Professional Documents

Culture Documents

Markets and Commodity Figures: Total Market Turnover Statistics

Uploaded by

Tiso Blackstar Group0 ratings0% found this document useful (0 votes)

14 views3 pagesBonds July 12 2017

Original Title

120717 Bonds

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBonds July 12 2017

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views3 pagesMarkets and Commodity Figures: Total Market Turnover Statistics

Uploaded by

Tiso Blackstar GroupBonds July 12 2017

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Markets and Commodity figures

12 July 2017

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1 435 31.90 bn Rbn 31.86 206 19.20 bn Rbn 18.06

Week to Date 3 280 92.76 bn Rbn 96.27 1 293 137.10 bn Rbn 135.60

Month to Date 9 700 246.23 bn Rbn 253.86 2 869 316.47 bn Rbn 308.22

Year to Date 148 853 3 832.69 bn Rbn 4 060.33 40 432 5 076.58 bn Rbn 4 964.28

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 139 5.08 bn Rbn 5.04 31 1.65 bn Rbn 1.49

Current Day Sell 117 3.85 bn Rbn 3.93 15 3.23 bn Rbn 3.32

Net 22 1.24 bn Rbn 1.11 16 -1.58 bn Rbn -1.83

Buy 321 14.99 bn Rbn 15.24 114 10.68 bn Rbn 9.63

Week to Date Sell 270 11.67 bn Rbn 11.76 54 13.56 bn Rbn 13.76

Net 51 3.32 bn Rbn 3.48 60 -2.88 bn Rbn -4.13

Buy 793 35.74 bn Rbn 35.95 254 22.46 bn Rbn 20.40

Month to Date Sell 794 37.65 bn Rbn 38.14 139 38.50 bn Rbn 39.46

Net -1 -1.91 bn Rbn -2.19 115 -16.04 bn Rbn -19.06

Buy 12 385 525.86 bn Rbn 546.34 2 873 260.55 bn Rbn 251.99

Year to Date Sell 10 094 484.33 bn Rbn 508.82 1 043 155.92 bn Rbn 159.56

Net 2 291 41.52 bn Rbn 37.52 1 830 104.62 bn Rbn 92.42

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 9.076%

All Bond Index Top 556.227

20 Composite 552.145 0.26% 4.27%

GOVI 8.971%Split - 554.847

ALBI20 Issuer Class GOVI 550.781 0.25% 4.41%

OTHI 9.357%

ALBI20 Issuer Class Split - 565.599

OTHI 561.434 0.29% 3.88%

CILI15 2.621%

Composite Inflation 245.116

Linked Index Top 15 245.133 -0.62% -0.22%

ICOR 3.910%

CILI15 Issuer Class 255.265

Split - ICOR 255.230 0.02% 2.67%

IGOV 2.571%

CILI15 Issuer Class 244.416

Split - IGOV 244.435 -0.66% -0.39%

ISOE 3.222%

CILI15 Issuer Class 242.257

Split - ISOE 242.228 0.10% 2.60%

MMI JSE Money Market Index

0 223.976 223.929 0.24% 4.13%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Dec 2018

AFRICA 7.505% 7.540% 7.28% 7.97%

R203 REPUBLIC OF SOUTH

Jan 2020

AFRICA 7.655% 7.735% 7.33% 8.15%

ES18 ESKOM HOLDINGSAugLIMITED

2020 8.545% 8.625% 8.13% 8.88%

R204 REPUBLIC OF SOUTH

Mar 2021

AFRICA 7.785% 7.865% 7.45% 8.31%

R207 REPUBLIC OF SOUTH

Jan 2023

AFRICA 9.225% 9.305% 8.72% 9.46%

R208 REPUBLIC OF SOUTH

Feb 2023

AFRICA 8.195% 8.275% 7.83% 8.65%

ES23 ESKOM HOLDINGSAprLIMITED

2026 9.925% 10.030% 9.30% 10.09%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.785% AFRICA 8.890% 8.31% 9.00%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 9.330% 9.430% 8.70% 9.47%

ES26 ESKOM HOLDINGSFebLIMITED

2031 9.405% 9.505% 8.74% 9.55%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.525% 9.620% 8.84% 9.66%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.890% 11.000% 10.05% 11.01%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.710% 9.820% 9.04% 9.83%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.680% 9.790% 9.03% 9.80%

ES33 ESKOM HOLDINGSJanLIMITED

2037 9.795% 9.900% 9.12% 9.91%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 9.885% 9.990% 9.14% 10.00%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 9.810% 9.920% 9.10% 9.92%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 11.070% 11.180% 10.18% 11.18%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 9.915% 10.020% 9.17% 10.03%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 9.885% 9.990% 9.16% 9.99%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.810% 6.810% 6.77% 6.83%

