Professional Documents

Culture Documents

Directors Report

Uploaded by

dinuindiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Directors Report

Uploaded by

dinuindiaCopyright:

Available Formats

DIRECTORS REPORT

This document would help in preparing Board of Directors

Report under Companies Act 2013

CA. Pramod Jain

B.Com (H), FCA, FCS, FCMA, LL.B, DISA, MIMA

26th August 2015

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

CONTENTS

S. NO CONTENT PAGE NO.

1 Statutory Summary 2

2 Importance 2

3 Old Points which shall Continue 3

4 New Reporting Points for all Companies 4

New Reporting Points for Listed Companies and

5 5-7

Specified Companies

6 Directors Report for One Person Company 7

7 Signing of Boards Report 7

8 Penalty for Non-Compliance 8

9 Annexure - Draft Directors Report 9-18

Company Law Directors Report Page1

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

BOARD OF DIRECTORS REPORT

STATUTORY SUMMARY

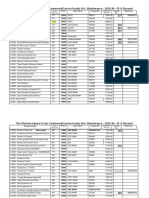

Section Rule Forms

134 (3) Companies (Accounts) Rules Particulars of contracts and

to (6) 2014 AOC-2

arrangements with related parties

Rule 8 to Rule 11

Companies (CSR Policies) Rules,

Annexure

2014

MGT 9 Extract of Annual Report

IMPORTANCE

These reports are primary source of information for an investor to understand the company,

management views and to analyse the Financials.

The Companies Act, 2013has enhanced the accountability and responsibilities of directors by

clearly defining their duties and responsibilities, qualification of independent directors and

mandating certain disclosures such as evaluation of performance of board, CSR policy, whistle

blower mechanism, risk policies etc in the Boards report.

Board Report together with complete Financial Statements and Auditors Report are to be sent

along with notice of Annual General meeting to members of the company.

Board Report is the only document along with Financial Statements that can be revised / re-

opened u/s 131 now.

The Board Report has to be of Standalone Financial Statements of the company and not of the

Consolidated Financial Statements. However, it shall contain a separate section wherein a

report on the performance and financial position of each of the subsidiaries, associates and JV

companies included in the CFS is presented.

Company Law Directors Report Page2

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

OLD POINTS WHICH SHALL CONTINUE

Reporting by directors in Directors Report under Companies Act 2013 has increased tremendously.

However, there are certain points which are still to be reported which were also required under the

1956 Act. These are:-

1. State of the Companys Affairs.

2. Amount, if any, proposed to be carried to reserves.

3. Proposed dividends, if any

4. Material changes and commitments, if any, which affect financial position of the company in

between the year end and the date of directors report.

5. Explanation to qualifications, if any, in auditors report.

6. Particulars of Conservation of Energy, Technology Absorption, Foreign Exchange Earnings

and Outgo.

7. Significant changes in the nature of business or businesses in which company or its

subsidiaries have an interest.

8. Particulars of employees drawing a specified 1 which are required to be given under Rule 5(2)

and (3) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules

2014.

9. Directors Responsibility Statement containing:

a. Applicable accounting standards have been followed with explanation for any material

departures

b. Selected accounting policies have been applied consistently to give a true and fair view

of the state of affairs of the company at the end of the financial year and of the profit

and loss of the company for that period.

c. Proper and sufficient care has been taken for the maintenance of adequate accounting

records for safeguarding the assets of the company and for preventing and detecting

fraud and other irregularities

d. The annual accounts are prepared on a going concern basis.

10. In addition to the above, listed companies have to attach a Corporate governance report as per

Clause no.49 giving details such as composition of board, audit committee, subsidiary

companies, disclosures and other useful information to shareholders.

Company Law Directors Report Page3

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

NEW REPORTING POINTS FOR ALL COMPANIES

Apart from the old reporting points certain new points are also to be reported by directors in the

Directors Report. These new points are as per Section 134(3), Companies (Accounts) Rules 2014 and

various other provisions under the Act. New points which are to be reported by all companies

including Private companies are:

1. The extract of the annual return in MGT 9.

2. Number of meetings of the Board. (It was covered earlier in case of listed companies only)

3. New Clause in Directors Responsibility Statement - Directors had devised proper systems to

ensure compliance with provisions of all applicable laws and that such system were adequate

and operating effectively.

4. Particulars of Loans, Guarantees or Investments u/s 186

5. Particulars of contracts or arrangements with Related Parties referred to in section 188(1) to be

reported in the Form AOC-2.

