.91

5 1400 1400 0.5194 727.12

6 1000 1400 2400 0.4556 1093.41

1531.30

The project will generate a positive net present value of 1,531,000, and so is

worthwhile.

b) Will the improved quality lead to increased sales, no sales increase is currently included? Will

it be possible to sublet the space released for seven years?

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

3

Q 4.5

'000 '000 '000 '000 '000 '000 '000

Net

other Other sales cash Discount Present

year capital salary staff costs contribution flow factor value

-

0 -7000 -7000 1 7000.00

1 -1300 -120 -3800 -1500 7000 280 0.9174 256.88

2 -120 -3800 -1500 7350 1930 0.8417 1624.44

3 -120 -3800 -2000 7700 1780 0.7722 1374.49

4 -120 -3800 -2000 8050 2130 0.7084 1508.95

5 -120 -3800 -2000 8400 2480 0.6499 1611.83

5 90 -1000

-623.42

Year Sales '000

1 20,000

2 21,000

3 22,000

4 23,000

5 24,000

There is a negative net present value of 623,415 if the company proceeds with the proposal.

On that basis it is recommended that the company does not undertake the development.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

You might also like

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- Net Present ValueDocument6 pagesNet Present ValueIshita KapadiaNo ratings yet

- Capital Investment 12-1 To 6 PanisalesDocument8 pagesCapital Investment 12-1 To 6 PanisalesVincent PanisalesNo ratings yet

- Silvia Caffe - SolutionDocument1 pageSilvia Caffe - SolutionMurtaza BadriNo ratings yet

- Cab Case StudyDocument7 pagesCab Case StudyPriyanka GoenkaNo ratings yet

- Year Cash Flows: 1. Calculate The Present Value Annuity Discounted at 10%Document6 pagesYear Cash Flows: 1. Calculate The Present Value Annuity Discounted at 10%Dr. VinothNo ratings yet

- SNR Local Eggs ProjectDocument11 pagesSNR Local Eggs ProjectSANAKKAYALA NIRANJANNo ratings yet

- Financial Management Session 10Document11 pagesFinancial Management Session 10Shivangi MohpalNo ratings yet

- Mod 4 Valuation and ConceptsDocument5 pagesMod 4 Valuation and Conceptsvenice cambryNo ratings yet

- CF Assignment 1 Group 9Document51 pagesCF Assignment 1 Group 9rishabh tyagiNo ratings yet

- Itsa Excel SheetDocument7 pagesItsa Excel SheetraheelehsanNo ratings yet

- MDKA SucorDocument6 pagesMDKA SucorFathan MujibNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- TUGAS AKL - P4-7, P4-8 - Niken Liza Mayasari - AM4C - 4112101091Document17 pagesTUGAS AKL - P4-7, P4-8 - Niken Liza Mayasari - AM4C - 4112101091advokesmahmmbNo ratings yet

- Cap Bud SolutionsDocument17 pagesCap Bud SolutionsSwati PorwalNo ratings yet

- Essay QuestionsDocument16 pagesEssay QuestionssheldonNo ratings yet

- Capital Investment Break-Up: Marketing and PromotionDocument7 pagesCapital Investment Break-Up: Marketing and PromotionDeepak RamamoorthyNo ratings yet

- Case File 2.0Document4 pagesCase File 2.0abeer alamNo ratings yet

- Advanced Corporate Finance Case 1Document2 pagesAdvanced Corporate Finance Case 1Adrien PortemontNo ratings yet

- Activity 2 MIlca BSA 3 3Document6 pagesActivity 2 MIlca BSA 3 3kyrie IrvingNo ratings yet

- Solution Manual - Capital Budgeting Part 2Document21 pagesSolution Manual - Capital Budgeting Part 2Lab Dema-alaNo ratings yet

- Financial Model For Check SMEDocument6 pagesFinancial Model For Check SMEDhanunjai IitbNo ratings yet

