Professional Documents

Culture Documents

HP 12 CP Amortization

Uploaded by

segecsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HP 12 CP Amortization

Uploaded by

segecsCopyright:

Available Formats

hp calculators

HP 12C Platinum

Loan Amortizations

Amortization

The HP12C Platinum amortization approach

Practice amortizing loans

hp calculators

HP 12C Platinum Loan Amortizations

Amortization

The word 'amortization' comes from a Latin word meaning "about to die". When a loan earning interest has regular, fixed

payments, it is said that the loan is being paid off or amortized. Although the debt is reduced by the same periodic

payments, different parts of each payment are applied against the principal and against the interest. The interest is

deduced from each payment and the remaining amount is used to reduce the debt. Figure 1 illustrates this process.

Periodic Payment

Part of each

(fixed value)

payment related

to the principal

Part of each

payment related

to interest

123 . . . . . . . . . . . . . . . . . . . n

Number of payments Figure 1

The HP12C Platinum amortization approach

In the HP12C Platinum, amortization uses the contents of the following Time Value of Money (TVM) registers:

n - used as a reference and contains the number of payments amortized

- periodic interest rate

P - periodic payment

$ - remaining balance

The display must contain the number of payments to be amortized before executing f!. It is important to keep in

mind that on the HP12C Platinum, amortization is a sequenced calculation. This means that once a number of payments

is amortized, all subsequent balances refer to the next amortized payments. If it is necessary to go back and review

previous balance, some values must be restored to their default values. This is because every time f! is pressed,

the following registers have their contents updated:

$ - contents updated to remaining balance

n - contents updated to current number of payments amortized

The following examples illustrate the HP12C Platinum amortization approach.

Practice amortizing loans

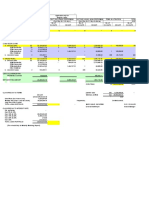

Example 1: Calculate the first year of the annual amortization schedule for a 30-year, $180,000 mortgage at 7.75%,

compounded monthly.

hp calculators -2- HP 12C Platinum Loan Amortizations - Version 1.0

hp calculators

HP 12C Platinum Loan Amortizations

Solution: Clear the TVM registers contents to zero and set END mode:

fG g

Set the relevant TVM values and calculate the PMT:

7.75 gC 30 gA 180000 $ 0 M P

Figure 2

To calculate the first year it is necessary to set n to zero and amortize twelve payments:

0 n 12 f!

Figure 3

This is the total interest paid after one year. To see the part of the principal that is paid, press:

Figure 4

To check the loan balance after one year:

:$

Figure 5

Answer: After one year, the loan balance is $178,420.18. The amount of principal paid so far is $1,579.82 and

$13,894.66 interest has been paid.

Example 2: With all data from the previous example still available in the calculator's memory, calculate the second year

of the annual amortization of the same mortgage.

Solution: Just to make sure the calculator is at the proper point in the loan, recall the contents of n to the display:

:n

Figure 6

hp calculators -3- HP 12C Platinum Loan Amortizations - Version 1.0

hp calculators

HP 12C Platinum Loan Amortizations

Now it is necessary to input the number of payments to be amortized. In this example, twelve more

payments must be amortized to calculate the second year:

12 f!

Figure 7

This is the total interest paid after two years. To see the part of the principal that is paid, press:

Figure 8

To check the loan balance after one year, press:

:$

Figure 9

Answer: After two years, the loan balance is $176,713.49. The amount of principal repaid is $1,706.69 and the

amount of interest paid is $13,767.79.

Example 3: Amortize the 10th payment of a 4-year car loan. The loan amount is $12,500 and the interest rate is 10.2%,

compounded monthly. Assume monthly payments starting immediately.

Solution: Clear the TVM registers contents to zero and set BEGIN mode:

fG g

Set the relevant TVM values and calculate PMT:

10.2 gC 4 gA 12500 $ 0 M P

Figure 10

To amortize the 10th payment it is necessary to amortize the first nine payments and then amortize the 10th

separately:

0 n 9 f! 1 f!

hp calculators -4- HP 12C Platinum Loan Amortizations - Version 1.0

hp calculators

HP 12C Platinum Loan Amortizations

Figure 11

This is the interest paid with the 10th payment. To see the part of the principal that is paid:

Figure 12

To check the loan balance after ten payments:

:$

Figure 13

Answer: After ten payments, the loan balance is $10,210.45. With the 10th payment, the amount of principal that has

been paid is $226.83 and $88.72 interest has been paid.

Example 4: With all data from the previous example still available in the calculator memory, amortize the 22nd payment.

Solution: Just to verify the calculator is still in the proper state, recall the contents of n to the display:

:n

Figure 14

To amortize the 22nd payment it is necessary to amortize the next eleven payments and then amortize the

22nd separately:

11 f! 1 f!

Figure 15

This is the interest paid with the 22nd payment. To see the part of the principal that is paid:

Figure 16

hp calculators -5- HP 12C Platinum Loan Amortizations - Version 1.0

hp calculators

HP 12C Platinum Loan Amortizations

To check the loan balance after ten payments, press:

:$

Figure 17

Answer: After twenty-two payments, the loan balance is $7,333.27. With the 22nd payment, the amount paid toward

principal is $251.08 and $64.47 interest has been paid.

hp calculators -6- HP 12C Platinum Loan Amortizations - Version 1.0

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Cold Storage Guidelines - NABARDDocument4 pagesCold Storage Guidelines - NABARDbsc_nabardNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Veritas College of Irosin: San Julian, Irosin, SorsogonDocument2 pagesVeritas College of Irosin: San Julian, Irosin, SorsogonFortes Roberto GajoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- FIN Money & Banking Chap 9 - Transactions Costs, Asymmetric Information, and The Structure of The Financial SystemDocument2 pagesFIN Money & Banking Chap 9 - Transactions Costs, Asymmetric Information, and The Structure of The Financial SystemGene'sNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Buying Vs Renting: Net Gain by Buying A HomeDocument2 pagesBuying Vs Renting: Net Gain by Buying A HomeAnonymous 2TgTjATtNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fintech Report 2019 PDFDocument28 pagesFintech Report 2019 PDFNadeem Khan50% (2)

- Reverse Mortgage in IndiaDocument42 pagesReverse Mortgage in Indiakavi2288No ratings yet

- Money Market InstrumentsDocument15 pagesMoney Market InstrumentsDharmendra Singh100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Case 4Document3 pagesCase 4Melana MuliNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Jaffee & Stiglitz, Credit RationingDocument52 pagesJaffee & Stiglitz, Credit RationingAnonymous ykRTOE100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Doxim Loan OriginationDocument4 pagesDoxim Loan OriginationVincentXuNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Economic Regulation of Domestic and Foreign Exchange MarketsDocument7 pagesEconomic Regulation of Domestic and Foreign Exchange Marketsisha mahajanNo ratings yet

- Arsh FFDocument7 pagesArsh FFArshdeepNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Acquisition of Archival MaterialsDocument3 pagesAcquisition of Archival MaterialsAmani Ndlovu100% (2)

- Balance Sheet PPT 183Document38 pagesBalance Sheet PPT 183Rita SinghNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Policies and cONDITIONDocument4 pagesPolicies and cONDITIONSheila Mae AramanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Time ValueDocument43 pagesTime ValueJaneNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Green Banking and Its Impacts PDFDocument16 pagesGreen Banking and Its Impacts PDFMuhammad TamimNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Documentation NCC BankDocument35 pagesDocumentation NCC Bankrajin_rammsteinNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Internship Report On FSIBDocument135 pagesInternship Report On FSIBRashed55No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Placement Training Centre Bank Interview Questions and AnswersDocument20 pagesPlacement Training Centre Bank Interview Questions and AnswershariNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- DC 16 15431Document41 pagesDC 16 15431goodmoineNo ratings yet

- Education: Engineering Economy Simple InterestDocument3 pagesEducation: Engineering Economy Simple InterestSalay GirlaNo ratings yet

- Credit Enhancement PracticesDocument30 pagesCredit Enhancement PracticesWondim TesfahunNo ratings yet

- Bajaj Auto FinancialsDocument21 pagesBajaj Auto FinancialsJanendra YadavNo ratings yet

- Chap 006Document59 pagesChap 006Bartholomew Szold93% (15)

- Project Management 3Document14 pagesProject Management 3Shraddha BorkarNo ratings yet

- Reports Apr 30Document28 pagesReports Apr 30Mary Ann PacariemNo ratings yet

- Sources of Business Finance (Hanith Forman)Document5 pagesSources of Business Finance (Hanith Forman)Hanith Adam FormanNo ratings yet

- AA1B Index Statement of AccountsDocument5 pagesAA1B Index Statement of AccountsbscurNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Credit Creation: Primary Deposits: Primary Deposits Arise or Formed When Cash or Cheque Is Deposited byDocument7 pagesCredit Creation: Primary Deposits: Primary Deposits Arise or Formed When Cash or Cheque Is Deposited byMaisha AnzumNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)