Professional Documents

Culture Documents

Statement I Broad Details of Revenue Receipts

Uploaded by

Atm AdnanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement I Broad Details of Revenue Receipts

Uploaded by

Atm AdnanCopyright:

Available Formats

5

Statement I

Broad Details of Revenue Receipts

( Excluding Grants, Loans and Food Account Transactions )

(Taka in Crore)

Budget Revised Budget Actual

Description

2017-18 2016-17 2016-17 2015-16

Tax Revenue

National Board of Revenue (NBR) Tax

Taxes on Income and Profit 85,176 62,754 71,940 45,078

Value Added Tax (VAT) 91,254 68,675 72,764 54,576

Import Duty 30,023 21,571 22,450 17,796

Export Duty 44 33 44 30

Excise Duty 1,599 1,199 4,449 1,560

Supplementary Duty 38,401 29,519 30,075 26,133

Other Taxes and Duties 1,690 1,245 1,428 1,067

Sub-Total - National Board of Revenue (NBR) Tax : 2,48,190 1,85,000 2,03,152 1,46,241

Non-NBR Tax

Narcotics and Liquor Duty 92 150 150 66

Taxes on Vehicles 1,800 1,720 1,770 1,627

Land Revenue 1,265 1,120 1,059 827

Stamp Duty (Non Judicial) 5,465 4,269 4,269 3,122

Sub-Total - Non-NBR Tax : 8,622 7,261 7,250 5,644

Total - Tax Revenue : 2,56,812 1,92,261 2,10,402 1,51,886

Non-Tax Revenue

Dividend and Profit 5,397 3,709 7,922 3,165

Interest 1,936 2,931 800 1,073

Administrative Fees and Charges 5,654 4,858 4,838 3,561

Fines, Penalties and Forfeiture 470 425 356 348

Receipts for Services Rendered 710 641 602 707

Rents, Leases and Recoveries 151 135 129 110

Tolls and Levies 1,008 918 758 772

Non-Commercial Sales 613 565 544 528

Defence Receipts 2,575 2,345 2,344 1,754

Other Non-Tax Revenue and Receipts 10,240 7,822 12,331 7,821

Railway 2,000 1,510 1,350 863

Post Offices 351 310 306 287

Capital Revenue 70 66 64 71

Total - Non-Tax Revenue : 31,179 26,239 32,350 21,065

Grant Total - Revenue Receipts : 2,87,990 2,18,500 2,42,752 1,72,951

You might also like

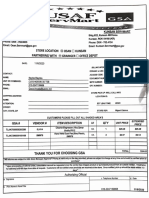

- Receipt and Expences M4Document6 pagesReceipt and Expences M4Eric Melchor RoyolNo ratings yet

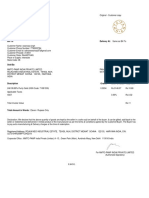

- Michael Nedd/ Theophilus Nedd 4 Bayleaf Court Santa Rosa ArimaDocument2 pagesMichael Nedd/ Theophilus Nedd 4 Bayleaf Court Santa Rosa Arimamichael neddNo ratings yet

- WS Retail Services Pvt. LTD.Document1 pageWS Retail Services Pvt. LTD.Umesh SiddarthNo ratings yet

- Print - Invoices - PDF ROLEA LAURA PDFDocument1 pagePrint - Invoices - PDF ROLEA LAURA PDFrolea catalinNo ratings yet

- Sergiu Stoica Invoice 22326-1Document1 pageSergiu Stoica Invoice 22326-1Sergiu StoicaNo ratings yet

- Invoice 19966341488Document2 pagesInvoice 19966341488Shyam Goud TeegalaNo ratings yet

- Cash Receipts MDocument8 pagesCash Receipts MAveryl Lei Sta.AnaNo ratings yet

- Invoices 1Document1 pageInvoices 1api-351788692No ratings yet

- Invoice INV/2019/0001: Invoice Date: Due Date: SourceDocument1 pageInvoice INV/2019/0001: Invoice Date: Due Date: SourcevinaysgvNo ratings yet