6. Statement indicating development and implementation of a risk management policy for the

company including identification therein of elements of risk, if any, which in the opinion of the

Board may threaten the existence of the Company. (Earlier listed companies only were

reporting under clause no.49).

7. Details of Directors or Key Managerial Personnel who were appointed or have resigned during

the year

8. Names of companies which have become or ceased to be its Subsidiaries, Joint Ventures or

Associate companies during the year along with reasons therefore.

9. Details relating to Deposits covered under Chapter V of the Act namely a) Accepted during the

year (b) remained unpaid or unclaimed as at the end of the year(c) whether there has been any

default in repayment of deposits or payment of interest thereon during the year and if so,

number of such cases and the total amount involved,

10. Orders passed by Regulators or Courts or Tribunal which impact the going concern status and

companys operations in future.

11. Apart from existing points, new reporting in Directors Responsibility Statement:

a) The directors had devised proper systems to ensure compliance with the provisions of

all applicable laws and that such systems were adequate and operating effectively.

Company Law Directors Report Page4

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

12. Details in respect of adequacy of Internal Financial Controls with reference to the Financial

Statements.

13. In case of Revision of or Re-opening of Financial Statements or Boards Report, detailed

reasons to be stated. (3rd Proviso to s. 131(1)

14. Voting rights not exercised by employees regarding purchase of its own shares by employees

or by trustees for benefit of employees as per S.67(3) read with rule 16(4) Company (Share

Capital & Debenture) Rules 2014

15. Transfer Of Unclaimed Dividend To Investor Education And Protection Fund

16. Disclosures under Companies (Share Capital and Debenture) Rules, 2014 regarding:-

a. Disclosures pursuant to shares with differential voting rights

b. Disclosure pursuant to Issue of Sweat Equity Shares

c. Disclosure pursuant to Employee Stock Option and Employee Stock Purchase Schemes

17. As per Rule 5(2) of Cos. (Appointment and Remuneration of Managerial Personnel) Rules,

2014 :

a. If employed throughout the Financial Year, was in receipt of remuneration for that year

which, in aggregate, was not less than Rs. 60 Lacs (Old Requirement);

b. If employed for a part of the Financial Year, was in receipt of remuneration for any part

of that year, at a rate which, in the aggregate, was not less than Rs. 5 Lacs per month

(Old Requirement);

c. If employed throughout Financial Year or part thereof, was in receipt of remuneration

in that year which, in aggregate, or as the case may be, at a rate which, in the aggregate,

is in excess of that drawn by the MD or WTD or Manager and holds by himself or

along with his spouse and dependent children, not less than 2% of the equity shares of

the company.

NEW REPORTING POINTS FOR LISTED COMPANIES AND SPECIFIED COMPANIES

Listed companies and certain specified companies i.e., companies who on basis of net-worth, paid up

capital, turnover, net profit, etc. are required to make specific disclosures in Directors Report. The

new disclosures for such specified companies are:

1. A statement on declaration given by independent director u/s 149(6).

Company Law Directors Report Page5

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

2. Listed companies and specified companies u/s178(1) to disclose companys policy on directors

appointment and remuneration including criteria for determining qualifications, positive attributes,

independence of a director and other matters provided u/s 178(3).

3. Explanations or comments by the Board on every qualification, reservation or adverse remark or

disclaimer made by not only statutory auditor in his report but also by the Company Secretary in

practice in his Secretarial Audit Report , wherever is applicable.

4. The details about the policy developed and implemented by the company on Corporate Social

Responsibility initiatives taken during the year along with related annexure.

5. In case of a listed company and every other public company having paid-up share capital of Rs. 25

crores or more, a statement indicating the manner in which formal annual evaluation has been

made by the Board of its own performance and that of its committees and individual directors as

per Rule 8(4).

6. Apart from existing points, new reporting in Directors Responsibility statement for listed

companies would include:

a. Internal Financial Controls laid have been followed by the company and that such controls

are adequate and are operating effectively.

