Professional Documents

Culture Documents

Investment in Equity Securities

Uploaded by

miss independentOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment in Equity Securities

Uploaded by

miss independentCopyright:

Available Formats

Investment in Equity Securities

Prepared by: Ronna Rica L. Co

3 dates for dividends

1. Date of Declaration

- Date approved by BOD

- Dividend shall be recognized as revenue at this date

- Shareholders right to receive payment is established

2. Date of records

- Stock and transfer book is closed for registration

- Only those shareholders registered on this date are entitled to receive dividends.

3. Date of payment

- Dividend is paid

Dividends

1. Cash dividend

- Treated as income

- Credited to investment account

- Not treated as income if equity method is used

2. Property dividend

- Or dividends in kind

- Treated as income at fair value of property received

3. Liquidating dividend

- Represents return on investment

- Not income

4. Stock dividend

- Increase share/ decrease cost per share / no effect on the total cost of investment

- Not income

a. Same as those held

memo entry on part of investor

Do not affect total cost of investment

Reduce the cost of investment per share

b. Different from those held

allocate cost of original investment between original shares and the

different stock dividends on the basis of fair value.

reduce the total cost of original investment because new investment

account is set up for stock dividend received.

Shares received in lieu of cash dividend

- Dividend are income at fair value of shares received

- In absence of fair value, income is equal to cash dividend that would have been

received.

- Entry: Investment in shares xx

Dividend income xx

Cash received in lieu of stock dividends

- as-if approach is followed

- Stock dividends are assumed to be reduced and subsequently sold at the cash

received.

- Gain or loss may be recognized.

Share split

- Does not affect total cost of investment

- But there is an increase or decrease in the cost per share

- Memo entry only

1. Split up

- Outstanding shares are called in and replaced by a larger number.

- Accompanied by reduction in the par or stated value.

2. Split down

- Outstanding shares are called in and replaced by a smaller number.

- Accompanied by an increase in the par or stated value.

Stock right or preemptive right

- Legal right granted to shareholders to subscribe for new shares at specified price

during definite period.

- Right issue (IAS Term)

- Inherent in every share

- Shareholder receives 1 right for 1 share owned

- Valuable to an investor because new shares are sold below prevailing market price

- Purpose: enable the shareholder to preserve their equity or proportionate interest.

- Evidenced by an instrument or certificate known as share warrant

Measurement of stock right

- Initially at fair value. Portion of CA of original investment in equity securities is

allocated to the stock rights at an amount equal to fair value of stock rights. Stock

rights are independent of original shares.

- Normally classified as current asset if stock rights are accounted for separately.

Stock rights

1. Accounted for separately

2. Not accounted for separately

- Embedded derivative but not stand alone derivative. Component of a hybrid or

combined contract(host contract), with the effect that some of the cash flow of

combined contract vary in a way similar to stand alone instrument.

- Embedded derivative shall be separated from the host contract and accounted for

separately under certain conditions.

- However, if host contract is a financial asset, embedded derivative is not separated.

- If host contract is measured at fair value thru profit or loss embedded derivative is

not separated.

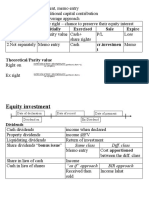

Theoretical or parity value of stock right

- Is the assumed fair value

- When the share is selling right-on

Value of 1 right = market value of share right-on less subscription price

# of rights to purchase 1 share + 1

- When share is selling ex-right

Value of 1 right = market value of share ex-right less subscription price

# of rights to purchase 1 share

Cost of new shares or investment

Initial cost ( stock rights x fair value or value of 1 right) xx

+ cash paid for new shares xx

Cost of new shares or investment xx

Initial measurement of investment

Purchase price xx

Add: Transaction cost xx

Less: Purchased dividend (xx)

Xx

Dividend on

- Excluded from cost of investment

- Example: Purchase date January 1, 2017; dividend declaration date December 15,

2016; date of record January 31, 2017; date of payment March 31, 2017

Initial CV (BS date) UG/UL ( change in

FV)