JIBAR1 JIBAR 1 Month 7.083% 7.083% 7.08% 7.12%

JIBAR3 JIBAR 3 Month 7.342% 7.342% 7.32% 7.38%

JIBAR6 JIBAR 6 Month 7.833% 7.833% 7.81% 8.00%

RSA 2 year retail bond 7.75% 0 0 0

RSA 3 year retail bond 8.00% 0 0 0

RSA 5 year retail bond 8.50% 0 0 0

RSA 3 year inflation linked retail

3.00%

bond 0 0 0

RSA 5 year inflation linked retail

2.50%

bond 0 0 0

RSA 10 year inflation linked retail

2.50%

bond 0 0 0

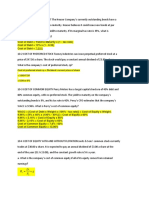

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Bonds - February 15 2017Document6 pagesBonds - February 15 2017Tiso Blackstar GroupNo ratings yet

- Bonds - July 17 2017Document6 pagesBonds - July 17 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 5 2019Document3 pagesBonds - February 5 2019Tiso Blackstar GroupNo ratings yet

- Bonds - July 18 2017Document6 pagesBonds - July 18 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 7 2017Document6 pagesBonds - April 7 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 10 2017Document6 pagesBonds - February 10 2017Tiso Blackstar GroupNo ratings yet

- Bonds - July 19 2017Document6 pagesBonds - July 19 2017Tiso Blackstar GroupNo ratings yet

- Bonds - July 31 2017Document6 pagesBonds - July 31 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 16 2017Document6 pagesBonds - February 16 2017Tiso Blackstar GroupNo ratings yet

- Bonds - February 20 2019Document3 pagesBonds - February 20 2019Tiso Blackstar GroupNo ratings yet

- Bonds - February 13 2019Document3 pagesBonds - February 13 2019Tiso Blackstar GroupNo ratings yet

- Bonds - August 14 2017Document3 pagesBonds - August 14 2017Tiso Blackstar GroupNo ratings yet

- Bonds - May 2 2017Document6 pagesBonds - May 2 2017Tiso Blackstar GroupNo ratings yet

- Bonds - March 29 2018Document6 pagesBonds - March 29 2018Tiso Blackstar GroupNo ratings yet

- Bonds - April 11 2019Document3 pagesBonds - April 11 2019Tiso Blackstar GroupNo ratings yet

- Bonds - October 26 2017Document6 pagesBonds - October 26 2017Tiso Blackstar GroupNo ratings yet

- Bonds - February 6 2018Document3 pagesBonds - February 6 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 9 2022Document3 pagesBonds - February 9 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 11 2017Document6 pagesBonds - April 11 2017Tiso Blackstar GroupNo ratings yet

- Bonds - May 14 2019Document3 pagesBonds - May 14 2019Tiso Blackstar GroupNo ratings yet

- Bonds - October 14 2021Document3 pagesBonds - October 14 2021Lisle Daverin BlythNo ratings yet

- Bonds - February 6 2019Document3 pagesBonds - February 6 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 21 2019Document3 pagesBonds - March 21 2019Tiso Blackstar GroupNo ratings yet

- Bonds - January 16 2019Document3 pagesBonds - January 16 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - May 28 2020Document3 pagesBonds - May 28 2020Lisle Daverin BlythNo ratings yet

- Bonds - February 17 2017Document6 pagesBonds - February 17 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds PDFDocument6 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Bonds - February 28 2018Document3 pagesBonds - February 28 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Bonds - February 2 2017Document6 pagesBonds - February 2 2017Tiso Blackstar GroupNo ratings yet

- Bonds - January 18 2019Document3 pagesBonds - January 18 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - May 5 2020Document3 pagesBonds - May 5 2020Lisle Daverin BlythNo ratings yet

- Bonds - August 9 2022Document3 pagesBonds - August 9 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - March 7 2022Document3 pagesBonds - March 7 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 11 2019Document6 pagesBonds - February 11 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 27 2020Document3 pagesBonds - May 27 2020Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Document2 pagesArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- Collective InsightDocument10 pagesCollective InsightTiso Blackstar GroupNo ratings yet

- Statement From The SA Tourism BoardDocument1 pageStatement From The SA Tourism BoardTiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- JP Verster's Letter To African PhoenixDocument2 pagesJP Verster's Letter To African PhoenixTiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Anti Corruption Working GuideDocument44 pagesAnti Corruption Working GuideTiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- JudgmentDocument30 pagesJudgmentTiso Blackstar GroupNo ratings yet