7. Re-appointment of independent director after term of 5 years u/s 149(10)

8. Composition of audit committee & reasons for not accepting recommendations of audit committee,

if any u/s.177(8)

9. Details of Establishment of Vigil mechanism u/s. 177(10)

10. Policy formulated by Nomination and Remuneration committee regarding criteria for determining

qualifications, positive attributes & independence of director u/s 178(4)

11. For listed company Rule 5(1) of Companies (Appointment & Remuneration of Managerial

Personnel) Rules, 2014

a. Ratio of remuneration of each director to median remuneration of the employees of

company for FY;

b. Percentage increase in remuneration of each director, CFO, CEO, CS or Manager, if any, in

the FY;

c. Percentage increase in the median remuneration of employees in the FY;

d. No. of permanent employees on the rolls of company;

e. Explanation on relationship between average increase in remuneration & co. performance;

Company Law Directors Report Page6

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

f. Comparison of remuneration of KMP & performance of co.;

g. Variations in market capitalisation of co., PE ratio as at closing date of current FY and

previous FY and % increase over decrease in market quotations of shares of co. in

comparison to rate at which co. came out with last public offer in case of listed cos., and in

case of unlisted companies, variations in net worth of co. at current FY and previous FY;

h. Average percentile increase already made in salaries of employees other than managerial

personnel in last FY and its comparison with percentile increase in managerial

remuneration and justification thereof and point out if there are any exceptional

circumstances for increase in managerial remuneration

i. Comparison of the each remuneration of the Key Managerial Personnel against the

performance of the company;

j. Key parameters for any variable component of remuneration availed by the directors;

k. Ratio of the remuneration of the highest paid director to that of the employees who are not

directors but receive remuneration in excess of the highest paid director during the year;

l. Affirmation that the remuneration is as per the remuneration policy of the company.

12. Secretarial audit report in prescribed form shall be annexed to Boards report as per Section 204

ONE PERSON COMPANY

The Board Report would contain explanations or comments by Board on every qualification,

reservation, adverse remarks made by Statutory Auditor in his report.

SIGNING OF BOARDS REPORT

Boards Report and annexures forming part of it, has to be signed as under:-

If authorised by the Board

o by the Chairperson of the company

If not authorized by the Board:

o by at least two directors, one of whom shall be a Managing Director; or

o by One director where there is one director.

Company Law Directors Report Page7

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

PENALTY FOR NON-COMPLIANCE

Contravention

If Company contravenes the provisions of Section 134, then the punishment shall be:

On Company

Fine which shall not be less than Rs. 50,000 but which may extend to Rs.25 Lacs

On Officer in Default

Imprisonment for a term which may extend to 3 years; or

With fine which shall not be less than Rs.50,000 but which may extend to Rs.5lacs; or

With both

I hope this document would be of use to you. I thank CS. Divya Khurana in assisting me to compile

this document.

Best Regards

CA. Pramod Jain

pramodjain@lunawat.com

+91 9811073867

(Disclaimer: Though full efforts have been made to state the interpretations and case laws correctly,

yet the author is not responsible / liable for any loss or damage caused to anyone due to any mistake /

error / omissions)

Company Law Directors Report Page8

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

ANNEXURE-1

DRAFT OF DIRECTORS REPORT

To the Members,

Your Directors have pleasure in submitting their Annual Report of the Company together with

the Audited Statements of Accounts for the year ended 31st March,

1. FINANCIAL RESULTS

The Companys financial performance for the year under review alongwith previous years figures are

given hereunder:

Particulars For the C.Y. Ended. For the P.Y. ended.

Net Sales /Income from

Business Operations

Other Income

Total Income

Less: Interest

Profit before Depreciation

Less: Depreciation

Profit after depreciation and Interest

Less: Current Income Tax

Net Profit after Tax

Dividend (including Interim if any and final )

Net Profit after dividend and Tax

Amount transferred to General Reserve

Balance carried to Balance Sheet

Performance and Financial Position of the Subsidiaries, Associates and Joint Venture companies

Subsidiaries

Associates

Joint Ventures

2. DIVIDEND

Company Law Directors Report Page9

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

In the month of the Company declared an Interim Dividend of Rsper share. Your

Directors are pleased to recommend a final dividend of Rsper share aggregating to Rs..per

share (both inclusive interim and final) for the current financial year. The dividend if approved and

declared in the forthcoming Annual General meeting would result a total Dividend outflow of

Rsand Dividend Distribution Tax of Rs aggregating a total outflow of Rs..

or

Your Directors are pleased to recommend a dividend of Rsper share aggregating to Rs..per share

for the current financial year. The dividend if approved and declared in the forthcoming Annual

General meeting would result a Dividend outflow of Rsand dividend Distribution Tax of

Rs aggregating a total outflow of Rs..

or

No Dividend was declared for the current financial year due to conservation of Profits/due to loss

incurred by the Company /due to insufficient profit.

3. TRANSFER OF UNCLAIMED DIVIDEND TO INVESTOR EDUCATION AND

PROTECTION FUND

In terms of Section 125 of the Companies Act, 2013, any unclaimed or unpaid Dividend relating to the

financial yearis due for remittance on..to the Investor Education and Protection

Fund established by the Central Government.

or

Since there was no unpaid/unclaimed Dividend declared and paid last year, the provisions of Section

125 of the Companies Act, 2013 do not apply.

or

The provisions of Section 125(2) of the Companies Act, 2013 do not apply as there was no dividend

declared and paid last year.

4. REVIEW OF BUSINESS OPERATIONS AND FUTURE PROSPECTS

Your Directors wish to present the details of Business operations done during the year under review:

a. Production and Profitability

b. Sales

c. Marketing and Market environment

d. Future Prospects including constraints affecting due to Government policies

Company Law Directors Report Page10

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

5. MATERIAL CHANGES AND COMMITMENT IF ANY AFFECTING THE FINANCIAL

POSITION OF THE COMPANY OCCURRED BETWEEN THE END OF THE FINANCIAL

YEAR TO WHICH THIS FINANCIAL STATEMENTS RELATE AND THE DATE OF THE

REPORT

No material changes and commitments affecting the financial position of the Company occurred

between the end of the financial year to which this financial statements relate on the date of this report

or

The following material changes and commitment occurred during the year under review affecting the

financial position of the Company.

6. CONSERVATION OF ENERGY, TECHNOLOGY ABSORPTION, FOREIGN EXCHANGE

EARNINGS AND OUTGO

The information pertaining to conservation of energy, technology absorption, Foreign exchange

Earnings and outgo as required under Section 134 (3)(m) of the Companies Act, 2013 read with Rule

8(3) of the Companies (Accounts) Rules, 2014 is furnished in Annexure.and is attached to this

report.

or

The provisions of Section 134(m) of the Companies Act, 2013 do not apply to our Company. There

was no foreign exchange inflow or Outflow during the year under review.

or

The provisions of Section 134(m) of the Companies Act, 2013 do not apply to our Company. The total

Foreign Exchange Inflow was Rs.and Outflow was Rs..during the year

under review.

7. STATEMENT CONCERNING DEVELOPMENT AND IMPLEMENTATION OF RISK

MANAGEMENT POLICY OF THE COMPANY

The Company has adopted the following measures concerning the development and implementation of

a Risk Management Policy after identifying the following elements of risks which in the opinion of the

Board may threaten the very existence of the Company itself.

a.

b.

c.

d.

Company Law Directors Report Page11

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

or

The Company does not have any Risk Management Policy as the elements of risk threatening the

Companys existence are very minimal.

8. DETAILS OF POLICY DEVELOPED AND IMPLEMENTED BY THE COMPANY ON ITS

CORPORATE SOCIAL RESPONSIBILITY INITIATIVES

The Company has not developed and implemented any Corporate Social Responsibility initiatives as

the said provisions are not applicable.

or

The Company has developed and implemented the following Corporate Social Responsibility

initiatives during the year under review.

The Annual Report on Companys CSR activities of the Company is furnished in Annexure. and

attached to this report.

or

The Company has made the relevant provisions for CSR activities in the Books of Accounts and has

deposited the money in a separate Bank Account. The Company shall find out ways and means to

spend the same in the coming months and shall submit the relevant report in the ensuing year. The

Company could not spend the money before finalising this report as the time was too short to identify

suitable projects for spending the same.

9. PARTICULARS OF LOANS, GUARANTEES OR INVESTMENTS MADE UNDER

SECTION 186 OF THE COMPANIES ACT, 2013

The particulars of Loans, guarantees or investments made under Section 186 are furnished in

Annexure ..and is attached to this report.

or

There was no loans, guarantees or investments made by the Company under Section 186 of the

Companies Act, 2013 during the year under review and hence the said provision is not applicable.

10. PARTICULARS OF CONTRACTS OR ARRANGEMENTS MADE WITH RELATED

PARTIES

The particulars of Contracts or Arrangements made with related parties made pursuant to Section 188

are furnished in Annexure..(Form AOC 2) and are attached to this report.

or

Company Law Directors Report Page12

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

There was no contract or arrangements made with related parties as defined under Section 188 of the

Companies Act, 2013 during the year under review.