- Capital Budgeting Class ExerciseDocument3 pagesCapital Budgeting Class ExerciseAryaman jaiswalNo ratings yet

- Year Project 1-Low Risk Project 2-High Risk Project 3 - Medium RiskDocument3 pagesYear Project 1-Low Risk Project 2-High Risk Project 3 - Medium RiskAkshaya LakshminarasimhanNo ratings yet

- Basic Underlying Accounting PrinciplesDocument67 pagesBasic Underlying Accounting Principlesraymond guintibanoNo ratings yet

- Financial PlanDocument9 pagesFinancial PlanFrancisco T. Del CastilloNo ratings yet

- Bond Valuation Version 1.xlsbDocument14 pagesBond Valuation Version 1.xlsbJessie jorgeNo ratings yet

- Acctg. 9 Prefi Quiz 1 KeyDocument3 pagesAcctg. 9 Prefi Quiz 1 KeyRica CatanguiNo ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- Group Assignment 1Document8 pagesGroup Assignment 1Tushar JainNo ratings yet

- Unit 14, 15 and 16 - SolutionDocument5 pagesUnit 14, 15 and 16 - SolutionHemant bhanawatNo ratings yet

- Dividend and Patronage Refund FinalDocument5 pagesDividend and Patronage Refund FinalJohnVerjoGeronimoNo ratings yet

- Hungry PediaDocument19 pagesHungry PediaPrashannaNo ratings yet

- Quiz 2 TableDocument5 pagesQuiz 2 TableSathish BNo ratings yet

- Particulers Quantity: Project CostDocument33 pagesParticulers Quantity: Project CostRashan GidaNo ratings yet

- Afm Capital Budgeting WorkoutDocument12 pagesAfm Capital Budgeting WorkoutDaniel HaileNo ratings yet

- Case Study CharlieDocument9 pagesCase Study CharlieHIMANSHU AGRAWALNo ratings yet

- Operating Profit - 200 2500 2500 2500 2500Document4 pagesOperating Profit - 200 2500 2500 2500 2500Archana J RetinueNo ratings yet

- Perhitungan Kriteria Investasi: Net Present Value (NPV)Document12 pagesPerhitungan Kriteria Investasi: Net Present Value (NPV)Nurul FitrianaNo ratings yet

- Without Discount With DiscountDocument13 pagesWithout Discount With DiscountleylaNo ratings yet

- Years Operating Cost Benefit Depreciation Net Benefit Old NewDocument8 pagesYears Operating Cost Benefit Depreciation Net Benefit Old NewBilal AhmedNo ratings yet

- Spicy Malunggay CookiesDocument19 pagesSpicy Malunggay CookiesChristine Margoux SiriosNo ratings yet

- Profitability RatioDocument11 pagesProfitability RatioNicole Kate PorrasNo ratings yet

- Particulers Quantity: Project CostDocument33 pagesParticulers Quantity: Project CostRashan GidaNo ratings yet

- Capital Budgeting SolutionDocument6 pagesCapital Budgeting SolutionAsad AliNo ratings yet

- Account Titles Trial Balance Adjustment Dr. Cr. Dr. CRDocument4 pagesAccount Titles Trial Balance Adjustment Dr. Cr. Dr. CRplaylist erikyoongNo ratings yet

- Latihan UTS AKUNDocument32 pagesLatihan UTS AKUNchittamahayantiNo ratings yet

- Perhitungan Cash FlowDocument10 pagesPerhitungan Cash FlowhafizhNo ratings yet

- Cash Flow ProjectionsDocument2 pagesCash Flow ProjectionsKabo LucasNo ratings yet

- Kangaroo Kids Limited: Particulars Amount (RS.) ParticularsDocument6 pagesKangaroo Kids Limited: Particulars Amount (RS.) ParticularsIshaan AgarwalNo ratings yet

- Cash Budgeting - Case1Document10 pagesCash Budgeting - Case1saurabh chaturvediNo ratings yet

- Lab 9 - What To Invest inDocument16 pagesLab 9 - What To Invest inbegum.ozturkNo ratings yet

- Financials - Dhobhi BhaiyaDocument9 pagesFinancials - Dhobhi Bhaiyaprince joshiNo ratings yet

- Cash Flow AnalysisDocument1 pageCash Flow AnalysisLULZNo ratings yet

- The Bass Model Unscrambling Regression Coefficients For P&QDocument4 pagesThe Bass Model Unscrambling Regression Coefficients For P&QCristhianNo ratings yet

- Statement of Financial Position 2018 2019 AssetsDocument19 pagesStatement of Financial Position 2018 2019 AssetsChristine Margoux SiriosNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Inventory Sales Accounts Receivable PurchasesDocument4 pagesInventory Sales Accounts Receivable PurchasesPhilip CastroNo ratings yet

- Solution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsDocument25 pagesSolution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsJay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document55 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document23 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Chapter 9 Transportation and Assignment Models: Quantitative Analysis For Management, 11e (Render)Document30 pagesChapter 9 Transportation and Assignment Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Document18 pagesChapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Aa2e Hal SM Ch09Document19 pagesAa2e Hal SM Ch09Jay BrockNo ratings yet

- Introduction To The Consolidation Process: Learning Objectives - Coverage by QuestionDocument21 pagesIntroduction To The Consolidation Process: Learning Objectives - Coverage by QuestionJay BrockNo ratings yet

- Chapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 13 Waiting Lines and Queuing Theory Models: Quantitative Analysis For Management, 11e (Render)Document34 pagesChapter 13 Waiting Lines and Queuing Theory Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Document32 pagesChapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Document36 pagesChapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Strategy and Control System Design Answer To End of Chapter ExercisesDocument5 pagesStrategy and Control System Design Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Chapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 1Document12 pagesChapter 1Dennisse M. Vázquez-Casiano IsraelNo ratings yet

- Measuring and Improving Internal Business Processes Answer To End of Chapter ExercisesDocument7 pagesMeasuring and Improving Internal Business Processes Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Evaluating Strategies and Writing The Business Plan Answer To End of Chapter ExercisesDocument4 pagesEvaluating Strategies and Writing The Business Plan Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Chapter 2 Probability Concepts and Applications: Quantitative Analysis For Management, 11e (Render)Document34 pagesChapter 2 Probability Concepts and Applications: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- CH23 PDFDocument5 pagesCH23 PDFJay BrockNo ratings yet

- Budgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesDocument2 pagesBudgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Measuring Shareholder Value Answer To End of Chapter ExercisesDocument5 pagesMeasuring Shareholder Value Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Identifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDDocument7 pagesIdentifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDJay BrockNo ratings yet

- Political: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesDocument6 pagesPolitical: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Funding The Business Answer To End of Chapter ExercisesDocument2 pagesFunding The Business Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Accounting and Strategic Analysis Answer To End of Chapter ExercisesDocument6 pagesAccounting and Strategic Analysis Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Internal Appraisal of The Organization Answer To End of Chapter ExercisesDocument5 pagesInternal Appraisal of The Organization Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Corporate Social Responsibility: Objectives, Strategy and Influences Answer To End of Chapter ExercisesDocument3 pagesCorporate Social Responsibility: Objectives, Strategy and Influences Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Standard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesDocument4 pagesStandard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Structural Analysis Cheat SheetDocument5 pagesStructural Analysis Cheat SheetByram Jennings100% (1)

- Types of Communicative StrategyDocument46 pagesTypes of Communicative StrategyMyra Bolinas100% (1)

- Elliot Kamilla - Literary Film Adaptation Form-Content DilemmaDocument14 pagesElliot Kamilla - Literary Film Adaptation Form-Content DilemmaDavid SalazarNo ratings yet