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- Tobacco Bill - Cabinet Approved VersionDocument41 pagesTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupNo ratings yet

- Collective Insight September 2022Document14 pagesCollective Insight September 2022Tiso Blackstar GroupNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- Critical Skills List - Government GazetteDocument24 pagesCritical Skills List - Government GazetteTiso Blackstar GroupNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- Bonds - June 8 2022Document3 pagesBonds - June 8 2022Lisle Daverin BlythNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- The ANC's New InfluencersDocument1 pageThe ANC's New InfluencersTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - June 1 2021Document2 pagesSanlam Stratus Funds - June 1 2021Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Dec ChallanDocument1 pageDec ChallanMoon MunawarNo ratings yet

- EF3320 Group ProjectDocument8 pagesEF3320 Group ProjectJohnny LamNo ratings yet

- Assessing Early Warning SystemsDocument45 pagesAssessing Early Warning SystemspasaitowNo ratings yet

- Republic of The Philippines Department of Education Public Technical - Vocational High SchoolsDocument10 pagesRepublic of The Philippines Department of Education Public Technical - Vocational High SchoolsKristel AcordonNo ratings yet

- Chapter 07 Financial Distress - FinalDocument22 pagesChapter 07 Financial Distress - FinalMohammad Salim HossainNo ratings yet

- Ipo Prospectus GsDocument164 pagesIpo Prospectus GsSehrish MushtaqNo ratings yet

- 03005003622Document24 pages03005003622AJK Engineers-PVTNo ratings yet

- AES Case FinalDocument23 pagesAES Case Finalwhaza789100% (1)

- International Finance & Financial Markets Maf306: I R D I M 14 H (Libid Libor) 15Document5 pagesInternational Finance & Financial Markets Maf306: I R D I M 14 H (Libid Libor) 15KÃLÅÏ SMÎLĒYNo ratings yet

- Chapter 11 AISDocument4 pagesChapter 11 AISMyka ManalotoNo ratings yet

- ACCT1198Document6 pagesACCT1198RuthNo ratings yet

- An Overview of The Shariah Issues of Rahn Based Financing in MalaysiaDocument15 pagesAn Overview of The Shariah Issues of Rahn Based Financing in MalaysiaPekasam LautNo ratings yet

- Clean Collection Documentary Collection and Direct CollectionDocument4 pagesClean Collection Documentary Collection and Direct CollectionWadzanai MuteroNo ratings yet

- Final Intership Report SampleDocument32 pagesFinal Intership Report SampleMaham QureshiNo ratings yet

- Icici ResultsDocument7 pagesIcici ResultsKishore IrctcNo ratings yet

- Multinational Financial Management: An OverviewDocument25 pagesMultinational Financial Management: An OverviewRazib AliNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Lecture Course Week 2Document61 pagesLecture Course Week 2juanpablooriolNo ratings yet

- Internal Check and ControlsDocument18 pagesInternal Check and ControlsAnonymous uxd1ydNo ratings yet

- Class 12 CBSE Economics Sample Paper 2023Document8 pagesClass 12 CBSE Economics Sample Paper 2023yazhinirekha4444No ratings yet

- Payment and Settlement Systems in IndiaDocument23 pagesPayment and Settlement Systems in IndiagopubooNo ratings yet

- WP392 PDFDocument41 pagesWP392 PDFnapierlogsNo ratings yet

- Optimize 50-stock portfolio using 1,890 estimatesDocument4 pagesOptimize 50-stock portfolio using 1,890 estimatesnotebook99No ratings yet

- Building Proforma Models in ExcelDocument13 pagesBuilding Proforma Models in ExcelCristina SimionNo ratings yet

- RLW 313 Tax Law 1 Course Outline 2023Document5 pagesRLW 313 Tax Law 1 Course Outline 2023Boldwin NdimboNo ratings yet

- Admission Offer For Alhagi Janneh: Robert Kennedy College Zurich GMBHDocument3 pagesAdmission Offer For Alhagi Janneh: Robert Kennedy College Zurich GMBHAlhagi JannehNo ratings yet

- Accrual Cash BasisDocument2 pagesAccrual Cash BasisSaranjam KhanNo ratings yet

- Guiding Principles of Monetary Administration by The Bangko SentralDocument8 pagesGuiding Principles of Monetary Administration by The Bangko SentralEuphoria BTSNo ratings yet

- MBA/MSc 2021 Students Request Fee Installment ExtensionDocument9 pagesMBA/MSc 2021 Students Request Fee Installment ExtensionChalitha DhananjaniNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet