Professional Documents

Culture Documents

RMC No 75-2015

Uploaded by

GoogleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No 75-2015

Uploaded by

GoogleCopyright:

Available Formats

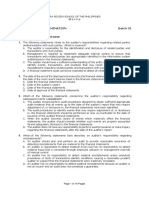

REPUBLIC OF THE PHILIPPINES BUREAU OF II.

ITEBNAT BSVENUE

R.ECORDS IVIGT. DTV:ISION

DEPARTMENT OF FINANCE

BUREAU OF II{TERNAL REVENUE 4; 4D F.14,

Quezon City DECl5Zrlfit+

/r'M'*"

December 1-4,201-5

RECEIVES

REVENUE MEM,RANDUM crRcuLAR No. 7 0 - nt'r

SUBJECT Suspension of All Audit and other Field Operations of the Bureau of

lnternal Revenue Effective December L6, 2015

TO All Internal Revenue Officers, Employees and Others Concerned

All field audit and other field operations of the Bureau of lnternal Revenue relative to

examinations and verifications of taxpayers'books of accounts, records and othertransactions are hereby

ordered suspended for the period December 16, 2A1,5 to January 5, 2016. Thus, no field audit, field

operations, or any form of business visitation in execution of Letters of Authority/Audit Notices, Letter

Notices, or Mission Orders should be conducted. Likewise, no written orders to audit and/or investigate

taxpayers'internal revenue tax liabilities shall be served except in the following cases:

a lnvestigation of cases prescribing on or before April 15, 2016;

a Tax evasion cases;

a Processing and verification of estate tax returns, donor's tax returns, capital gains tax

returns and withholding tax returns on the sale of real properties or shares of stocks

together with the doqumentary stamp tax returns related thereto;

Examination and/or verification of internal revenue tax liabilities of taxpayers retiring

from business;

Audit of National Government Agencies (NGAs), Local Government Units (LGUs) and

Government Owned and Controlled Corporations (GOCCs) including subsidiaries and

affiliates of GOCCs;

o Monitoring of privilege stores (tiangge);

o Stocktaking; and

r Other matters/concerns where deadlines have been imposed or under the orders of

the Commissioner of lnternal Revenue.

ln general, examiners and investigators shall make use of this period to do office work on their

cases and to complete the report on those with already completed field work.

It is reminded though that all efforts should be directed to ensure maximum revenue collection

throughout the year. Thus, service of Assessment Notices, Warrants and Seizure Notices should still be

effected. Also, taxpayers may pay voluntarily their known deficiency iaxes without the need to secure

authority from concerned Revenue Officials.

All internal revenue officers and others concerned are enjoined to give this Circular as wide a

publicity as possible.

KIM S. JAC!?{TO-HENARES

Commissioner of lnternal Revenue

0378 6s

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Business Value Analysis FloQastDocument9 pagesBusiness Value Analysis FloQastGoogleNo ratings yet

- Ifrs For SMEsDocument104 pagesIfrs For SMEsApril AcboNo ratings yet

- BIR Order Amends 2014 Revenue Office Performance MetricsDocument1 pageBIR Order Amends 2014 Revenue Office Performance MetricsGoogleNo ratings yet

- RR 7-2015 PDFDocument2 pagesRR 7-2015 PDFGoogleNo ratings yet

- Ifrs For SMEsDocument104 pagesIfrs For SMEsApril AcboNo ratings yet

- RMC 22-2015Document1 pageRMC 22-2015gelskNo ratings yet

- RMC No 45-2015Document4 pagesRMC No 45-2015GoogleNo ratings yet

- RMC No 24-2018 (Guidelines For FS)Document6 pagesRMC No 24-2018 (Guidelines For FS)GoogleNo ratings yet

- SEC - SMR With 2 Different AuditorsDocument2 pagesSEC - SMR With 2 Different AuditorsGoogleNo ratings yet

- RMC 61-2015 PDFDocument1 pageRMC 61-2015 PDFGoogleNo ratings yet

- RR No. 10-2015v2 Thermal PrinterDocument3 pagesRR No. 10-2015v2 Thermal PrinterPedro BrugadaNo ratings yet

- Sss Summary of BenefitsDocument2 pagesSss Summary of BenefitsgerardNo ratings yet

- RMO NO. 5-2015 DigestDocument1 pageRMO NO. 5-2015 DigestGoogleNo ratings yet

- Revenue Regulations No 5-2015Document2 pagesRevenue Regulations No 5-2015Yaz CarlomanNo ratings yet

- RMC 66-2015Document1 pageRMC 66-2015GoogleNo ratings yet

- RMC 67-2015Document1 pageRMC 67-2015GoogleNo ratings yet

- RMC 63-2015Document1 pageRMC 63-2015GoogleNo ratings yet

- RMC 69-2015Document1 pageRMC 69-2015GoogleNo ratings yet

- RMC 62-2015Document1 pageRMC 62-2015GoogleNo ratings yet

- RMC 61-2015Document1 pageRMC 61-2015GoogleNo ratings yet

- Full Text RMO 1-2015 PDFDocument4 pagesFull Text RMO 1-2015 PDFGoogleNo ratings yet

- Summary of Benefits PDFDocument2 pagesSummary of Benefits PDFGoogleNo ratings yet

- RMO 12-2015.doc Full Text PDFDocument5 pagesRMO 12-2015.doc Full Text PDFGoogleNo ratings yet

- RMO No 15-2015Document4 pagesRMO No 15-2015GoogleNo ratings yet

- RMO 2-2015.doc REVISED Full Text PDFDocument5 pagesRMO 2-2015.doc REVISED Full Text PDFGoogleNo ratings yet

- RMO 18-2015 Full Text PDFDocument4 pagesRMO 18-2015 Full Text PDFGoogleNo ratings yet

- RMO No 11-2015 - FT PDFDocument1 pageRMO No 11-2015 - FT PDFGoogleNo ratings yet

- RMO 3-2015 Full Text PDFDocument4 pagesRMO 3-2015 Full Text PDFGoogleNo ratings yet

- Rmo 14-2015 PDFDocument2 pagesRmo 14-2015 PDFGoogleNo ratings yet

- Amendments to VAT Audit Program of Large Taxpayers ServiceDocument3 pagesAmendments to VAT Audit Program of Large Taxpayers ServiceGoogleNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chap 21-2Document8 pagesChap 21-2JackNo ratings yet

- Methodology and Specifications Guide: North American ElectricityDocument18 pagesMethodology and Specifications Guide: North American ElectricitykoinsuriNo ratings yet

- GSK Annual Report 2006 PDFDocument71 pagesGSK Annual Report 2006 PDFslantyyNo ratings yet

- DSD Annual Report 2019 PDFDocument304 pagesDSD Annual Report 2019 PDFSimba TapererwaNo ratings yet

- Chapter 1 Nature of Auditing MCQs Rohit Sir PDFDocument184 pagesChapter 1 Nature of Auditing MCQs Rohit Sir PDFkrishna chaitanya67% (6)

- West Cost Paper MillDocument62 pagesWest Cost Paper MillAffy Love100% (1)

- Adjusting EntriesDocument71 pagesAdjusting EntriesLeteSsie66% (29)

- Modules Logistics ManagementDocument12 pagesModules Logistics ManagementNel MuyaNo ratings yet

- Pub Lire Portage enDocument8 pagesPub Lire Portage enshahamit1610No ratings yet

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- Perf & Env Audit Manual 111Document134 pagesPerf & Env Audit Manual 111hNo ratings yet

- Law On Accountability of Public Officer - COMPLETEDocument396 pagesLaw On Accountability of Public Officer - COMPLETEColBenjaminAsiddaoNo ratings yet

- Objectives of AuditDocument4 pagesObjectives of AuditSana ShafiqNo ratings yet

- Credit Risk Management. KsfeDocument71 pagesCredit Risk Management. KsfeJith EG86% (7)

- P Iail PDFDocument323 pagesP Iail PDFAFC Capital LimitedNo ratings yet

- 3.0 NC & OFI ABMS Internal Audit 2021Document6 pages3.0 NC & OFI ABMS Internal Audit 2021Möhd JâbïRNo ratings yet

- Partnership Acctg Course Outline (CUP)Document1 pagePartnership Acctg Course Outline (CUP)Baron AJNo ratings yet

- Chapter 18Document49 pagesChapter 18John TomNo ratings yet

- Achievement of Organizational Targets and Objectives Using Management AuditDocument21 pagesAchievement of Organizational Targets and Objectives Using Management AuditNwigwe Promise ChukwuebukaNo ratings yet

- SBD ACA Palma, JDADocument3 pagesSBD ACA Palma, JDAJames Daniel PalmaNo ratings yet

- Guess PaperDocument17 pagesGuess PaperVinay ChawlaNo ratings yet

- The Accounting Cycle: 9-Step Accounting ProcessDocument2 pagesThe Accounting Cycle: 9-Step Accounting Processfazal rahmanNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- LawDocument29 pagesLawMichael ArciagaNo ratings yet

- Domino's Corporate Governance PrinciplesDocument6 pagesDomino's Corporate Governance PrinciplesNovi AnriNo ratings yet

- MedGenome Labs Consolidated Financial Statements 2020-21Document112 pagesMedGenome Labs Consolidated Financial Statements 2020-21Sagar SangoiNo ratings yet

- Feedback - MOCKP1DEDocument12 pagesFeedback - MOCKP1DERaman ANo ratings yet

- CreditManagerEurope 2014-Issue 5Document40 pagesCreditManagerEurope 2014-Issue 5Anonymous bDCiOqNo ratings yet

- MCS - Cost Volume Analysis ProjectDocument21 pagesMCS - Cost Volume Analysis ProjectsanjaysinhaNo ratings yet

- A E S O P: Ccounting For Mployee Tock Ption LANDocument26 pagesA E S O P: Ccounting For Mployee Tock Ption LANanon_33294114No ratings yet