Professional Documents

Culture Documents

Two types-R-Return (Nostro) - Submitted by A and B

Uploaded by

Jayakrishnaraj AJDOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Two types-R-Return (Nostro) - Submitted by A and B

Uploaded by

Jayakrishnaraj AJDCopyright:

Available Formats

L.

C (Letter of Credit) is an undertaking by a bank , on R-Return enables RBI to arrive at Balance of Payment

behalf of the buyer(importer), to the beneficiary(seller) (BoP) position of the country. GMUK consolidates R

of the credit that it would honour bills drawn in terms of return of all branches and submits fortnightly (within 7

the credit. days of corresponding fortnight) to RBI in respect of

Irrevocable Letter of Credit: Cant be amended or foreign exchange transactions.

cancelled by the opening bank without the Two types- R-Return (Nostro)- submitted by A and B

consent of all the concerned parties. branches and R-Return (Vostro)- to be submitted by

Revocable Letter of credit: Can be revoked at any branches which are maintaining the Vostro a/c of foreign

time by the opening bank without the consent of banks.

the parties. ENC - report of all export bills negotiated and sent for

Standby Letter of Credit: One bank advises collection

another bank to pay only if a transaction agreed XOS Export receivables outstanding for more than

to by the opener of the credit with the prescribed period. To be submitted to RBI at half yearly

beneficiary is not performed. interval(30thjune and 31st Dec).

Revolving Letter of Credit: On payment of bill the

LC shall be reinstated by the value of the bill

negotiated but within the original value of the LC NRI DEPOSIT SCHEMES NRE a/c Non Resident

and before its validity. The validity of such LCs (External)

should not be more than one year. A,B,C-1,C-2 branches can open Credit only by foreign

Red Clause Letter of credit: When the opening source CA,SB and others Term Deposit in rupees only

bank requests the advising bank to give loan to Not Taxable. loan can be given and be repaid from local

the exporter for the purpose of export. or external sources Both Principal and Interest

Green Clause Letter of Credit: When the Red repatriable. Funds can be transferred to NRO and FCNB

Clause credit provides for the grant of storage a/c interest rates have been freed by RBI Exchange risk

facilities at the port of shipment. faced by the depositor Nomination allowed but

Back to Back Letter of Credit: When an inland L/C repatriation allowed if nominee is NRI Joint a/cs with

is backed by the Foreign Letter of Credit for non residents are allowed

supply of goods by the manufacturer to the

NR(O) a/c (Non Resident Ordinary)

exporter for onward exporting the goods to

A,B,C-1,C-2 branches can open Credit by local & foreign

foreign contry.

source CA,SB and others Term Deposit in rupees only

Demand/sight bill under import LC shall be crystalised if

Taxable. TDS @ 30% loan can be given and be repaid from

not retired by the customer on the 10th day from the

local or external sources Principal repatriable only up to US

date of receipt thereof by converting the foreign currency

$ 1 million p.a. Interest repatriable. Transfer to NRE a/c not

amount in to rupees at the Banks Bill selling rate.

allowed Domestic interest rates applicable Not convertible

UCP(600) (Uniform Custom and Practices for in other currencies so no exchange risk Nomination allowed

Documentary Credits): various rules, practices if nominee is NRI, but repatriation will not be allowed, his

and assumptions relating to LC. NR(O) a/c will be credited Joint a/cs are allowed with close

Codified by ICC (International Chambers of relatives / other NRIs. Foreign tourists during short visit to

Commerce) Paris and effective from 01.07.2007. India can also open up to a maximum period of 6 months

There are 39 articles in the UCP 600(2007).

VISHWA YATRA FOREIGN TRAVEL CARD (1)SBI EXPRESS (UK) MIN GBP 500, MAX GBP

MIN INTIAL AMT/RELOAD 1)USD- USD 200 (2)GBP 120 5000/TRANSACTION, GBP 12000 MAX MONTHLY(2) SBI

(3)CAD 200 (4) EUR 150 (5) AUD 200 (6) JPY 15800 EXPRESS REMIT (US) MIN $50 ,$5000/- PER DAY ,MAX -

(7) SAR 750 (8)SGD - 250 @10,000/- PER DAY.MAX REMMITTANCES 3- WEEKLY 6- FORT

WEEKLY 12 MONTHLY (3)SBI EXPRESS (GULF)MIN RS.500/-

MAX RS.10,00,000/-

You might also like

- Anansit QP-DOC-01 Context of OrganizationDocument5 pagesAnansit QP-DOC-01 Context of OrganizationTan Tok Hoi100% (2)