TS/FVPL PP FV P/L

AFS/FVOCI PP + TC FV OCI*

Invest. in Assoc. PP + TC FV none

*Cumulative balance

1. PFRS 9 cumulative balance of UG/UL taken to SHE. (FV Original Cost = UG/UL)

2. PAS 39 0

Sale

1. TS

Net SP FV = G/ L on Sale

2. AFS

a. PAS 39

Net SP Cost = G/L on Sale

b. PFRS 9 0 ; no G/L

You might also like

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity SecuritiesElaineJrV-IgotNo ratings yet

- Module 1 - FA at FVDocument5 pagesModule 1 - FA at FVNorfaidah Didato GogoNo ratings yet

- Week 05 - 02 - Module 11 - Investment in Equity InstrumentsDocument10 pagesWeek 05 - 02 - Module 11 - Investment in Equity Instruments지마리No ratings yet

- Investment in AssociateDocument21 pagesInvestment in AssociateSky SoronoiNo ratings yet

- FAFVPL-FAFVOCI IARev RLPDocument2 pagesFAFVPL-FAFVOCI IARev RLPBrian Daniel BayotNo ratings yet

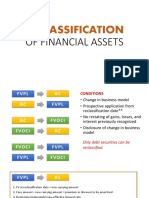

- Reclassification: of Financial AssetsDocument15 pagesReclassification: of Financial AssetsHazel Jane EsclamadaNo ratings yet

- Equity FVPL AND FVOCI Theory For PrintingDocument3 pagesEquity FVPL AND FVOCI Theory For PrintingJaycee Ryan DimacaliNo ratings yet

- Chapter 9 InvestmentsDocument18 pagesChapter 9 InvestmentsChristian Jade Lumasag NavaNo ratings yet

- FINANCIAL ASSET AT FAIR VALUE (103 e-NOTES)Document3 pagesFINANCIAL ASSET AT FAIR VALUE (103 e-NOTES)Soleil LeisolNo ratings yet

- Far Eastern University - Makati: Discussion ProblemsDocument2 pagesFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNo ratings yet

- Chapter 11 Other Long Term InvestmentsDocument10 pagesChapter 11 Other Long Term InvestmentsChristian Jade Lumasag NavaNo ratings yet

- Financial Accounting and Reporting PartDocument6 pagesFinancial Accounting and Reporting PartLalaine De JesusNo ratings yet

- Activities - Cash Payments To Acquire PropertyDocument2 pagesActivities - Cash Payments To Acquire PropertyPrecious ViterboNo ratings yet

- Ias 23 - Borrowing CostDocument11 pagesIas 23 - Borrowing CostATIFREHMANWARRIACHNo ratings yet

- REVIEW QUESTIONS Investment in Debt SecuritiesDocument1 pageREVIEW QUESTIONS Investment in Debt SecuritiesJake BundokNo ratings yet

- #16 Investment PropertyDocument4 pages#16 Investment PropertyClaudine DuhapaNo ratings yet

- Non-Current Asset Held For SaleDocument28 pagesNon-Current Asset Held For SaleTrisha Mae AlburoNo ratings yet

- PFRS 17Document2 pagesPFRS 17Annie JuliaNo ratings yet

- TAX May2021 1st Preboard Questions PDFDocument7 pagesTAX May2021 1st Preboard Questions PDFGoze, Cassandra Jane0% (1)

- Investments in Debt SecuritiesDocument19 pagesInvestments in Debt SecuritiesdfsdfdsfNo ratings yet

- GEN 010 For BSA INVESTMENTS IN DEBT SECURITIESDocument7 pagesGEN 010 For BSA INVESTMENTS IN DEBT SECURITIESJoy RadaNo ratings yet

- Chapter 27 Leases (Student)Document29 pagesChapter 27 Leases (Student)Kelvin Chu JYNo ratings yet

- Pfrs 16 LeasesDocument4 pagesPfrs 16 LeasesR.A.No ratings yet

- Chapter 15 Ppe Part 1Document28 pagesChapter 15 Ppe Part 1marianNo ratings yet

- 2 Inventory Cost Flow Intermediate Accounting ReviewerDocument3 pages2 Inventory Cost Flow Intermediate Accounting ReviewerDalia ElarabyNo ratings yet

- Inventories - TheoriesDocument9 pagesInventories - TheoriesIrisNo ratings yet

- Pas 40 Investment PropertyDocument3 pagesPas 40 Investment PropertyR.A.No ratings yet

- 13 Financial Asset at Amortized CostDocument5 pages13 Financial Asset at Amortized CostLara Jane Dela CruzNo ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotessibivjohnNo ratings yet

- Pas 2 Inventories W RecordingDocument13 pagesPas 2 Inventories W Recordingwendy alcoseba100% (1)

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoRaymond RosalesNo ratings yet

- Chapter 10 Investments in Debt SecuritiesDocument24 pagesChapter 10 Investments in Debt SecuritiesChristian Jade Lumasag NavaNo ratings yet

- CHAPTER 6 PPE Zeus Milan Lecture AidDocument39 pagesCHAPTER 6 PPE Zeus Milan Lecture AidJerome Regalario EspinaNo ratings yet

- AttachmentDocument23 pagesAttachmentAbegail Cabero100% (1)

- FA1PPE Revaluation and ImpairmentDocument3 pagesFA1PPE Revaluation and ImpairmentTrisha Zaraspe MarananNo ratings yet

- IAS 40 - Investment PropertyDocument16 pagesIAS 40 - Investment Propertywakemeup143No ratings yet

- Investment in Associate PDFDocument3 pagesInvestment in Associate PDFVillaruz Shereen MaeNo ratings yet

- Investment in Associate Summary - A Project of Barters PHDocument5 pagesInvestment in Associate Summary - A Project of Barters PHEvita Faith LeongNo ratings yet

- Biological AssetsDocument45 pagesBiological AssetsEmily Rose ZafeNo ratings yet

- Investment in AssociateDocument26 pagesInvestment in AssociateJay-L TanNo ratings yet

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaNo ratings yet

- RRC FAR Property Plant and EquipmentDocument18 pagesRRC FAR Property Plant and Equipmenthazel alvarezNo ratings yet

- Accounts Receivable - Demo TeachingDocument59 pagesAccounts Receivable - Demo TeachingNicole Flores100% (1)

- Lecture Notes On Revaluation and Impairment PDFDocument6 pagesLecture Notes On Revaluation and Impairment PDFjudel ArielNo ratings yet

- Accounting 404BDocument2 pagesAccounting 404BMelicah Chantel SantosNo ratings yet

- Shareholders' Equity LectureDocument3 pagesShareholders' Equity LectureCurtain SoenNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- Pfrs 3 Business CombinationDocument44 pagesPfrs 3 Business CombinationLindsay MadeloNo ratings yet

- Chapter 15 - Financial Asset at Fair ValueDocument22 pagesChapter 15 - Financial Asset at Fair ValueTurksNo ratings yet

- Property, Plant and EquipmentDocument6 pagesProperty, Plant and EquipmenthemantbaidNo ratings yet

- Notes FAR Investment in Associates Equity MethodDocument4 pagesNotes FAR Investment in Associates Equity MethodKerwin Lester MandacNo ratings yet

- Receivable Financing Notes LoansDocument7 pagesReceivable Financing Notes Loansemman neriNo ratings yet

- Lecture Note - Receivables Sy 2014-2015Document10 pagesLecture Note - Receivables Sy 2014-2015LeneNo ratings yet

- Property, Plant and Equipment Property, Plant and EquipmentDocument5 pagesProperty, Plant and Equipment Property, Plant and EquipmentWertdie stanNo ratings yet

- Initially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Document8 pagesInitially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Bryan NatadNo ratings yet

- Equity InvesetmentzDocument1 pageEquity InvesetmentzromamikhaelalouisseNo ratings yet

- IA-final NotesDocument5 pagesIA-final NotesRocel B. LigayaNo ratings yet

- Basic EPS Diluted EPS: Basic EPS Net Income Preferred Dividends Weighted Average of Ordinary SharesDocument3 pagesBasic EPS Diluted EPS: Basic EPS Net Income Preferred Dividends Weighted Average of Ordinary SharesRenz AlconeraNo ratings yet

- Actrev2 - InvestmentsDocument19 pagesActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- Investment in Equity Securities 2Document2 pagesInvestment in Equity Securities 2miss independentNo ratings yet

- PLEDGEDocument23 pagesPLEDGEmiss independentNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in Associatemiss independentNo ratings yet

- Financial Asset at Amortized Cost BDocument2 pagesFinancial Asset at Amortized Cost Bmiss independentNo ratings yet

- Investment in Associate 2Document2 pagesInvestment in Associate 2miss independent100% (1)

- Special Power of AttorneyDocument2 pagesSpecial Power of Attorneymiss independentNo ratings yet

- I Love My FamilyDocument1 pageI Love My Familymiss independentNo ratings yet

- Whether or Not RA 6552 Otherwise Known As Maceda Law Can Be Applied Retroactively?Document1 pageWhether or Not RA 6552 Otherwise Known As Maceda Law Can Be Applied Retroactively?miss independentNo ratings yet

- Bsact 2-2Document1 pageBsact 2-2miss independentNo ratings yet

- Prayer RequestDocument1 pagePrayer Requestmiss independentNo ratings yet

- People Vs GonzalesDocument2 pagesPeople Vs Gonzalesmiss independentNo ratings yet

- Investment Setting Measures of Historical Rates of ReturnDocument4 pagesInvestment Setting Measures of Historical Rates of Returnmiss independentNo ratings yet

- Investment in Equity Securities 2Document2 pagesInvestment in Equity Securities 2miss independentNo ratings yet

- Araullo Vs AquinoDocument1 pageAraullo Vs Aquinomiss independentNo ratings yet

- Family Code III and IVDocument22 pagesFamily Code III and IVmiss independentNo ratings yet

- Thank You Dearest JESUSDocument1 pageThank You Dearest JESUSmiss independentNo ratings yet

- I Love MyselfDocument1 pageI Love Myselfmiss independentNo ratings yet

- Family Code VIIDocument15 pagesFamily Code VIImiss independentNo ratings yet

- Family Code VIIIDocument11 pagesFamily Code VIIImiss independentNo ratings yet

- Yu Oh Vs CADocument1 pageYu Oh Vs CAmiss independentNo ratings yet

- Family Code I and IIDocument10 pagesFamily Code I and IImiss independentNo ratings yet

- People of The Philippines vs. Jesus Retubado: FactsDocument10 pagesPeople of The Philippines vs. Jesus Retubado: FactsAnonymous fL9dwyfekNo ratings yet

- Family Code V, VI, VIDocument19 pagesFamily Code V, VI, VImiss independentNo ratings yet

- Stars at The NightDocument1 pageStars at The Nightmiss independentNo ratings yet

- Security Markets ReportsDocument10 pagesSecurity Markets Reportsmiss independentNo ratings yet

- Comprehensive Dangerous Act of 2002 (R.a. 9165)Document39 pagesComprehensive Dangerous Act of 2002 (R.a. 9165)Karl_Patayon_2642No ratings yet

- Investment Setting Measures of Historical Rates of ReturnDocument4 pagesInvestment Setting Measures of Historical Rates of Returnmiss independentNo ratings yet

- Annex A: Groom and Grooms Men SuitsDocument1 pageAnnex A: Groom and Grooms Men Suitsmiss independentNo ratings yet

- Abando, Ann Margarette G. Legal Research LLB Tsu 1ADocument2 pagesAbando, Ann Margarette G. Legal Research LLB Tsu 1Amiss independentNo ratings yet

- Correlation Trader EA StrategyDocument2 pagesCorrelation Trader EA StrategyPankaj BhabanNo ratings yet

- Learn Orderflow: Tradezilla 2.0Document52 pagesLearn Orderflow: Tradezilla 2.0Ayesha Mariya100% (2)

- BFIN Week 11-20Document14 pagesBFIN Week 11-20KingDyther Velasco92% (13)