11. EXPLANATION OR COMMENTS ON QUALIFICATIONS, RESERVATIONS OR

ADVERSE REMARKS OR DISCLAIMERS MADE BY THE AUDITORS AND THE

PRACTICING COMPANY SECRETARY IN THEIR REPORTS

There were no qualifications, reservations or adverse remarks made by the Auditors in their report.

The provisions relating to submission of Secretarial Audit Report in not applicable to the Company.

or

There was no qualifications, reservations or adverse remarks made by the either by the Auditors or by

the Practising Company Secretary in their respective reports.

or

The explanations /comments made by the Board relating to the qualifications, reservations or adverse

remarks made by the Auditors in their report are furnished Annexure and is attached to this report.

The provisions relating to submission of Secretarial Audit Report in not applicable to the Company.

or

The explanations /comments made by the Board relating to the qualifications, reservations or adverse

remarks made by the Auditors and the Practicing Company Secretary in their respective reports are

furnished Annexure . and are attached to this report.

or

The explanations /comments made by the Board relating to the qualifications, reservations or adverse

remarks made by the Auditors in their report are furnished Annexure . and is attached to this report.

There was no an adverse comment, qualifications or reservations or adverse remarks in the Secretarial

Audit Report.

12. COMPANYS POLICY RELATING TO DIRECTORS APPOINTMENT, PAYMENT OF

REMUNERATION AND DISCHARGE OF THEIR DUTIES

The provisions of Section 178(1) relating to constitution of Nomination and Remuneration Committee

are not applicable to the Company and hence the Company has not devised any policy relating to

appointment of Directors, payment of Managerial remuneration, Directors qualifications, positive

attributes, independence of Directors and other related matters as provided under Section 178(3) of the

Companies Act, 2013.

or

Company Law Directors Report Page13

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

The Companys Policy relating to appointment of Directors, payment of Managerial remuneration,

Directors qualifications, positive attributes, independence of Directors and other related matters as

provided under Section 178(3) of the Companies Act, 2013 is furnished in Annexure . and is

attached to this report

13. PARTICULARS OF EMPLOYEES

The Company did not employ any such person whose particulars are required to be given under Rule

5(2) and (3) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014.

or

The particulars of employees drawing a specified remuneration which are required to be given under

under Rule 5(2) and (3) of the Companies (Appointment and Remuneration of Managerial Personnel)

Rules 2014 are furnished in Annexure . and attached to this report.

or

The table containing the names and other Particulars of employees of the Company in accordance

with the provisions of Section 197(12) of the Companies Act, 2013 read with Rule 5(1) of the

Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014 is appended as

Annexure . of the Boards report.

14. ANNUAL RETURN

The extracts of Annual Return pursuant to the provisions of Section 92 read with Rule 12 of the

Companies (Management and Administration) Rules, 2014 is furnished in Annexure .. (MGT 9) and

is attached to this Report.

15. NUMBER OF BOARD MEETINGS CONDUCTED DURING THE YEAR UNDER

REVIEW

The Company had Board meetings during the financial year under review.

16. DIRECTORS RESPONSIBILITY STATEMENT

In accordance with the provisions of Section 134(5) of the Companies Act, 2013 the Board hereby

submit its responsibility Statement:

(a) in the preparation of the annual accounts, the applicable accounting standards had been followed

along with proper explanation relating to material departures;

Company Law Directors Report Page14

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

(b) the directors had selected such accounting policies and applied them consistently and made

judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state

of affairs of the company at the end of the financial year and of the profit and loss of the company for

that period;

(c) the directors had taken proper and sufficient care for the maintenance of adequate accounting

records in accordance with the provisions of this Act for safeguarding the assets of the company and

for preventing and detecting fraud and other irregularities;

(d) the directors had prepared the annual accounts on a going concern basis;

(e) the directors, in the case of a listed company, had laid down Internal Financial Controls to be

followed by the company and that such internal financial controls are adequate and were operating

effectively.(Not applicable to an unlisted Company, including Private Company); and

(f) the directors had devised proper systems to ensure compliance with the provisions of all applicable

laws and that such systems were adequate and operating effectively.

17. SUBSIDIARIES, JOINT VENTURES AND ASSOCIATE COMPANIES

The Company does not have any Subsidiary, Joint venture or Associate Company.

or

The details of financial performance of Subsidiary/ Joint Venture/Associate Company are furnished in

Annexure . and attached to this report.

18. DEPOSITS

The Company has neither accepted nor renewed any deposits during the year under review.

or

The details of deposits accepted/renewed during the year under review are furnished hereunder

S.NO PARTICULARS AMOUNT IN RS.

a) Amount accepted during the year

b) Amount remained unpaid or unclaimed

as at the end of the year

c) whether there has been any default in repayment of deposits or payment of interest thereon

during the year and if so, number of such cases and the total amount involved

i) at the beginning of the year

ii) maximum during the year

Company Law Directors Report Page15

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

iii)at the end of the year

19. DIRECTORS

There was no Director who got re-elected/reappointed during the year under review

Mrwho was appointed as Additional Director on .and holds the said office

till the date of the Annual General Meeting. A notice has been received from a member proposing his

candidature for his reappointment.

or

Mrand Mr.retire at this Annual General Meeting and being eligible offer

themselves for re-election.

20. DECLARATION OF INDEPENDENT DIRECTORS

The Independent Directors have submitted their disclosures to the Board that they fulfil all the

requirements as stipulated in Section 149(6) of the Companies Act, 2013 so as to qualify themselves to

be appointed as Independent Directors under the provisions of the Companies Act, 2013 and the

relevant rules.

or

The provisions of Section 149 pertaining to the appointment of Independent Directors do not apply to

our Company.

21. STATUTORY AUDITORS

M/s __________________, Chartered Accountants, were appointed as Statutory

Auditors for a period of .years in the Annual General Meeting held on Their

continuance of appointment is to be ratified in the ensuing Annual General Meeting.

22. RISK MANAGEMENT POLICY

The Statement showing the details regarding the development and implementation of Risk

Management Policy of the Company is furnished in Annexure. and attached to this report. The risk

management includes identifying types of risks and its assessment, risk handling and monitoring and

reporting.

23. DISCLOSURE OF COMPOSITION OF AUDIT COMMITTEE AND PROVIDING VIGIL

MECHANISM

Company Law Directors Report Page16

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

The provisions of Section 177 of the Companies Act, 2013 read with Rule 6 and 7 of the Companies

(Meetings of the Board and its Powers) Rules, 2013 is not applicable to the Company.

or

The Audit Committee consists of the following members

a.

b.

c.

The above composition of the Audit Committee consists of independent Directors viz.,

Mr and Mr.. who form the majority.

The Company has established a vigil mechanism and overseas through the committee, the genuine

concerns expressed by the employees and other Directors. The Company has also provided adequate

safeguards against victimization of employees and Directors who express their concerns. The

Company has also provided direct access to the chairman of the Audit Committee on reporting issues

concerning the interests of co employees and the Company.

24. SHARES

a. BUY BACK OF SECURITIES

The Company has bought back ..equity shares of Rs..each for a total consideration of

Rsin accordance with the provisions of Section 68 of the Companies Act, 2013 read with

Rule 17 of the Companies (Share Capital and Debentures) Rules, 2014. The said buy back of shares

constituted % of the total paid up Capital and free reserves.

or

The Company has not bought back any of its securities during the year under review.

b. SWEAT EQUITY

The Company has issued .Equity of Shares of Rs..each as Sweat Equity in accordance with

the provisions of Section 54 of the Companies Act, 2013 read with Rule 8 of the Companies (Share

Capital and Debentures) Rules, 2014

or

The Company has not issued any Sweat Equity Shares during the year under review.

c. BONUS SHARES

The Company has issued shares of Rsas Bonus Shares to the existing shareholders of the

Company in the proportion of .share for every.shares held in accordance with the provisions

Company Law Directors Report Page17

CA. PRAMOD JAIN

B. COM (H), FCA, FCS,

FCMA, LL.B, DISA, MIMA

of Section 63 of the Companies Act, 2013 read with Rule 14 of the Companies(Share Capital and

Debentures), Rules 2014.

or

No Bonus Shares were issued during the year under review.

d. EMPLOYEES STOCK OPTION PLAN

The Company had issued .Equity Shares of Rs.10/- aggregating to Rsunder the

Employees Stock Option Plan during the year under review .

or

The Company has not provided any Stock Option Scheme to the employees.

25. INTERNAL FINANCIAL CONTROLS

The Company had laid down Internal Financial Controls and such internal financial controls are

adequate with reference to the Financial Statements and were operating effectively

26. ACKNOWLEDGEMENT

Your Directors place on record their sincere thanks to bankers, business associates, consultants, and

various Government Authorities for their continued support extended to your Companies activities

during the year under review. Your Directors also acknowledges gratefully the shareholders for their

support and confidence reposed on your Company.

By Order of the Board of Directors

For .. PRIVATE LIMITED/ LIMITED

Managing Director Director Chairperson (if authorized by the Board)

Date:

Place:

Company Law Directors Report Page18

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ekadash Rudra ShivaDocument61 pagesEkadash Rudra Shivaaurax143100% (4)

- Themis - Corporation OutlineDocument7 pagesThemis - Corporation OutlineParker BushNo ratings yet

- Pranic Healing PDFDocument11 pagesPranic Healing PDFdinuindia100% (4)

- Soundaryalahari1 Explanation by of Kanchi Mahaperiyava - His HolinessDocument92 pagesSoundaryalahari1 Explanation by of Kanchi Mahaperiyava - His HolinessNarayanan Ramaswamy100% (1)

- SupplExam2020QuestionPapers 24102Document14 pagesSupplExam2020QuestionPapers 24102dinuindiaNo ratings yet

- Circular: October 08, 2020Document2 pagesCircular: October 08, 2020Rahul NairNo ratings yet

- Solar Power PlantDocument12 pagesSolar Power PlantdinuindiaNo ratings yet

- MBL I Year Annual Examination (26 JULY) 2020 Paper Iii - Corporate Law Marks: 100Document2 pagesMBL I Year Annual Examination (26 JULY) 2020 Paper Iii - Corporate Law Marks: 100dinuindiaNo ratings yet

- Visual Basic Enterprise 6.0 EnglishDocument8 pagesVisual Basic Enterprise 6.0 EnglishdinuindiaNo ratings yet

- SME Exchange: Launching Pad To Unlock WealthDocument20 pagesSME Exchange: Launching Pad To Unlock WealthPragya Singh BaghelNo ratings yet

- MBL I Year Annual Examination (25 JULY) 2020 Paper Ii - Banking Law Marks: 100Document2 pagesMBL I Year Annual Examination (25 JULY) 2020 Paper Ii - Banking Law Marks: 100dinuindiaNo ratings yet

- Number System and Set TheoryDocument13 pagesNumber System and Set TheoryBiju JosephNo ratings yet

- Anti Corruption CodeDocument1 pageAnti Corruption CodedinuindiaNo ratings yet

- Fema Updated Current Account Transactions PDFDocument6 pagesFema Updated Current Account Transactions PDFdinuindiaNo ratings yet

- Faqs On Existing Scheme of Education and Training: Provisional-Admission-To-Foundation-CourseDocument5 pagesFaqs On Existing Scheme of Education and Training: Provisional-Admission-To-Foundation-CoursedinuindiaNo ratings yet

- Statement of Accounts FormatDocument2 pagesStatement of Accounts FormatdinuindiaNo ratings yet

- Internal Audit ChecklistDocument80 pagesInternal Audit ChecklistdinuindiaNo ratings yet

- WIRC Dos and Donts Under FEMA For NRIsDocument52 pagesWIRC Dos and Donts Under FEMA For NRIsdinuindiaNo ratings yet

- Luxury Tax - KeralaDocument33 pagesLuxury Tax - KeraladinuindiaNo ratings yet

- GCLDocument461 pagesGCLLav GaurNo ratings yet

- Admiralty Jurisdiction and Arrest and RegistratonDocument52 pagesAdmiralty Jurisdiction and Arrest and RegistratondinuindiaNo ratings yet

- Sectorwise Investment in IndiaDocument10 pagesSectorwise Investment in IndiadinuindiaNo ratings yet

- FCRA 2010 - Final in GazetteDocument48 pagesFCRA 2010 - Final in GazettePrakash KamathNo ratings yet

- Seven Pranayama: Breathing Techniques and ProcedureDocument27 pagesSeven Pranayama: Breathing Techniques and ProceduredinuindiaNo ratings yet

- Application Form For Registration - FCRADocument6 pagesApplication Form For Registration - FCRAdinuindiaNo ratings yet

- AgniMukham San LatestDocument10 pagesAgniMukham San LatestMatt HuishNo ratings yet

- Varahi NigrahashtakamDocument7 pagesVarahi NigrahashtakamdinuindiaNo ratings yet

- Sri Rudram CompleteDocument23 pagesSri Rudram Completekishenav100% (1)

- Hanuman ChalisaDocument4 pagesHanuman ChalisaAnoop MuraliNo ratings yet

- Circular 36-2011 07jun2011Document12 pagesCircular 36-2011 07jun2011CA Harish GargNo ratings yet

- Option Strategies That Can Be Implemented Based On Implied VolatilityDocument8 pagesOption Strategies That Can Be Implemented Based On Implied Volatilitysivasundaram anushanNo ratings yet

- 23 Corporation Code Part 2Document37 pages23 Corporation Code Part 2keirahlaviegnaNo ratings yet

- Fundamentals of AcctgDocument4 pagesFundamentals of AcctgIts meh SushiNo ratings yet

- Duty of Care and Skill of Company DirectorsDocument7 pagesDuty of Care and Skill of Company Directorsarchit malhotra100% (2)

- Leela Ventures Annual ReportDocument88 pagesLeela Ventures Annual ReportArun PrakashNo ratings yet

- Derivatives OptionsDocument2 pagesDerivatives Optionssaidutt sharmaNo ratings yet

- Company Formation - ST-IDocument5 pagesCompany Formation - ST-IAlexandra GeorgianaNo ratings yet

- Nliu 4Document19 pagesNliu 4Kriti SinghNo ratings yet

- Contracts 2Document27 pagesContracts 2ANJALI KAPOORNo ratings yet

- Module-05 - Ethics, Corporate Governance and Business Law - by MD - Monowar FCA, CPA, FCMA - 2nd EditionDocument6 pagesModule-05 - Ethics, Corporate Governance and Business Law - by MD - Monowar FCA, CPA, FCMA - 2nd EditionMark MarasiganNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report March 16, 2012srichardequipNo ratings yet

- Data Tables Foxia - Responsive Bootstrap 5 Admin DashboardDocument2 pagesData Tables Foxia - Responsive Bootstrap 5 Admin DashboardnaimahadouNo ratings yet

- 20181122Document1 page20181122Brian HuangNo ratings yet

- Important Question by Shantanu & Tanya Academy: Company LAW Important Questions FOR December 2021Document7 pagesImportant Question by Shantanu & Tanya Academy: Company LAW Important Questions FOR December 2021punugauriNo ratings yet

- G.R. No. 153468 - Tan v. SycipDocument10 pagesG.R. No. 153468 - Tan v. SycipmanerissaNo ratings yet

- Ziphakamise Cooperative Bank Is About Self EmpowermentDocument2 pagesZiphakamise Cooperative Bank Is About Self EmpowermentJohn-EdwardNo ratings yet

- Part 1Document26 pagesPart 1Andrew ChanNo ratings yet

- Hq07corporation PDFDocument18 pagesHq07corporation PDFIOI100% (2)

- Chapter 10 and 11 HWDocument4 pagesChapter 10 and 11 HWkanielafinNo ratings yet

- EwrfDocument15 pagesEwrfcamilleNo ratings yet

- Business Laws - Part 01 PDFDocument23 pagesBusiness Laws - Part 01 PDFdarcyNo ratings yet

- Clemente V CA DigestDocument1 pageClemente V CA DigestMarteCaronoñganNo ratings yet

- Mid Term Exams Corporation Code 2019 2nd YearDocument6 pagesMid Term Exams Corporation Code 2019 2nd YearDensel James Abua SilvaniaNo ratings yet

- The Failure of BCCI (Bank of Credit & Commerce International)Document6 pagesThe Failure of BCCI (Bank of Credit & Commerce International)ajinkya750% (2)

- Option Payoff ChartsDocument6 pagesOption Payoff Chartsakhil doiphodeNo ratings yet

- Implementation of Ifrs in Different CountriesDocument24 pagesImplementation of Ifrs in Different CountriesNavneet NandaNo ratings yet

- Ey Corporate and Commercial Law Global Update 25 Jan 2023Document46 pagesEy Corporate and Commercial Law Global Update 25 Jan 2023Waqas AhmedNo ratings yet

- Basel AccordsDocument9 pagesBasel AccordsErika Anne JaurigueNo ratings yet

- Main 201bbbbbb9 20 Bank Cheque & Receipt No 1Document12 pagesMain 201bbbbbb9 20 Bank Cheque & Receipt No 1Govind ThakorNo ratings yet