Professional Documents

Culture Documents

Standard Costing and Control Using Accounting Rules Answer To End of Chapter Exercises

Uploaded by

Jay BrockOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standard Costing and Control Using Accounting Rules Answer To End of Chapter Exercises

Uploaded by

Jay BrockCopyright:

Available Formats

1

Chapter 11

Standard Costing and Control Using Accounting Rules

Answer to End of Chapter Exercises

Q 11.1

20x6/7 20X7/8

Profitability ratios

R.O.C.E net profit 610 40.40 % 580 27.10 %

net capital 1510 2140

employed

net 610 25.42 % 580 20.14 %

profit margin 2400 2880

capital turnover 2400 1.59 2880 1.35

1510 2140

gross profit/sales 1200 50.00 % 1380 47.92 %

2400 2880

liquidity

current ratio 865 1.59 :1 1385 2.37 :1

545 585

liquid ratio 545 1.00 :1 940 1.61

545 585

Efficiency

Trade receivables (days) 2400 4.80 times 2880 3.06 times

500 940

76 days 119 days

Trade payables days 800 5.84 times 1050 5.38 times

137 195

63 days 68 days

Inventory days 1200 3.75 times 1500 3.37 times

320 445

97 days 108 days

Solvency

debt 300 19.87 % 740 34.58 %

Debt + equity 1510 2140

profit 610 12.20 580 7.25

interest 50 80

Purchases of raw materials were 800,000 in 20x6/7 and 1,050,000 in 20X7/8

Commentary

Profitability

In 20X7/8 Digiprintscan earned a 27% return on capital employed compared to 40% in 20X6/7.

This was due to a deterioration in net profit margin( reducing from 25% to 20% and an

reduction in capital turnover from 1.6X to 1.35X due to a significant increase in capital employed of

43% at a time when sales "only" increased by 20%

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

2

Liquidity

There was an increase in both the current ratio (1.6:1 improving to 2.4:1) and in the liquid ratio

which improved from 1:1 to 1.6:1. Both ratios maybe higher than necessary in 2002 and

reasons for the increase should be investigated. A comparion v industry norms would be helpful.

Efficiency

Average time to collect debts days declined from 76 days to 119 days. Stock holding rose from

146 days to 155 days and time to pay creditors rose from 63 days to 68 days. The increase

in stock holdings in particular is significant and reasons should be identified.

Solvency

Gearing is still relatively low at approximately 50% in both years and the interest cover has improve

from 12.2 times to 14.5 times

Summary

The company has expanded fast this year with sales increasing

from 2.4 million to 2.88 million. However the increased investment in assets has led to a lower

return on capital employed. It needs to be investigated whether the investment will lead to increase

sales in the coming year.

To fund the expansion the company has issued some shares and some debt capital. This issue

of debt capital has meant that the gearing ratio of debt to equity has remained stationary and the

overall gearing is still relatively low. Interest cover has in fact improved.

Short term liquidity ratios have also improved although there has been a decline in the efficiency

ratios which should be addressed

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

3

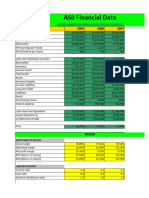

Q 11.2 20X6/7 20X7/8

Anglesea PLC Anglesea PLC

Profitability

R.O.C.E. 852 46.3 % 754 24.9 %

(Net profit/ capital 1841 3024

employed)

net profit margin 852 29.6 % 754 20.1 %

2880 3744

capital turnover 2880 1.6 3744 1.2

1841 3024

gross profit margin 1560 54.2 % 1794 47.9 %

2880 3744

admin/sales 708 24.6 % 1040 27.8 %

2880 3744

liquidity

current ratio 1084 1.5 2070 2.4

705 846

liquid ratio 668 0.9 1403 1.7

705 846

Efficiency

Trade receivables days 2880 4.8 times 3744 2.7 times

600 1363

365 76.0 days 365 132.9 days

4.8 2.7

Trade payables days 650 4.31 times 950 3.74 times

151 254

365 85 days 365 97.6 days

4.31 3.74

Inventory days 1320 3.2 times 1950 2.9 times

416 667

365 114 days 365 124.8 days

3.2 2.9

Gearing

debt:

Debt + equity 500 0.27:1 1450 0.48:1

500+1341 1450 + 1574

times interest earned 852 17.0 754 7.2

50 105

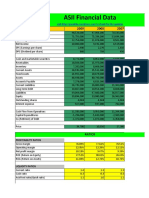

Profitability

The return on capital employed of Anglesea PLC has reduced from 46% in 20X6/7 to 25% in 20X7/8. This

has been due to a reduction in both the operating profit margin and the capital turnover. Gross profit to

sales has reduced from 54% to 48% Admin costs as a percentage of sales have increased from 25% to

28%.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

4

Liquidity

current ratio has increased from 1.5:1 from 2.4:1 in the year while liquid ratio has increased from0.9 to 1 to

1.7:1. Both ratios seem to be getting very high although a comparison v industry norm would be beneficial.

Efficiency

The adverse movement in some ratios is of particular concern. is the increase in trade receivables from

76 days to 133 days. Trade payables increased to just under 100 days.

Solvency The company issued loan capital during the year and the gearing rose to nearly 0.5 to 1. The

company is likely to find it difficult to raise further funds through issuing loans.

Summary The sales of the company have increased significantly during the year and the additional loans

and share capital have been used to purchase both free hold property and equipment. Liquidity and

efficiency ratios have increased substantially potentially giving worrying signs that the business is getting

overextended

Further information would like to obtain

Comment on further %ages further information on accounting standards - have there been any changes in

the year.

Future plans What have they purchased? Plans for these assets?

Need to investigate the deterioration in liquidity and efficiency.

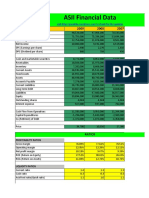

Q 11.3

i) Profit 400,000

interest 30,000

370,000

tax 185,000

185,000

EPS 185,000 =18.5 pence

1,000,000

P.E. ratio 3.20 =17.3

0.185

Gearing

ii) ratio 500,000 = 15.2%

(2800000 + 500,000)

Interest

iii) cover 400,000 = 13.3x

30,000

185,000 = 1.85x

iv) div cover 100,000

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

You might also like

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Airthread Acquisition: Income StatementDocument31 pagesAirthread Acquisition: Income StatementnidhidNo ratings yet

- Fixed Assets 870 1000 Total Equity 880Document7 pagesFixed Assets 870 1000 Total Equity 880Muhammad MussayabNo ratings yet

- FA Assingement wk3Document13 pagesFA Assingement wk3pranjal92pandeyNo ratings yet

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- Accounting Firm PL and KPIs 1Document6 pagesAccounting Firm PL and KPIs 1Creanga GeorgianNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- Data Finansial Gap IncDocument4 pagesData Finansial Gap IncTohirNo ratings yet

- SAS AirlineDocument9 pagesSAS AirlinejamilkhannNo ratings yet

- Total Sales 4800 8000 Gross Profit 1968 3200Document28 pagesTotal Sales 4800 8000 Gross Profit 1968 3200lika rukhadzeNo ratings yet

- Airthread Acquisition Operating AssumptionsDocument27 pagesAirthread Acquisition Operating AssumptionsnidhidNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Kellblog SaaS Dashboards, One Slide and Two SlideDocument12 pagesKellblog SaaS Dashboards, One Slide and Two SlideramblingmanNo ratings yet

- Final Paper Saira 28476Document10 pagesFinal Paper Saira 28476saira awanNo ratings yet

- Asad MemonDocument3 pagesAsad Memonshahzeb memonNo ratings yet

- Copia de Caso Healthy Bear 2022Document4 pagesCopia de Caso Healthy Bear 2022rataNo ratings yet

- 2) Integrating Statements PDFDocument8 pages2) Integrating Statements PDFAkshit SoniNo ratings yet

- IFS Dividends IntroductionDocument2 pagesIFS Dividends IntroductionMohamedNo ratings yet

- Almarai Annual Report enDocument128 pagesAlmarai Annual Report enHassen AbidiNo ratings yet

- Finance ProjectDocument9 pagesFinance ProjectMujtaba HassanNo ratings yet

- ABC Case StudyDocument5 pagesABC Case StudyAkanksha KNo ratings yet

- Airthread ValuationDocument7 pagesAirthread ValuationAbhinav UtkarshNo ratings yet

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelThanh NguyenNo ratings yet

- Declining BalanceDocument15 pagesDeclining BalanceGigih Adi PambudiNo ratings yet

- Fin 643 CasesDocument23 pagesFin 643 CasesMashfequl EhsanNo ratings yet

- A Simple Model: Integrating Financial StatementsDocument10 pagesA Simple Model: Integrating Financial Statementssps fetrNo ratings yet

- AirThread SecBC Group9Document4 pagesAirThread SecBC Group9Vishal BhanushaliNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- Form Annual Report (Feb 29 2008)Document329 pagesForm Annual Report (Feb 29 2008)serpepeNo ratings yet

- Total Aset: A. Rangkuman Data Laporan Keuangan Yang Diperlukan Untuk Analisis Ratio Akun 2009 2010Document7 pagesTotal Aset: A. Rangkuman Data Laporan Keuangan Yang Diperlukan Untuk Analisis Ratio Akun 2009 2010IdaNo ratings yet