- Quiz Week 2Document6 pagesQuiz Week 2Riri FahraniNo ratings yet

- Summer Project On Kotak SecuritiesDocument55 pagesSummer Project On Kotak SecuritiesAvinash Singh75% (16)

- Financial Modeling & Valuation Analyst (FMVA) ® Certification ProgramDocument2 pagesFinancial Modeling & Valuation Analyst (FMVA) ® Certification ProgramJoseph KachereNo ratings yet

- PDF FinanceDocument25 pagesPDF FinanceThulani NdlovuNo ratings yet

- Assignment 1 KFC and MC DonaldsDocument27 pagesAssignment 1 KFC and MC DonaldsLow Xuan YinNo ratings yet

- Literature Review Cash Flow ManagementDocument6 pagesLiterature Review Cash Flow Managementafmzitaaoxahvp100% (2)

- Adani Ports and Sez Economic Zone Companyname: Strong Quarter Encouraging GuidanceDocument13 pagesAdani Ports and Sez Economic Zone Companyname: Strong Quarter Encouraging GuidanceAmey TiwariNo ratings yet

- Suresh Rathi Mana Ram JangidDocument56 pagesSuresh Rathi Mana Ram Jangidmanajangid786No ratings yet

- Unit 1Document48 pagesUnit 1DeshikNo ratings yet

- Short AnswerDocument21 pagesShort AnswerTuan An NguyenNo ratings yet

- Auditing TheoryDocument24 pagesAuditing TheoryLuisitoNo ratings yet

- Consolidated Statements of Financial Position Debts & CashDocument4 pagesConsolidated Statements of Financial Position Debts & CashMuhammad Desca Nur RabbaniNo ratings yet

- 2019 Mock Exam A - Afternoon Session PDFDocument23 pages2019 Mock Exam A - Afternoon Session PDFDhruva Sareen Consultancy100% (1)

- Structured Finance: Benefits, Examples of Structured FinancingDocument10 pagesStructured Finance: Benefits, Examples of Structured FinancingsfNo ratings yet

- Advantages and Disadvantages of FIFO MethodDocument2 pagesAdvantages and Disadvantages of FIFO MethodMohammad MHNo ratings yet

- Intraday Options Trading Account - Phase 2 (1cr To 5cr) - Markets With MadanDocument2 pagesIntraday Options Trading Account - Phase 2 (1cr To 5cr) - Markets With Madanhey rajNo ratings yet

- Amfi Exam Nism V ADocument218 pagesAmfi Exam Nism V AUmang Jain67% (6)

- Format of Desk ResearchDocument2 pagesFormat of Desk ResearchRajesh SwainNo ratings yet

- Fairway Group Holdings Corp - Form S-1A (Apr-04-2013)Document327 pagesFairway Group Holdings Corp - Form S-1A (Apr-04-2013)gtg414gNo ratings yet

- Case Studies Financial ManagementDocument15 pagesCase Studies Financial ManagementRahul Sharma0% (2)

- Qii2007 AbcpDocument64 pagesQii2007 Abcpkarasa1No ratings yet

- SOUTHWEST AIRWAYS CORPORATION NewDocument8 pagesSOUTHWEST AIRWAYS CORPORATION NewMelrose UretaNo ratings yet

- Capital-Structure-and-Long-term-Financing-Decisions Quick NotesDocument6 pagesCapital-Structure-and-Long-term-Financing-Decisions Quick NotesAlliah Mae ArbastoNo ratings yet

- Capitalisation AssignmentDocument5 pagesCapitalisation AssignmentFayis FYSNo ratings yet

- How To Read Stock ChartsDocument36 pagesHow To Read Stock Chartsnayan kumar duttaNo ratings yet

- Hilega Milega TradingDocument8 pagesHilega Milega Tradingmaurya.vikas11111No ratings yet

- Mind Mapping Chap2 Money Market - Nur Shahira ParjoDocument6 pagesMind Mapping Chap2 Money Market - Nur Shahira ParjoNur ShahiraNo ratings yet