- Tax Invoice Inv1868 CleartaxDocument1 pageTax Invoice Inv1868 CleartaxAditya ShahNo ratings yet

- Description: Lusaka Water & Sewerage Company LimitedDocument1 pageDescription: Lusaka Water & Sewerage Company Limitedpasyani nyirendaNo ratings yet

- InvoiceDocument1 pageInvoiceChintan ParmarNo ratings yet

- Ride Details Bill Details: Thanks For Traveling With Us, AlthafDocument3 pagesRide Details Bill Details: Thanks For Traveling With Us, AlthafMoham'medAlthafAs'lamNo ratings yet

- AbunawasDocument2 pagesAbunawasDania KartikaNo ratings yet

- Invoice 282012Document1 pageInvoice 282012Shah Fakhrul Islam AlokNo ratings yet

- Example: Cash Receipts Book: A B F G J L M ODocument1 pageExample: Cash Receipts Book: A B F G J L M Omiuchu73No ratings yet

- Duplicate Receipts For Vehicle Number JH17B5978paid On 2015-06-1818-03-44.0 and Printed On 2015-06-18Document1 pageDuplicate Receipts For Vehicle Number JH17B5978paid On 2015-06-1818-03-44.0 and Printed On 2015-06-18Abhishek KumarNo ratings yet

- ACT Invoice Feb2022Document1 pageACT Invoice Feb2022VinuNo ratings yet

- Invoice: Item Description Unit Price Quantity AmountDocument1 pageInvoice: Item Description Unit Price Quantity AmountAnonymous trzywIgsNo ratings yet

- Nairendrapal Sharma GST InvoiceDocument1 pageNairendrapal Sharma GST InvoiceDrv LimtedNo ratings yet

- B BIL PrintStatementDocument1 pageB BIL PrintStatementMandla RebirthNo ratings yet

- Invoices 2393974Document1 pageInvoices 2393974KkNo ratings yet

- SGHN2456014QLD Logistics Invoice 1560316148514Document1 pageSGHN2456014QLD Logistics Invoice 1560316148514MananNo ratings yet

- Description Amount: Parts, and Then Click Receipt Slips (3 Per Page) in The Quick Parts Drop Down MenuDocument2 pagesDescription Amount: Parts, and Then Click Receipt Slips (3 Per Page) in The Quick Parts Drop Down MenuUsman QurayshiNo ratings yet

- AR Invoice - 13300310 PDFDocument1 pageAR Invoice - 13300310 PDFAli Ab AsNo ratings yet

- Invoice INV/2020/0011: Chaussée de Namur, 40 1367 Grand-Rosière BelgiumDocument1 pageInvoice INV/2020/0011: Chaussée de Namur, 40 1367 Grand-Rosière BelgiumRubenSilvaNo ratings yet

- 3rd Floor, No - AK-2, RBN Tower Fourth Avenue, Shanthi Colony Chennai - 600 040 GSTN Num - 33AAACL2937J1ZLDocument1 page3rd Floor, No - AK-2, RBN Tower Fourth Avenue, Shanthi Colony Chennai - 600 040 GSTN Num - 33AAACL2937J1ZLcharliNo ratings yet

- Cash Receipts JournalDocument1 pageCash Receipts Journalarul umamNo ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- Federal Polytechnic Ado: Payment ReceiptsDocument1 pageFederal Polytechnic Ado: Payment ReceiptsAjewole Eben TopeNo ratings yet

- Servmart ReceiptsDocument2 pagesServmart ReceiptsGandalf 99No ratings yet

- Receipts and Payments of Christ Nagar Residents' Association (CNRA), Christ Nagar, Neyyattinkara, Trivandrum, Kerala, India For The Year Ended 31st March, 2015Document6 pagesReceipts and Payments of Christ Nagar Residents' Association (CNRA), Christ Nagar, Neyyattinkara, Trivandrum, Kerala, India For The Year Ended 31st March, 2015Jenipher Carlos HosannaNo ratings yet

- 17 Container 5Document2 pages17 Container 5Ibrahima Sory CamaraNo ratings yet

- Invoice 2001321Document1 pageInvoice 2001321Abdul MNo ratings yet

- Cash Receipts 2015Document2 pagesCash Receipts 2015ProtozoaNo ratings yet

- (615612035) ReceiptsDocument2 pages(615612035) ReceiptsShivam AtriNo ratings yet

- Invoice: Institute of Advanced Engineering and ScienceDocument1 pageInvoice: Institute of Advanced Engineering and ScienceMuhammad Zaki MustapaNo ratings yet

- Francis InvoicesDocument2 pagesFrancis InvoicesefffrancisNo ratings yet

- Thanks For Riding, Harsh: Total 204.56Document2 pagesThanks For Riding, Harsh: Total 204.56harsh kanojiaNo ratings yet

- Tax Invoice: Bill To Delivery atDocument1 pageTax Invoice: Bill To Delivery atSwaroop SinghNo ratings yet

- Invoice # 0547 PDFDocument1 pageInvoice # 0547 PDFshafiqrehman7No ratings yet

- Summary of Assertions For Cash Receipts Transactions Flashcards - QuizletDocument3 pagesSummary of Assertions For Cash Receipts Transactions Flashcards - QuizletWilliam SusetyoNo ratings yet

- Outlier Innovations Private Limited Other Charges Invoice (Dec-2022)Document2 pagesOutlier Innovations Private Limited Other Charges Invoice (Dec-2022)SiddharthNo ratings yet

- Invoice 1Document1 pageInvoice 1Gaëtan ColpartNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceChristine FosterNo ratings yet

- Renovation/Improvement ContractDocument2 pagesRenovation/Improvement ContractPao BrillsNo ratings yet

- Chhatrapati Shivaji Road, Dahisar (East), Mumbai - 400 068Document2 pagesChhatrapati Shivaji Road, Dahisar (East), Mumbai - 400 068nilay parlikarNo ratings yet

- Pec Exam Fees Receipts 26.07.2021Document180 pagesPec Exam Fees Receipts 26.07.2021Kavitha DNo ratings yet

- AmazonDocument1 pageAmazongeethaNo ratings yet

- Assignment 2 - Invoice Assignment InvoiceDocument3 pagesAssignment 2 - Invoice Assignment Invoiceapi-507334562No ratings yet

- Original Receipts For Vehicle Number JH17H1266 Paid On 21-05-201511-50-16Document1 pageOriginal Receipts For Vehicle Number JH17H1266 Paid On 21-05-201511-50-16Abhishek KumarNo ratings yet

- Receipts ListDocument86 pagesReceipts ListRaquel Dacup GarciaNo ratings yet

- Cash ReceiptsDocument1 pageCash ReceiptsSiti Zalikha Md JamilNo ratings yet

- Service ReceiptsDocument2 pagesService ReceiptsAnonymous dH1spCNo ratings yet

- Example - Partially Reduce Invoices - Logistics Invoice Verification (MM-IV-LIV) - SAP LibraryDocument2 pagesExample - Partially Reduce Invoices - Logistics Invoice Verification (MM-IV-LIV) - SAP LibraryLokesh ModemzNo ratings yet

- Cash ReceiptsDocument1 pageCash ReceiptsLionell Al FatihNo ratings yet

- Invoice SurveymonkeyDocument1 pageInvoice SurveymonkeyOlegNo ratings yet

- Sample Invoice A PDFDocument1 pageSample Invoice A PDFSirliindaNo ratings yet

- Dolat: Algoieg-IlimitedDocument14 pagesDolat: Algoieg-IlimitedPãräs PhútélàNo ratings yet