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- gLLjeluWEem7ixL - 6m9HFg - PolyPanel TO DO Before WEEK 1Document2 pagesgLLjeluWEem7ixL - 6m9HFg - PolyPanel TO DO Before WEEK 1Mohammed Soliman MasliNo ratings yet

- 新城发展2022年中期业绩PPT 0830v1Document39 pages新城发展2022年中期业绩PPT 0830v1Muska ChiuNo ratings yet

- Mark Scheme (Results) Summer 2007: GCE Accounting (6002) Paper 1Document15 pagesMark Scheme (Results) Summer 2007: GCE Accounting (6002) Paper 1RadhmaowNo ratings yet

- CasesDocument74 pagesCasesPollsNo ratings yet

- S9 - XLS069-XLS-ENG MarriottDocument12 pagesS9 - XLS069-XLS-ENG MarriottCarlosNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0David Syah putraNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007AdrianNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007yrperdanaNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007Gilang AnggoroNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Akhi DanuNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007Arif SupriyadiNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- MERALCO Annual Report 2011Document162 pagesMERALCO Annual Report 2011Anonymous ic2CDkFNo ratings yet

- New Microsoft Excel WorksheetDocument5 pagesNew Microsoft Excel Worksheetsara_AlQuwaifliNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (43)

- Without Discount With DiscountDocument13 pagesWithout Discount With DiscountleylaNo ratings yet

- Annual Report Telkomsel 2003Document44 pagesAnnual Report Telkomsel 2003jakabareNo ratings yet

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- Cash Plant Size 1 Plant Size 2 Plant Size 3Document7 pagesCash Plant Size 1 Plant Size 2 Plant Size 3Angelica Jane AradoNo ratings yet

- Financials WorksheetDocument3 pagesFinancials WorksheetSiddharthNo ratings yet

- BritanniaDocument4 pagesBritanniaHiral JoshiNo ratings yet

- AnandamDocument12 pagesAnandamNarinderNo ratings yet

- Analisis Del CasoDocument3 pagesAnalisis Del CasoAlida PolancoNo ratings yet

- Finanical SpreadsDocument11 pagesFinanical Spreadsnauman farooqNo ratings yet

- % Growth: FY14A FY15A FY16A FY17E FY18E FY19E FY20E FY21EDocument2 pages% Growth: FY14A FY15A FY16A FY17E FY18E FY19E FY20E FY21EAtul KolteNo ratings yet

- Advanced Accounting Jeter 5th Edition Solutions ManualDocument21 pagesAdvanced Accounting Jeter 5th Edition Solutions Manuallilyduxjrj54No ratings yet

- Brief About The Co Brands Competitive Positioning of The Co / Advantages Tracking Points Financials Incl Shareholding Pattern Valuation Rational SwotDocument42 pagesBrief About The Co Brands Competitive Positioning of The Co / Advantages Tracking Points Financials Incl Shareholding Pattern Valuation Rational SwotMitesh PatilNo ratings yet

- Aa2e Hal SM Ch09Document19 pagesAa2e Hal SM Ch09Jay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document55 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Introduction To The Consolidation Process: Learning Objectives - Coverage by QuestionDocument21 pagesIntroduction To The Consolidation Process: Learning Objectives - Coverage by QuestionJay BrockNo ratings yet

- Chapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Solution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsDocument25 pagesSolution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsJay BrockNo ratings yet

- Chapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Document18 pagesChapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document23 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Chapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Measuring and Improving Internal Business Processes Answer To End of Chapter ExercisesDocument7 pagesMeasuring and Improving Internal Business Processes Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Chapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Document36 pagesChapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Document32 pagesChapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Accounting and Strategic Analysis Answer To End of Chapter ExercisesDocument6 pagesAccounting and Strategic Analysis Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Identifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDDocument7 pagesIdentifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDJay BrockNo ratings yet

- Internal Appraisal of The Organization Answer To End of Chapter ExercisesDocument5 pagesInternal Appraisal of The Organization Answer To End of Chapter ExercisesJay BrockNo ratings yet

- CH23 PDFDocument5 pagesCH23 PDFJay BrockNo ratings yet

- Political: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesDocument6 pagesPolitical: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Budgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesDocument2 pagesBudgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Budgetary Control Systems Answer To End of Chapter ExercisesDocument3 pagesBudgetary Control Systems Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Strategy and Control System Design Answer To End of Chapter ExercisesDocument5 pagesStrategy and Control System Design Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Further Decision-Making Problems Answers To End of Chapter ExercisesDocument6 pagesFurther Decision-Making Problems Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Standard Costing and Manufacturing Methods Answer To End of Chapter ExercisesDocument5 pagesStandard Costing and Manufacturing Methods Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachDocument4 pagesActivity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachJay BrockNo ratings yet