- Trading Setups 1) Gap Down Opening Below / Cutting Across Previous Day VPLDocument20 pagesTrading Setups 1) Gap Down Opening Below / Cutting Across Previous Day VPLJayakrishnaraj AJDNo ratings yet

- Worksmart 008 - Transaction CodesDocument3 pagesWorksmart 008 - Transaction CodesJayakrishnaraj AJDNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- Arch Act - Ar Intan PDFDocument89 pagesArch Act - Ar Intan PDFIhsan Rahim100% (1)

- ACCTGBKSDocument4 pagesACCTGBKSRejed VillanuevaNo ratings yet

- (PaperzoneVN - Com) - Christ The Redeemer in Rio de JaneiroDocument14 pages(PaperzoneVN - Com) - Christ The Redeemer in Rio de Janeirokako2006No ratings yet

- Design, Modelling and Development of Electric Walking Bike: Mr. Chetan KDocument16 pagesDesign, Modelling and Development of Electric Walking Bike: Mr. Chetan KNagabhushanaNo ratings yet

- Swift FinalDocument119 pagesSwift FinalJayakrishnaraj AJDNo ratings yet

- Pyfa LK TW Iv 2016 PDFDocument63 pagesPyfa LK TW Iv 2016 PDFRobert Chou0% (1)

- Innovative Finance in AgricultureDocument142 pagesInnovative Finance in AgricultureJuan Pryor100% (1)

- Decision Point Version 2 PDFDocument51 pagesDecision Point Version 2 PDFJayakrishnaraj AJD100% (2)

- Uco BankDocument325 pagesUco Bankdoon devbhoomi realtorsNo ratings yet

- Forex Nre Nro NriDocument5 pagesForex Nre Nro NriManu MaheshwariNo ratings yet

- Forex Nre Nro NriDocument5 pagesForex Nre Nro NriChirpi CeliaNo ratings yet

- Forex NRE NRO NRIDocument5 pagesForex NRE NRO NRIadifaahNo ratings yet

- Gist On Foreign ExchangeDocument8 pagesGist On Foreign Exchangenaveen_ch522No ratings yet

- Loan Checklist - List of Compliances For A Loan TransactionDocument6 pagesLoan Checklist - List of Compliances For A Loan TransactionDinesh GadkariNo ratings yet

- HKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyDocument25 pagesHKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyParamu NatarajanNo ratings yet

- PCFCDocument6 pagesPCFCambrosialnectarNo ratings yet

- Accounts in Foreign Currency: Section-IDocument2 pagesAccounts in Foreign Currency: Section-IFaysal HaqueNo ratings yet

- Foreign Exchange Management - An Overview of Current Account TransactionsDocument26 pagesForeign Exchange Management - An Overview of Current Account TransactionsAmrita KaurNo ratings yet

- Liberalised Remittance SchemeDocument11 pagesLiberalised Remittance SchemeJahnavi tiwariNo ratings yet

- Foreign Exchange Department - Punjab National BankDocument23 pagesForeign Exchange Department - Punjab National BankHusein RangwalaNo ratings yet

- International Trade FinanceDocument19 pagesInternational Trade FinanceEknath BirariNo ratings yet

- SyllabusDocument24 pagesSyllabusRipon DebNo ratings yet

- Knowledge Bank: Fedai RulesDocument10 pagesKnowledge Bank: Fedai RulesRohan Singh100% (1)

- Sanction Letter 2604Document3 pagesSanction Letter 2604sdfdsfNo ratings yet

- Obus Republic Act No. 6426: Section 52. Transactions With Residents Which Are Not BanksDocument1 pageObus Republic Act No. 6426: Section 52. Transactions With Residents Which Are Not Bankslajefa lajefaNo ratings yet

- Foreign Remittance: Importance of Remittance: Impact On The GNPDocument10 pagesForeign Remittance: Importance of Remittance: Impact On The GNPMamunoor RashidNo ratings yet

- As 11Document17 pagesAs 11Akshay PatilNo ratings yet

- NRI Banking: I) Foreign Currency (Non-Resident) AccountsDocument5 pagesNRI Banking: I) Foreign Currency (Non-Resident) AccountsPALAKNo ratings yet

- BAFEDA Circular On USD Exchange RateDocument2 pagesBAFEDA Circular On USD Exchange RateTarek mahmood rahathNo ratings yet

- Foreign Exchange Dealers' Association of India: General Guidelines/InstructionsDocument18 pagesForeign Exchange Dealers' Association of India: General Guidelines/InstructionsSUVANKAR NANDINo ratings yet

- Nov 032009 Fepd 21 eDocument9 pagesNov 032009 Fepd 21 edff_jxNo ratings yet

- Foreign Exchange Dealers' Association of India: General Guidelines/InstructionsDocument18 pagesForeign Exchange Dealers' Association of India: General Guidelines/InstructionssannnNo ratings yet

- Trade Certification Level 2 Exclude ImportsDocument15 pagesTrade Certification Level 2 Exclude ImportsRAHUL BISHWASNo ratings yet

- 14 - 10 - 23 Afternoon Test 1 Without AnswerDocument8 pages14 - 10 - 23 Afternoon Test 1 Without Answerkkprabhu1122No ratings yet

- English FDForm IndividualDocument2 pagesEnglish FDForm IndividualPOLATI BHASKARNo ratings yet

- Liberalized Remittance SchemeDocument6 pagesLiberalized Remittance SchemeAmrit SohalNo ratings yet

- GAF Loan Funding ProceduresDocument3 pagesGAF Loan Funding ProceduresNamita SardaNo ratings yet

- The U.S. Dollar Premium Bond Rules, 2002: Government of The Peoples Republic of BangladeshDocument13 pagesThe U.S. Dollar Premium Bond Rules, 2002: Government of The Peoples Republic of Bangladeshshobu_iujNo ratings yet

- CBL Updated 189-05-20Document38 pagesCBL Updated 189-05-20HamzaNo ratings yet

- Appendix 10.1 Certificate of Inward Remittance (Cir) of Foreign Exchange No. Ccyy-Nnnnnn-BbbbbbbbbbbDocument4 pagesAppendix 10.1 Certificate of Inward Remittance (Cir) of Foreign Exchange No. Ccyy-Nnnnnn-BbbbbbbbbbbRalph AcobaNo ratings yet

- Asset, Liability, Cash Reserves and Credit InfoDocument3 pagesAsset, Liability, Cash Reserves and Credit InfoPrachi GoelNo ratings yet

- Foreign Exchange Products in BangladeshDocument61 pagesForeign Exchange Products in BangladeshfatemabintekhairmoonNo ratings yet

- Banking Report: Interbank Rates: Submitted byDocument12 pagesBanking Report: Interbank Rates: Submitted byAicha XaheerNo ratings yet

- Sep 302009 Fepd 16 eDocument15 pagesSep 302009 Fepd 16 edff_jxNo ratings yet

- Pre Shipment FINANCEDocument4 pagesPre Shipment FINANCEaniket7777No ratings yet

- ES 1 - General Guidelines On Gold LoanDocument3 pagesES 1 - General Guidelines On Gold LoanVishnu AppuNo ratings yet

- Export Finance1Document29 pagesExport Finance1Yashwanth PrasadNo ratings yet

- Mr,.#Fllfterac: Finance CorporationDocument8 pagesMr,.#Fllfterac: Finance CorporationJahangir SajfdarNo ratings yet

- Some Information On Export Some Information On Export Financing FinancingDocument23 pagesSome Information On Export Some Information On Export Financing FinancingRoshani JoshiNo ratings yet

- 1 Pre-Promotion Training Material 2021 Indian Overseas Bank, Staff CollegeDocument7 pages1 Pre-Promotion Training Material 2021 Indian Overseas Bank, Staff CollegeAman MujeebNo ratings yet

- Page 36 of 100: Back To TopDocument1 pagePage 36 of 100: Back To Toplajefa lajefaNo ratings yet

- Module 4 PDFDocument19 pagesModule 4 PDFRAJASAHEB DUTTANo ratings yet

- 25 S49Loans, GoldLoans, UBLN, SuretyLoanDocument13 pages25 S49Loans, GoldLoans, UBLN, SuretyLoanSyed FaisalNo ratings yet

- FCLDocument37 pagesFCLChintan ManekNo ratings yet

- Forloans PDFDocument8 pagesForloans PDFJanlo FevidalNo ratings yet

- Di FormatDocument3 pagesDi FormatStudents AffairsNo ratings yet

- Project Funding Procedures - GSFDocument2 pagesProject Funding Procedures - GSFMartha L. Arango Pinzon100% (1)

- Atm Abcd-2Document20 pagesAtm Abcd-2Ark CutNo ratings yet

- Islami Bank Bangladesh Export LC PresentationDocument25 pagesIslami Bank Bangladesh Export LC PresentationMd. Zahedul Ahasan100% (1)

- IGL, General Banking Law (Riguera Lec)Document12 pagesIGL, General Banking Law (Riguera Lec)Ivan LeeNo ratings yet

- Who Can Open A NRE Account?Document6 pagesWho Can Open A NRE Account?Ravishankar PrasadNo ratings yet

- Case Study Revision - BFMDocument8 pagesCase Study Revision - BFMMOHAMED FAROOKNo ratings yet

- NBP Schedule of Bank ChargesDocument15 pagesNBP Schedule of Bank ChargesaavaraichNo ratings yet

- Best Practices in Foreign Exchange TransactionsDocument23 pagesBest Practices in Foreign Exchange Transactionsramnath86No ratings yet

- Question On Domain KnowledgeDocument60 pagesQuestion On Domain KnowledgebahuNo ratings yet

- Retail Banking Deposits: Deposit ProductsDocument25 pagesRetail Banking Deposits: Deposit ProductsShikha ShethNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- About AxisbankDocument1 pageAbout AxisbankJayakrishnaraj AJDNo ratings yet

- Nri Easy Savings AccountDocument2 pagesNri Easy Savings AccountJayakrishnaraj AJDNo ratings yet

- Prime Salary AccountDocument2 pagesPrime Salary AccountJayakrishnaraj AJDNo ratings yet

- Burgundy Savings AccountDocument2 pagesBurgundy Savings AccountJayakrishnaraj AJDNo ratings yet

- ABS1 S1L1 010312 Hindipod101 RecordingscriptDocument8 pagesABS1 S1L1 010312 Hindipod101 RecordingscriptJayakrishnaraj AJDNo ratings yet

- ABS1 S1L1 010312 Hindipod101Document6 pagesABS1 S1L1 010312 Hindipod101Jayakrishnaraj AJDNo ratings yet

- AddressDocument1 pageAddressJayakrishnaraj AJDNo ratings yet

- Pillars of Retail Banking OperationsDocument17 pagesPillars of Retail Banking OperationsJayakrishnaraj AJDNo ratings yet

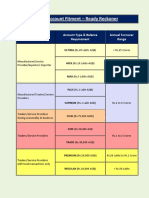

- Amount of Monthly Instalment Rate of Interest RD Term - No. of Months Maturity ValueDocument2 pagesAmount of Monthly Instalment Rate of Interest RD Term - No. of Months Maturity ValueJayakrishnaraj AJDNo ratings yet

- CON2015-487 Service Manager RL KMBL 23102015Document2 pagesCON2015-487 Service Manager RL KMBL 23102015Jayakrishnaraj AJDNo ratings yet

- Icici Ops StrategyDocument30 pagesIcici Ops StrategyJayakrishnaraj AJDNo ratings yet

- Two Wheelers Policy WordingsDocument9 pagesTwo Wheelers Policy WordingsAman BindNo ratings yet

- LTR Online Updation and ReviewDocument4 pagesLTR Online Updation and ReviewJayakrishnaraj AJDNo ratings yet

- Handling Unprocessed Customer InstructionsDocument1 pageHandling Unprocessed Customer InstructionsJayakrishnaraj AJDNo ratings yet

- Process of Cash AcceptanceDocument5 pagesProcess of Cash AcceptanceJayakrishnaraj AJDNo ratings yet

- Net Interest Hdfcbank Xl2003 18jan13Document4 pagesNet Interest Hdfcbank Xl2003 18jan13Jayakrishnaraj AJDNo ratings yet

- Worksmart - Re KYC ProcessDocument5 pagesWorksmart - Re KYC ProcessJayakrishnaraj AJDNo ratings yet

- Provisioning Coverage Ratio - Part IIDocument4 pagesProvisioning Coverage Ratio - Part IIJayakrishnaraj AJDNo ratings yet

- Documentation For NR Account OpeningDocument17 pagesDocumentation For NR Account OpeningJayakrishnaraj AJDNo ratings yet

- Trade FinanceDocument23 pagesTrade FinanceJayakrishnaraj AJDNo ratings yet

- Transaction Charges of Credit Cards at A Glance PDFDocument6 pagesTransaction Charges of Credit Cards at A Glance PDFJayakrishnaraj AJDNo ratings yet

- Eq Acc Opening Form Revised 3-6-17Document8 pagesEq Acc Opening Form Revised 3-6-17Jayakrishnaraj AJDNo ratings yet

- Worksmart 026 - Process For Handling Mutilated NotesDocument27 pagesWorksmart 026 - Process For Handling Mutilated NotesJayakrishnaraj AJDNo ratings yet

- Branch ReportsDocument5 pagesBranch ReportsJayakrishnaraj AJDNo ratings yet

- Current Account FitmentDocument1 pageCurrent Account FitmentJayakrishnaraj AJDNo ratings yet

- Eq Acc Opening Form Revised 3-6-17Document4 pagesEq Acc Opening Form Revised 3-6-17Jayakrishnaraj AJDNo ratings yet

- Google Glass: Case StudyDocument10 pagesGoogle Glass: Case StudyUtkarsh ChaturvediNo ratings yet

- (2012) A Greenhouse Gas Accounting Tool For Palm Products (RSPO - PalmGHG Beta Version 1)Document56 pages(2012) A Greenhouse Gas Accounting Tool For Palm Products (RSPO - PalmGHG Beta Version 1)anon_369860093No ratings yet

- Protecting Malaysian Automobile Industry: A Case OnDocument10 pagesProtecting Malaysian Automobile Industry: A Case OnRamiz AhmedNo ratings yet

- Banco Gaskets (India) Ltd. An Division: Earnings DeductionsDocument1 pageBanco Gaskets (India) Ltd. An Division: Earnings DeductionsAnkur J PatelNo ratings yet

- IFRS1Document125 pagesIFRS1Sergiu CebanNo ratings yet

- Final Project EconomicsDocument5 pagesFinal Project EconomicsAayan AhmedNo ratings yet

- EC426 Option Meeting 29 September 2010Document14 pagesEC426 Option Meeting 29 September 2010Prathibha HaridasNo ratings yet

- Motherson SumiDocument18 pagesMotherson SumivishalNo ratings yet

- Token Numbers List PDFDocument87 pagesToken Numbers List PDFParkashNo ratings yet

- Godrej Loud-PresentationDocument12 pagesGodrej Loud-PresentationBhargavNo ratings yet

- Brown - Innovative Energy Efficiency PoliciesDocument26 pagesBrown - Innovative Energy Efficiency PolicieschrisNo ratings yet

- Circular Flow of Eco ActivityDocument18 pagesCircular Flow of Eco ActivityDeisha SzNo ratings yet

- Farmaid Tractor Limited Case StudyDocument2 pagesFarmaid Tractor Limited Case StudyRahul Savalia0% (1)

- Parkin Econ SM CH01ADocument12 pagesParkin Econ SM CH01AMaciel García FuentesNo ratings yet

- Unit 7Document22 pagesUnit 7Sandhya ChimmiliNo ratings yet

- Development TrendsDocument4 pagesDevelopment TrendsMary Charisse SandroNo ratings yet

- .Au Evidence Historical Details For ABN 72 066 207 615 - ABN LookupDocument2 pages.Au Evidence Historical Details For ABN 72 066 207 615 - ABN LookupricharddrawsstuffNo ratings yet

- Final Intern ReportsDocument123 pagesFinal Intern ReportsKAWSER RAFINo ratings yet

- Chapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019Document5 pagesChapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019阮幸碧No ratings yet

- Fin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Document3 pagesFin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Ray Gworld50% (2)

- Trader Website Fund Details - W - SummaryDocument1,430 pagesTrader Website Fund Details - W - SummaryGtc Diaz CarlosNo ratings yet