- Assets Non-Current AssetsDocument9 pagesAssets Non-Current AssetsswapnilNo ratings yet

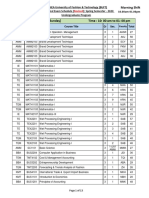

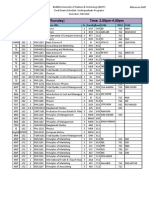

- All - ClassRoutine, WednesdayDocument218 pagesAll - ClassRoutine, WednesdayAtm AdnanNo ratings yet

- Revised Online Final Exam - Morning ShiftDocument13 pagesRevised Online Final Exam - Morning ShiftAtm AdnanNo ratings yet

- For Students - Steps To Follow For Submitting Exam Scripts Via Google ClassroomDocument8 pagesFor Students - Steps To Follow For Submitting Exam Scripts Via Google ClassroomAtm AdnanNo ratings yet

- Revised Online Final Exam - Afternoon ShiftDocument10 pagesRevised Online Final Exam - Afternoon ShiftAtm AdnanNo ratings yet

- Faculty List Final AttendenceDocument5 pagesFaculty List Final AttendenceAtm AdnanNo ratings yet

- Notice of Webinar On "Time and Stress Management"Document3 pagesNotice of Webinar On "Time and Stress Management"Atm AdnanNo ratings yet

- Online Final Exams Policy Spring 2020...Document4 pagesOnline Final Exams Policy Spring 2020...Atm AdnanNo ratings yet

- Chapter 02 IM 10th EdDocument21 pagesChapter 02 IM 10th Edkoakley4564No ratings yet

- Online Final Exams Policy Spring 2020...Document4 pagesOnline Final Exams Policy Spring 2020...Atm AdnanNo ratings yet

- Letter of Recommendation: (Form 5)Document4 pagesLetter of Recommendation: (Form 5)Atm AdnanNo ratings yet

- AbirDocument3 pagesAbirAtm AdnanNo ratings yet

- Acaemic Calendar, Spring-2020Document1 pageAcaemic Calendar, Spring-2020Atm AdnanNo ratings yet

- Adnan CertificateDocument1 pageAdnan CertificateAtm AdnanNo ratings yet

- Day - Final - Fall 18 With InvDocument7 pagesDay - Final - Fall 18 With InvAtm AdnanNo ratings yet

- Joining Letter BUF-2Document1 pageJoining Letter BUF-2Atm AdnanNo ratings yet

- Worker Safety in Bangladesh's Readymade Garment (RMG) IndustryDocument2 pagesWorker Safety in Bangladesh's Readymade Garment (RMG) IndustryAtm AdnanNo ratings yet

- Scholarship LSBUDocument5 pagesScholarship LSBUAtm AdnanNo ratings yet

- Guide For New Applicant - Rev0 PDFDocument5 pagesGuide For New Applicant - Rev0 PDFAtm AdnanNo ratings yet

- BangladeshDocument7 pagesBangladeshNimisha PoudyalNo ratings yet

- Current Course Map For BBA Program: Course Name Genre Credit Weight Bangladesh StudiesDocument3 pagesCurrent Course Map For BBA Program: Course Name Genre Credit Weight Bangladesh StudiesAtm AdnanNo ratings yet

- New Book Requ. 15-04-05Document3 pagesNew Book Requ. 15-04-05Atm AdnanNo ratings yet

- Advertisement For Recruitment of Trainee Officer GeneralDocument3 pagesAdvertisement For Recruitment of Trainee Officer GeneralAtm AdnanNo ratings yet

- AutoFix - 2012 04 16 - 11 38 36Document1 pageAutoFix - 2012 04 16 - 11 38 36Atm AdnanNo ratings yet

- PFS U485Document1 pagePFS U485Atm AdnanNo ratings yet

- Model CV 02Document2 pagesModel CV 02Atm AdnanNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementshuvro25No ratings yet