- Traditional Approaches To Full Costing Answers To End of Chapter ExercisesDocument4 pagesTraditional Approaches To Full Costing Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Funding The Business Answer To End of Chapter ExercisesDocument2 pagesFunding The Business Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Control in Divisionalized Organizations Answer To End of Chapter ExercisesDocument6 pagesControl in Divisionalized Organizations Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Capital Investment Decisions Answers To End of Chapter ExercisesDocument3 pagesCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Pricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesDocument2 pagesPricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Mba III IV SemDocument119 pagesMba III IV SemKirtiNo ratings yet

- Wade CatalogueDocument10 pagesWade CatalogueMohamed IbrahimNo ratings yet

- Soft Copy ReportDocument3 pagesSoft Copy ReportChristine Nathalie BalmesNo ratings yet

- Bubble and Bee Lecture TemplateDocument2 pagesBubble and Bee Lecture TemplateMavin JeraldNo ratings yet

- Merger ReportDocument9 pagesMerger ReportArisha KhanNo ratings yet

- Behavioral FinanceDocument15 pagesBehavioral FinanceanupmidNo ratings yet

- Impact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual ModelDocument6 pagesImpact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual ModelYusuf HusseinNo ratings yet

- (IBF301) - International Finance SyllabusDocument2 pages(IBF301) - International Finance SyllabusSu NgNo ratings yet

- Rental IncomeDocument2 pagesRental IncomeAlex SirgiovanniNo ratings yet

- The Need For AdjustmentDocument5 pagesThe Need For AdjustmentAnna CharlotteNo ratings yet

- A161 Tutorial 4 - Annual Report Fin AnalysisDocument10 pagesA161 Tutorial 4 - Annual Report Fin AnalysisAmeer Al-asyraf MuhamadNo ratings yet

- Fac1601 Exam Pack 2018 - Financial Accounting ReportingDocument97 pagesFac1601 Exam Pack 2018 - Financial Accounting ReportingandreqwNo ratings yet

- File Sec 17a 2015Document330 pagesFile Sec 17a 2015Jhomer ClaroNo ratings yet

- PhonePe Statement Nov2023 Jan2024Document33 pagesPhonePe Statement Nov2023 Jan2024Arvind KumarNo ratings yet

- Su001 1209en PDFDocument2 pagesSu001 1209en PDFKimi RaikNo ratings yet

- Snap Sua - Qa - 3-15-2011Document3 pagesSnap Sua - Qa - 3-15-2011Patricia DillonNo ratings yet

- Auditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPADocument29 pagesAuditing Problems IAS 17: LEASES (0ld Standard) Dr. Glen de Leon, CPAArcelli Dela CruzNo ratings yet

- Tutorial 4 QAsDocument6 pagesTutorial 4 QAsJin HueyNo ratings yet

- Multiple Choice Questions (MCQ) : Finance and Accounts DivisionDocument9 pagesMultiple Choice Questions (MCQ) : Finance and Accounts DivisionKawoser AhammadNo ratings yet

- Circular Flow of EconomyDocument19 pagesCircular Flow of EconomyAbhijeet GuptaNo ratings yet

- Shipping Invoice: Kentex CargoDocument3 pagesShipping Invoice: Kentex Cargomaurice gituaraNo ratings yet

- Approved List of ValuersDocument7 pagesApproved List of ValuersTim Tom100% (1)

- Reading 71.2 Guidance For Standards I (C) and I (D)Document11 pagesReading 71.2 Guidance For Standards I (C) and I (D)AmineNo ratings yet

- PrepmateDocument69 pagesPrepmatevishal pathaniaNo ratings yet

- Inventory Record Keeping Methods: Example: Use FIFO, LIFO, and WAC To Evaluate The Following Inventory RecordDocument5 pagesInventory Record Keeping Methods: Example: Use FIFO, LIFO, and WAC To Evaluate The Following Inventory Recordsanji xxxNo ratings yet

- Naghmeh Panahi Vs Saeed AbediniDocument24 pagesNaghmeh Panahi Vs Saeed AbediniLeonardo BlairNo ratings yet

- Accounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Document81 pagesAccounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Layla MainNo ratings yet

- Bbma MHV - Ms.enDocument15 pagesBbma MHV - Ms.enXeno WerkNo ratings yet

- Pre-Feasibility Study of The Iloilo Central Business District Revitalization ProjectDocument46 pagesPre-Feasibility Study of The Iloilo Central Business District Revitalization ProjectCarl100% (3)

- User Manual KIP7000Document82 pagesUser Manual KIP7000Jorge SalaverryNo ratings yet