- Application of Schiff Base Ligamd ComplexDocument7 pagesApplication of Schiff Base Ligamd Complexrajbharaths1094No ratings yet

- Scientific Writing VerbsDocument3 pagesScientific Writing VerbsNejdetEXn100% (1)

- APQP TrainingDocument22 pagesAPQP TrainingSandeep Malik100% (1)

- Levels of Curriculum PlanningDocument3 pagesLevels of Curriculum Planningysndnl0% (1)

- Devi Strotam PDFDocument9 pagesDevi Strotam PDFDiary Of A Wise ManNo ratings yet

- Day 4 - 10.7-8 Notes HandoutDocument4 pagesDay 4 - 10.7-8 Notes HandoutRusherNo ratings yet

- Deep Learning Assignment 1 Solution: Name: Vivek Rana Roll No.: 1709113908Document5 pagesDeep Learning Assignment 1 Solution: Name: Vivek Rana Roll No.: 1709113908vikNo ratings yet

- Mythbusters - Archimedes Cannon QuestionsDocument2 pagesMythbusters - Archimedes Cannon QuestionsVictoria RojugbokanNo ratings yet

- Clinical Standards For Heart Disease 2010Document59 pagesClinical Standards For Heart Disease 2010Novita Dwi MardiningtyasNo ratings yet

- Psychological Science1Document23 pagesPsychological Science1Jatin RaghavNo ratings yet

- 4 Modes Operations RC4Document37 pages4 Modes Operations RC4Komal BansalNo ratings yet

- Cohort 2 Assignment Essay FinalDocument4 pagesCohort 2 Assignment Essay Finalapi-652640066No ratings yet

- E2.d Solar System FlipbookDocument39 pagesE2.d Solar System FlipbookSaurabh100% (1)

- Odisha State Museum-1Document26 pagesOdisha State Museum-1ajitkpatnaikNo ratings yet

- Market MikroDocument21 pagesMarket Mikrogurumurthy poobalanNo ratings yet

- Basic English: Unit 14 Guidelines Leisure ActivitiesDocument5 pagesBasic English: Unit 14 Guidelines Leisure ActivitiesDeyan BrenesNo ratings yet

- Tugas Pak Hendro PoemDocument24 pagesTugas Pak Hendro PoemLaila LalaNo ratings yet

- Fossils (DK Smithsonian Handbook) by DKDocument320 pagesFossils (DK Smithsonian Handbook) by DKAnthony Mello71% (7)

- RCBC Capital Corporation Vs Banco de OroDocument18 pagesRCBC Capital Corporation Vs Banco de OroLove HatredNo ratings yet

- Naija Docs Magazine Issue 6Document46 pagesNaija Docs Magazine Issue 6Olumide ElebuteNo ratings yet

- Aarvee Denim & Export LTD.: CertificateDocument46 pagesAarvee Denim & Export LTD.: CertificateVinita AgrawalNo ratings yet

- Thesis Project Management SoftwareDocument7 pagesThesis Project Management Softwarehollyschulzgilbert100% (2)

- Alternative Forms of BusOrgDocument16 pagesAlternative Forms of BusOrgnatalie clyde matesNo ratings yet

- Spalding Application SampleDocument5 pagesSpalding Application Sampleapi-66670156No ratings yet

- Schedule Standard and Syllabus: Section A: Geomorphology and Remote SensingDocument6 pagesSchedule Standard and Syllabus: Section A: Geomorphology and Remote SensingPankaj SharmaNo ratings yet

- Unit 4: Modern Biotechnological Processes: Guidelines For Choosing Host-Vector SystemsDocument3 pagesUnit 4: Modern Biotechnological Processes: Guidelines For Choosing Host-Vector SystemsSudarsan CrazyNo ratings yet

- Arup Kumar Mandal (New Format)Document2 pagesArup Kumar Mandal (New Format)sharafat_321No ratings yet