- Dutch BG BDDocument1 pageDutch BG BDAtm AdnanNo ratings yet

- Model CV 01Document2 pagesModel CV 01Atm AdnanNo ratings yet

- Bhaskar Pay Slip 2016 PDFDocument1 pageBhaskar Pay Slip 2016 PDFBHASKAR DUTT MishraNo ratings yet

- Public Finance and Other SciencesDocument3 pagesPublic Finance and Other SciencesAshutosh ShuklaNo ratings yet

- 2307 WestmeridianDocument2 pages2307 WestmeridianRheddy RaymundoNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Ajmain Abdullah UtshowNo ratings yet

- CIR V Magsaysay LinesDocument2 pagesCIR V Magsaysay LinesReyna RemultaNo ratings yet

- Cramer For SenateDocument1,359 pagesCramer For SenateRob PortNo ratings yet

- Dr. Arti SinghDocument11 pagesDr. Arti SinghArti SinghNo ratings yet

- Minimum Alternate Tax Section 115JbDocument17 pagesMinimum Alternate Tax Section 115JbEmeline SoroNo ratings yet

- SATURDAYS Lotte Shopping Avenue Payslip: Take Home Pay Rp5.789.925Document1 pageSATURDAYS Lotte Shopping Avenue Payslip: Take Home Pay Rp5.789.925Dhea Shafira KintanNo ratings yet

- InvoiceDocument1 pageInvoiceSahil GoyalNo ratings yet

- Marubeni vs. CIRDocument2 pagesMarubeni vs. CIRJay-ar Rivera BadulisNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAbhishekNo ratings yet

- Identify and Discuss Direct TaxDocument7 pagesIdentify and Discuss Direct Taxsamuel asefaNo ratings yet

- Syllabus BS 4years Economics PDFDocument114 pagesSyllabus BS 4years Economics PDFJaveria WahabNo ratings yet

- BIR Ruling NoDocument1 pageBIR Ruling NoPau Line EscosioNo ratings yet

- Gross Reciept Cert - FABCADDocument4 pagesGross Reciept Cert - FABCADamara corpNo ratings yet

- Mock Bar in Taxation Law (March 7)Document19 pagesMock Bar in Taxation Law (March 7)Jaliel Moeen Metrillo BasayNo ratings yet

- List of BIR FORMSDocument2 pagesList of BIR FORMSLoreta Manaol VinculadoNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherDeepak SinghNo ratings yet

- Salary Certificate PDFDocument4 pagesSalary Certificate PDFsunny singh100% (1)

- Documentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), orDocument2 pagesDocumentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), orShaina ObreroNo ratings yet

- Income Taxation 1Document4 pagesIncome Taxation 1nicole bancoroNo ratings yet

- Taxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBDocument35 pagesTaxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBFlorante De LeonNo ratings yet

- Chapter 1Document102 pagesChapter 1Chelsi XiaoNo ratings yet

- Quiz 1Document2 pagesQuiz 1Richelle ManocayNo ratings yet

- Tax ProjectDocument8 pagesTax ProjectKunalNo ratings yet

- Reinforced Earth India PVT LTD E-11, B1 EXTN, Mcie Mathura Road, New Delhi NEW DELHI - 110044 Delhi Payslip For April - 2019Document1 pageReinforced Earth India PVT LTD E-11, B1 EXTN, Mcie Mathura Road, New Delhi NEW DELHI - 110044 Delhi Payslip For April - 2019Kaushik BiswasNo ratings yet

- RR No. 15-2018 PDFDocument2 pagesRR No. 15-2018 PDFmark linganNo ratings yet

- Are Your Property Taxes Too HighDocument8 pagesAre Your Property Taxes Too HighcutmytaxesNo ratings yet

- Transfer and Business Taxation SyllabusDocument5 pagesTransfer and Business Taxation SyllabusamqqndeahdgeNo ratings yet